Reports

Reports

Analysts’ Viewpoint on Industrial Dust Collector Market Scenario

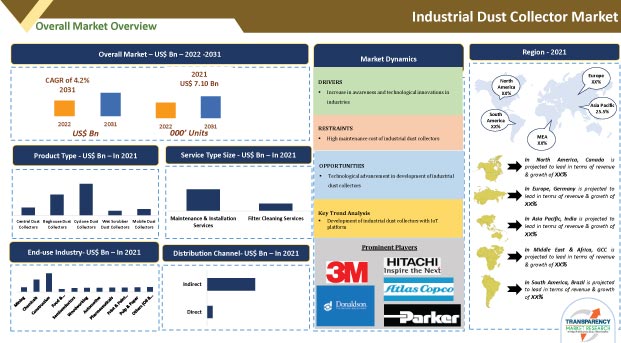

Industrial dust collectors play a vital role in every industry, offering safety and health benefits to workers. Companies in the industrial dust collector market are focusing on implementing effective methods to achieve environmental compliance and improve air quality in order to meet end-user requirements. Jet pulse dust collectors with scraper conveyors offer outstanding advantages in establishing a safe workplace environment. Key benefits of industrial dust collector are enhancement of air quality and prevention of further contamination. Technological advancement in industrial dust collectors, such as real-time visualization and monitoring with cloud-based IoT platforms, is estimated to propel the global market. Therefore, companies should increase their R&D in advanced technologies. Manufacturers should also tap into incremental opportunities to broaden their revenue streams in the industrial dust collector market.

Growth of the industrial dust collector market is expected to be driven by the increase in hygiene standards in the food industry and implementation of stringent government regulations to achieve environmental compliance. Rise in industrial production and global economic activities; rapid infrastructure development; and increase in number of coal power plants are also anticipated to boost the global market. Additionally, agencies such as Occupational Safety and Health Administration (OSHA) have been enacting laws that set requirements for air quality in industries. This is also augmenting the global market.

Industrial dust removal equipment comprises industrial dust collector system, which helps improve the quality of air by eliminating airborne particles that are formed during industrial processes. Industries use different types of industrial dust collectors, such as central dust collectors, wet scrubber dust collectors, mobile dust collectors, baghouse dust collectors, and cyclone dust collectors, to maximize the efficiency of dust control systems. These equipment may possess functional features such as protection against electrostatic discharge (ESD).

The global Industrial dust collector market is estimated to grow steadily in the near future, due to the high demand from various industries such as mining, chemicals, construction, food & beverages, semiconductors, woodworking, automotive, pharmaceuticals, print & paint manufacturing, pulp & paper, and others (oil & gas, textiles). Industrial dust collectors play a vital role in the construction industry. Innovative upgrades and a wide range of options make industrial dust collectors a key equipment in the construction industry. This is driving the demand for industrial dust collectors in various applications in the construction industry.

Industrial dust collector manufacturers are focusing on innovations and upgrades such as turboelectric and charge induction particulate intelligent controls, real-time diagnostics, and sensing technologies for maintenance planning, process control, regulatory compliance, and increased production efficiency. This is expected to drive the industrial dust collector market during the forecast period.

Constant growth of diverse industries in various countries has led to a significant rise in demand for different models of dust collector machines. Increase in urbanization and industrialization is also likely to propel the demand for industrial dust collectors in food & beverage, semiconductor, woodworking, and construction industries. Additionally, producers are focusing on industrial dust extraction and removal solutions.

Manufacturers are increasing R&D to develop laser cutter dust collectors. Automation has become part and parcel of the global industrial landscape. Automatic laser cutting machines have led to the issue of increased amount of metal cutting fumes in the industrial landscape. Hence, laser cutter dust collectors are gaining demand in the market. High efficiency in production is also driving the demand for industrial dust collectors.

