Reports

Reports

Analysts’ Viewpoint

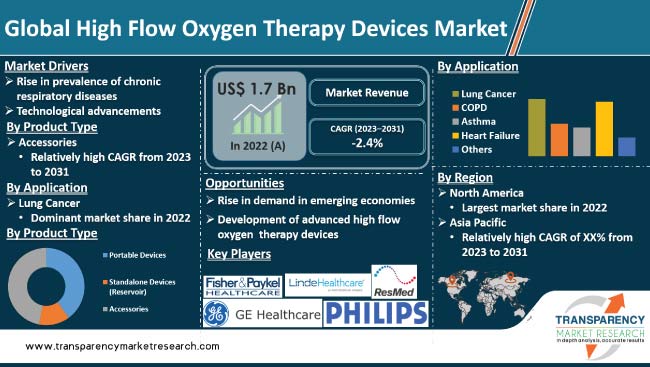

Rise in prevalence of chronic diseases is expected to augment the global high flow oxygen therapy devices market during the forecast period. High flow oxygen therapy device is a type of respiratory support that provides high flow of oxygen-enriched air to patients having difficulty in breathing. Technological advancements in high-flow oxygen therapy equipment, such as compact design, portability, and improved patient comfort features, are driving market growth.

R&D of new devices is likely to offer lucrative opportunities to market players. Leading companies are launching advanced devices in order to increase their high flow oxygen therapy devices market share. However, high cost, lack of trained healthcare personnel, and patient discomfort are anticipated to hamper market statistics during the forecast period.

High flow oxygen therapy is a medical treatment that involves delivery of supplemental oxygen to a patient through a device that increases the flow and humidity of the oxygen. This therapy is used to treat patients with chronic respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD), Interstitial Lung Disease (ILD), and bronchial asthma, as well as Acute Respiratory Distress Syndrome (ARDS). High flow oxygen therapy devices are available in two types: portable and standalone.

Increase in prevalence of chronic respiratory diseases is driving the global high flow oxygen therapy devices industry. Incidence of chronic respiratory diseases, such as COPD and asthma, is rising across the globe.

According to the World Health Organization (WHO), chronic respiratory disease was the third leading cause of death across the world in 2021. Around 65 million people globally have moderate to severe COPD.

Asthma affects an estimated 334 million people across the world, and the number is expected to increase in the next few years. Smoking is another significant factor driving the prevalence of chronic respiratory diseases. According to the WHO, tobacco smoking is the leading cause of COPD. It is also a major risk factor for the development of asthma. Furthermore, surge in usage of biomass fuels, such as wood and dung, for cooking and heating in low-income countries is boosting the prevalence of chronic respiratory diseases.

Innovations in design and functionality have made high flow oxygen therapy devices more user-friendly, portable, and efficient. Development of continuous flow systems is a key technological advancement that has accelerated market expansion. These systems provide constant flow of oxygen, which makes them ideal for patients with severe respiratory distress. Continuous flow systems have also been designed to be more compact and lightweight, and are ideal devices for usage in home-based healthcare and during transport.

Development of hybrid systems that combine high flow oxygen with non-invasive positive pressure ventilation (NIPPV) is another breakthrough technological advancement in the market. This combination allows for improved oxygenation and ventilation in patients with acute respiratory distress syndrome (ARDS), thereby reducing the risk of intubation and mechanical ventilation.

In terms of product type, the accessories segment held leading share of the global high flow oxygen therapy devices market in 2022. Rise in prevalence of chronic respiratory diseases is likely to drive the segment during the forecast period. Accessories of high flow oxygen therapy devices include nasal cannula and mask.

High flow nasal cannulas deliver heated and humidified oxygen to patient through a nasal cannula. These are designed to provide higher flow of oxygen than traditional humidified oxygen nasal cannulas and are used in the treatment of a range of respiratory conditions, including COPD, asthma, and pneumonia. Usage of high flow nasal cannulas has increased in the last few years due to their ability to deliver oxygen more efficiently and comfortably than traditional nasal cannulas.

High flow oxygen masks are used to treat patients with severe respiratory distress. They are often used in conjunction with non-invasive positive pressure ventilation (NIPPV). High flow oxygen masks have also become more popular in the past few years due to advancements in technology that have made these devices more user-friendly and efficient.

Based on application, the lung cancer segment is likely to account for major share of the global high flow oxygen therapy devices market during the forecast period. Lung cancer is the leading cause of cancer deaths worldwide, accounting for approximately one in four cancer deaths.

Increase in number of cases of lung cancer, rise in global population, and aging population are expected to drive the demand for lung cancer treatment. Additionally, advancements in treatment options, such as targeted therapy and immunotherapy, which have improved patient outcomes, are expected to bolster the segment in the next few years.

North America held the largest share of around 35.0% of the global high flow oxygen therapy devices market demand in 2022. The region is projected to be a highly lucrative market during the forecast period. North America's global dominance can be ascribed to the increase in incidence chronic diseases. The U.S. dominated the market in the region owing to factors such as presence of leading players and increase in research & development activities in high flow oxygen therapy devices.

