Reports

Reports

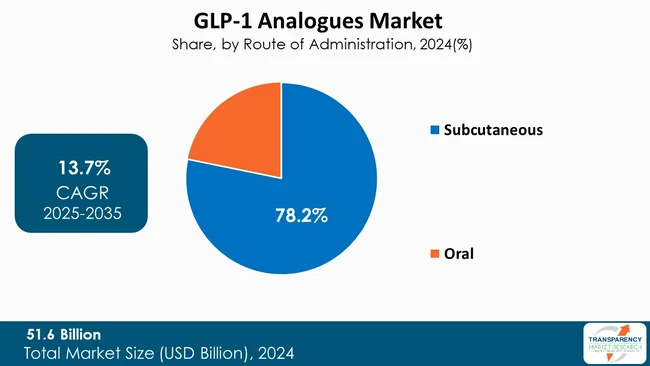

The global GLP-1 analogues market size was valued at US$ 51.6 Bn in 2024 and is projected to reach US$ 211.8 Bn by 2035, expanding at a CAGR of 13.7% from 2025 to 2035. The market growth is driven by the increasing prevalence of type 2 diabetes and obesity, rising aging population and lifestyle changes, and ongoing development of new and improved drug formulations.

GLP-1 analogues market is driven by strong clinical evidence demonstrating benefits to the cardiovascular and metabolic systems, growing healthcare spending, and extended reimbursement plans that further enhance patient access. Moreover, enhanced physician confidence and guideline support for wider therapeutic applications propel earlier adoption in a large number of healthcare facilities and payer systems, worldwide.

Another key driver is the diversification of therapeutic area, i.e., obesity and management of cardio metabolic risk to expand market opportunity. Increased scale of manufacturing, efficient cold-chain logistics, and increasing investments by biopharma stakeholders reduces unit cost and increases geographic presence, especially into previously underpenetrated emerging markets, thus, solidifying clinical partnerships and distribution networks.

The ongoing trends include a growing use of oral formulations of GLP-1 together with long-acting injectables, integration of digital health tools for adherence, and a focused approach to real-world evidence studies that provide long-term outcomes. Payers increasingly use value-based contracting and stepwise access models that impact formulary placement and commercial strategies across markets, together with personalized patient engagement.

The competitive landscape changes are reflective of these companies' strategic alliances, licensing agreements, and targeted M&A to quickly gain access to the pipeline and enter the market. Companies are expanding their manufacturing capacity, patient support programs, outcome-based pricing schemes, and digital companion services while concentrating regulatory engagement and differentiated commercialization tactics to attract more customers and get the favor of payers, strategically.

GLP-1 analogues or GLP-1 receptor agonists refer to a class of medication that mimics the activity of endogenous incretin hormone GLP-1 responsible for the stimulation of insulin secretion, inhibition of glucagon release, and regulation of blood glucose. The analogues provide glucose regulation through stimulation of the GLP-1 receptors.

In addition to glucose regulation, GLP-1 analogues have additional metabolic action. They block gastric emptying, decrease appetite, and reduces weight, which makes them particularly profitable in type 2 diabetic patients and obese patients. Their cardiovascular value evident in clinical trials has also expanded their usage in cardiovascular morbidity.

Their mode of action is inclusive of increasing release of insulin in a glucose-dependent manner, thereby lowering the risk of hypoglycemia as compared to the other anti-diabetic agents. Additionally, these agents improve pancreatic β-cell function and become a means of achieving better long-term metabolic control, thereby making them a key part of modern approaches to diabetes management.

GLP-1 analogues vary in their formulations, consisting of both - daily and weekly injections, as well as oral formulations.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing incidence of type 2 diabetes is a major trend driving the GLP-1 analogues market. As diabetes has reached an epidemic level globally. Healthcare systems are more focused on newer therapeutic approaches that not only control blood glucose but also target linked comorbidities.

GLP-1 analogues have become a clinician's best friend as they are able to maintain glycemic control and decrease hypoglycemia and the other risks as well as promote weight loss. With increasing numbers of patients diagnosed with diabetes, demand for such multi-indication therapy increases, forcing uniform adoption in developing and mature economies as well.

Furthermore, type 2 diabetes, being chronic and progressive, necessitates long-term treatment. Hence, there is a continuous need for drugs that are innovative and efficacious like GLP-1 analogues, which have shown superior clinical outcomes and cardiovascular benefits as compared to traditional antidiabetic agents. In fact, their capability to postpone the progression of the disease further enhances its’ market penetration.

