Reports

Reports

Analysts’ Viewpoint on Market Scenario

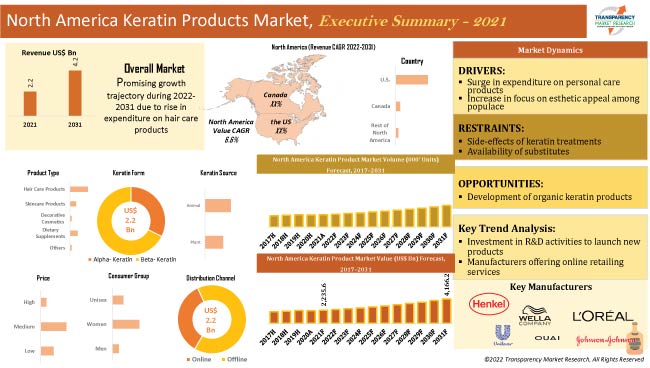

Surge in the expenditure on personal care products is fueling the North America keratin products market. Keratin products have gained popularity in the last few years due to widespread marketing and advertisements. Social media posts influence consumers to opt for various beauty products and supplements. Thus, increase in focus on esthetic appeal among the populace is expected to propel market progress during the forecast period.

Development of organic keratin products is likely to offer lucrative growth opportunities for vendors in the industry. Vendors are investing significantly in R&D activities to launch new products. They are also offering online retail services to expand their North America keratin products market revenue.

Keratin is a type of fibrous structural protein that is used to provide strength to cells that form the skin, hair, and nails. Keratin products and supplements help regulate key cellular activities, including protein synthesis and cell growth. This allows tissues to resist damage from friction and minor trauma such as scratching and rubbing.

Keratin is obtained from various plants and animals. It is available in different forms such as alpha-keratin and beta-keratin. Keratin products in the form of hair care, skin care, decorative cosmetics, and dietary supplements are available for men and women. Vendors in the industry also offer unisex products that are applicable to both men and women.

Keratin plays an important role in the development of healthy hair, skin, and nails. It is a strong protein found concentrated in body parts that are built for toughness or needed for protection. The mixture of amino acids and fibrous structures that make up keratin is a vital component of a biological process that occurs inside the body.

Keratin-based supplements help maintain hair health and promote hair growth. Daily dose of keratin also aids to make nails more resilient and strong. These properties have prompted the use of keratin in healthcare and pharmaceutical industries for the development of a wide range of medicines and supplements. This, in turn, is likely to contribute to North America keratin products market growth in the near future.

Consumers have become more concerned and conscious about maintaining their overall appearance. Thus, cosmetic and personal care products play an important role in personal health and hygiene. Keratin hair treatments reduce frizz and increase shine. Keratin therapy also promotes healthy skin. Keratin-based anti-aging products are also gaining traction among the geriatric population. Therefore, surge in the geriatric population is estimated to boost North America keratin products market expansion in the next few years.

Keratin is widely employed in skincare and hair care products due to its moisturizing ability. Keratin treatments and keratin-based products help increase hydration of the skin. These advantages are likely to propel market statistics in the region in the near future.

Vendors in the industry are investing significantly in R&D activities to launch innovative products, such as keratin-based hair sprays, to fulfill customer needs. They are also developing plant-based and vegan keratin products to expand their North America keratin products market share.

Vegan or plant-based keratin-based products are best known to supply the hair with fibrous properties that help protect them from damage. These products also replenish the protein that acts as an anti-breakage mechanism for hair. New products such as keratin-based body lotion combined with multifunctional active ingredients help soothe, moisturize, and other hair care improvements.

The plant keratin source segment is projected to dominate the North America keratin products market during the forecast period. Vegan keratin is primarily derived from natural sources and is not treated with chemicals or any other synthetic substances. Demand for vegan keratin has increased significantly among consumers due to rise in adoption of cruelty-free beauty products, particularly among the younger generation. Consumers are increasingly preferring vegan products that are free of animal-derived ingredients.

The online distribution channel segment is expected to grow at a rapid pace during the forecast period. Online websites are gaining popularity over physical stores, as consumers find it easier to select products based on their needs through these platforms. Consumers are also drawn to promotional activities and discounts offered by brands on online websites.