Asia Pacific is projected to be the fastest growing market for high flow oxygen therapy devices during the forecast period. The market in the region is anticipated to expand at a high CAGR from 2022 to 2031 due to high incidence rate and increasing population.

The global high flow oxygen therapy devices market is fragmented, with the presence of large number of players. Expansion of product portfolio and mergers & acquisitions are key strategies adopted by the leading players.

GE HealthCare, Koninklijke Philips N.V, ResMed, Fisher & Paykel Healthcare, Hamilton Medical, Besmed Health Business Corp, Linde Healthcare, BMC Medical, Movair, and VYAIRE Medical are the prominent players operating in the market.

Each of these players has been profiled in the high flow oxygen therapy devices market report based on parameters such as company overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 1.7 Bn |

|

Forecast (Value) in 2031 |

More than US$ 1.4 Bn |

|

Growth Rate (CAGR) |

-2.4% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 1.7 Bn in 2022

It is projected to reach more than US$ 1.4 Bn by 2031

The CAGR is anticipated to be -2.4% from 2023 to 2031

Rise in prevalence of chronic diseases and technological advancements

North America is likely to account for leading share during the forecast period

GE HealthCare, Koninklijke Philips N.V, ResMed, Fisher & Paykel Healthcare, Hamilton Medical, Besmed Health Business Corp, Linde Healthcare, BMC Medical, Movair, and VYAIRE Medical

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global High Flow Oxygen Therapy Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global High Flow Oxygen Therapy Devices Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate Globally With Key Countries

5.3. Key Product/Brand Analysis

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global High Flow Oxygen Therapy Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Portable Devices

6.3.2. Standalone Devices (Reservoir)

6.3.3. Accessories

6.3.3.1. High-flow Nasal Cannula

6.3.3.2. High-flow Face Mask (HFFM)

6.3.3.3. Respiratory Humidifier

6.3.3.4. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global High Flow Oxygen Therapy Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Lung Cancer

7.3.2. COPD

7.3.3. Asthma

7.3.4. Heart Failure

7.3.5. Others

7.4. Market Attractiveness Analysis, by Application

8. Global High Flow Oxygen Therapy Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Specialty Clinics

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global High Flow Oxygen Therapy Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America High Flow Oxygen Therapy Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Portable Devices

10.2.2. Standalone Devices (Reservoir)

10.2.3. Accessories

10.2.3.1. High-flow Nasal Cannula

10.2.3.2. High-flow Face Mask (HFFM)

10.2.3.3. Respiratory Humidifier

10.2.3.4. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Lung Cancer

10.3.2. COPD

10.3.3. Asthma

10.3.4. Heart Failure

10.3.5. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Specialty Clinics

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe High Flow Oxygen Therapy Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Portable Devices

11.2.2. Standalone Devices (Reservoir)

11.2.3. Accessories

11.2.3.1. High-flow Nasal Cannula

11.2.3.2. High-flow Face Mask (HFFM)

11.2.3.3. Respiratory Humidifier

11.2.3.4. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Lung Cancer

11.3.2. COPD

11.3.3. Asthma

11.3.4. Heart Failure

11.3.5. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Specialty Clinics

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific High Flow Oxygen Therapy Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Portable Devices

12.2.2. Standalone Devices (Reservoir)

12.2.3. Accessories

12.2.3.1. High-flow Nasal Cannula

12.2.3.2. High-flow Face Mask (HFFM)

12.2.3.3. Respiratory Humidifier

12.2.3.4. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Lung Cancer

12.3.2. COPD

12.3.3. Asthma

12.3.4. Heart Failure

12.3.5. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Specialty Clinics

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America High Flow Oxygen Therapy Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Portable Devices

13.2.2. Standalone Devices (Reservoir)

13.2.3. Accessories

13.2.3.1. High-flow Nasal Cannula

13.2.3.2. High-flow Face Mask (HFFM)

13.2.3.3. Respiratory Humidifier

13.2.3.4. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Lung Cancer

13.3.2. COPD

13.3.3. Asthma

13.3.4. Heart Failure

13.3.5. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Specialty Clinics

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa High Flow Oxygen Therapy Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Portable Devices

14.2.2. Standalone Devices (Reservoir)

14.2.3. Accessories

14.2.3.1. High-flow Nasal Cannula

14.2.3.2. High-flow Face Mask (HFFM)

14.2.3.3. Respiratory Humidifier

14.2.3.4. Others

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Lung Cancer

14.3.2. COPD

14.3.3. Asthma

14.3.4. Heart Failure

14.3.5. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Specialty Clinics

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. GE HealthCare

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Koninklijke Philips N.V

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. ResMed

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Fisher & Paykel Healthcare

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Hamilton Medical

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.6. Besmed Health Business Corp

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.7. Linde Healthcare

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.8. BMC Medical

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.9. VYAIRE Medical

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.10. Movair

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

List of Tables

Table 01: Global High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: North America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Europe High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Asia Pacific High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 19: Latin America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Middle East & Africa High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global High Flow Oxygen Therapy Devices Market Value Share, by Product Type (2022)

