Reports

Reports

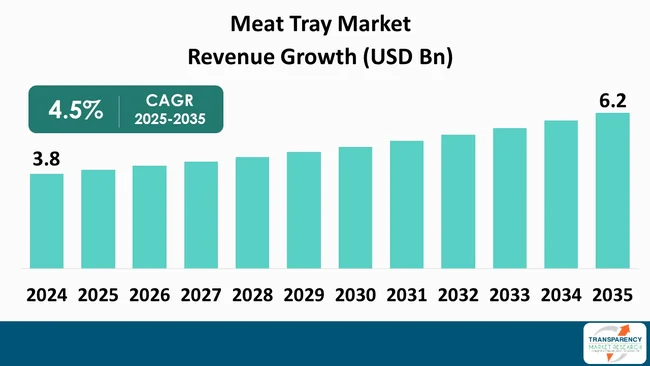

The global meat tray market size was valued at US$ 3.8 Bn in 2024 and is projected to reach US$ 6.2 Bn by 2035, expanding at a CAGR of 4.5% from 2025 to 2035. The market growth is driven by Growth in processed meat & modern retail, and rising awareness in food safety & shelf-life extension.

The demand for meat trays almost exactly equals that of chilled and processed meat, which means that trays are always important facilitators of the contemporary protein supply chains. As per the Food and Agriculture Organization, meat production across the globe is expected to be around 364 million tons, and this huge quantity of meat produced is an indication of the dependency on protein, which is safe and well-packed.

The market is being influenced by three major tensions: protection versus cost, sustainability versus performance, and regulation versus speed to shell. These tensions are leading converters and brand owners to look for solutions such as mono-material plastics, better barrier coatings, and molded-fiber or hybrid constructions. Brands that can integrate tray design with retailer automation, recyclability requirements, and brand sustainability stories are likely to be in the premium position rather than just competing on per-unit price.

The meat tray market is positioned right at the point of primary protein processing, modern-day retail, and changing food safety standards. Trays ensure physical safety, mess control, and stable support for wrapping films or lids, which, combined, help fresh and processed meat to flow smoothly through the entire supply chain of abattoirs, cutting plants, supermarkets, and foodservice outlets.

Trays have turned out to be the main surface for branding and information. The space of labels on the tray allows retailers and producers to talk about origin, animal welfare claims, storage guidance, and cooking instructions while adhering to strict labelling regulations. At the same time, the push to minimize plastic use and enhance end-of-life results is spurring up interest in the market for recyclable, compostable, or lightweight tray formats, which, in turn, making the market a hub of packaging innovation in the entire protein value chain.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing global meat supply is a basic demand factor for trays. The OECD-FAO Agricultural Outlook foresees that meat supply worldwide would reach about 374 million tons, which would mean slaughtering, cutting, and packing facilities that depend on standard trays for efficiency, would all have very high volumes structurally. Thus, a long-time volume support for steady consumption of trays is set even through price cycles.

With expansion of retail, discount chains, and e-Commerce grocery in emerging economies, meat more often than not is sold chilled and pre-packed instead of the traditional way through butchers. This change in packaging comes with a very central role in operations rather than being an ancillary activity.

Supermarkets impose pack sizes that are universally the same for shelf planning, automatic case-ready systems, and less in-store handling. Trays that can connect to high-speed filling,

Consumer convenience trends also indirectly strengthen the use of trays. Consumers are looking for smaller, portion-controlled packs, ready-to-cook marinated cuts, and mixed protein assortments designed for quick meal preparation almost every time. Such formats require strong and stable trays that can survive modified-atmosphere packaging, home-freezing, and oven or microwave use (depending on the design).

