Reports

Reports

The burden of blood pressure-related diseases continues to increase global public health issues. The significance of high blood pressure as a major cause of common serious diseases has been identified in most Western countries for patients aged around 50 years and above. Apart from that, malignant hypertension has been a frequent reason for hospital admissions and a common cause of death. These aspects are making blood pressure monitoring a crucial activity in the process of effective disease prevention and management. Changing lifestyles of individuals in developed countries have led to a rise in the prevalence of hypertension. According to WHO statistics, an estimated 1.1 billion people, worldwide, are suffering from hypertension, with most living in low- and middle-income countries. Home blood pressure monitoring devices bring in the new era of hypertension management.

The prevalence of this chronic disease coupled with the development of diagnostic devices and tools is expected to bolster the growth of the home blood pressure monitoring devices market. Transparency Market Research (TMR) recently presented a comprehensive study on the home blood pressure monitoring devices market, with a positive perspective of the industry. This market report unveils the key factors driving market growth, while highlighting the developments witnessed across the home blood pressure monitoring devices market.

The advent of microscopy and advances in physics have led to increased knowledge in pathology and physiology, marking the beginning of clinical transformations. The first efforts to measure the pulse were witnessed in the mid-19th century with the help of pulse writers-sphygmographs. The historical gap between ease of use associated with the currently used products such as upper arm instruments and the bulky sphygmographs highlighted the shadowy existence of the past. However, upper arm blood pressure measurement started its exultant success over a century ago.

Ever since, a number of innovations in healthcare have led to the development of advanced medical devices, including blood pressure monitoring devices that deliver precision and accuracy. Moreover, as healthcare and clinical care settings adopt a patient-centric approach, the need to reduce hospital admissions and develop more products for homecare settings, including 'do-it-yourself’ blood pressure monitors', is being observed. The home blood pressure monitoring devices market is likely to hold a value of ~ US$ 1.1 Bn in the 2019. The incorporation of multiple functional tools in diagnostic devices and the prevalence of wearable technologies such as wrist watch monitors are the major trends that are expected to influence the global home blood pressure monitoring market.

Increasing Prevalence of 'Smart' Monitoring

Smart monitoring has become a significant aspect governing the home blood pressure monitoring devices market, as smart technology continues to ease the functionality of medical devices. Moreover, as smartphone penetration grows, devices being integrated with smartphone applications gives better access and control in the hands of patients, influencing the growth of the market.

Evolving Health-monitoring Wearables

Wearable medical devices have gained rapid acceptance among today’s tech-savvy consumers. The usher of wearable technology in the healthcare industry has led to significant developments. Wearable technologies offer a convenient means of monitoring various physiological factors, presenting a facet of medical solutions. Evolving monitoring wearables have a positive impact on the home blood pressure monitoring devices market.

Physicians are majorly recommending the use of home blood pressure monitoring devices for patients suffering from severe hypertension. Regular check-ups in the convenience of homes for patients with hypertension are believed to offer better control over the disease. However, accuracy issues with the results provided by home blood pressure monitoring devices may impact their utilization, as accurate blood pressure monitoring remains significant for patients. Having said that, certain revelations state otherwise, wherein, it is believed that, the self-measurement of blood pressure at home has been seen to be useful in the elimination of the white-coat effect.

Prioritize Innovation in Wrist Monitors

The increasing preference of patients for the convenient monitoring of blood pressure is providing growth opportunities to home blood pressure monitoring devices market players. There is increasing acceptance of wrist monitoring and higher adoption of novel and advanced methods for blood pressure monitoring, despite their high prices as compared to their counterparts. Established players are focusing investments on the development of wrist monitors to capture a larger consumer base.

Solidify Distribution across Online Sales Channels

Although retail pharmacies continue to remain the sought-after distribution channel currently, online stores is an emerging distribution channel for home blood pressure monitors. Rise in the adoption of online purchase and availability of more purchase options on online platforms are the key factors driving the popularity of this segment. Several companies are focusing on online distribution collaborations to reach more people for delivering home blood pressure monitoring devices on a global level.

