Reports

Reports

The HVAC chillers market is recording a steady growth globally, due to the demand of sustainable cooling and energy-saving cooling in the commercial, industrial, and residential environment. Modern day infrastructure such as data centers, hospitals and in manufacturing industries, where temperature control is very important use chillers. Growing awareness of the carbon footprints and transition to smarter and more environmentally friendly systems are making companies look at how they can be more innovative with newer and advanced refrigerants, digital control and AI-based systems.

Asia-Pacific leads regionally, since there is rapid urbanization, industry development, and sustainability-driven government initiatives in China, India and Japan. It is also equipped with smart cities, digital infrastructure, and data centers, which contribute to its leadership. On the other hand, North America and Europe are also mature markets, but they are expanding at a stable rate, with strict regulation of energy consumption and early adoption of advanced chiller technologies.

The HVAC chillers market revolves around systems that regulate temperature in a home, commercial, and industrial setup. Liquids can also be cooled using chillers to a vapour-compression or an absorption cycle to provide cooled water, in air conditioning or process cooling. They are the key to the modern HVAC system, and thus controlling the temperature and comfort is energy-effective and can be implemented in various settings. HVAC chillers can be placed under different categories like air-cooled chillers and water-cooled chillers, each with their characteristic and benefits. Air-cooled are also cheaper to assemble and service whereas water-cooled are more efficient and fit in large systems. The systems have vast applications in the commercial buildings, hospitals, data centres, manufacturing industries and large public infrastructure where accuracy of temperature control is paramount. They have features such as low noise level, energy saving, compactness, and adjusting to various climate conditions.

The demand of HVAC chiller has seen a steady rise with growing demand of energy efficient cooling systems, a boom in urbanization and industrialization. Improvements in the form of advances in chiller technology, such as smart and eco-friendly chillers boost the HVAC chillers market growth. As concerns are raised about sustainability and the need to mitigate carbon footprints, HVAC chillers remain the central part of contemporary building managing and industrial process optimization.

| Attribute | Detail |

|---|---|

| HVAC Chillers Market Drivers |

|

The rate of increase in cloud computing, big data, and digital services justifies the increasing data centers. These data centers have dense groups of computer servers, along with other IT equipment that generates significant heat and requires a steady reliable cooling source to maintain the best working conditions and minimize the chances of systems failures.

HVAC Chillers are efficient and reliable in controlling temperature and are therefore crucial to a data center, as it must have a certain temperature. Water-cooled and air-cooled chiller systems will ensure all servers are at safe thermal conditions and efficient chillers will ensure the low cost of operations and facility carbon footprint. The demand of chillers in the digital infrastructure has and is projected to increase, this is especially true in the case of HVAC chillers employed in data centers, and this factor contributes significantly in this market.

Modular and Prefabricated construction techniques are becoming popular because of their speed, efficiencies and cost effectiveness. HVAC Chiller’s are perfectly suited to these techniques because material is produced off-site in standard dimensions and can be erected on-site within a short timeframe. This saves a lot of construction time as it takes lesser time when compared to the common brick-and-mortar methods, and projects are built to deliver quality and integrity in their structures. The HVAC Chiller’s are also easily transportable and the modular structure does not need much labor hence it saves labor cost and simplifies the logistics involved.

Besides this, the versatility of the HVAC Chiller’s enables an architect and other developers to come up with structures that can fulfill a particular functional and aesthetic demand. HVAC Chillers modular construction is very flexible and can subsequently be extended, adjusted and moved to another location. This flexibility, coupled with high-energy performance, resistance to fire and durability, is why HVAC Chiller’s are currently playing an important role in the construction sector of prefabricated structures.

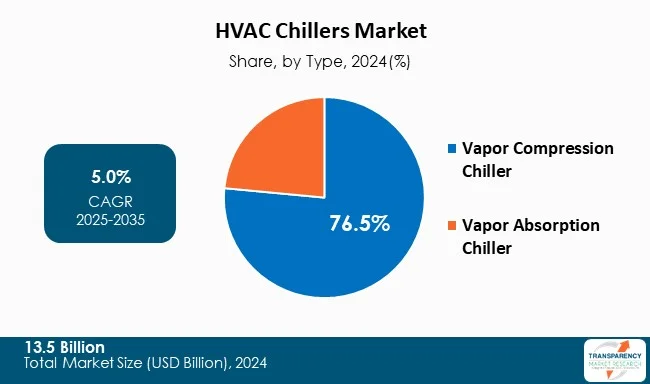

The market of the HVAC chillers is divided into vapor compression chillers and vapor absorption chillers, and the former- vapor compression chillers is turning out to be the dominant market. Vapor compression chillers, comprising of reciprocating, centrifugal, screw, and scroll chillers, occupy the largest portion as they are the most energy-efficient, low initial cost, and versatile in use in both commercial, residential and industrial markets. Such chillers are especially popular in areas that have a stable power supply as they can deliver steady cooling efficiency and could be adjusted to meet the needs of different scale requirements, both - small offices and large factories.

