Reports

Reports

Life science reagents are an integral part of pharmaceutical, biotechnology, life science, and healthcare industries. The global life science reagents market is expected to witness strong growth during the forecast period due to increase in the application of life science reagents in in-vitro diagnostics for the diagnosis of various chronic as well as infectious diseases.

Life science reagents are also used to predict disease course, formulate treatment, and monitor the effectiveness of the therapy. Increase in pharmaceutical R&D budgets by governments and private players is likely to support the development of new products and technologies. This is projected to create lucrative revenue opportunities for manufacturers of life science reagents during the forecast period.

Life science reagents are substances or compounds used in a chemical reaction to observe and record changes. Medical researchers analyze this data to determine the cause of a disease. Life science and analytical reagents are used in chemical reactions to measure, detect, or examine other substances.

Technological advancements in molecular biology, life sciences, and biotechnology have brought about significant changes in healthcare diagnostics, drug discovery, personalized medicines, forensic sciences, and clinical research & development. This has increased the demand for biotechnology media, sera and reagents, biotechnology reagents, etc. Growth of the life science industry and increase in incidence rate of chronic and infectious diseases are driving the global life science reagents market.

| Attribute | Detail |

|---|---|

| Life Science Reagents Market Drivers |

|

Growing geriatric population and heightened demand for disease diagnosis are some of the most significant factors driving the market. With the advancement in age globally, there is a greater prevalence of long-term illnesses like cancer, diabetes, and cardiovascular illness among old individuals that results in higher demand for diagnostic test and monitoring. Such testing requires a variety of life science reagents, which are critical elements in laboratory testing, molecular testing, and point-of-care testing.

Meanwhile, the growing incidence of infectious diseases and also chronic disease worldwide is generating frequent and complicated testing, even enhancing the use of reagents. Technological innovations in diagnostic techniques, along with growth in healthcare facilities and priority of early disease detection, are pushing this trend as well. The market for life science reagents is therefore witnessing strong growth with growing demand for high-performance.

Growing uptake of next-generation products is one of the major growth drivers to the life science reagents market since it has a direct impact on demand for highly qualified, specialized reagents that constitute the building blocks of modern-day research and diagnostic equipment.

With ongoing development in biotechnology, genomics, and pharma R&D, demand for newer, more sophisticated technologies such as next-generation sequencing (NGS), CRISPR gene editing, high-throughput screening, and automation-based diagnostic platforms has risen. These products need accurate, reliable reagents to work properly, which further stimulates demand for new reagent products.

Moreover, creation and sales of new treatments-monoclonal antibodies, gene therapies, cell-based therapies-are reliant on state-of-the-art reagents for activities like drug discovery screening, toxicity screening, and production of large molecules.

The computer solutions, artificial intelligence, and automation put into the laboratory also accelerate the use of reagents as such platforms require continuous influx of high-purity reagents to operate at their utmost efficiency and accuracy. This has consequently led to the expansion of life science reagents market by increasing both - the volume and the complexity of reagents needed across pharmaceutical firms, biotech firms, clinical labs, and research institutions.

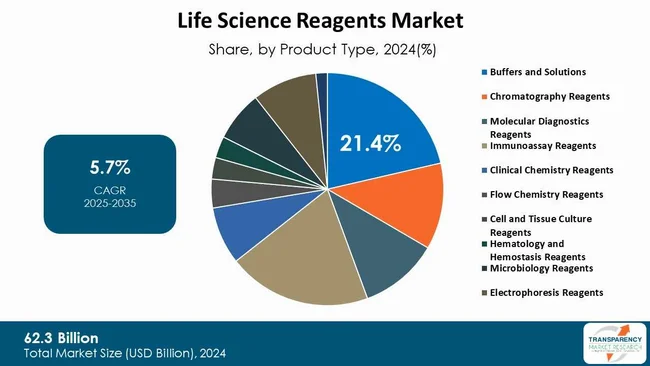

Buffers and solutions are driving the life science reagents market globally by product type as they are integral components in almost any laboratory process and diagnostic application in the life sciences market. These are essential for maintaining pH levels constant and biochemical reaction conditions optimal, which is required for experiments involving molecular biology, cell culture, protein purification, and clinical diagnostics.