Strengthen Production across Developing Countries

Key players in the home blood pressure monitoring devices market continue to emphasize on production expansion, particularly in the Asian economies that are home to a pool of opportunities. A large number of patients with hypertension coupled with the increasing geriatric population recorded across these countries is generating significant demand for home blood pressure monitoring devices. Companies, in a bid to cash in on these opportunities, are strengthening their production capabilities in this region.

In 2018, Omron Healthcare, Inc. was granted FDA approval for its HeartGuide, which is claimed to be the first wearable blood pressure monitor. HeartGuide is available with a new smartphone application - HeartAdvisor.

In 2019, A&D Medical released a new line of professional blood pressure monitors that allow clinicians to diagnose hypertension accurately and manage blood pressure throughout the care continuum. The new line includes Professional Office Blood Pressure Monitors and Ambulatory Blood Pressure Monitors (ABPM), among which, ABPM aids in the diagnosis and assessment of hypertension.

In 2018, nearly 50-60% of the global market share was held by leading home blood pressure monitoring devices market competitors, from which, around 50% share is held by Omron Healthcare, while the rest is controlled by A&D Company, Limited and Hill-Rom, Inc. Owing to this scenario, the home blood pressure monitoring devices market remains consolidated in nature. New product development strategy remains a growth catalyst for leading home blood pressure monitoring devices market competitors, which is further supported by continual progress in R&D activities. The development of lightweight, compact devices remains a priority for manufacturers. Furthermore, improving production capabilities also aids in effective product development. Established players are also prioritizing distribution expansion to maximize the sales of home blood pressure monitoring devices.

Analysts’ Opinion of the Market

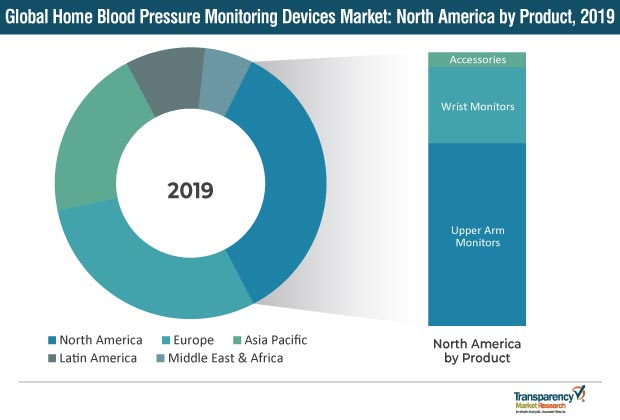

The rise in the prevalence of hypertension resulting from the changing lifestyles of individuals, along with increasing awareness among patients to keep track of their health through timely monitoring has led TMR’s analysts to have a positive perspective of the home blood pressure monitoring devices market. Analysts revealed the leadership of North America in the home blood pressure monitoring devices market in terms of value. This is attributed to the larger user base of new, advanced products such as wrist monitors. However, an increase in the number of local manufacturers has created pricing pressure in the market, which is likely to impede the growth of the home blood pressure monitoring devices market in North America during the latter half of the forecast period. Asia Pacific is expected to become a highly lucrative market for companies providing home blood pressure monitors during the forecast period. Companies entering this market could consider the opportunities available in this region.

Home Blood Pressure Monitoring Devices Market - Overview

Home Blood Pressure Monitoring Devices Market: Drivers

Global Home Blood Pressure Monitoring Devices Market: Segmentation

Global Home Blood Pressure Monitoring Devices Market: Geographic Overview

Global Home Blood Pressure Monitoring Devices Market: Major Players

Key players analyzed in this home blood pressure monitoring devices market report are

Each of these players have been profiled in the home blood pressure monitoring devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Home blood pressure monitoring devices market to reach ~US$ 1.7 Bn by 2027

Home blood pressure monitoring devices market is projected to expand at a CAGR of ~6% from 2019 to 2027

Home blood pressure monitoring devices market is driven by rise in the use of home blood pressure monitors in developing economies to combat hypertension

The upper arm monitors segment dominated the global home blood pressure monitoring devices market, and the trend is likely to continue during the forecast period

Key players in the home blood pressure monitoring devices market include Omron Healthcare, Inc., A&D Medical, Welch Allyn, Inc. (Hill-Rom Holdings, Inc.), SunTech Medical, Inc. (Halma plc), Rossmax International Ltd.