Comparatively, vapor absorption chillers are experiencing increasing usage but are still a smaller portion of the market. They are also dependent on a heat source like steam, hot water, or exhaust gases, and are thus suitable in niche applications where recovery of waste heat can be done, e.g. in chemical plant or refinery. Although they have the benefits of using natural refrigerants, and consuming less electricity, they have disadvantages in the form of increased initial cost and more complicated maintenance needs, which restricts their entry into the mainstream market.

The consistent advances in compressor engineering, intelligent controls and efficiency of refrigerants strengthen the leading position of vapor compression chillers and they remain the best solution in data centers, hospitals, airports, and commercial complexes across the globe. With sustainability rules growing stricter, the manufacturers are also into incorporation of low-GWP (global warming potential) refrigerants and inverter-based compressor, thereby reinforcing the status of vapor compression chillers as the solution of choice in the worldwide HVAC market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific leads the HVAC Chillers market owing to the urbanization, industrialization, as well as massive development in infrastructure in countries such as China, India, Japan and Southeast Asia. There is an upsurge in the construction activities in the region such as residential complexes, commercial buildings and industrial facilities, warehouses. This rising construction demand needs materials that are durable, light, energy saving, and of low cost, and HVAC Chiller’s are ones that would be suitable.

Low costs of production and favorable policies are also factors contributing to the supremacy of Asia Pacific. The area has easy access of raw materials and cheap labor hence manufacturers in the region are capable of producing HVAC Chiller’s at competitive prices to both local consumption and export. Governments are increasingly advancing the objective of energy efficiency and a more sustainable system of buildings, which further increases opportunities for HVAC Chiller’s rather than traditional material.

North America and Europe have established slow-growing construction markets that lack capacity to absorb significant quantities of HVAC Chillers despite a concentration on sustainability. The market size and the industrial base in the Middle East and Africa is less than in the Asia Pacific, though there is expansion due to infrastructure development. The high construction activity, infrastructure investment, cost-efficient production, and supportive government policies makes Asia pacific the leading region when it comes to HVAC Chillers in the world.

The global HVAC chillers market is consolidated with a few large-scale vendors controlling a majority share. Companies in HVAC chillers are spending significantly on comprehensive research and development, primarily in advancing technology, product specifications, etc. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players

Ab Electrolux, Carrier Global Corporation, Daikin Industries Ltd., Honeywell International Inc., Johnson Controls International plc, Shuangliang Eco-Energy Co., Ltd., LG Electronics Inc., Mitsubishi Electric Corp., Panasonic Corporation, Samsung Electronics Co. Ltd., Siemens AG, Trane Technologies Plc, Thermal Care Inc., along with several other prominent regional and global manufacturers are the prominent entities operating in this market.

Each of these players has been profiled in the HVAC chillers market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

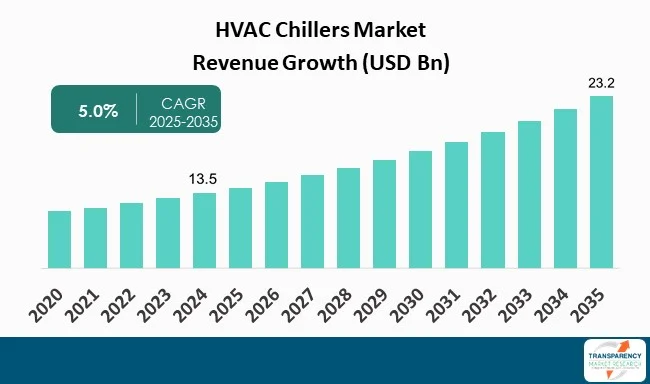

| Size in 2024 | US$ 13.5 Bn |

| Forecast Value in 2035 | US$ 23.2 Bn |

| CAGR | 5.0% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume. |

| HVAC Chillers Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global HVAC chillers market was valued at US$ 13.5 Bn in 2024

The global HVAC chillers industry is projected to reach at US$ 23.2 Bn by the end of 2035

Increasing number of data centers, and increase in prefabricated and modular construction demand are some of the factors driving the expansion of HVAC chillers market.

