Reports

Reports

The Medical Device Technologies market is growing steadily as demand increases for more sophisticated diagnostic technologies, less invasive treatment modalities, and the increasing global burden of chronic illnesses. A primary catalyst for this growth is the aging population leading to a rising incidence of age-related conditions, regardless of their origin, that will necessitate continued innovation in imaging, monitoring, and therapeutic devices. One major constraint is the difficult global regulatory environment - particularly in the U.S. and Europe - that is constantly evolving and increases time-to-market and costs of development for developers of next generation technologies such as AI-enabled devices and implantable devices.

.webp)

One strong opportunity to consider is the rapid adoption of digital health and home-based care. For example, it is already happening where devices that are connected via internet of things (IoT) technologies or remote monitoring, are being used for personalized, more timely, and cost effective delivery of care while taking advantage of technologies that give us access to cost-effective "restorative" options- particularly in emerging markets. Analysts will focus on the sector itself, noting it continues to tend to be driven by innovation, and the future for it, especially to address aging in population will probably trend towards data-enabled, interoperable, patient-centred device ecosystems.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Technological developments are a primary driver expanding the Medical Device Technologies Market because they establish more precise, more efficient, and more patient-friendly devices. More specifically, recent developments have resulted in the incorporation of artificial intelligence (AI), robotic-assisted surgery, wearable sensors, miniaturized implants, and connected devices (referred to as IoMT) in the manner in which diseases are diagnosed, monitored, and treated.

Advances in technology do not only positively influence clinical outcomes; they also reduce hospital length of stay and allow for personalized care, about which there is growing interest. AI-enabled imaging systems can now identify anomalies faster and with greater accuracy and robotic systems allow surgeons to conduct complex surgical procedures with limited invasiveness. Integrating software and cloud-based platforms has promoted real-time data sharing and remote monitoring, in helpful ways, when managing chronic diseases.

As health care systems globally strive for efficiency, outcomes, and cost, incorporating advanced technologies into the medical device industry, and improving our approach to patient care within healthcare systems, is surely impacting the growth of the industry.

Rising Prevalence of Chronic Diseases is expected to propel the growth of Medical Device Technologies Market over the forecast period. There is a rise in chronic health conditions, including cardiovascular disease, diabetes, and cancer caused by an array of factors such as an aging population, changes in lifestyles (daily activity, nutrition), and the capability to perform advanced diagnostic techniques.

The increased incidence of chronic health conditions is ultimately fueling the demand for medical devices that include medical technologies that assist with diagnosis such as in-vitro diagnostics that works toward the early detection of chronic health conditions, therapeutic devices that are used to treat chronic health conditions such as pacemakers and stents, and wearable medical technologies that continuously monitor chronic health conditions in regards to lifestyle changes.

Moreover, the demand for new and innovative solutions that treat chronic health conditions and provide effective and efficient means of identifying chronic health conditions is being further fueled in regions experiencing healthcare infrastructure growth such as North America and Asia Pacific.

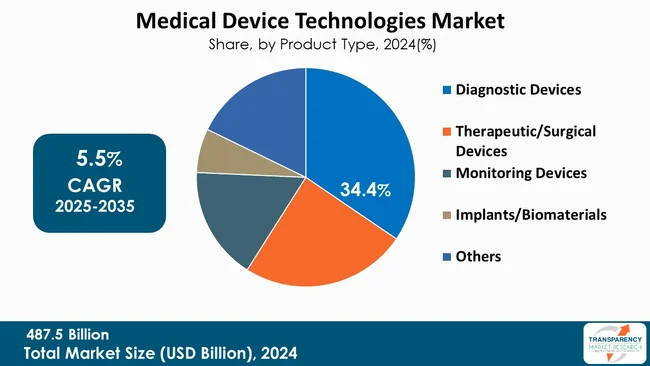

Diagnostic devices are a major contributor to the growth of the global medical device technologies market. The prevalence of chronic diseases such as cardiovascular diseases, diabetes, and cancer are increasing driven by aging populations and changing lifestyles. The diagnostic devices market, which includes diagnostics technology devices like in-vitro diagnostics (IVD) and diagnostic imaging equipment such as X-ray, MRI, CT scanners and ultrasound has the leading market share.