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary: Global Home Blood Pressure Monitoring Devices Market

Chapter 4. Market Overview

4.1. Introduction

4.1.1. Product Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Home Blood Pressure Monitoring Devices Market Analysis and Forecast, 2017–2027

4.3.1. Market Revenue Projection, by Value (US$ Mn)

Chapter 5. Market Outlook

5.1. Home Blood Pressure Devices Pricing Analysis

5.2. Vendor and Distributor Analysis

5.3. Reimbursement Scenario

5.4. Regulatory Scenario

5.5. Technological Advancement

5.6. Consumers Buying Patterns, by Regions

5.6.1. North America

5.6.2. Europe

5.6.2.1. Northern Europe

5.6.2.2. Southern Europe

5.6.2.3. Eastern Europe

5.6.3. Asia Pacific

5.6.4. Latin America

5.6.5. Middle East & Africa

Chapter 6. Global Home Blood Pressure Monitoring Devices Market Analysis and Forecast, by Product

6.1. Key Findings/Developments

6.2. Introduction & Definition

6.3. Market Value Forecast, by Product, 2017–2027

6.3.1. Upper Arm Monitors

6.3.2. Wrist Monitors

6.3.3. Accessories

6.4. Market Attractiveness, by Product

Chapter 7. Global Home Blood Pressure Monitoring Devices Market Analysis and Forecasts, by Distribution Channel

7.1. Key Findings/Developments

7.2. Introduction & Definition

7.3. Market Value Forecast, by Distribution Channel, 2017–2027

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Online Stores

7.3.4. Others

7.4. Market Attractiveness, by Distribution Channel

Chapter 8. Global Home Blood Pressure Monitoring Devices Market Analysis and Forecasts, by Region

8.1. Geographical Representation

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

Chapter 9. North America Home Blood Pressure Monitoring Devices Market Analysis and Forecast

9.1. Market Value Forecast, by Country, 2017–2027

9.1.1. U.S.

9.1.2. Canada

9.2. Market Value Share Analysis, by Product, 2018–2027

9.3. Market Value Forecast, by Product, 2017–2027

9.3.1. Upper Arm Monitors

9.3.2. Wrist Monitors

9.3.3. Accessories

9.4. Market Value Share Analysis, by Distribution Channel, 2018–2027

9.5. Market Value Forecast, by Distribution Channel, 2017–2027

9.5.1. Hospital Pharmacies

9.5.2. Retail Pharmacies

9.5.3. Online Stores

9.5.4. Others

9.6. Market Attractiveness Analysis

9.6.1. By Country

9.6.2. By Product

9.6.3. Distribution Channel

Chapter 10. Europe Home Blood Pressure Monitoring Devices Market Analysis and Forecast

10.1. Market Value Forecast, by Country/Sub-region, 2017–2027

10.1.1. Germany

10.1.2. France

10.1.3. U.K.

10.1.4. Spain

10.1.5. Italy

10.1.6. Russia

10.1.7. Belgium

10.1.8. Portugal

10.1.9. Poland

10.1.10. Rest of Europe

10.2. Market Value Share Analysis, by Product, 2018–2027

10.3. Market Value Forecast, by Product, 2017–2027

10.3.1. Upper Arm Monitors

10.3.2. Wrist Monitors

10.3.3. Accessories

10.4. Market Value Share Analysis, by Distribution Channel, 2018–2027

10.5. Market Value Forecast, by Distribution Channel, 2017–2027

10.5.1. Hospital Pharmacies

10.5.2. Retail Pharmacies

10.5.3. Online Stores

10.5.4. Others

10.6. Market Attractiveness Analysis

10.6.1. By Country/Sub-region

10.6.2. By Product

10.6.3. By Distribution Channel

Chapter 11. Asia Pacific Home Blood Pressure Monitoring Devices Market Analysis and Forecast

