Reports

Reports

The global liquid dressing market is likely to experience stability during the forecast period supported by the increasing incidences of chronic wound cases, burns, and surgical interventions as well as the escalating requirement for easy, patient-friendly wound care solutions. The technological progress that has been made in the field of spray and film formulations and their rising use in home healthcare and outpatient settings.

Although well-organized healthcare systems have been set up in North America and Europe, which are still at the top, the expectation is that Asia Pacific and Latin America will be the fastest-growing regions within the next few years. Building up healthcare facilities with people becoming more conscious of their health have been the principal factors driving this trend. Nevertheless, the market for advanced wound care dressings is still disrupted by high product costs, diverse reimbursement policies, and competition from conventional dressings. Moreover, a significant probability exists that the pharmaceutical market scenario will get better in the future due to a substantial increase in the allocation of funds for research and development activities as well as the formation of collaborations among the top players leading to the fastening of pharmaceutical innovations.

The ongoing trend in the liquid dressing market indicates a significant increase in the dynamics, thus signaling that the market for new wound healing methods is a promising one. The advancements’ aspect enables the patients not only to correctly bandage their injuries but also to bring about the healing process by using a film-forming spray or gel. Typically, such products provide complete protection from the wound, which is the main reason for the alleviation of pain, healing of wounds, hence, a shorter healing time as compared to the traditional dressing methods.

The use of liquid dressings is becoming more popular as they are a practical, hygienic, and less expensive solution in the new wound management. Their scope of application, for instance, goes from minor injuries and skin rashes to chronic wounds, burns, and post-surgical care. Moreover, the market is estimated to grow due to various factors such as increasing health consciousness among people, advancements in technology, and a greater preference for healthcare at home. Besides, a positive regulatory environment and increasing funds in wound care research are likely to foster global acceptance at a much faster pace. According to a report by the National Institutes of Health (NIH), healthcare expenditure per capita in the U.S. reached approximately US$ 12,500 in 2020, which highlights the financial burden associated with chronic wound care.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing occurrence of chronic diseases is one of the main reasons that the liquid dressing market is growing. Diseases such as diabetes are the main causes that result in diabetic foot ulcers, whereas continued inactivity among the elderly has led to pressure ulcers. A global assessment done by the U.S. Centers for Disease Control & Prevention, 90% of the nation's US$ 4.9 Tn in annual healthcare expenditures are for people with chronic and mental health conditions.

Furthermore, the rising number of operations across the globe has led to a greater frequency of post-operative injuries that need implementation of efficient treatment plans. In general, these wounds that last long and present complexities call for professional care that goes beyond the usage of standard dressings, hence the need for dressing innovations such as the healing process that is rapid.

The prevalence of chronic diseases at the global scale has been on the rise, thereby resulting into healthcare systems that are focusing on the effective management of wounds in order to not only save money in the long run but also provide better results to the patients. According to Organization for Economic Co-operation and Development, in 2021, 6.9% of the adult population were living with diabetes across OECD countries. It further states that a further 48 million adults across OECD countries were estimated to have undiagnosed diabetes.

The global liquid dressing industry has been growing exponentially, and one of the key factors behind this is the increase in the geriatric population worldwide. Elderly people are at a higher risk of chronic diseases such as cardiovascular disorders, diabetes, and limited mobility, which have eventually become the main reasons for the occurrence of pressure ulcers, prolonged wound healing, and venous leg ulcers.

According to World Health Organization, by 2030, 1 in 6 people in the world will be aged 60 and above. Physiological changes connected to age, such as the thinning of the skin, declining blood flow, and lowered immune function do aggravate the process of wound healing. Due to the rise in the average lifespan and the changes in healthcare services to cater to the older people, the demand for such wound treatment methods that are easy for patients and are effective such as liquid dressings is anticipated to increase significantly.

Wound care providers with innovative solutions are directing their focus majorly on the growing elderly demographics as it is one of the most important target groups.

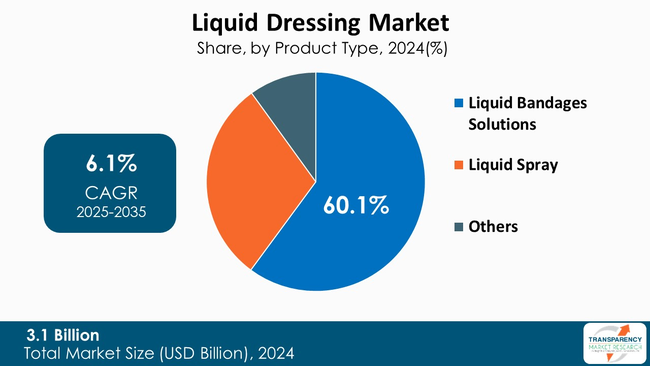

At a global scale, the leading application area for the liquid dressing sector is the consumption of liquid bandage products with market share of 60.1% as they provide the easiest and most effective way of treating minor cuts and abrasions. Liquid spray dressings are gaining popularity as they are more comfortable to use and compatible with chronic wounds.