The increasing requirement for early identification and assessment of chronic diseases has amplified demand for diagnostic devices in hospitals and diagnostics centers in regions such as North America and Asia-Pacific, where regions have established and expanding healthcare systems.The increased pace of investigation and assessment from advancements in diagnostics devices is enhancing the presence of diagnostic devices.

The development of AI in imaging to delivery of point-of-care testing is accelerating expansion and advancement of diagnostic devices. IVD devices also have vital significance in real time for testing in an individual with chronic conditions i.e. diabetes or infectious diseases, while novel imaging systems have heightened the detection of complex conditions i.e. cancer. As the diagnostic devices segment continues to advance the management of the increasing burden of chronic diseases, it is therefore integral to the overall advancement of the medical device technologies industry.

| Attribute | Detail |

|---|---|

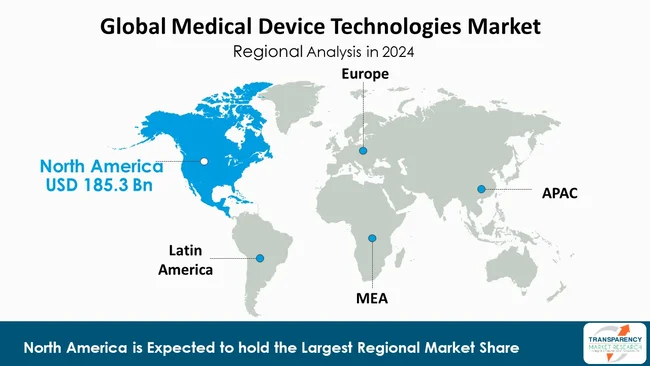

| Leading Region | North America |

The North America region has continued to drive patient care with increasing advances in medical device technologies with strong infrastructure, support for innovative devices, and extensive Research and Development across its healthcare sector. The region also has some of the largest players in the medical device sector including Medtronic and Abbott, which are facilitating further advancements in the types of diagnostic and therapeutic devices that can improve patient care.

Chronic diseases such as diabetes and cardiovascular conditions contribute significantly to the types of devices being developed (imaging systems, pacemakers, etc.). With favorable reimbursement rates, strong healthcare expenditure and some of the fastest FDA approvals, North America is positioned as the market leader in this sector.

Medtronic, Abbott, Siemens Healthineers AG, GE HealthCare, Koninklijke Philips N.V., Stryker, Boston Scientific Corporation or its affiliates, Edwards Lifesciences Corporation., Intuitive Surgical Operations, Inc., Baxter., Cardinal Health., Zimmer Biomet, FUJIFILM Corporation, Johnson & Johnson and its affiliates and Other Prominent Players are operating in the global medical device technologies market.

Each of these players has been profiled in the Medical Device Technologies Market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 487.5 Bn |

| Forecast Value in 2035 | More than US$ 882.1 Bn |

| CAGR | 5.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 487.5 Bn in 2024.

It is projected to cross US$ 882.1 Bn by the end of 2035.

Technological Advancements, Rising Prevalence of Chronic Diseases and Supportive Regulatory & Reimbursement Frameworks.

It is anticipated to grow at a CAGR of 5.5% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Medtronic, Abbott, Siemens Healthineers AG, GE HealthCare, Koninklijke Philips N.V., Stryker, Boston Scientific Corporation or its affiliates, Edwards Lifesciences Corporation., Intuitive Surgical Operations, Inc., Baxter., Cardinal Health., Zimmer Biomet, FUJIFILM Corporation, Johnson & Johnson and its affiliates and Other Prominent Players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Device Technologies Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Device Technologies Market Analysis and Forecasts, 2020 - 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Regulatory Landscape across Key Regions / Countries

5.2. Market Trends

5.3. PORTER’s Five Forces Analysis

5.4. PESTEL Analysis

5.5. Key Purchase Metrics for End-users

5.6. Brand and Pricing Analysis

5.7. Go to Marketing Strategies

5.8. End-users Preference

6. Global Medical Device Technologies Market Analysis and Forecasts, By Device Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Device Type, 2020 - 2035

