Reports

Reports

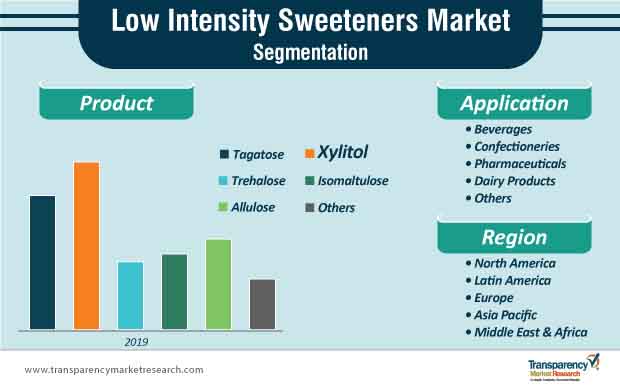

The trend of natural sweeteners is resonating with consumers in the low intensity sweeteners market. Beverage makers are manufacturing drinks that contain low-to-no sugar content. Likewise, allulose is one of the low intensity sweeteners amongst fructose, tagatose, and erythritol, which serves as an efficient sweetening solution for beverage manufacturers.

Sweetening combinations of allulose, erythritol, stevia, and monk fruit are becoming more popular amongst beverage manufacturers. Although allulose is classified as an added sugar, it is projected that the FDA (Food and Drug Administration) will soon take it out from the added sugars category and claim it on the list of the nutritional panel, similar to alcohol sugars. Allulose is also replacing sugar alcohol erythritol in several beverage applications to establish calorie reduction in the low intensity sweeteners market.

The growth of consumerism has given rise to the demand for clean-label sweeteners. Market players are devising more reliable and cost-effective sweetening systems to replace sucrose in the supply chain. For instance, in April 2019, Ingredion — a leading global provider operating in the low intensity sweeteners market, announced the launch of ASTRAEA® Allulose, a low intensity sweetener that offers similar taste profile and functionality to sucrose, with reduced calorie content.

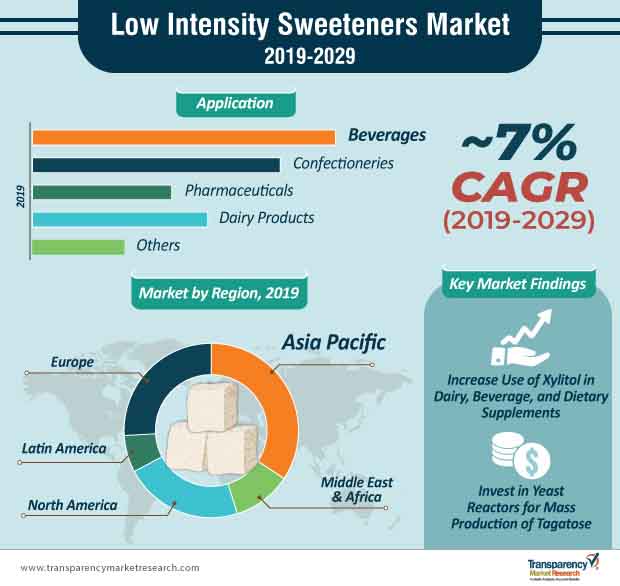

Xylitol is claimed to lower the risks of dental caries in consumers aged three to 80 years. These attributes are helping manufacturers operating in the low intensity sweeteners market develop sugar-free products in various beverages, dairy products, confectionaries, and bakery products, as well as dietary supplements.

The low intensity sweeteners market is expected to reach a valuation of ~US$ 3.1 billion by the year 2029, and currently, xylitol accounts for the highest market value with a share of ~29%. This is why market players are increasing the production of xylitol from naturally-occurring wood, which has half the calories as compared to regular sugar, and supports dental health.

Due to growing awareness about the health issues related to sugar, stakeholders in the confectionary industry are using xylitol as a low intensity sweetener to add freshness to fruit flavors and efficaciously mask any bitter taste. Manufacturers are using xylitol for pharmaceutical and nutritional applications, such as in tablets, injectable treatments, and parenteral nutrition.

