Reports

Reports

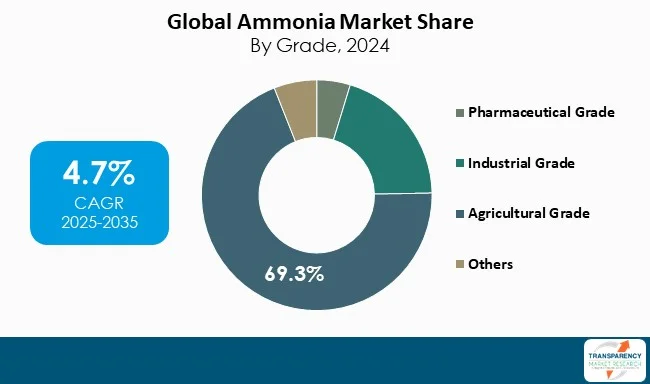

The ammonia market is likely to witness a CAGR of 4.7% during the forecast period owing to increasing demand from the agriculture sector. Nearly 70% of ammonia produced worldwide is consumed by the agriculture sector. As a primary feedstock of nitrogen-based fertilizers, ammonia has a big role in food security worldwide. There is a growing potential for ammonia as a safer hydrogen carrier.

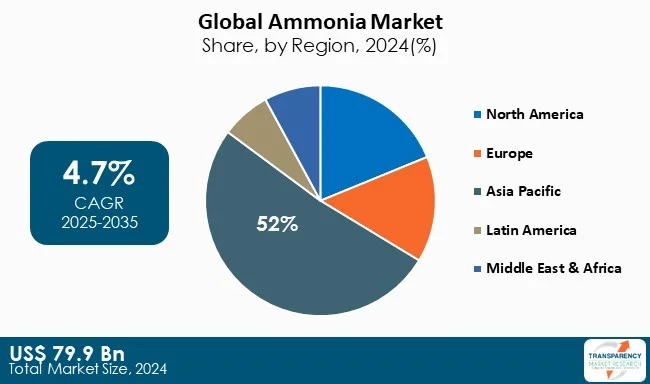

Ammonia provides efficient storage and transportation of hydrogen as it possesses better energy density when compared to liquid hydrogen. Many economies and players are investing in green ammonia projects around the world. Ammonia has industrial applications such as in the manufacturing of explosives, synthetic resins, fibers, and plastics. Agriculture grade of ammonia has higher demand in comparison with the other grades. Asia Pacific leads the global ammonium market due to the presence of large ammonium producing countries such as China and India.

Ammonia (NH₃) is a colorless, pungent gas composed of nitrogen and hydrogen. It is valuable to numerous industries due to its adaptability and economic value. It is among the most highly manufactured inorganic chemicals at a global level and an important feedstock for fertilizers, chemicals, and energy applications. Due to the quantity of ammonia's production and consumption, the strategic importance of ammonia is familiar well beyond crop production to clean energy sources.

The major advantage ammonia provides is food security to the world. Ammonia is utilized in almost 70% of the production of fertilizers such as urea, ammonium nitrate, and ammonium sulfate, which provide plant and soil fertility. Apart from agriculture, ammonia’s industrial uses include plastics and fibers, explosives, and synthetic resins. Due to its use as a refrigerant, ammonia also provides a cheap and eco-friendly solution for industrial cooling needs. In addition to its traditional applications, ammonia is becoming popular in the energy sector as a potential hydrogen carrier and carbon-free fuel, opening up new opportunities in the shift toward cleaner forms of energy systems.

| Attribute | Detail |

|---|---|

| Ammonia Market Drivers |

|

One of the most important drivers to the global ammonia market is increasing demand for fertilizers to produce sufficient food for a growing population and its food security. Ammonia is the basic feedstock for nitrogen-based fertilizers including urea, ammonium nitrate, and ammonium sulfate that collectively constitute about 70% of global ammonia demand.

As per the Food and Agriculture Organization (FAO), the global population is expected to reach 9.7 billion by 2050, which means that food production will have to grow by about 60% over the baseline quantity, which was estimated by FAO to be approximately 2.5 Billion metric tons in 2010. This provides a significant driver regarding demand for ammonia-based fertilizers to produce higher crop yields and maximize use of arable land. For example, the International Fertilizer Association (IFA) estimates that the global need for fertilizer demand is nearly 200 Million metric tons of nutrients that is produced each year, which means that the quantity of nitrogen-based fertilizers is likely to hold the largest share.