11.1. Market Value Forecast, by Country/Sub-region, 2017–2027

11.1.1. China

11.1.2. Japan

11.1.3. India

11.1.4. Australia & New Zealand

11.1.5. Vietnam

11.1.6. South Korea

11.1.7. Rest of Asia Pacific

11.2. Market Value Share Analysis, by Product, 2018–2027

11.3. Market Value Forecast, by Product, 2017–2027

11.3.1. Upper Arm Monitors

11.3.2. Wrist Monitors

11.3.3. Accessories

11.4. Market Value Share Analysis, by Distribution Channel, 2018–2027

11.5. Market Value Forecast, by Distribution Channel, 2017–2027

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Stores

11.5.4. Others

11.6. Market Attractiveness Analysis

11.6.1. By Country/Sub-region

11.6.2. By Product

11.6.3. By Distribution Channel

Chapter 12. Latin America Home Blood Pressure Monitoring Devices Market Analysis and Forecast

12.1. Market Value Forecast, by Country/Sub-region, 2017–2027

12.1.1. Brazil

12.1.2. Mexico

12.1.3. Argentina

12.1.4. Rest of Latin America

12.2. Market Value Share Analysis, by Product, 2018–2027

12.3. Market Value Forecast, by Product, 2017–2027

12.3.1. Upper Arm Monitors

12.3.2. Wrist Monitors

12.3.3. Accessories

12.4. Market Value Share Analysis, by Distribution Channel, 2018–2027

12.5. Market Value Forecast, by Distribution Channel, 2017–2027

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Online Stores

12.5.4. Others

12.6. Market Attractiveness Analysis

12.6.1. By Country/Sub-region

12.6.2. By Product

12.6.3. By Distribution Channel

Chapter 13. Middle East & Africa Home Blood Pressure Monitoring Devices Market Analysis and Forecast

