Reports

Reports

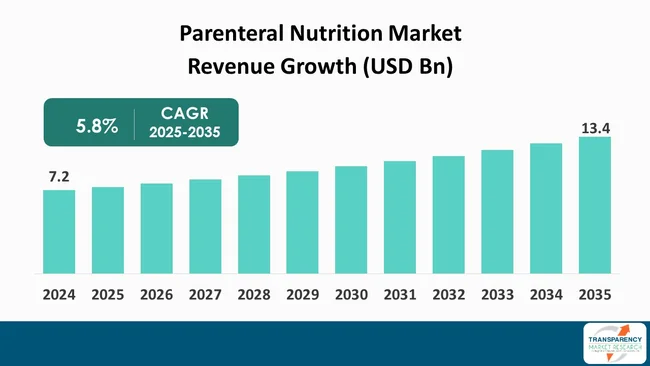

The global parenteral nutrition market size was valued at US$ 7.2 billion in 2024 and is projected to reach US$ 13.4 billion by 2035, expanding at a CAGR of 5.8% from 2025 to 2035. The market growth is driven by increasing global prevalence of chronic diseases, growing elderly population susceptible to malnutrition and advancements in home parenteral nutrition.

Parenteral nutrition industry is fueled by several key drivers including the growing prevalence of chronic diseases, hospitalization, and advancements in medical technology. Due to growing incidences of gastrointestinal disease, neurological disease, and cancer, the market for specialized nutrition has accelerated.

Additionally, parenteral nutrition market is fueled by increasing geriatric population all over the world, which demonstrates the demand for long-term nutritional treatments. Advancements in parenteral nutrition products and delivery systems improve patient safety and outcomes, thereby making the products even more appealing to healthcare professionals.

Another prominent factor contributing to the growth of parenteral nutrition market is the shift toward home-based and outpatient healthcare solutions. As more attention paid toward lowering hospitalization and healthcare expenses, parenteral nutrition is optimized for home administration. In addition, enhanced awareness among healthcare professionals regarding the advantages of customized parenteral nutrition products has spurred adoption. These are complemented by favorable government policies and clinical guidelines facilitating the application of specialized nutrition therapies to maximize patient recovery and health.

Of late, the parenteral nutrition market has been influenced by the introduction of ready-to-use multi-chamber bags that allow better convenience, safety, and accuracy in administration. The growing popularity of lipid emulsions formulated with new oil blends such as olive or fish oil is attributed to their superior efficacy and safety profiles as compared to conventional formulations.

Moreover, emphasis on geriatric and pediatric patient population has resulted in product innovations that are specifically designed for meeting their metabolic needs. In addition, sustainability efforts such as eco-friendly packaging for infusion products are drawing interest.

The competitive landscape of the parenteral nutrition market is characterized by continual innovations in products and strategic initiatives undertaken by the industry players. The companies are dedicating resources to research and development activities in order to introduce lipid emulsions, amino acid solutions, and trace element formulations with better compatibility and patient safety.

Strategic partnerships with hospitals and home-infusion providers are contributing to increasing market access and acceptance. Moreover, investments in expansion of sterile manufacturing capacity, upgrading of compounding technologies, and compliance with stringent regulatory standards are among the proactive measures taken by players in the parenteral nutrition market to secure their position in the industry.

Parenteral nutrition implies a specialized medical intervention used for delivering the essential nutrients into the bloodstream on direct basis via intravenous infusion, thereby bypassing the digestive system. The method is employed along with peripheral and/or central venous catheters for patients battling enteral and oral refractory malnutrition owing to intestinal failure, postoperative conditions or acute gastrointestinal diseases, thereby making it a primary choice for nutrition support. In addition to macronutrients like carbohydrates, fats, and proteins, parenteral nutrition also provides micronutrients like vitamins, trace elements, and electrolytes, which are vital for maintenance of metabolic functions and facilitate recovery.

The formulation of parenteral nutrition is meticulously individualized to a single patient's requirements in order to meet appropriate nutrient distribution. Patients may be receive total parenteral nutrition (TPN), whereby all the nutritional needs are met intravenously, or partial parenteral nutrition (PPN), which is considered as one of the supplements to enteral or oral alimentation.

One of the significant advancements in the field of parenteral nutrition is the use of multi-chamber bags, which improve usability, does expedite the preparation process and notably lowers the risk of contamination. In addition to this, introduction of specialized lipid emulsions with oil safety blends is becoming increasingly common with the purpose to give patients positive outcomes and better tolerance.