Countries like India and China collectively cover 30% of global fertilizer consumption are experiencing an increasing demand for ammonia due to their reliance on agriculture. In India alone, more than 24 million tons of urea was produced in 2023, which is heavily reliant on ammonia based inputs.

The agricultural sector will always need fertilizer to continue producing food and with limited additional land available for farming, application of fertilizers to fields is going to continue to be the key driver for agricultural production. It would be expected that consistent growth in the ammonia market for the foreseeable future will continue to be the case due to agricultural reliance on ammonia in the cultivation of crops to achieve food security goals.

Another major driver is the increasing acknowledgment of ammonia as a viable low-carbon energy carrier in global decarbonization approaches. Ammonia has the potential to fairly easily store and transport hydrogen with higher energy density (12.7 MJ/L) than liquid hydrogen (8.5 MJ/L). Ammonia has also established infrastructure for storage and shipping and therefore is more economical in opening the hydrogen economy.

The International Energy Agency (IEA) suggests that by 2050 the demand for hydrogen could be 530 million tons. Ammonia will be used to ship hydrogen and thread it into the market. Japan is paving the way for usage of ammonia. They recently announced that they will now be importing 3 million tons of fuel ammonia annually, and by 2030 they will move to clean energy using ammonia for power generation, potentially increasing their imported ammonia to 30 million by 2050.

Similarly, the European Union has poured millions of Euros into “green ammonia” projects. With the decarbonization targets being established, the EU is investing into renewable energy to produce carbon-free ammonia. Additionally, the global shipping industry is looking upon ammonia as a marine fuel.

As of 2024, there are currently over 120 green ammonia projects that have been announced globally. Investments in green ammonia projects around the world are rapid, particularly in Asia-Pacific, Europe, and the Middle East. Not only is ammonia traditionally used in industrial applications but the evolution of ammonia clearly shows that it will serve as a significant enabler for the clean energy transition and increase demand in the future.

Agricultural grade ammonia occupies the largest grade in the worldwide ammonia industry due to its distinct role in fertilizer production. The fact is that 70% of ammonia produced worldwide is meant for agriculture, which uses ammonia for nitrogen fertilizer as a feedstock. Urea, ammonium sulfate, and ammonium nitrate are applied to improve soil fertility and agricultural productivity.

The International Fertilizer Association (IFA) has reported that nitrogen fertilizers account for almost 60% of all fertilizer nutrients consumed worldwide, as compared to the consumption of the other classes of fertilizers, confirming ammonia's rapidly growing use in farming.

Economies like China, India, and the United States are heavy consumers of ammonia, with India alone consuming over 35 million metric tons of urea every single year. Urea is produced from ammonia, so we can infer that there is a significant demand for ammonia in the fertilizer sector. Additionally, increase in grain consumption worldwide will encourage the use of fertilizers, and ultimately agricultural growth (OECD-FAO expects grain consumption to increase 13% by 2030), re-emphasizing the importance of agricultural grade ammonia. The necessity of agricultural grade ammonia for food security assures that it is the most stable and largest segment in the ammonia sector, with steady growth into the longer term.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific is the leading region in the Ammonia market |

The Asia-Pacific region leads the global ammonia production and consumption. About 52% of global consumption arises from the Asia Pacific region as a result of massive fertilizer consumption in agricultural economies like China and India. Global leaders in ammonia, both – regarding production and consumption, are China and India, with China alone producing over 45 million metric tons of ammonia annually, largely for urea and ammonium phosphate production. India now consumes over 35 million tons of urea per year whereby ammonia is the primary feedstock. This only further illustrates the presence of power in the region.

North America is another leading region where ammonia is chiefly produced in the United States as a result of significant reserves of natural gas that keep production costs competitive as production of ammonia in the U.S. surpassed 14 million metric tons in 2023. Europe also plays a unique, but important role as it is an avid consumer of industrial-grade ammonia, and increasingly green ammonia as is happening with several new projects announced in the EU with a renewable, net-zero vision for future growth across the region.