Furthermore, the recognition for self-wound care and the growing number of chronic wounds have been the main factors behind the market's positive development. New product innovations such as quick drying formulas and better protective coatings are helping the use of liquid dressing products to grow not only in the healthcare sector but also in home environment.

Additionally, the ease and mobility of these items have made them a hit with consumers of various ages. Healthcare professionals are increasingly recognizing the benefits of using liquid bandages in clinical settings to promote optimal wound healing outcomes and reduce the risk of healthcare-associated infections.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America holds the largest share of the global liquid dressing market (35.6%). The high consumption of products in the global market for liquid dressing is primarily due to the well-established healthcare ecosystem in the U.S. The presence in North America has been further supported by the high prevalence of chronic diseases and the quick uptake of sophisticated wound care technologies, so the liquid dressing industry leader position goes to the North American region.

The region benefits from insurance policies, comprehensive knowledge amongst the medical professionals, and the existence of prominent market players providing the market with neutralizing solutions. Additionally, the progressively aged population and the increasing incidence of diabetes and obesity continue to support the requirement for liquid dressings in the U.S. and Canada.

For instance, The U.S. Food and Drug Administration (FDA) has presented new regulations that categorize wound dressings, such as antimicrobial liquid wound washes and sprays. The proposal states that products with a high risk of antimicrobial resistance (AMR) will be considered Class III medical devices, and thus premarket approval will be necessary.

3M, Smith+Nephew, Johnson & Johnson, Convatec Inc., Mölnlycke AB, Essity Health & Medical, B. Braun SE, Lokus Medical (M) Sdn Bhd, Baxter International, Inc., HYNAUT Group, URGO SAS, Integra LifeSciences, HARTMANN USA, Inc., Dr. Ausbüttel & Co. GmbH, Medline Industries, LP. and others are some of the leading manufacturers operating in the global liquid dressing market.

Each of these companies has been profiled in the liquid dressing market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 3.1 Bn |

| Forecast Value in 2035 | More than US$ 6.0 Bn |

| CAGR | 6.1 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global liquid dressing market was valued at US$ 3.1 Bn in 2024

The global liquid dressing industry is projected to reach more than US$ 6.0 Bn by the end of 2035

Rising prevalence of chronic diseases & increase in aging population are some of the factors driving the expansion of liquid dressing market.

The CAGR is anticipated to be 6.1 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

3M, Smith+Nephew, Johnson & Johnson, Convatec Inc., Mölnlycke AB, Essity Health & Medical, B. Braun SE, Lokus Medical (M) Sdn Bhd, Baxter International, Inc., HYNAUT Group, URGO SAS, Integra LifeSciences, HARTMANN USA, Inc., Dr. Ausbüttel & Co. GmbH, Medline Industries, LP., and other prominent players.

Table 01: Global Liquid Dressing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Liquid Dressing Market Value (US$ Bn) Forecast, By Wound Type, 2020 to 2035

Table 03: Global Liquid Dressing Market Value (US$ Bn), by Acute Wounds, 2020 to 2035

Table 04: Global Liquid Dressing Market Value (US$ Bn), by Chronic Wounds, 2020 to 2035

Table 05: Global Liquid Dressing Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 06: Global Liquid Dressing Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Liquid Dressing Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Liquid Dressing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 09: North America Liquid Dressing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 10: North America Liquid Dressing Market Value (US$ Bn), by Acute Wounds, 2020 to 2035

Table 11: North America Liquid Dressing Market Value (US$ Bn), by Chronic Wounds, 2020 to 2035

Table 12: North America Liquid Dressing Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 13: Europe Liquid Dressing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Europe Liquid Dressing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 15: Europe Liquid Dressing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 16: Europe Liquid Dressing Market Value (US$ Bn), by Acute Wounds, 2020 to 2035

Table 17: Europe Liquid Dressing Market Value (US$ Bn), by Chronic Wounds, 2020 to 2035

Table 18: Europe Liquid Dressing Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 19: Asia Pacific Liquid Dressing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Asia Pacific Liquid Dressing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 21: Asia Pacific Liquid Dressing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 22: Asia Pacific Liquid Dressing Market Value (US$ Bn), by Acute Wounds, 2020 to 2035