Industrial dust collector systems have been adopted by stakeholders in end-user industries due to the growth in awareness about environmental restrictions. Cyclone dust collectors have undergone product advancements as a result of this development. Therefore, cyclone dust collectors are anticipated to account for the highest production in the industrial dust collector industry in the near future.

Companies in the industrial dust collector market are manufacturing multi-cyclonic separators based on centrifugal actions that are technologically sound. End-users can reduce operational and downtime expenses in an industrial setting with the aid of these cutting-edge separators. End-users are becoming increasingly aware and conducting research before purchasing industrial dust extraction systems and industrial dust collector machines.

The baghouse type segment dominates the global industrial dust collector market. Industrial baghouse dust collectors show good efficiency in collecting particulate matter including dust, smoke, bio-contaminants, and other toxic particles. Furthermore, they are fairly cost effective compared to other types of products such as electrostatic precipitators and cartridge dust collectors. Three major types of inertial separators – settling chambers, baffle chambers, and centrifugal collectors – remove or gather dust particles utilizing a mix of inertial, centrifugal, and gravitational forces. This product category is ideal for sectors where the flue gas temperature is between 40°F and 200°F.

The construction end-use industry segment is likely to dominate the global market during the forecast period, as the construction industry produces a large amount of dust. Cement facilities require various types of construction dust collectors. The concrete batching business involves various processes such as measuring, storing, and transport; all these processes need dust collectors. Energy & power is also one of the major industries that emits toxic gases. The flue gas released from the energy & power industry contains harmful particles that need to be removed before being released into the environment. Thus, dust collectors help in collection and removal of harmful particles from flue gas.

Asia Pacific is expected to dominate the global industrial dust collector market during the forecast period due to rapid industrialization and growth in number of infrastructure development projects in the region. Increase in investments in the infrastructure sector by various governments, particularly across developing economies in Asia Pacific, is likely to significantly impact the steel and cement industry. This is expected to drive the market in the region. According to the World Steel Association AISBL, China is the largest steel manufacturer in the world, while India is the third largest manufacturer of crude steel in the world.

North America accounted for notable share of the global industrial dust collector market in 2021. Wide range of industrial dust collectors is used in food & beverages, semiconductors, woodworking, automotive, and pharmaceutical industries in the region. This is estimated to augment the market in North America in the near future.

The global industrial dust collector market is consolidated, with a few large-scale vendors controlling majority of the share. Most of the firms are spending significantly on comprehensive research and development activities, primarily to develop innovative industrial dust collectors. Diversification of product portfolios and mergers and acquisitions are major strategies adopted by key players. 3M Company, Donaldson Company, Inc., Hitachi Ltd., Atlas Copco, Parker Hannifin Corp., Nederman Holding AB, CECO Environmental, Alstom SA, Camfil APC, and American Air Filter Company, Inc. are the prominent players operating in the market.

Each of these players has been profiled in the industrial dust collector market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 7.10 Bn |

|

Market Forecast Value in 2031 |

US$ 10.65 Bn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industrial dust collector market stood at US$ 7.10 Bn in 2021

The industrial dust collector market is estimated to grow at a CAGR of 4.2% during the forecast period

High demand from industries and increasing awareness about safety of workers

Baghouse type contributed largest share in the industrial dust collector market in 2021

Asia Pacific is a more attractive region for vendors in the industrial dust collector market

3M. Co, Donaldson Company, Inc., Hitachi Ltd., Atlas Copco, Parker Hannifin Corp., Nederman Holding AB, CECO Environmental, Alstom SA, Camfil APC, and American Air Filter Company, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Dust Collector Overview

