Reports

Reports

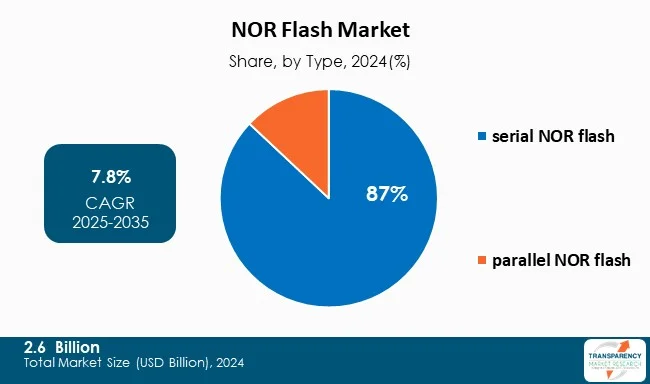

The global NOR Flash Market size was valued at US$ 2.6 Bn in 2024 and is projected to reach US$ 11.5 Bn by 2035, expanding at a CAGR of 7.8% from 2025 to 2035. The market growth is driven by rising demand in automotive electronics, technological advancements in serial nor and high-density solutions.

The NOR Flash market is seeing a steady streak of growth due to strong demand for reliable, fast-boot, and code execution memory in various embedded system environments. The long-term growth of the market is correlated to the number of devices that rely on stable firmware storage instead of large-capacity data storage. Designers will continue to choose NOR Flash for their designs, as the reliability and instant-on performance combined with endurance and data integrity are important.

The automotive electronics sector is driving the majority of growth in this market. Modern automotive electronics, such as safety modules, digital dashboards, advanced driver assistance system (ADAS) controllers, and electric vehicle (EV) power systems, increasingly depend on predictable boot time and reliability in harsh environments. In contrast to many alternatives, NOR Flash offers these properties.

The NOR Flash sector is an important part of the larger non-volatile memory market, and is increasing in size as the need for reliable, fast, and high endurance memory solutions is increasing across a variety of electronic applications. NOR Flash is especially important for applications that need code storage and frequent reading of code as it provides fast random read performance, long retention time of stored data and high reliability. Examples include automotive electronic systems, industrial systems, consumer electronics, medical devices, and IoT solutions.

With the growth of connected and intelligent devices, NOR Flash's ability to tolerate extreme operating conditions and maintain excellent performance has led to even greater demand for this type of memory. Increased development of automotive advanced driver assistance systems (ADAS), smart factory solutions, and edge-computing systems also create a need for high-performance memory solutions, further driving the growth of the NOR Flash market.

In addition, developing next-generation serial NOR interfaces and the trend toward higher density NOR Flash will drive further growth in the NOR Flash industry due to increased efficiency and reduced power consumption. Although other memory types also offer high reliability, instant-on and stable execution from code remain major differentiators for those who require these characteristics. As a result, NOR Flash is expected to continue to grow due to innovations and developing technologies.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing demand for electronic technologies in cars is likely to cause a considerable increase in the global NOR Flash memory industry. This is the result of the increasing number of cars that are becoming more digital and connected. With the introduction of new systems such as Advanced Driver Assistance Systems (ADAS), Autonomous Driving Systems, Digital Cluster Instrumentation Systems, Telematics, and Infotainment Systems into today's vehicles, there is a demand for reliable, high-performance memory components.

Due to this growing need for robust memory components, the NOR Flash memory family has become ideal for use in the automotive market due to fast booting, high endurance, and excellent data retention qualities necessary for the system's ability to boot quickly, operate safely, and adapt to varying operating conditions.

Automotive electronics are also dependent upon consistent, secure execution of code. NOR Flash is a reliable solution providing stable memory storage for firmware, microcontroller software, and real-time operations. NOR Flash is also very capable of operating under extreme temperature ranges and in challenging environmental conditions that characterize automotive-grade products.

As consumer and business requirements for embedded memory continue to grow, so does the scope of the embedded memory market. Many of these new functionality requirements include support for 3D graphics generation and high levels of programming compatibility. New types of memory have been developed to meet the requirements of these newer technologies. In addition, the advancements in technology have allowed the creation of extremely dense memory solutions, called NOR and NAND Flash Solutions, which can now integrate multiple code sets onto a single chip.