Table 23: Asia Pacific Liquid Dressing Market Value (US$ Bn), by Chronic Wounds, 2020 to 2035

Table 24: Asia Pacific Liquid Dressing Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 25: Latin America Liquid Dressing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Latin America Liquid Dressing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 27: Latin America Liquid Dressing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 28: Latin America Liquid Dressing Market Value (US$ Bn), by Acute Wounds, 2020 to 2035

Table 29: Latin America Liquid Dressing Market Value (US$ Bn), by Chronic Wounds, 2020 to 2035

Table 30: Latin America Liquid Dressing Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 31: Middle East and Africa Liquid Dressing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 32: Middle East and Africa Liquid Dressing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 33: Middle East and Africa Liquid Dressing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 34: Middle East and Africa Liquid Dressing Market Value (US$ Bn), by Acute Wounds, 2020 to 2035

Table 35: Middle East and Africa Liquid Dressing Market Value (US$ Bn), by Chronic Wounds, 2020 to 2035

Table 36: Middle East and Africa Liquid Dressing Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Figure 01: Global Liquid Dressing Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 02: Global Liquid Dressing Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 03: Global Liquid Dressing Market Revenue (US$ Bn), by Liquid Bandages Solutions, 2020 to 2035

Figure 04: Global Liquid Dressing Market Revenue (US$ Bn), by Liquid Spray, 2020 to 2035

Figure 05: Global Liquid Dressing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 06: Global Liquid Dressing Market Value Share Analysis, by Wound Type, 2024 and 2035

Figure 07: Global Liquid Dressing Market Attractiveness Analysis, by Wound Type, 2025 to 2035

Figure 08: Global Liquid Dressing Market Revenue (US$ Bn), by Acute Wounds, 2020 to 2035

Figure 09: Global Liquid Dressing Market Revenue (US$ Bn), by Chronic Wounds, 2020 to 2035

Figure 10: Global Liquid Dressing Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 11: Global Liquid Dressing Market Attractiveness Analysis, by Distribution Channel, 2024 and 2035

Figure 12: Global Liquid Dressing Market Revenue (US$ Bn), by Hospital Pharmacies, 2025 to 2035

Figure 13: Global Liquid Dressing Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 14: Global Liquid Dressing Market Revenue (US$ Bn), by Online Sales / E-commerce, 2020 to 2035

Figure 15: Global Liquid Dressing Market Value Share Analysis, By Region, 2024 and 2035

Figure 16: Global Liquid Dressing Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 17: North America Liquid Dressing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 18: North America Liquid Dressing Market Value Share Analysis, by Country, 2024 and 2035

Figure 19: North America Liquid Dressing Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 20: North America Liquid Dressing Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 21: North America Liquid Dressing Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 22: North America Liquid Dressing Market Value Share Analysis, by Wound Type, 2024 and 2035

Figure 23: North America Liquid Dressing Market Attractiveness Analysis, by Wound Type, 2025 to 2035

Figure 24: North America Liquid Dressing Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 25: North America Liquid Dressing Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 26: Europe Liquid Dressing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: Europe Liquid Dressing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 28: Europe Liquid Dressing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 29: Europe Liquid Dressing Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 30: Europe Liquid Dressing Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 31: Europe Liquid Dressing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 32: Europe Liquid Dressing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 33: Europe Liquid Dressing Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 34: Europe Liquid Dressing Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 35: Asia Pacific Liquid Dressing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: Asia Pacific Liquid Dressing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: Asia Pacific Liquid Dressing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: Asia Pacific Liquid Dressing Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 39: Asia Pacific Liquid Dressing Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 40: Asia Pacific Liquid Dressing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 41: Asia Pacific Liquid Dressing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 42: Asia Pacific Liquid Dressing Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 43: Asia Pacific Liquid Dressing Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 44: Latin America Liquid Dressing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Latin America Liquid Dressing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Latin America Liquid Dressing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Latin America Liquid Dressing Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 48: Latin America Liquid Dressing Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 49: Latin America Liquid Dressing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 50: Latin America Liquid Dressing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 51: Latin America Liquid Dressing Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 52: Latin America Liquid Dressing Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 53: Middle East and Africa Liquid Dressing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Middle East and Africa Liquid Dressing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Middle East and Africa Liquid Dressing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Middle East and Africa Liquid Dressing Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 57: Middle East and Africa Liquid Dressing Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 58: Middle East and Africa Liquid Dressing Market Value Share Analysis, by Wound Type, 2024 and 2035

Figure 59: Middle East and Africa Liquid Dressing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 60: Middle East and Africa Liquid Dressing Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 61: Middle East and Africa Liquid Dressing Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035