6.3.1. Diagnostic Devices

6.3.1.1. In Vitro Diagnostics (IVD)

6.3.1.2. Imaging Systems

6.3.1.3. Others

6.3.2. Therapeutic/Surgical Devices

6.3.2.1. Surgical Instruments

6.3.2.2. Minimally Invasive Surgery (MIS) Devices

6.3.2.3. Drug Delivery Systems

6.3.2.4. Others

6.3.3. Monitoring Devices

6.3.3.1. Vital Signs Monitors

6.3.3.2. Cardiac Monitoring

6.3.3.3. Respiratory Monitoring

6.3.3.4. Diabetes Monitoring

6.3.3.5. Others

6.3.4. Implants/Biomaterials

6.3.4.1. Orthopedic Implants

6.3.4.2. Cardiovascular Implants

6.3.4.3. Neurological Implants

6.3.4.4. Others

6.3.5. Others

6.4. Market Attractiveness By Device Type

7. Global Medical Device Technologies Market Analysis and Forecasts, By Application Area

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application Area, 2020 - 2035

7.3.1. Cardiology

7.3.2. Orthopedics

7.3.3. Oncology

7.3.4. Neurology

7.3.5. Respiratory

7.3.6. Wound Care

7.3.7. Gynecology

7.3.8. Others

7.4. Market Attractiveness By Application Area

8. Global Medical Device Technologies Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020 - 2035

8.3.1. Hospitals & Clinics

8.3.2. Ambulatory Care Centers

8.3.3. Home Care Settings

8.3.4. Others

8.4. Market Attractiveness By End-user

9. Global Medical Device Technologies Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Medical Device Technologies Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Device Type, 2020 - 2035

