Reports

Reports

The global market is driven by technological advancements, surge in R&D funding, increase in government support, and rise in prevalence of diabetes. In addition, R&D activities in the insulin market are rising, as researchers across the globe are striving to develop a superior insulin molecule for diabetes patients that increases efficiency and curbs side-effects.

.webp)

Moreover, the market is anticipated to witness growth due to no price-cap regulation on drugs as a result of which several key pharmaceutical companies are increasing the prices of generic drugs, including insulin. The global market players can also leverage opportunities in the premixed insulin segment, due to their ease of use and portability, and premixed insulin conveyance gadgets.

Insulin is a hormone produced by the human pancreas that controls the amount of glucose (sugar) levels in the bloodstream and regulates the human body’s metabolism of fats, proteins, and carbohydrates. Insulin is available in various strengths; the most common is U-100, which is used as an adjunct to diet and exercise in order to improve glycemic control in children and adults.

The growth of the global market can be attributed to key factors such as a rise in demand for human insulin analogs and favorable reimbursements. Technological innovations in the field of human insulin delivery devices also augment the market. For instance, in May 2024, research led by University of Sydney and Sydney Local Health District developed a new type of oral insulin based on nanotechnology. In the future, it could offer the 75 million people worldwide who use insulin for diabetes a more effective and needle-free alternative.

| Attribute | Detail |

|---|---|

| Insulin Market Drivers |

|

Insulin is a pharmaceutical preparation of the protein hormone insulin that is utilized as a medication to treat multiple conditions such as type 2 diabetes, gestational diabetes, type 1 diabetes, and complications of diabetes. The demand for insulin is anticipated to increase due to surge in the incidence of diabetes across the globe.

For instance, as per IDF Diabetes Atlas 2025 Report, 1 in 8 adults, approximately 853 million, will be living with diabetes, an increase of 46%. It further states that 90% of them have type 2 diabetes, which is driven by socio-economic, demographic, environmental, and genetic factors.

Additionally, three-quarters of adults with diabetes are prevailing in low- and middle-income countries, and around 240 million remain undiagnosed. The IDF emphasizes the importance of preventive measures, early diagnosis, and proper care for mitigating disease complications. The IDF Diabetes Atlas serves as a key resource, providing vital statistics on diabetes prevalence, mortality, and healthcare costs globally, aiming to improve lives and prevent diabetes in at-risk population.

Insulin delivery technology is driving the world insulin market aggressively by enhancing patient convenience, compliance, and diabetic control as a whole. Sophisticated delivery devices such as insulin pens, patch pumps, and automatic insulin-delivery systems are simpler to use and more accurate than older syringe-based systems and thus are more favorable to patients and clinicians. They promote better glycemic control by real-time glucose monitoring and computer-dosed dosing, thereby reducing the risk of complications and enhancing outcomes.

Due to the enhanced awareness and availability, mostly in the developing economies, adoption of such advanced systems is rising at an unprecedented rate. Besides, innovations such as intelligent pens, application integration, and artificial intelligence-enabled insulin pumps are changing diabetes care in line with the universal trend toward home- and personalized care. Collectively, all of these not only improve the quality of lives of patients but also increase the customer base, thus facilitating long-term growth in the world market for insulin.

The evolution of diabetes technologies has led to the expansion of automated insulin delivery for type 2 diabetes, continuous glucose monitoring for people without diabetes, and calls for a higher standard of care in type 1 diabetes. The American Diabetes Association Standards of Care for 2025 states that continuous glucose monitoring (CGM) should be offered to all people with diabetes who use any insulin therapy.

Now, diabetes technology for insulin-treated diabetes is going beyond CGM. The FDA has cleared the Omnipod 5 automated insulin delivery system (Insulet) in August and the Control IQ+ (Tandem) in March for adults with type 2 diabetes based on data that show the devices could provide glycemic benefits.

