Reports

Reports

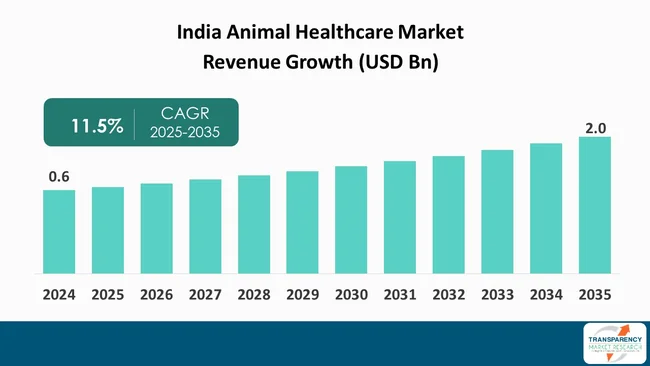

The India animal healthcare market size was valued at US$ 0.6 Bn in 2024 and is projected to reach US$ 2.0 Bn by 2035, expanding at a CAGR of 11.5% from 2025 to 2035. The market growth is driven by an increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing.

India animal healthcare sector has seen robust expansion, driven by a rising awareness of animal health and increasing disposable incomes. Some factors that have contributed to the growth curve of this industry include improved veterinary services, technological advances, and increased investments in research and development. This has led to phenomenal demand for quality consumables with regards to animal care. Increased ownership of pets in urban areas, together with improved management against diseases in agriculture, has fueled this growth.

Emerging technologies like telemedicine and wearable health trackers have already begun to revolutionize the field of medicine. Such innovations will result in increased accuracy of diagnosis, can enable even consultations from a distance, and, in particular, reach remote or underserved areas. Additionally, more emphasis is put on biotechnology and genetics to make treatment and vaccines effective. As far as competitive dynamics go, there are international and local players who are struggling to demonstrate their presence.

The Indian animal healthcare market is dynamic and reflects systematic wide changes in consumer behavior as well as the capabilities of the industry. Surging demand in the market is triggered basically by increasing awareness about the health of pets and livestock, besides growing infrastructure investments in veterinary care. The key driver advocating this growth is the fast-growing trend toward pet humanization. More households consider pets as family members, hence increasing spending on higher-value premium products and advanced health services. This manifests itself in specialty foods, supplements, and innovative treatments that are in demand for pets. On the farm, sectors adopt more advanced care to increase productivity and prevent outbreaks of diseases.

Technology is taking up space. Online consultations by veterinary services and health-related mobile applications are becoming a common feature, making options for care with ease available, as well as improving processes for diagnosis. This, if all goes accordingly, will give way to data analytics and artificial intelligence use in monitoring and managing animal health for more accurate and personalized care solutions. The competition is turning intense, as both global and local players flex their muscles.

| Attribute | Detail |

|---|---|

| India Animal Healthcare Drivers |

|

The rising demand for animal products such as eggs, meat, and milk is one of the major driving factors of the Indian animal healthcare market. This scenario can be best exemplified in the case of the dairy segment. In this segment, India's milk production capacity is likely to increase from 198 million tones to 330 million tones by 2024. This steep growth will be the result of both - increased demand and improved production capacity. The poultry sector, too, seems to portray this trend. Egg production in India has increased by more than 30% since 2014. This further dictates that consumption of chicken products in India is increasing. The Indian poultry market has also shown constant growth at an annual growth rate of 12-15% during the last five years.

Although in the past there was a relatively weaker demand for poultry products in rural areas as compared to their urban counterparts, the trend is moving toward higher consumption. This is driven by increasing incomes, changing dietary preferences, and improving infrastructure. Growth in the poultry industry in rural regions is expected at an annual 8-10% clip. With increased consumption of animal products in India, demand for better animal healthcare services and products increases.

The growing prevalence of zoonotic diseases is one major factor behind the growth of the Indian animal healthcare market. Zoonotic diseases originating in humans are progressively becoming common at a global scale. A UN report revealed that 75% of new infectious diseases are zoonotic. Such trends are influenced by rising demand for animal protein, intensive farming practices, wildlife exploitation, poor natural resource management, and the rate of population growth. India is becoming vulnerable to zoonotic diseases, as zoonosis has increased due to the rapidly growing population and urbanization. The World Bank recently approved loan worth US $82 million for adopting, piloting, and demonstrating global best practices in animal health management for the benefit of livestock and associated livelihoods linked to attaining preventive, detention, and zoonotic, transboundary, as well as emerging infectious diseases.