10.2.1. Diagnostic Devices

10.2.1.1. In Vitro Diagnostics (IVD)

10.2.1.2. Imaging Systems

10.2.1.3. Others

10.2.2. Therapeutic/Surgical Devices

10.2.2.1. Surgical Instruments

10.2.2.2. Minimally Invasive Surgery (MIS) Devices

10.2.2.3. Drug Delivery Systems

10.2.2.4. Others

10.2.3. Monitoring Devices

10.2.3.1. Vital Signs Monitors

10.2.3.2. Cardiac Monitoring

10.2.3.3. Respiratory Monitoring

10.2.3.4. Diabetes Monitoring

10.2.3.5. Others

10.2.4. Implants/Biomaterials

10.2.4.1. Orthopedic Implants

10.2.4.2. Cardiovascular Implants

10.2.4.3. Neurological Implants

10.2.4.4. Others

10.2.5. Others

10.3. Market Value Forecast By Application Area, 2020 - 2035

10.3.1. Cardiology

10.3.2. Orthopedics

10.3.3. Oncology

10.3.4. Neurology

10.3.5. Respiratory

10.3.6. Wound Care

10.3.7. Gynecology

10.3.8. Others

10.4. Market Value Forecast By End-user, 2020 - 2035

10.4.1. Hospitals & Clinics

10.4.2. Ambulatory Care Centers

10.4.3. Home Care Settings

10.4.4. Others

10.5. Market Value Forecast By Country, 2020 - 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Device Type

10.6.2. By Application Area

10.6.3. By End-user

10.6.4. By Country

11. Europe Medical Device Technologies Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Device Type, 2020 - 2035

11.2.1. Diagnostic Devices

11.2.1.1. In Vitro Diagnostics (IVD)

11.2.1.2. Imaging Systems

11.2.1.3. Others

11.2.2. Therapeutic/Surgical Devices

11.2.2.1. Surgical Instruments

11.2.2.2. Minimally Invasive Surgery (MIS) Devices

11.2.2.3. Drug Delivery Systems

11.2.2.4. Others

11.2.3. Monitoring Devices

11.2.3.1. Vital Signs Monitors

11.2.3.2. Cardiac Monitoring

11.2.3.3. Respiratory Monitoring

11.2.3.4. Diabetes Monitoring

11.2.3.5. Others

11.2.4. Implants/Biomaterials

11.2.4.1. Orthopedic Implants

11.2.4.2. Cardiovascular Implants

11.2.4.3. Neurological Implants

11.2.4.4. Others

11.2.5. Others

11.3. Market Value Forecast By Application Area, 2020 - 2035

11.3.1. Cardiology

11.3.2. Orthopedics

11.3.3. Oncology

11.3.4. Neurology

11.3.5. Respiratory

11.3.6. Wound Care

11.3.7. Gynecology

11.3.8. Others

11.4. Market Value Forecast By End-user, 2020 - 2035

11.4.1. Hospitals & Clinics

11.4.2. Ambulatory Care Centers

11.4.3. Home Care Settings

11.4.4. Others

11.5. Market Value Forecast By Country/Sub-region, 2020 - 2035

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Device Type

11.6.2. By Application Area

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Medical Device Technologies Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Device Type, 2020 - 2035

12.2.1. Diagnostic Devices

12.2.1.1. In Vitro Diagnostics (IVD)

12.2.1.2. Imaging Systems

12.2.1.3. Others

12.2.2. Therapeutic/Surgical Devices

12.2.2.1. Surgical Instruments

12.2.2.2. Minimally Invasive Surgery (MIS) Devices

12.2.2.3. Drug Delivery Systems

12.2.2.4. Others

12.2.3. Monitoring Devices

12.2.3.1. Vital Signs Monitors

12.2.3.2. Cardiac Monitoring

12.2.3.3. Respiratory Monitoring

12.2.3.4. Diabetes Monitoring

12.2.3.5. Others

12.2.4. Implants/Biomaterials

12.2.4.1. Orthopedic Implants

12.2.4.2. Cardiovascular Implants

12.2.4.3. Neurological Implants

12.2.4.4. Others

12.2.5. Others

12.3. Market Value Forecast By Application Area, 2020 - 2035

12.3.1. Cardiology

12.3.2. Orthopedics

12.3.3. Oncology

12.3.4. Neurology

12.3.5. Respiratory

12.3.6. Wound Care

12.3.7. Gynecology

12.3.8. Others

12.4. Market Value Forecast By End-user, 2020 - 2035

12.4.1. Hospitals & Clinics

12.4.2. Ambulatory Care Centers

12.4.3. Home Care Settings

12.4.4. Others

12.5. Market Value Forecast By Country/Sub-region, 2020 - 2035

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. South Korea

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Device Type

12.6.2. By Application Area

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Medical Device Technologies Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Device Type, 2020 - 2035

13.2.1. Diagnostic Devices

13.2.1.1. In Vitro Diagnostics (IVD)

13.2.1.2. Imaging Systems

13.2.1.3. Others

13.2.2. Therapeutic/Surgical Devices

13.2.2.1. Surgical Instruments

13.2.2.2. Minimally Invasive Surgery (MIS) Devices

13.2.2.3. Drug Delivery Systems

13.2.2.4. Others

13.2.3. Monitoring Devices

13.2.3.1. Vital Signs Monitors

13.2.3.2. Cardiac Monitoring

13.2.3.3. Respiratory Monitoring

13.2.3.4. Diabetes Monitoring

13.2.3.5. Others

13.2.4. Implants/Biomaterials

13.2.4.1. Orthopedic Implants

13.2.4.2. Cardiovascular Implants

13.2.4.3. Neurological Implants

13.2.4.4. Others

13.2.5. Others

13.3. Market Value Forecast By Application Area, 2020 - 2035

13.3.1. Cardiology

13.3.2. Orthopedics

13.3.3. Oncology

13.3.4. Neurology

13.3.5. Respiratory

13.3.6. Wound Care

13.3.7. Gynecology

13.3.8. Others

13.4. Market Value Forecast By End-user, 2020 - 2035

13.4.1. Hospitals & Clinics

13.4.2. Ambulatory Care Centers

13.4.3. Home Care Settings

13.4.4. Others

13.5. Market Value Forecast By Country/Sub-region, 2020 - 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Device Type

13.6.2. By Application Area

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Medical Device Technologies Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Device Type, 2020 - 2035

