Reports

Reports

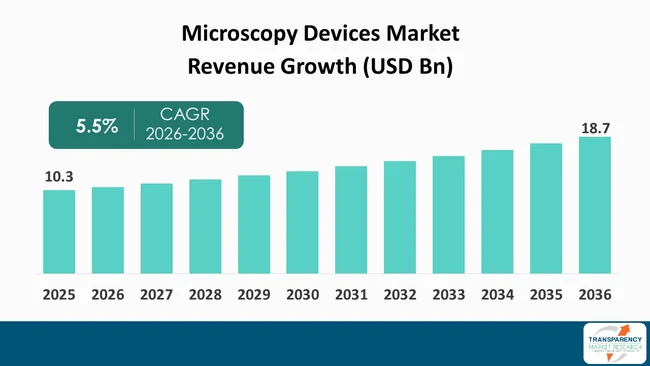

The global microscopy devices market size was valued at US$ 10.3 Bn in 2025 and is projected to reach US$ 18.7 Bn by 2036, expanding at a CAGR of 5.5% from 2026 to 2036. The microscopy devices industry is primarily driven by the rising demand for advanced imaging techniques in life sciences and clinical diagnostics, supported by increasing investments in biomedical research and drug discovery. Additionally, technological advancements such as super-resolution microscopy, digital imaging integration, and AI-enabled analysis are accelerating adoption across academic, pharmaceutical, and industrial laboratories.

The growth of the microscopy devices market is limited primarily by the expense of the advanced devices, and the need for highly skilled personnel to operate and process complex systems. Additionally, limited accessibility due to small laboratories and emerging regions, as well as high maintenance and training costs associated with these devices, continue to present hindrances to an expanded adoption.

The microscopy devices market presents significant opportunities through the invention of smaller and more mobile, automated microscopy systems, which provide increased accessibility and efficiency in the workflow. Increased research will likely be supported and incentivized by significant advancements in the use of AI, machine learning, and cloud-based technology in the interpretation of microscopy-related data and in the acceleration of making decisive decisions.

Furthermore, expanding markets for nanotechnology, material science, and semiconductor inspection offer additional avenues for expanding these markets. Overall, the combination of continued technological improvements and growth, along with an ongoing increase in research funding and investment in research infrastructure, will lead to the continued growth and success of the microscopy devices market for the foreseeable future.

Microscopy devices employ optical, electron, or scanning probe technologies for magnifying samples and providing detailed images of cells, tissues, microorganisms, materials, and nanoscale structures. Microscopy devices are broadly used in clinical diagnostics, life sciences, nanotechnology, material science, semiconductor inspection, and academic research for studying morphology, composition, and structural characteristics at microscopic as well as sub-microscopic levels.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increase in demand for advanced imaging technologies such as microscopy devices in the life sciences, biotechnology, and clinical diagnostics markets are a major booster to the microscopy devices market. The use of high-resolution microscopy by researchers studying cells, molecules, and the other biological processes within the life sciences and biotechnology is increasing, as it provides accurate data.

Creating detailed images of biological samples with advanced imaging techniques (for example fluorescence microscopy, confocal microscopy, super-resolution microscopy) provides researchers with critical data to facilitate their understanding of diseases, resulting in targeted treatments and personalized medicine.

In the clinical diagnostics market, microscopy devices can be used to detect disease, pathological disorders, and to perform laboratory diagnostic tests. As an increasing number of patients with chronic and infectious diseases require fast and accurate diagnoses, there is more need to have high-quality imaging systems able to produce reliable results.

Advanced microscopy allows clinicians to see how disease processes occur at the cellular and tissue levels, which increases the accuracy of diagnosis and treatment. The integration of digital images/automation/artificial intelligence into microscopy devices continues to improve the quality of images produced by them as well as improving the speed and efficiency of data analysis and workflow, which is leading to overall increased use of these technologies in research, hospitals, and diagnostic laboratories throughout the globe.