As chip size becomes smaller through Moore's Law, the desire for additional functionality is creating increased demand for all types of memory products. As the density of modern NOR and NAND Flash Solutions enables manufacturers to produce low-cost, mass-market products, many memory products are becoming available at significantly lower prices than comparable products of earlier generations. These new technologies represent a unique opportunity for manufacturers of embedded memory to meet the demand for larger capacity, lower cost products while simultaneously providing a superior value to their customers.

The continued expansion of the embedded memory market is bound to rely heavily on the ability of manufacturers to develop and implement innovative technologies and support materials, as well as their ability to maximize production efficiencies through economies of scale.

Serial NOR Flash with 87% revenues share in 2024, leads the worldwide NOR Flash sector as it offers the best combination of cost-effectiveness, performance, and size. The preference of Serial NOR Flash is due to many applications requiring high-speed reading performance, reliable code storage, and low pin count, most importantly SPI, Serial NOR Flash has gained popularity among the majority of those applications. The simplified interface of Serial NOR Flash decreases the complexity of circuit boards, thus lowering power consumption.

Motor vehicle manufacturers and manufacturers of industrial equipment are beginning to increase their reliance upon Serial NOR Flash for secure boot, firmware storage, and system initialization, being as Serial NOR Flash has a great data retention and endurance. Serial NOR Flash has been continually advancing in technology with higher densities, faster read performance, and increased security. The increasing number of smart devices adds to the growth in the demand for Serial NOR Flash, further confirming Serial NOR Flash as a leading global source for NOR Flash.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific region dominates the NOR Flash market with 63% revenue share in 2024, due to its strong electronics manufacturing ecosystem and extensive supply chain for semiconductors. Economies such as China, Taiwan, South Korea, and Japan house the largest foundries, assembly plants, and OEMs. Therefore, these countries can produce memory components at scale and at low cost.

In addition, the Asia-Pacific region produces many consumer electronic products such as smartphones, smart home devices, wearables, and IoT modules, all of which require NOR Flash for storing firmware and fast booting capabilities. The rise of automotive electronics and industrial automation in developing parts of Asia-Pacific has led to a higher demand for reliable non-volatile memory in that region.

Governments in the Asia-Pacific region are encouraging the development of semiconductors, as evidenced by the increase in the number of fabs being built and the consolidation of global electronic suppliers, which creates a highly competitive technological environment in that area. Asia-Pacific has the highest production volumes, multiple sectors with large volumes of demand, and investment from industries with long-term interests; therefore, it continues to lead in the global market for NOR Flash memory.

Key players operating in the NOR Flash market are investing in strategic partnerships, innovation, and technological advancements. They focus on improving imaging clarity, and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

Infineon Technologies AG, Micron Technology, Inc., GigaDevice Semiconductor (Beijing) Inc., Macronix International Co., Ltd., Winbond Electronics, Toshiba Electronic Devices & Storage Corp., Intel Corporation, SAMSUNG, Renesas Electronics, Seagate Technology LLC, SK HYNIX INC., LAPIS Semiconductor Co., Ltd., Integrated Silicon Solution Inc., Eon Silicon Solution Inc. are some of the leading players operating in the global NOR Flash market.

Each of these players has been profiled in the NOR Flash market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 2.6 Bn |

| Forecast Value in 2035 | US$ 11.5 Bn |

| CAGR | 7.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Solar EPC [Engineering, Procurement, and Construction] Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The NOR Flash market was valued at US$ 2.6 Bn in 2024

The NOR Flash market is projected to reach US$ 11.5 Bn by the end of 2035

Rising demand in automotive electronics, technological advancements in serial nor and high-density solutions are some of the driving factor of NOR flash market.

The CAGR is anticipated to be 7.8% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Infineon Technologies AG, Micron Technology, Inc., GigaDevice Semiconductor (Beijing) Inc., Macronix International Co., Ltd., Winbond Electronics, Toshiba Electronic Devices & Storage Corp., Intel Corporation, SAMSUNG, Renesas Electronics, Seagate Technology LLC, SK HYNIX INC., LAPIS Semiconductor Co., Ltd., Integrated Silicon Solution Inc., Eon Silicon Solution Inc., and others.

