Reports

Reports

Analyst Viewpoint

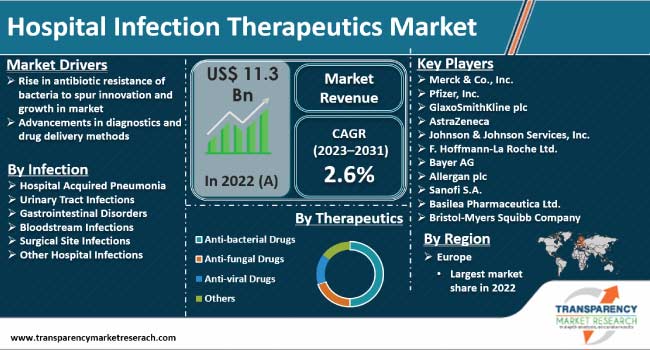

Rise in antibiotic resistance of bacteria is projected to spur innovation and growth in the global hospital infection therapeutics market. Advancements in diagnostics and drug delivery methods are also anticipated to boost market statistics. Rise in geriatric population is another factor driving the demand for hospital infection therapeutics, since this group is more prone to hospital-acquired infections due to weakened immune system.

Emerging economies present high growth potential to drug manufacturers, with individuals in such countries seeking improved healthcare services owing to the rise in general income levels. Investments in R&D in non-antibiotic treatment options and partnerships for co-development and commercialization of anti-infective agents are likely to further bolster the hospital infection therapeutics market size.

Hospital-acquired infections are a common occurrence in the healthcare sector. In low and medium income countries, the presence of unsanitary environments in and around hospitals is a major contributory factor to hospital-acquired infections.

Faulty sterilization procedures and lack of medical facility infection control solutions in these settings also result in an increase in the occurrence of hospital-acquired diseases. Rise in infections caused by resistant bacteria is augmenting the global hospital therapeutics market development.

Companies operating in the global landscape are investing in research and development activities to produce new antibiotics. However, growth in treatment resistance, requirement of large investments due to high attrition rates in clinical trials, and dearth of reimbursement policies are resulting in a restricted pipeline of medications. This is likely to hamper the hospital infection therapeutics market value to a certain extent.

Over time, microorganisms such as fungi and bacteria develop resistance to drugs that are designed to eliminate them. Thus, they continue to thrive, causing infections among the population. Such resistant infections can often be difficult to treat.

Antimicrobial resistance is an urgent global public health threat, killing at least 1.27 million people worldwide and associated with nearly five million deaths in 2019. More than 2.8 million antimicrobial-resistant infections are reported each year in the U.S.

People at any stage of life can be affected by antibiotic resistance. It has the potential to derail industries such as healthcare and agriculture industries. Thus, antibiotic resistance is one of the key public health issues across the world.

Growth in initiatives such as the WHO's Global Action Plan on Antimicrobial Resistance and related programs is likely to augment the demand for anti-bacterial medications during the forecast period. This, in turn, is expected to result in an increase in awareness about hospital infectious disease treatments.

Technological developments in diagnostics, drug delivery, and therapy monitoring are bolstering the sales of healthcare facility infection control drugs. Development of rapid diagnostic tests and point-of-care devices is assisting healthcare personnel in swiftly diagnosing and treating hospital-acquired infections. This is resulting in better patient outcomes and lower risk of infection transmission.

Telemedicine and digital health platforms also increase patient access to healthcare services and allow for remote monitoring of patients with hospital-acquired infections. Furthermore, development of innovative drug delivery technologies, such as nanoparticles and liposomes, enhances treatment efficacy and minimizes toxicity, thereby increasing the effectiveness of hospital infection therapy.

As per the global hospital infection therapeutics industry analysis, Europe accounted for significant share of the global industry in 2022. High incidence of hospital-acquired infections, rise in number of surgeries and the resultant hospitalizations, increase in the elderly population, and growth in spending on advanced healthcare are driving the region’s hospital infection therapeutics market share.

North America is another region that is recording significant hospital infection therapeutics market expansion. Presence of highly developed health care infrastructure and larger reimbursement coverage are propelling the market dynamics of the region.

Future analysis of hospital infection therapeutics reveals that the high growth rate of the pharmaceutical industry in India and China is expected to sustain the market trajectory in Asia Pacific. Companies are increasingly investing in China for the development of novel treatment approaches for hospital-acquired infections. These key trends in Asia Pacific are expected to hold strong through 2031.