The decrease in food loss and waste is becoming an important factor in the decision-making process regarding meat packaging. The data from FAO’s SDG indicator show that the supply chain of meat and animal products is about 14% loss, which is a huge amount of value being lost from the farmer to the consumer. Thus, in this case, there is a direct economic justification for retailers and processors to invest in such packaging that can prolong the products’ life and protect the quality.

The meat trays are the main players in this whole initiative as they not only stabilize the products but also hold the purge and keep the barrier films or lidding intact. The ideal combination of the tray design and rigidity is responsible for the atmosphere modification and sealed-conditions preservation, while the absorbent pads that are on the cold chain are the ones that minimize drip and prevent cross-contamination. As the food safety authorities tighten their regulations and the retailers become pickier in terms of their requirements, the trays that provide better control of the temperature, tampering proof, and cleanliness are not only preferred but also more automatic than the bare minimum or makeshift packaging options.

Earth-friendly priorities are now layered on top of this safety and waste-reduction agenda. The regulators and the brands are getting ready to lose not just the meat but also the environmental impact of the packaging that was protecting it. In turn, this is leading to the production of less heavy plastic trays, very strong mono-material structures that are designed to be part of the recycle stream, and the molded fiber or hybrid solutions that can give the same protection as the conventional formats.

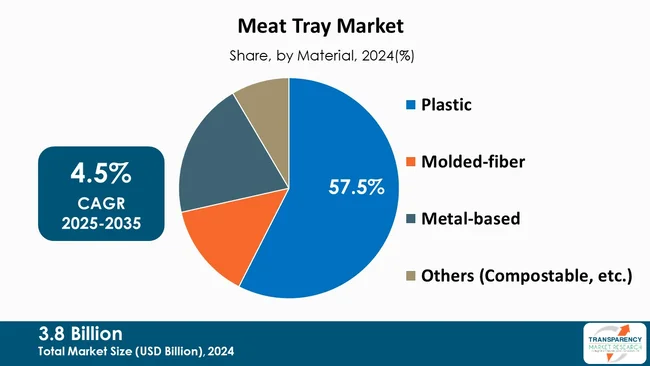

Plastic holds a considerable percentage of the meat tray market, reaching up to 57.5%. This indicates that plastic is still heavily used in mass, case-ready meat systems. The main areas of plastic's advantage are its ability to be formed into various packaging shapes, its strong rigidity-to-weight ratio, the possibility of using modified-atmosphere and vacuum-skin technologies, and its relatively low costs per unit. For processors and retailers who have to deal with a wide variety of products, plastic trays provide more benefits than just being easy to work with; they also come with cold-chain performance that is very clear and well-established supply networks.

Molded-fiber types of trays are gaining popularity. However, they still have a long way to go since retailers mainly look for eco-friendly products and differentiation. The reason for this is that molded-fiber types of trays very sensitive to moisture, and therefore, they are usually integrated into barrier and line-speed combinations.

On the other hand, metal trays are used for special purposes such as high-heat or premium ones, and newly developed compostable and bio-based trays are still mostly limited to pilot or restricted regional use.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific region takes the lead in the global meat tray market with an estimated share of 39.2%, which is based on its large and rapidly growing populations, and the swift development of modern retail. There is an upward trend in the share of meat being sold pre-packed in trays due to the fact that more number of consumers are moving from wet markets to supermarkets and convenience stores, especially in the case of chilled poultry, pork, and value-added products. The whole process of shifting from one channel to another has led to the constant need for standard the tray solutions that are customized to regional tastes and infrastructure.

Asia Pacific will continue to be the main source of growth for meat trays even if the old-world regions put more emphasis on premiumization and sustainability upgrades rather than pure volume expansion. Changes in the local food safety regulations, investments in cold-chain and waste management policies, and management of waste will all be factors that determine which among plastic, molded fiber, and compostable options will be the most commonly used.

