Reports

Reports

Analyst Viewpoint

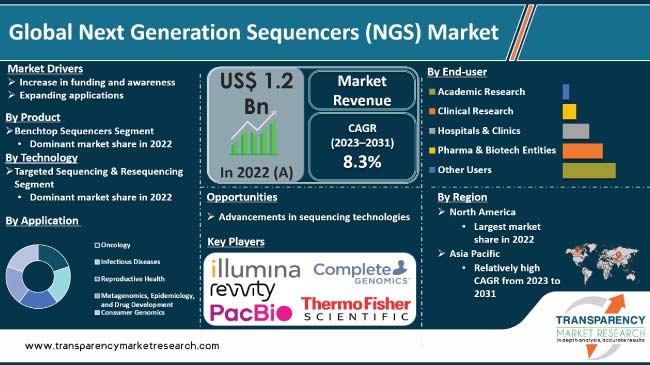

Advancements in sequencing technologies is driving the global next generation sequencers (NGS) market. NGS technologies have emerged as a cornerstone in deciphering the complexities of genomics by enabling rapid and cost-effective sequencing of DNA and RNA. Increase in demand for personalized medicine and precision diagnostics is propelling market expansion. Furthermore, surge in funding for and awareness about advanced genomic technologies is expected to bolster the global next generation sequencers (NGS) industry size during the forecast period.

Advancements in sequencing technologies, such as improved read lengths, enhanced accuracy, and reduced costs per base pair offer lucrative opportunities to market players. Furthermore, companies are focusing on collaborations and partnerships with research institutions in order to develop more user-friendly and automated NGS platforms.

However, challenges such as data management, standardization of protocols, and ethical concerns related to genetic privacy is likely to restrain the global next generation sequencers (NGS) market in the near future.

Next Generation Sequencers (NGS) represent a breakthrough in DNA sequencing technology, offering a departure from traditional methods. NGS platforms employ highly parallelized approaches, enabling simultaneous sequencing of millions of DNA fragments. This capability results in significantly enhanced throughput, allowing for the rapid and cost-effective analysis of genetic material.

NGS technologies leverage diverse sequencing methodologies, including sequencing-by-synthesis, ion semiconductor sequencing, and single-molecule real-time sequencing. The high-throughput nature of NGS has transformed genomics research by facilitating comprehensive analyses of entire genomes, exomes, or specific target regions.

This versatility has extended applications across various domains, including basic research, clinical diagnostics, personalized medicine, and agricultural genomics.

The ongoing evolution of NGS platforms continues to improve factors such as accuracy, read length, and cost-effectiveness, establishing them as pivotal tools for unraveling the complexities of genetic information and advancing genomics research.

Next generation sequencers (NGS) has emerged as a dynamic and rapidly evolving sector within the biotechnology industry. The market has witnessed substantial growth due to the widespread adoption of NGS platforms across various research, clinical, and industrial applications.

Researchers and healthcare professionals leverage the high-throughput capabilities of NGS for diverse purposes, including genomics research, personalized medicine, clinical diagnostics, and agricultural genomics.

Advancements in sequencing technologies are driving the global next generation sequencers (NGS) market demand. Relentless pursuit of innovation in this domain has paved the way for unprecedented improvements in sequencing efficiency, accuracy, and cost-effectiveness. The evolution from traditional Sanger sequencing to state-of-the-art NGS platforms has been marked by breakthroughs in various aspects of sequencing technologies.

One pivotal advancement is the development of massively parallel sequencing techniques, enabling the simultaneous analysis of millions of DNA fragments. This parallelization has significantly expedited the sequencing process, allowing for rapid generation of large-scale genomic datasets.

Advancements in base-calling algorithms and error correction methodologies have substantially enhanced the accuracy of sequencing results. This improvement is particularly crucial in applications such as clinical diagnostics and personalized medicine, where precision is paramount.

