Reports

Reports

Analyst Viewpoint

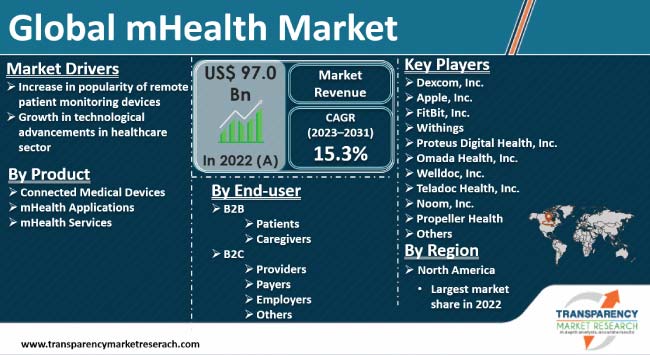

Increase in popularity of remote patient monitoring devices and technological advancements in the healthcare sector are fueling the mHealth market size. mHealth enables monitoring real-time patient information to track their heart rate, sugar levels, blood pressure, and other parameters. Rise in demand for remote patient monitoring devices for chronic diseases is driving the demand for mobile healthcare services.

Surge in adoption of digital health and easy availability of wearable fitness trackers is boosting market expansion. Increase in government initiatives to promote fitness awareness is likely to offer lucrative mHealth market opportunities. Leading companies in the sector are launching new applications with advanced technologies to meet patient demands. Moreover, manufacturers are investing in research and development activities to analyze the requirements of physicians and develop relevant services accordingly.

mHealth or mobile health is a general term for the use of mobile phones and other wireless technology in medical care. mHealth is used to improve health outcomes, research, and healthcare services to enhance patient care. These are available in devices, connections, applications, and service forms. mHealth plays a crucial part in telemedicine by increasing patient interaction and enabling remote data access to healthcare providers.

Digital health is on the rise across the globe due to the availability of advanced technologies and accessibility to modern healthcare services. mHealth enables mobile self-care services for patients suffering from diabetes, chronic diseases, and other health issues. The technology simplifies interaction among patients and allows physicians to access real-time patient data, such as sugar level, blood pressure, and heart rate.

Remote patient monitoring devices are extensively utilized by healthcare professionals to track patient information and change the treatment mode as per the requirements. Mobile healthcare devices are employed to monitor patient data where patients can update their details at their end. These devices help provide better treatment, increase patient engagement, reduce patient visits to the hospitals, decrease healthcare costs, and keep patient data updated. Thus, increase in popularity of advanced remote patient monitoring devices is fueling mHealth market value.

Rise in demand for remote patient monitoring solutions for chronic conditions is bolstering the market statistics. Chronic conditions, such as diabetes, cancer, and heart disease require regular patient data monitoring to avoid severe issues and disabilities. mHealth allows patients to register their blood sugar levels, heart rate, and other symptoms through remote devices. Hence, increase in prevalence of chronic conditions is driving market revenue.

According to the American Hospital Association, around 133 million Americans, nearly half the population, suffer from at least one chronic condition, such as arthritis, hypertension, or heart disease. The number is estimated to reach approximately 170 million by 2030.

Increase in penetration of 5G connectivity, artificial intelligence, machine learning, and augmented reality are some of the trending technologies adopted by the healthcare sector. Incorporation of Internet of Things (IoT) in mHealth enhances connectivity and accessibility through remote networks. Leading companies in the market are investing heavily to develop advanced mobile health apps for diabetes management, which in turn is fueling market progress. For instance, AT&T collaborated with Smart Meter to develop advanced digital health solutions for monitoring and tracking chronic ailments, such as diabetes, using Smart Meter’s IoT devices and AT&T’s well-established IoT network.

Rise in demand for wearable fitness trackers for heart rate monitoring is boosting market dynamics. Manufacturers are employing motion detectors, temperature monitors, and sensors to precisely record patient data. People are keen on using wearable fitness trackers due to its high efficiency, accuracy, easy availability, and feasibility.