In conclusion, parenteral nutrition serves as a critical intervention that provides optimal nourishment when the digestive tract is compromised. It plays an important role in medical-aid since it is the energy source required by the body, facilitates the healing process, and also keeps the patient behind the curtain of starvation-related diseases. The ongoing enhancement of parenteral nutrition reflects the shift from standardized to patient-specific treatment and the continuous advancement of nutritional science.

| Attribute | Detail |

|---|---|

| Parenteral Nutrition Market Drivers |

|

The increasing incidences of chronic conditions such as cancer, Crohn's disease, short bowel syndrome, and acute pancreatitis is a major driver to the parenteral nutrition market. These conditions have negative effects on the gastrointestinal tract, thus preventing the patient from obtaining adequate nutrition. In these circumstances, parenteral nutrition is required to provide balanced liquid nutritional solution that is delivered into the circulatory system thus providing the nutrition that a patient need for treatment.

Nutritional deficiencies, particularly in cancer patient undergoing chemotherapy or radiotherapy, are extremely common. The treatment impacts patients’ ability to ingest food and absorb nutrients, such that they are unable to eat. Parenteral nutrition provides both - nutrition to individuals undergoing cancer therapies, while preventing weight loss and preserving the immune status of patients undergoing the therapy.

Individuals with chronic gastrointestinal disorders like Crohn's disease or ulcerative colitis often face long-term malabsorption. When traditional routes of nutrition are no longer sufficient, parenteral nutrition (PN) offers a practical route to deliver energy and ultimately try to prevent other complications.

The increased prevalence of chronic disease has resulted in an increased acceptance of parenteral nutrition in clinical practice. PN provides essential support to the seriously ill and nutritionally compromised patients and is not only associated with improvement in survival and recovery but improvements in quality of life. As the prevalence of chronic disease continues to rise worldwide, the need for personalized and sophisticated parenteral nutrition products is anticipated to rise, bolstering the global parenteral nutrition market.

Incorporating artificial intelligence (AI) in the medical field is making an impact on the parenteral nutrition market. AI-powered applications are capable of analyzing patient data such as laboratory reports, metabolic rates, and medical history to suggest optimal PN formula. This kind of personalized care not only facilitates healing with the correct blend of nutrients but also sizably minimizes the risk of adverse reactions and ascertains better clinical outcomes.

Moreover, AI enables continuous, real-time monitoring of patients on PN, thereby allowing healthcare professionals to swiftly locate unfavorable reactions, lack of micronutrients or errors in infusion. Predictive algorithms can recommend adjustments in infusion rates or nutrient composition, improving patient safety, and minimizing hospital readmissions This technology can be of remarkable significance in intensive care units and neonatal departments, where nutritional support is extremely personalized.

Furthermore, the integration of AI-driven automation in PN compounding and preparation has significantly enhanced operational efficiency in hospitals as well as in home-infusion settings. Automated systems, which are AI-designed mitigate chances of human-errors, ensure consistent delivery of nutrients, and streamline workflows, thus saving time while maintaining high-quality care. This effectiveness directly affects healthcare providers in terms of cost savings and scalability.

In conclusion, the AI integration is revolutionizing the PN market through the application of personalized nutrition along with advanced monitoring and automation capabilities. These developments in technology are driving demand for smart PN solutions, which, in turn, allows the healthcare providers to have a better prognosis of their patients, lower the risks, and increase the efficiency of the healthcare system as a whole. As the adoption of AI in the parenteral nutrition market accelerates, the utilization of AI-assisted nutritional therapies is expected to expand, further improving patient care.

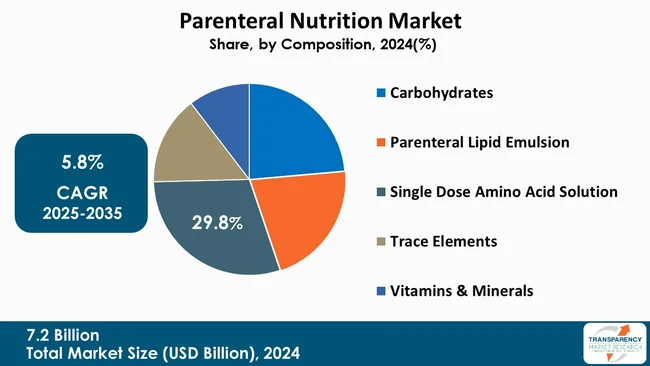

Single dose amino acid solutions are dominating the parenteral nutrition market, owing to their significance in maintaining the body’s nitrogen balance and supporting protein synthesis in critically ill or malnourished patients. These feedings supply both - the non-essential and essential amino acids in a balanced ratio, thereby ensuring the efficient uptake of nutrients and accelerated recovery of patients with intravenous nutrition.

