Reports

Reports

Analysts’ Viewpoint

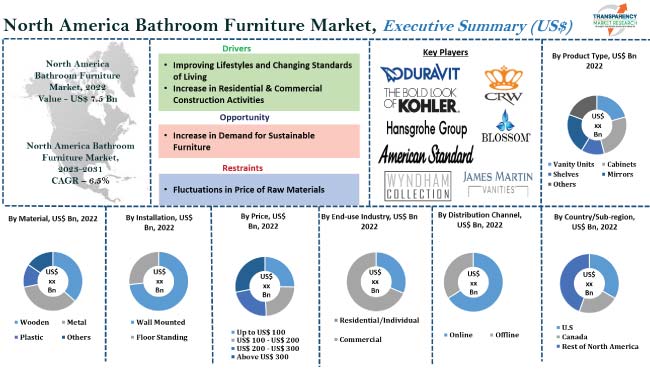

Rapid growth in urbanization, rise in number of residential construction activities, and increase in consumer preference for modular bathroom furniture are expected to drive the bathroom furniture market in North America during the forecast period. Surge in demand for customization options in bathroom furniture and environmentally friendly products are propelling market development.

Rise in disposable income and increase in living standards of consumers is likely to offer lucrative opportunities for manufacturers in North America. Companies are focusing on launch of innovative bathroom furniture with new designs & customizable options, smart technologies such as Bluetooth speakers, socket & interior lighting with a motion sensor, and mirrors with LED lights.

Bathroom furniture refers to a number of pieces used to decorate and furnish a bathroom. These pieces could include vanities, cabinets, shelves, shower curtains, towel racks, and other items that are designed to improve the functionality and appearance of a bathroom. Bathroom vanities are often the centerpiece of a bathroom, and come in different sizes and styles to fit various spaces and personal preference. These could have sinks, countertops, and storage areas for towels, toiletries, and other items.

Modern wall mounted bathroom cabinets are another important type of bathroom furniture, as these provide additional storage space for items such as towels, washcloths, and personal care products. Home Depot bathroom wall cabinets can be wall-mounted, freestanding, or integrated into a vanity. In addition to the more functional pieces, there are several restroom decor products that can be used to enhance the appearance of a bathroom, such as shower curtains, artwork, and rugs.

Increase in spending capacity has improved the standard of living of consumers in the U.S. They are looking for more aesthetic and modern home interiors, which has led to surge in spending on bath furnishings. According to the U.S. Bureau of Economic Analysis, in 2023, personal income increased to US$ 131.1 Bn (0.6%) in January, disposable personal income (DPI) surged to US$ 387.4 billion (2.0%), and personal consumption expenditure (PCE) increased to US$ 312.5 Bn (1.8%).

Consumers in the U.S. expect more from a modern bathroom than a utilitarian suite. Bathroom is now considered a place to relax and linger. Hence, aesthetics has become equally important to consumers. This factor is expected to drive demand for bathroom furniture during the forecast period. Bathroom furniture acts as a space-saving option and gives a visually appealing look to the bathrooms. Bathroom furniture such as vanities and consoles are designed to save as much space as possible. Moreover, rise in hygiene consciousness is expected to propel demand for bathroom furniture as well as bath hardware products. Rise in consumer demand for high quality bathroom furniture is expected to augment North America bathroom furniture business growth during the forecast period.

Rapid urbanization has led to increase in demand for residential and commercial infrastructure. Surge in population and rise in disposable income have fueled the construction sector in the past few years. The bathroom furniture market in North America is anticipated to be driven by new construction of residential and commercial spaces. Growth in trend toward home modernization and renovation in the U.S. has led to increased installation and usage of various bathroom furniture.

Massive migration toward cities, increase in population, and rise in middle class income across the U.S. are creating significant demand for real estate. This is projected to bolster market progress in the U.S. According to a latest study by Harvard Joint Center for Housing Studies in 2022, consumer spending in home repair and renovation activities is expected to rise in the next few years.