Additionally, investments are being made by governments and healthcare providers in diabetes awareness programs and access to treatment. As awareness and diagnosis rates of diabetes increase for patients with the condition, this too is expected to impact global rates of use of GLP-1 analogues, and continued product market growth.

Novel and advanced drug formulation technologies are amongst the key drivers in the GLP-1 analogues market. There is a greater focus on enhanced delivery, stability, and convenience for the patient. The use of these technologies alleviates notable barriers, such as injection discomfort and dosing schedule frequency, which have enhanced general therapy compliance and satisfaction.

Long-acting and extended-release formulas have transformed delivery by switching from a daily dosing schedule to a weekly one. Such convenience has also improved physician preference and patient acceptability, and net effect has increased prescription rates. These advances again produce better long-term glycemic control and stable metabolic results, reinforcing their clinical value.

Oral GLP-1 analogs are a significant breakthrough since they avoid injections altogether. The oral formulation appeals to a larger group of patients, mainly those who do not want injections. This move to an oral dose was made possible due to the advancement in bioavailability technology and is widely recognized as a breakthrough in the management of both type 2 diabetes and obesity.

Moreover, formulation improvements directed at stability, shelf life, and storage conditions increase the accessibility of various vaccines within geographical areas that have very low cold-chain capabilities. These breakthroughs together are enhancing the competitive position of the market by extending the patient base, compliance, and thus GLP-1 analogue therapy continues to be in demand in both established and emerging markets.

By route of administration, Subcutaneous segment captures majority share in the GLP-1 analogues market, which is attributed to its effectiveness, good safety profile, and acceptance in clinics. These formulations provide drug absorption that is both - efficient and long-lasting in terms of therapeutic action. Thus they are considered as the delivery method that is mostly recommended by healthcare providers for attaining not only glycemic control but also good metabolic outcomes.

Moreover, improvements in the injection instruments like the prefilled pens and autoinjectors have facilitated the administration process and increased the patient's comfort, thus the adherence rates have been uplifted. The broad availability of subcutaneous GLP-1 products together with their strong clinical data are the main factors that have been driving this segment to lead on the global market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest GLP-1 analogues market analysis, North America dominated in 2024, capturing a market share of 68.4%. This is attributed to this region’s its mature healthcare system, high prevalence of diabetes, and rapid uptake of advanced treatment options. Additionally, the region's patient-friendly reimbursement schemes and increased healthcare budget are also major factors that promote the use of GLP-1 analogues in different patient groups.

Moreover, a large number of clinical trials and early regulatory approvals accelerate the introduction of new formulations. The high level of knowledge among healthcare professionals, as well as strong commercial presence of the leading pharmaceutical manufacturers, are the main drivers of the continuous market penetration. The focus on preventive care and chronic disease management is another factor that helps North America to be at the forefront of the GLP-1 analogues industry.

Companies operating within the GLP-1 analogues market adopt strategic collaborations, product lifecycle management, and diversification of pipelines as some of their strategies. In order to fuel global expansion, companies are investing in developing new drugs in sustained release and oral modality, add capacity for production, enhance patient support programs, and write applications for regulatory approval of additional indications.

Novo Nordisk A/S, Eli Lilly and Company, Sanofi, AstraZeneca, GSK, Regeneron Pharmaceuticals Inc., Pfizer Inc., Amgen Inc., Sun Pharmaceutical Industries Ltd., Boehringer Ingelheim International GmbH, ZEALAND PHARMA, Hanmi Pharm. Co., Ltd., F. Hoffmann-La Roche AG, Teva Pharmaceutical Industries Ltd, Viking Therapeutics, Shanghai Benemae Pharmaceutical Corporation, and Biocon Limited are some of the leading players operating in the market.

Each of these players has been profiled in the GLP-1 analogues industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 51.6 Bn |

| Forecast Value in 2035 | US$ 211.8 Bn |

| CAGR | 13.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| GLP-1 Analogues Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Drug Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global GLP-1 analogues market was valued at US$ 51.6 Bn in 2024

The global GLP-1 analogues industry is projected to reach more than US$ 211.8 Bn by the end of 2035

The rising prevalence of type 2 diabetes and obesity, rising aging populations and lifestyle changes, development of new and improved formulations, such as oral and multi-agonist therapies, and the increasing awareness regarding dual benefits of GLP-1 analogues for glycemic control and weight loss are some of the factors driving the expansion of GLP-1 analogues market.