In January 2024, QIAGEN announced the launch of two syndromic testing panels for its QIAstat-Dx instruments in India, including the Gastrointestinal Panel 2 and Meningitis/Encephalitis Panel, which join the Respiratory SARS-CoV-2 Panel that had been authorized for emergency use in 2020 for the first time. The panels have already received regulatory approval from the Central Drugs Standard Control Organization (CDSCO), thereby enabling healthcare providers in India to diagnose patients precisely, faster, and easier.

| Attribute | Detail |

|---|---|

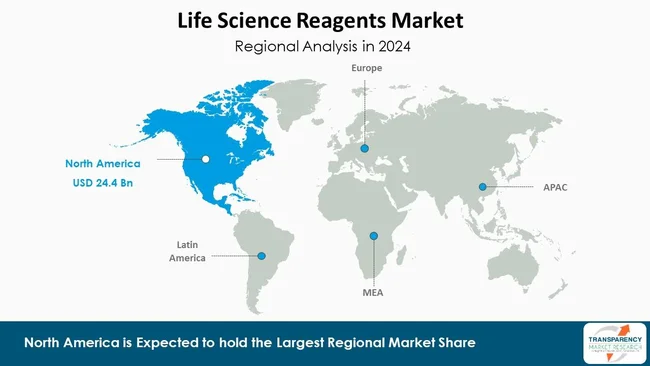

| Leading Region | North America |

North America is expected to hold a major market share in the global life science reagents industry due to the rise in the incidence of infectious diseases in this region. According to Centers for Disease Control and Prevention, in July 2022 it was reported that around six in ten Americans are living with at least one chronic disease, and four in ten adults have two or more chronic diseases. These diseases are amongst the major causes of death and disability in North America.

Similarly, according to the Canadian Cancer Statistics released in November 2021, an estimated 229,200 Canadians were diagnosed with cancer in 2021. Furthermore, the International Diabetes Federation (IDF) published in December 2021 estimated that 14 million adults in Mexico were living with diabetes. Therefore, for the early and effective diagnosis of the diseases, the demand for life science reagents is expected to increase, hence augmenting the market studied during the forecast period.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. Becton, Dickinson and Company, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, F. Hoffman-La Roche Ltd, Abbott, Siemens Healthineers, STEMCELL Technologies, Merck KGAA, Sysmex Corporation, Waters Corporation, Promega Corporation, Miltenyi Biotec, Beckman Coulter, Inc., Bio-Techne, Biotium are the prominent market players.

Each of these players has been have been profiled in the life science reagents market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

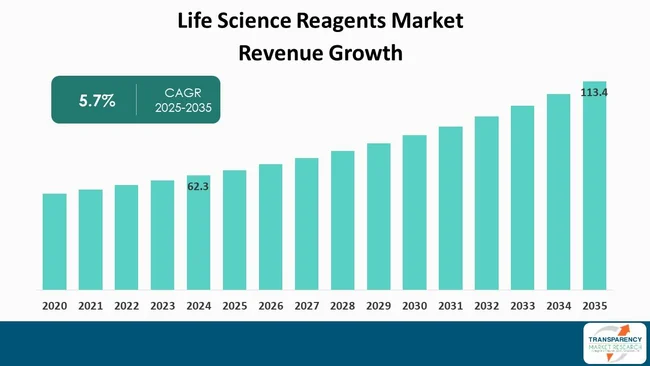

| Size in 2024 | US$ 62.3 Bn |

| Forecast Value in 2035 | US$ 113.4 Bn |

| CAGR | 5.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global life science reagents market was valued at US$ 62.3 Bn in 2024.

Life science reagents business is projected to cross US$ 113.4 Bn by the end of 2035.

Increase in geriatric population, rise in need for disease diagnosis, and rise in adoption of advanced products.

The CAGR is anticipated to be 5.7% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Becton, Dickinson and Company, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, F. Hoffman-La Roche Ltd, Abbott, Siemens Healthineers, STEMCELL Technologies, Merck KGAA, Sysmex Corporation, Waters Corporation, Promega Corporation, Miltenyi Biotec, Beckman Coulter, Inc., Bio-Techne, Biotium, and Other players are the prominent life science reagents market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Life Science Reagents Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Life Science Reagents Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Technological Advancements associated with Life Science Reagents