With the ever-in-present substantial risks of zoonotic diseases to public health and economic stability, the need for effective animal healthcare solutions in India has been on the rise. This growing requirement pushes investments into advanced diagnostic tools, preventive measures, and comprehensive health management practices against such diseases.

By product type, the therapeutics segment is projected to dominate the India Animal Healthcare market during the forecast period. The leading segment in the market within the animal therapeutics category is primarily driven by the increasing demand for antibiotics and anti-parasitic drugs (anthelmintics). These therapeutics are mainly used for treating common diseases and infections among livestock and companion animals that are highly prevalent in India's diverse agricultural setting.

Antibiotics have wide usage across the country as a prophylaxis and treatment of bacterial infection in animals. Antibiotics represent a considerable market segment with the continuously rising population of livestock and the growing need to maintain good health and productivity among animals. For example, they are vital in fighting off infections such as mastitis among dairy cattle and respiratory infections among poultry and pigs. In addition to this, Zydus Animal Health and Cadila Pharmaceuticals are selling veterinary antibiotics covering livestock and companion animals.

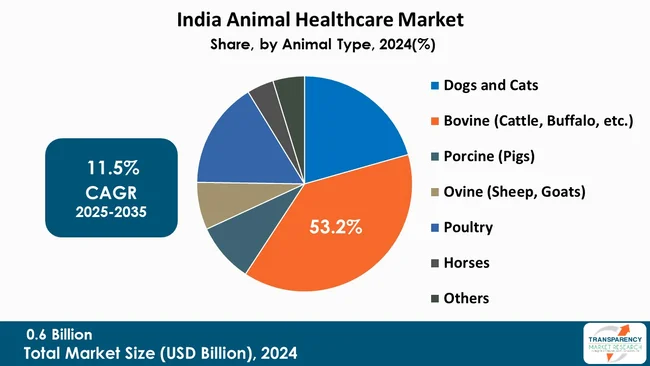

The Bovine segment is projected to dominate the India market during the forecast period. The bovine animal type segment is expected to dominate the Indian animal healthcare market owing to the proper population of bovine animals within the country. India holds a considerable population of bovine animals in the world. The large population propels demand for healthcare products, vaccines, and medications suitable for their needs.

Bovine animals are one of the major contributors to the agricultural economy of India through milk and meat production, as well as labor. Among those, cattle and buffaloes are the most prominent factors in the dairy sector and, as such, need an intense program for animal healthcare for their productivity and health aspects. India's bovine population has been considerable during the period 2020-2023. The estimated cattle population is more than 193 million, whereas the buffalo population is about 110 million. This large and stable population underpins the dominance of the bovine segment in the animal healthcare market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North India dominate the market with 43.1% share due to it has a high concentration of livestock and poultry farms in conjunction with increasing awareness among farmers and animal health professionals. Besides, increasing demand for food products of animal origin propels the demand for effective vaccination and health solutions. The upsurge in incidence of zoonotic diseases is a major challenge that arises to be one of the key drivers of the market.

Demographic changes, land encroachment, as well as agricultural practices, have resulted in an upsurge in the incidence of these diseases. This, in turn, has encouraged various government and private sectors to invest in its preventive measures and treatments, thereby driving the demand for veterinary healthcare services. The West Zone is expected to have the second-largest market share after North India, with an expected CAGR of 11.9% within the forecast period. Growth within the livestock sector, further complemented by the increase in investments in animal health products, is one of the main props for this regional market.

The leading players in the India Animal Healthcare market include Alivira Animal Health Limited (Sequent Scientific Limited), Alltech Biotechnology Pvt. Ltd., Ashish Life Science Pvt. Limited, Century Pharmaceuticals Ltd, GMT Pharma International, Hester Biosciences Ltd., Inmed Animal Health. (Inmed Therapeutics India), Intas Animal Health, ISKON Remedies, Megha Biotech, Sriwalls Healthcare, Vee Remedies, Venkateshwara Hatcheries Private Limited, Vetnation, Virbac, Zenex Animal Health India Private Limited, and Zovix Pharmaceuticals

Each of these players have been have been profiled in the venous stents market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2023 | US$ 0.6 Bn |

| Forecast Value in 2034 | US$ 2.0 Bn |

| CAGR | 11.5% |

| Forecast Period | 2024-2034 |

| Historical Data Available for | 2018-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The India animal healthcare market was valued at US$ 0.6 Bn in 2024