Detailed profiles of vendors have been provided in the North America keratin products market report to evaluate their financials, key product offerings, recent developments, and strategies. Most firms are investing significantly in the R&D of new products. Collaborations, partnerships, and mergers & acquisitions are key strategies adopted by vendors such as Henkel AG & Co. KGaA, Unilever, Wella Company, OUAI Haircare, Keranique, L'Oréal Group, OGX Beauty, Inspired Beauty Brands, Peter Coppola, Everest NeoCell LLC, and Johnson & Johnson.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 2.2 Bn |

|

Market Forecast Value in 2031 |

US$ 4.2 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Regional qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, and regulatory analysis. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Countries or Sub-regions Covered |

|

|

Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It stood at US$ 2.2 Bn in 2021

It is expected to reach US$ 4.2 Bn by 2031

It is estimated to grow at a CAGR of 6.6% from 2022 to 2031

Surge in expenditure on personal care products and increase in focus on esthetic appeal among the populace

The hair care product type segment accounted for 51.5% share in 2021

The U.S. is a more attractive country for vendors

Henkel AG & Co. KGaA, Unilever, Wella Company, OUAI Haircare, Keranique, L'Oréal Group, OGX Beauty, Inspired Beauty Brands, Peter Coppola, Everest NeoCell LLC, and Johnson & Johnson

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Personal Care Products Market

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Ingredient Analysis

5.9. North America Keratin Products Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Mn)

5.9.2. Market Volume Projection (Thousand Units)

6. North America Keratin Products Market Analysis and Forecast, by Product Type

6.1. North America Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

6.1.1. Hair Care Products

6.1.1.1. Shampoos

6.1.1.2. Conditioners & Masks

6.1.1.3. Serums & Oils

6.1.1.4. Others (Gels, Hair Colors, etc.)

6.1.2. Skincare Products

6.1.2.1. Creams & Moisturizers

6.1.2.2. Skin Serums

6.1.2.3. Others (Face Washes, etc.)

6.1.3. Decorative Cosmetics

6.1.4. Dietary Supplements

6.1.5. Others (Nail Oils, Nail Serums, etc.)

6.2. Incremental Opportunity, by Product Type

7. North America Keratin Products Market Analysis and Forecast, by Keratin Form

7.1. North America Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Keratin Form, 2017 - 2031

7.1.1. Alpha-keratin

7.1.2. Beta-keratin

7.2. Incremental Opportunity, by Keratin Form

8. North America Keratin Products Market Analysis and Forecast, by Keratin Source

8.1. North America Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Keratin Source, 2017 - 2031

8.1.1. Plant

8.1.2. Animal

8.2. Incremental Opportunity, by Keratin Source

9. North America Keratin Products Market Analysis and Forecast, by Price

9.1. North America Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, by Price

10. North America Keratin Products Market Analysis and Forecast, by Consumer Group

10.1. North America Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Consumer Group, 2017 - 2031

10.1.1. Men

10.1.2. Women

10.1.3. Unisex

10.2. Incremental Opportunity, by Consumer Group

11. North America Keratin Products Market Analysis and Forecast, by Distribution Channel

11.1. North America Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.1.1. E-commerce Websites

11.1.1.2. Company-owned Website

11.1.2. Offline

11.1.2.1. Hypermarkets/Supermarkets

11.1.2.2. Specialty Stores

11.1.2.3. Other Retail Stores

11.2. Incremental Opportunity, by Distribution Channel

12. North America Keratin Products Market Analysis and Forecast, by Country

12.1. North America Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 - 2031

12.1.1. U.S.

12.1.2. Canada

12.1.3. Rest of North America

12.2. Incremental Opportunity, by Country

13. U.S. Keratin Products Market Analysis and Forecast

13.1. Country Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price (US$)

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

13.6.1. Hair Care Products

13.6.1.1. Shampoos

13.6.1.2. Conditioners & Masks

13.6.1.3. Serums & Oils

13.6.1.4. Others (Gels, Hair Colors, etc.)

13.6.2. Skincare Products

13.6.2.1. Creams & Moisturizers

13.6.2.2. Skin Serums

13.6.2.3. Others (Face Washes, etc.)

13.6.3. Decorative Cosmetics

13.6.4. Dietary Supplements

13.6.5. Others (Nail Oils, Nail Serums, etc.)

13.7. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Keratin Form, 2017 - 2031

13.7.1. Alpha-keratin

13.7.2. Beta-keratin

13.8. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Keratin Source, 2017 - 2031

13.8.1. Plant

13.8.2. Animal

13.9. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

13.9.1. Low

13.9.2. Medium

13.9.3. High

13.10. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Consumer Group, 2017 - 2031