Tagatose serves as an ideal low intensity sweetener alternative that has similar taste and texture to sucrose. It also helps lower the risks of increased blood glucose levels and has fewer calories as compared to sucrose. However, efficient and cost-effective production of tagatose is one of the major roadblocks for manufacturers in the low intensity sweeteners market.

Tagatose has a high manufacturing cost that hinders its growth for expansion in several commercial applications. Although it is naturally found in fruits and dairy products, these concentrations are too low to extract it effectively. Also, traditional manufacturing methods isolate only less than half of the tagatose from galactose, and involves a multi-step enzymatic procedure. Thus, manufacturers are increasingly investing in yeast reactors that serve as a modern method for the mass production of tagatose. Research and development efforts are being made to develop a special type of yeast that produces tagatose from lactose with the help of genetic engineering.

Analysts’ Viewpoint

The low intensity sweeteners market is set for exponential growth during the forecast period. Growing awareness about sugar possessing twice the calorie content as compared to sugar alcohols, resulting in risks such as diabetes, obesity, and other health issues, has triggered the demand for reduced and no-sugar products. As a result, manufacturers are using xylitol in mints, candies, and chocolates to address the growing health concerns of consumers. However, the low intensity sweeteners market is highly consolidated, and manufacturers are challenged with inefficient and traditional production methods of tagatose. Thus, players of the low intensity sweeteners market should invest in yeast reactors for the mass production of tagatose. Apart from beverages and confectionaries, market players should expand their operations in the healthcare industry using xylitol that has proven results for improved skin health, nasal irrigation, and post-surgery recovery.

Asia Pacific to Stand Out in Terms of Sales and Growth

Inclusion of Organic and Natural Ingredients by Major Players

Health Concerns & Interest in Personal Appearance

Economic Developments in BRICS Countries

Low Intensity Sweeteners Market: Competitive Landscape

Low Intensity Sweeteners Market: Key Developments

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Matrix

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Low Intensity Sweeteners Market Background

