Reports

Reports

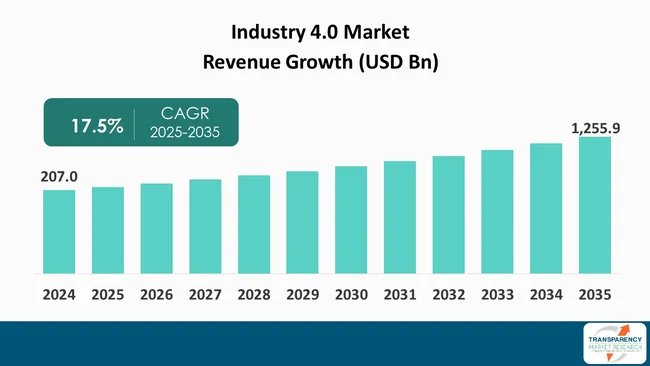

The global Industry 4.0 market size was valued at US$ 207.0 Bn in 2024 and is projected to reach US$ 1,255.9 Bn by 2035, expanding at a CAGR of 17.5% from 2025 to 2035. The market growth is driven by Predictive maintenance & reduced downtime and flexible, demand-driven production & mass customization.

Industry 4.0 implies the integration of data exchange, automation, and analytics. The market is fueled by the demand for improved productivity, flexibility, and cost-effectiveness through the use of cloud, AI/ML, IoT, and edge analytics. The key innovators are driving the market forward with their platform-based offerings, vertical-specific applications, and pay-as-you-go pricing, which have opened the market for more participants. Partnerships among vendors, startups, and the established equipment manufacturing industry have compressed the timeline, developing synergies with ecosystems.

The adoption of Industry 4.0 is driven by a variety of structural forces. Operational resilience and cost control stemming from global supply chain disruptions are leading many companies to digitize both - manufacturing and logistics. The players’ drive to achieve operational excellence (higher yields, less downtime, better quality) will create a high priority for investments in predictive maintenance and real time analytics.

Customers creating high demands for customized products and shorter lead times require new production lines that have the ability to flexibly synchronize their production based on digital signals. Regulations and corporate responsibility for sustainable business practices are driving companies to use connected sensors and analytics to be able to monitor energy and emissions.

Overall, the falling cost of sensors, computing power, and connectivity are providing an economically viable deployment solution for mid-sized manufacturing entities as opposed to only large companies. Lastly, a large number of vendor ecosystems (i.e., cloud providers, OEM's in automation, and software providers) are developing pre-integrated stacks that reduce risk when deploying these technologies and help to accelerate the implementation of these technologies.

| Attribute | Detail |

|---|---|

| Industry 4.0 Market Drivers |

|

One of the main drivers to Industry 4.0 technology is predictive maintenance. It allows organizations to move from a traditional reactionary repair cycle and instead perform scheduled interventions based on data-based insights, decreasing unplanned downtime, and extending the useful life of their assets.

As organizations can utilize distributed sensors, edge analytics, and machine learning models to identify and analyze patterns of anomalies, they can identify impending failures earlier as compared to using traditional preventive maintenance schedules. As such, organizations can reduce their inventories of spare parts, increase the efficiency of their labour deployment, and enhance the overall equipment efficiency (OEE) of their plants.

The economics of predictive maintenance are straightforward: fewer emergency repairs will yield an increase in throughput and improved quality of the products manufactured, resulting in increased returns on investment for sensors, connectivity, and analytics. For legacy plants that are not equipped with the latest technology, the availability of retrofittable sensor kits and the use of gateway devices to connect sensors to the internet lowers the capital investment pertaining to using predictive maintenance solutions and allows organizations to implement these solutions incrementally, that too, without having to fully replace all equipment at once.

For example, a medium-sized manufacturer can use a vibration sensor to replace their traditional calendar-based bearing change schedule and can plan to do the bearing changes during the normal business day rather than having to do emergency repairs overnight. This will save on overtime costs and decrease the amount of scrap created due to process disruptions.

