Reports

Reports

The green ammonia market is gaining strong momentum, fueled by the global push for decarbonization, increased reliance on renewable hydrogen, and strong interest in renewable energy systems across many sectors, including fertilizers, energy storage, marine fuel, end use in power generation, etc.

The green ammonia production process generally uses renewable powered electrolysis to produce hydrogen and then ammonia is produced by decarbonized nitrogen and hydrogen using Haber-Bosch method to produce carbon free ammonia. This route avoids the excessive emissions associated with traditional ammonia production and makes the case of green ammonia as an important part of the energy transition pathway.

Green ammonia is emerging to not only have an established market as fertilizers, but also to have a critical path in clean shipping, substitution as industrial feedstock, and renewable energy systems as large-scale energy storage. The major companies in the industry and governments are accelerating this movement with investment through collaboration in partnerships, pilot plants and multi-billion dollar infrastructure investments.

Projects such as these are taking shape in Europe, Asia Pacific, Middle East and Africa, and Latin America aim to commercialize their technologies on a large-scale through collaborative efforts across areas in both energy, chemical companies, and renewable developers as elements of a scalable and sustainable green ammonia economy.

Green ammonia is a carbon-free ammonia that is produced from renewable energy using modern hydrogen generation from water through the electrolysis of water that is driven by renewable energy. In this process, hydrogen is generated from water with no associated carbon emissions. This hydrogen is then combined with nitrogen from the atmosphere using the Haber-Bosch process for producing ammonia.

Green ammonia is a carbon-free, sustainable, and climate friendly alternative that finds uses in a number of applications ranging from its role as a key input in fertilizer production to a clean energy carrier, ship fuel for zero-emission shipping, and as a solution for large-scale energy storage. Green ammonia is emerging as a low-carbon economy corner stone enabling industries to decarbonize key operations in their organizations.

| Attribute | Detail |

|---|---|

| Drivers |

|

The fertilizer sector is the largest consuming sector of ammonia globally, with over 60% of ammonia produced worldwide used as a nitrogen based fertilizer. Traditional methods of producing ammonia, through Haber-Bosch ammonia manufacturing, are witnessed as highly carbon intensive responsible for almost 1 to 2% of total global CO₂ emissions. Sustainability needs to become a pillar of agriculture practices and as agricultural production systems are required to transition to low-carbon input agriculture, soil health and productivity, they contribute to climate change and make it necessary to fully consider the carbon footprint of agricultural inputs.

Green ammonia that is produced using renewable sourced electricity to produce hydrogen gas through the process of electrolysis means that natural gas is no longer needed in the production of green ammonia and we are further displacing emissions. The evolution of machinery and technology provide an opportunity to eliminate carbon and decarbonize the entire fertilizer supply chain with agriculture's adoption of commitments to climate strategies being seen across the globe in both developed and developing countries.

Governments, agribusiness owners, and social consciousness around sustainable operations in permaculture and farming have increased within the ecosystem. Major fertilizer companies have made commitments to measurable carbon reductions and partnered with renewable providers to help transition to generate green ammonia.

Countries like India, Brazil, and the U.S. where agriculture is counted as part of their economies have also begun to explore pilot projects and invest in green ammonia for fertilizer applications. This shift in approach is aligning with commitments made to support policy adoption that support limiting emissions for agricultural inputs alongside the increased social license provided to engage with other shift to market changes by the bigger fertilizer companies on the conversation mentioned.

Additionally, the increasing global population is expected to drive greater food demand in the decades to come, and will require more food production via fertilizers. Traditional ammonia is going to have sustainability challenges, and green ammonia has the benefit of increasing agricultural output and meeting environmental obligations. There is increasing demand for sustainable food production and because of stakeholders encouraging decarbonization up and down the value chain, the fertilizer industry is projected to be one of the significant demand sources for green ammonia in the short to medium term.