14.2.1. Diagnostic Devices

14.2.1.1. In Vitro Diagnostics (IVD)

14.2.1.2. Imaging Systems

14.2.1.3. Others

14.2.2. Therapeutic/Surgical Devices

14.2.2.1. Surgical Instruments

14.2.2.2. Minimally Invasive Surgery (MIS) Devices

14.2.2.3. Drug Delivery Systems

14.2.2.4. Others

14.2.3. Monitoring Devices

14.2.3.1. Vital Signs Monitors

14.2.3.2. Cardiac Monitoring

14.2.3.3. Respiratory Monitoring

14.2.3.4. Diabetes Monitoring

14.2.3.5. Others

14.2.4. Implants/Biomaterials

14.2.4.1. Orthopedic Implants

14.2.4.2. Cardiovascular Implants

14.2.4.3. Neurological Implants

14.2.4.4. Others

14.2.5. Others

14.3. Market Value Forecast By Application Area, 2020 - 2035

14.3.1. Cardiology

14.3.2. Orthopedics

14.3.3. Oncology

14.3.4. Neurology

14.3.5. Respiratory

14.3.6. Wound Care

14.3.7. Gynecology

14.3.8. Others

14.4. Market Value Forecast By End-user, 2020 - 2035

14.4.1. Hospitals & Clinics

14.4.2. Ambulatory Care Centers

14.4.3. Home Care Settings

14.4.4. Others

14.5. Market Value Forecast By Country/Sub-region, 2020 - 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Device Type

14.6.2. By Application Area

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. Medtronic

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Abbott

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Siemens Healthineers AG

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. GE HealthCare

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Koninklijke Philips N.V.

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Stryker

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Boston Scientific Corporation or its affiliates

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Edwards Lifesciences Corporation.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Intuitive Surgical Operations, Inc.

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Baxter

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Cardinal Health

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Zimmer Biomet

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. FUJIFILM Corporation

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Johnson & Johnson and its affiliates

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. Other Prominent Players

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Product Portfolio

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

List of Tables

Table 01: Global Medical Device Technologies Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 02: Global Medical Device Technologies Market Value (US$ Bn) Forecast, By Diagnostic Devices, 2020 to 2035

Table 03: Global Medical Device Technologies Market Value (US$ Bn) Forecast, By Therapeutic/Surgical Devices, 2020 to 2035

Table 04: Global Medical Device Technologies Market Value (US$ Bn) Forecast, By Monitoring Devices, 2020 to 2035

Table 05: Global Medical Device Technologies Market Value (US$ Bn) Forecast, By Implants/Biomaterials, 2020 to 2035

Table 06: Global Medical Device Technologies Market Value (US$ Bn) Forecast, By Application Area, 2020 to 2035

Table 07: Global Medical Device Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 08: Global Medical Device Technologies Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Country, 2020 to 2035

Table 10: North America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 11: North America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Diagnostic Devices, 2020 to 2035

Table 12: North America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Therapeutic/Surgical Devices, 2020 to 2035

Table 13: North America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Monitoring Devices, 2020 to 2035

Table 14: North America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Implants/Biomaterials, 2020 to 2035

Table 15: North America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Application Area, 2020 to 2035

Table 16: North America - Medical Device Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Europe - Medical Device Technologies Market Value (US$ Bn) Forecast, By Country/Sub-region, 2020 to 2035

Table 18: Europe - Medical Device Technologies Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 19: Europe - Medical Device Technologies Market Value (US$ Bn) Forecast, By Diagnostic Devices, 2020 to 2035

Table 20: Europe - Medical Device Technologies Market Value (US$ Bn) Forecast, By Therapeutic/Surgical Devices, 2020 to 2035

Table 21: Europe - Medical Device Technologies Market Value (US$ Bn) Forecast, By Monitoring Devices, 2020 to 2035

Table 22: Europe - Medical Device Technologies Market Value (US$ Bn) Forecast, By Implants/Biomaterials, 2020 to 2035

Table 23: Europe - Medical Device Technologies Market Value (US$ Bn) Forecast, By Application Area, 2020 to 2035

Table 24: Europe - Medical Device Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Asia Pacific - Medical Device Technologies Market Value (US$ Bn) Forecast, By Country/Sub-region, 2020 to 2035