Figure 03: Global High Flow Oxygen Therapy Devices Market Value Share, by End-user (2022)

Figure 04: Global High Flow Oxygen Therapy Devices Market Value Share, by Application (2022)

Figure 05: Global High Flow Oxygen Therapy Devices Market Value Share, by Region (2022)

Figure 06: Global High Flow Oxygen Therapy Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 07: Global High Flow Oxygen Therapy Devices Market Attractiveness, by Product Type, 2023–2031

Figure 08: Global High Flow Oxygen Therapy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 09: Global High Flow Oxygen Therapy Devices Market Attractiveness, by Application, 2023–2031

Figure 10: Global High Flow Oxygen Therapy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 11: Global High Flow Oxygen Therapy Devices Market Attractiveness, by End-user, 2023–2031

Figure 12: Global High Flow Oxygen Therapy Devices Market Value Share Analysis, by Region, 2022 and 2031

Figure 13: Global High Flow Oxygen Therapy Devices Market Attractiveness, by Region, 2022-2031

Figure 14: North America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 15: North America High Flow Oxygen Therapy Devices Market Value Share (%), by Country, 2022 and 2031

Figure 16: North America High Flow Oxygen Therapy Devices Market Attractiveness, by Country, 2023–2031

Figure 17: North America High Flow Oxygen Therapy Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 18: North America High Flow Oxygen Therapy Devices Market Attractiveness, by Product Type, 2023–2031

Figure 19: North America High Flow Oxygen Therapy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 20: North America High Flow Oxygen Therapy Devices Market Attractiveness, by Application, 2023–2031

Figure 21: North America High Flow Oxygen Therapy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 22: North America High Flow Oxygen Therapy Devices Market Attractiveness, by End-user, 2023–2031

Figure 23: Europe High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 24: Europe High Flow Oxygen Therapy Devices Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 25: Europe High Flow Oxygen Therapy Devices Market Attractiveness, by Country/Sub-region, 2023–2031

Figure 26: Europe High Flow Oxygen Therapy Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 27: Europe High Flow Oxygen Therapy Devices Market Attractiveness, by Product Type, 2023–2031

Figure 28: Europe High Flow Oxygen Therapy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 29: Europe High Flow Oxygen Therapy Devices Market Attractiveness, by Application, 2023–2031

Figure 30: Europe High Flow Oxygen Therapy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 31: Europe High Flow Oxygen Therapy Devices Market Attractiveness, by End-user, 2023–2031

Figure 32: Asia Pacific High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 33: Asia Pacific High Flow Oxygen Therapy Devices Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 34: Asia Pacific High Flow Oxygen Therapy Devices Market Attractiveness, by Country/Sub-region, 2023–2031

Figure 35: Asia Pacific High Flow Oxygen Therapy Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 36: Asia Pacific High Flow Oxygen Therapy Devices Market Attractiveness, by Product Type, 2023–2031

Figure 37: Asia Pacific High Flow Oxygen Therapy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 38: Asia Pacific High Flow Oxygen Therapy Devices Market Attractiveness, by Application, 2023–2031

Figure 39: Asia Pacific High Flow Oxygen Therapy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Asia Pacific High Flow Oxygen Therapy Devices Market Attractiveness, by End-user, 2023–2031

Figure 41: Latin America High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 42: Latin America High Flow Oxygen Therapy Devices Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 43: Latin America High Flow Oxygen Therapy Devices Market Attractiveness, by Country/Sub-region, 2023–2031

Figure 44: Latin America High Flow Oxygen Therapy Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 45: Latin America High Flow Oxygen Therapy Devices Market Attractiveness, by Product Type, 2023–2031

Figure 46: Latin America High Flow Oxygen Therapy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 47: Latin America High Flow Oxygen Therapy Devices Market Attractiveness, by Application, 2023–2031

Figure 48: Latin America High Flow Oxygen Therapy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 49: Latin America High Flow Oxygen Therapy Devices Market Attractiveness, by End-user, 2023–2031

Figure 50: Middle East & Africa High Flow Oxygen Therapy Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 51: Middle East & Africa High Flow Oxygen Therapy Devices Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 52: Middle East & Africa High Flow Oxygen Therapy Devices Market Attractiveness, by Country/Sub-region, 2023–2031

Figure 53: Middle East & Africa High Flow Oxygen Therapy Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 54: Middle East & Africa High Flow Oxygen Therapy Devices Market Attractiveness, by Product Type, 2023–2031

Figure 55: Middle East & Africa High Flow Oxygen Therapy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 56: Middle East & Africa High Flow Oxygen Therapy Devices Market Attractiveness, by Application, 2023–2031

Figure 57: Middle East & Africa High Flow Oxygen Therapy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 58: Middle East & Africa High Flow Oxygen Therapy Devices Market Attractiveness, by End-user, 2023–2031

Figure 59: Global High Flow Oxygen Therapy Devices Market Share Analysis, by Company, 2021