Reports

Reports

The push toward end-to-end healthcare information systems in every aspect of healthcare delivery is primarily being driven by the digitalization of all settings. Organizations are moving away from paper-based environments to electronic environments, not only to automate administrative functions, reduce inaccurate patient data through transcription errors, and streamline patient data access, but also due to the fact that international regulatory organizations are encouraging the use of electronic health records through reimbursement-based documentation policies.

Financial pressure is further driving organizations to adopt technologies that enhance revenue-cycle management, appointment management within clinical quality frameworks, and charge capture through automatic billing, especially for companies that provide service in-patient facilities. These technologies collectively support operational performance, increase patient throughput, and promote compliance with changing policies in health care.

Cost containment is also driving HIS platform deployment. Healthcare organizations are on the lookout for systems that decrease operational costs by automating duplicative work, reducing personnel overhead, and decreasing billing and coding errors.

Furthermore, the pressure toward interoperability standards, like those facilitating secure transfer of health data between disparate systems, invests in Health Information Exchanges (HIEs) and integration-friendly systems. Providers increasingly demand solutions allowing standardized data formats and messaging protocols to facilitate more efficient coordination between primary care, specialists, laboratory, and pharmacy.

Enhanced cybersecurity features and data protection-encryption, multi-factor authentication, audit trails, and overall security features are now more standard due to increased cyber threats. There's also a growing focus on patient engagement through telehealth portals and secure messaging, which supports remote access to services without the constraints of delivery and non-AI based customizable user experiences.

Companies in the HIS area are expanding capabilities through partnerships, modular suites, and open-architecture frameworks. Numerous companies are expanding their service ecosystem by providing interoperability toolkits and connectors into legacy systems and third-party applications for easier client system integration.

Many organizations are launching subscription services-models, which are scalable to their clients of various sizes, to build adoption with smaller clinics as well as larger hospital networks. Companies are actively investing in the user experience through customizable dashboards, workflows to ease clinician experience, and context-based alerting functionality.

Healthcare Information System (HIS) is an integrated system designed to manage, store, and disseminate healthcare information in a more efficient way. HIS includes medical, administrative, financial, and legal information in one unit and includes both - clinical and non-clinical functions. HIS reduces the burden of paperwork through the electronic documenting of a patient's records, treatment, billing, and resource usage. This organized process makes any information relevant to their work readily available to health workers and assists them in making well-reasoned, always informed, and time-sensitive decisions that improve patient care.

One of the key components of HIS is the Electronic Health Record (EHR) system. It stores patient information about medical and surgical histories, laboratory tests and diagnosis, and treatment protocols, among others. In addition to EHRs, HIS includes Laboratory Information Systems, Radiology Information Systems, Pharmacy Management systems, and the other information systems to create one integrated entity.

Beyond clinical functions, HIS also has administrative applications aimed at improving scheduling, billing, and inventory organization. There could be improvements in administrative efficiency with the implementation of automated systems that reduce human error and cut down on wasted time, allowing for refined efficiencies to be implemented in hospitals and clinics.

HIS also improves communication between healthcare providers and patients through patient portals, secure messaging, and mobile access. HIS meets the criteria for secure data security while they increase access to individual patients. In conclusion, healthcare information systems benefit healthcare delivery systems as they combine the advantages of technology, efficiency, and patient-centered care.

| Attribute | Detail |

|---|---|

|

Healthcare Information System Market Drivers |

|

Artificial Intelligence (AI) and Machine Learning (ML) implementation in healthcare information systems has been a driving force behind business growth by improving decision-making and clinical accuracy. The applications allow for sophisticated data analysis, transforming raw health data into actionable knowledge. AI-powered HIS assists doctors with early diagnosis and treatment planning, improved patient outcomes, and medical error avoidance through the automation of pattern detection and disease risk estimation.

AI and ML also mechanize administrative functions in HIS, reducing time-consuming manual labor. Smart algorithms maximize scheduling, billing, and resource allocation to improve the efficiency of operations in health care organizations.

Personalized medicine is another realm wherein the incorporation of AI and ML influences the HIS development. In predictive analytics, machine learning models are used to analyze a patients' history, genetic data, and lifestyle, to suggest a personalized treatment plan. HIS platforms with AI tools are also poised to increase patient engagement through virtual assistants, chatbot interactions, and suggestive predictive reminders meant to build adherence to therapies and follow-ups.