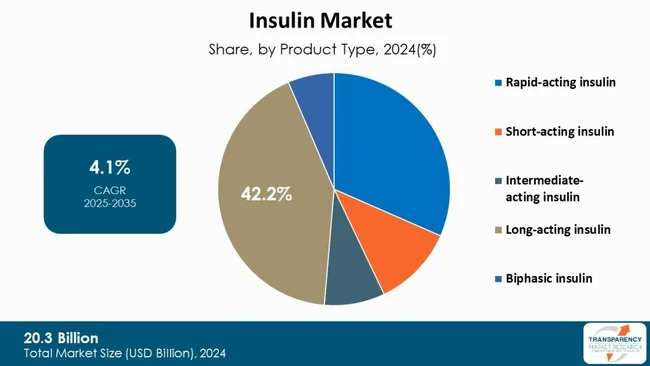

Long-acting insulin are driving the Insulin market globally by product type as it can provide stable and predictable blood glucose with less daily injection. Compared to greater than one dose of short-acting insulin injected at meals, long-acting insulin replicates the body's own basal release of insulin and is typically injected once a day. Its ease of use improves patient compliance and minimizes hypoglycemia risk, especially nocturnal. It is most suited for type 1 diabetic patients as well as for type 2 diabetic patients requiring continuous infusion of insulin.

Finally, newer formulation development-insulin glargine, detemir, and degludec-has extended duration of action and improved pharmacokinetic profile, additionally making them clinically suitable. Growing prevalence of type 2 diabetes, rising need for an effective and hassle-free regimen of therapy, and physician recommendation are all propelling the use of long-acting insulin worldwide, thereby becoming the top product segment in the global market for insulin.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is dominating the globe in the case of the insulin market due to a combination of high rates of diabetes prevalence, advanced healthcare infrastructure, and strong purchasing power. The region, with the United States most prominently included, possesses a large and growing population of diabetic patients driven by lifestyle-induced reasons such as obesity and inactivity. This creates a steady and rising demand for insulin and related therapies.

Additionally, North America enjoys the first-mover position in adopting new insulin products and delivery systems like insulin pumps, smart pens, and continuous glucose sensors, which tend to be developed or initially introduced in the U.S. based on supportive regulation policies and high R&D investments. Availability of such key pharma giants like Eli Lilly and Novo Nordisk with strong distribution channels and good marketing efforts is another reason for the predominance.

Besides, increased insurance coverage and government assistance in offsetting the expense of diabetes treatment give patients access to standard and high-expense insulin therapies.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. Shanghai Fosun Pharmaceutical Co., Ltd., Tonghua Dongbao, Eli Lilly and Company, Sanofi, Novo Nordisk A/S, Julphar, Biocon Ltd., Becton, Dickinson, and Company, Ypsomed AG, Biodel, Inc., and B. Braun Melsungen AG are the prominent Insulin market players.

Each of these players has been have been profiled in the Insulin market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 20.3 Bn |

| Forecast Value in 2035 | US$ 31.5 Bn |

| CAGR | 4.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global Insulin market was valued at US$ 20.3 Bn in 2024.

Insulin business is projected to cross US$ 31.5 Bn by the end of 2035.

Increase in incidence of diabetes and advancements in insulin delivery systems.

The CAGR is anticipated to be 4.1% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Shanghai Fosun Pharmaceutical Co., Ltd., Tonghua Dongbao, Eli Lilly and Company, Sanofi, Novo Nordisk A/S, Julphar, Biocon Ltd., Becton, Dickinson, and Company, Ypsomed AG, Biodel, Inc., and B. Braun Melsungen AG, and Other players are the prominent Insulin market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Insulin Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Insulin Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events