Orica Limited, Nutrien Ltd, Mitsubishi Gas Chemical Company, Inc, Praxair Technology, Inc, Achema, PT Pertamina Gas, Linde plc, CNPC, Jiangsu Huachang Chemical Co., Ltd, and SABIC are the major companies in the global market. Each of these players has been profiled in the ammonia market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 79.9 Bn |

| Market Forecast Value in 2035 | US$ 131.8 Bn |

| Growth Rate (CAGR) | 4.7% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Ammonia market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Form

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The ammonia market was valued at US$ 79.9 Bn in 2024

The ammonia industry is expected to grow at a CAGR of 4.7% from 2025 to 2035

Rising demand for fertilizers to support global food security and emerging role of ammonia as a low-carbon energy carrier

Agricultural was the largest grade segment in the ammonia market.

Asia Pacific was the most lucrative region in 2024

BASF SE, CF Industries Holdings, Inc, Orica Limited, Nutrien Ltd, Mitsubishi Gas Chemical Company, Inc, Praxair Technology, Inc, Achema, PT Pertamina Gas, Linde plc, CNPC, Jiangsu Huachang Chemical Co., Ltd, and SABIC are the major companies in the global ammonia market

Table 1 Global Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 2 Global Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 3 Global Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 4 Global Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 5 Global Ammonia Market Volume (Tons) Forecast, by Grade 2020 to 2035

Table 6 Global Ammonia Market Value (US$ Bn) Forecast, by Grade 2020 to 2035

Table 7 Global Ammonia Market Volume (Tons) Forecast, by Purity 2020 to 2035

Table 8 Global Ammonia Market Value (US$ Bn) Forecast, by Purity 2020 to 2035

Table 9 Global Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 10 Global Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 11 Global Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 12 Global Ammonia Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 13 Global Ammonia Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 14 Global Ammonia Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 15 North America Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 16 North America Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 17 North America Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 18 North America Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 19 North America Ammonia Market Volume (Tons) Forecast, by Grade 2020 to 2035

Table 20 North America Ammonia Market Value (US$ Bn) Forecast, by Grade 2020 to 2035

Table 21 North America Ammonia Market Volume (Tons) Forecast, by Purity 2020 to 2035

Table 22 North America Ammonia Market Value (US$ Bn) Forecast, by Purity 2020 to 2035

Table 23 North America Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 24 North America Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25 North America Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 26 North America Ammonia Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 27 North America Ammonia Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 28 North America Ammonia Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 29 U.S. Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 30 U.S. Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 31 U.S. Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 32 U.S. Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 33 U.S. Ammonia Market Volume (Tons) Forecast, by Grade 2020 to 2035

Table 34 U.S. Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 35 U.S. Ammonia Market Volume (Tons) Forecast, by Purity 2020 to 2035

Table 36 U.S. Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 37 U.S. Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 38 U.S. Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39 U.S. Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 40 U.S. Ammonia Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 41 Canada Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 42 Canada Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 43 Canada Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 44 Canada Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 45 Canada Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 46 Canada Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 47 Canada Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 48 Canada Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 49 Canada Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 50 Canada Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51 Canada Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 52 Canada Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 53 Europe Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 54 Europe Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 55 Europe Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 56 Europe Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 57 Europe Ammonia Market Volume (Tons) Forecast, by Grade 2020 to 2035

Table 58 Europe Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 59 Europe Ammonia Market Volume (Tons) Forecast, by Purity 2020 to 2035

Table 60 Europe Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 61 Europe Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 62 Europe Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 63 Europe Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 64 Europe Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 65 Europe Ammonia Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 66 Europe Ammonia Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 67 Germany Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 68 Germany Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 69 Germany Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 70 Germany Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 71 Germany Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 72 Germany Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 73 Germany Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 74 Germany Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 75 Germany Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Germany Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Germany Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Germany Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 79 France Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 80 France Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 81 France Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 82 France Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 83 France Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 84 France Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 85 France Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 86 France Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 87 France Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 88 France Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 89 France Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 90 France Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 91 U.K. Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 92 U.K. Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 93 U.K. Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 94 U.K. Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 95 U.K. Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 96 U.K. Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 97 U.K. Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 98 U.K. Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 99 U.K. Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 100 U.K. Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101 U.K. Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 102 U.K. Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 103 Italy Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 104 Italy Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 105 Italy Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 106 Italy Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 107 Italy Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 108 Italy Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 109 Italy Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 110 Italy Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 111 Italy Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 112 Italy Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 113 Italy Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 114 Italy Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 115 Spain Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 116 Spain Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 117 Spain Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 118 Spain Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 119 Spain Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 120 Spain Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 121 Spain Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 122 Spain Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 123 Spain Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 124 Spain Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Spain Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 126 Spain Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 127 Russia & CIS Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 128 Russia & CIS Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 129 Russia & CIS Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 130 Russia & CIS Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 131 Russia & CIS Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 132 Russia & CIS Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 133 Russia & CIS Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 134 Russia & CIS Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 135 Russia & CIS Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 136 Russia & CIS Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 137 Russia & CIS Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Russia & CIS Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 139 Rest of Europe Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 140 Rest of Europe Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 141 Rest of Europe Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 142 Rest of Europe Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 143 Rest of Europe Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 144 Rest of Europe Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 145 Rest of Europe Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 146 Rest of Europe Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 147 Rest of Europe Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 148 Rest of Europe Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 149 Rest of Europe Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Rest of Europe Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 151 Asia Pacific Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 152 Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 153 Asia Pacific Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 154 Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 155 Asia Pacific Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 156 Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 157 Asia Pacific Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 158 Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 159 Asia Pacific Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 160 Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 161 Asia Pacific Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 162 Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 163 Asia Pacific Ammonia Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 164 Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 165 China Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 166 China Ammonia Market Value (US$ Bn) Forecast, by Form 2020 to 2035