Moreover, single-dose solutions offer significant advantages in terms of sterility, convenience, and dosing accuracy as compared to compounded mixtures. Their ready-to-use form significantly reduces the probabilities of contamination and preparation errors, which, in turn, does increase safety at medical and home-care facilities. The increasing clinical preference for standardized and high-quality amino acid solutions is one of the factors that sustain the dominance of their market share.

| Attribute | Detail |

|---|---|

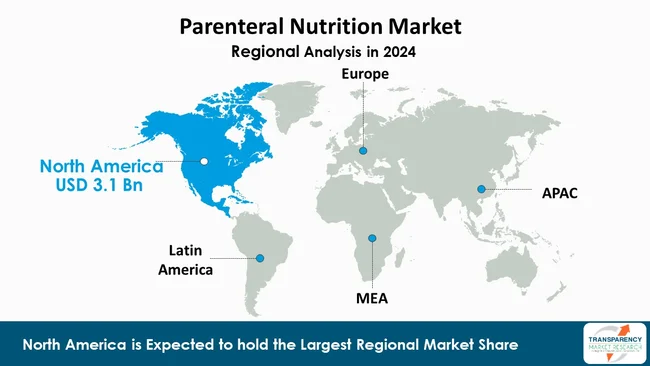

| Leading Region |

|

As per the latest parenteral nutrition market analysis, North America held the market share of 42.5% in 2024. This is basically attributed to the region's well-established healthcare infrastructure, which focuses on clinical nutrition management. This region is characterized by high rate of acceptance of innovative therapies as there are a lot of specialized intensive care units, facilities for neonatal care, and home-infusion services. Besides, the practice of parenteral nutrition is made simpler in different patient population owing to supportive reimbursement policies and the existence of clear clinical guidelines.

Moreover, the area is reaping the benefits of the considerable investments into research and development activities, which has led to the emergence of new formulations and technologies. Additionally, the rising number of chronic diseases and high surgical volumes, along with growing healthcare provider’s awareness, continues to be key reasons behind North America’s dominance in the parenteral nutrition market.

The companies operating in the parenteral nutrition market concentrate on creating new and improved formulations, increasing their sterile production capacities, and improving multi-chamber delivery systems. The companies are undertaking several initiatives for expanding their business operations including strategic partnerships with home-infusion providers and hospitals, investment in R&D, emphasizing regulatory compliance and marketing presence to seizing the rising global demand stand out.

Baxter, B. Braun SE, Fresenius Kabi AG, Pfizer Inc., Grifols, S.A., Otsuka Pharmaceutical Factory, Inc., Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd, ICU Medical, Inc., Otsuka Holdings Co., Ltd., Aculife, SGD Pharma, Optum, Inc., Torbay Pharma, KENHEAL HEALTHCARE PVT LTD, and Option Care Health Inc. are some of the leading players operating in the global parenteral nutrition market.

Each of these players has been profiled in the parenteral nutrition market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 7.2 Bn |

| Forecast Value in 2035 | US$ 13.4 Bn |

| CAGR | 5.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Parenteral Nutrition Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Nutrition Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global parenteral nutrition market was valued at US$ 7.2 Bn in 2024

The global parenteral nutrition industry is projected to reach more than US$ 13.4 Bn by the end of 2035

The increasing global prevalence of chronic diseases, growing elderly population susceptible to malnutrition, advancements in home parenteral nutrition, and the rising number of complex surgeries are some of the factors driving the expansion of parenteral nutrition market.

The CAGR is anticipated to be 5.8% from 2025 to 2035

Baxter, B. Braun SE, Fresenius Kabi AG, Pfizer Inc., Grifols, S.A., Otsuka Pharmaceutical Factory, Inc., Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd, ICU Medical, Inc., Otsuka Holdings Co., Ltd., Aculife, SGD Pharma, Optum, Inc., Torbay Pharma, KENHEAL HEALTHCARE PVT LTD, and Option Care Health Inc.