5.4. Key Factor Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. COVID-19 Impact Analysis

5.9. Global Industrial Dust Collector Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections

5.9.2. Market Volume Projections (Thousand Units)

6. Global Industrial Dust Collector Analysis and Forecast, By Product Type

6.1. Global Industrial Dust Collector Size (US$ Bn and Thousand Units), By Product Type, 2017 – 2031

6.1.1. Central Dust Collectors

6.1.2. Baghouse Dust Collectors

6.1.3. Cyclone Dust Collectors

6.1.4. Wet Scrubber Dust Collectors

6.1.5. Mobile Dust Collectors

6.2. Incremental Opportunity, By product Type

7. Global Industrial Dust Collector Analysis and Forecast, By Service Type

7.1. Global industrial Dust Collector Size (US$ Bn and Thousand Units), By Service Type, 2017 - 2031

7.1.1. Maintenance & Installation Services

7.1.2. Filter Cleaning Services

7.2. Incremental Opportunity, By Service Type

8. Global Industrial Dust Collector Analysis and Forecast, By End-use Industry

8.1. Global Industrial Dust Collector Size (US$ Bn and Thousand Units), By End-use Industry, 2017 - 2031

8.1.1. Mining

8.1.2. Chemicals

8.1.3. Construction

8.1.4. Food & Beverages

8.1.5. Semiconductors

8.1.6. Woodworking

8.1.7. Automotive

8.1.8. Pharmaceuticals

8.1.9. Print & Paint Manufacturing

8.1.10. Pulp & Paper

8.1.11. Others (Oil & Gas, Textiles)

9. Global Industrial Dust Collector Analysis and Forecast, by Distribution Channel

9.1. Global Industrial Dust Collector Size (US$ Bn & Thousand Units), by Distribution Channel, 2017- 2031

9.1.1. Direct Sales (OEMs)

9.1.2. Indirect Sales

9.1.2.1. Distributors

9.1.2.2. Wholesalers

9.1.2.3. Online Retail

9.2. Incremental Opportunity, by Distribution Channel

10. Global Industrial Dust Collector Analysis and Forecast, by Region

10.1. Global Industrial Dust Collector Size (US$ Bn & Thousand Units), by Region, 2017- 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Industrial Dust Collector Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Supplier Analysis

11.4. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Product Type, 2017- 2031

11.4.1. Central Dust Collectors

11.4.2. Baghouse Dust Collectors

11.4.3. Cyclone Dust Collectors

11.4.4. Wet Scrubber Dust Collectors

11.4.5. Mobile Dust Collectors

11.5. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Service Type, 2017- 2031

11.5.1. Maintenance & Installation Services

11.5.2. Filter Cleaning Services

11.6. Industrial Dust Collector Size (US$ Bn & Thousand Units), by End-use Industry, 2017- 2031

11.6.1. Mining

11.6.2. Chemicals

11.6.3. Construction

11.6.4. Food & Beverages

11.6.5. Semiconductors

11.6.6. Woodworking

11.6.7. Automotive

11.6.8. Pharmaceuticals

11.6.9. Print & Paint Manufacturing

11.6.10. Pulp & Paper

11.6.11. Others (Oil & Gas, Textiles)

11.7. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Distribution Channel, 2017- 2031

11.7.1. Direct Sales (OEMs)

11.7.2. Indirect Sales

11.7.2.1. Distributors

11.7.2.2. Wholesalers

11.7.2.3. Online Retail

11.8. Industrial Dust Collector Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

1.1.1. U.S.

1.1.2. Canada

1.1.3. Rest of North America

11.9. Incremental Opportunity Analysis

12. Europe Industrial Dust Collector Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Supplier Analysis

12.4. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Product Type, 2017- 2031

12.4.1. Central Dust Collectors

12.4.2. Baghouse Dust Collectors

12.4.3. Cyclone Dust Collectors

12.4.4. Wet Scrubber Dust Collectors

12.4.5. Mobile Dust Collectors

12.5. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Service Type, 2017- 2031