Microscopy devices market is poised to grow significantly From technological advancements of super-resolution microscopy, digital imaging, automation, and AI-enabled analysis technologies. The incorporation of automation into microscopy systems has reduced the amount of human input, increased throughput, and decreased the likelihood that human error will affect results. The aforementioned reasons have made microscopes much easier to use in high-throughput laboratories and industrial settings than historically difficult to use manual microscopes.

AI-enabled analysis is one territory where technology integration is anticipated to produce significant advancements. AI-enabled technologies permit automated processing of images, automated detection and classification of patterns in images, and real-time interpretation of data.

| Attribute | Detail |

|---|---|

| Market Opportunity |

|

The microscopy devices market has a huge growth opportunity due to the increase in the investment of genomics, proteomics and precision medicine. Advanced microscopes are used extensively in genomics and proteomics research for gaining insight into the structure of cells, how the genes are expressed, and how proteins interact at the molecular level.

The use of high-resolution imaging techniques allows researchers to visualize complicated biological processes, which leads to additional insight into the underlying mechanisms of diseases and how they function on a cellular basis. This increasing demand for advanced microscopy systems can be found in Academic Institutions, Research Facilities and the Pharmaceutical Business.

To create treatment based on an individual’s genetic/molecular make-up, precision medicine relies on a detailed examination of an individual’s cells and tissues. Microscopy devices provide excellent support by allowing researchers to visualize accurately the biomarkers of a cell (or tissue) and how it reacts toward certain stimuli or how it has changed through pathology. For instance, Fluorescence Microscopy, Confocal Microscopy, and Super-Resolution Microscopy are being used more often to support the development of personalized medications as well as assist in research for targeted therapies.

Moreover, the continuous increase in public and private funding of Life Sciences Research is causing an increase in Innovation within the Genomics and Proteomics fields. In fact, leaders in governments and the Healthcare Industry (Health Care Organizations) are investing significant resources into large scale research programs that require a vast quantity of data to be produced and validated through the use of microscopy. Therefore, there continues to be a strong opportunity for growth in the global microscopy devices market.

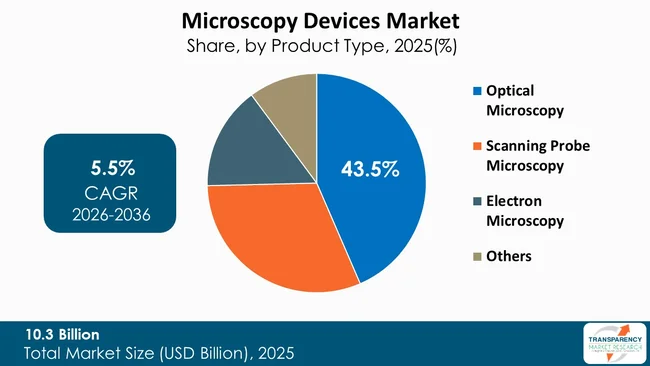

In the microscopy devices market, optical microscopy is leading the product type segment as it is widely accepted in many fields including Life Sciences, Clinical Diagnostics, and Academic Research. Optical microscopy has been widely adopted due to the simplicity of their use; their cost effectiveness; the ability for real-time visualization of biological, and material samples while also providing researchers with an array of applications for doing so within the laboratory including but not limited to, cell imaging, tissue analysis, microbiological studies (both - in-vivo and in-vitro), and histopathology, making these instruments essential in both - Research and Healthcare fields.

Compared to scanning and electron microscopy systems, optical microscopy systems are more affordable and less complicated regarding preparation of samples than their counterparts, which allow for small laboratories and educational facilities to be able to successfully use optical microscopy in research.

With the level of investment into Life Sciences research, Pharmaceutical Development and Clinical Diagnostics continuing to increase, there are also strong market indicators that will continue to enhance all aspects of optical microscopy, thus supporting optical microscopy as the dominant product type segment in the microscopy devices market for many years to come.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America dominates the microscopy devices market, accounting for a considerable 41.2% market share. With significant investments into life sciences, drug development, and clinical diagnostics in North America supporting the high volume of use of microscopy devices, North America is the dominant player in the microscopy devices industry due to strong research ecosystems, advanced healthcare infrastructure, and high uptake of advanced imaging technology.