According to the regional mHealth market analysis, North America dominated the global landscape in 2022. Implementation of government initiatives to promote mHealth is likely to propel the mHealth industry share during the forecast period. For instance, the U.S. Department of Health and Human Services, the National Institutes of Health, and the National Cancer Institute initiated Smokefree.gov and BeTobaccoFree.gov, to spread awareness among the population. Leading companies in the region are adopting the latest technologies to introduce new applications and services for patients.

Increase in use of connected devices and mHealth applications to manage chronic conditions is fueling market growth. Availability of strong network connectivity and developed healthcare infrastructure is favoring market conditions in the region. Moreover, easy accessibility to advanced technologies allows companies to develop services according to patient requirements.

Leading companies in the market are focusing on adopting the latest technologies to meet recent mHealth market trends. They are incorporating IoT, artificial intelligence, motion sensors, and temperature trackers into wearable fitness trackers to monitor real-time patient data. Manufacturers are introducing new applications and services to increase patient engagement and enhance their fitness awareness.

Some of the key players in the industry are Dexcom, Inc., Apple, Inc., FitBit, Inc., Withings, Proteus Digital Health, Inc., Omada Health, Inc., Welldoc, Inc., Teladoc Health, Inc., Noom, Inc., Propeller Health, Canary Health, BiogeniQ Inc., Glooko, Inc., Firstbeat Technologies, and BioTelemetry, Inc.

These companies have been profiled in the mHealth market report based on various parameters including company overview, business segments, product portfolio, recent developments, business strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 97.0 Bn |

| Market Forecast (Value) in 2031 | US$ 353.4 Bn |

| Growth Rate (CAGR) | 15.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 97.0 Bn in 2022

It is projected to register a CAGR of 15.3% from 2023 to 2031

Increase in popularity of remote patient monitoring devices, and growth in technological advancements in the healthcare sector

North America was the most lucrative region in 2022

Dexcom, Inc., Apple, Inc., FitBit, Inc., Withings, Proteus Digital Health, Inc., Omada Health, Inc., Welldoc, Inc., Teladoc Health, Inc., Noom, Inc., Propeller Health, Canary Health, BiogeniQ Inc., Glooko, Inc., Firstbeat Technologies, and BioTelemetry, Inc.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global mHealth Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global mHealth Market Analysis and Forecasts, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. COVID-19 Pandemic Impact on Industry

6. mHealth Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Connected Medical Devices

6.3.1.1. Heart Rate Monitors

6.3.1.2. Activity Monitors

6.3.1.3. Electrocardiograph

6.3.1.4. Fetal Monitoring

6.3.1.5. Neuromonitoring

6.3.1.6. Others

6.3.2. mHealth Applications

6.3.2.1. Fitness & Wellness

6.3.2.2. Diabetes

6.3.2.3. Cardiovascular Diseases

6.3.2.4. Central Nervous System Diseases

6.3.2.5. Respiratory Diseases

6.3.2.6. Musculoskeletal Diseases

6.3.2.7. Smoking Cessation

6.3.2.8. Medication Adherence

6.3.2.9. Others

6.3.3. mHealth Services

6.4. Market Attractiveness, by Product

7. Global mHealth Market Analysis and Forecast, by End-user

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. B2B

7.3.1.1. Patients

7.3.1.2. Caregivers

7.3.2. B2C

7.3.2.1. Providers

7.3.2.2. Payers

7.3.2.3. Employers

7.3.2.4. Others

7.4. Market Attractiveness, by End-user

8. Global mHealth Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America mHealth Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. Connected Medical Devices

9.2.1.1. Heart Rate Monitors

9.2.1.2. Activity Monitors

9.2.1.3. Electrocardiograph

9.2.1.4. Fetal Monitoring

9.2.1.5. Neuromonitoring

9.2.1.6. Others

9.2.2. mHealth Applications

9.2.2.1. Fitness & Wellness

9.2.2.2. Diabetes

9.2.2.3. Cardiovascular Diseases

9.2.2.4. Central Nervous System Diseases

9.2.2.5. Respiratory Diseases

9.2.2.6. Musculoskeletal Diseases

9.2.2.7. Smoking Cessation

9.2.2.8. Medication Adherence

9.2.2.9. Others

9.2.3. mHealth Services

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. B2B

9.3.1.1. Patients

9.3.1.2. Caregivers

9.3.2. B2C

9.3.2.1. Providers

9.3.2.2. Payers

9.3.2.3. Employers

9.3.2.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe mHealth Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Connected Medical Devices