Table 01: Global Parenteral Nutrition Market Value (US$ Bn) Forecast, By Nutrition Type, 2020 to 2035

Table 02: Global Parenteral Nutrition Market Value (US$ Bn) Forecast, By Composition, 2020 to 2035

Table 03: Global Parenteral Nutrition Market Value (US$ Bn) Forecast, By Patient Age Group, 2020 to 2035

Table 04: Global Parenteral Nutrition Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 05: Global Parenteral Nutrition Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Parenteral Nutrition Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Parenteral Nutrition Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Parenteral Nutrition Market Value (US$ Bn) Forecast, By Nutrition Type, 2020 to 2035

Table 09: North America Parenteral Nutrition Market Value (US$ Bn) Forecast, By Composition, 2020 to 2035

Table 10: North America Parenteral Nutrition Market Value (US$ Bn) Forecast, By Patient Age Group, 2020 to 2035

Table 11: North America Parenteral Nutrition Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 12: North America Parenteral Nutrition Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Parenteral Nutrition Market Value (US$ Bn) Forecast, by Country/Sib-region, 2020-2035

Table 14: Europe Parenteral Nutrition Market Value (US$ Bn) Forecast, By Nutrition Type, 2020 to 2035

Table 15: Europe Parenteral Nutrition Market Value (US$ Bn) Forecast, By Composition, 2020 to 2035

Table 16: Europe Parenteral Nutrition Market Value (US$ Bn) Forecast, By Patient Age Group, 2020 to 2035

Table 17: Europe Parenteral Nutrition Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 18: Europe Parenteral Nutrition Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Parenteral Nutrition Market Value (US$ Bn) Forecast, by Country/Sib-region, 2020-2035

Table 20: Asia Pacific Parenteral Nutrition Market Value (US$ Bn) Forecast, By Nutrition Type, 2020 to 2035

Table 21: Asia Pacific Parenteral Nutrition Market Value (US$ Bn) Forecast, By Composition, 2020 to 2035

Table 22: Asia Pacific Parenteral Nutrition Market Value (US$ Bn) Forecast, By Patient Age Group, 2020 to 2035

Table 23: Asia Pacific Parenteral Nutrition Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 24: Asia Pacific Parenteral Nutrition Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Parenteral Nutrition Market Value (US$ Bn) Forecast, by Country/Sib-region, 2020-2035

Table 26: Latin America Parenteral Nutrition Market Value (US$ Bn) Forecast, By Nutrition Type, 2020 to 2035

Table 27: Latin America Parenteral Nutrition Market Value (US$ Bn) Forecast, By Composition, 2020 to 2035

Table 28: Latin America Parenteral Nutrition Market Value (US$ Bn) Forecast, By Patient Age Group, 2020 to 2035

Table 29: Latin America Parenteral Nutrition Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 30: Latin America Parenteral Nutrition Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Parenteral Nutrition Market Value (US$ Bn) Forecast, by Country/Sib-region, 2020-2035

Table 32: Middle East & Africa Parenteral Nutrition Market Value (US$ Bn) Forecast, By Nutrition Type, 2020 to 2035

Table 33: Middle East & Africa Parenteral Nutrition Market Value (US$ Bn) Forecast, By Composition, 2020 to 2035

Table 34: Middle East & Africa Parenteral Nutrition Market Value (US$ Bn) Forecast, By Patient Age Group, 2020 to 2035

Table 35: Middle East & Africa Parenteral Nutrition Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 36: Middle East & Africa Parenteral Nutrition Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Parenteral Nutrition Market Value Share Analysis, By Nutrition Type, 2024 and 2035

Figure 02: Global Parenteral Nutrition Market Attractiveness Analysis, By Nutrition Type, 2025 to 2035

Figure 03: Global Parenteral Nutrition Market Revenue (US$ Bn), by Total Parenteral Nutrition (TPN), 2020 to 2035

Figure 04: Global Parenteral Nutrition Market Revenue (US$ Bn), by Partial Parenteral Nutrition (PPN), 2020 to 2035

Figure 05: Global Parenteral Nutrition Market Value Share Analysis, By Composition, 2024 and 2035

Figure 06: Global Parenteral Nutrition Market Attractiveness Analysis, By Composition, 2025 to 2035

Figure 07: Global Parenteral Nutrition Market Revenue (US$ Bn), by Carbohydrates, 2020 to 2035

Figure 08: Global Parenteral Nutrition Market Revenue (US$ Bn), by Parenteral Lipid Emulsion, 2020 to 2035