3.1. Global Sweeteners Market Overview

3.2. Key Developments and Product Launches

3.3. Overview of Claims and Certifications for Low Intensity Sweeteners Products

3.4. Overview of Production and Processing Methods

3.5. Macro-Economic Indicators

3.5.1. Global GDP by Region and Country

3.5.2. Global Industry Value Added

3.5.3. Global Food and Beverage Industry Outlook

3.6. Value Chain Analysis

3.6.1. Raw Material Suppliers

3.6.2. Product Manufacturers

3.6.3. Distributors/Suppliers/Wholesalers

3.6.4. Private Label

3.6.5. End Users

3.7. Market Dynamics

3.7.1. Drivers

3.7.2. Restraints

3.7.3. Opportunities

3.7.4. Trends

3.8. Consumer Perception and End User Survey

3.9. Forecast Factors – Relevance and Impact

4. Global Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029

4.1. Market Size (US$ Mn) and Forecast

4.1.1. Market Size (US$ Mn) and Y-o-Y Growth

4.1.2. Absolute $ Opportunity

5. Global Low Intensity Sweeteners Market Pricing Analysis

5.1. Regional Average Pricing Analysis (US$)

5.1.1. North America

5.1.2. Latin America

5.1.3. Europe

5.1.4. Asia Pacific

5.1.5. Middle East & Africa

5.2. Pricing Analysis, By Product

6. Global Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029, by Region

6.1. Introduction

6.2. Historical Market Size (US$ Mn) By Region, 2014–2018

6.3. Market Size (US$ Mn) Forecast By Region, 2019-2029

6.3.1. North America

6.3.2. Latin America

6.3.3. Europe

6.3.4. Asia Pacific

6.3.5. Middle East & Africa

6.4. Attractiveness Analysis by Region

7. Global Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029, by Product

7.1. Introduction

7.2. Historical Market Size (US$ Mn) By Product, 2014–2018

7.3. Market Size (US$ Mn) Forecast By Product, 2019-2029

7.3.1. Tagatose

7.3.2. Xylitol

7.3.3. Trehalose

7.3.4. Isomaltulose

7.3.5. Allulose

7.3.6. Others

7.4. Market Attractiveness Analysis By Product

8. Global Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029, by Application

8.1. Introduction

8.2. Historical Market Size (US$ Mn) By Application, 2014–2018

8.3. Market Size (US$ Mn) Forecast By Application, 2019-2029

8.3.1. Beverage

8.3.2. Confectionery

8.3.3. Pharmaceutical

8.3.4. Dairy Products

8.3.5. Others

8.4. Market Attractiveness Analysis By Application

9. North America Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029

9.1. Introduction

9.2. Historical Market Value (US$ Mn) By Market Segments, 2014–2018

9.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2029

9.3.1. By Country

9.3.1.1. U.S.

9.3.1.2. Canada

9.3.2. By Product

9.3.3. By Application

9.4. Market Attractiveness Analysis

9.4.1. By Country

9.4.2. By Product

9.4.3. By Application

9.5. Drivers and Restraints: Impact Analysis

9.6. Key Participants Market Presence Intensity Mapping

10. Latin America Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029

10.1. Introduction

10.2. Historical Market Value (US$ Mn) By Market Segments, 2014–2018

10.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2029

10.3.1. By Country

10.3.1.1. Brazil

10.3.1.2. Mexico

10.3.1.3. Peru

10.3.1.4. Rest of Latin America

10.3.2. By Product

10.3.3. By Application

10.4. Market Attractiveness Analysis

10.4.1. By Country

10.4.2. By Product

10.4.3. By Application

10.5. Drivers and Restraints: Impact Analysis

10.6. Key Participants Market Presence Intensity Mapping

11. Europe Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029

11.1. Introduction

11.2. Historical Market Value (US$ Mn) By Market Segments, 2014–2018

11.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2029

11.3.1. By Country

11.3.1.1. U.K

11.3.1.2. Germany

11.3.1.3. France

11.3.1.4. Italy

11.3.1.5. Rest of Europe

11.3.2. By Product

11.3.3. By Application

11.4. Market Attractiveness Analysis

11.4.1. By Country

11.4.2. By Product

11.4.3. By Application

11.5. Drivers and Restraints: Impact Analysis

11.6. Key Participants Market Presence Intensity Mapping

12. Asia Pacific Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029

12.1. Introduction

12.2. Historical Market Value (US$ Mn) By Market Segments, 2014–2018

12.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2029

12.3.1. By Country

12.3.1.1. China

12.3.1.2. India

12.3.1.3. Japan

12.3.1.4. Rest of Asia Pacific

12.3.2. By Product

12.3.3. By Application

12.4. Market Attractiveness Analysis

12.4.1. By Country

1.1.1. By Product

1.1.2. By Application

12.5. Drivers and Restraints: Impact Analysis

12.6. Key Participants Market Presence Intensity Mapping