Advent of single-molecule sequencing technologies has ushered in a new era in genomics. Technologies such as nanopore sequencing and single-molecule real-time (SMRT) sequencing offer the ability to directly read individual DNA molecules without the need for amplification. This not only reduces the risk of bias introduced during amplification, but also facilitates the detection of epigenetic modifications, providing a more comprehensive understanding of the genome.

Miniaturization and automation have played pivotal roles in advancing sequencing technologies. Development of microfluidic devices and integrated systems has led to higher throughput and reduced costs per base pair sequenced. These technological strides have made NGS more accessible across various research domains, fueling its widespread adoption.

Collectively, the market is driven by continuous advancements in sequencing technologies. The collective impact of parallelization, improved accuracy, single-molecule sequencing, and miniaturization has not only revolutionized genomic research, but has also expanded the scope of applications in fields ranging from clinical diagnostics to agriculture and beyond. As these technologies continue to mature, the next generation sequencers (NGS) market is poised for sustained growth and transformative impact on diverse scientific endeavors.

The burgeoning demand for advanced genomic technologies has stimulated a surge in funding from governmental bodies, private investors, and research institutions. This influx of financial support is instrumental in fostering research & development endeavors aimed at enhancing NGS technologies, thereby fueling innovation and expanding the next generation sequencers (NGS) market landscape.

Rise in awareness and recognition of the transformative potential of NGS technologies across diverse sectors, including healthcare, agriculture, and research, contribute significantly to market expansion.

As stakeholders become increasingly cognizant of the advantages offered by NGS, there is a rising trend of adoption in clinical diagnostics, personalized medicine, and precision agriculture. The recognition of NGS as a powerful tool for deciphering complex biological information is driving the global next generation sequencers (NGS) industry growth.

Alignment of funding initiatives with awareness campaigns creates a synergistic effect, fostering a conducive environment for market development. Initiatives that aim to educate stakeholders about the benefits and applications of NGS technologies not only enhance market penetration, but also contribute to building a robust ecosystem for continued advancements.

Collaborative efforts between industry players, research institutions, and regulatory bodies, facilitated by increased funding, promote the dissemination of knowledge and best practices. The interplay of increased funding and heightened awareness is expected to be a dynamic force propelling the next generation sequencers (NSG) market.

This symbiotic relationship not only accelerates technological advancements, but also cultivates a broader understanding of the potential applications of NGS across various domains. As financial support continues to pour into the sector and awareness campaigns gain momentum, the market is poised for sustained growth and innovation.

In terms of product, the benchtop sequencers segment accounted for the largest global next generation sequencers (NGS) market share in 2022. These devices are characterized by compact size, ease of use, and cost-effectiveness, and have emerged as the preferred choice for researchers and laboratories aiming to streamline sequencing processes.

Smaller footprint of benchtop sequencers allows for efficient utilization of laboratory space, a critical consideration in resource optimization. Additionally, these sequencers offer quicker turnaround times and lower initial investment requirements compared to their floor standing counterparts, making them more accessible to a wider range of research institutions.

Dominance of the benchtop sequencers segment can be ascribed to advancements in sequencing technologies that have empowered these compact devices to deliver high-throughput results with remarkable accuracy.

Researchers appreciate the flexibility and scalability offered by benchtop sequencers, allowing them to adapt to various experimental demands seamlessly. The user-friendly interfaces of these sequencers further contribute to their popularity, enabling researchers with diverse skill sets to efficiently operate and interpret results. Hence, benchtop sequencers have become integral to a multitude of applications, ranging from clinical diagnostics to agricultural genomics.

North America's dominance of the global next generation sequencers (NGS) market can be ascribed to several key factors. The region boasts a robust research & development infrastructure, with numerous well-established biotechnology and pharmaceutical companies leading innovation in genomics. These entities invest significantly in cutting-edge technologies, driving demand for NGS platforms.

North America also benefits from high level of government support for genomics research. Federal funding and grants contribute significantly to advancements in genomic medicine and personalized healthcare, fueling the adoption of NGS technologies. The presence of world-renowned research institutions and academic centers also plays a pivotal role in shaping the next generation sequencers (NGS) market in the region.