The animal healthcare business is projected to reach more than US$ 2.0 Bn by the end of 2035

Rising Demand for Animal Products like Eggs, Meat and Dairy Products

The CAGR is anticipated to be 11.5% from 2025 to 2035

North India is expected to account for the largest share from 2025 to 2035

Alivira Animal Health Limited (Sequent Scientific Limited), Alltech Biotechnology Pvt. Ltd., Ashish Life Science Pvt. Limited, Century Pharmaceuticals Ltd, GMT Pharma International, Hester Biosciences Ltd., Inmed Animal Health. (Inmed Therapeutics India), Intas Animal Health, ISKON Remedies, Megha Biotech, Sriwalls Healthcare, Vee Remedies, Venkateshwara Hatcheries Private Limited, Vetnation, Virbac, Zenex Animal Health India Private Limited, and Zovix Pharmaceuticals

Table 1: West India Animal Healthcare Market Value (US$ Bn) Forecast, by Veterinary Drugs, 2020 to 2035

Table 2: West India Animal Healthcare Market Value (US$ Bn) Forecast, by Diagnostics, 2020 to 2035

Table 3: West India Animal Healthcare Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 4: West India Animal Healthcare Market Value (US$ Bn) Forecast, by Inhabitant, 2020 to 2035

Table 5: West India Animal Healthcare Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 6: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by States, 2020 to 2035

Table 7: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 8: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by Therapeutics, 2020 to 2035

Table 9: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by Vaccines, 2020 to 2035

Table 10: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by Veterinary Drugs, 2020 to 2035

Table 11: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by Diagnostics, 2020 to 2035

Table 12: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 13: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by Inhabitant, 2020 to 2035

Table 14: Central India Animal Healthcare Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 15: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by States, 2020 to 2035

Table 16: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 17: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by Therapeutics, 2020 to 2035

Table 18: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by Vaccines, 2020 to 2035

Table 19: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by Veterinary Drugs, 2020 to 2035

Table 20: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by Diagnostics, 2020 to 2035

Table 21: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by Animal Type, 2020 to 2035

Table 22: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by Inhabitant, 2020 to 2035

Table 23: North East India Animal Healthcare Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Figure 01: India Animal Healthcare Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: India Animal Healthcare Market Value Share, by Product Type, 2024

Figure 03: India Animal Healthcare Market Value Share, by Animal Type, 2024

Figure 04: India Animal Healthcare Market Value Share, by Inhabitant, 2024

Figure 05: India Animal Healthcare Market Value Share, by Distribution Channel, 2024

Figure 06: India Animal Healthcare Market Value Share, by Region, 2024

Figure 07: India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Product Type, 2024 and 2035

Figure 08: India Animal Healthcare Market Share Analysis, by Product Type, 2024

Figure 09: India Animal Healthcare Market Share Analysis, by Product Type, 2035

Figure 10: India Animal Healthcare Market Attractiveness Analysis, by Product Type, 2024 to 2035

Figure 11: India Animal Healthcare Market Value (US$ Bn), by Therapeutics, 2020 - 2035

Figure 12: India Animal Healthcare Market Value Share Analysis, by Therapeutics, 2024 and 2035

Figure 13: India Animal Healthcare Market Value (US$ Bn), by Diagnostics, 2020 - 2035

Figure 14: India Animal Healthcare Market Value Share Analysis, by Diagnostics, 2024 and 2035

Figure 15: India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Animal Type, 2024 and 2035

Figure 16: India Animal Healthcare Market Share Analysis, by Animal Type, 2024

Figure 17: India Animal Healthcare Market Share Analysis, by Animal Type, 2035

Figure 18: India Animal Healthcare Market Attractiveness Analysis, by Animal Type, 2024 to 2035

Figure 19: India Animal Healthcare Market Value (US$ Bn), by Dogs and Cats, 2020 - 2035

Figure 20: India Animal Healthcare Market Value Share Analysis, by Dogs and Cats, 2024 and 2035

Figure 21: India Animal Healthcare Market Value (US$ Bn), by Bovine, 2020 - 2035

Figure 22: India Animal Healthcare Market Value Share Analysis, by Bovine, 2024 and 2035

Figure 23: India Animal Healthcare Market Value (US$ Bn), by Porcine, 2020 - 2035

Figure 24: India Animal Healthcare Market Value Share Analysis, by Porcine, 2024 and 2035

Figure 25: India Animal Healthcare Market Value (US$ Bn), by Ovine, 2020 - 2035

Figure 26: India Animal Healthcare Market Value Share Analysis, by Ovine, 2024 and 2035