In terms of product type, the mirrors segment accounted for largest North America bathroom furniture market share in 2022. The cabinets segment is expected to expand at the fastest CAGR during the forecast period. Rise in demand for multi-purpose wall-mounted bathroom cabinets is expected propel the cabinets segment.

Bathroom vanities offer the added benefit of making the entire bathroom wall storage space much easier. The need for bathroom vanities is increasing due to surge in consumer demand for modern amenities such as specialty counters with sinks. Rise in demand for more functional furniture units is expected to promote the installation of specialized countertops such as large wall mounted bathroom cabinets and mirror.

In terms of country, the U.S. accounted for major share of North America bathroom furniture market size in 2022. The market in the country is expected to grow at a rapid pace during the forecast period. The market in the U.S. is driven by rise in standard of living, sustainable income of consumers, and increase in investment in modern furniture with advanced features.

Detailed profiles of companies in North America bathroom furniture market report are provided to evaluate their financials, key product offerings, recent developments, and strategies. Majority of companies are investing significantly in R&D activities, primarily to develop innovative products. Expansion of product portfolio and merger & acquisition are the key strategies adopted by manufacturers in the bathroom furniture market in North America. Companies operating in the market are American Standards, Apollo, COSO, CRW Bathrooms, Duravit, Hansgrohe, Kohler, Moen, ROCA, Britton Bathrooms, VitrA, Wyndham Collection, and TOTO.

Each of these players has been profiled in North America bathroom furniture industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 (Base Year) |

US$ 7.5 Bn |

|

Forecast (Value) in 2031 |

US$ 13.1 Bn |

|

Growth Rate (CAGR) |

6.5% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, qualitative analysis at the country level includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

North America Bathroom Furniture Market Prominent Players – Competition Dashboard and Revenue Share Analysis 2022 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

|

Countries/Sub-region Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The industry in the region was valued at US$ 7.5 Bn in 2022

It is projected to reach US$ 13.1 Bn by 2031.

Improving lifestyles & changing standards of living and increase in residential & commercial construction activities

The mirrors segment accounted for leading share in 2022

The U.S. captured 80% share of the bathroom furniture market in North America in 2022.

American Standards, Apollo, COSO, CRW Bathrooms, Duravit, Hansgrohe, Kohler, Moen, ROCA, TOTO, VitrA, James Martin, and Wyndham Collection.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Raw Material Analysis