13. Middle East & Africa Low Intensity Sweeteners Market Analysis 2014–2018 and Forecast 2019–2029

13.1. Introduction

13.2. Historical Market Value (US$ Mn) By Market Segments, 2014–2018

13.3. Market Value (US$ Mn) Forecast By Market Segments, 2019-2029

13.3.1. By Country

13.3.1.1. GCC Countries

13.3.1.2. South Africa

13.3.1.3. Israel

13.3.1.4. Turkey

13.3.1.5. Rest of MEA

13.3.2. By Product

13.3.3. By Application

13.4. Market Attractiveness Analysis

13.4.1. By Country

13.4.2. By Product

13.4.3. By Application

13.5. Drivers and Restraints: Impact Analysis

13.6. Key Participants Market Presence Intensity Mapping

14. Low Intensity Sweeteners Market Industry Structure

14.1. Market Analysis by Tier of Companies

14.2. Market Concentration

14.3. Market Share Analysis of Top 10 Players

14.4. Market Presence Analysis

14.4.1. By Regional Footprint

14.4.2. By Product Footprint

14.4.3. By Channel Footprint

15. Competition Analysis

15.1. Competition Dashboard

15.2. Competition Developments (Mergers, Acquisitions and Expansions)

15.3. Competition Deepdive

15.3.1. Cargill Inc.

15.3.1.1. Overview

15.3.1.2. Product Portfolio

15.3.1.3. Profitability by Market Segments (Product/Channel/Region)

15.3.1.4. Sales Footprint

15.3.1.5. Channel Footprint

15.3.1.6. Strategy Overview

15.3.1.6.1. Marketing Strategy

15.3.1.6.2. Product Strategy

15.3.1.6.3. Channel Strategy

15.3.2. Roquette Freres Company

15.3.2.1. Overview

15.3.2.2. Product Portfolio

15.3.2.3. Profitability by Market Segments (Product/Channel/Region)

15.3.2.4. Sales Footprint

15.3.2.5. Channel Footprint

15.3.2.6. Strategy Overview

15.3.2.6.1. Marketing Strategy

15.3.2.6.2. Product Strategy

15.3.2.6.3. Channel Strategy

15.3.3. Ingredion

15.3.3.1. Overview

15.3.3.2. Product Portfolio

15.3.3.3. Profitability by Market Segments (Product/Channel/Region)

15.3.3.4. Sales Footprint

15.3.3.5. Channel Footprint

15.3.3.6. Strategy Overview

15.3.3.6.1. Marketing Strategy

15.3.3.6.2. Product Strategy

15.3.3.6.3. Channel Strategy

15.3.4. Matsutani Chemical Industry Co., Ltd.

15.3.4.1. Overview

15.3.4.2. Product Portfolio

15.3.4.3. Profitability by Market Segments (Product/Channel/Region)

15.3.4.4. Sales Footprint

15.3.4.5. Channel Footprint

15.3.4.6. Strategy Overview

15.3.4.6.1. Marketing Strategy

15.3.4.6.2. Product Strategy

15.3.4.6.3. Channel Strategy

15.3.5. E.I. Du Pont de Nemours and Company

15.3.5.1. Overview

15.3.5.2. Product Portfolio

15.3.5.3. Profitability by Market Segments (Product/Channel/Region)

15.3.5.4. Sales Footprint

15.3.5.5. Channel Footprint

15.3.5.6. Strategy Overview

15.3.5.6.1. Marketing Strategy

15.3.5.6.2. Product Strategy

15.3.5.6.3. Channel Strategy

15.3.6. ZuChem Inc.

15.3.6.1. Overview

15.3.6.2. Product Portfolio

15.3.6.3. Profitability by Market Segments (Product/Channel/Region)

15.3.6.4. Sales Footprint

15.3.6.5. Channel Footprint

15.3.6.6. Strategy Overview

15.3.6.6.1. Marketing Strategy

15.3.6.6.2. Product Strategy

15.3.6.6.3. Channel Strategy

15.3.7. Nova Green Inc.

15.3.7.1. Overview

15.3.7.2. Product Portfolio

15.3.7.3. Profitability by Market Segments (Product/Channel/Region)

15.3.7.4. Sales Footprint

15.3.7.5. Channel Footprint

15.3.7.6. Strategy Overview

15.3.7.6.1. Marketing Strategy

15.3.7.6.2. Product Strategy

15.3.7.6.3. Channel Strategy

15.3.8. Foodchem International Corporation

15.3.8.1. Overview

15.3.8.2. Product Portfolio

15.3.8.3. Profitability by Market Segments (Product/Channel/Region)

15.3.8.4. Sales Footprint

15.3.8.5. Channel Footprint

15.3.8.6. Strategy Overview

15.3.8.6.1. Marketing Strategy

15.3.8.6.2. Product Strategy

15.3.8.6.3. Channel Strategy

15.3.9. Ecogreen Oleochemicals

15.3.9.1. Overview

15.3.9.2. Product Portfolio

15.3.9.3. Profitability by Market Segments (Product/Channel/Region)

15.3.9.4. Sales Footprint

15.3.9.5. Channel Footprint

15.3.9.6. Strategy Overview

15.3.9.6.1. Marketing Strategy

15.3.9.6.2. Product Strategy

15.3.9.6.3. Channel Strategy

15.3.10. Gulshan Polyols Limited

15.3.10.1. Overview

15.3.10.2. Product Portfolio

15.3.10.3. Profitability by Market Segments (Product/Channel/Region)

15.3.10.4. Sales Footprint

15.3.10.5. Channel Footprint

15.3.10.6. Strategy Overview

15.3.10.6.1. Marketing Strategy

15.3.10.6.2. Product Strategy

15.3.10.6.3. Channel Strategy

16. Assumptions and Acronyms Used

17. Research Methodology

List of Tables

Table 01: Global Low Intensity Sweetener Forecast Market Value (US$ Mn) by Region, 2019–2029

