Reports

Reports

Since the COVID-19 pandemic is becoming widespread in countries such as India, Canada, Brazil, and Pakistan, emphasis on neonatal coronavirus infection management is growing. Companies in the NICU catheters market are capitalizing on this opportunity to keep steady and robust supply of products. Since infants are at a high risk of contracting the novel infection, the importance of neonatal coronavirus infection management is surging in healthcare facilities.

India has recently witnessed cases of COVID-19 infection in pregnant mothers and infants. Such trends are increasing revenue flow in the India NICU catheters market. Since the novel infection is capable of causing clinical conditions ranging from asymptomatic viral shedding to mild illness resembling the common cold in infants, there is a need for neonatal coronavirus infection management.

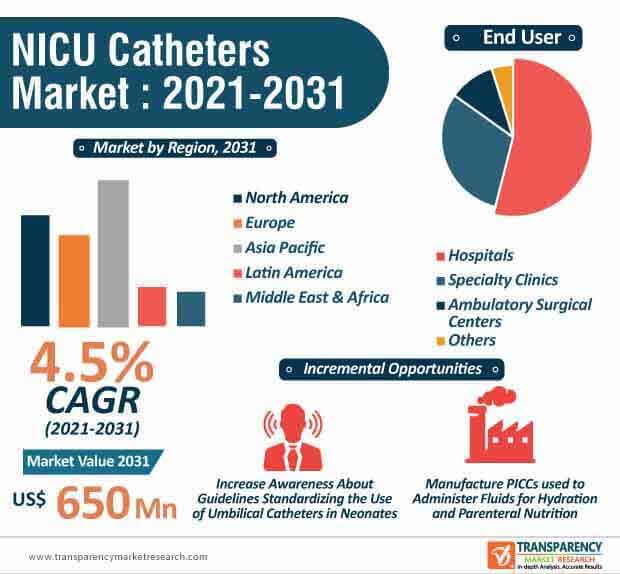

The global NICU catheters market is expected to cross US$ 650 Mn by 2031. However, the association between infection and intravascular catheters is raising concerns for med-tech companies, thus affecting market growth. These catheters involve peripherally inserted central lines, umbilical lines, and central vascular catheters. Hence, med-tech companies are increasing awareness about implementing care bundles focused on improving the hygiene routines concerning the intravenous lines.

It has been found that a considerable amount of coagulase-negative staphylococci (CoNS) sepsis cases are a result of contaminated catheter. This has led to increased awareness about improving hygiene routines pertaining to intravenous lines.

Manufacturers in the NICU catheters market are increasing their production capabilities in umbilical venous catheters (UVCs) and replogle & suction catheters. Cardinal Health, Inc. - a U.S. multinational healthcare services company, is gaining recognition for its comprehensive portfolio in neonatal products, including peripherally inserted central catheters (PICC) and umbilical vessel catheters. Manufacturers are increasing the availability of UVCs that reduce the need for painful venipunctures and provide double or triple the access of a single lumen catheter.

Companies in the NICU catheters market are innovating in replogle catheters made with clear dual-lumen tube. They are avoiding the use of DEHP & natural rubber latex and instead using PVC (Polyvinyl Chloride) in replogle catheters. The vent lumen in these cutting-edge catheters is designed to reduce adherence to the mucosal wall.

Supplementary factors such as innovations in diapers are contributing to the growth of the NICU catheters market. The new Pampers Preemie Swaddlers diapers help to minimize interruption during sleep, owing to discomfort created by inserting catheters, nasal CPAP or heel pricks. Such diapers are improving clinical numbers, building the credibility of healthcare facilities, and help to support healthy development of babies.

Manufacturers in the NICU catheters market are boosting their output capacities in neonatal peripherally inserted central catheters. PICCs are being increasingly used to administer fluids for hydration, parenteral nutrition, and other common intravenous medications.

Wireless monitors are storming the NICU catheters market. Since parents may feel helpless and undergo anxiety when their babies are kept in NICU (Neonatal Intensive Care Unit), wireless monitors in the form of biosensors help to improve infant quality of life. Wired monitoring has the possibility of creating blood clots and blood vessel blockage. These wires also interfere with feeding and cleaning. Hence, companies are benefitting with the introduction of wireless biosensors.

The precise monitoring of NICU patients is essential, but is potentially invasive, especially in the case of specialized catheters inserted into a patient’s tiny veins. Thus, stakeholders in the NICU catheters market are benefitting from the introduction of wireless biosensors that are demonstrating clinical advantages.