The global crisis of long-term diseases (such as diabetes, cardiovascular disease, cancer, and respiratory diseases) has created a demand for sophisticated healthcare information system market. In the process of treating long-term conditions, there is a significant quantity of repetitious monitoring, multi-faceted diagnostic investigations, and timely intervention; all producing great volumes of patient data.

HIS technology offers a centralized hub to save, categorize, and analyze the information, allowing physicians to monitor improvement in patients and adjust treatment accordingly.

It is collaboration of more than one health provider such as labs, specialists, and pharmacies to manage chronic disease. HIS enables the free flow of communication and information sharing between providers to enable them to have accurate and up-to-date information throughout the continuum of care.

This flow of information facilitates the avoidance of duplicate testing, mitigate flaws within the work process and supports evidence-based decision making with the ultimate goal of providing superior patient outcomes for patients that were suffering from long-term diseases.

Patient engagement is important for chronic disease management. HIS addresses this need through patient portals, reminders, and telehealth services. HIS can allow the patient to actively participate in management of their own health - .For instance, by allowing the patient to view their health information, schedule appointments or follow-up appointments, and/or track medication regimens.

Such outcomes may lessen instances of hospital readmissions and the other adverse events. Many conditions require continued monitoring of patients for life, and HIS can also be instrumental in maintaining patient engagement in the monitoring process long term, and supporting adherence.

Additionally, HIS supports population health management by providing the ability to identify prevalence trends for chronic disease burden across the community. Predictive analytics tools let healthcare organizations plan for chronic disease strategies proactively, identify necessary resources and resources allocation, and ultimately reduce overall costs associated with care for chronic disease. Given that chronic diseases represent a persistent global healthcare burden, it’s expected that demand for newer HIS technologies will only grow and expand the market with increasing efficiency, coordination, and patient-centric care.

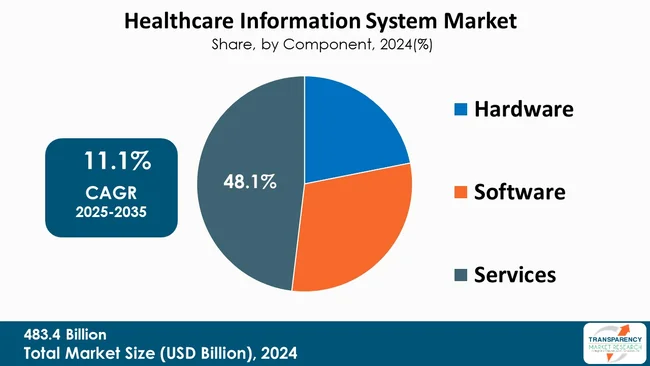

The services segment dominates the healthcare information system market as healthcare providers rely heavily on services for the implementation, maintenance, training. HIS systems are complicated and require trained staff to properly integrate within an existing infrastructure. The staff requires ongoing technical support and active management of their HIS data at all times, and providers must maintain compliance to dynamic regulatory frameworks. This reliance on services increases demand for services instead of products.

The shift toward cloud-based solutions and interoperability has significantly increased demand for continual monitoring of, and upgrades to, data security, in addition to demand for oversight of data security. Service providers work further to ensure HIS is customized, scalable, and functions well to allow healthcare organizations to continue to provide patient care.

| Attribute | Detail |

|---|---|

|

Leading Region |

|

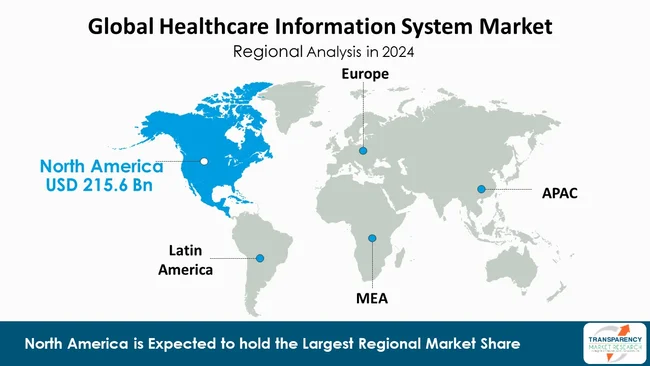

As per the latest healthcare information system market analysis, North America dominated in 2024. This is due to their fully developed healthcare systems, technology adoption, and government policies. Regulations such as the HITECH Act, and regulations related to EHR promotion have sped the adoption of HIS as a standard of practice across all hospitals and clinics. North America benefits from high healthcare spend and strong adoption of new technologies early.