The rapid growth of renewable energy infrastructure has become one of the catalysts to the commercialization of the green ammonia market. Green ammonia production needs substantial renewable electricity for electrolysis, which provides the green hydrogen needed for combining with nitrogen to create ammonia. As such, the amount and cost of renewable energy will directly impact any green ammonia project.

With annual investment into solar and wind committing billions more than ever before, the availability of cheap, clean electricity is improving significantly. The production cost of green ammonia is approximately US$ 800 per ton in 2024; which is anticipated to decline by nearly 50% by 2035, driven by technological advancements and economies of scale.

Governments and investors are driving capital flows into integrated projects that combine renewable energy generation with ammonia production and green hydrogen. Countries with abundant solar and wind capacity such as Australia, Chile, and Saudi Arabia, are positioning themselves as the major green ammonia exporters by leveraging their renewable resources not just for improved domestic decarbonization but also becoming future suppliers to the energy-importing economies (e.g., Japan and South Korea).

The combination of policy structures, subsidies, and carbon neutrality commitments are removing investment risk and stimulating non-financial partnerships among energy producers, fertilizer firms, and shipping firms. These partnerships illustrate the ways renewable energy infrastructure development is translating into international trade opportunities for green ammonia.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 74.4 Mn |

| Market Forecast Value in 2035 | US$ 13,175 Mn |

| Growth Rate (CAGR) | 60.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Green Ammonia market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Energy Source

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The green ammonia market was valued at US$ 74.4 Mn in 2024

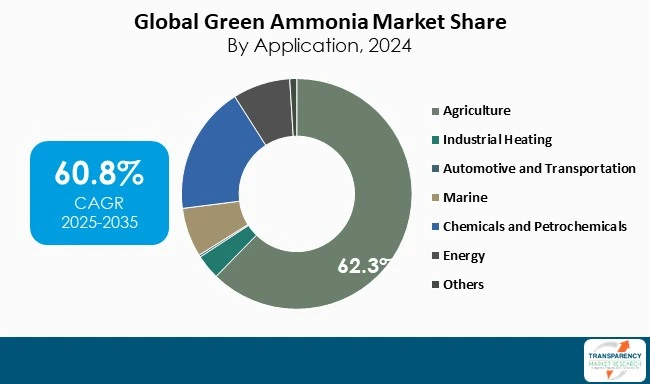

The green ammonia industry is expected to grow at a CAGR of 60.8% from 2025 to 2035

Rising demand for decarbonized fertilizer production and growing investments in renewable energy infrastructure.

Alkaline Water Electrolysis (AWE) was the largest process segment and its value is anticipated to grow at a CAGR of 62.7% during the forecast period

Europe was the most lucrative region in 2024

ACME Group, CF Industries, Kenya Nut Company, Stamicarbon, Iberdrola, S.A., Siemens Energy, Yara International ASA, Fraunhofer IGB, Unigel, KBR Inc., First Ammonia, Starfire Energy, ENGIE, Uniper SE, Greenko Group, Allied Green Ammonia Pty Ltd are the major players in the green ammonia market

Table 1 Global Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 2 Global Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 3 Global Green Ammonia Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 4 Global Green Ammonia Market Value (US$ Mn) Forecast, by Technology 2020 to 2035

Table 5 Global Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 6 Global Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 7 Global Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 8 Global Green Ammonia Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 9 Global Green Ammonia Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 10 Global Green Ammonia Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 11 North America Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 12 North America Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 13 North America Green Ammonia Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 14 North America Green Ammonia Market Value (US$ Mn) Forecast, by Technology 2020 to 2035