Analysts’ Viewpoint

The virtual connectivity is significantly changing the care delivery model in intensive care units during the COVID-19 pandemic for infants in India, China, and more likely, in the first world countries. The NICU catheters market is anticipated to register a modest CAGR of 4.5% during the assessment period. This is evident since thromboembolism is a major concern with the use of umbilical arterial catheters. Hence, companies should increase awareness about guidelines standardizing the use of umbilical catheters in neonates. Supplementary innovations such as diapers that support infant development and wireless biosensors in NICU are increasing medical outcomes. PICCs are being made using the polyurethane material, which helps to deliver maximum strength and flow rates.

NICU catheters market is expected to reach US$ 650 million by 2031

NICU catheters market is anticipated to expand at a CAGR of 4.5% to 2021-2031

NICU catheters market is driven by increase in incidence of preterm births and low birthweight births and surge in demand for specialized neonatal care

Top key players in NICU catheters market are Becton, Dickinson and Company, Smiths Medical, ICU Medical, Inc., Vygon SA, Footprint Medical Incorporated, Utah Medical Products, Inc., Cardinal Health, Inc.

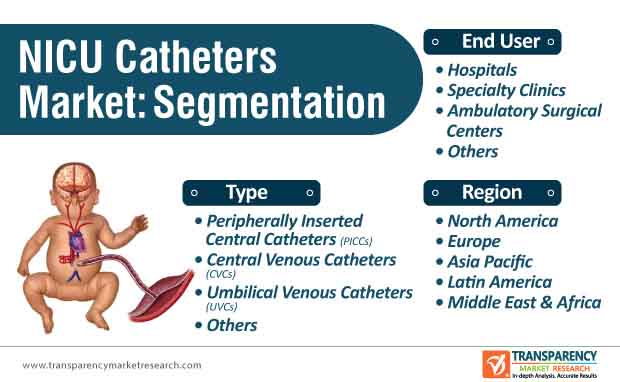

The peripherally inserted central catheters (PICCs) segment dominated the global NICU catheters market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global NICU Catheters Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global NICU Catheters Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. List of Small and Medium Players in U.S.

5.2. Key Industry Events

5.3. Regulatory Scenario, by Region/Globally

5.4. COVID-19 Pandemic Impact on Industry

6. Global NICU Catheters Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Peripherally Inserted Central Catheter (PICCs)

6.3.2. Central Venous Catheters (CVCs)

6.3.3. Umbilical Venous Catheters (UVCs)

6.3.4. Others

6.4. Market Attractiveness Analysis, by Type

7. Global NICU Catheters Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Specialty Clinics

7.3.3. Ambulatory Surgical Centers

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global NICU Catheters Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Country/Region

9. North America NICU Catheters Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Type, 2017–2031

9.2.1. Peripherally Inserted Central Catheter (PICCs)

9.2.2. Central Venous Catheters (CVCs)

9.2.3. Umbilical Venous Catheters (UVCs)

9.2.4. Others

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Specialty Clinics

9.3.3. Ambulatory Surgical Centers

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Type

9.5.2. By End-user

9.5.3. By Country

10. U.S. NICU Catheters Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. Peripherally Inserted Central Catheter (PICCs)

10.2.2. Central Venous Catheters (CVCs)

10.2.3. Umbilical Venous Catheters (UVCs)

10.2.4. Others

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Specialty Clinics

10.3.3. Ambulatory Surgical Centers

10.3.4. Others

10.4. Market Attractiveness Analysis

10.4.1. By Type

10.4.2. By End-user

11. Europe NICU Catheters Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. Peripherally Inserted Central Catheter (PICCs)

11.2.2. Central Venous Catheters (CVCs)

11.2.3. Umbilical Venous Catheters (UVCs)

11.2.4. Others

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Specialty Clinics

11.3.3. Ambulatory Surgical Centers

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. U.K.