13.10.1. Men

13.10.2. Women

13.10.3. Unisex

13.11. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.11.1. Online

13.11.1.1. E-commerce Websites

13.11.1.2. Company-owned Website

13.11.2. Offline

13.11.2.1. Hypermarkets/Supermarkets

13.11.2.2. Specialty Stores

13.11.2.3. Other Retail Stores

13.12. Incremental Opportunity Analysis

14. Canada Keratin Products Market Analysis and Forecast

14.1. Country Snapshot

14.2. Key Trend Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price (US$)

14.4. Brand Analysis

14.4.1. Consumer Buying Behavior Analysis

14.5. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

14.5.1. Hair Care Products

14.5.1.1. Shampoos

14.5.1.2. Conditioners & Masks

14.5.1.3. Serums & Oils

14.5.1.4. Others (Gels, Hair Colors, etc.)

14.5.2. Skincare Products

14.5.2.1. Creams & Moisturizers

14.5.2.2. Skin Serums

14.5.2.3. Others (Face Washes, etc.)

14.5.3. Decorative Cosmetics

14.5.4. Dietary Supplements

14.5.5. Others (Nail Oils, Nail Serums, etc.)

14.6. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Keratin Form, 2017 - 2031

14.6.1. Alpha-keratin

14.6.2. Beta-keratin

14.7. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Keratin Source, 2017 - 2031

14.7.1. Plant

14.7.2. Animal

14.8. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

14.8.1. Low

14.8.2. Medium

14.8.3. High

14.9. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Consumer Group, 2017 - 2031

14.9.1. Men

14.9.2. Women

14.9.3. Unisex

14.10. Keratin Products Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.10.1. Online

14.10.1.1. E-commerce Websites

14.10.1.2. Company-owned Website

14.10.2. Offline

14.10.2.1. Hypermarkets/Supermarkets

14.10.2.2. Specialty Stores

14.10.2.3. Other Retail Stores

14.11. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%), 2021

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

15.3.1. Henkel AG & Co. KGaA

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue (Segmental Revenue)

15.3.1.4. Strategy & Business Overview

15.3.1.5. Sales Channel Analysis

15.3.1.6. Product Portfolio & Pricing

15.3.2. Unilever

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue (Segmental Revenue)

15.3.2.4. Strategy & Business Overview

15.3.2.5. Sales Channel Analysis

15.3.2.6. Product Portfolio & Pricing

15.3.3. Wella Company

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue (Segmental Revenue)

15.3.3.4. Strategy & Business Overview

15.3.3.5. Sales Channel Analysis

15.3.3.6. Product Portfolio & Pricing

15.3.4. OUAI Haircare

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue (Segmental Revenue)

15.3.4.4. Strategy & Business Overview

15.3.4.5. Sales Channel Analysis

15.3.4.6. Product Portfolio & Pricing

15.3.5. Keranique

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue (Segmental Revenue)

15.3.5.4. Strategy & Business Overview

15.3.5.5. Sales Channel Analysis

15.3.5.6. Product Portfolio & Pricing

15.3.6. L'Oréal Group

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue (Segmental Revenue)

15.3.6.4. Strategy & Business Overview

15.3.6.5. Sales Channel Analysis

15.3.6.6. Product Portfolio & Pricing

15.3.7. OGX Beauty

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue (Segmental Revenue)

15.3.7.4. Strategy & Business Overview

15.3.7.5. Sales Channel Analysis

15.3.7.6. Product Portfolio & Pricing

15.3.8. Inspired Beauty Brands

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue (Segmental Revenue)

15.3.8.4. Strategy & Business Overview

15.3.8.5. Sales Channel Analysis

15.3.8.6. Product Portfolio & Pricing

15.3.9. Peter Coppola

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue (Segmental Revenue)

15.3.9.4. Strategy & Business Overview

15.3.9.5. Sales Channel Analysis

15.3.9.6. Product Portfolio & Pricing

15.3.10. Everest NeoCell LLC

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue (Segmental Revenue)

15.3.10.4. Strategy & Business Overview

15.3.10.5. Sales Channel Analysis

15.3.10.6. Product Portfolio & Pricing

15.3.11. Johnson & Johnson

15.3.11.1. Company Overview

15.3.11.2. Sales Area/Geographical Presence

15.3.11.3. Financial/Revenue (Segmental Revenue)

15.3.11.4. Strategy & Business Overview

15.3.11.5. Sales Channel Analysis

15.3.11.6. Product Portfolio & Pricing

16. Key Takeaway

16.1. Identification of Potential Market Spaces

16.1.1. Product Type

16.1.2. Keratin Form

16.1.3. Keratin Source

16.1.4. Price

16.1.5. Consumer Group

16.1.6. Distribution Channel

16.1.7. Geography

16.2. Understanding Buying Process of Customers

16.3. Prevailing Market Risks

16.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Keratin Products Market Volume Size & Forecast, by Product Type (Thousand Units)