Amcor plc, CKF Inc., Coover, Cosmo Plastech, Cosmoplast, Guoliang Packing, Hotpack Global, Neeyog Packaging, NPX ONE, Pactiv Evergreen Inc., ProAmpac, Swarna Enterprises, Tekni-Plex, Total Packaging Solutions, and Yantai Shenhai Packaging Co., Ltd. and others are some of the leading manufacturers operating in the global Meat Tray market.

Each of these companies has been profiled in the meat tray market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 3.8 Bn |

| Market Forecast Value in 2035 | US$ 6.2 Bn |

| Growth Rate (CAGR 2025 to 2035) | 4.5% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Material

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global meat tray market was valued at US$ 3.8 Bn in 2024

The global meat tray industry is projected to reach at US$ 6.2 Bn by the end of 2035

Growth in processed meat & modern retail and rising awareness in food safety & shelf-life extension, are some of the driving factors for this market

The CAGR is anticipated to be 4.5% from 2025 to 2035

Amcor plc, CKF Inc., Coover, Cosmo Plastech, Cosmoplast, Guoliang Packing, Hotpack Global, Neeyog Packaging, NPX ONE, Pactiv Evergreen Inc., ProAmpac, Swarna Enterprises, Tekni-Plex, Total Packaging Solutions, and Yantai Shenhai Packaging Co., Ltd., and others

Table 01: Global Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 02: Global Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 03: Global Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 04: Global Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 05: Global Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 06: Global Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 07: Global Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 08: Global Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 09: Global Meat Tray Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 10: Global Meat Tray Market Volume (Tons) Projection, By Region 2020 to 2035

Table 11: North America Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 12: North America Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 13: North America Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 14: North America Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 15: North America Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 16: North America Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 17: North America Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 18: North America Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 19: North America Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 20: North America Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Table 21: U.S. Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 22: U.S. Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 23: U.S. Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 24: U.S. Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 25: U.S. Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 26: U.S. Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 27: U.S. Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 28: U.S. Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 29: Canada Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 30: Canada Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 31: Canada Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 32: Canada Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 33: Canada Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 34: Canada Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 35: Canada Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 36: Canada Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 37: Europe Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 38: Europe Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 39: Europe Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 40: Europe Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 41: Europe Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 42: Europe Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 43: Europe Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 44: Europe Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 45: Europe Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 46: Europe Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Table 47: U.K. Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 48: U.K. Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 49: U.K. Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 50: U.K. Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 51: U.K. Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 52: U.K. Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 53: U.K. Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 54: U.K. Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 55: Germany Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 56: Germany Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 57: Germany Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 58: Germany Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 59: Germany Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 60: Germany Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 61: Germany Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 62: Germany Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 63: France Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 64: France Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 65: France Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 66: France Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 67: France Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 68: France Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 69: France Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 70: France Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 71: Italy Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 72: Italy Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 73: Italy Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 74: Italy Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 75: Italy Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 76: Italy Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 77: Italy Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 78: Italy Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 79: Spain Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 80: Spain Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 81: Spain Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 82: Spain Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 83: Spain Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 84: Spain Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 85: Spain Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 86: Spain Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 87: The Netherlands Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 88: The Netherlands Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 89: The Netherlands Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 90: The Netherlands Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 91: The Netherlands Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 92: The Netherlands Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 93: The Netherlands Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 94: The Netherlands Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 95: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 96: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 97: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 98: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 99: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 100: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 101: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 102: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 103: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 104: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Table 105: China Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 106: China Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 107: China Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 108: China Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 109: China Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 110: China Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 111: China Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 112: China Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 113: India Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 114: India Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 115: India Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 116: India Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 117: India Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 118: India Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 119: India Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 120: India Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 121: Japan Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 122: Japan Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 123: Japan Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 124: Japan Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 125: Japan Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 126: Japan Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 127: Japan Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 128: Japan Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 129: Australia Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 130: Australia Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 131: Australia Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 132: Australia Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 133: Australia Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 134: Australia Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 135: Australia Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 136: Australia Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 137: South Korea Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 138: South Korea Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 139: South Korea Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 140: South Korea Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 141: South Korea Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 142: South Korea Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 143: South Korea Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 144: South Korea Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 145: ASEAN Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 146: ASEAN Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 147: ASEAN Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 148: ASEAN Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 149: ASEAN Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 150: ASEAN Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 151: ASEAN Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 152: ASEAN Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 153: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 154: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 155: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 156: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 157: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 158: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 159: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 160: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 161: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 162: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Table 163: GCC Countries Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 164: GCC Countries Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 165: GCC Countries Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 166: GCC Countries Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 167: GCC Countries Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 168: GCC Countries Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 169: GCC Countries Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 170: GCC Countries Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 171: South Africa Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 172: South Africa Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 173: South Africa Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 174: South Africa Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 175: South Africa Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 176: South Africa Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 177: South Africa Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 178: South Africa Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 179: Latin America Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 180: Latin America Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 181: Latin America Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 182: Latin America Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 183: Latin America Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 184: Latin America Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 185: Latin America Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 186: Latin America Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 187: Latin America Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 188: Latin America Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Table 189: Brazil Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 190: Brazil Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 191: Brazil Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 192: Brazil Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 193: Brazil Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 194: Brazil Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 195: Brazil Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 196: Brazil Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 197: Mexico Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 198: Mexico Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 199: Mexico Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 200: Mexico Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 201: Mexico Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 202: Mexico Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 203: Mexico Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 204: Mexico Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 205: Argentina Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Table 206: Argentina Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Table 207: Argentina Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 208: Argentina Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Table 209: Argentina Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 210: Argentina Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Table 211: Argentina Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 212: Argentina Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 01: Global Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 02: Global Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 03: Global Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 04: Global Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 05: Global Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 06: Global Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 07: Global Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 08: Global Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 09: Global Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 10: Global Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 11: Global Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 12: Global Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 13: Global Meat Tray Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 14: Global Meat Tray Market Volume (Tons) Projection, By Region 2020 to 2035