Table 01: Global NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 02: Global NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 03: Global NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 04: Global NOR Flash Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 05: North America NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 06: North America NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 07: North America NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 08: North America NOR Flash Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 09: U.S. NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 10: U.S. NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 11: U.S. NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 12: Canada NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 13: Canada NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 14: Canada NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 15: Europe NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 16: Europe NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 17: Europe NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 18: Europe NOR Flash Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 19: Germany NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 20: Germany NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 21: Germany NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 22: U.K. NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 23: U.K. NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 24: U.K. NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 25: France NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 26: France NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 27: France NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 28: Italy NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 29: Italy NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 30: Italy NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 31: Spain NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 32: Spain NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 33: Spain NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 34: Switzerland NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 35: Switzerland NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 36: Switzerland NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 37: The Netherlands NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 38: The Netherlands NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 39: The Netherlands NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 40: Rest of Europe NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 41: Rest of Europe NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 42: Rest of Europe NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 43: Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 44: Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 45: Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 46: Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 47: China NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 48: China NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 49: China NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 50: Japan NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 51: Japan NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 52: Japan NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 53: India NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 54: India NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 55: India NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 56: South Korea NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 57: South Korea NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 58: South Korea NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 59: Australia and New Zealand NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 60: Australia and New Zealand NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 61: Australia and New Zealand NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 62: Rest of Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 63: Rest of Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 64: Rest of Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 65: Latin America NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 66: Latin America NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 67: Latin America NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 68: Latin America NOR Flash Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 69: Brazil NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 70: Brazil NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 71: Brazil NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 72: Mexico NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 73: Mexico NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 74: Mexico NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 75: Argentina NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 76: Argentina NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 77: Argentina NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 78: Rest of Latin America NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 79: Rest of Latin America NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 80: Rest of Latin America NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 81: Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 82: Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 83: Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 84: Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 85: GCC Countries NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 86: GCC Countries NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 87: GCC Countries NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 88: South Africa NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 89: South Africa NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 90: South Africa NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 91: Rest of Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 92: Rest of Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, by Density, 2020 to 2035

Table 93: Rest of Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Figure 01: Global NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 03: Global NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 04: Global NOR Flash Market Revenue (US$ Bn), by serial NOR flash, 2020 to 2035

Figure 05: Global NOR Flash Market Revenue (US$ Bn), by parallel NOR flash, 2020 to 2035

Figure 06: Global NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 07: Global NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 08: Global NOR Flash Market Revenue (US$ Bn), by 1 Mb to 16 Mb, 2020 to 2035

Figure 09: Global NOR Flash Market Revenue (US$ Bn), by 32 Mb to 128 Mb, 2020 to 2035

Figure 10: Global NOR Flash Market Revenue (US$ Bn), by 256 Mb and Above, 2020 to 2035

Figure 11: Global NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 12: Global NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 13: Global NOR Flash Market Revenue (US$ Bn), by IT and Telecommunication, 2020 to 2035

Figure 14: Global NOR Flash Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 15: Global NOR Flash Market Revenue (US$ Bn), by Defense and aerospace, 2020 to 2035

Figure 16: Global NOR Flash Market Revenue (US$ Bn), by Consumer electronics, 2020 to 2035