Table 02: Global Low Intensity Sweetener Absolute $ Opportunity Market Value by Region, 2014–2018

Table 03: Global Low Intensity Sweetener Absolute $ Opportunity Market Value by Region, 2019–2029

Table 04: Global Low Intensity Sweetener Historical Market Value (US$ Mn) by Product, 2014–2018

Table 05: Global Low Intensity Sweetener Forecast Market Value (US$ Mn) by Product, 2019–2029

Table 06: Global Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2014–2018

Table 07: Global Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2019–2029

Table 08: Global Low Intensity Sweetener Historical Market Value (US$ Mn) by Application, 2014–2018

Table 09: Global Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2014–2018

Table 10: Global Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2014–2018

Table 11: Global Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2019–2029

Table 12: Global Low Intensity Sweetener Forecast Market Value (US$ Mn) Application, 2019–2029

Table 13: North America Low Intensity Sweetener Historical Market Value (US$ Mn) by Country, 2014–2018

Table 14: North America Low Intensity Sweetener Forecast Market Value (US$ Mn) by Country, 2019–2029

Table 15: North America Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2014–2018

Table 16: North America Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2019–2029

Table 17: North America Low Intensity Sweetener Historical Market Value (US$ Mn) by Product, 2014–2018

Table 18: North America Low Intensity Sweetener Forecast Market Value (US$ Mn) by Product, 2019–2029

Table 19: North America Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2014–2018

Table 20: North America Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2019–2029

Table 21: North America Low Intensity Sweetener Historical Market Value (US$ Mn) by Application, 2014–2018

Table 22: North America Low Intensity Sweetener Forecast Market Value (US$ Mn) by Application, 2019–2029

Table 23: North America Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2014–2018

Table 24: North America Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2019–2029

Table 25: Latin America Low Intensity Sweetener Historical Market Value (US$ Mn) by Country, 2014–2018

Table 26: Latin America Low Intensity Sweetener Forecast Market Value (US$ Mn) by Country, 2019–2029

Table 27: Latin America Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2014–2018

Table 28: Latin America Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2019–2029

Table 29: Latin America Low Intensity Sweetener Historical Market Value (US$ Mn) by Product, 2014–2018

Table 30: Latin America Low Intensity Sweetener Market Value (US$ Mn) and Forecast by Product, 2019–2029

Table 31: Latin America Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2014–2018

Table 32: Latin America Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2019–2029

Table 33: Latin America Low Intensity Sweetener Historical Market Value (US$ Mn) by Application, 2014–2018

Table 34: Latin America Low Intensity Sweetener Market Value (US$ Mn) and Forecast by Application, 2019–2029

Table 35: Latin America Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2014–2018

Table 36: Latin America Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2019–2029

Table 37: Europe Low Intensity Sweetener Historical Market Value (US$ Mn) by Country, 2014–2018

Table 38: Europe Low Intensity Sweetener Forecast Market Value (US$ Mn) by Country, 2019–2029

Table 39: Europe Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2014–2018

Table 40: Europe Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2019–2029

Table 41: Europe Low Intensity Sweetener Historical Market Value (US$ Mn) by Product, 2014–2018

Table 42: Europe Low Intensity Sweetener Forecast Market Value (US$ Mn) by Product, 2019–2029

Table 43: Europe Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2014–2018

Table 44: Europe Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2019–2029

Table 45: Europe Low Intensity Sweetener Historical Market Value (US$ Mn) by Application, 2014–2018

Table 46: Europe Low Intensity Sweetener Forecast Market Value (US$ Mn) by Application, 2019–2029