The CAGR is anticipated to be 5.0% from 2025 to 2035

Ab Electrolux, Carrier Global Corporation, Daikin Industries Ltd., Honeywell International Inc., Johnson Controls International plc, Shuangliang Eco-Energy Co., Ltd., LG Electronics Inc., Mitsubishi Electric Corp., Panasonic Corporation, Samsung Electronics Co. Ltd., Siemens AG, Trane Technologies Plc, Thermal Care Inc., and the other key players.

Table 1: Global HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 2: Global HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 3: Global HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 4: Global HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 5: Global HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 6: Global HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 7: Global HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 8: Global HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 9: Global HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 10: Global HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 11: Global HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 12: Global HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 13: Global HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Region

Table 14: Global HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Region

Table 15: North America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 16: North America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 17: North America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 18: North America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 19: North America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 20: North America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 21: North America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 22: North America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 23: North America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 24: North America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 25: North America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 26: North America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 27: North America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 28: North America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 29: U.S. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 30: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 31: U.S. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 32: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 33: U.S. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 34: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 35: U.S. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 36: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 37: U.S. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 38: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 39: U.S. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 40: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 41: Canada HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 42: Canada HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 43: Canada HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 44: Canada HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 45: Canada HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 46: Canada HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 47: Canada HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 48: Canada HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 49: Canada HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 50: Canada HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 51: Canada HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 52: Canada HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 53: Europe HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 54: Europe HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 55: Europe HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 56: Europe HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 57: Europe HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 58: Europe HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 59: Europe HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 60: Europe HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 61: Europe HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 62: Europe HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 63: Europe HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 64: Europe HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 65: Europe HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 66: Europe HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 67: U.K. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 68: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 69: U.K. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 70: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 71: U.K. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 72: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 73: U.K. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 74: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 75: U.K. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 76: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 77: U.K. HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 78: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 79: Germany HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 80: Germany HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 81: Germany HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 82: Germany HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 83: Germany HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 84: Germany HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 85: Germany HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 86: Germany HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 87: Germany HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 88: Germany HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 89: Germany HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 90: Germany HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 91: France HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 92: France HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 93: France HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 94: France HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 95: France HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 96: France HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 97: France HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 98: France HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 99: France HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 100: France HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 101: France HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 102: France HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 103: Italy HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 104: Italy HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 105: Italy HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 106: Italy HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 107: Italy HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 108: Italy HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 109: Italy HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 110: Italy HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 111: Italy HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 112: Italy HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 113: Italy HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 114: Italy HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 115: Spain HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 116: Spain HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 117: Spain HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 118: Spain HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 119: Spain HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 120: Spain HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 121: Spain HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 122: Spain HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 123: Spain HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 124: Spain HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 125: Spain HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 126: Spain HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 127: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 128: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 129: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 130: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 131: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 132: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 133: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 134: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 135: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 136: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 137: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 138: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 139: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 140: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 141: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 142: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 143: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 144: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 145: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 146: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 147: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 148: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 149: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 150: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 151: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 152: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 153: China HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 154: China HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 155: China HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 156: China HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 157: China HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 158: China HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 159: China HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 160: China HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 161: China HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 162: China HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 163: China HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 164: China HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 165: India HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 166: India HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 167: India HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 168: India HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 169: India HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 170: India HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 171: India HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 172: India HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 173: India HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 174: India HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 175: India HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 176: India HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 177: Japan HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 178: Japan HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 179: Japan HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 180: Japan HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 181: Japan HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 182: Japan HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 183: Japan HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 184: Japan HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 185: Japan HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 186: Japan HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 187: Japan HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 188: Japan HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 189: Australia HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 190: Australia HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 191: Australia HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 192: Australia HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 193: Australia HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 194: Australia HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 195: Australia HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 196: Australia HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 197: Australia HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 198: Australia HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 199: Australia HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 200: Australia HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 201: South Korea HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 202: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 203: South Korea HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 204: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 205: South Korea HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 206: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 207: South Korea HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 208: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 209: South Korea HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 210: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 211: South Korea HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 212: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 213: ASEAN HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 214: ASEAN HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 215: ASEAN HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 216: ASEAN HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 217: ASEAN HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 218: ASEAN HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 219: ASEAN HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 220: ASEAN HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 221: ASEAN HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 222: ASEAN HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 223: ASEAN HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 224: ASEAN HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 225: Middle East & Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 226: Middle East & Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 227: Middle East & Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 228: Middle East & Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 229: Middle East & Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 230: Middle East & Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 231: Middle East & Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 232: Middle East & Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 233: Middle East & Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 234: Middle East & Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 235: Middle East & Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 236: Middle East & Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 237: Middle East & Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 238: Middle East & Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 239: GCC Countries HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 240: GCC Countries HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 241: GCC Countries HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 242: GCC Countries HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 243: GCC Countries HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 244: GCC Countries HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 245: GCC Countries HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 246: GCC Countries HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 247: GCC Countries HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 248: GCC Countries HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 249: GCC Countries HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 250: GCC Countries HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 251: South Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 252: South Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 253: South Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 254: South Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 255: South Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 256: South Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 257: South Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 258: South Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 259: South Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 260: South Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 261: South Africa HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 262: South Africa HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 263: Latin America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 264: Latin America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 265: Latin America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 266: Latin America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 267: Latin America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 268: Latin America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 269: Latin America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 270: Latin America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 271: Latin America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 272: Latin America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 273: Latin America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 274: Latin America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 275: Latin America HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 276: Latin America HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 277: Brazil HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 278: Brazil HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 279: Brazil HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 280: Brazil HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 281: Brazil HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 282: Brazil HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 283: Brazil HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 284: Brazil HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 285: Brazil HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 286: Brazil HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 287: Brazil HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 288: Brazil HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 289: Argentina HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 290: Argentina HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 291: Argentina HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 292: Argentina HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 293: Argentina HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 294: Argentina HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 295: Argentina HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 296: Argentina HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 297: Argentina HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 298: Argentina HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 299: Argentina HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 300: Argentina HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 301: Mexico HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 302: Mexico HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 303: Mexico HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Power Source