12.5.1. Maintenance & Installation Services

12.5.2. Filter Cleaning Services

12.6. Industrial Dust Collector Size (US$ Bn & Thousand Units), by End-use Industry, 2017- 2031

12.6.1. Mining

12.6.2. Chemicals

12.6.3. Construction

12.6.4. Food & Beverages

12.6.5. Semiconductors

12.6.6. Woodworking

12.6.7. Automotive

12.6.8. Pharmaceuticals

12.6.9. Print & Paint Manufacturing

12.6.10. Pulp & Paper

12.6.11. Others (Oil & Gas, Textiles)

12.7. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Distribution Channel, 2017- 2031

12.7.1. Direct Sales (OEMs)

12.7.2. Indirect Sales

12.7.2.1. Distributors

12.7.2.2. Wholesalers

12.7.2.3. Online Retail

12.8. Industrial Dust Collector Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

1.1.4. Germany

1.1.5. France

1.1.6. U.K.

1.1.7. Rest of Europe

12.9. Incremental Opportunity Analysis

13. Asia Pacific Industrial Dust Collector Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Supplier Analysis

13.4. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Product Type, 2017- 2031

13.4.1. Central Dust Collectors

13.4.2. Baghouse Dust Collectors

13.4.3. Cyclone Dust Collectors

13.4.4. Wet Scrubber Dust Collectors

13.4.5. Mobile Dust Collectors

13.5. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Service Type, 2017- 2031

13.5.1. Maintenance & Installation Services

13.5.2. Filter Cleaning Services

13.6. Industrial Dust Collector Size (US$ Bn & Thousand Units), by End-use Industry, 2017- 2031

13.6.1. Mining

13.6.2. Chemicals

13.6.3. Construction

13.6.4. Food & Beverages

13.6.5. Semiconductors

13.6.6. Woodworking

13.6.7. Automotive

13.6.8. Pharmaceuticals

13.6.9. Print & Paint Manufacturing

13.6.10. Pulp & Paper

13.6.11. Others (Oil & Gas, Textiles)

13.7. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Distribution Channel, 2017- 2031

13.7.1. Direct Sales (OEMs)

13.7.2. Indirect Sales

13.7.2.1. Distributors

13.7.2.2. Wholesalers

13.7.2.3. Online Retail

13.8. Industrial Dust Collector Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. Rest of Asia Pacific

13.9. Incremental Opportunity Analysis

14. Middle East & Africa Industrial Dust Collector Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Supplier Analysis

14.4. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Product Type, 2017- 2031

14.4.1. Central Dust Collectors

14.4.2. Baghouse Dust Collectors

14.4.3. Cyclone Dust Collectors

14.4.4. Wet Scrubber Dust Collectors

14.4.5. Mobile Dust Collectors

14.5. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Service Type, 2017- 2031

14.5.1. Maintenance & Installation Services

14.5.2. Filter Cleaning Services

14.6. Industrial Dust Collector Size (US$ Bn & Thousand Units), by End-use Industry, 2017- 2031

14.6.1. Mining

14.6.2. Chemicals

14.6.3. Construction

14.6.4. Food & Beverages

14.6.5. Semiconductors

14.6.6. Woodworking

14.6.7. Automotive

14.6.8. Pharmaceuticals

14.6.9. Print & Paint Manufacturing

14.6.10. Pulp & Paper

14.6.11. Others (Oil & Gas, Textiles)

14.7. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Distribution Channel, 2017- 2031

14.7.1. Direct Sales (OEMs)

14.7.2. Indirect Sales

14.7.2.1. Distributors

14.7.2.2. Wholesalers

14.7.2.3. Online Retail

14.8. Industrial Dust Collector Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Incremental Opportunity Analysis

15. South America Industrial Dust Collector Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Supplier Analysis

15.4. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Product Type, 2017- 2031

15.4.1. Central Dust Collectors

15.4.2. Baghouse Dust Collectors

15.4.3. Cyclone Dust Collectors

15.4.4. Wet Scrubber Dust Collectors

15.4.5. Mobile Dust Collectors

15.5. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Service Type, 2017- 2031