Table 15 North America Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 16 North America Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 17 North America Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 18 North America Green Ammonia Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 19 North America Green Ammonia Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 20 North America Green Ammonia Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 21 U.S. Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 22 U.S. Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 23 U.S. Green Ammonia Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 24 U.S. Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 25 U.S. Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 U.S. Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 27 U.S. Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 U.S. Green Ammonia Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 29 Canada Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 30 Canada Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 31 Canada Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 32 Canada Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 33 Canada Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 34 Canada Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 35 Canada Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 36 Canada Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 37 Europe Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 38 Europe Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 39 Europe Green Ammonia Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 40 Europe Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 41 Europe Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Europe Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 43 Europe Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Europe Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 45 Europe Green Ammonia Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 46 Europe Green Ammonia Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 47 Germany Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 48 Germany Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 49 Germany Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 50 Germany Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 51 Germany Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Germany Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 53 Germany Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Germany Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 55 France Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 56 France Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 57 France Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 58 France Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 59 France Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 60 France Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 61 France Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 62 France Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 63 U.K. Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 64 U.K. Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 65 U.K. Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 66 U.K. Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 67 U.K. Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 68 U.K. Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 69 U.K. Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 70 U.K. Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 71 Italy Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 72 Italy Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 73 Italy Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 74 Italy Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 75 Italy Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Italy Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 77 Italy Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Italy Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 79 Spain Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 80 Spain Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 81 Spain Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 82 Spain Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 83 Spain Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 Spain Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 85 Spain Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 Spain Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 87 Russia & CIS Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 88 Russia & CIS Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 89 Russia & CIS Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 90 Russia & CIS Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 91 Russia & CIS Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 92 Russia & CIS Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 93 Russia & CIS Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 94 Russia & CIS Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 95 Rest of Europe Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 96 Rest of Europe Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 97 Rest of Europe Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 98 Rest of Europe Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 99 Rest of Europe Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 100 Rest of Europe Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 101 Rest of Europe Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 102 Rest of Europe Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 103 Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 104 Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 105 Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 106 Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 107 Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 108 Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 109 Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 110 Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 111 Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 112 Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 113 China Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 114 China Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source 2020 to 2035

Table 115 China Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 116 China Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 117 China Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 118 China Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 119 China Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 120 China Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 121 Japan Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 122 Japan Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 123 Japan Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 124 Japan Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 125 Japan Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 126 Japan Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 127 Japan Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 128 Japan Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 129 India Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 130 India Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 131 India Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 132 India Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 133 India Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 India Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 135 India Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 India Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 137 ASEAN Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 138 ASEAN Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 139 ASEAN Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 140 ASEAN Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 141 ASEAN Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 ASEAN Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 143 ASEAN Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 ASEAN Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 145 Rest of Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 146 Rest of Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 147 Rest of Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 148 Rest of Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 149 Rest of Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 150 Rest of Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 151 Rest of Asia Pacific Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 152 Rest of Asia Pacific Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 153 Latin America Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 154 Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 155 Latin America Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 156 Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 157 Latin America Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 158 Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 159 Latin America Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 160 Latin America Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 161 Latin America Green Ammonia Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 162 Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 163 Brazil Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 164 Brazil Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 165 Brazil Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 166 Brazil Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 167 Brazil Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Brazil Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 169 Brazil Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Brazil Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 171 Mexico Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 172 Mexico Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 173 Mexico Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 174 Mexico Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 175 Mexico Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 Mexico Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 177 Mexico Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 Mexico Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Latin America Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 180 Rest of Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 181 Rest of Latin America Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 182 Rest of Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 183 Rest of Latin America Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 184 Rest of Latin America Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 185 Rest of Latin America Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 186 Rest of Latin America Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 187 Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 188 Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 189 Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 190 Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 191 Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 192 Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 193 Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 194 Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 195 Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 196 Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 197 GCC Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 198 GCC Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 199 GCC Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 200 GCC Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 201 GCC Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 202 GCC Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 203 GCC Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 204 GCC Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 205 South Africa Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 206 South Africa Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 207 South Africa Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 208 South Africa Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 209 South Africa Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 210 South Africa Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 211 South Africa Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 212 South Africa Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by Energy Source, 2020 to 2035

Table 214 Rest of Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Energy Source, 2020 to 2035

Table 215 Rest of Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 216 Rest of Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 217 Rest of Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Rest of Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 219 Rest of Middle East & Africa Green Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Rest of Middle East & Africa Green Ammonia Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Figure 1 Global Green Ammonia Market Volume Share Analysis, by Energy Source, 2024, 2028, and 2035