5.8. Brand Analysis

5.9. Key Trend Analysis

5.9.1. Demand Side

5.9.2. Supply Side

5.10. Price Trend Analysis

5.10.1. Weighted Average Selling Price (US$)

5.11. Consumer Buying Behavior Analysis

5.12. North America Bathroom Furniture Market Analysis and Forecast, 2017–2031

5.12.1. Market Value Projections (US$ Mn)

5.12.2. Market Volume Projections (Thousand Units)

6. North America Bathroom Furniture Market Analysis and Forecast, by Product Type

6.1. Bathroom Furniture Market Size (US$ Mn and Million Units), by Product Type, 2017 – 2031

6.1.1. Vanity Units

6.1.2. Cabinets

6.1.3. Shelfs

6.1.4. Mirrors

6.1.5. Others

6.2. Incremental Opportunity, by Product Type

7. North America Bathroom Furniture Market Analysis and Forecast, by Material

7.1. Bathroom Furniture Market Size (US$ Mn and Million Units), by Material, 2017–2031

7.1.1. Wooden

7.1.2. Metal

7.1.3. Plastic

7.1.4. Others

7.2. Incremental Opportunity, by Material

8. North America Bathroom Furniture Market Analysis and Forecast, by Installation

8.1. Bathroom Furniture Market Size (US$ Mn and Million Units), by Installation, 2017–2031

8.1.1. Wall Mounted

8.1.2. Floor Standing

8.2. Incremental Opportunity, by Installation

9. North America Bathroom Furniture Market Analysis and Forecast, by Price

9.1. Bathroom Furniture Market Size (US$ Mn and Million Units), by Price, 2017–2031

9.1.1. Up to US$ 100

9.1.2. US$ 100 - US$ 200

9.1.3. US$ 201 - US$ 300

9.1.4. Above US$ 300

9.2. Incremental Opportunity, by Price

10. North America Bathroom Furniture Market Analysis and Forecast, by End-use Industry

10.1. Bathroom Furniture Market Size (US$ Mn and Million Units), by End-use Industry, 2017–2031

10.1.1. Residential

10.1.2. Commercial

10.1.2.1. Hotels & Restaurants

10.1.2.2. Workplace

10.1.2.3. Others

10.2. Incremental Opportunity, by End-use Industry

11. North America Bathroom Furniture Market Analysis and Forecast, by Distribution Channel

11.1. Bathroom Furniture Market Size (US$ Mn and Million Units), by Distribution Channel, 2017–2031

11.1.1. Online

11.1.1.1. E-Commerce Websites

11.1.1.2. Company-Owned Websites

11.1.2. Offline

11.1.2.1. Hypermarkets & Supermarkets

11.1.2.2. Specialty Stores

11.1.2.3. Other Retail Stores

11.2. Incremental Opportunity, by Distribution Channel

12. North America Bathroom Furniture Market Analysis and Forecast, by Country/Sub-region

12.1. Bathroom Furniture Market Size (US$ Mn and Million Units), by Country/Sub-region, 2017–2031

12.1.1. U.S

12.1.2. Canada

12.1.3. Rest of North America

12.2. Incremental Opportunity, by Country/Sub-region

13. U.S. Bathroom Furniture Market Analysis and Forecast

13.1. Country Snapshot

13.2. Demographic Overview

13.3. Consumer Buying Behavior

13.4. Brand Analysis

13.5. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Product Type, 2017–2031

13.5.1. Vanity Units

13.5.2. Cabinets

13.5.3. Shelf

13.5.4. Mirrors

13.5.5. Others

13.6. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Material, 2017–2031

13.6.1. Wooden

13.6.2. Metal

13.6.3. Plastic

13.6.4. Others

13.7. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Installation, 2017–2031

13.7.1. Wall Mounted

13.7.2. Floor Standing

13.8. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Price, 2017–2031

13.8.1. Up to US$ 100

13.8.2. US$ 100 - US$ 200

13.8.3. US$ 200 - US$ 300

13.8.4. Above US$ 300

13.9. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by End-use Industry, 2017–2031

13.9.1. Residential

13.9.2. Commercial

13.9.2.1. Hotels & Restaurants

13.9.2.2. Workplace

13.9.2.3. Others

13.10. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017–2031

13.10.1. Online

13.10.1.1. E-Commerce Websites

13.10.1.2. Company Owned Websites

13.10.2. Offline

13.10.2.1. Hyper Market/Super Market

13.10.2.2. Specialty Stores

13.10.2.3. Other Retail Stores

13.11. Incremental Opportunity Analysis

14. Canada Bathroom Furniture Market Analysis and Forecast

14.1. Country Snapshot

14.2. Demographic Overview

14.3. Consumer Buying Behavior

14.4. Brand Analysis

14.5. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Product Type, 2017–2031

14.5.1. Vanity Units

14.5.2. Cabinets

14.5.3. Shelf

14.5.4. Mirrors

14.5.5. Others

14.6. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Material, 2017–2031

14.6.1. Wooden

14.6.2. Metal

14.6.3. Plastic

14.6.4. Others

14.7. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Installation, 2017–2031

14.7.1. Wall Mounted

14.7.2. Floor Standing

14.8. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Price, 2017–2031

14.8.1. Up to US$ 100

14.8.2. US$ 100 - US$ 200

14.8.3. US$ 200 - US$ 300

14.8.4. Above US$ 300

14.9. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by End-use Industry, 2017–2031

14.9.1. Residential

14.9.2. Commercial

14.9.2.1. Hotels & Restaurants

14.9.2.2. Workplace

14.9.2.3. Others

14.10. Bathroom Furniture Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017–2031

14.10.1. Online

14.10.1.1. E-Commerce Websites

14.10.1.2. Company Owned Websites

14.10.2. Offline

14.10.2.1. Hyper Market/Super Market

14.10.2.2. Specialty Stores

14.10.2.3. Other Retail Stores

14.11. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis-2022 (%)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, , Product Portfolio & Pricing)