The CAGR is anticipated to be 13.7% from 2025 to 2035

Novo Nordisk A/S, Eli Lilly and Company, Sanofi, AstraZeneca, GSK, Regeneron Pharmaceuticals Inc., Pfizer Inc., Amgen Inc., Sun Pharmaceutical Industries Ltd., Boehringer Ingelheim International GmbH, ZEALAND PHARMA, Hanmi Pharm. Co., Ltd., F. Hoffmann-La Roche Ltd, Teva Pharmaceutical Industries Ltd, Viking Therapeutics, Shanghai Benemae Pharmaceutical Corporation and Biocon Limited

Table 01: Global GLP-1 Analogues Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 02: Global GLP-1 Analogues Market Value (US$ Bn) Forecast, By Therapy Approach, 2020 to 2035

Table 03: Global GLP-1 Analogues Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 04: Global GLP-1 Analogues Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 05: Global GLP-1 Analogues Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 06: Global GLP-1 Analogues Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America GLP-1 Analogues Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 09: North America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Therapy Approach, 2020 to 2035

Table 10: North America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 11: North America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 12: North America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 13: Europe GLP-1 Analogues Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Europe GLP-1 Analogues Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 15: Europe GLP-1 Analogues Market Value (US$ Bn) Forecast, By Therapy Approach, 2020 to 2035

Table 16: Europe GLP-1 Analogues Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 17: Europe GLP-1 Analogues Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 18: Europe GLP-1 Analogues Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 19: Asia Pacific GLP-1 Analogues Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Asia Pacific GLP-1 Analogues Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 21: Asia Pacific GLP-1 Analogues Market Value (US$ Bn) Forecast, By Therapy Approach, 2020 to 2035

Table 22: Asia Pacific GLP-1 Analogues Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 23: Asia Pacific GLP-1 Analogues Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 24: Asia Pacific GLP-1 Analogues Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 25: Latin America GLP-1 Analogues Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Latin America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 27: Latin America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Therapy Approach, 2020 to 2035

Table 28: Latin America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 29: Latin America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 30: Latin America GLP-1 Analogues Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 31: Middle East & Africa GLP-1 Analogues Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 32: Middle East & Africa GLP-1 Analogues Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 33: Middle East & Africa GLP-1 Analogues Market Value (US$ Bn) Forecast, By Therapy Approach, 2020 to 2035

Table 34: Middle East & Africa GLP-1 Analogues Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 35: Middle East & Africa GLP-1 Analogues Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 36: Middle East & Africa GLP-1 Analogues Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Figure 01: Global GLP-1 Analogues Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 02: Global GLP-1 Analogues Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 03: Global GLP-1 Analogues Market Revenue (US$ Bn), by Dulaglutide, 2020 to 2035

Figure 04: Global GLP-1 Analogues Market Revenue (US$ Bn), by Exenatide, 2020 to 2035

Figure 05: Global GLP-1 Analogues Market Revenue (US$ Bn), by Liraglutide, 2020 to 2035

Figure 06: Global GLP-1 Analogues Market Revenue (US$ Bn), by Lixisenatide, 2020 to 2035

Figure 07: Global GLP-1 Analogues Market Revenue (US$ Bn), by Semaglutide, 2020 to 2035

Figure 08: Global GLP-1 Analogues Market Revenue (US$ Bn), by Tirzepatide, 2020 to 2035

Figure 09: Global GLP-1 Analogues Market Value Share Analysis, By Therapy Approach, 2024 and 2035

Figure 10: Global GLP-1 Analogues Market Attractiveness Analysis, By Therapy Approach, 2025 to 2035

Figure 11: Global GLP-1 Analogues Market Revenue (US$ Bn), by Monotherapy, 2020 to 2035

Figure 12: Global GLP-1 Analogues Market Revenue (US$ Bn), by Combination Therapy, 2020 to 2035

Figure 13: Global GLP-1 Analogues Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 14: Global GLP-1 Analogues Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 15: Global GLP-1 Analogues Market Revenue (US$ Bn), by Subcutaneous, 2020 to 2035

Figure 16: Global GLP-1 Analogues Market Revenue (US$ Bn), by Oral, 2020 to 2035

Figure 17: Global GLP-1 Analogues Market Value Share Analysis, By Indication, 2024 and 2035

Figure 18: Global GLP-1 Analogues Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 19: Global GLP-1 Analogues Market Revenue (US$ Bn), by Type 2 Diabetes, 2020 to 2035

Figure 20: Global GLP-1 Analogues Market Revenue (US$ Bn), by Obesity, 2020 to 2035