Figure 17: Global NOR Flash Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global NOR Flash Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 19: Global NOR Flash Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 20: North America NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: North America NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 22: North America NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 23: North America NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 24: North America NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 25: North America NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 26: North America NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 27: North America NOR Flash Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 28: North America NOR Flash Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 29: U.S. NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: U.S. NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 31: U.S. NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 32: U.S. NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 33: U.S. NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 34: U.S. NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 35: U.S. NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 36: Canada NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Canada NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 38: Canada NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 39: Canada NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 40: Canada NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 41: Canada NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 42: Canada NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 43: Europe NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Europe NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 45: Europe NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 46: Europe NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 47: Europe NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 48: Europe NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 49: Europe NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 50: Europe NOR Flash Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Europe NOR Flash Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Germany NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 53: Germany NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 54: Germany NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 55: Germany NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 56: Germany NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 57: Germany NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 58: Germany NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 59: U.K. NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 60: U.K. NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 61: U.K. NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 62: U.K. NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 63: U.K. NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 64: U.K. NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 65: U.K. NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 66: France NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: France NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 68: France NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 69: France NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 70: France NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 71: France NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 72: France NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 73: Italy NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 74: Italy NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 75: Italy NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 76: Italy NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 77: Italy NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 78: Italy NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 79: Italy NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 80: Spain NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 81: Spain NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 82: Spain NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 83: Spain NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 84: Spain NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 85: Spain NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 86: Spain NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 87: Switzerland NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 88: Switzerland NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 89: Switzerland NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 90: Switzerland NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 91: Switzerland NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 92: Switzerland NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 93: Switzerland NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 94: The Netherlands NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 95: The Netherlands NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 96: The Netherlands NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 97: The Netherlands NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 98: The Netherlands NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 99: The Netherlands NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 100: The Netherlands NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 101: Rest of Europe NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 102: Rest of Europe NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 103: Rest of Europe NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 104: Rest of Europe NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 105: Rest of Europe NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 106: Rest of Europe NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 107: Rest of Europe NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 108: Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 109: Asia Pacific NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 110: Asia Pacific NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 111: Asia Pacific NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 112: Asia Pacific NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 113: Asia Pacific NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 114: Asia Pacific NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 115: Asia Pacific NOR Flash Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 116: Asia Pacific NOR Flash Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 117: China NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 118: China NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 119: China NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 120: China NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 121: China NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 122: China NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 123: China NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 124: Japan NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 125: Japan NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 126: Japan NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 127: Japan NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 128: Japan NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 129: Japan NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 130: Japan NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 131: India NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 132: India NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 133: India NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 134: India NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 135: India NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 136: India NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 137: India NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 138: South Korea NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 139: South Korea NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 140: South Korea NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 141: South Korea NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 142: South Korea NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 143: South Korea NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 144: South Korea NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 145: Australia and New Zealand NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 146: Australia and New Zealand NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 147: Australia and New Zealand NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 148: Australia and New Zealand NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 149: Australia and New Zealand NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 150: Australia and New Zealand NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 151: Australia and New Zealand NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 152: Rest of Asia Pacific NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 153: Rest of Asia Pacific NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 154: Rest of Asia Pacific NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 155: Rest of Asia Pacific NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 156: Rest of Asia Pacific NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 157: Rest of Asia Pacific NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 158: Rest of Asia Pacific NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 159: Latin America NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 160: Latin America NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 161: Latin America NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 162: Latin America NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 163: Latin America NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 164: Latin America NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 165: Latin America NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 166: Latin America NOR Flash Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 167: Latin America NOR Flash Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 168: Brazil NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 169: Brazil NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 170: Brazil NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 171: Brazil NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 172: Brazil NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 173: Brazil NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 174: Brazil NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 175: Mexico NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 176: Mexico NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 177: Mexico NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 178: Mexico NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 179: Mexico NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 180: Mexico NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 181: Mexico NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 182: Argentina NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 183: Argentina NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 184: Argentina NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 185: Argentina NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 186: Argentina NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 187: Argentina NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 188: Argentina NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 189: Rest of Latin America NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 190: Rest of Latin America NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 191: Rest of Latin America NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 192: Rest of Latin America NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 193: Rest of Latin America NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 194: Rest of Latin America NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 195: Rest of Latin America NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 196: Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 197: Middle East and Africa NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 198: Middle East and Africa NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 199: Middle East and Africa NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 200: Middle East and Africa NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 201: Middle East and Africa NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 202: Middle East and Africa NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 203: Middle East and Africa NOR Flash Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 204: Middle East and Africa NOR Flash Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 205: GCC Countries NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 206: GCC Countries NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 207: GCC Countries NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 208: GCC Countries NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 209: GCC Countries NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 210: GCC Countries NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 211: GCC Countries NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 212: South Africa NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 213: South Africa NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 214: South Africa NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 215: South Africa NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 216: South Africa NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 217: South Africa NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 218: South Africa NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 219: Rest of Middle East and Africa NOR Flash Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 220: Rest of Middle East and Africa NOR Flash Market Value Share Analysis, by Type, 2024 and 2035

Figure 221: Rest of Middle East and Africa NOR Flash Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 222: Rest of Middle East and Africa NOR Flash Market Value Share Analysis, by Density, 2024 and 2035

Figure 223: Rest of Middle East and Africa NOR Flash Market Attractiveness Analysis, by Density, 2025 to 2035

Figure 224: Rest of Middle East and Africa NOR Flash Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 225: Rest of Middle East and Africa NOR Flash Market Attractiveness Analysis, by End-User Industry, 2025 to 2035