Table 167 China Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 168 China Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 169 China Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 170 China Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 171 China Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 172 China Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 173 China Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 174 China Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 175 China Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 176 China Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 177 Japan Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 178 Japan Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 179 Japan Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 180 Japan Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 181 Japan Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 182 Japan Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 183 Japan Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 184 Japan Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 185 Japan Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 186 Japan Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 187 Japan Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 188 Japan Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 189 India Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 190 India Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 191 India Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 192 India Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 193 India Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 194 India Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 195 India Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 196 India Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 197 India Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 198 India Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 199 India Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 200 India Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 201 ASEAN Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 202 ASEAN Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 203 ASEAN Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 204 ASEAN Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 205 ASEAN Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 206 ASEAN Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 207 ASEAN Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 208 ASEAN Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 209 ASEAN Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 210 ASEAN Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 211 ASEAN Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 212 ASEAN Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Asia Pacific Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 214 Rest of Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 215 Rest of Asia Pacific Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 216 Rest of Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 217 Rest of Asia Pacific Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 218 Rest of Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 219 Rest of Asia Pacific Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 220 Rest of Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 221 Rest of Asia Pacific Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 222 Rest of Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 223 Rest of Asia Pacific Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 224 Rest of Asia Pacific Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 225 Latin America Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 226 Latin America Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 227 Latin America Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 228 Latin America Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 229 Latin America Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 230 Latin America Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 231 Latin America Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 232 Latin America Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 233 Latin America Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 234 Latin America Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 235 Latin America Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 236 Latin America Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 237 Latin America Ammonia Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 238 Latin America Ammonia Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 239 Brazil Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 240 Brazil Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 241 Brazil Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 242 Brazil Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 243 Brazil Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 244 Brazil Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 245 Brazil Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 246 Brazil Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 247 Brazil Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 248 Brazil Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 249 Brazil Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 250 Brazil Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 251 Mexico Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 252 Mexico Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 253 Mexico Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 254 Mexico Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 255 Mexico Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 256 Mexico Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 257 Mexico Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 258 Mexico Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 259 Mexico Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 260 Mexico Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 261 Mexico Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 262 Mexico Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 263 Rest of Latin America Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 264 Rest of Latin America Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 265 Rest of Latin America Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 266 Rest of Latin America Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 267 Rest of Latin America Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 268 Rest of Latin America Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 269 Rest of Latin America Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 270 Rest of Latin America Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 271 Rest of Latin America Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 272 Rest of Latin America Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 273 Rest of Latin America Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 274 Rest of Latin America Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 275 Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 276 Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 277 Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 278 Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 279 Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 280 Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 281 Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 282 Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 283 Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 284 Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 285 Middle East & Africa Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 286 Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 287 Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 288 Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 289 GCC Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 290 GCC Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 291 GCC Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 292 GCC Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 293 GCC Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 294 GCC Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 295 GCC Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 296 GCC Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 297 GCC Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 298 GCC Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 299 GCC Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 300 GCC Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 301 South Africa Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 302 South Africa Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 303 South Africa Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 304 South Africa Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 305 South Africa Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 306 South Africa Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 307 South Africa Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 308 South Africa Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 309 South Africa Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 310 South Africa Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 311 South Africa Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 312 South Africa Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 313 Rest of Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 314 Rest of Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 315 Rest of Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 316 Rest of Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 317 Rest of Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Grade, 2020 to 2035

Table 318 Rest of Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Grade, 2020 to 2035

Table 319 Rest of Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 320 Rest of Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 321 Rest of Middle East & Africa Ammonia Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 322 Rest of Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 323 Rest of Middle East & Africa Ammonia Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 324 Rest of Middle East & Africa Ammonia Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Ammonia Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 2 Global Ammonia Market Attractiveness, by Form

Figure 3 Global Ammonia Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 4 Global Ammonia Market Attractiveness, by Source

Figure 5 Global Ammonia Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 6 Global Ammonia Market Attractiveness, by Grade

Figure 7 Global Ammonia Market Volume Share Analysis, by Purity, 2024, 2028, and 2035

