Reports

Reports

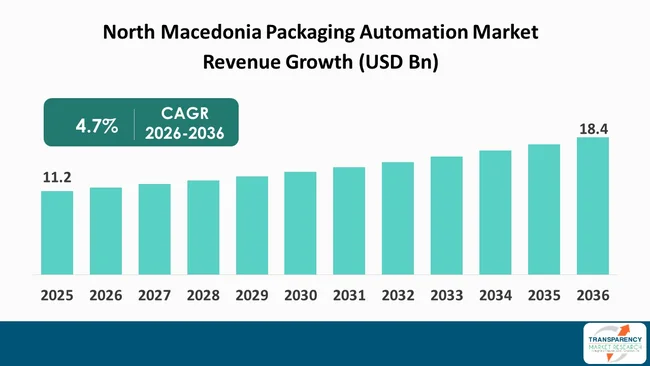

North Macedonia packaging automation market size was valued at US$ 11.2 Bn in 2025 and is projected to reach US$ 18.4 Bn by 2036, expanding at a CAGR of 4.7% from 2026 to 2036. The market growth is driven by increasing manufacturing activity, rising demand for efficient packaging solutions, export-oriented food and beverage production, labor cost optimization, gradual adoption of Industry 4.0 practices, modernization of small and mid-sized factories, and growing emphasis on productivity, quality consistency, and automated packaging lines.

The market is evolving from being selectively adopted to widely incorporated in North Macedonia, as cost pressures increase, production standards change, and more number of companies are exporting. Packaging automation comprising robotic systems, automated filling, labeling, and palletizing, has evolved to being a strategic investment to seek efficiency and consistency instead of a capital upgrade for manufacturers.

The penetration is still limited to the manufacturers of food, beverage, pharmaceutical, and household products, who are also the largest user base of the automated packaging system. In line with Macedonia's State Statistical Office and Ministry of Economy, improvement of manufacturing productivity continues to be the main focus of the industrial policy in 2024-2025, which indirectly generates a boost for automation-associated spending.

The main growth drivers are a continued increase in labor costs, labor shortage for monotonous operational work, and energy price volatility. With automation, unit costs can become stable, waste can be minimized, and throughput reliability can be improved. EU packaging, labeling, and hygiene rules, which are essential for exports, have further raised the demand for precision-driven automated machinery.

The direction of development is also from a trend in the field of packaging machinery toward fully integrated packaging lines and robot-assisted end-of-line solutions. There is a clear preference from the manufacturers for modular and scalable solutions, rather than one large investment. Yet another trend is a strong demand from the fitting suppliers that can provide local technical service and training, a sign of mature operational risk management for Macedonian manufacturers.

Overall, the packaging automation in North Macedonia is a complex issue owing to the market being practical in adoption, demand-driven, and cost-saving in investment, in particular from food and beverage manufacturers. The market is still maturing as compared to Western Europe; the fundamentals are being driven by industrial modernization, export growth, and the adoption of automation for competitors rather than an optional upgrade.

In case of North Macedonia, packaging automation is crucial in providing high efficiency production, product uniformity, and compliance with the regulations in both home and export markets.

The packaging automation equipment such as filling, sealing, labeling, wrapping, cartoning, and palletizing is available at various levels. These systems are common in industries such as food and drinks, pharmaceuticals, cosmetics, chemicals, and consumer goods, where an end-of-line high-volume, repeatable packaging operation is critical. Uniformity is guaranteed, hygiene improved, waste of material minimized, and production reliability augmented by automation.

There are many types of packaging automation systems. Primary packaging automation deals with processes or machines having direct contact with products, such as filling machines and sealing machines. Secondary packaging automation comprises cartoning, bundling, and labeling solutions, and tertiary packaging automation refers to palletizing, depalletizing, and stretch-wrapping equipment. Among these types of packaging, robotic packaging systems are more widely used for their flexibility to work with different product types.

In terms of the offerings, the market is segmented into hardware, software, and services. The hardware includes packaging machines, robotic arms, conveyors, sensors, and vision systems. Software products include machine control systems, monitoring solutions, and production analytics. System integration, maintenance, operator training, and after-sales support are a few services that are acquiring significance as the manufacturers of packaging machinery look forward to a consistent long-term operational viability.

In North Macedonia, packaging automation is particularly relevant for export-oriented producers that comply with EU product safety, labeling accuracy, and traceability requirements.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Cost reduction has become a leading factor influencing the adoption of packaging automation solutions in North Macedonia. Manufacturers are under increasing pressure from escalating labor costs, energy costs, raw material price volatility, and logistics inefficiency. Packaging automation is an ideal choice to control costs rather than being a cost item for potential buyers.