Figure 15: Global Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 16: North America Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 17: North America Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 18: North America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 19: North America Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 20: North America Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 21: North America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 22: North America Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 23: North America Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 24: North America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 25: North America Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 26: North America Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 27: North America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 28: North America Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 29: North America Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 30: North America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 32: U.S. Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 33: U.S. Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 34: U.S. Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 35: U.S. Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 36: U.S. Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 37: U.S. Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 38: U.S. Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 39: U.S. Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 40: U.S. Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 41: U.S. Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 42: U.S. Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Canada Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 44: Canada Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 45: Canada Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 46: Canada Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 47: Canada Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 48: Canada Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 49: Canada Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 50: Canada Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 51: Canada Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 52: Canada Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 53: Canada Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 54: Canada Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 55: Europe Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 56: Europe Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 57: Europe Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 58: Europe Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 59: Europe Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 60: Europe Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 61: Europe Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 62: Europe Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 63: Europe Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 64: Europe Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Europe Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 66: Europe Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 68: Europe Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 69: Europe Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 71: U.K. Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 72: U.K. Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 73: U.K. Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 74: U.K. Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 75: U.K. Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 76: U.K. Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 77: U.K. Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 78: U.K. Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 79: U.K. Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: U.K. Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 81: U.K. Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Germany Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 83: Germany Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 84: Germany Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 85: Germany Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 86: Germany Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 87: Germany Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 88: Germany Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 89: Germany Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 90: Germany Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 91: Germany Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 92: Germany Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 93: Germany Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 94: France Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 95: France Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 96: France Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 97: France Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 98: France Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 99: France Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 100: France Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 101: France Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 102: France Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 103: France Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 104: France Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 105: France Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 106: Italy Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 107: Italy Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 108: Italy Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 109: Italy Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 110: Italy Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 111: Italy Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 112: Italy Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 113: Italy Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 114: Italy Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 115: Italy Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Italy Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 117: Italy Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Spain Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 119: Spain Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 120: Spain Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 121: Spain Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 122: Spain Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 123: Spain Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 124: Spain Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 125: Spain Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 126: Spain Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 127: Spain Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 128: Spain Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 129: Spain Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: The Netherlands Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 131: The Netherlands Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 132: The Netherlands Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 133: The Netherlands Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 134: The Netherlands Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 135: The Netherlands Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 136: The Netherlands Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 137: The Netherlands Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 138: The Netherlands Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 139: The Netherlands Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 140: The Netherlands Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 141: The Netherlands Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 143: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 144: Asia Pacific Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 145: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 146: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 147: Asia Pacific Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 148: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 149: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 150: Asia Pacific Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 151: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 152: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 153: Asia Pacific Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Asia Pacific Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 157: China Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 158: China Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 159: China Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 160: China Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 161: China Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 162: China Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 163: China Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 164: China Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 165: China Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 166: China Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 167: China Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 168: China Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 169: India Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 170: India Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 171: India Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 172: India Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 173: India Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 174: India Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 175: India Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 176: India Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 177: India Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 178: India Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 179: India Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 180: India Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 181: Japan Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 182: Japan Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 183: Japan Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 184: Japan Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 185: Japan Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 186: Japan Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 187: Japan Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 188: Japan Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 189: Japan Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 190: Japan Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 191: Japan Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 192: Japan Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 193: Australia Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 194: Australia Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 195: Australia Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 196: Australia Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 197: Australia Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 198: Australia Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 199: Australia Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 200: Australia Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 201: Australia Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 202: Australia Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 203: Australia Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 204: Australia Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: South Korea Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 206: South Korea Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 207: South Korea Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 208: South Korea Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 209: South Korea Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 210: South Korea Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 211: South Korea Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 212: South Korea Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 213: South Korea Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 214: South Korea Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 215: South Korea Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 216: South Korea Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 217: ASEAN Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 218: ASEAN Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 219: ASEAN Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 220: ASEAN Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 221: ASEAN Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 222: ASEAN Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 223: ASEAN Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 224: ASEAN Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 225: ASEAN Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 226: ASEAN Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 227: ASEAN Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 228: ASEAN Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 229: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 230: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 231: Middle East & Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 232: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 233: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 234: Middle East & Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 235: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 236: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 237: Middle East & Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 238: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 239: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 240: Middle East & Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 241: Middle East & Africa Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 245: GCC Countries Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 246: GCC Countries Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 247: GCC Countries Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 248: GCC Countries Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 249: GCC Countries Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 250: GCC Countries Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 251: GCC Countries Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 252: GCC Countries Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 253: GCC Countries Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 254: GCC Countries Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 255: GCC Countries Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 256: South Africa Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 257: South Africa Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 258: South Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 259: South Africa Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 260: South Africa Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 261: South Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 262: South Africa Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 263: South Africa Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 264: South Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 265: South Africa Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Africa Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Africa Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: Latin America Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 269: Latin America Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 270: Latin America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 271: Latin America Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 272: Latin America Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 273: Latin America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 274: Latin America Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 275: Latin America Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 276: Latin America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 277: Latin America Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 278: Latin America Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 279: Latin America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 280: Latin America Meat Tray Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 281: Latin America Meat Tray Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 282: Latin America Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 284: Brazil Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 285: Brazil Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 286: Brazil Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 287: Brazil Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 288: Brazil Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 289: Brazil Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 290: Brazil Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 291: Brazil Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 292: Brazil Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 293: Brazil Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 294: Brazil Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 295: Mexico Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 296: Mexico Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 297: Mexico Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 298: Mexico Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 299: Mexico Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 300: Mexico Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 301: Mexico Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 302: Mexico Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 303: Mexico Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 304: Mexico Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 305: Mexico Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 306: Mexico Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 307: Argentina Meat Tray Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 308: Argentina Meat Tray Market Volume (Tons) Projection, By Material 2020 to 2035

Figure 309: Argentina Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Material 2025 to 2035

Figure 310: Argentina Meat Tray Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 311: Argentina Meat Tray Market Volume (Tons) Projection, By Category 2020 to 2035

Figure 312: Argentina Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 313: Argentina Meat Tray Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 314: Argentina Meat Tray Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 315: Argentina Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 316: Argentina Meat Tray Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 317: Argentina Meat Tray Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 318: Argentina Meat Tray Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035