10.2.1.1. Heart Rate Monitors

10.2.1.2. Activity Monitors

10.2.1.3. Electrocardiograph

10.2.1.4. Fetal Monitoring

10.2.1.5. Neuromonitoring

10.2.1.6. Others

10.2.2. mHealth Applications

10.2.2.1. Fitness & Wellness

10.2.2.2. Diabetes

10.2.2.3. Cardiovascular Diseases

10.2.2.4. Central Nervous System Diseases

10.2.2.5. Respiratory Diseases

10.2.2.6. Musculoskeletal Diseases

10.2.2.7. Smoking Cessation

10.2.2.8. Medication Adherence

10.2.2.9. Others

10.2.3. mHealth Services

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. B2B

10.3.1.1. Patients

10.3.1.2. Caregivers

10.3.2. B2C

10.3.2.1. Providers

10.3.2.2. Payers

10.3.2.3. Employers

10.3.2.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific mHealth Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Connected Medical Devices

11.2.1.1. Heart Rate Monitors

11.2.1.2. Activity Monitors

11.2.1.3. Electrocardiograph

11.2.1.4. Fetal Monitoring

11.2.1.5. Neuromonitoring

11.2.1.6. Others

11.2.2. mHealth Applications

11.2.2.1. Fitness & Wellness

11.2.2.2. Diabetes

11.2.2.3. Cardiovascular Diseases

11.2.2.4. Central Nervous System Diseases

11.2.2.5. Respiratory Diseases

11.2.2.6. Musculoskeletal Diseases

11.2.2.7. Smoking Cessation

11.2.2.8. Medication Adherence

11.2.2.9. Others

11.2.3. mHealth Services

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. B2B

11.3.1.1. Patients

11.3.1.2. Caregivers

11.3.2. B2C

11.3.2.1. Providers

11.3.2.2. Payers

11.3.2.3. Employers

11.3.2.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America mHealth Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Connected Medical Devices

12.2.1.1. Heart Rate Monitors

12.2.1.2. Activity Monitors

12.2.1.3. Electrocardiograph

12.2.1.4. Fetal Monitoring

12.2.1.5. Neuromonitoring

12.2.1.6. Others

12.2.2. mHealth Applications

12.2.2.1. Fitness & Wellness

12.2.2.2. Diabetes

12.2.2.3. Cardiovascular Diseases

12.2.2.4. Central Nervous System Diseases

12.2.2.5. Respiratory Diseases

12.2.2.6. Musculoskeletal Diseases

12.2.2.7. Smoking Cessation

12.2.2.8. Medication Adherence

12.2.2.9. Others

12.2.3. mHealth Services

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. B2B

12.3.1.1. Patients

12.3.1.2. Caregivers

12.3.2. B2C

12.3.2.1. Providers

12.3.2.2. Payers

12.3.2.3. Employers

12.3.2.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa mHealth Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Connected Medical Devices

13.2.1.1. Heart Rate Monitors

13.2.1.2. Activity Monitors

13.2.1.3. Electrocardiograph

13.2.1.4. Fetal Monitoring

13.2.1.5. Neuromonitoring

13.2.1.6. Others

13.2.2. mHealth Applications

13.2.2.1. Fitness & Wellness

13.2.2.2. Diabetes

13.2.2.3. Cardiovascular Diseases

13.2.2.4. Central Nervous System Diseases

13.2.2.5. Respiratory Diseases

13.2.2.6. Musculoskeletal Diseases

13.2.2.7. Smoking Cessation

13.2.2.8. Medication Adherence

13.2.2.9. Others

13.2.3. mHealth Services

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. B2B

13.3.1.1. Patients

13.3.1.2. Caregivers

13.3.2. B2C

13.3.2.1. Providers

13.3.2.2. Payers

13.3.2.3. Employers

13.3.2.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Dexcom, Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Apple, Inc.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. FitBit, Inc.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Withings

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Proteus Digital Health, Inc.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Omada Health, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Welldoc, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Teladoc Health, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Noom, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Propeller Health.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Canary Health

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. BiogeniQ Inc.