Figure 8 Global Ammonia Market Attractiveness, by Purity

Figure 9 Global Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 10 Global Ammonia Market Attractiveness, by Application

Figure 11 Global Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 12 Global Ammonia Market Attractiveness, by End-use

Figure 13 Global Ammonia Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 14 Global Ammonia Market Attractiveness, by Region

Figure 15 North America Ammonia Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 16 North America Ammonia Market Attractiveness, by Form

Figure 17 North America Ammonia Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 18 North America Ammonia Market Attractiveness, by Source

Figure 19 North America Ammonia Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 20 North America Ammonia Market Attractiveness, by Grade

Figure 21 North America Ammonia Market Volume Share Analysis, by Purity, 2024, 2028, and 2035

Figure 22 North America Ammonia Market Attractiveness, by Purity

Figure 23 North America Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 24 North America Ammonia Market Attractiveness, by Application

Figure 25 North America Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 26 North America Ammonia Market Attractiveness, by End-use

Figure 27 North America Ammonia Market Attractiveness, by Country and Sub-region

Figure 28 Europe Ammonia Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 29 Europe Ammonia Market Attractiveness, by Form

Figure 30 Europe Ammonia Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 31 Europe Ammonia Market Attractiveness, by Source

Figure 32 Europe Ammonia Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 33 Europe Ammonia Market Attractiveness, by Grade

Figure 34 Europe Ammonia Market Volume Share Analysis, by Purity, 2024, 2028, and 2035

Figure 35 Europe Ammonia Market Attractiveness, by Purity

Figure 36 Europe Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 37 Europe Ammonia Market Attractiveness, by Application

Figure 38 Europe Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 39 Europe Ammonia Market Attractiveness, by End-use

Figure 40 Europe Ammonia Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 41 Europe Ammonia Market Attractiveness, by Country and Sub-region

Figure 42 Asia Pacific Ammonia Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 43 Asia Pacific Ammonia Market Attractiveness, by Form

Figure 44 Asia Pacific Ammonia Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 45 Asia Pacific Ammonia Market Attractiveness, by Source

Figure 46 Asia Pacific Ammonia Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 47 Asia Pacific Ammonia Market Attractiveness, by Grade

Figure 48 Asia Pacific Ammonia Market Volume Share Analysis, by Purity, 2024, 2028, and 2035

Figure 49 Asia Pacific Ammonia Market Attractiveness, by Purity

Figure 50 Asia Pacific Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 51 Asia Pacific Ammonia Market Attractiveness, by Application

Figure 52 Asia Pacific Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 53 Asia Pacific Ammonia Market Attractiveness, by End-use

Figure 54 Asia Pacific Ammonia Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 55 Asia Pacific Ammonia Market Attractiveness, by Country and Sub-region

Figure 56 Latin America Ammonia Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 57 Latin America Ammonia Market Attractiveness, by Form

Figure 58 Latin America Ammonia Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 59 Latin America Ammonia Market Attractiveness, by Source

Figure 60 Latin America Ammonia Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 61 Latin America Ammonia Market Attractiveness, by Grade

Figure 62 Latin America Ammonia Market Volume Share Analysis, by Purity, 2024, 2028, and 2035

Figure 63 Latin America Ammonia Market Attractiveness, by Purity

Figure 64 Latin America Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 65 Latin America Ammonia Market Attractiveness, by Application

Figure 66 Latin America Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 67 Latin America Ammonia Market Attractiveness, by End-use

Figure 68 Latin America Ammonia Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 69 Latin America Ammonia Market Attractiveness, by Country and Sub-region

Figure 70 Middle East & Africa Ammonia Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 71 Middle East & Africa Ammonia Market Attractiveness, by Form

Figure 72 Middle East & Africa Ammonia Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 73 Middle East & Africa Ammonia Market Attractiveness, by Source

Figure 74 Middle East & Africa Ammonia Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 75 Middle East & Africa Ammonia Market Attractiveness, by Grade

Figure 76 Middle East & Africa Ammonia Market Volume Share Analysis, by Purity, 2024, 2028, and 2035

Figure 77 Middle East & Africa Ammonia Market Attractiveness, by Purity

Figure 78 Middle East & Africa Ammonia Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 79 Middle East & Africa Ammonia Market Attractiveness, by Application

Figure 80 Middle East & Africa Ammonia Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 81 Middle East & Africa Ammonia Market Attractiveness, by End-use

Figure 82 Middle East & Africa Ammonia Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 83 Middle East & Africa Ammonia Market Attractiveness, by Country and Sub-region