A mature healthcare system in North America facilitates widespread adoption of NGS in clinical settings. The region's well-developed regulatory framework ensures compliance with standards, fostering a favorable environment for the commercialization of NGS products.

Collaborations between industry players and academic institutions further accelerate the development and application of NGS technologies. This collaborative approach enhances knowledge transfer and accelerates the integration of NGS into routine clinical practices.

As per next generation sequencers (NGS) market forecast, Asia Pacific is projected to be the fastest growing region during forecast period. This is ascribed to increase in demand for personalized medicine and genomic research, bolstered by rise in awareness about the potential applications of NGS technologies.

Additionally, the region benefits from robust government initiatives and investments in genomics and biotechnology research, fostering a conducive environment for NGS market expansion.

Asia Pacific has a large and diverse population, contributing to a vast pool of genomic data that fuels research and development in the NGS sector. Collaborative efforts between academic institutions, research organizations, and industry players in the region have also played a pivotal role in advancing NGS technologies.

The region's growing healthcare infrastructure and adoption of cutting-edge technologies also contribute significantly to the escalating demand for NGS solutions, propelling Asia Pacific to the forefront of the next generation sequencers (NGS) market.

This report provides profiles of leading players operating in the global next generation sequencers (NGS) market. These players engage in mergers & acquisitions, strategic collaborations, and new product launches to expand presence and increase share.

Illumina, Inc., Thermo Fisher Scientific, Inc., Pacific Biosciences, Complete Genomics Incorporated, Vela Diagnostics, Oxford Nanopore Technologies plc, Singular Genomics Systems, Inc., HTG Molecular Diagnostics, Inc., and Revvity are the prominent players in the market.

The next generation sequencers (NGS) market report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 1.2 Bn |

| Forecast (Value) in 2031 | More than US$ 2.4 Bn |

| Growth Rate (CAGR) | 8.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.2 Bn in 2022

It is projected to reach more than US$ 2.4 Bn by 2031

The CAGR is anticipated to be 8.3% from 2023 to 2031

The benchtop sequencers product segment accounted for the largest share in 2022

North America is anticipated to account for the leading share during the forecast period.

Illumina, Inc., Thermo Fisher Scientific, Inc., Pacific Biosciences, Complete Genomics Incorporated, Vela Diagnostics, Oxford Nanopore Technologies plc, Singular Genomics Systems, Inc., HTG Molecular Diagnostics, Inc., and Revvity.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Next Generation Sequencers (NGS) Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Next Generation Sequencers (NGS) Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario

5.3. COVID-19 Pandemic Impact on Industry

6. Global Next Generation Sequencers (NGS) Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Benchtop Sequencers

6.3.2. Floor Standing Sequencers

6.4. Market Attractiveness Analysis, by Product

7. Global Next Generation Sequencers (NGS) Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Oncology

7.3.2. Infectious Diseases

7.3.3. Reproductive Health

7.3.4. Metagenomics, Epidemiology, and Drug Development

7.3.5. Consumer Genomics

7.4. Market Attractiveness Analysis, by Application

8. Global Next Generation Sequencers (NGS) Market Analysis and Forecast, by Technology

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Technology, 2017–2031

8.3.1. WGS

8.3.2. Whole Exome Sequencing

8.3.3. Targeted Sequencing & Resequencing

8.4. Market Attractiveness Analysis, by Technology

9. Global Next Generation Sequencers (NGS) Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Academic Research

9.3.2. Clinical Research

9.3.3. Hospitals & Clinics

9.3.4. Pharma & Biotech Entities

9.3.5. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Next Generation Sequencers (NGS) Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Next Generation Sequencers (NGS) Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Benchtop Sequencers