Manufacturers are adopting Industry 4.0 practices to respond to the demand for increased customization and quicker time-to-market with the introduction of flexible small-batch manufacturing processes. Digitally orchestrated production allows manufacturers to leverage programmable automation, modular tooling, and cloud-based scheduling tools to help them create flexibility within their production processes by allowing them to rapidly reconfigure their existing production lines to run several different SKUs with minimal time lost for changeovers.

Digital processes and digital twin technology enable manufacturers to simulate and validate what production changes will look like, thereby allowing manufacturers to implement these changes faster while minimizing the associated trial-and-error costs. IoT-based real-time data and MES integration provide production planners with the ability to respond quickly to demand signals, supplier delays, or deviations in quality without having to rely on manual intervention.

The flexibility built into these systems also supports the use of new business models, such as configure-to-order and product-as-a-service, which require integration between operational and sales and after-sales systems. For example, a consumer electronics manufacturer that traditionally produced long, single-SKU runs can now use automated changeover sequences and a cloud-based scheduling engine to change their production line for the manufacture of personalized variations of products, thereby allowing them to charge a premium price while maintaining a level of competitive pricing for each unit produced and reducing total inventory costs. This capability not only enhances their ability to respond to customer demand, but it also provides new opportunities for value capture across the entire product lifecycle.

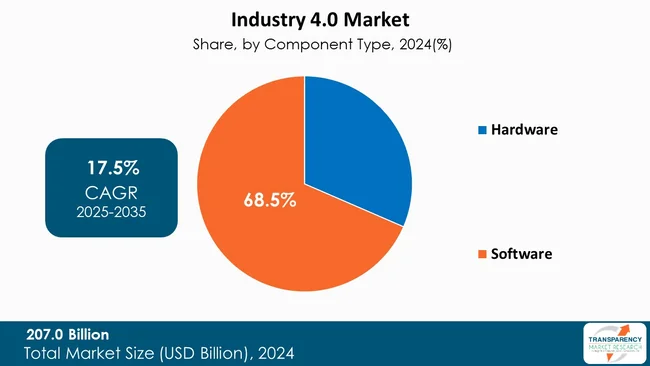

Software dominates the Industry 4.0 market with 68.5% share capture by weaving together Sensors, Machines, People, and Enterprise Systems together into Workflows, which are able to generate actionable insights. What sets software apart from hardware is that, unlike hardware, software can provide continual improvements through various methods such as Updates, Refinements of Algorithms, and Integrations of New Technologies. Therefore, software has the opportunity to create recurring revenue streams for Vendors and to provide scalability for end-users.

The key software components of Industry 4.0 are Device Management, Industrial IoT Platforms, MES (Manufacturing Execution Systems), Analytics and Machine Learning Algorithms (ML), Digital Twin Technology, Orchestration Providers, and control actions that convert insight into action. Due to the abstract nature of software, it has the capability of interfacing with multiple types of hardware, as well as with legacy systems. This provides Manufacturers with a higher level of Interoperability and the ability to provide Faster Time to Value.

Software also has the capability of being deployed via Cloud-native Deployment Models, which will reduce the amount of time and cost associated with maintaining on-premise infrastructure. As a result, investing in Software is a better return on investment (ROI) from the buyer's standpoint, as well as providing improved decision-making capabilities for maintenance, quality, energy, and production planning without the need for full-capital replacement of physical assets.

As an example, an IoT platform with built-in predictive analytics enabled a manufacturer to consolidate data from 10 different PLC vendors in less than 90 Days and launch a predictive maintenance program across the entire facility. However, it would take several years and significant capital expenditures (CAPEX) to replace and/or standardize PLCs. As software enables both - upstream and downstream activities, vendors who can provide software in combination with services, integrations, and ecosystems will further solidify their position in the market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is the dominant region with 40.2% share. This is due to an advanced industrial base, a large number of technology vendors, and a favorable environment for investment. The U.S. has provided an environment conducive to the growth of many cloud service providers, analytics firms, OEMs (Original Equipment Manufacturers), and systems integrators, therefore creating an ecosystem with lower risk for integration and faster time to market for companies deploying these technologies commercially.