The hospital infection therapeutics market report scope includes an analysis of key players operating in the global market. Merck & Co., Inc., Pfizer, Inc., GlaxoSmithKline plc, AstraZeneca, Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd., Bayer AG, Allergan plc, Sanofi S.A., Basilea Pharmaceutica Ltd., and Bristol-Myers Squibb Company are the prominent companies in the global landscape.

Leading companies such as Merck & Co., Inc. and Pfizer, Inc. are engaged in the manufacture of anti-bacterial drugs. These companies are also investing substantially in research and development activities to overcome drug resistance.

The research report on hospital infection therapeutics market summarizes the prominent players in terms of parameters such as company overview, portfolio, recent developments, business segments, growth strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 11.3 Bn |

| Market Forecast Value in 2031 | US$ 14.4 Bn |

| Growth Rate (CAGR) | 2.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 11.3 Bn in 2022

It is likely to grow at a CAGR of 2.6% from 2023 to 2031

Rise in antibiotic resistance of bacteria spurring innovation in hospital infection therapeutics, and advancements in diagnostics and drug delivery methods

The anti-bacterial drugs segment commands a bulk of the share

Europe was the leading region in 2022

Merck & Co., Inc., Pfizer, Inc., GlaxoSmithKline plc, AstraZeneca, Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd., Bayer AG, Allergan plc, Sanofi S.A., Basilea Pharmaceutica Ltd., and Bristol-Myers Squibb Company.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Hospital Infection Therapeutics Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hospital Infection Therapeutics Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Disease Prevalence & Incidence Rate Globally With Key Countries

5.3. COVID-19 Pandemic Impact on Industry

6. Hospital Infection Therapeutics Market Analysis and Forecast, by Therapeutics

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Therapeutics, 2017-2031

6.3.1. Anti-bacterial Drugs

6.3.2. Anti-fungal Drugs

6.3.3. Anti-viral Drugs

6.3.4. Others

6.4. Market Attractiveness, by Therapeutics

7. Global Hospital Infection Therapeutics Market Analysis and Forecast, by Infection

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Infection, 2017-2031

7.3.1. Hospital Acquired Pneumonia

7.3.2. Urinary Tract Infections

7.3.3. Gastrointestinal Disorders

7.3.4. Bloodstream Infections

7.3.5. Surgical Site Infections

7.3.6. Other Hospital Infections

7.4. Market Attractiveness, by Infection

8. Global Hospital Infection Therapeutics Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Hospital Infection Therapeutics Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Therapeutics, 2023-2031

9.2.1. Anti-bacterial Drugs

9.2.2. Anti-fungal Drugs

9.2.3. Anti-viral Drugs

9.2.4. Others

9.3. Market Value Forecast, by Infection, 2023-2031

9.3.1. Hospital Acquired Pneumonia

9.3.2. Urinary Tract Infections

9.3.3. Gastrointestinal Disorders

9.3.4. Bloodstream Infections

9.3.5. Surgical Site Infections

9.3.6. Other Hospital Infections

9.4. Market Value Forecast, by Country, 2023-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Therapeutics

9.5.2. By Infection

9.5.3. By Country

10. Europe Hospital Infection Therapeutics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Therapeutics, 2023-2031

10.2.1. Anti-bacterial Drugs

10.2.2. Anti-fungal Drugs

10.2.3. Anti-viral Drugs

10.2.4. Others

10.3. Market Value Forecast, by Infection, 2023-2031

10.3.1. Hospital Acquired Pneumonia

10.3.2. Urinary Tract Infections

10.3.3. Gastrointestinal Disorders

10.3.4. Bloodstream Infections

10.3.5. Surgical Site Infections

10.3.6. Other Hospital Infections

10.4. Market Value Forecast, by Country/Sub-region, 2023-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Therapeutics

10.5.2. By Infection

10.5.3. By Country/Sub-region

11. Asia Pacific Hospital Infection Therapeutics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Therapeutics, 2023-2031

11.2.1. Anti-bacterial Drugs

11.2.2. Anti-fungal Drugs

11.2.3. Anti-viral Drugs

11.2.4. Others

11.3. Market Value Forecast, by Infection, 2023-2031

11.3.1. Hospital Acquired Pneumonia

11.3.2. Urinary Tract Infections

11.3.3. Gastrointestinal Disorders

11.3.4. Bloodstream Infections

11.3.5. Surgical Site Infections

11.3.6. Other Hospital Infections

11.4. Market Value Forecast, by Country/Sub-region, 2023-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Therapeutics