North America has well-developed technology providers, interoperability standards, and a large focus on security compliance on their regulations.

The companies leading the healthcare information system market are focused on developing cloud-based solutions while improving interoperability and offering their products in a modular platform. These market players are actively engaging in partnerships and collaborations and continuously upgrading patient engagement tools and proactively managing data cyber-security. Additionally, they are providing subscription-based pricing packages with continuous developments and upgrades to ensure scale, cost effectiveness, and widespread market uptake from all different healthcare settings.

GE HealthCare, Siemens Healthineers AG, IQVIA, InterSystems Corporation, Medical Information Technology, Inc., Oracle, Veradigm LLC, Koninklijke Philips N.V., Keycentrix, LLC, Athenahealth, Inc., Agfa-Gevaert Group, Orion Health, NEXUS AG, Carestream Health, Epic Systems Corporation, and McKesson Corporation are some of the leading players operating in the global healthcare information system market.

Each of these players has been profiled in the healthcare information system market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

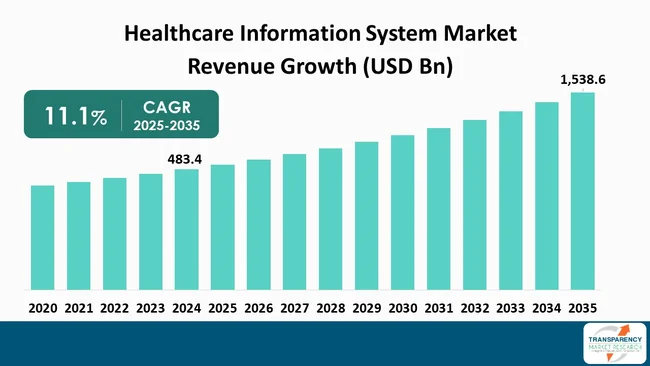

| Size in 2024 | US$ 483.4 Bn |

| Forecast Value in 2035 | US$ 1,538.6 Bn |

| CAGR | 11.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global healthcare information system market was valued at US$ 483.4 Bn in 2024

The global healthcare information system industry is projected to reach more than US$ 1,538.6 Bn by the end of 2035

Favorable government initiatives and regulations, rise of telemedicine and remote patient monitoring, increasing emphasis on cybersecurity, and rising prevalence of chronic diseases are some of the factors driving the expansion of healthcare information system market.

The CAGR is anticipated to be 11.1% from 2025 to 2035

GE HealthCare, Siemens Healthineers AG, IQVIA, InterSystems Corporation, Medical Information Technology, Inc., Oracle, Veradigm LLC, Koninklijke Philips N.V., Keycentrix, LLC, Athenahealth, Inc., Agfa-Gevaert Group, Orion Health, NEXUS AG, Carestream Health, Epic Systems Corporation, and McKesson Corporation

Table 01: Global Healthcare Information System Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 02: Global Healthcare Information System Market Value (US$ Bn) Forecast, By Deployment Type, 2020 to 2035

Table 03: Global Healthcare Information System Market Value (US$ Bn) Forecast, By Hospital Information System, 2020 to 2035

Table 04: Global Healthcare Information System Market Value (US$ Bn) Forecast, By Pharmacy Automation System, 2020 to 2035

Table 05: Global Healthcare Information System Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Healthcare Information System Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Healthcare Information System Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Healthcare Information System Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Healthcare Information System Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 10: North America Healthcare Information System Market Value (US$ Bn) Forecast, By Deployment Type, 2020 to 2035

Table 11: North America Healthcare Information System Market Value (US$ Bn) Forecast, By Hospital Information System, 2020 to 2035

Table 12: North America Healthcare Information System Market Value (US$ Bn) Forecast, By Pharmacy Automation System, 2020 to 2035

Table 13: North America Healthcare Information System Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 14: North America Healthcare Information System Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 15: Europe Healthcare Information System Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 16: Europe Healthcare Information System Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 17: Europe Healthcare Information System Market Value (US$ Bn) Forecast, By Deployment Type, 2020 to 2035

Table 18: Europe Healthcare Information System Market Value (US$ Bn) Forecast, By Hospital Information System, 2020 to 2035