Figure 09: Global Parenteral Nutrition Market Revenue (US$ Bn), by Single Dose Amino Acid Solution, 2020 to 2035

Figure 10: Global Parenteral Nutrition Market Revenue (US$ Bn), by Trace Elements, 2020 to 2035

Figure 11: Global Parenteral Nutrition Market Revenue (US$ Bn), by Vitamins & Minerals, 2020 to 2035

Figure 12: Global Parenteral Nutrition Market Value Share Analysis, By Patient Age Group, 2024 and 2035

Figure 13: Global Parenteral Nutrition Market Attractiveness Analysis, By Patient Age Group, 2025 to 2035

Figure 14: Global Parenteral Nutrition Market Revenue (US$ Bn), by Pediatric, 2020 to 2035

Figure 15: Global Parenteral Nutrition Market Revenue (US$ Bn), by Adult, 2020 to 2035

Figure 16: Global Parenteral Nutrition Market Revenue (US$ Bn), by Geriatric, 2020 to 2035

Figure 17: Global Parenteral Nutrition Market Value Share Analysis, By Indication, 2024 and 2035

Figure 18: Global Parenteral Nutrition Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 19: Global Parenteral Nutrition Market Revenue (US$ Bn), by Neurodegenerative Disorders, 2020 to 2035

Figure 20: Global Parenteral Nutrition Market Revenue (US$ Bn), by Nutrition Deficiency, 2020 to 2035

Figure 21: Global Parenteral Nutrition Market Revenue (US$ Bn), by Cancer Care, 2020 to 2035

Figure 22: Global Parenteral Nutrition Market Revenue (US$ Bn), by Diabetes, 2020 to 2035

Figure 23: Global Parenteral Nutrition Market Revenue (US$ Bn), by Chronic Kidney Diseases, 2020 to 2035

Figure 24: Global Parenteral Nutrition Market Revenue (US$ Bn), by Dysphagia, 2020 to 2035

Figure 25: Global Parenteral Nutrition Market Revenue (US$ Bn), by Pain Management, 2020 to 2035

Figure 26: Global Parenteral Nutrition Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 27: Global Parenteral Nutrition Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: Global Parenteral Nutrition Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Global Parenteral Nutrition Market Revenue (US$ Bn), by Hospitals and Ambulatory Surgical Centers, 2020 to 2035

Figure 30: Global Parenteral Nutrition Market Revenue (US$ Bn), by Long-term Care Facilities, 2020 to 2035

Figure 31: Global Parenteral Nutrition Market Revenue (US$ Bn), by Outpatient Clinics, 2020 to 2035

Figure 32: Global Parenteral Nutrition Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 33: Global Parenteral Nutrition Market Value Share Analysis, By Region, 2024 and 2035

Figure 34: Global Parenteral Nutrition Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 35: North America Parenteral Nutrition Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: North America Parenteral Nutrition Market Value Share Analysis, by Country, 2024 and 2035

Figure 37: North America Parenteral Nutrition Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 38: North America Parenteral Nutrition Market Value Share Analysis, By Nutrition Type, 2024 and 2035

Figure 39: North America Parenteral Nutrition Market Attractiveness Analysis, By Nutrition Type, 2025 to 2035

Figure 40: North America Parenteral Nutrition Market Value Share Analysis, By Composition, 2024 and 2035

Figure 41: North America Parenteral Nutrition Market Attractiveness Analysis, By Composition, 2025 to 2035

Figure 42: North America Parenteral Nutrition Market Value Share Analysis, By Patient Age Group, 2024 and 2035

Figure 43: North America Parenteral Nutrition Market Attractiveness Analysis, By Patient Age Group, 2025 to 2035

Figure 44: North America Parenteral Nutrition Market Value Share Analysis, By Indication, 2024 and 2035

Figure 45: North America Parenteral Nutrition Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 46: North America Parenteral Nutrition Market Value Share Analysis, By End-user, 2024 and 2035

Figure 47: North America Parenteral Nutrition Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 48: Europe Parenteral Nutrition Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Europe Parenteral Nutrition Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 50: Europe Parenteral Nutrition Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 51: Europe Parenteral Nutrition Market Value Share Analysis, By Nutrition Type, 2024 and 2035

Figure 52: Europe Parenteral Nutrition Market Attractiveness Analysis, By Nutrition Type, 2025 to 2035

Figure 53: Europe Parenteral Nutrition Market Value Share Analysis, By Composition, 2024 and 2035

Figure 54: Europe Parenteral Nutrition Market Attractiveness Analysis, By Composition, 2025 to 2035