5.2. Regulatory Landscape across Key Regions / Countries

5.3. PORTER's Five Forces Analysis

5.4. PESTEL Analysis

5.5. Key Product/Brand Analysis

5.6. Key Industry Events

5.7. Feature Analysis based on the Key Product Manufacturers

5.8. Pricing Analysis

5.9. Benchmarking of the Products Offered by the Competitors

6. Global Life Science Reagents Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Buffers and Solutions

6.3.2. Chromatography Reagents

6.3.3. Molecular Diagnostics Reagents

6.3.4. Immunoassay Reagents

6.3.5. Clinical Chemistry Reagents

6.3.6. Flow Chemistry Reagents

6.3.7. Cell and Tissue Culture Reagents

6.3.8. Hematology and Hemostasis Reagents

6.3.9. Microbiology Reagents

6.3.10. Electrophoresis Reagents

6.3.11. Others

6.4. Market Attractiveness By Product Type

7. Global Life Science Reagents Market Analysis and Forecasts, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application, 2020 to 2035

7.3.1. Clinical Diagnostics

7.3.2. Drug Discovery

7.3.3. Genetic Engineering

7.3.4. Others

7.4. Market Attractiveness By Application

8. Global Life Science Reagents Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020 to 2035

8.3.1. Hospitals and Diagnostic Laboratories

8.3.2. Pharmaceutical & Biotechnology Companies

8.3.3. CROs & CMOs

8.3.4. Others

8.4. Market Attractiveness By End-user

9. Global Life Science Reagents Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Life Science Reagents Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2020 to 2035

10.2.1. Buffers and Solutions

10.2.2. Chromatography Reagents

10.2.3. Molecular Diagnostics Reagents

10.2.4. Immunoassay Reagents

10.2.5. Clinical Chemistry Reagents

10.2.6. Flow Chemistry Reagents

10.2.7. Cell and Tissue Culture Reagents

10.2.8. Hematology and Hemostasis Reagents

10.2.9. Microbiology Reagents

10.2.10. Electrophoresis Reagents

10.2.11. Others

10.3. Market Value Forecast By Application, 2020 to 2035

10.3.1. Clinical Diagnostics

10.3.2. Drug Discovery

10.3.3. Genetic Engineering

10.3.4. Others

10.4. Market Value Forecast By End-user, 2020 to 2035

10.4.1. Hospitals and Diagnostic Laboratories

10.4.2. Pharmaceutical & Biotechnology Companies

10.4.3. CROs & CMOs

10.4.4. Others

10.5. Market Value Forecast By Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Life Science Reagents Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2020 to 2035

11.2.1. Buffers and Solutions

11.2.2. Chromatography Reagents

11.2.3. Molecular Diagnostics Reagents

11.2.4. Immunoassay Reagents

11.2.5. Clinical Chemistry Reagents

11.2.6. Flow Chemistry Reagents

11.2.7. Cell and Tissue Culture Reagents

11.2.8. Hematology and Hemostasis Reagents

11.2.9. Microbiology Reagents

11.2.10. Electrophoresis Reagents

11.2.11. Others

11.3. Market Value Forecast By Application, 2020 to 2035

11.3.1. Clinical Diagnostics

11.3.2. Drug Discovery

11.3.3. Genetic Engineering

11.3.4. Others

11.4. Market Value Forecast By End-user, 2020 to 2035

11.4.1. Hospitals and Diagnostic Laboratories

11.4.2. Pharmaceutical & Biotechnology Companies

11.4.3. CROs & CMOs

11.4.4. Others

11.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Life Science Reagents Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Buffers and Solutions

12.2.2. Chromatography Reagents

12.2.3. Molecular Diagnostics Reagents

12.2.4. Immunoassay Reagents

12.2.5. Clinical Chemistry Reagents

12.2.6. Flow Chemistry Reagents

12.2.7. Cell and Tissue Culture Reagents

12.2.8. Hematology and Hemostasis Reagents

12.2.9. Microbiology Reagents

12.2.10. Electrophoresis Reagents

12.2.11. Others

12.3. Market Value Forecast By Application, 2020 to 2035

12.3.1. Clinical Diagnostics

12.3.2. Drug Discovery

12.3.3. Genetic Engineering

12.3.4. Others

12.4. Market Value Forecast By End-user, 2020 to 2035

12.4.1. Hospitals and Diagnostic Laboratories

12.4.2. Pharmaceutical & Biotechnology Companies

12.4.3. CROs & CMOs

12.4.4. Others

12.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Life Science Reagents Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Buffers and Solutions