Automation also saves on cost as product waste and packaging material is reduced. Filling, sealing, and labeling processes are automated and are more accurate than manual operations, resulting in less rework and fewer rejected batches. In addition, stable packaging rates and less downtime bring about increased equipment utilization and more predictable production costs.

Energy-related expenses are another factor affecting the cost. Contemporary automatic packaging machines incorporate energy-efficient designs and power-saving functions, enabling production lines to effectively manage their power usage, a growing concern with changing energy prices in Southeast Europe.

The Ministry of Economy of the Republic of North Macedonia, in particular, is included in its industrial competitiveness report, which states that manufacturers that have made investments in automation technologies have realized quantifiable decreases in costs of production per unit, especially in the sectors of food processing and packaging of consumer goods. A number of domestic manufacturers state that investments in automation paid for themselves within a matter of production runs due to savings in labor and reduction in waste. In addition, the growing emphasis on reducing operating costs is rendering packaging automation essential for manufacturers in Macedonia who want to remain financially viable and environmentally sustainable in the long run.

The growing food and drink production in North Macedonia is pushing the demand for packaging automation. The industry is among the country’s largest manufacturing facilities for domestic consumption as well as export to the EU and surrounding countries.

In December 2025, the manufacture of food products and beverages were specifically highlighted as key contributors to industrial production growth, where food product manufacturing contributed 3.5% and beverage manufacturing contributed 34.2% to the growth. With increasing output, the manual packaging process is becoming less productive, inconsistent, and unable to be scaled up, so manufacturers are beginning to pursue automation solutions.

Consumer goods such as food and beverages need to be hygienically handled, accurately portioned, and labelled in compliance. Automated systems for packaging minimize human contact in favor of better food safety and the fulfillment of regulatory requirements equivalent to those of the food safety frameworks of the EU. Automation provides a consistent packaged look, which is important to brand positioning in a competitive retail environment.

In conclusion, the increasing size and regulatory burden of food and beverage manufacturing are driving the need for packaging automation. With the industry still evolving, automated packaging solutions should continue to be at the forefront of growth, compliance, and operational efficiency in the industry.

Small and medium-sized manufacturers constitute a significant untapped potential in North Macedonia packaging automation market. In the past, automation was considered to be costly and viable for mass production only. However, with the introduction of new technologies and the development of modular-designed systems, the barriers to market access for small companies are decreasing.

Government-sponsored industrial rehabilitation programs have contributed to the shift. The Ministry of Economy of North Macedonia and the Agency for Foreign Investments and Export Promotion have underlined the focus on productivity improvements and digital transformation in the national industrial roadmaps. The schemes also motivate SMEs to take up automation to enhance competitiveness and export-readiness.

In some cases, SME aid programs featured on government-backed export promotion platforms demonstrate that small food processors that incorporate semi-automated packaging lines increase their capacity to fulfill orders and decrease. A handful of European automation manufacturers and local equipment suppliers exhibit SME-based solutions in North Macedonia on their corporate web pages, a rallying call to the underserved subset.

Manufacturers have an increasing preference for single-source suppliers to provide all of their equipment and integration needs as opposed to working with multiple vendors for their systems. Turnkey solutions may consist of system design, equipment provision, installation, software integration and customization, testing, user training, and after-sales support.

For manufacturers lacking the depth of in-house automation expertise, this approach minimizes implementation risk, downtime, and project complexity. In North Macedonia, a lot of the manufacturing plants are staffed with small engineering teams. This means that turnkey solutions enable quicker implementation and less disruptive migration from manual or semi-automated processes to fully automated packaging solutions. This is particularly relevant to export-oriented companies, subject to strict compliance and submission deadlines.

Another factor contributing to the demand for turnkey services is the inclusion of robotics, vision systems, and data collection devices on packaging lines. For instance, European Automation producers with local presence have noted that the number of turnkey packaging projects in Europe, including North Macedonia, has been growing, driven by customers' requests for "ready-to-run" systems.

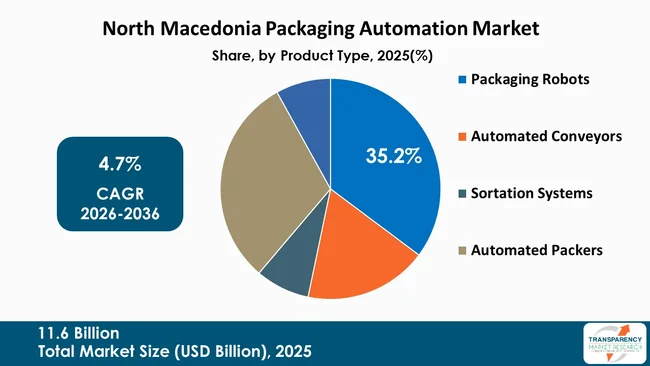

The packaging robots segment held the largest market share of North Macedonia packaging automation market in 2025, accounting for a share of around 35.2% in terms of the value of total automation installations. This dominance is indicative of an increasing demand for flexible, high-end performance robots in a wide range of applications in packaging.