Figure 21: Global GLP-1 Analogues Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 22: Global GLP-1 Analogues Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 23: Global GLP-1 Analogues Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 24: Global GLP-1 Analogues Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 25: Global GLP-1 Analogues Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 26: Global GLP-1 Analogues Market Value Share Analysis, By Region, 2024 and 2035

Figure 27: Global GLP-1 Analogues Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 28: North America GLP-1 Analogues Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: North America GLP-1 Analogues Market Value Share Analysis, by Country, 2024 and 2035

Figure 30: North America GLP-1 Analogues Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 31: North America GLP-1 Analogues Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 32: North America GLP-1 Analogues Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 33: North America GLP-1 Analogues Market Value Share Analysis, By Therapy Approach, 2024 and 2035

Figure 34: North America GLP-1 Analogues Market Attractiveness Analysis, By Therapy Approach, 2025 to 2035

Figure 35: North America GLP-1 Analogues Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 36: North America GLP-1 Analogues Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 37: North America GLP-1 Analogues Market Value Share Analysis, By Indication, 2024 and 2035

Figure 38: North America GLP-1 Analogues Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 39: North America GLP-1 Analogues Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 40: North America GLP-1 Analogues Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 41: Europe GLP-1 Analogues Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 42: Europe GLP-1 Analogues Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 43: Europe GLP-1 Analogues Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 44: Europe GLP-1 Analogues Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 45: Europe GLP-1 Analogues Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 46: Europe GLP-1 Analogues Market Value Share Analysis, By Therapy Approach, 2024 and 2035

Figure 47: Europe GLP-1 Analogues Market Attractiveness Analysis, By Therapy Approach, 2025 to 2035

Figure 48: Europe GLP-1 Analogues Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 49: Europe GLP-1 Analogues Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 50: Europe GLP-1 Analogues Market Value Share Analysis, By Indication, 2024 and 2035

Figure 51: Europe GLP-1 Analogues Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 52: Europe GLP-1 Analogues Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 53: Europe GLP-1 Analogues Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 54: Asia Pacific GLP-1 Analogues Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Asia Pacific GLP-1 Analogues Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 56: Asia Pacific GLP-1 Analogues Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 57: Asia Pacific GLP-1 Analogues Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 58: Asia Pacific GLP-1 Analogues Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 59: Asia Pacific GLP-1 Analogues Market Value Share Analysis, By Therapy Approach, 2024 and 2035

Figure 60: Asia Pacific GLP-1 Analogues Market Attractiveness Analysis, By Therapy Approach, 2025 to 2035

Figure 61: Asia Pacific GLP-1 Analogues Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 62: Asia Pacific GLP-1 Analogues Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 63: Asia Pacific GLP-1 Analogues Market Value Share Analysis, By Indication, 2024 and 2035

Figure 64: Asia Pacific GLP-1 Analogues Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 65: Asia Pacific GLP-1 Analogues Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 66: Asia Pacific GLP-1 Analogues Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 67: Latin America GLP-1 Analogues Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Latin America GLP-1 Analogues Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 69: Latin America GLP-1 Analogues Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 70: Latin America GLP-1 Analogues Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 71: Latin America GLP-1 Analogues Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 72: Latin America GLP-1 Analogues Market Value Share Analysis, By Therapy Approach, 2024 and 2035

Figure 73: Latin America GLP-1 Analogues Market Attractiveness Analysis, By Therapy Approach, 2025 to 2035

Figure 74: Latin America GLP-1 Analogues Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 75: Latin America GLP-1 Analogues Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 76: Latin America GLP-1 Analogues Market Value Share Analysis, By Indication, 2024 and 2035

Figure 77: Latin America GLP-1 Analogues Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 78: Latin America GLP-1 Analogues Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 79: Latin America GLP-1 Analogues Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 80: Middle East & Africa GLP-1 Analogues Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 81: Middle East & Africa GLP-1 Analogues Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 82: Middle East & Africa GLP-1 Analogues Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 83: Middle East & Africa GLP-1 Analogues Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 84: Middle East & Africa GLP-1 Analogues Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 85: Middle East & Africa GLP-1 Analogues Market Value Share Analysis, By Therapy Approach, 2024 and 2035

Figure 86: Middle East & Africa GLP-1 Analogues Market Attractiveness Analysis, By Therapy Approach, 2025 to 2035

Figure 87: Middle East & Africa GLP-1 Analogues Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 88: Middle East & Africa GLP-1 Analogues Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 89: Middle East & Africa GLP-1 Analogues Market Value Share Analysis, By Indication, 2024 and 2035

Figure 90: Middle East & Africa GLP-1 Analogues Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 91: Middle East & Africa GLP-1 Analogues Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 92: Middle East & Africa GLP-1 Analogues Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035