13.2.2. Chromatography Reagents

13.2.3. Molecular Diagnostics Reagents

13.2.4. Immunoassay Reagents

13.2.5. Clinical Chemistry Reagents

13.2.6. Flow Chemistry Reagents

13.2.7. Cell and Tissue Culture Reagents

13.2.8. Hematology and Hemostasis Reagents

13.2.9. Microbiology Reagents

13.2.10. Electrophoresis Reagents

13.2.11. Others

13.3. Market Value Forecast By Application, 2020 to 2035

13.3.1. Clinical Diagnostics

13.3.2. Drug Discovery

13.3.3. Genetic Engineering

13.3.4. Others

13.4. Market Value Forecast By End-user, 2020 to 2035

13.4.1. Hospitals and Diagnostic Laboratories

13.4.2. Pharmaceutical & Biotechnology Companies

13.4.3. CROs & CMOs

13.4.4. Others

13.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Life Science Reagents Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2020 to 2035

14.2.1. Buffers and Solutions

14.2.2. Chromatography Reagents

14.2.3. Molecular Diagnostics Reagents

14.2.4. Immunoassay Reagents

14.2.5. Clinical Chemistry Reagents

14.2.6. Flow Chemistry Reagents

14.2.7. Cell and Tissue Culture Reagents

14.2.8. Hematology and Hemostasis Reagents

14.2.9. Microbiology Reagents

14.2.10. Electrophoresis Reagents

14.2.11. Others

14.3. Market Value Forecast By Application, 2020 to 2035

14.3.1. Clinical Diagnostics

14.3.2. Drug Discovery

14.3.3. Genetic Engineering

14.3.4. Others

14.4. Market Value Forecast By End-user, 2020 to 2035

14.4.1. Hospitals and Diagnostic Laboratories

14.4.2. Pharmaceutical & Biotechnology Companies

14.4.3. CROs & CMOs

14.4.4. Others

14.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. Becton, Dickinson and Company

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Financial Overview

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Agilent Technologies, Inc.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Financial Overview

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Bio-Rad Laboratories, Inc.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Financial Overview

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Thermo Fisher Scientific

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Financial Overview

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. F. Hoffman-La Roche Ltd

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Financial Overview

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Abbott

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Financial Overview

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Siemens Healthineers

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Financial Overview

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. STEMCELL Technologies

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Financial Overview

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Merck KGAA

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Financial Overview

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Sysmex Corporation

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Financial Overview

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Waters Corporation

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Financial Overview

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Promega Corporation

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Financial Overview

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Miltenyi Biotec

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Financial Overview

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Beckman Coulter, Inc.

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Financial Overview

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. Bio-Techne

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Financial Overview

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

15.3.16. Biotium

15.3.16.1. Company Overview

15.3.16.2. Financial Overview

15.3.16.3. Financial Overview

15.3.16.4. Business Strategies

15.3.16.5. Recent Developments

List of Tables

Table 01: Global Life Science Reagents Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Life Science Reagents Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 03: Global Life Science Reagents Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Life Science Reagents Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Life Science Reagents Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America Life Science Reagents Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 07: North America Life Science Reagents Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: North America Life Science Reagents Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Europe Life Science Reagents Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 10: Europe Life Science Reagents Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 11: Europe Life Science Reagents Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12 Europe Life Science Reagents Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific Life Science Reagents Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 14: Asia Pacific Life Science Reagents Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 15: Asia Pacific Life Science Reagents Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 16: Asia Pacific Life Science Reagents Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America Life Science Reagents Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 18: Latin America Life Science Reagents Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 19: Latin America Life Science Reagents Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Latin America Life Science Reagents Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa Life Science Reagents Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 22: Middle East & Africa Life Science Reagents Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 23: Middle East & Africa Life Science Reagents Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Middle East & Africa Life Science Reagents Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Life Science Reagents Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Life Science Reagents Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 03: Global Life Science Reagents Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 04: Global Life Science Reagents Market Revenue (US$ Bn), by Buffers and Solutions, 2020 to 2035

Figure 05: Global Life Science Reagents Market Revenue (US$ Bn), by Chromatography Reagents, 2020 to 2035

Figure 06: Global Life Science Reagents Market Revenue (US$ Bn), by Molecular Diagnostics Reagents, 2020 to 2035

Figure 07: Global Life Science Reagents Market Revenue (US$ Bn), by Immunoassay Reagents, 2020 to 2035

Figure 08: Global Life Science Reagents Market Revenue (US$ Bn), by Clinical Chemistry Reagents, 2020 to 2035