The pay-per-use model in the region allows a closer alignment of incentives between vendors and the businesses that use them (by achieving measurable outcomes). In addition, access to skilled labor that can support the deployment and customization of Industry 4.0 solutions (through software, data science, and controls engineering) is another factor in creating conditions for these implementations.

The availability of capital to the company's R&D budget and through venture/private equity funds has enabled start-ups and platform vendors to evolve to provide enterprise-level solutions in a short time frame.

Companies operating in the Industry 4.0 market focus on forging strategic collaborations, innovating their products, and validating the performance of their products across various clinical settings. These firms invest significantly in R&D pertaining to cutting-edge microfluidic and non-invasive techniques, broaden their distribution channels, and provide integrated service solutions to have a strong market presence and a high customer loyalty.

Bosch Rexroth AG, SAS, Maschinenfabrik Reinhausen GmbH, Wittenstein AG, Daimler AG, General Electric Company, Siemens AG, Klockner & Co. SE, ABB Ltd., Festo AG & Co. KG, Microsoft, Amazon Web Services are some of the leading players operating in the global industry 4.0 market.

Each of these players has been profiled in the industry 4.0 Industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 207.0 Bn |

| Forecast Value in 2035 | US$ 1,255.9 Bn |

| CAGR | 17.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Industry 4.0 Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Component Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global industry 4.0 market was valued at US$ 207.0 Bn in 2024

The global industry 4.0 industry is projected to reach more than US$ 1,255.9 Bn by the end of 2035

Predictive maintenance & reduced downtime and Flexible, demand-driven production & mass customization

The CAGR is anticipated to be 17.5% from 2025 to 2035

Bosch Rexroth AG, SAS, Maschinenfabrik Reinhausen GmbH, Wittenstein AG, Daimler AG, General Electric Company, Siemens AG, Klockner & Co. SE, ABB Ltd., Festo AG & Co. KG, Microsoft, Amazon Web Services, and Others

Table 01: Global Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 02: Global Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 03: Global Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 04: Global Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 05: Global Industry 4.0 Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 06: North America Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 07: North America Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 08: North America Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 09: North America Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 10: North America Industry 4.0 Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 11: U.S. Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 12: U.S. Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 13: U.S. Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14: U.S. Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 15: Canada Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 16: Canada Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 17: Canada Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 18: Canada Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 19: Europe Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 20: Europe Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 21: Europe Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 22: Europe Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 23: Europe Industry 4.0 Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Germany Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 25: Germany Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 26: Germany Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27: Germany Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 28: U.K. Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 29: U.K. Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 30: U.K. Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31: U.K. Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 32: France Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 33: France Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 34: France Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35: France Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 36: Italy Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 37: Italy Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 38: Italy Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39: Italy Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 40: Spain Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 41: Spain Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 42: Spain Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43: Spain Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 44: The Netherlands Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 45: The Netherlands Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 46: The Netherlands Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47: The Netherlands Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 48: Rest of Europe Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 49: Rest of Europe Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 50: Rest of Europe Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51: Rest of Europe Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 52: Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 53: Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 54: Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55: Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 56: Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 57: China Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 58: China Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 59: China Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 60: China Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 61: Japan Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 62: Japan Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 63: Japan Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 64: Japan Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 65: India Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 66: India Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 67: India Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68: India Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 69: South Korea Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 70: South Korea Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 71: South Korea Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 72: South Korea Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 73: ASEAN Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 74: ASEAN Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 75: ASEAN Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 76: ASEAN Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 77: Australia Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 78: Australia Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 79: Australia Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 80: Australia Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 81: Rest of Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 82: Rest of Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 83: Rest of Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 84: Rest of Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 85: Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 86: Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 87: Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 88: Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 89: Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 90: Brazil Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 91: Brazil Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 92: Brazil Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93: Brazil Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 94: Mexico Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 95: Mexico Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 96: Mexico Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97: Mexico Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 98: Argentina Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 99: Argentina Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 100: Argentina Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101: Argentina Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 102: Rest of Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 103: Rest of Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 104: Rest of Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105: Rest of Latin America Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 106: Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 107: Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 108: Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 109: Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 110: Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: GCC Countries Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 112: GCC Countries Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 113: GCC Countries Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 114: GCC Countries Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 115: South Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 116: South Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 117: South Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 118: South Africa Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 119: Rest of Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 120: Rest of Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 121: Rest of Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 122: Rest of Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Figure 01: Global Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 03: Global Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 04: Global Industry 4.0 Market Revenue (US$ Bn), by Hardware, 2020 to 2035