15.5.1. Maintenance & Installation Services

15.5.2. Filter Cleaning Services

15.6. South America Industrial Dust Collector Size (US$ Bn & Thousand Units), by End-use Industry, 2017- 2031

15.6.1. Mining

15.6.2. Chemicals

15.6.3. Construction

15.6.4. Food & Beverages

15.6.5. Semiconductors

15.6.6. Woodworking

15.6.7. Automotive

15.6.8. Pharmaceuticals

15.6.9. Print & Paint Manufacturing

15.6.10. Pulp & Paper

15.6.11. Others (Oil & Gas, Textiles)

15.7. Industrial Dust Collector Size (US$ Bn & Thousand Units), by Distribution Channel, 2017- 2031

15.7.1. Direct Sales (OEMs)

15.7.2. Indirect Sales

15.7.2.1. Distributors

15.7.2.2. Wholesalers

15.7.2.3. Online Retail

15.8. Industrial Dust Collector Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2021)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

16.3.1. 3M Company,

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information, (Subject to Data Availability)

16.3.1.4. Business Strategies / Recent Developments

16.3.2. Donaldson Company, Inc.,

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information, (Subject to Data Availability)

16.3.2.4. Business Strategies / Recent Developments

16.3.3. Hitachi Ltd.,

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information, (Subject to Data Availability)

16.3.3.4. Business Strategies / Recent Developments

16.3.4. Atlas Copco,

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information, (Subject to Data Availability)

16.3.4.4. Business Strategies / Recent Developments

16.3.5. Parker Hannifin Corp.,

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information, (Subject to Data Availability)

16.3.5.4. Business Strategies / Recent Developments

16.3.6. Nederman Holding AB,

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information, (Subject to Data Availability)

16.3.6.4. Business Strategies / Recent Developments

16.3.7. CECO Environmental,

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information, (Subject to Data Availability)

16.3.7.4. Business Strategies / Recent Developments

16.3.8. Alstom SA,

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information, (Subject to Data Availability)

16.3.8.4. Business Strategies / Recent Developments

16.3.9. Camfil APC,

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information, (Subject to Data Availability)

16.3.9.4. Business Strategies / Recent Developments

16.3.10. American Air Filter Company, Inc.

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information, (Subject to Data Availability)

16.3.10.4. Business Strategies / Recent Developments

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Product Type

17.1.2. Service Type

17.1.3. End-use Industry

17.1.4. Distribution Channel

17.1.5. Region

17.2. Understanding the Buying Process of Customers

17.3. Prevailing Market Risks

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Dust Collector Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 2: Global Industrial Dust Collector Market Volume (Thousand Units) Projection By Product Type 2017-2031

Table 3: Global Industrial Dust Collector Market Value (US$ Bn) Projection By Service Type 2017-2031

Table 4: Global Industrial Dust Collector Market Volume (Thousand Units) Projection By Service Type 2017-2031

Table 5: Global Industrial Dust Collector Market Value (US$ Bn) Projection By End-user 2017-2031

Table 6: Global Industrial Dust Collector Market Volume (Thousand Units) Projection By End-user 2017-2031

Table 7: Global Industrial Dust Collector Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 8: Global Industrial Dust Collector Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 9: Global Industrial Dust Collector Market Value (US$ Bn) Projection By Region 2017-2031

Table 10: Global Industrial Dust Collector Market Volume (Thousand Units) Projection By Region 2017-2031

Table 11: North America Industrial Dust Collector Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 12: North America Industrial Dust Collector Market Volume (Thousand Units) Projection By Product Type 2017-2031

Table 13: North America Industrial Dust Collector Market Value (US$ Bn) Projection By Service Type 2017-2031

Table 14: North America Industrial Dust Collector Market Volume (Thousand Units) Projection By Service Type 2017-2031

Table 15: North America Industrial Dust Collector Market Value (US$ Bn) Projection By End-user 2017-2031

Table 16: North America Industrial Dust Collector Market Volume (Thousand Units) Projection By End-user 2017-2031