Figure 09: Global Life Science Reagents Market Revenue (US$ Bn), by Flow Chemistry Reagents, 2020 to 2035

Figure 10: Global Life Science Reagents Market Revenue (US$ Bn), by Cell and Tissue Culture Reagents, 2020 to 2035

Figure 11: Global Life Science Reagents Market Revenue (US$ Bn), by Hematology and Hemostasis Reagents, 2020 to 2035

Figure 12: Global Life Science Reagents Market Revenue (US$ Bn), by Microbiology Reagents, 2020 to 2035

Figure 13: Global Life Science Reagents Market Revenue (US$ Bn), by Electrophoresis Reagents, 2020 to 2035

Figure 14: Global Life Science Reagents Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 15: Global Life Science Reagents Market Value Share Analysis, By Application, 2024 and 2035

Figure 16: Global Life Science Reagents Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 17: Global Life Science Reagents Market Revenue (US$ Bn), by Clinical Diagnostics, 2020 to 2035

Figure 18: Global Life Science Reagents Market Revenue (US$ Bn), by Drug Discovery, 2020 to 2035

Figure 19: Global Life Science Reagents Market Revenue (US$ Bn), by Genetic Engineering, 2020 to 2035

Figure 20: Global Life Science Reagents Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Life Science Reagents Market Value Share Analysis, By End-user, 2024 and 2035

Figure 22: Global Life Science Reagents Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 23: Global Life Science Reagents Market Revenue (US$ Bn), by Hospitals and Diagnostic Laboratories, 2020 to 2035

Figure 24: Global Life Science Reagents Market Revenue (US$ Bn), by Pharmaceutical & Biotechnology Companies, 2020 to 2035

Figure 25: Global Life Science Reagents Market Revenue (US$ Bn), by CROs & CMOs, 2020 to 2035

Figure 26: Global Life Science Reagents Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 27: Global Life Science Reagents Market Value Share Analysis, By Region, 2024 and 2035

Figure 28: Global Life Science Reagents Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 29: North America Life Science Reagents Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: North America Life Science Reagents Market Value Share Analysis, by Country, 2024 and 2035

Figure 31: North America Life Science Reagents Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 32: North America Life Science Reagents Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 33: North America Life Science Reagents Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 34: North America Life Science Reagents Market Value Share Analysis, By Application, 2024 and 2035

Figure 35: North America Life Science Reagents Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 36: North America Life Science Reagents Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: North America Life Science Reagents Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Europe Life Science Reagents Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 39: Europe Life Science Reagents Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 40: Europe Life Science Reagents Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 41: Europe Life Science Reagents Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 42: Europe Life Science Reagents Market Value Share Analysis, By Application, 2024 and 2035

Figure 43: Europe Life Science Reagents Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 44: Europe Life Science Reagents Market Value Share Analysis, By End-user, 2024 and 2035

Figure 45: Europe Life Science Reagents Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 46: Asia Pacific Life Science Reagents Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: Asia Pacific Life Science Reagents Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48 Asia Pacific Life Science Reagents Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 49: Asia Pacific Life Science Reagents Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 50: Asia Pacific Life Science Reagents Market Value Share Analysis, By Application, 2024 and 2035

Figure 51: Asia Pacific Life Science Reagents Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 52: Asia Pacific Life Science Reagents Market Value Share Analysis, By End-user, 2024 and 2035

Figure 53: Asia Pacific Life Science Reagents Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 54: Latin America Life Science Reagents Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Latin America Life Science Reagents Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Latin America Life Science Reagents Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 57: Latin America Life Science Reagents Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 58: Latin America Life Science Reagents Market Value Share Analysis, By Application, 2024 and 2035

Figure 59: Latin America Life Science Reagents Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 60: Latin America Life Science Reagents Market Value Share Analysis, By End-user, 2024 and 2035

Figure 61: Latin America Life Science Reagents Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 62: Middle East & Africa Life Science Reagents Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Middle East & Africa Life Science Reagents Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 64: Middle East & Africa Life Science Reagents Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 65: Middle East & Africa Life Science Reagents Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 66: Middle East & Africa Life Science Reagents Market Value Share Analysis, By Application, 2024 and 2035

Figure 67: Middle East & Africa Life Science Reagents Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 68: Middle East & Africa Life Science Reagents Market Value Share Analysis, By End-user, 2024 and 2035

Figure 69: Middle East & Africa Life Science Reagents Market Attractiveness Analysis, By End-user, 2025 to 2035