Table 19: Europe Healthcare Information System Market Value (US$ Bn) Forecast, By Pharmacy Automation System, 2020 to 2035

Table 20: Europe Healthcare Information System Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 21: Europe Healthcare Information System Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 22: Asia Pacific Healthcare Information System Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 23: Asia Pacific Healthcare Information System Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 24: Asia Pacific Healthcare Information System Market Value (US$ Bn) Forecast, By Deployment Type, 2020 to 2035

Table 25: Asia Pacific Healthcare Information System Market Value (US$ Bn) Forecast, By Hospital Information System, 2020 to 2035

Table 26: Asia Pacific Healthcare Information System Market Value (US$ Bn) Forecast, By Pharmacy Automation System, 2020 to 2035

Table 27: Asia Pacific Healthcare Information System Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 28: Asia Pacific Healthcare Information System Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 29: Latin America Healthcare Information System Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 30: Latin America Healthcare Information System Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 31: Latin America Healthcare Information System Market Value (US$ Bn) Forecast, By Deployment Type, 2020 to 2035

Table 32: Latin America Healthcare Information System Market Value (US$ Bn) Forecast, By Hospital Information System, 2020 to 2035

Table 33: Latin America Healthcare Information System Market Value (US$ Bn) Forecast, By Pharmacy Automation System, 2020 to 2035

Table 34: Latin America Healthcare Information System Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 35: Latin America Healthcare Information System Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 36: Middle East & Africa Healthcare Information System Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 37: Middle East & Africa Healthcare Information System Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 38: Middle East & Africa Healthcare Information System Market Value (US$ Bn) Forecast, By Deployment Type, 2020 to 2035

Table 39: Middle East & Africa Healthcare Information System Market Value (US$ Bn) Forecast, By Hospital Information System, 2020 to 2035

Table 40: Middle East & Africa Healthcare Information System Market Value (US$ Bn) Forecast, By Pharmacy Automation System, 2020 to 2035

Table 41: Middle East & Africa Healthcare Information System Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 42: Middle East & Africa Healthcare Information System Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Healthcare Information System Market Value Share Analysis, By Component, 2024 and 2035

Figure 02: Global Healthcare Information System Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 03: Global Healthcare Information System Market Revenue (US$ Bn), by Hardware, 2020 to 2035

Figure 04: Global Healthcare Information System Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 05: Global Healthcare Information System Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 06: Global Healthcare Information System Market Value Share Analysis, By Deployment Type, 2024 and 2035

Figure 07: Global Healthcare Information System Market Attractiveness Analysis, By Deployment Type, 2025 to 2035

Figure 08: Global Healthcare Information System Market Revenue (US$ Bn), by Web Based, 2020 to 2035

Figure 09: Global Healthcare Information System Market Revenue (US$ Bn), by On-premise, 2020 to 2035

Figure 10: Global Healthcare Information System Market Revenue (US$ Bn), by Cloud Based / SaaS, 2020 to 2035

Figure 11: Global Healthcare Information System Market Value Share Analysis, By Application, 2024 and 2035

Figure 12: Global Healthcare Information System Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 13: Global Healthcare Information System Market Revenue (US$ Bn), by Hospital Information System, 2020 to 2035

Figure 14: Global Healthcare Information System Market Revenue (US$ Bn), by Pharmacy Automation System, 2020 to 2035

Figure 15: Global Healthcare Information System Market Revenue (US$ Bn), by Laboratory Information System, 2020 to 2035

Figure 16: Global Healthcare Information System Market Revenue (US$ Bn), by Revenue Cycle Management, 2020 to 2035

Figure 17: Global Healthcare Information System Market Revenue (US$ Bn), by Medical Imaging Information System, 2020 to 2035

Figure 18: Global Healthcare Information System Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Healthcare Information System Market Value Share Analysis, By End-user, 2024 and 2035

Figure 20: Global Healthcare Information System Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 21: Global Healthcare Information System Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 22: Global Healthcare Information System Market Revenue (US$ Bn), by Diagnostic Centers, 2020 to 2035

Figure 23: Global Healthcare Information System Market Revenue (US$ Bn), by Research & Academic Institutions, 2020 to 2035

Figure 24: Global Healthcare Information System Market Revenue (US$ Bn), by Pharmacies, 2020 to 2035