Figure 27: India Animal Healthcare Market Value (US$ Bn), by Poultry, 2020 - 2035

Figure 28: India Animal Healthcare Market Value Share Analysis, by Poultry, 2024 and 2035

Figure 29: India Animal Healthcare Market Value (US$ Bn), by Horses, 2020 - 2035

Figure 30: India Animal Healthcare Market Value Share Analysis, by Horses, 2024 and 2035

Figure 31: India Animal Healthcare Market Value (US$ Bn), by Others, 2020 - 2035

Figure 32: India Animal Healthcare Market Value Share Analysis, by Others, 2024 and 2035

Figure 33: India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Inhabitant, 2024 and 2035

Figure 34: India Animal Healthcare Market Share Analysis, by Inhabitant, 2024

Figure 35: India Animal Healthcare Market Share Analysis, by Inhabitant, 2035

Figure 36: India Animal Healthcare Market Attractiveness Analysis, by Inhabitant, 2024 to 2035

Figure 37: India Animal Healthcare Market Value (US$ Bn), by Metro, 2020 - 2035

Figure 38: India Animal Healthcare Market Value Share Analysis, by Metro, 2024 and 2035

Figure 39: India Animal Healthcare Market Value (US$ Bn), by Rural, 2020 - 2035

Figure 40: India Animal Healthcare Market Value Share Analysis, by Rural, 2024 and 2035

Figure 41: India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Distribution Channel, 2024 and 2035

Figure 42: India Animal Healthcare Market Share Analysis, by Distribution Channel, 2024

Figure 43: India Animal Healthcare Market Share Analysis, by Distribution Channel, 2035

Figure 44: India Animal Healthcare Market Attractiveness Analysis, by Distribution Channel, 2024 to 2035

Figure 45: India Animal Healthcare Market Value (US$ Bn), by Veterinary Hospitals , 2020 - 2035

Figure 46: India Animal Healthcare Market Value Share Analysis, by Veterinary Hospitals, 2024 and 2035

Figure 47: India Animal Healthcare Market Value (US$ Bn), by Veterinary Clinics, 2020 - 2035

Figure 48: India Animal Healthcare Market Value Share Analysis, by Veterinary Clinics, 2024 and 2035

Figure 49: India Animal Healthcare Market Value (US$ Bn), by Retail Pharmacies, 2020 - 2035

Figure 50: India Animal Healthcare Market Value Share Analysis, by Retail Pharmacies, 2024 and 2035

Figure 51: India Animal Healthcare Market Value (US$ Bn), by Others, 2020 - 2035

Figure 52: India Animal Healthcare Market Value Share Analysis, by Others, 2024 and 2035

Figure 53: India Animal Healthcare Market Value Share Analysis, by Region, 2024 and 2035

Figure 54: India Animal Healthcare Market Share Analysis, by Region, 2024

Figure 55: India Animal Healthcare Market Share Analysis, by Region, 2035

Figure 56: India Animal Healthcare Market Attractiveness Analysis, by region, 2024 to 2035

Figure 57: North India Animal Healthcare Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2020 to 2035

Figure 58: North India Animal Healthcare Market Value (US$ Bn) Share Analysis, by States, 2024 and 2035

Figure 59: North India Animal Healthcare Market Attractiveness Analysis, by States, 2024 to 2035

Figure 60: North India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Product Type, 2024 and 2035

Figure 61: North India Animal Healthcare Market Attractiveness Analysis, by Product Type, 2024 to 2035

Figure 62: North India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Animal Type, 2024 and 2035

Figure 63: North India Animal Healthcare Market Attractiveness Analysis, by Animal Type, 2024 to 2035

Figure 64: North India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Inhabitant, 2024 and 2035

Figure 65: North India Animal Healthcare Market Attractiveness Analysis, by Inhabitant, 2024 to 2035

Figure 66: North India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Distribution Channel, 2024 and 2035

Figure 67: North India Animal Healthcare Market Attractiveness Analysis, by Distribution Channel, 2024 to 2035

Figure 68: East India Animal Healthcare Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2020 to 2035

Figure 69: East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by State, 2024 and 2035

Figure 70: East India Animal Healthcare Market Attractiveness Analysis, by State, 2024 to 2035

Figure 71: East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Product Type, 2024 and 2035

Figure 72: East India Animal Healthcare Market Attractiveness Analysis, by Product Type, 2024 to 2035

Figure 73: East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Animal Type, 2024 and 2035