Pick and place packaging robots are used extensively in case packing, palletizing, depalletizing, and end-of-line processing. Their flexibility and capacity to deal with different product sizes, weights, and packaging formats make them particularly useful to producers that have a mix of products or frequent changes on their production line. Packaged food and beverages, household product manufacturers, and processors for export products are the early users of robotic packaging machines in North Macedonia. Robots provide greater flexibility and longer useful life as compared to conventional fixed automation, resulting in an increased return on investment.

The growth of collaborative robots (cobots) has also bolstered this segment. Safe human robot interactions are enabled by cobots, which also have smaller footprints and simpler programming, thereby making them ideal for plants with minimal automation.

Therefore, the packaging robots segment is dominating the market due to its flexibility, scalability, and application-friendliness for both - large-scale and mid-scale industries. With rising production complexity and the need for customization, robotic packaging machines are anticipated to be the staple of packaging automation in North Macedonia.

3M, DS Smith, Endoline Automation, GEA Group Aktiengesellschaft, KHS GmbH, Krones AG, SCALIGERA PACKAGING S.r.l., Schneider Electric SE, SOMIC Verpackungsmaschinen GmbH & Co. KG, YAMATO-SCALE and other are some of the leading manufacturers operating in the North Macedonia Packaging Automation Market.

Each of these companies has been profiled in North Macedonia packaging automation industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 11.2 Bn |

| Market Forecast Value in 2036 | US$ 18.4 Bn |

| Growth Rate (CAGR 2026 to 2036) | 4.7% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value and Units for Volume |

| Market Analysis | North Macedonia qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the country level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Product Type

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

North Macedonia packaging automation market was valued at US$ 11.2 Bn in 2025

North Macedonia packaging automation industry is projected to reach at US$ 18.4 Bn by the end of 2036

Increased focus on operational cost reduction and growing food & beverage production, are some of the driving factors for this market

The CAGR is anticipated to be 4.7% from 2026 to 2036

3M, DS Smith, Endoline Automation, GEA Group Aktiengesellschaft, KHS GmbH, Krones AG, SCALIGERA PACKAGING S.r.l., Schneider Electric SE, SOMIC Verpackungsmaschinen GmbH & Co. KG, YAMATO-SCALE, and other key players.

Table 1: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, 2021 to 2036 By Product Type

Table 2: North Macedonia Packaging Automation Market Volume (Units) Projection, 2021 to 2036 By Product Type

Table 3: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, 2021 to 2036 By Function

Table 4: North Macedonia Packaging Automation Market Volume (Units) Projection, 2021 to 2036 By Function

Table 5: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, 2021 to 2036 By Automation

Table 6: North Macedonia Packaging Automation Market Volume (Units) Projection, 2021 to 2036 By Automation

Table 7: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, 2021 to 2036 By End-use

Table 8: North Macedonia Packaging Automation Market Volume (Units) Projection, 2021 to 2036 By End-use

Table 9: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, 2021 to 2036 By Distribution Channel

Table 10: North Macedonia Packaging Automation Market Volume (Units) Projection, 2021 to 2036 By Distribution Channel

Figure 1: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 2: North Macedonia Packaging Automation Market Volume (Units) Projection, By Product Type 2021 to 2036

Figure 3: North Macedonia Packaging Automation Market, Incremental Opportunities (US$ Bn), Forecast, By Product Type 2026 to 2036

Figure 4: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, By Function 2021 to 2036

Figure 5: North Macedonia Packaging Automation Market Volume (Units) Projection, By Function 2021 to 2036

Figure 6: North Macedonia Packaging Automation Market, Incremental Opportunities (US$ Bn), Forecast, By Function 2026 to 2036

Figure 7: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, By Automation 2021 to 2036

Figure 8: North Macedonia Packaging Automation Market Volume (Units) Projection, By Automation 2021 to 2036

Figure 9: North Macedonia Packaging Automation Market, Incremental Opportunities (US$ Bn), Forecast, By Automation 2026 to 2036

Figure 10: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, By End-use 2021 to 2036

Figure 11: North Macedonia Packaging Automation Market Volume (Units) Projection, By End-use 2021 to 2036

Figure 12: North Macedonia Packaging Automation Market, Incremental Opportunities (US$ Bn), Forecast, By End-use 2026 to 2036

Figure 13: North Macedonia Packaging Automation Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 14: North Macedonia Packaging Automation Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 15: North Macedonia Packaging Automation Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2026 to 2036