Table 2: North America Keratin Products Market Value Size & Forecast, by Product Type (US$ Mn)

Table 3: North America Keratin Products Market Volume Size & Forecast, by Keratin Form (Thousand Units)

Table 4: North America Keratin Products Market Value Size & Forecast, by Keratin Form (US$ Mn)

Table 5: North America Keratin Products Market Volume Size & Forecast, by Keratin Source (Thousand Units)

Table 6: North America Keratin Products Market Value Size & Forecast, by Keratin Source (US$ Mn)

Table 7: North America Keratin Products Market Volume Size & Forecast, by Price (Thousand Units)

Table 8: North America Keratin Products Market Value Size & Forecast, by Price (US$ Mn)

Table 9: North America Keratin Products Market Volume Size & Forecast, by Consumer Group (Thousand Units)

Table 10: North America Keratin Products Market Value Size & Forecast, by Consumer Group (US$ Mn)

Table 11: North America Keratin Products Market Volume Size & Forecast, by Distribution Channel (Thousand Units)

Table 12: North America Keratin Products Market Value Size & Forecast, by Distribution Channel (US$ Mn)

Table 13: North America Keratin Products Market Volume Size & Forecast, by Country (Thousand Units)

Table 14: North America Keratin Products Market Value Size & Forecast, by Country (US$ Mn)

Table 15: U.S. Keratin Products Market Volume Size & Forecast, by Product Type (Thousand Units)

Table 16: U.S. Keratin Products Market Value Size & Forecast, by Product Type (US$ Mn)

Table 17: U.S. Keratin Products Market Volume Size & Forecast, by Keratin Form (Thousand Units)

Table 18: U.S. Keratin Products Market Value Size & Forecast, by Keratin Form (US$ Mn)

Table 19: U.S. Keratin Products Market Volume Size & Forecast, by Keratin Source (Thousand Units)

Table 20: U.S. Keratin Products Market Value Size & Forecast, by Keratin Source (US$ Mn)

Table 21: U.S. Keratin Products Market Volume Size & Forecast, by Price (Thousand Units)

Table 22: U.S. Keratin Products Market Value Size & Forecast, by Price (US$ Mn)

Table 23: U.S. Keratin Products Market Volume Size & Forecast, by Consumer Group (Thousand Units)

Table 24: U.S. Keratin Products Market Value Size & Forecast, by Consumer Group (US$ Mn)

Table 25: U.S. Keratin Products Market Volume Size & Forecast, by Distribution Channel (Thousand Units)

Table 26: U.S. Keratin Products Market Value Size & Forecast, by Distribution Channel (US$ Mn)

Table 27: Canada Keratin Products Market Volume Size & Forecast, by Product Type (Thousand Units)

Table 28: Canada Keratin Products Market Value Size & Forecast, by Product Type (US$ Mn)

Table 29: Canada Keratin Products Market Volume Size & Forecast, by Keratin Form (Thousand Units)

Table 30: Canada Keratin Products Market Value Size & Forecast, by Keratin Form (US$ Mn)

Table 31: Canada Keratin Products Market Volume Size & Forecast, by Keratin Source (Thousand Units)

Table 32: Canada Keratin Products Market Value Size & Forecast, by Keratin Source (US$ Mn)

Table 33: Canada Keratin Products Market Volume Size & Forecast, by Price (Thousand Units)

Table 34: Canada Keratin Products Market Value Size & Forecast, by Price (US$ Mn)

Table 35: Canada Keratin Products Market Volume Size & Forecast, by Consumer Group (Thousand Units)

Table 36: Canada Keratin Products Market Value Size & Forecast, by Consumer Group (US$ Mn)

Table 37: Canada Keratin Products Market Volume Size & Forecast, by Distribution Channel (Thousand Units)

Table 38: Canada Keratin Products Market Value Size & Forecast, by Distribution Channel (US$ Mn)

List of Figures

Figure 1: North America Keratin Products Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 2: North America Keratin Products Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 3: North America Keratin Products Market, Incremental Opportunity, by product type, US$ Mn

Figure 4: North America Keratin Products Market Projection, by Keratin Form, Thousand Units, 2017-2031

Figure 5: North America Keratin Products Market Projection, by Keratin Form, US$ Mn, 2017-2031

Figure 6: North America Keratin Products Market, Incremental Opportunity, by Keratin Form, US$ Mn

Figure 7: North America Keratin Products Market Projection, by Keratin Source, Thousand Units, 2017-2031