11.4.2. Germany

11.4.3. France

11.4.4. Spain

11.4.5. Italy

11.4.6. Rest of Europe

11.5. Market Attractiveness Analysis

11.5.1. By Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Asia Pacific NICU Catheters Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Peripherally Inserted Central Catheter (PICCs)

12.2.2. Central Venous Catheters (CVCs)

12.2.3. Umbilical Venous Catheters (UVCs)

12.2.4. Others

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Specialty Clinics

12.3.3. Ambulatory Surgical Centers

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. China

12.4.2. India

12.4.3. Japan

12.4.4. Australia & New Zealand

12.4.5. Rest of Asia Pacific

12.5. Market Attractiveness Analysis

12.5.1. By Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Latin America NICU Catheters Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Peripherally Inserted Central Catheter (PICCs)

13.2.2. Central Venous Catheters (CVCs)

13.2.3. Umbilical Venous Catheters (UVCs)

13.2.4. Others

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Specialty Clinics

13.3.3. Ambulatory Surgical Centers

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. Brazil

13.4.2. Mexico

13.4.3. Rest of Latin America

13.5. Market Attractiveness Analysis

13.5.1. By Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Middle East & Africa NICU Catheters Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017–2031

14.2.1. Peripherally Inserted Central Catheter (PICCs)

14.2.2. Central Venous Catheters (CVCs)

14.2.3. Umbilical Venous Catheters (UVCs)

14.2.4. Others

14.3. Market Value Forecast, by End-user, 2017–2031

14.3.1. Hospitals

14.3.2. Specialty Clinics

14.3.3. Ambulatory Surgical Centers

14.3.4. Others

14.4. Market Value Forecast, by Country/Sub-region, 2017–2031

14.4.1. GCC Countries

14.4.2. South Africa

14.4.3. Rest of Middle East & Africa

14.5. Market Attractiveness Analysis

14.5.1. By Type

14.5.2. By End-user

14.5.3. By Country/Sub-region

15. Competition Landscape

15.1. Market Share Analysis, by Company, 2019

15.2. Company Profiles

15.2.1. Becton, Dickinson and Company

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.1.5. SWOT Analysis

15.2.2. B. Braun Melsungen AG

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.2.5. SWOT Analysis

15.2.3. Smiths Medical

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.3.5. SWOT Analysis

15.2.4. ICU Medical, Inc.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.4.5. SWOT Analysis

15.2.5. Vygon SA

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.5.5. SWOT Analysis

15.2.6. Footprint Medical Incorporated

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.6.5. SWOT Analysis

15.2.7. Utah Medical Products, Inc.

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.7.5. SWOT Analysis

15.2.8. Cardinal Health, Inc.

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.8.5. SWOT Analysis

15.2.9. Argon Medical Devices, Inc.

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.9.5. SWOT Analysis

15.2.10. NeoMedical, Inc.

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

15.2.10.5. SWOT Analysis

15.2.11. Marian Medical, Inc.

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.11.3. Financial Overview

15.2.11.4. Strategic Overview

15.2.11.5. SWOT Analysis

15.2.12. Angiplast Pvt. Ltd.

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.12.3. Financial Overview

15.2.12.4. Strategic Overview

15.2.12.5. SWOT Analysis

15.2.13. Vigmed AB (Greiner Bio-One International GmbH)

15.2.13.1. Company Description

15.2.13.2. Business Overview

15.2.13.3. Financial Overview

15.2.13.4. Strategic Overview

15.2.13.5. SWOT Analysis

15.2.14. Bactiguard AB

15.2.14.1. Company Description

15.2.14.2. Business Overview

15.2.14.3. Financial Overview

15.2.14.4. Strategic Overview

15.2.14.5. SWOT Analysis

15.2.15. Advin Health Care

15.2.15.1. Company Description

15.2.15.2. Business Overview

15.2.15.3. Financial Overview

15.2.15.4. Strategic Overview

15.2.15.5. SWOT Analysis

15.2.16. Pergo Medikal ve ilaç Sanayi AS

15.2.16.1. Company Description

15.2.16.2. Business Overview

15.2.16.3. Financial Overview

15.2.16.4. Strategic Overview

15.2.16.5. SWOT Analysis

15.2.17. Sterimed Group

15.2.17.1. Company Description

15.2.17.2. Business Overview

15.2.17.3. Financial Overview

15.2.17.4. Strategic Overview

15.2.17.5. SWOT Analysis

List of Tables

Table 01: Global NICU Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Global NICU Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global NICU Catheters Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America NICU Catheters Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America NICU Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 06: North America NICU Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: U.S. NICU Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 08: U.S. NICU Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe NICU Catheters Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe NICU Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 11: Europe NICU Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Asia Pacific NICU Catheters Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 13: Asia Pacific NICU Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 14: Asia Pacific NICU Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Latin America NICU Catheters Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 16: Latin America NICU Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 17: Latin America NICU Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Middle East & Africa NICU Catheters Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 19: Middle East & Africa NICU Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 20: Middle East & Africa NICU Catheters Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global NICU Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global NICU Catheters Market Value Share, by Type, 2020