Additionally, large players in North America that are both - technology providers and market leaders - are investing heavily into the development of new products and forming strategic partnerships The use of automation, digital microscopy, and AI-enabled imaging devices is driving increased productivity and precision in workflow processes and improved accuracy in data verification.

Olympus Corporation, Leica Microsystems, Carl Zeiss AG, Bruker, Nikon Corporation, Thermo Fisher Scientific Inc., Hitachi, Ltd, JEOL Ltd, KEYENCE CORPORATION., Nanosurf, EVIDENT, Oxford Instruments, Agilent Technologies, Inc, Motic Microscopes are the key players governing the global microscopy devices market.

Each of these players has been profiled in the microscopy devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 10.3 Bn |

| Forecast Value in 2036 | More than US$ 18.7 Bn |

| CAGR | 5.5% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global microscopy devices market was valued at US$ 10.3 Bn in 2025

The global microscopy devices market is projected to cross US$ 18.7 Bn by the end of 2036

Rising demand for advanced imaging techniques in life sciences, biotechnology, and clinical diagnostics and Technological advancements such as super-resolution microscopy, digital imaging, automation, and AI-enabled analysis

The global microscopy devices market is anticipated to grow at a CAGR 5.5% from 2026 to 2036

North America is expected to account for the largest share from 2026 to 2036

Olympus Corporation, Leica Microsystems, Carl Zeiss AG, Bruker, Nikon Corporation, Thermo Fisher Scientific Inc., Hitachi, Ltd, JEOL Ltd, KEYENCE CORPORATION., Nanosurf, EVIDENT, Oxford Instruments, Agilent Technologies, Inc, Motic Microscopes, and other prominent players

Table 01: Global Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 02: Global Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 03: Global Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 04: Global Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 05: Global Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 06: Global Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 07: Global Microscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 08: North America Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 09: North America Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 10: North America Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 11: North America Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 12: North America Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 13: North America Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 14: North America Microscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 15: U.S. Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 16: U.S. Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 17: U.S. Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 18: U.S. Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 19: U.S. Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 20: U.S. Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 21: Canada Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 22: Canada Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 23: Canada Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 24: Canada Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 25: Canada Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 26: Canada Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 27: Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 28: Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 29: Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 30: Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 31: Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 32: Europe Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 33: Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 34: Germany Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 35: Germany Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 36: Germany Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 37: Germany Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 38: Germany Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 39: Germany Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 40: U.K. Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 41: U.K. Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 42: U.K. Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 43: U.K. Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 44: U.K. Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 45: U.K. Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 46: France Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 47: France Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 48: France Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 49: France Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 50: France Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 51: France Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 52: Italy Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 53: Italy Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 54: Italy Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 55: Italy Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 56: Italy Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 57: Italy Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 58: Spain Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 59: Spain Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 60: Spain Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 61: Spain Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 62: Spain Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 63: Spain Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 64: The Netherlands Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 65: The Netherlands Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 66: The Netherlands Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 67: The Netherlands Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 68: The Netherlands Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 69: The Netherlands Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 70: Rest of Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 71: Rest of Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 72: Rest of Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 73: Rest of Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 74: Rest of Europe Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 75: Rest of Europe Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 76: Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 77: Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 78: Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 79: Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 80: Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 81: Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 82: Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 83: China Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 84: China Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 85: China Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 86: China Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 87: China Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 88: China Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 89: Japan Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 90: Japan Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 91: Japan Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 92: Japan Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 93: Japan Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 94: Japan Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 95: India Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 96: India Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 97: India Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 98: India Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 99: India Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 100: India Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 101: South Korea Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 102: South Korea Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 103: South Korea Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 104: South Korea Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 105: South Korea Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 106: South Korea Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 107: Australia Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 108: Australia Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 109: Australia Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 110: Australia Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 111: Australia Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 112: Australia Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 113: Rest of Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 114: Rest of Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 115: Rest of Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 116: Rest of Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 117: Rest of Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 118: Rest of Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 119: Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 120: Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 121: Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 122: Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 123: Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 124: Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 125: Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 126: Brazil Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 127: Brazil Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 128: Brazil Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 129: Brazil Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 130: Brazil Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 131: Brazil Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 132: Mexico Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 133: Mexico Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 134: Mexico Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 135: Mexico Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 136: Mexico Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 137: Mexico Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 138: Argentina Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 139: Argentina Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 140: Argentina Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 141: Argentina Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 142: Argentina Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 143: Argentina Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 144: Rest of Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 145: Rest of Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 146: Rest of Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 147: Rest of Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 148: Rest of Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 149: Rest of Latin America Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 150: Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 151: Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 152: Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 153: Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 154: Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 155: Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 156: Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 157: GCC Countries Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 158: GCC Countries Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 159: GCC Countries Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 160: GCC Countries Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 161: GCC Countries Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 162: GCC Countries Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 163: South Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 164: South Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 165: South Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 166: South Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 167: South Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 168: South Africa Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 169: Rest of Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Product Type, 2021 to 2036