Table 304: Mexico HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Power Source

Table 305: Mexico HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Technology

Table 306: Mexico HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Technology

Table 307: Mexico HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Cooling Capacity

Table 308: Mexico HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Cooling Capacity

Table 309: Mexico HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 310: Mexico HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 311: Mexico HVAC Chillers Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 312: Mexico HVAC Chillers Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Figure 1: Global HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 2: Global HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 3: Global HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 4: Global HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 5: Global HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 6: Global HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 7: Global HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 8: Global HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 9: Global HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 10: Global HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 11: Global HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 12: Global HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 13: Global HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 14: Global HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 15: Global HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 16: Global HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 17: Global HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 18: Global HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 19: Global HVAC Chillers Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 20: Global HVAC Chillers Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 21: Global HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 22: North America HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 23: North America HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 24: North America HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 25: North America HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 26: North America HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 27: North America HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 28: North America HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 29: North America HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 30: North America HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 31: North America HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 32: North America HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 33: North America HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 34: North America HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 35: North America HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 36: North America HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 37: North America HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 38: North America HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 39: North America HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 40: North America HVAC Chillers Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 41: North America HVAC Chillers Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 42: North America HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 43: U.S. HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 44: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 45: U.S. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 46: U.S. HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 47: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 48: U.S. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 49: U.S. HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 50: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 51: U.S. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 52: U.S. HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 53: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 54: U.S. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 55: U.S. HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 56: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 57: U.S. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 58: U.S. HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 59: U.S. HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 60: U.S. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 61: Canada HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 62: Canada HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 63: Canada HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 64: Canada HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 65: Canada HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 66: Canada HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 67: Canada HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 68: Canada HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 69: Canada HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 70: Canada HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 71: Canada HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 72: Canada HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 73: Canada HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 74: Canada HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 75: Canada HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 76: Canada HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 77: Canada HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 78: Canada HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 79: Europe HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 80: Europe HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 81: Europe HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 82: Europe HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 83: Europe HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 84: Europe HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 85: Europe HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 86: Europe HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 87: Europe HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 88: Europe HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 89: Europe HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 90: Europe HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 91: Europe HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 92: Europe HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 93: Europe HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 94: Europe HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 95: Europe HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 96: Europe HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 97: Europe HVAC Chillers Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 98: Europe HVAC Chillers Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 99: Europe HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 100: U.K. HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 101: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 102: U.K. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 103: U.K. HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 104: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 105: U.K. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 106: U.K. HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 107: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 108: U.K. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 109: U.K. HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 110: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 111: U.K. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 112: U.K. HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 113: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 114: U.K. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 115: U.K. HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 116: U.K. HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 117: U.K. HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Germany HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 119: Germany HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 120: Germany HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 121: Germany HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 122: Germany HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 123: Germany HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 124: Germany HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 125: Germany HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 126: Germany HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 127: Germany HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 128: Germany HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 129: Germany HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 130: Germany HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 131: Germany HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 132: Germany HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 133: Germany HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 134: Germany HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 135: Germany HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 136: France HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 137: France HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 138: France HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 139: France HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 140: France HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 141: France HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 142: France HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 143: France HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 144: France HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 145: France HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 146: France HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 147: France HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 148: France HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 149: France HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 150: France HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 151: France HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 152: France HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 