Figure 25: Global Healthcare Information System Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 26: Global Healthcare Information System Market Value Share Analysis, By Region, 2024 and 2035

Figure 27: Global Healthcare Information System Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 28: North America Healthcare Information System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: North America Healthcare Information System Market Value Share Analysis, by Country, 2024 and 2035

Figure 30: North America Healthcare Information System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 31: North America Healthcare Information System Market Value Share Analysis, By Component, 2024 and 2035

Figure 32: North America Healthcare Information System Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 33: North America Healthcare Information System Market Value Share Analysis, By Deployment Type, 2024 and 2035

Figure 34: North America Healthcare Information System Market Attractiveness Analysis, By Deployment Type, 2025 to 2035

Figure 35: North America Healthcare Information System Market Value Share Analysis, By Application, 2024 and 2035

Figure 36: North America Healthcare Information System Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 37: North America Healthcare Information System Market Value Share Analysis, By End-user, 2024 and 2035

Figure 38: North America Healthcare Information System Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 39: Europe Healthcare Information System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Europe Healthcare Information System Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 41: Europe Healthcare Information System Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 42: Europe Healthcare Information System Market Value Share Analysis, By Component, 2024 and 2035

Figure 43: Europe Healthcare Information System Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 44: Europe Healthcare Information System Market Value Share Analysis, By Deployment Type, 2024 and 2035

Figure 45: Europe Healthcare Information System Market Attractiveness Analysis, By Deployment Type, 2025 to 2035

Figure 46: Europe Healthcare Information System Market Value Share Analysis, By Application, 2024 and 2035

Figure 47: Europe Healthcare Information System Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 48: Europe Healthcare Information System Market Value Share Analysis, By End-user, 2024 and 2035

Figure 49: Europe Healthcare Information System Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 50: Asia Pacific Healthcare Information System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: Asia Pacific Healthcare Information System Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 52: Asia Pacific Healthcare Information System Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 53: Asia Pacific Healthcare Information System Market Value Share Analysis, By Component, 2024 and 2035

Figure 54: Asia Pacific Healthcare Information System Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 55: Asia Pacific Healthcare Information System Market Value Share Analysis, By Deployment Type, 2024 and 2035

Figure 56: Asia Pacific Healthcare Information System Market Attractiveness Analysis, By Deployment Type, 2025 to 2035

Figure 57: Asia Pacific Healthcare Information System Market Value Share Analysis, By Application, 2024 and 2035

Figure 58: Asia Pacific Healthcare Information System Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 59: Asia Pacific Healthcare Information System Market Value Share Analysis, By End-user, 2024 and 2035

Figure 60: Asia Pacific Healthcare Information System Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 61: Latin America Healthcare Information System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Latin America Healthcare Information System Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 63: Latin America Healthcare Information System Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 64: Latin America Healthcare Information System Market Value Share Analysis, By Component, 2024 and 2035

Figure 65: Latin America Healthcare Information System Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 66: Latin America Healthcare Information System Market Value Share Analysis, By Deployment Type, 2024 and 2035

Figure 67: Latin America Healthcare Information System Market Attractiveness Analysis, By Deployment Type, 2025 to 2035

Figure 68: Latin America Healthcare Information System Market Value Share Analysis, By Application, 2024 and 2035

Figure 69: Latin America Healthcare Information System Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 70: Latin America Healthcare Information System Market Value Share Analysis, By End-user, 2024 and 2035

Figure 71: Latin America Healthcare Information System Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 72: Middle East & Africa Healthcare Information System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 73: Middle East & Africa Healthcare Information System Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 74: Middle East & Africa Healthcare Information System Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 75: Middle East & Africa Healthcare Information System Market Value Share Analysis, By Component, 2024 and 2035

Figure 76: Middle East & Africa Healthcare Information System Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 77: Middle East & Africa Healthcare Information System Market Value Share Analysis, By Deployment Type, 2024 and 2035

Figure 78: Middle East & Africa Healthcare Information System Market Attractiveness Analysis, By Deployment Type, 2025 to 2035

Figure 79: Middle East & Africa Healthcare Information System Market Value Share Analysis, By Application, 2024 and 2035

Figure 80: Middle East & Africa Healthcare Information System Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 81: Middle East & Africa Healthcare Information System Market Value Share Analysis, By End-user, 2024 and 2035

Figure 82: Middle East & Africa Healthcare Information System Market Attractiveness Analysis, By End-user, 2025 to 2035