11.5.2. By Infection

11.5.3. By Country/Sub-region

12. Latin America Hospital Infection Therapeutics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Therapeutics, 2023-2031

12.2.1. Anti-bacterial Drugs

12.2.2. Anti-fungal Drugs

12.2.3. Anti-viral Drugs

12.2.4. Others

12.3. Market Value Forecast, by Infection, 2023-2031

12.3.1. Hospital Acquired Pneumonia

12.3.2. Urinary Tract Infections

12.3.3. Gastrointestinal Disorders

12.3.4. Bloodstream Infections

12.3.5. Surgical Site Infections

12.3.6. Other Hospital Infections

12.4. Market Value Forecast, by Country/Sub-region, 2023-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Therapeutics

12.5.2. By Infection

12.5.3. By Country/Sub-region

13. Middle East & Africa Hospital Infection Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Therapeutics, 2023-2031

13.2.1. Anti-bacterial Drugs

13.2.2. Anti-fungal Drugs

13.2.3. Anti-viral Drugs

13.2.4. Others

13.3. Market Value Forecast, by Infection, 2023-2031

13.3.1. Hospital Acquired Pneumonia

13.3.2. Urinary Tract Infections

13.3.3. Gastrointestinal Disorders

13.3.4. Bloodstream Infections

13.3.5. Surgical Site Infections

13.3.6. Other Hospital Infections

13.4. Market Value Forecast, by Country/Sub-region, 2023-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Therapeutics

13.5.2. By Infection

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Merck & Co., Inc.

14.3.1.1. Company Revenue

14.3.1.2. Business Overview

14.3.1.3. Product Segments

14.3.1.4. Geographic Footprint

14.3.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.2. Pfizer, Inc.

14.3.2.1. Company Revenue

14.3.2.2. Business Overview

14.3.2.3. Product Segments

14.3.2.4. Geographic Footprint

14.3.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.3. GlaxoSmithKline plc

14.3.3.1. Company Revenue

14.3.3.2. Business Overview

14.3.3.3. Product Segments

14.3.3.4. Geographic Footprint

14.3.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.4. AstraZeneca

14.3.4.1. Company Revenue

14.3.4.2. Business Overview

14.3.4.3. Product Segments

14.3.4.4. Geographic Footprint

14.3.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.5. Johnson & Johnson Services, Inc.

14.3.5.1. Company Revenue

14.3.5.2. Business Overview

14.3.5.3. Product Segments

14.3.5.4. Geographic Footprint

14.3.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.6. F. Hoffmann-La Roche Ltd.

14.3.6.1. Company Revenue

14.3.6.2. Business Overview

14.3.6.3. Product Segments

14.3.6.4. Geographic Footprint

14.3.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.7. Bayer AG

14.3.7.1. Company Revenue

14.3.7.2. Business Overview

14.3.7.3. Product Segments

14.3.7.4. Geographic Footprint

14.3.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.8. Allergan plc.

14.3.8.1. Company Revenue

14.3.8.2. Business Overview

14.3.8.3. Product Segments

14.3.8.4. Geographic Footprint

14.3.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.9. Sanofi S.A.

14.3.9.1. Company Revenue

14.3.9.2. Business Overview

14.3.9.3. Product Segments

14.3.9.4. Geographic Footprint

14.3.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.10. Gilead Sciences, Inc.

14.3.10.1. Company Revenue

14.3.10.2. Business Overview

14.3.10.3. Product Segments

14.3.10.4. Geographic Footprint

14.3.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.11. Basilea Pharmaceutica Ltd.

14.3.11.1. Company Revenue

14.3.11.2. Business Overview

14.3.11.3. Product Segments

14.3.11.4. Geographic Footprint

14.3.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.3.12. Bristol-Myers Squibb Company

14.3.12.1. Company Revenue

14.3.12.2. Business Overview

14.3.12.3. Product Segments

14.3.12.4. Geographic Footprint

14.3.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

List of Tables

Table 1: Global Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Therapeutics, 2017-2031

Table 2: Global Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Infection, 2017-2031

Table 3: Global Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 4: North America Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 5: North America Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Therapeutics, 2017-2031

Table 6: North America Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Infection, 2017-2031

Table 7: Europe Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 8: Europe Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Therapeutics, 2017-2031

Table 9: Europe Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Infection 2017-2031

Table 10: Asia Pacific Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 11: Asia Pacific Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Therapeutics, 2017-2031

Table 12: Asia Pacific Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Infection, 2017-2031