Table 170: Rest of Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Optical Microscopy, 2021 to 2036

Table 171: Rest of Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Scanning Probe Microscopy, 2021 to 2036

Table 172: Rest of Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Electron Microscopy, 2021 to 2036

Table 173: Rest of Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 174: Rest of Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Figure 01: Global Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 03: Global Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 04: Global Microscopy Devices Market Revenue (US$ Bn), by Optical Microscopy, 2021 to 2036

Figure 05: Global Microscopy Devices Market Revenue (US$ Bn), by Scanning Probe Microscopy, 2021 to 2036

Figure 06: Global Microscopy Devices Market Revenue (US$ Bn), by Electron Microscopy, 2021 to 2036

Figure 07: Global Microscopy Devices Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 08: Global Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 09: Global Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 10: Global Microscopy Devices Market Revenue (US$ Bn), by Cell and Molecular Biology, 2021 to 2036

Figure 11: Global Microscopy Devices Market Revenue (US$ Bn), by Pharmacology and Toxicology, 2021 to 2036

Figure 12: Global Microscopy Devices Market Revenue (US$ Bn), by Clinical Pathology and Diagnostics, 2021 to 2036

Figure 13: Global Microscopy Devices Market Revenue (US$ Bn), by Surgery, 2021 to 2036

Figure 14: Global Microscopy Devices Market Revenue (US$ Bn), by Biomedical Engineering, 2021 to 2036

Figure 15: Global Microscopy Devices Market Revenue (US$ Bn), by Neuroscience, 2021 to 2036

Figure 16: Global Microscopy Devices Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 17: Global Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 18: Global Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 19: Global Microscopy Devices Market Revenue (US$ Bn), by Hospitals, 2021 to 2036

Figure 20: Global Microscopy Devices Market Revenue (US$ Bn), by Diagnostic Laboratory, 2021 to 2036

Figure 21: Global Microscopy Devices Market Revenue (US$ Bn), by Ambulatory Surgery Centers, 2021 to 2036

Figure 22: Global Microscopy Devices Market Revenue (US$ Bn), by Physician Offices, 2021 to 2036