Table 17: North America Industrial Dust Collector Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 18: North America Industrial Dust Collector Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 19: North America Industrial Dust Collector Market Value (US$ Bn) Projection By Region 2017-2031

Table 20: North America Industrial Dust Collector Market Volume (Thousand Units) Projection By Region 2017-2031

Table 21: Europe Industrial Dust Collector Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 22: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection By Product Type 2017-2031

Table 23: Europe Industrial Dust Collector Market Value (US$ Bn) Projection By Service Type 2017-2031

Table 24: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection By Service Type 2017-2031

Table 25: Europe Industrial Dust Collector Market Value (US$ Bn) Projection By End-user 2017-2031

Table 26: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection By End-user 2017-2031

Table 27: Europe Industrial Dust Collector Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 28: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 29: Europe Industrial Dust Collector Market Value (US$ Bn) Projection By Region 2017-2031

Table 30: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection By Region 2017-2031

Table 31: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 32: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection By Product Type 2017-2031

Table 33: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection By Service Type 2017-2031

Table 34: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection By Service Type 2017-2031

Table 35: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection By End-user 2017-2031

Table 36: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection By End-user 2017-2031

Table 37: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 38: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 39: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection By Region 2017-2031

Table 40: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection By Region 2017-2031

Table 41: Middle East and Africa Industrial Dust Collector Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 42: Middle East and Africa Industrial Dust Collector Market Volume (Thousand Units) Projection By Product Type 2017-2031

Table 43: Middle East and Africa Industrial Dust Collector Market Value (US$ Bn) Projection By Service Type 2017-2031

Table 44: Middle East and Africa Industrial Dust Collector Market Volume (Thousand Units) Projection By Service Type 2017-2031

Table 45: Middle East and Africa Industrial Dust Collector Market Value (US$ Bn) Projection By End-user 2017-2031

Table 46: Middle East and Africa Industrial Dust Collector Market Volume (Thousand Units) Projection By End-user 2017-2031

Table 47: Middle East and Africa Industrial Dust Collector Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 48: Middle East and Africa Industrial Dust Collector Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 49: Middle East and Africa Industrial Dust Collector Market Value (US$ Bn) Projection By Region 2017-2031

Table 50: Middle East and Africa Industrial Dust Collector Market Volume (Thousand Units) Projection By Region 2017-2031

Table 51: South America Industrial Dust Collector Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 52: South America Industrial Dust Collector Market Volume (Thousand Units) Projection By Product Type 2017-2031

Table 53: South America Industrial Dust Collector Market Value (US$ Bn) Projection By Service Type 2017-2031

Table 54: South America Industrial Dust Collector Market Volume (Thousand Units) Projection By Service Type 2017-2031

Table 55: South America Industrial Dust Collector Market Value (US$ Bn) Projection By End-user 2017-2031

Table 56: South America Industrial Dust Collector Market Volume (Thousand Units) Projection By End-user 2017-2031

Table 57: South America Industrial Dust Collector Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 58: South America Industrial Dust Collector Market Volume (Thousand Units) Projection By Distribution Channel 2017-2031

Table 59: South America Industrial Dust Collector Market Value (US$ Bn) Projection By Region 2017-2031

Table 60: South America Industrial Dust Collector Market Volume (Thousand Units) Projection By Region 2017-2031

List of Figure

Figure 1: Global Industrial Dust Collector Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 2: Global Industrial Dust Collector Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 3: Global Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 4: Global Industrial Dust Collector Market Value (US$ Bn) Projection, By Service Type 2017-2031

Figure 5: Global Industrial Dust Collector Market Volume (Thousand Units) Projection, By Service Type 2017-2031

Figure 6: Global Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Service Type 2022-2031

Figure 7: Global Industrial Dust Collector Market Value (US$ Bn) Projection, By End-User 2017-2031

Figure 8: Global Industrial Dust Collector Market Volume (Thousand Units) Projection, By End-User 2017-2031