Table 13: Latin America Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Latin America Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Therapeutics, 2017-2031

Table 15: Latin America Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Infection 2017-2031

Table 16: Middle East & Africa Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Middle East & Africa Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Therapeutics, 2017-2031

Table 18: Middle East & Africa Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, by Infection 2017-2031

List of Figures

Figure 1: Global Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, 2017-2031

Figure 2: Global Hospital Infection Therapeutics Market Value Share, by Therapeutics, 2022

Figure 3: Global Hospital Infection Therapeutics Market Value Share, by Infection, 2022

Figure 4: Global Hospital Infection Therapeutics Market Value Share Analysis, by Therapeutics, 2022 and 2031

Figure 5: Global Hospital Infection Therapeutics Market Attractiveness Analysis, by Therapeutics, 2023-2031

Figure 6: Global Hospital Infection Therapeutics Market Value Share Analysis, by Infection, 2022 and 2031

Figure 7: Global Hospital Infection Therapeutics Market Attractiveness Analysis, by Infection 2023-2031

Figure 8: Global Hospital Infection Therapeutics Market Value Share Analysis, by Region, 2022 and 2031

Figure 9: Global Hospital Infection Therapeutics Market Attractiveness Analysis, by Region, 2023-2031

Figure 10: North America Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, 2017-2031

Figure 11: North America Hospital Infection Therapeutics Market Value Share Analysis, by Country, 2022 and 2031

Figure 12: North America Hospital Infection Therapeutics Market Attractiveness Analysis, by Country, 2023-2031

Figure 13: North America Hospital Infection Therapeutics Market Value Share Analysis, by Therapeutics, 2022 and 2031

Figure 14: North America Hospital Infection Therapeutics Market Attractiveness Analysis, by Therapeutics, 2023-2031

Figure 15: North America Hospital Infection Therapeutics Market Value Share Analysis, by Infection, 2022 and 2031

Figure 16: North America Hospital Infection Therapeutics Market Attractiveness Analysis, by Infection 2023-2031

Figure 17: Europe Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, 2017-2031

Figure 18: Europe Hospital Infection Therapeutics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 19: Europe Hospital Infection Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 20: Europe Hospital Infection Therapeutics Market Value Share Analysis, by Therapeutics, 2022 and 2031

Figure 21: Europe America Hospital Infection Therapeutics Market Attractiveness Analysis, by Therapeutics, 2023-2031

Figure 22: Europe Hospital Infection Therapeutics Market Value Share Analysis, by Infection, 2022 and 2031

Figure 23: Europe Hospital Infection Therapeutics Market Attractiveness Analysis, by Infection 2023-2031

Figure 24: Asia Pacific Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, 2017-2031

Figure 25: Asia Pacific Hospital Infection Therapeutics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Asia Pacific Hospital Infection Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 27: Asia Pacific Hospital Infection Therapeutics Market Value Share Analysis, by Therapeutics, 2022 and 2031

Figure 28: Asia Pacific America Hospital Infection Therapeutics Market Attractiveness Analysis, by Therapeutics, 2023-2031

Figure 29: Asia Pacific Hospital Infection Therapeutics Market Value Share Analysis, by Infection, 2022 and 2031

Figure 30: Asia Pacific Hospital Infection Therapeutics Market Attractiveness Analysis, by Infection 2023-2031

Figure 31: Latin America Hospital Infection Therapeutics Market Value (US$ Mn) Forecast, 2017-2031

Figure 32: Latin America Hospital Infection Therapeutics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Latin America Hospital Infection Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34: Latin America Hospital Infection Therapeutics Market Value Share Analysis, by Therapeutics, 2022 and 2031

Figure 35: Latin America Hospital Infection Therapeutics Market Attractiveness Analysis, by Therapeutics, 2023-2031

Figure 36: Middle East & Africa Hospital Infection Therapeutics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 37: Middle East & Africa Hospital Infection Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 38: Middle East & Africa America Hospital Infection Therapeutics Market Value Share Analysis, by Therapeutics, 2023-2031

Figure 39: Middle East & Africa America Hospital Infection Therapeutics Market Attractiveness Analysis, by Therapeutics, 2023-2031

Figure 40: Middle East & Africa Hospital Infection Therapeutics Market Value Share Analysis, by Infection, 2022 and 2031

Figure 41: Middle East & Africa Hospital Infection Therapeutics Market Attractiveness Analysis, by Infection 2023-2031

Figure 42: Global Hospital Infection Therapeutics Market Share Analysis, by Company (2022)