Figure 03: Global NICU Catheters Market Value Share, by End-user, 2020

Figure 04: Global NICU Catheters Market Value Share, by Region, 2020

Figure 05: Global NICU Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 06: Global NICU Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 07: Global NICU Catheters Market Revenue (US$ Mn), by Peripherally Inserted Central Catheters (PICCs), 2017–2031

Figure 08: Global NICU Catheters Market Revenue (US$ Mn), by Central Venous Catheters (CVCs), 2017–2031

Figure 09: Global NICU Catheters Market Revenue (US$ Mn), by Umbilical Venous Catheters (UVCs), 2017–2031

Figure 10: Global NICU Catheters Market Revenue (US$ Mn), by Others, 2017–2031

Figure 11: Global NICU Catheters Market Value Share Analysis, by End-user, 2020 and 2031

Figure 12: Global NICU Catheters Market Attractiveness Analysis, by End-user, 2021–2031

Figure 13: Global NICU Catheters Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 14: Global NICU Catheters Market Revenue (US$ Mn), by Specialty Clinics, 2017–2031

Figure 15: Global NICU Catheters Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 16: Global NICU Catheters Market Revenue (US$ Mn), by Others, 2017–2031

Figure 17: Global NICU Catheters Market Value Share Analysis, by Region, 2020 and 2031

Figure 18: Global NICU Catheters Market Attractiveness Analysis, by Region, 2021–2031

Figure 19: North America NICU Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: North America NICU Catheters Market Attractiveness Analysis, by Country, 2021–2031

Figure 21: North America NICU Catheters Market Value Share Analysis, by Country, 2020 and 2031

Figure 22: North America NICU Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 23: North America NICU Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 24: North America NICU Catheters Market Attractiveness Analysis, by End-user, 2021–2031

Figure 25: North America NICU Catheters Market Value Share Analysis, by End-user, 2020 and 2031

Figure 26: U.S. NICU Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 27: U.S. NICU Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 28: U.S. NICU Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 29: U.S. NICU Catheters Market Attractiveness Analysis, by End-user, 2021–2031

Figure 30: U.S. NICU Catheters Market Value Share Analysis, by End-user, 2020 and 2031

Figure 31: Europe NICU Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Europe NICU Catheters Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 33: Europe NICU Catheters Market Value Share Analysis, by Country/Sub-Region, 2020 and 2031

Figure 34: Europe NICU Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 35: Europe NICU Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 36: Europe NICU Catheters Market Attractiveness Analysis, by End-user, 2021–2031

Figure 37: Europe NICU Catheters Market Value Share Analysis, by End-user, 2020 and 2031

Figure 38: Asia Pacific NICU Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: Asia Pacific NICU Catheters Market Attractiveness Analysis, by Country/Sub-Region, 2021–2031

Figure 40: Asia Pacific NICU Catheters Market Value Share Analysis, by Country/Sub-Region, 2020 and 2031

Figure 41: Asia Pacific NICU Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 42: Asia Pacific NICU Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 43: Asia Pacific NICU Catheters Market Attractiveness Analysis, by End-user, 2021–2031

Figure 44: Asia Pacific NICU Catheters Market Value Share Analysis, by End-user, 2020 and 2031

Figure 45: Latin America NICU Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Latin America NICU Catheters Market Attractiveness Analysis, by Country/Sub-Region, 2021–2031

Figure 47: Latin America NICU Catheters Market Value Share Analysis, by Country/Sub-Region, 2020 and 2031

Figure 48: Latin America NICU Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 49: Latin America NICU Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 50: Latin America NICU Catheters Market Attractiveness Analysis, by End-user, 2021–2031

Figure 51: Latin America NICU Catheters Market Value Share Analysis, by End-user, 2020 and 2031

Figure 52: Middle East & Africa NICU Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 53: Middle East & Africa NICU Catheters Market Attractiveness Analysis, by Country/Sub-Region, 2021–2031

Figure 54: Middle East & Africa NICU Catheters Market Value Share Analysis, by Country/Sub-Region, 2020 and 2031

Figure 55: Middle East & Africa NICU Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 56: Middle East & Africa NICU Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 57: Middle East & Africa NICU Catheters Market Attractiveness Analysis, by End-user, 2021–2031

Figure 58: Middle East & Africa NICU Catheters Market Value Share Analysis, by End-user, 2020 and 2031

Figure 59: NICU Catheters Market Analysis, by Top Company Ranking, 2020

Figure 60: Global Company Share Analysis, 2020

Figure 61: Company Share Analysis for U.S., 2020