11.2.2. Floor Standing Sequencers

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Oncology

11.3.2. Infectious Diseases

11.3.3. Reproductive Health

11.3.4. Metagenomics, Epidemiology, and Drug Development

11.3.5. Consumer Genomics

11.4. Market Value Forecast, by Technology, 2017–2031

11.4.1. WGS

11.4.2. Whole Exome Sequencing

11.4.3. Targeted Sequencing & Resequencing

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Academic Research

11.5.2. Clinical Research

11.5.3. Hospitals & Clinics

11.5.4. Pharma & Biotech Entities

11.5.5. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Application

11.7.3. By Technology

11.7.4. By End-user

11.7.5. By Country

12. Europe Next Generation Sequencers (NGS) Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Benchtop Sequencers

12.2.2. Floor Standing Sequencers

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Oncology

12.3.2. Infectious Diseases

12.3.3. Reproductive Health

12.3.4. Metagenomics, Epidemiology, and Drug Development

12.3.5. Consumer Genomics

12.4. Market Value Forecast, by Technology, 2017–2031

12.4.1. WGS

12.4.2. Whole Exome Sequencing

12.4.3. Targeted Sequencing & Resequencing

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Academic Research

12.5.2. Clinical Research

12.5.3. Hospitals & Clinics

12.5.4. Pharma & Biotech Entities

12.5.5. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Application

12.7.3. By Technology

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Next Generation Sequencers (NGS) Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Benchtop Sequencers

13.2.2. Floor Standing Sequencers

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Oncology

13.3.2. Infectious Diseases

13.3.3. Reproductive Health

13.3.4. Metagenomics, Epidemiology, and Drug Development

13.3.5. Consumer Genomics

13.4. Market Value Forecast, by Technology, 2017–2031

13.4.1. WGS

13.4.2. Whole Exome Sequencing

13.4.3. Targeted Sequencing & Resequencing

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Academic Research

13.5.2. Clinical Research

13.5.3. Hospitals & Clinics

13.5.4. Pharma & Biotech Entities

13.5.5. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Application

13.7.3. By Technology

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Next Generation Sequencers (NGS) Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Benchtop Sequencers

14.2.2. Floor Standing Sequencers

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Oncology

14.3.2. Infectious Diseases

14.3.3. Reproductive Health

14.3.4. Metagenomics, Epidemiology, and Drug Development

14.3.5. Consumer Genomics

14.4. Market Value Forecast, by Technology, 2017–2031

14.4.1. WGS

14.4.2. Whole Exome Sequencing

14.4.3. Targeted Sequencing & Resequencing

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Academic Research

14.5.2. Clinical Research

14.5.3. Hospitals & Clinics

14.5.4. Pharma & Biotech Entities

14.5.5. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Application

14.7.3. By Technology

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Next Generation Sequencers (NGS) Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017–2031

15.2.1. Benchtop Sequencers

15.2.2. Floor Standing Sequencers

15.3. Market Value Forecast, by Application, 2017–2031

15.3.1. Oncology

15.3.2. Infectious Diseases

15.3.3. Reproductive Health

15.3.4. Metagenomics, Epidemiology, and Drug Development

15.3.5. Consumer Genomics

15.4. Market Value Forecast, by Technology, 2017–2031

15.4.1. WGS

15.4.2. Whole Exome Sequencing

15.4.3. Targeted Sequencing & Resequencing

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Academic Research

15.5.2. Clinical Research

15.5.3. Hospitals & Clinics

15.5.4. Pharma & Biotech Entities

15.5.5. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Application

15.7.3. By Technology

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Illumina, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Thermo Fisher Scientific, Inc.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Pacific Biosciences

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Complete Genomics Incorporated

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Vela Diagnostics

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Oxford Nanopore Technologies plc.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Singular Genomics Systems, Inc.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. HTG Molecular Diagnostics, Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Revvity

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

List of Tables

Table 01: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 03: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 04: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 05: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 07: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 08: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 09: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 10: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 11: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 13: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 14: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 15: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 18: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 19: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 20: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 23: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 25: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 26: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 28: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 29: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 30: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Next Generation Sequencers (NGS) Market Size, by Product, 2022