13.1. Market Value Forecast, by Country/Sub-region, 2017–2027

13.1.1. GCC Countries

13.1.2. South Africa

13.1.3. Rest of Middle East & Africa

13.2. Market Value Share Analysis, by Product, 2018–2027

13.3. Market Value Forecast, by Product, 2017–2027

13.3.1. Upper Arm Monitors

13.3.2. Wrist Monitors

13.3.3. Accessories

13.4. Market Value Share Analysis, by Distribution Channel, 2018–2027

13.5. Market Value Forecast, by Distribution Channel, 2017–2027

13.5.1. Hospital Pharmacies

13.5.2. Retail Pharmacies

13.5.3. Online Stores

13.5.4. Others

13.6. Market Attractiveness Analysis

13.6.1. By Country/Sub-region

13.6.2. By Product

13.6.3. By Distribution Channel

Chapter 14. Competition Landscape

14.1. Competition Matrix

14.1.1. Omron Healthcare, Inc.

14.1.2. A&D Company, Limited

14.2. Company Profiles (Details - Overview, Financials, Recent Developments, Strategy)

14.2.1. OMRON Healthcare, Inc. (HQ, Business Segments, Employee Strength)

14.2.1.1. Company Details

14.2.1.2. Company Description

14.2.1.3. Business Overview

14.2.1.4. SWOT Analysis

14.2.1.5. Financial Analysis

14.2.1.6. Strategic Overview

14.2.2. A&D Company, Limited (HQ, Business Segments, Employee Strength)

14.2.2.1. Company Details

14.2.2.2. Company Description

14.2.2.3. Business Overview

14.2.2.4. SWOT Analysis

14.2.2.5. Strategic Overview

14.2.3. Hill-Rom, Inc. (HQ, Business Segments, Employee Strength)

14.2.3.1. Company Details

14.2.3.2. Company Description

14.2.3.3. Business Overview

14.2.3.4. SWOT Analysis

14.2.3.5. Strategic Overview

14.2.4. SunTech Medical, Inc. (Elanco Animal Health) (HQ, Business Segments, Employee Strength)

14.2.4.1. Company Details

14.2.4.2. Company Description

14.2.4.3. Business Overview

14.2.4.4. SWOT Analysis

14.2.4.5. Strategic Overview

14.2.5. Rossmax International Ltd. (HQ, Business Segments, Employee Strength)

14.2.5.1. Company Details

14.2.5.2. Company Description

14.2.5.3. Business Overview

14.2.5.4. SWOT Analysis

14.2.5.5. Financial Analysis

14.2.5.6. Strategic Overview

14.2.6. Koninklijke Philips N.V. (HQ, Business Segments, Employee Strength)

14.2.6.1. Company Details

14.2.6.2. Company Description

14.2.6.3. Business Overview

14.2.6.4. SWOT Analysis

14.2.6.5. Financial Analysis

14.2.6.6. Strategic Overview

14.2.7. Beurer GmbH (HQ, Business Segments, Employee Strength)

14.2.7.1. Company Details

14.2.7.2. Company Description

14.2.7.3. Business Overview

14.2.7.4. SWOT Analysis

14.2.7.5. Financial Analysis

14.2.7.6. Strategic Overview

14.2.8. Qardio, Inc. (HQ, Business Segments, Employee Strength)

14.2.8.1. Company Details

14.2.8.2. Company Description

14.2.8.3. Business Overview

14.2.8.4. SWOT Analysis

14.2.8.5. Financial Analysis

14.2.8.6. Strategic Overview

14.2.9. Spengler SAS (HQ, Business Segments, Employee Strength)

14.2.9.1. Company Details

14.2.9.2. Company Description

14.2.9.3. Business Overview

14.2.9.4. SWOT Analysis

14.2.10. American Diagnostic Corporation (HQ, Business Segments, Employee Strength)

14.2.10.1. Company Details

14.2.10.2. Company Description

14.2.10.3. Business Overview

14.2.10.4. SWOT Analysis

14.2.10.5. Strategic Overview Strategic Overview

List of Tables

Table 01: Global Pricing Analysis - Home Blood Pressure Monitors

Table 02: Key Vendor and Distributor Analysis - Home Blood Pressure Monitoring

Table 03: Medical Device Classification as per European Commission (EC)

Table 04: Global Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 05: Global Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 06: Global Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 07: North America Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 08: North America Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 09: North America Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 10: U.S. Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 11: Canada Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 12: Europe Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 13: Europe Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 14: Europe Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 15: Germany Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 16: U.K. Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 17: France Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 18: Italy Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 19: Spain Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 20: Russia Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 21: Belgium Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 22: Portugal Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 23: Poland Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 24: Rest of Europe Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 25: Asia Pacific Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 26: Asia Pacific Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 27: Asia Pacific Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 28: Japan Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 29: China Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 30: India Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 31: Australia & New Zealand Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 32: Vietnam Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 33: South Korea Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 34: Rest of APAC Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 35: Latin America Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 36: Latin America Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 37: Latin America Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 38: Brazil Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 39: Mexico Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 40: Argentina Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 41: Rest of LATAM Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 42: Middle East & Africa Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 43: Middle East & Africa Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 44: Middle East & Africa Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 45: GCC Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 46: South Africa Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 47: Rest of MEA Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

List of Figures

Figure 01: Global Home Blood Pressure Monitoring Devices Market Size (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Market Snapshot of Global Home Blood Pressure Monitoring Devices Market

Figure 03: Global Home Blood Pressure Monitoring Devices Market Overview

Figure 04: Global Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2027

Figure 05: Global Home Blood Pressure Monitoring Devices Market Value Share, by Product, 2018

Figure 06: Global Home Blood Pressure Monitoring Devices Market Value Share, by Distribution Channel, 2018

Figure 07: Global Home Blood Pressure Monitoring Devices Market Value Share, by Region, 2018

Figure 08: Global Home Blood Pressure Monitoring Devices Market Value Share Analysis, by Product, 2018 and 2027

Figure 09: Global Home Blood Pressure Monitoring Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Upper Arm Monitors, 2017–2027

Figure 10: Global Home Blood Pressure Monitoring Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Wrist Monitors, 2017–2027

Figure 11: Global Home Blood Pressure Monitoring Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Accessories, 2017–2027

Figure 12: Global Home Blood Pressure Monitoring Devices Market Attractiveness Analysis, by Product, 2019–2027