15.3.1. American Standards

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue (Segmental Revenue)

15.3.1.4. Strategy & Business Overview

15.3.1.5. Product Portfolio & Pricing

15.3.2. Apollo

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue (Segmental Revenue)

15.3.2.4. Strategy & Business Overview

15.3.2.5. Product Portfolio & Pricing

15.3.3. COSO

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue (Segmental Revenue)

15.3.3.4. Strategy & Business Overview

15.3.3.5. Product Portfolio & Pricing

15.3.4. CRW Bathrooms

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue (Segmental Revenue)

15.3.4.4. Strategy & Business Overview

15.3.4.5. Product Portfolio & Pricing

15.3.5. Duravit

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue (Segmental Revenue)

15.3.5.4. Strategy & Business Overview

15.3.5.5. Product Portfolio & Pricing

15.3.6. Hansgrohe

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue (Segmental Revenue)

15.3.6.4. Strategy & Business Overview

15.3.6.5. Product Portfolio & Pricing

15.3.7. Kohler

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue (Segmental Revenue)

15.3.7.4. Strategy & Business Overview

15.3.7.5. Product Portfolio & Pricing

15.3.8. Moen

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue (Segmental Revenue)

15.3.8.4. Strategy & Business Overview

15.3.8.5. Product Portfolio & Pricing

15.3.9. ROCA

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue (Segmental Revenue)

15.3.9.4. Strategy & Business Overview

15.3.9.5. Product Portfolio & Pricing

15.3.10. TOTO

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue (Segmental Revenue)

15.3.10.4. Strategy & Business Overview

15.3.10.5. Product Portfolio & Pricing

15.3.11. VitrA

15.3.11.1. Company Overview

15.3.11.2. Sales Area/Geographical Presence

15.3.11.3. Financial/Revenue (Segmental Revenue)

15.3.11.4. Strategy & Business Overview

15.3.11.5. Product Portfolio & Pricing

15.3.12. James Martin

15.3.12.1. Company Overview

15.3.12.2. Sales Area/Geographical Presence

15.3.12.3. Financial/Revenue (Segmental Revenue)

15.3.12.4. Strategy & Business Overview

15.3.12.5. Product Portfolio & Pricing

15.3.13. Wyndham Collection

15.3.13.1. Company Overview

15.3.13.2. Sales Area/Geographical Presence

15.3.13.3. Financial/Revenue (Segmental Revenue)

15.3.13.4. Strategy & Business Overview

15.3.13.5. Product Portfolio & Pricing

16. Key Takeaway

16.1. Identification of Potential Market Spaces

16.1.1. Product Type

16.1.2. Material

16.1.3. Installation

16.1.4. Price

16.1.5. End-use Industry

16.1.6. Distribution Channel

16.1.7. Country/Sub-region

16.2. Understanding the Buying Process of the Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Bathroom Furniture Market Value, by Product Type, US$ Bn, 2017-2031

Table 2: North America Bathroom Furniture Market Volume, by Product Type, Thousand Units, 2017-2031

Table 3: North America Bathroom Furniture Market Value, by Material, US$ Bn, 2017-2031

Table 4: North America Bathroom Furniture Market Volume, by Material, Thousand Units, 2017-2031

Table 5: North America Bathroom Furniture Market Value, by Installation, US$ Bn, 2017-2031

Table 6: North America Bathroom Furniture Market Volume, by Installation, Thousand Units, 2017-2031

Table 7: North America Bathroom Furniture Market Value, by Price, US$ Bn, 2017-2031

Table 8: North America Bathroom Furniture Market Volume, by Price, Thousand Units, 2017-2031

Table 9: North America Bathroom Furniture Market Value, by End-use Industry, US$ Bn, 2017-2031

Table 10: North America Bathroom Furniture Market Volume, by End-use Industry, Thousand Units, 2017-2031