Table 47: Europe Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2014–2018

Table 48: Europe Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2019–2029

Table 49: Asia Pacific Low Intensity Sweetener Historical Market Value (US$ Mn) by Country, 2014–2018

Table 50: Asia Pacific Low Intensity Sweetener Forecast Market Value (US$ Mn) by Country, 2019–2029

Table 51: Asia Pacific Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2014–2018

Table 52: Asia Pacific Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2019–2029

Table 53: Asia Pacific Low Intensity Sweetener Historical Market Value (US$ Mn) by Product, 2014–2018

Table 54: Asia Pacific Low Intensity Sweetener Forecast Market Value (US$ Mn) by Product, 2019–2029

Table 55: Asia Pacific Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2014–2018

Table 56: Asia Pacific Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2019–2029

Table 57: Asia Pacific Low Intensity Sweetener Historical Market Value (US$ Mn) by Application, 2014–2018

Table 58: Asia Pacific Low Intensity Sweetener Forecast Market Value (US$ Mn) by Application, 2019–2029

Table 59: Asia Pacific Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2014–2018

Table 60: Asia Pacific Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2019–2029

Table 61: Middle East & Africa Low Intensity Sweetener Historical Market Value (US$ Mn) by Country, 2014–2018

Table 62: Middle East & Africa Low Intensity Sweetener Forecast Market Value (US$ Mn) by Country, 2019–2029

Table 63: Middle East & Africa Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2014–2018

Table 64: Middle East & Africa Low Intensity Sweetener Absolute $ Opportunity Market Value by Country, 2019–2029

Table 65: Middle East & Africa Low Intensity Sweetener Historical Market Value (US$ Mn) by Product, 2014–2018

Table 66: Middle East & Africa Low Intensity Sweetener Forecast Market Value (US$ Mn) by Product, 2019–2029

Table 67: Middle East & Africa Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2014–2018

Table 68: Middle East & Africa Low Intensity Sweetener Absolute $ Opportunity Market Value by Product, 2019–2029

Table 69: Middle East & Africa Low Intensity Sweetener Historical Market Value (US$ Mn) by Application, 2014–2018

Table 70: Middle East & Africa Low Intensity Sweetener Forecast Market Value (US$ Mn) by Application, 2019–2029

Table 71: Middle East & Africa Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2014–2018

Table 72: Middle East & Africa Low Intensity Sweetener Absolute $ Opportunity Market Value by Application, 2019–2029

List of Figures

Figure 01: Global Low Intensity Sweetener Market Value (US$ Mn) Forecast, 2019–2029

Figure 02: Global Low Intensity Sweetener Market Absolute $ Opportunity (US$ Mn), 2019-2029

Figure 03: Global Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Region, 2019 & 2029

Figure 04: Global Low Intensity Sweetener Market Y-o-Y Growth Rate by Region, 2019 - 2029

Figure 05: Global Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Product, 2019 & 2029

Figure 06: Global Low Intensity Sweetener Market Y-o-Y Growth Rate by Product, 2019 - 2029

Figure 07: Global Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Application, 2019 & 2029

Figure 08: Global Low Intensity Sweetener Market Y-o-Y Growth Rate by Application, 2019 - 2029

Figure 09: Global Low Intensity Sweetener Market Attractiveness Analysis by Region, 2019 - 2029

Figure 10: Global Low Intensity Sweetener Market Attractiveness Analysis by Product, 2019 - 2029

Figure 11: Global Low Intensity Sweetener Market Attractiveness Analysis by Application, 2019 - 2029

Figure 12: North America Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 13: U.S Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 14: Canada Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 15: North America Low Intensity Sweetener Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 16: North America Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Product,2019 & 2029

Figure 17: North America Low Intensity Sweetener Market Y-o-Y Growth Rate by Product, 2019 - 2029

Figure 18: North America Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Application, 2019 & 2029

Figure 19: North America Low Intensity Sweetener Market Y-o-Y Growth Rate by Application, 2019 - 2029

Figure 20: North America Low Intensity Sweetener Market Attractiveness Analysis by Region, 2019 - 2029

Figure 21: North America Low Intensity Sweetener Market Attractiveness Analysis by Product, 2019 - 2029