Figure 02: Global Next Generation Sequencers (NGS) Market Share (%), by Product, 2022

Figure 03: Global Next Generation Sequencers (NGS) Market Size, by Application, 2022

Figure 04: Global Next Generation Sequencers (NGS) Market Share (%), by Application, 2022

Figure 05: Global Next Generation Sequencers (NGS) Market Size, by Technology, 2022

Figure 06: Global Next Generation Sequencers (NGS) Market Share (%), by Technology, 2022

Figure 07: Global Next Generation Sequencers (NGS) Market Size, by End-user, 2022

Figure 08: Global Next Generation Sequencers (NGS) Market Share (%), by End-user, 2022

Figure 09: Global Next Generation Sequencers (NGS) Market, by Region (2022 and 2031)

Figure 10: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Product, 2022 and 2031

Figure 12: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Product, 2022

Figure 13: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Product, 2031

Figure 14: Global Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Product, 2023–2031

Figure 15: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 16: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Application, 2022

Figure 17: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Application, 2031

Figure 18: Global Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Application, 2023–2031

Figure 19: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Technology, 2022 and 2031

Figure 20: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Technology, 2022

Figure 21: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Technology, 2031

Figure 22: Global Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Technology, 2023–2031

Figure 23: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 24: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 25: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by End-user, 2031

Figure 26: Global Next Generation Sequencers (NGS) Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Region, 2022 and 2031

Figure 28: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Region, 2022

Figure 29: Global Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Region, 2031

Figure 30: Global Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Region, 2023–2031

Figure 31: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 32: North America Next Generation Sequencers (NGS) Market Value Share Analysis, by Country, 2022 and 2031

Figure 33: North America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Country, 2023–2031

Figure 34: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Product, 2022 and 2031

Figure 35: North America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Product, 2023-2031

Figure 36: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 37: North America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Application, 2023-31

Figure 38: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Technology, 2022 and 2031

Figure 39: North America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Technology, 2023-31

Figure 40: North America Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 41: North America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 42: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 43: Europe Next Generation Sequencers (NGS) Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Europe Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 45: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Product, 2022 and 2031

Figure 46: Europe Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Product, 2023-2031

Figure 47: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 48: Europe Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Application, 2023-2031

Figure 49: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Technology, 2022 and 2031

Figure 50: Europe Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Technology, 2023-2031

Figure 51: Europe Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 52: Europe Next Generation Sequencers (NGS) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 53: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 54: Asia Pacific Next Generation Sequencers (NGS) Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 55: Asia Pacific Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Product, 2022 and 2031

Figure 57: Asia Pacific Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Product, 2023-2031

Figure 58: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 59: Asia Pacific Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Application, 2023-2031

Figure 60: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Technology, 2022 and 2031

Figure 61: Asia Pacific Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Technology, 2023-2031

Figure 62: Asia Pacific Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 63: Asia Pacific Next Generation Sequencers (NGS) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 64: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 65: Latin America Next Generation Sequencers (NGS) Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 66: Latin America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 67: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Product, 2022 and 2031

Figure 68: Latin America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Product, 2023-2031

Figure 69: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 70: Latin America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Application, 2023-2031

Figure 71: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Technology, 2022 and 2031

Figure 72: Latin America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Technology, 2023-2031

Figure 73: Latin America Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 74: Latin America Next Generation Sequencers (NGS) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 75: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 76: Middle East & Africa Next Generation Sequencers (NGS) Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 77: Middle East & Africa Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 78: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Product, 2022 and 2031

Figure 79: Middle East & Africa Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Product, 2023-2031

Figure 80: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 81: Middle East & Africa Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Application, 2023-2031

Figure 82: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by Technology, 2022 and 2031

Figure 83: Middle East & Africa Next Generation Sequencers (NGS) Market Attractiveness Analysis, by Technology, 2023-2031

Figure 84: Middle East & Africa Next Generation Sequencers (NGS) Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 85: Middle East & Africa Next Generation Sequencers (NGS) Market Attractiveness Analysis, by End-user, 2023-2031