Figure 13: Global Home Blood Pressure Monitoring Devices Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 14: Global Home Blood Pressure Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017–2027

Figure 15: Global Home Blood Pressure Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017–2027

Figure 16: Global Home Blood Pressure Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Online Stores, 2017–2027

Figure 17: Global Home Blood Pressure Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 18: Global Home Blood Pressure Monitoring Devices Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 19: Global Home Blood Pressure Monitoring Devices Market Value Share Analysis, by Region, 2018 and 2027

Figure 20: Global Home Blood Pressure Monitoring Devices Market Attractiveness Analysis, by Region, 2019–2027

Figure 21: North America Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 22: North America Home Blood Pressure Monitoring Devices Market Value Share, by Country, 2018 and 2027

Figure 23: North America Home Blood Pressure Monitoring Devices Market Attractiveness, by Country, 2019–2027

Figure 24: North America Home Blood Pressure Monitoring Devices Market Value Share, by Product, 2018 and 2027

Figure 25: North America Home Blood Pressure Monitoring Devices Market Attractiveness, by Product, 2019–2027

Figure 26: North America Home Blood Pressure Monitoring Devices Market Value Share, by Distribution Channel, 2018 and 2027

Figure 27: North America Home Blood Pressure Monitoring Devices Market Attractiveness, by Distribution Channel, 2019–2027

Figure 28: Europe Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 29: Europe Home Blood Pressure Monitoring Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 30: Europe Home Blood Pressure Monitoring Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 31: Europe Home Blood Pressure Monitoring Devices Market Value Share, by Product, 2018 and 2027

Figure 32: Europe Home Blood Pressure Monitoring Devices Market Attractiveness, by Product, 2019–2027

Figure 33: Europe Home Blood Pressure Monitoring Devices Market Value Share, by Distribution Channel, 2018 and 2027

Figure 34: Europe Home Blood Pressure Monitoring Devices Market Attractiveness, by Distribution Channel, 2019–2027

Figure 35: Asia Pacific Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 36: Asia Pacific Home Blood Pressure Monitoring Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 37: Asia Pacific Home Blood Pressure Monitoring Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 38: Asia Pacific Home Blood Pressure Monitoring Devices Market Value Share, by Product, 2018 and 2027

Figure 39: Asia Pacific Home Blood Pressure Monitoring Devices Market Attractiveness, by Product, 2019–2027

Figure 40: Asia Pacific Home Blood Pressure Monitoring Devices Market Value Share, by Distribution Channel, 2018 and 2027

Figure 41: Asia Pacific Home Blood Pressure Monitoring Devices Market Attractiveness, by Distribution Channel, 2019–2027

Figure 42: Latin America Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 43: Latin America Home Blood Pressure Monitoring Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 44: Latin America Home Blood Pressure Monitoring Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 45: Latin America Home Blood Pressure Monitoring Devices Market Value Share, by Product, 2018 and 2027

Figure 46: Latin America Home Blood Pressure Monitoring Devices Market Attractiveness, by Product, 2019–2027

Figure 47: Latin America Home Blood Pressure Monitoring Devices Market Value Share, by Distribution Channel, 2018 and 2027

Figure 48: Latin America Home Blood Pressure Monitoring Devices Market Attractiveness, by Distribution Channel, 2019–2027

Figure 49: Middle East & Africa Home Blood Pressure Monitoring Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 50: Middle East & Africa Home Blood Pressure Monitoring Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 51: Middle East & Africa Home Blood Pressure Monitoring Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 52: Middle East & Africa Home Blood Pressure Monitoring Devices Market Value Share, by Product, 2018 and 2027

Figure 53: Middle East & Africa Home Blood Pressure Monitoring Devices Market Attractiveness, by Product, 2019–2027

Figure 54: Middle East & Africa Home Blood Pressure Monitoring Devices Market Value Share, by Distribution Channel, 2018 and 2027

Figure 55: Middle East & Africa Home Blood Pressure Monitoring Devices Market Attractiveness, by Distribution Channel, 2019–2027

Figure 56: Global Home Blood Pressure Market Share Analysis, by Company, 2018