Figure 22: North America Low Intensity Sweetener Market Attractiveness Analysis by Application, 2019 - 2029

Figure 23: Latin America Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 24: Latin America Low Intensity Sweetener Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 25: Mexico Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 26: Brazil Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 27: Argentina Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 28: Rest of Latin America Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 29: Latin America Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Product, 2019 & 2029

Figure 30: Latin America Low Intensity Sweetener Market Y-o-Y Growth Rate by Product, 2019 - 2029

Figure 31: Latin America Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Application, 2019 & 2029

Figure 32: Latin America Low Intensity Sweetener Market Y-o-Y Growth Rate by Application, 2019 - 2029

Figure 33: Latin America Low Intensity Sweetener Market Attractiveness Analysis by Region, 2019 - 2029

Figure 34: Latin America Low Intensity Sweetener Market Attractiveness Analysis by Product, 2019 - 2029

Figure 35: Latin America Low Intensity Sweetener Market Attractiveness Analysis by Application, 2019 - 2029

Figure 36: Europe Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 37: Europe Low Intensity Sweetener Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 38: U.K Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 39: Germany Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 40: France Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 41: Italy Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 42: Rest of Europe Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 43: Europe Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Product, 2019 & 2029

Figure 44: Europe Low Intensity Sweetener Market Y-o-Y Growth Rate by Product, 2019 - 2029

Figure 45: Europe Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Application, 2019 & 2029

Figure 46: Europe Low Intensity Sweetener Market Y-o-Y Growth Rate by Application, 2019 - 2029

Figure 47: Europe Low Intensity Sweetener Market Attractiveness Analysis by Region, 2019 - 2029

Figure 48: Europe Low Intensity Sweetener Market Attractiveness Analysis by Product, 2019 - 2029

Figure 49: Europe Low Intensity Sweetener Market Attractiveness Analysis by Application, 2019 - 2029

Figure 50: Asia Pacific Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Country, 2019 & 2029

Figure 51: Asia Pacific Low Intensity Sweetener Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 52: China Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 53: India Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 54: Japan Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 55: Rest of Asia Pacific Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 56: Asia Pacific Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Product, 2019 & 2029

Figure 57: Asia Pacific Low Intensity Sweetener Market Y-o-Y Growth Rate by Product, 2019 - 2029

Figure 58: Asia Pacific Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Application, 2019 & 2029

Figure 59: Asia Pacific Low Intensity Sweetener Market Y-o-Y Growth Rate by Application, 2019 - 2029

Figure 60: Asia Pacific Low Intensity Sweetener Market Attractiveness Analysis by Region, 2019 - 2029

Figure 61: Asia Pacific Low Intensity Sweetener Market Attractiveness Analysis by Product, 2019 - 2029

Figure 62: Asia Pacific Low Intensity Sweetener Market Attractiveness Analysis by Application, 2019 - 2029

Figure 63: Oceania Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Sales Channel, 2019 & 2029

Figure 64: Middle East & Africa Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Country,2019 & 2029

Figure 65: Middle East & Africa Low Intensity Sweetener Market Y-o-Y Growth Rate by Country, 2019 - 2029

Figure 66: GCC Countries Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 67: South Africa Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 68: Israel Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 69: Turkey Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 70: Rest of Middle East & Africa Low Intensity Sweetener Market Incremental $ Opportunity 2019-2029

Figure 71: Middle East & Africa Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Product,2019 & 2029

Figure 72: Middle East & Africa Low Intensity Sweetener Market Y-o-Y Growth Rate by Product, 2019 - 2029

Figure 73: Middle East & Africa Low Intensity Sweetener Market Value (US$ Mn) and % Growth by Application,2019 & 2029

Figure 74: Middle East & Africa Low Intensity Sweetener Market Y-o-Y Growth Rate by Application, 2019 - 2029

Figure 75: Middle East & Africa Low Intensity Sweetener Market Attractiveness Analysis by Region, 2019 - 2029

Figure 76: Middle East & Africa Low Intensity Sweetener Market Attractiveness Analysis by Product, 2019 - 2029

Figure 77: Middle East & Africa Low Intensity Sweetener Market Attractiveness Analysis by Application, 2019 - 2029