Table 26: Asia Pacific - Medical Device Technologies Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 27: Asia Pacific - Medical Device Technologies Market Value (US$ Bn) Forecast, By Diagnostic Devices, 2020 to 2035

Table 28: Asia Pacific - Medical Device Technologies Market Value (US$ Bn) Forecast, By Therapeutic/Surgical Devices, 2020 to 2035

Table 29: Asia Pacific - Medical Device Technologies Market Value (US$ Bn) Forecast, By Monitoring Devices, 2020 to 2035

Table 30: Asia Pacific - Medical Device Technologies Market Value (US$ Bn) Forecast, By Implants/Biomaterials, 2020 to 2035

Table 31: Asia Pacific - Medical Device Technologies Market Value (US$ Bn) Forecast, By Application Area, 2020 to 2035

Table 32: Asia Pacific - Medical Device Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 33: Latin America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Country/Sub-region, 2020 to 2035

Table 34: Latin America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 35: Latin America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Diagnostic Devices, 2020 to 2035

Table 36: Latin America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Therapeutic/Surgical Devices, 2020 to 2035

Table 37: Latin America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Monitoring Devices, 2020 to 2035

Table 38: Latin America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Implants/Biomaterials, 2020 to 2035

Table 39: Latin America - Medical Device Technologies Market Value (US$ Bn) Forecast, By Application Area, 2020 to 2035

Table 40: Latin America - Medical Device Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 41: Middle East & Africa - Medical Device Technologies Market Value (US$ Bn) Forecast, By Country/Sub-region, 2020 to 2035

Table 42: Middle East & Africa - Medical Device Technologies Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 43: Middle East & Africa - Medical Device Technologies Market Value (US$ Bn) Forecast, By Diagnostic Devices, 2020 to 2035

Table 44: Middle East & Africa - Medical Device Technologies Market Value (US$ Bn) Forecast, By Therapeutic/Surgical Devices, 2020 to 2035

Table 45: Middle East & Africa - Medical Device Technologies Market Value (US$ Bn) Forecast, By Monitoring Devices, 2020 to 2035

Table 46: Middle East & Africa - Medical Device Technologies Market Value (US$ Bn) Forecast, By Implants/Biomaterials, 2020 to 2035

Table 47: Middle East & Africa - Medical Device Technologies Market Value (US$ Bn) Forecast, By Application Area, 2020 to 2035

Table 48: Middle East & Africa - Medical Device Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Medical Device Technologies Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 02: Global Medical Device Technologies Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 03: Global Medical Device Technologies Market Revenue (US$ Bn), By Diagnostic Devices, 2020 to 2035

Figure 04: Global Medical Device Technologies Market Revenue (US$ Bn), By Therapeutic/Surgical Devices, 2020 to 2035

Figure 05: Global Medical Device Technologies Market Revenue (US$ Bn), By Monitoring Devices, 2020 to 2035

Figure 06: Global Medical Device Technologies Market Revenue (US$ Bn), By Implants/Biomaterials, 2020 to 2035

Figure 07: Global Medical Device Technologies Market Revenue (US$ Bn), By Others, 2020 to 2035

Figure 08: Global Medical Device Technologies Market Value Share Analysis, By Application Area, 2024 and 2035

Figure 09: Global Medical Device Technologies Market Attractiveness Analysis, By Application Area, 2025 to 2035

Figure 10: Global Medical Device Technologies Market Revenue (US$ Bn), By Cardiology, 2020 to 2035

Figure 11: Global Medical Device Technologies Market Revenue (US$ Bn), By Orthopedics, 2020 to 2035

Figure 12: Global Medical Device Technologies Market Revenue (US$ Bn), By Oncology, 2024 and 2035

Figure 13: Global Medical Device Technologies Market Revenue (US$ Bn), By Neurology, 2025 to 2035

Figure 14: Global Medical Device Technologies Market Revenue (US$ Bn), By Respiratory, 2020 to 2035

Figure 15: Global Medical Device Technologies Market Revenue (US$ Bn), By Wound Care, 2020 to 2035

Figure 16: Global Medical Device Technologies Market Revenue (US$ Bn), By Gynecology, 2020 to 2035