Figure 74: East India Animal Healthcare Market Attractiveness Analysis, by Animal Type, 2024 to 2035

Figure 75: East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Inhabitant, 2024 and 2035

Figure 76: East India Animal Healthcare Market Attractiveness Analysis, by Inhabitant, 2024 to 2035

Figure 77: East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Distribution Channel, 2024 and 2035

Figure 78: East India Animal Healthcare Market Attractiveness Analysis, by Distribution Channel, 2024 to 2035

Figure 79: South India Animal Healthcare Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2020 to 2035

Figure 80: South India Animal Healthcare Market Value (US$ Bn) Share Analysis, by States, 2024 and 2035

Figure 81: South India Animal Healthcare Market Attractiveness Analysis, by States, 2024 to 2035

Figure 82: South India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Product Type, 2024 and 2035

Figure 83: South India Animal Healthcare Market Attractiveness Analysis, by Product Type, 2024 to 2035

Figure 84: South India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Animal Type, 2024 and 2035

Figure 85: South India Animal Healthcare Market Attractiveness Analysis, by Animal Type, 2024 to 2035

Figure 86: South India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Inhabitant, 2024 and 2035

Figure 87: South India Animal Healthcare Market Attractiveness Analysis, by Inhabitant, 2024 to 2035

Figure 88: South India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Distribution Channel, 2024 and 2035

Figure 89: South India Animal Healthcare Market Attractiveness Analysis, by Distribution Channel, 2024 to 2035

Figure 90: West India Animal Healthcare Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2020 to 2035

Figure 91: West India Animal Healthcare Market Value (US$ Bn) Share Analysis, by States, 2024 and 2035

Figure 92: West India Animal Healthcare Market Attractiveness Analysis, by States, 2024 to 2035

Figure 93: West India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Product Type, 2024 and 2035

Figure 94: West India Animal Healthcare Market Attractiveness Analysis, by Product Type, 2024 to 2035

Figure 95: West India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Animal Type, 2024 and 2035

Figure 96: West India Animal Healthcare Market Attractiveness Analysis, by Animal Type, 2024 to 2035

Figure 97: West India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Inhabitant, 2024 and 2035

Figure 98: West India Animal Healthcare Market Attractiveness Analysis, by Inhabitant, 2024 to 2035

Figure 99: West India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Distribution Channel, 2024 and 2035

Figure 100: West India Animal Healthcare Market Attractiveness Analysis, by Distribution Channel, 2024 to 2035

Figure 101: Central India Animal Healthcare Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2020 to 2035

Figure 102: Central India Animal Healthcare Market Value (US$ Bn) Share Analysis, by States, 2024 and 2035

Figure 103: Central India Animal Healthcare Market Attractiveness Analysis, by States, 2024 to 2035

Figure 104: Central India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Product Type, 2024 and 2035

Figure 105: Central India Animal Healthcare Market Attractiveness Analysis, by Product Type, 2024 to 2035

Figure 106: Central India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Animal Type, 2024 and 2035

Figure 107: Central India Animal Healthcare Market Attractiveness Analysis, by Animal Type, 2024 to 2035

Figure 108: Central India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Inhabitant, 2024 and 2035

Figure 109: Central India Animal Healthcare Market Attractiveness Analysis, by Inhabitant, 2024 to 2035

Figure 110: Central India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Distribution Channel, 2024 and 2035

Figure 111: Central India Animal Healthcare Market Attractiveness Analysis, by Distribution Channel, 2024 to 2035

Figure 112: North East India Animal Healthcare Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2020 to 2035

Figure 113: North East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by States, 2024 and 2035

Figure 114: North East India Animal Healthcare Market Attractiveness Analysis, by States, 2024 to 2035

Figure 115: North East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Product Type, 2024 and 2035

Figure 116: North East India Animal Healthcare Market Attractiveness Analysis, by Product Type, 2024 to 2035

Figure 117: North East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Animal Type, 2024 and 2035

Figure 118: North East India Animal Healthcare Market Attractiveness Analysis, by Animal Type, 2024 to 2035

Figure 119: North East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Inhabitant, 2024 and 2035

Figure 120: North East India Animal Healthcare Market Attractiveness Analysis, by Inhabitant, 2024 to 2035

Figure 121: North East India Animal Healthcare Market Value (US$ Bn) Share Analysis, by Distribution Channel, 2024 and 2035

Figure 122: North East India Animal Healthcare Market Attractiveness Analysis, by Distribution Channel, 2024 to 2035