Figure 8: North America Keratin Products Market Projection, by Keratin Source, US$ Mn, 2017-2031

Figure 9: North America Keratin Products Market, Incremental Opportunity, by Keratin Source, US$ Mn

Figure 10: North America Keratin Products Market Projection, by Price, Thousand Units, 2017-2031

Figure 11: North America Keratin Products Market Projection, by Price, US$ Mn, 2017-2031

Figure 12: North America Keratin Products Market, Incremental Opportunity, by Price, US$ Mn

Figure 13: North America Keratin Products Market Projection, by Consumer Group, Thousand Units, 2017-2031

Figure 14: North America Keratin Products Market Projection, by Consumer Group, US$ Mn, 2017-2031

Figure 15: North America Keratin Products Market, Incremental Opportunity, by Consumer Group, US$ Mn

Figure 16: North America Keratin Products Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 17: North America Keratin Products Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 18: North America Keratin Products Market, Incremental Opportunity, by Distribution Channel, US$ Mn

Figure 19: North America Keratin Products Market Projection, by Country, Thousand Units, 2017-2031

Figure 20: North America Keratin Products Market Projection, by Country, US$ Mn, 2017-2031

Figure 21: North America Keratin Products Market, Incremental Opportunity, by Country, US$ Mn

Figure 22: U.S. Keratin Products Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 23: U.S. Keratin Products Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 24: U.S. Keratin Products Market, Incremental Opportunity, by product type, US$ Mn

Figure 25: U.S. Keratin Products Market Projection, by Keratin Form, Thousand Units, 2017-2031

Figure 26: U.S. Keratin Products Market Projection, by Keratin Form, US$ Mn, 2017-2031

Figure 27: U.S. Keratin Products Market, Incremental Opportunity, by Keratin Form, US$ Mn

Figure 28: U.S. Keratin Products Market Projection, by Keratin Source, Thousand Units, 2017-2031

Figure 29: U.S. Keratin Products Market Projection, by Keratin Source, US$ Mn, 2017-2031

Figure 30: U.S. Keratin Products Market, Incremental Opportunity, by Keratin Source, US$ Mn

Figure 31: U.S. Keratin Products Market Projection, by Price, Thousand Units, 2017-2031

Figure 32: U.S. Keratin Products Market Projection, by Price, US$ Mn, 2017-2031

Figure 33: U.S. Keratin Products Market, Incremental Opportunity, by Price, US$ Mn

Figure 34: U.S. Keratin Products Market Projection, by Consumer Group, Thousand Units, 2017-2031

Figure 35: U.S. Keratin Products Market Projection, by Consumer Group, US$ Mn, 2017-2031

Figure 36: U.S. Keratin Products Market, Incremental Opportunity, by Consumer Group, US$ Mn

Figure 37: U.S. Keratin Products Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 38: U.S. Keratin Products Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 39: U.S. Keratin Products Market, Incremental Opportunity, by Distribution Channel, US$ Mn

Figure 40: Canada Keratin Products Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 41: Canada Keratin Products Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 42: Canada Keratin Products Market, Incremental Opportunity, by product type, US$ Mn

Figure 43: Canada Keratin Products Market Projection, by Keratin Form, Thousand Units, 2017-2031

Figure 44: Canada Keratin Products Market Projection, by Keratin Form, US$ Mn, 2017-2031

Figure 45: Canada Keratin Products Market, Incremental Opportunity, by Keratin Form, US$ Mn

Figure 46: Canada Keratin Products Market Projection, by Keratin Source, Thousand Units, 2017-2031

Figure 47: Canada Keratin Products Market Projection, by Keratin Source, US$ Mn, 2017-2031

Figure 48: Canada Keratin Products Market, Incremental Opportunity, by Keratin Source, US$ Mn

Figure 49: Canada Keratin Products Market Projection, by Price, Thousand Units, 2017-2031

Figure 50: Canada Keratin Products Market Projection, by Price, US$ Mn, 2017-2031

Figure 51: Canada Keratin Products Market, Incremental Opportunity, by Price, US$ Mn

Figure 52: Canada Keratin Products Market Projection, by Consumer Group, Thousand Units, 2017-2031

Figure 53: Canada Keratin Products Market Projection, by Consumer Group, US$ Mn, 2017-2031

Figure 54: Canada Keratin Products Market, Incremental Opportunity, by Consumer Group, US$ Mn

Figure 55: Canada Keratin Products Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Canada Keratin Products Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 57: Canada Keratin Products Market, Incremental Opportunity, by Distribution Channel, US$ Mn