Figure 2 Global Green Ammonia Market Attractiveness, by Energy Source

Figure 3 Global Green Ammonia Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 4 Global Green Ammonia Market Attractiveness, by Technology

Figure 5 Global Green Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Global Green Ammonia Market Attractiveness, by Application

Figure 7 Global Green Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 Global Green Ammonia Market Attractiveness, by End-use

Figure 9 Global Green Ammonia Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 Global Green Ammonia Market Attractiveness, by Region

Figure 11 North America Green Ammonia Market Volume Share Analysis, by Energy Source, 2024, 2028, and 2035

Figure 12 North America Green Ammonia Market Attractiveness, by Energy Source

Figure 13 North America Green Ammonia Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 14 North America Green Ammonia Market Attractiveness, by Technology

Figure 15 North America Green Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 16 North America Green Ammonia Market Attractiveness, by Application

Figure 17 North America Green Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 18 North America Green Ammonia Market Attractiveness, by End-use

Figure 19 North America Green Ammonia Market Attractiveness, by Country and Sub-region

Figure 20 Europe Green Ammonia Market Volume Share Analysis, by Energy Source, 2024, 2028, and 2035

Figure 21 Europe Green Ammonia Market Attractiveness, by Energy Source

Figure 22 Europe Green Ammonia Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 23 Europe Green Ammonia Market Attractiveness, by Technology

Figure 24 Europe Green Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 25 Europe Green Ammonia Market Attractiveness, by Application

Figure 26 Europe Green Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 27 Europe Green Ammonia Market Attractiveness, by End-use

Figure 28 Europe Green Ammonia Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 29 Europe Green Ammonia Market Attractiveness, by Country and Sub-region

Figure 30 Asia Pacific Green Ammonia Market Volume Share Analysis, by Energy Source, 2024, 2028, and 2035

Figure 31 Asia Pacific Green Ammonia Market Attractiveness, by Energy Source

Figure 32 Asia Pacific Green Ammonia Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 33 Asia Pacific Green Ammonia Market Attractiveness, by Technology

Figure 34 Asia Pacific Green Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 35 Asia Pacific Green Ammonia Market Attractiveness, by Application

Figure 36 Asia Pacific Green Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 37 Asia Pacific Green Ammonia Market Attractiveness, by End-use

Figure 38 Asia Pacific Green Ammonia Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 39 Asia Pacific Green Ammonia Market Attractiveness, by Country and Sub-region

Figure 40 Latin America Green Ammonia Market Volume Share Analysis, by Energy Source, 2024, 2028, and 2035

Figure 41 Latin America Green Ammonia Market Attractiveness, by Energy Source

Figure 42 Latin America Green Ammonia Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 43 Latin America Green Ammonia Market Attractiveness, by Technology

Figure 44 Latin America Green Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 45 Latin America Green Ammonia Market Attractiveness, by Application

Figure 46 Latin America Green Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 47 Latin America Green Ammonia Market Attractiveness, by End-use

Figure 48 Latin America Green Ammonia Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 49 Latin America Green Ammonia Market Attractiveness, by Country and Sub-region

Figure 50 Middle East & Africa Green Ammonia Market Volume Share Analysis, by Energy Source, 2024, 2028, and 2035

Figure 51 Middle East & Africa Green Ammonia Market Attractiveness, by Energy Source

Figure 52 Middle East & Africa Green Ammonia Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 53 Middle East & Africa Green Ammonia Market Attractiveness, by Technology

Figure 54 Middle East & Africa Green Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 55 Middle East & Africa Green Ammonia Market Attractiveness, by Application

Figure 56 Middle East & Africa Green Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 57 Middle East & Africa Green Ammonia Market Attractiveness, by End-use

Figure 58 Middle East & Africa Green Ammonia Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 59 Middle East & Africa Green Ammonia Market Attractiveness, by Country and Sub-region