Figure 9: Global Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2022-2031

Figure 10: Global Industrial Dust Collector Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 11: Global Industrial Dust Collector Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 12: Global Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 13: Global Industrial Dust Collector Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 14: Global Industrial Dust Collector Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 15: Global Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2022-2031

Figure 16: North America Industrial Dust Collector Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 17: North America Industrial Dust Collector Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 18: North America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 19: North America Industrial Dust Collector Market Value (US$ Bn) Projection, By Service Type 2017-2031

Figure 20: North America Industrial Dust Collector Market Volume (Thousand Units) Projection, By Service Type 2017-2031

Figure 21: North America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Service Type 2022-2031

Figure 22: North America Industrial Dust Collector Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 23: North America Industrial Dust Collector Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 24: North America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2022-2031

Figure 25: North America Industrial Dust Collector Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 26: North America Industrial Dust Collector Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 27: North America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 28: North America Industrial Dust Collector Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 29: North America Industrial Dust Collector Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 30: North America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2022-2031

Figure 31: Europe Industrial Dust Collector Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 32: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 33: Europe Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 34: Europe Industrial Dust Collector Market Value (US$ Bn) Projection, By Service Type 2017-2031

Figure 35: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection, By Service Type 2017-2031

Figure 36: Europe Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Service Type 2022-2031

Figure 37: Europe Industrial Dust Collector Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 38: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 39: Europe Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2022-2031

Figure 40: Europe Industrial Dust Collector Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 41: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 42: Europe Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 43: Europe Industrial Dust Collector Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 44: Europe Industrial Dust Collector Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 45: Europe Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2022-2031

Figure 46: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 47: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 48: Asia Pacific Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 49: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection, By Service Type 2017-2031

Figure 50: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection, By Service Type 2017-2031

Figure 51: Asia Pacific Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Service Type 2022-2031

Figure 52: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 53: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 54: Asia Pacific Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2022-2031

Figure 55: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 56: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 57: Asia Pacific Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 58: Asia Pacific Industrial Dust Collector Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 59: Asia Pacific Industrial Dust Collector Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 60: Asia Pacific Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2022-2031

Figure 61: Middle East & Africa Industrial Dust Collector Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 62: Middle East & Africa Industrial Dust Collector Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 63: Middle East & Africa Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 64: Middle East & Africa Industrial Dust Collector Market Value (US$ Bn) Projection, By Service Type 2017-2031

Figure 65: Middle East & Africa Industrial Dust Collector Market Volume (Thousand Units) Projection, By Service Type 2017-2031

Figure 66: Middle East & Africa Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Service Type 2022-2031

Figure 67: Middle East & Africa Industrial Dust Collector Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 68: Middle East & Africa Industrial Dust Collector Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 69: Middle East & Africa Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2022-2031

Figure 70: Middle East & Africa Industrial Dust Collector Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 71: Middle East & Africa Industrial Dust Collector Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 72: Middle East & Africa Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 73: Middle East & Africa Industrial Dust Collector Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 74: Middle East & Africa Industrial Dust Collector Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 75: Middle East & Africa Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2022-2031

Figure 76: South America Industrial Dust Collector Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 77: South America Industrial Dust Collector Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 78: South America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 79: South America Industrial Dust Collector Market Value (US$ Bn) Projection, By Service Type 2017-2031

Figure 80: South America Industrial Dust Collector Market Volume (Thousand Units) Projection, By Service Type 2017-2031

Figure 81: South America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Service Type 2022-2031

Figure 82: South America Industrial Dust Collector Market Value (US$ Bn) Projection, By End-user 2017-2031

Figure 83: South America Industrial Dust Collector Market Volume (Thousand Units) Projection, By End-user 2017-2031

Figure 84: South America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By End-user 2022-2031

Figure 85: South America Industrial Dust Collector Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 86: South America Industrial Dust Collector Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 87: South America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 88: South America Industrial Dust Collector Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 89: South America Industrial Dust Collector Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 90: South America Industrial Dust Collector Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2022-2031