Figure 55: Europe Parenteral Nutrition Market Value Share Analysis, By Patient Age Group, 2024 and 2035

Figure 56: Europe Parenteral Nutrition Market Attractiveness Analysis, By Patient Age Group, 2025 to 2035

Figure 57: Europe Parenteral Nutrition Market Value Share Analysis, By Indication, 2024 and 2035

Figure 58: Europe Parenteral Nutrition Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 59: Europe Parenteral Nutrition Market Value Share Analysis, By End-user, 2024 and 2035

Figure 60: Europe Parenteral Nutrition Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 61: Asia Pacific Parenteral Nutrition Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Asia Pacific Parenteral Nutrition Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Asia Pacific Parenteral Nutrition Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 64: Asia Pacific Parenteral Nutrition Market Value Share Analysis, By Nutrition Type, 2024 and 2035

Figure 65: Asia Pacific Parenteral Nutrition Market Attractiveness Analysis, By Nutrition Type, 2025 to 2035

Figure 66: Asia Pacific Parenteral Nutrition Market Value Share Analysis, By Composition, 2024 and 2035

Figure 67: Asia Pacific Parenteral Nutrition Market Attractiveness Analysis, By Composition, 2025 to 2035

Figure 68: Asia Pacific Parenteral Nutrition Market Value Share Analysis, By Patient Age Group, 2024 and 2035

Figure 69: Asia Pacific Parenteral Nutrition Market Attractiveness Analysis, By Patient Age Group, 2025 to 2035

Figure 70: Asia Pacific Parenteral Nutrition Market Value Share Analysis, By Indication, 2024 and 2035

Figure 71: Asia Pacific Parenteral Nutrition Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 72: Asia Pacific Parenteral Nutrition Market Value Share Analysis, By End-user, 2024 and 2035

Figure 73: Asia Pacific Parenteral Nutrition Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 74: Latin America Parenteral Nutrition Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 75: Latin America Parenteral Nutrition Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 76: Latin America Parenteral Nutrition Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 77: Latin America Parenteral Nutrition Market Value Share Analysis, By Nutrition Type, 2024 and 2035

Figure 78: Latin America Parenteral Nutrition Market Attractiveness Analysis, By Nutrition Type, 2025 to 2035

Figure 79: Latin America Parenteral Nutrition Market Value Share Analysis, By Composition, 2024 and 2035

Figure 80: Latin America Parenteral Nutrition Market Attractiveness Analysis, By Composition, 2025 to 2035

Figure 81: Latin America Parenteral Nutrition Market Value Share Analysis, By Patient Age Group, 2024 and 2035

Figure 82: Latin America Parenteral Nutrition Market Attractiveness Analysis, By Patient Age Group, 2025 to 2035

Figure 83: Latin America Parenteral Nutrition Market Value Share Analysis, By Indication, 2024 and 2035

Figure 84: Latin America Parenteral Nutrition Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 85: Latin America Parenteral Nutrition Market Value Share Analysis, By End-user, 2024 and 2035

Figure 86: Latin America Parenteral Nutrition Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 87: Middle East & Africa Parenteral Nutrition Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 88: Middle East & Africa Parenteral Nutrition Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 89: Middle East & Africa Parenteral Nutrition Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 90: Middle East & Africa Parenteral Nutrition Market Value Share Analysis, By Nutrition Type, 2024 and 2035

Figure 91: Middle East & Africa Parenteral Nutrition Market Attractiveness Analysis, By Nutrition Type, 2025 to 2035

Figure 92: Middle East & Africa Parenteral Nutrition Market Value Share Analysis, By Composition, 2024 and 2035

Figure 93: Middle East & Africa Parenteral Nutrition Market Attractiveness Analysis, By Composition, 2025 to 2035

Figure 94: Middle East & Africa Parenteral Nutrition Market Value Share Analysis, By Patient Age Group, 2024 and 2035

Figure 95: Middle East & Africa Parenteral Nutrition Market Attractiveness Analysis, By Patient Age Group, 2025 to 2035

Figure 96: Middle East & Africa Parenteral Nutrition Market Value Share Analysis, By Indication, 2024 and 2035

Figure 97: Middle East & Africa Parenteral Nutrition Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 98: Middle East & Africa Parenteral Nutrition Market Value Share Analysis, By End-user, 2024 and 2035

Figure 99: Middle East & Africa Parenteral Nutrition Market Attractiveness Analysis, By End-user, 2025 to 2035