153: France HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Italy HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 155: Italy HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 156: Italy HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 157: Italy HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 158: Italy HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 159: Italy HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 160: Italy HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 161: Italy HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 162: Italy HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 163: Italy HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 164: Italy HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 165: Italy HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 166: Italy HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 167: Italy HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 168: Italy HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 169: Italy HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 170: Italy HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 171: Italy HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 172: Spain HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 173: Spain HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 174: Spain HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 175: Spain HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 176: Spain HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 177: Spain HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 178: Spain HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 179: Spain HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 180: Spain HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 181: Spain HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 182: Spain HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 183: Spain HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 184: Spain HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 185: Spain HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 186: Spain HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 187: Spain HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 188: Spain HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 189: Spain HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 190: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 191: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 192: The Netherlands HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 193: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 194: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 195: The Netherlands HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 196: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 197: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 198: The Netherlands HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 199: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 200: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 201: The Netherlands HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 202: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 203: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 204: The Netherlands HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 205: The Netherlands HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 206: The Netherlands HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 207: The Netherlands HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 208: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 209: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 210: Asia Pacific HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 211: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 212: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 213: Asia Pacific HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 214: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 215: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 216: Asia Pacific HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 217: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 218: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 219: Asia Pacific HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 220: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 221: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 222: Asia Pacific HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 223: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 224: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 225: Asia Pacific HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 226: Asia Pacific HVAC Chillers Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 227: Asia Pacific HVAC Chillers Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 228: Asia Pacific HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 229: China HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 230: China HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 231: China HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 232: China HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 233: China HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 234: China HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 235: China HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 236: China HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 237: China HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 238: China HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 239: China HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 240: China HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 241: China HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 242: China HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 243: China HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 244: China HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 245: China HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 246: China HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 247: India HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 248: India HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 249: India HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 250: India HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 251: India HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 252: India HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 253: India HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 254: India HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 255: India HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 256: India HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 257: India HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 258: India HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 259: India HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 260: India HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 261: India HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 262: India HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 263: India HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 264: India HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 265: Japan HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 266: Japan HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 267: Japan HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 268: Japan HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 269: Japan HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 270: Japan HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 271: Japan HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 272: Japan HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 273: Japan HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 274: Japan HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 275: Japan HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 276: Japan HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 277: Japan HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 278: Japan HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 279: Japan HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 280: Japan HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 281: Japan HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 282: Japan HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 283: Australia HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 284: Australia HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 285: Australia HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 286: Australia HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 287: Australia HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 288: Australia HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 289: Australia HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 290: Australia HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 291: Australia HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035

Figure 292: Australia HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Capacity 2020 to 2035

Figure 293: Australia HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Capacity 2020 to 2035

Figure 294: Australia HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Capacity 2025 to 2035

Figure 295: Australia HVAC Chillers Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 296: Australia HVAC Chillers Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 297: Australia HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 298: Australia HVAC Chillers Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 299: Australia HVAC Chillers Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 300: Australia HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 301: South Korea HVAC Chillers Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 302: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 303: South Korea HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 304: South Korea HVAC Chillers Market Value (US$ Bn) Projection, By Power Source 2020 to 2035

Figure 305: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, By Power Source 2020 to 2035

Figure 306: South Korea HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Power Source 2025 to 2035

Figure 307: South Korea HVAC Chillers Market Value (US$ Bn) Projection, By Cooling Technology 2020 to 2035

Figure 308: South Korea HVAC Chillers Market Volume (Thousand Units) Projection, By Cooling Technology 2020 to 2035

Figure 309: South Korea HVAC Chillers Market Incremental Opportunities (US$ Bn) Forecast, By Cooling Technology 2025 to 2035