Figure 05: Global Industry 4.0 Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 06: Global Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 07: Global Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 08: Global Industry 4.0 Market Revenue (US$ Bn), by Artificial Intelligence (AI) & Machine Learning (ML), 2020 to 2035

Figure 09: Global Industry 4.0 Market Revenue (US$ Bn), by IoT (Internet of Things), 2020 to 2035

Figure 10: Global Industry 4.0 Market Revenue (US$ Bn), by Cloud Computing, 2020 to 2035

Figure 11: Global Industry 4.0 Market Revenue (US$ Bn), by 5G Connectivity, 2020 to 2035

Figure 12: Global Industry 4.0 Market Revenue (US$ Bn), by Blockchain, 2020 to 2035

Figure 13: Global Industry 4.0 Market Revenue (US$ Bn), by Cybersecurity, 2020 to 2035

Figure 14: Global Industry 4.0 Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 15: Global Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 16: Global Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 17: Global Industry 4.0 Market Revenue (US$ Bn), by Remote Monitoring & Management, 2020 to 2035

Figure 18: Global Industry 4.0 Market Revenue (US$ Bn), by Smart Networks, 2020 to 2035

Figure 19: Global Industry 4.0 Market Revenue (US$ Bn), by Connected Devices Management, 2020 to 2035

Figure 20: Global Industry 4.0 Market Revenue (US$ Bn), by Wearables Devices, 2020 to 2035

Figure 21: Global Industry 4.0 Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 22: Global Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 23: Global Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 24: Global Industry 4.0 Market Revenue (US$ Bn), by E-commerce, 2020 to 2035

Figure 25: Global Industry 4.0 Market Revenue (US$ Bn), by Transport and logistics, 2020 to 2035

Figure 26: Global Industry 4.0 Market Revenue (US$ Bn), by Media, 2020 to 2035

Figure 27: Global Industry 4.0 Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 28: Global Industry 4.0 Market Revenue (US$ Bn), by Banking, 2020 to 2035

Figure 29: Global Industry 4.0 Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 30: Global Industry 4.0 Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 31: Global Industry 4.0 Market Value Share Analysis, by Region, 2024 and 2035

Figure 32: Global Industry 4.0 Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 33: North America Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: North America Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 35: North America Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 36: North America Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 37: North America Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 38: North America Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 39: North America Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 40: North America Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 41: North America Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 42: North America Industry 4.0 Market Value Share Analysis, by Country, 2024 and 2035