Figure 17: Global Medical Device Technologies Market Revenue (US$ Bn), By Others, 2020 to 2035

Figure 18: Global Medical Device Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 19: Global Medical Device Technologies Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 20: Global Medical Device Technologies Market Revenue (US$ Bn), By Hospitals & Clinics, 2020 to 2035

Figure 21: Global Medical Device Technologies Market Revenue (US$ Bn), By Ambulatory Care Centers, 2020 to 2035

Figure 22: Global Medical Device Technologies Market Revenue (US$ Bn), By Home Care Settings, 2020 to 2035

Figure 23: Global Medical Device Technologies Market Revenue (US$ Bn), By Others, 2020 to 2035

Figure 24: Global Medical Device Technologies Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Medical Device Technologies Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America Medical Device Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America Medical Device Technologies Market Value Share Analysis, By Country, 2024 and 2035

Figure 28: North America Medical Device Technologies Market Attractiveness Analysis, By Country, 2025 to 2035

Figure 29: North America Medical Device Technologies Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 30: North America Medical Device Technologies Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 31: North America Medical Device Technologies Market Value Share Analysis, By Application Area, 2024 and 2035

Figure 32: North America Medical Device Technologies Market Attractiveness Analysis, By Application Area, 2025 to 2035

Figure 33: North America Medical Device Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 34: North America Medical Device Technologies Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 35: Europe Medical Device Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: Europe Medical Device Technologies Market Value Share Analysis, By Country, 2024 and 2035

Figure 37: Europe Medical Device Technologies Market Attractiveness Analysis, By Country, 2025 to 2035

Figure 38: Europe Medical Device Technologies Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 39: Europe Medical Device Technologies Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 40: Europe Medical Device Technologies Market Value Share Analysis, By Application Area, 2024 and 2035

Figure 41: Europe Medical Device Technologies Market Attractiveness Analysis, By Application Area, 2025 to 2035

Figure 42: Europe Medical Device Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Europe Medical Device Technologies Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Asia Pacific Medical Device Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific Medical Device Technologies Market Value Share Analysis, By Country, 2024 and 2035

Figure 46: Asia Pacific Medical Device Technologies Market Attractiveness Analysis, By Country, 2025 to 2035

Figure 47: Asia Pacific Medical Device Technologies Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 48: Asia Pacific Medical Device Technologies Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 49: Asia Pacific Medical Device Technologies Market Value Share Analysis, By Application Area, 2024 and 2035

Figure 50: Asia Pacific Medical Device Technologies Market Attractiveness Analysis, By Application Area, 2025 to 2035

Figure 51: Asia Pacific Medical Device Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 52: Asia Pacific Medical Device Technologies Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 53: Latin America Medical Device Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Latin America Medical Device Technologies Market Value Share Analysis, By Country, 2024 and 2035

Figure 55: Latin America Medical Device Technologies Market Attractiveness Analysis, By Country, 2025 to 2035

Figure 56: Latin America Medical Device Technologies Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 57: Latin America Medical Device Technologies Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 58: Latin America Medical Device Technologies Market Value Share Analysis, By Application Area, 2024 and 2035

Figure 59: Latin America Medical Device Technologies Market Attractiveness Analysis, By Application Area, 2025 to 2035

Figure 60: Latin America Medical Device Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 61: Latin America Medical Device Technologies Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 62: Middle East & Africa Medical Device Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 63: Middle East & Africa Medical Device Technologies Market Value Share Analysis, By Country, 2024 and 2035

Figure 64: Middle East & Africa Medical Device Technologies Market Attractiveness Analysis, By Country, 2025 to 2035

Figure 65: Middle East & Africa Medical Device Technologies Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 66: Middle East & Africa Medical Device Technologies Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 67: Middle East & Africa Medical Device Technologies Market Value Share Analysis, By Application Area, 2024 and 2035

Figure 68: Middle East & Africa Medical Device Technologies Market Attractiveness Analysis, By Application Area, 2025 to 2035

Figure 69: Middle East & Africa Medical Device Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 70: Middle East & Africa Medical Device Technologies Market Attractiveness Analysis, By End-user, 2025 to 2035