Figure 23: Global Microscopy Devices Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 24: Global Microscopy Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 25: Global Microscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 26: North America Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 27: North America Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 28: North America Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 29: North America Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 30: North America Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 31: North America Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 32: North America Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 33: North America Microscopy Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 34: North America Microscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 35: U.S. Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 36: U.S. Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 37: U.S. Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 38: U.S. Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 39: U.S. Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 40: U.S. Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 41: U.S. Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 42: Canada Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 43: Canada Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 44: Canada Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 45: Canada Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 46: Canada Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 47: Canada Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 48: Canada Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 49: Europe Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 50: Europe Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 51: Europe Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 52: Europe Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 53: Europe Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 54: Europe Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 55: Europe Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 56: Europe Microscopy Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 57: Europe Microscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 58: Germany Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 59: Germany Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 60: Germany Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 61: Germany Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 62: Germany Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 63: Germany Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 64: Germany Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 65: U.K. Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 66: U.K. Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 67: U.K. Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 68: U.K. Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 69: U.K. Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 70: U.K. Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 71: U.K. Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 72: France Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 73: France Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 74: France Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 75: France Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 76: France Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 77: France Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 78: France Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 79: Italy Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 80: Italy Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 81: Italy Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 82: Italy Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 83: Italy Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 84: Italy Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 85: Italy Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 86: Spain Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 87: Spain Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 88: Spain Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 89: Spain Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 90: Spain Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 91: Spain Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 92: Spain Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 93: The Netherlands Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 94: The Netherlands Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 95: The Netherlands Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 96: The Netherlands Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 97: The Netherlands Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 98: The Netherlands Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 99: The Netherlands Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 100: Rest of Europe Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 101: Rest of Europe Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 102: Rest of Europe Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 103: Rest of Europe Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 104: Rest of Europe Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 105: Rest of Europe Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 106: Rest of Europe Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 107: Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 108: Asia Pacific Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 109: Asia Pacific Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 110: Asia Pacific Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 111: Asia Pacific Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 112: Asia Pacific Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 113: Asia Pacific Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 114: Asia Pacific Microscopy Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 115: Asia Pacific Microscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 116: China Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 117: China Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 118: China Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 119: China Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 120: China Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 121: China Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 122: China Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 123: Japan Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 124: Japan Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 125: Japan Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 126: Japan Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 127: Japan Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 128: Japan Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 129: Japan Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 130: India Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 131: India Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 132: India Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 133: India Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 134: India Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 135: India Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 136: India Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 137: South Korea Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 138: South Korea Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 139: South Korea Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 140: South Korea Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 141: South Korea Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 142: South Korea Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 143: South Korea Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 144: Australia Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 145: Australia Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 146: Australia Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 147: Australia Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 148: Australia Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 149: Australia Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 150: Australia Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 151: ASEAN Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 152: ASEAN Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 153: ASEAN Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 154: ASEAN Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 155: ASEAN Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 156: ASEAN Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 157: ASEAN Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 158: Rest of Asia Pacific Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 159: Rest of Asia Pacific Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 160: Rest of Asia Pacific Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 161: Rest of Asia Pacific Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 162: Rest of Asia Pacific Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 163: Rest of Asia Pacific Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 164: Rest of Asia Pacific Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 165: Latin America Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 166: Latin America Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 167: Latin America Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 168: Latin America Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 169: Latin America Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 170: Latin America Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 171: Latin America Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 172: Latin America Microscopy Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 173: Latin America Microscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 174: Brazil Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 175: Brazil Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 176: Brazil Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 177: Brazil Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 178: Brazil Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 179: Brazil Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 180: Brazil Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 181: Mexico Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 182: Mexico Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 183: Mexico Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 184: Mexico Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 185: Mexico Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 186: Mexico Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 187: Mexico Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 188: Argentina Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 189: Argentina Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 190: Argentina Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 191: Argentina Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 192: Argentina Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 193: Argentina Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 194: Argentina Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 195: Rest of Latin America Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 196: Rest of Latin America Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 197: Rest of Latin America Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 198: Rest of Latin America Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 199: Rest of Latin America Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 200: Rest of Latin America Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 201: Rest of Latin America Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 202: Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 203: Middle East and Africa Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 204: Middle East and Africa Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 205: Middle East and Africa Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 206: Middle East and Africa Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 207: Middle East and Africa Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 208: Middle East and Africa Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 209: Middle East and Africa Microscopy Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 210: Middle East and Africa Microscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 211: GCC Countries Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 212: GCC Countries Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 213: GCC Countries Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 214: GCC Countries Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 215: GCC Countries Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 216: GCC Countries Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 217: GCC Countries Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 218: South Africa Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 219: South Africa Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 220: South Africa Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 221: South Africa Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 222: South Africa Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 223: South Africa Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 224: South Africa Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 225: Rest of Middle East and Africa Microscopy Devices Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 226: Rest of Middle East and Africa Microscopy Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 227: Rest of Middle East and Africa Microscopy Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 228: Rest of Middle East and Africa Microscopy Devices Market Value Share Analysis, by Application, 2025 and 2036

Figure 229: Rest of Middle East and Africa Microscopy Devices Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 230: Rest of Middle East and Africa Microscopy Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 231: Rest of Middle East and Africa Microscopy Devices Market Attractiveness Analysis, by End-user, 2026 to 2036