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Glooko, Inc.

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

14.3.14. Firstbeat Technologies

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Product Portfolio

14.3.14.3. Financial Overview

14.3.14.4. SWOT Analysis

14.3.14.5. Strategic Overview

14.3.15. BioTelemetry, Inc.

14.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.15.2. Product Portfolio

14.3.15.3. Financial Overview

14.3.15.4. SWOT Analysis

14.3.15.5. Strategic Overview

List of Tables

Table 01: Global mHealth Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global mHealth Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global mHealth Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America mHealth Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America mHealth Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 06: North America mHealth Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Europe mHealth Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe mHealth Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: Europe mHealth Market Value (US$ Mn) Forecast, by End-user 2017–2031

Table 10: Asia Pacific mHealth Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific mHealth Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 12: Asia Pacific mHealth Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Latin America mHealth Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America mHealth Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Latin America mHealth Market Value (US$ Mn) Forecast, by End-user 2017–2031

Table 16: Middle East & Africa mHealth Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa mHealth Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Middle East & Africa mHealth Market Value (US$ Mn) Forecast, by End-user 2017–2031

List of Figures

Figure 01: Global mHealth Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global mHealth Market Value Share, by Product, 2022

Figure 03: Global mHealth Market Value Share, by End-user, 2022

Figure 04: Global mHealth Market Value Share Analysis, by Product, 2022 and 2031

Figure 05: Global mHealth Market Attractiveness Analysis, by Product, 2023–2031

Figure 06: Global mHealth Market Value Share Analysis, by End-user, 2022 and 2031

Figure 07: Global mHealth Market Attractiveness Analysis, by End-user 2023–2031

Figure 08: Global mHealth Market Value Share Analysis, by Region, 2022 and 2031

Figure 09: Global mHealth Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America mHealth Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America mHealth Market Value Share Analysis, by Country, 2022 and 2031

Figure 12: North America mHealth Market Attractiveness Analysis, by Country, 2023–2031

Figure 13: North America mHealth Market Value Share Analysis, by Product, 2022 and 2031

Figure 14: North America mHealth Market Attractiveness Analysis, by Product, 2023–2031

Figure 15: North America mHealth Market Value Share Analysis, by End-user, 2022 and 2031

Figure 16: North America mHealth Market Attractiveness Analysis, by End-user 2023–2031

Figure 17: Europe mHealth Market Value (US$ Mn) Forecast, 2017–2031

Figure 18: Europe mHealth Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 19: Europe mHealth Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 20: Europe mHealth Market Value Share Analysis, by Product, 2022 and 2031

Figure 21: Europe America mHealth Market Attractiveness Analysis, by Product, 2023–2031

Figure 22: Europe mHealth Market Value Share Analysis, by End-user, 2022 and 2031

Figure 23: Europe mHealth Market Attractiveness Analysis, by End-user 2023–2031

Figure 24: Asia Pacific mHealth Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: Asia Pacific mHealth Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Asia Pacific mHealth Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 27: Asia Pacific mHealth Market Value Share Analysis, by Product, 2022 and 2031

Figure 28: Asia Pacific America mHealth Market Attractiveness Analysis, by Product, 2023–2031

Figure 29: Asia Pacific mHealth Market Value Share Analysis, by End-user, 2022 and 2031

Figure 30: Asia Pacific mHealth Market Attractiveness Analysis, by End-user 2023–2031

Figure 31: Latin America mHealth Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Latin America mHealth Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Latin America mHealth Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Latin America mHealth Market Value Share Analysis, by Product, 2022 and 2031

Figure 35: Latin America mHealth Market Attractiveness Analysis, by Product, 2023–2031

Figure 36: Middle East & Africa mHealth Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 37: Middle East & Africa mHealth Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Middle East & Africa America mHealth Market Value Share Analysis, by Product, 2022 and 2031

Figure 39: Middle East & Africa America mHealth Market Attractiveness Analysis, by Product, 2023–2031

Figure 40: Middle East & Africa mHealth Market Value Share Analysis, by End-user, 2022 and 2031

Figure 41: Middle East & Africa mHealth Market Attractiveness Analysis, by End-user 2023–2031

Figure 42: Global mHealth Market Share Analysis, by Company (2022)