Figure 43: North America Industry 4.0 Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 44: U.S. Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: U.S. Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 46: U.S. Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 47: U.S. Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 48: U.S. Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 49: U.S. Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 50: U.S. Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 51: U.S. Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 52: U.S. Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 53: Canada Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Canada Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 55: Canada Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 56: Canada Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 57: Canada Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 58: Canada Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 59: Canada Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 60: Canada Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 61: Canada Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 62: Europe Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 63: Europe Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 64: Europe Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 65: Europe Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 66: Europe Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 67: Europe Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 68: Europe Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 69: Europe Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 70: Europe Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 71: Europe Industry 4.0 Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 72: Europe Industry 4.0 Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 73: Germany Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 74: Germany Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 75: Germany Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 76: Germany Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 77: Germany Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 78: Germany Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 79: Germany Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 80: Germany Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 81: Germany Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 82: U.K. Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 83: U.K. Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 84: U.K. Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 85: U.K. Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 86: U.K. Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 87: U.K. Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 88: U.K. Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 89: U.K. Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 90: U.K. Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 91: France Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 92: France Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 93: France Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 94: France Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 95: France Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 96: France Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 97: France Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 98: France Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 99: France Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 100: Italy Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 101: Italy Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 102: Italy Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 103: Italy Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 104: Italy Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 105: Italy Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 106: Italy Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 107: Italy Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 108: Italy Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 109: Spain Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 110: Spain Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 111: Spain Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 112: Spain Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 113: Spain Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 114: Spain Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 115: Spain Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 116: Spain Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 117: Spain Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 118: The Netherlands Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 119: The Netherlands Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 120: The Netherlands Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 121: The Netherlands Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 122: The Netherlands Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 123: The Netherlands Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 124: The Netherlands Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 125: The Netherlands Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 126: The Netherlands Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 127: Rest of Europe Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 128: Rest of Europe Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 129: Rest of Europe Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 130: Rest of Europe Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 131: Rest of Europe Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 132: Rest of Europe Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 133: Rest of Europe Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 134: Rest of Europe Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 135: Rest of Europe Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 136: Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 137: Asia Pacific Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 138: Asia Pacific Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 139: Asia Pacific Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 140: Asia Pacific Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 141: Asia Pacific Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 142: Asia Pacific Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 143: Asia Pacific Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 144: Asia Pacific Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 145: Asia Pacific Industry 4.0 Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 146: Asia Pacific Industry 4.0 Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 147: China Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 148: China Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 149: China Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 150: China Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 151: China Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 152: China Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 153: China Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 154: China Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 155: China Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 156: Japan Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 157: Japan Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 158: Japan Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 159: Japan Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 160: Japan Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 161: Japan Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 162: Japan Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 163: Japan Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 164: Japan Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 165: India Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 166: India Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 167: India Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 168: India Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 169: India Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 170: India Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 171: India Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 172: India Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 173: India Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 174: South Korea Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 175: South Korea Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 176: South Korea Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 177: South Korea Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 178: South Korea Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 179: South Korea Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 180: South Korea Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 181: South Korea Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 182: South Korea Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 183: ASEAN Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 184: ASEAN Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 185: ASEAN Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 186: ASEAN Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 187: ASEAN Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 188: ASEAN Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 189: ASEAN Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 190: ASEAN Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 191: ASEAN Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 192: Australia Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 193: Australia Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 194: Australia Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 195: Australia Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 196: Australia Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 197: Australia Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 198: Australia Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 199: Australia Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 200: Australia Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 201: Rest of Asia Pacific Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 202: Rest of Asia Pacific Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 203: Rest of Asia Pacific Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 204: Rest of Asia Pacific Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 205: Rest of Asia Pacific Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 206: Rest of Asia Pacific Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 207: Rest of Asia Pacific Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 208: Rest of Asia Pacific Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 209: Rest of Asia Pacific Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 210: Latin America Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 211: Latin America Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 212: Latin America Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 213: Latin America Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 214: Latin America Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 215: Latin America Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 216: Latin America Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 217: Latin America Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 218: Latin America Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 219: Latin America Industry 4.0 Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 220: Latin America Industry 4.0 Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 221: Brazil Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 222: Brazil Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 223: Brazil Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 224: Brazil Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 225: Brazil Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 226: Brazil Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 227: Brazil Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 228: Brazil Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 229: Brazil Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 230: Mexico Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 231: Mexico Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 232: Mexico Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 233: Mexico Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 234: Mexico Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 235: Mexico Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 236: Mexico Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 237: Mexico Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 238: Mexico Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 239: Argentina Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 240: Argentina Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 241: Argentina Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 242: Argentina Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 243: Argentina Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 244: Argentina Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 245: Argentina Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 246: Argentina Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 247: Argentina Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 248: Rest of Latin America Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 249: Rest of Latin America Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 250: Rest of Latin America Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 251: Rest of Latin America Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 252: Rest of Latin America Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 253: Rest of Latin America Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 254: Rest of Latin America Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 255: Rest of Latin America Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 256: Rest of Latin America Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 257: Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 258: Middle East and Africa Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 259: Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 260: Middle East and Africa Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 261: Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 262: Middle East and Africa Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 263: Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 264: Middle East and Africa Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 265: Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 266: Middle East and Africa Industry 4.0 Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 267: Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 268: GCC Countries Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 269: GCC Countries Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 270: GCC Countries Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 271: GCC Countries Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 272: GCC Countries Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 273: GCC Countries Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 274: GCC Countries Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 275: GCC Countries Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 276: GCC Countries Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 277: South Africa Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 278: South Africa Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 279: South Africa Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 280: South Africa Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 281: South Africa Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 282: South Africa Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 283: South Africa Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 284: South Africa Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 285: South Africa Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 286: Rest of Middle East and Africa Industry 4.0 Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 287: Rest of Middle East and Africa Industry 4.0 Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 288: Rest of Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 289: Rest of Middle East and Africa Industry 4.0 Market Value Share Analysis, by Technology, 2024 and 2035

Figure 290: Rest of Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 291: Rest of Middle East and Africa Industry 4.0 Market Value Share Analysis, by Application, 2024 and 2035

Figure 292: Rest of Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 293: Rest of Middle East and Africa Industry 4.0 Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 294: Rest of Middle East and Africa Industry 4.0 Market Attractiveness Analysis, by End-use Industry, 2025 to 2035