Table 11: North America Bathroom Furniture Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 12: North America Bathroom Furniture Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 13: North America Bathroom Furniture Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Table 14: North America Bathroom Furniture Market Volume, by Country/Sub-region, Thousand Units, 2017-2031

Table 15: U.S. Bathroom Furniture Market Value, by Product Type, US$ Bn, 2017-2031

Table 16: U.S. Bathroom Furniture Market Volume, by Product Type, Thousand Units, 2017-2031

Table 17: U.S. Bathroom Furniture Market Value, by Material, US$ Bn, 2017-2031

Table 18: U.S. Bathroom Furniture Market Volume, by Material, Thousand Units, 2017-2031

Table 19: U.S. Bathroom Furniture Market Value, by Installation, US$ Bn, 2017-2031

Table 20: U.S. Bathroom Furniture Market Volume, by Installation, Thousand Units, 2017-2031

Table 21: U.S. Bathroom Furniture Market Value, by Price, US$ Bn, 2017-2031

Table 22: U.S. Bathroom Furniture Market Volume, by Price, Thousand Units, 2017-2031

Table 23: U.S. Bathroom Furniture Market Value, by End-use Industry, US$ Bn, 2017-2031

Table 24: U.S. Bathroom Furniture Market Volume, by End-use Industry, Thousand Units, 2017-2031

Table 25: U.S. Bathroom Furniture Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 26: U.S. Bathroom Furniture Market Volume, by Distribution Channel, Thousand Units, 2017-2031

Table 27: Canada Bathroom Furniture Market Value, by Product Type, US$ Bn, 2017-2031

Table 28: Canada Bathroom Furniture Market Volume, by Product Type, Thousand Units, 2017-2031

Table 29: Canada Bathroom Furniture Market Value, by Material, US$ Bn, 2017-2031

Table 30: Canada Bathroom Furniture Market Volume, by Material, Thousand Units, 2017-2031

Table 31: Canada Bathroom Furniture Market Value, by Installation, US$ Bn, 2017-2031

Table 32: Canada Bathroom Furniture Market Volume, by Installation, Thousand Units, 2017-2031

Table 33: Canada Bathroom Furniture Market Value, by Price, US$ Bn, 2017-2031

Table 34: Canada Bathroom Furniture Market Volume, by Price, Thousand Units, 2017-2031

Table 35: Canada Bathroom Furniture Market Value, by End-use Industry, US$ Bn, 2017-2031

Table 36: Canada Bathroom Furniture Market Volume, by End-use Industry, Thousand Units, 2017-2031

Table 37: Canada Bathroom Furniture Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 38: Canada Bathroom Furniture Market Volume, by Distribution Channel, Thousand Units, 2017-2031

List of Figures

Figure 1: North America Bathroom Furniture Market Value, by Product Type, US$ Bn, 2017-2031

Figure 2: North America Bathroom Furniture Market Volume, by Product Type, Thousand Units,2017-2031

Figure 3: North America Bathroom Furniture Market Incremental Opportunity, by Product Type, 2021-2031

Figure 4: North America Bathroom Furniture Market Value, by Material, US$ Bn, 2017-2031

Figure 5: North America Bathroom Furniture Market Volume, by Material, Thousand Units,2017-2031

Figure 6: North America Bathroom Furniture Market Incremental Opportunity, by Material, 2021-2031

Figure 7: North America Bathroom Furniture Market Value, by Installation, US$ Bn, 2017-2031

Figure 8: North America Bathroom Furniture Market Volume, by Installation, Thousand Units,2017-2031

Figure 9: North America Bathroom Furniture Market Incremental Opportunity, by Installation, 2021-2031

Figure 10: North America Bathroom Furniture Market Value, by Price, US$ Bn, 2017-2031

Figure 11: North America Bathroom Furniture Market Volume, by Price, Thousand Units,2017-2031

Figure 12: North America Bathroom Furniture Market Incremental Opportunity, by Price, 2021-2031

Figure 13: North America Bathroom Furniture Market Value, by End-use Industry, US$ Bn, 2017-2031

Figure 14: North America Bathroom Furniture Market Volume, by End-use Industry, Thousand Units,2017-2031

Figure 15: North America Bathroom Furniture Market Incremental Opportunity, by End-use Industry, 2021-2031

Figure 16: North America Bathroom Furniture Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 17: North America Bathroom Furniture Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 18: North America Bathroom Furniture Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 19: North America Bathroom Furniture Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Figure 20: North America Bathroom Furniture Market Volume, by Country/Sub-region, Thousand Units,2017-2031

Figure 21: North America Bathroom Furniture Market Incremental Opportunity, by Country/Sub-region, 2021-2031

Figure 22: U.S. Bathroom Furniture Market Value, by Product Type, US$ Bn, 2017-2031

Figure 23: U.S. Bathroom Furniture Market Volume, by Product Type, Thousand Units,2017-2031

Figure 24: U.S. Bathroom Furniture Market Incremental Opportunity, by Product Type, 2021-2031

Figure 25: U.S. Bathroom Furniture Market Value, by Material, US$ Bn, 2017-2031

Figure 26: U.S. Bathroom Furniture Market Volume, by Material, Thousand Units,2017-2031

Figure 27: U.S. Bathroom Furniture Market Incremental Opportunity, by Material, 2021-2031

Figure 28: U.S. Bathroom Furniture Market Value, by Installation, US$ Bn, 2017-2031

Figure 29: U.S. Bathroom Furniture Market Volume, by Installation, Thousand Units,2017-2031

Figure 30: U.S. Bathroom Furniture Market Incremental Opportunity, by Installation, 2021-2031

Figure 31: U.S. Bathroom Furniture Market Value, by Price, US$ Bn, 2017-2031

Figure 32: U.S. Bathroom Furniture Market Volume, by Price, Thousand Units,2017-2031

Figure 33: U.S. Bathroom Furniture Market Incremental Opportunity, by Price, 2021-2031

Figure 34: U.S. Bathroom Furniture Market Value, by End-use Industry, US$ Bn, 2017-2031

Figure 35: U.S. Bathroom Furniture Market Volume, by End-use Industry, Thousand Units,2017-2031

Figure 36: U.S. Bathroom Furniture Market Incremental Opportunity, by End-use Industry, 2021-2031

Figure 37: U.S. Bathroom Furniture Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 38: U.S. Bathroom Furniture Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 39: U.S. Bathroom Furniture Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 40: Canada Bathroom Furniture Market Value, by Product Type, US$ Bn, 2017-2031

Figure 41: Canada Bathroom Furniture Market Volume, by Product Type, Thousand Units,2017-2031

Figure 42: Canada Bathroom Furniture Market Incremental Opportunity, by Product Type, 2021-2031

Figure 43: Canada Bathroom Furniture Market Value, by Material, US$ Bn, 2017-2031

Figure 44: Canada Bathroom Furniture Market Volume, by Material, Thousand Units,2017-2031

Figure 45: Canada Bathroom Furniture Market Incremental Opportunity, by Material, 2021-2031

Figure 46: Canada Bathroom Furniture Market Value, by Installation, US$ Bn, 2017-2031

Figure 47: Canada Bathroom Furniture Market Volume, by Installation, Thousand Units,2017-2031

Figure 48: Canada Bathroom Furniture Market Incremental Opportunity, by Installation, 2021-2031

Figure 49: Canada Bathroom Furniture Market Value, by Price, US$ Bn, 2017-2031

Figure 50: Canada Bathroom Furniture Market Volume, by Price, Thousand Units,2017-2031

Figure 51: Canada Bathroom Furniture Market Incremental Opportunity, by Price, 2021-2031

Figure 52: Canada Bathroom Furniture Market Value, by End-use Industry, US$ Bn, 2017-2031

Figure 53: Canada Bathroom Furniture Market Volume, by End-use Industry, Thousand Units,2017-2031

Figure 54: Canada Bathroom Furniture Market Incremental Opportunity, by End-use Industry, 2021-2031

Figure 55: Canada Bathroom Furniture Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 56: Canada Bathroom Furniture Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 57: Canada Bathroom Furniture Market Incremental Opportunity, by Distribution Channel, 2021-2031