5.2. Epidemiology by Key Countries/Regions

5.3. Supply Chain Analysis

5.4. Technological advancements

5.5. Regulatory Scenario by Key Countries/Regions

5.6. Go-to Market Strategy

5.7. End-user Preference

5.8. Reimbursement Scenario by Key Countries

5.9. Top 10 Players Operating In the Market Space- Global

5.10. Key Product/Brand Analysis

5.11. Porter’s Five Forces Analysis

5.12. PESTLE Analysis

5.13. Benchmarking of Products offered by Competitors

6. Global Insulin Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Rapid-acting insulin

6.3.2. Short-acting insulin

6.3.3. Intermediate-acting insulin

6.3.4. Long-acting insulin

6.3.5. Biphasic insulin

6.4. Market Attractiveness By Product Type

7. Global Insulin Market Analysis and Forecasts, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application, 2020 to 2035

7.3.1. Type 1 Diabetes

7.3.2. Type 2 Diabetes

7.3.3. Gestational Diabetes

7.4. Market Attractiveness By Application

8. Global Insulin Market Analysis and Forecasts, By Delivery Device

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Delivery Device, 2020 to 2035

8.3.1. Pens

8.3.2. Insulin Pumps

8.3.3. Syringes

8.3.4. Jets

8.4. Market Attractiveness By Delivery Device

9. Global Insulin Market Analysis and Forecasts, By Source

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Source, 2020 to 2035

9.3.1. Human Insulin

9.3.2. Insulin Analog

9.4. Market Attractiveness By Source

10. Global Insulin Market Analysis and Forecasts, By Distribution Channel

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast By Distribution Channel, 2020 to 2035

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Attractiveness By Distribution Channel

11. Global Insulin Market Analysis and Forecasts, By Region

11.1. Key Findings

11.2. Market Value Forecast By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness By Region

12. North America Insulin Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Rapid-acting insulin

12.2.2. Short-acting insulin

12.2.3. Intermediate-acting insulin

12.2.4. Long-acting insulin

12.2.5. Biphasic insulin

12.3. Market Value Forecast By Application, 2020 to 2035

12.3.1. Type 1 Diabetes

12.3.2. Type 2 Diabetes

12.3.3. Gestational Diabetes

12.4. Market Value Forecast By Delivery Device, 2020 to 2035

12.4.1. Pens

12.4.2. Insulin Pumps

12.4.3. Syringes

12.4.4. Jets

12.5. Market Value Forecast By Source, 2020 to 2035

12.5.1. Human Insulin

12.5.2. Insulin Analog

12.6. Market Value Forecast By Distribution Channel, 2020 to 2035

12.6.1. Hospital Pharmacies

12.6.2. Retail Pharmacies

12.6.3. Online Pharmacies

12.7. Market Value Forecast By Country, 2020 to 2035

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Product Type

12.8.2. By Application

12.8.3. By Delivery Device

12.8.4. By Source

12.8.5. By Distribution Channel

12.8.6. By Country

13. Europe Insulin Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Rapid-acting insulin

13.2.2. Short-acting insulin

13.2.3. Intermediate-acting insulin

13.2.4. Long-acting insulin

13.2.5. Biphasic insulin

13.3. Market Value Forecast By Application, 2020 to 2035

13.3.1. Type 1 Diabetes

13.3.2. Type 2 Diabetes

13.3.3. Gestational Diabetes

13.4. Market Value Forecast By Delivery Device, 2020 to 2035

13.4.1. Pens

13.4.2. Insulin Pumps

13.4.3. Syringes

13.4.4. Jets

13.5. Market Value Forecast By Source, 2020 to 2035

13.5.1. Human Insulin

13.5.2. Insulin Analog

13.6. Market Value Forecast By Distribution Channel, 2020 to 2035

13.6.1. Hospital Pharmacies

13.6.2. Retail Pharmacies

13.6.3. Online Pharmacies

13.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Switzerland

13.7.7. The Netherlands

13.7.8. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Product Type

13.8.2. By Application

13.8.3. By Delivery Device

13.8.4. By Source

13.8.5. By Distribution Channel

13.8.6. By Country/Sub-region

14. Asia Pacific Insulin Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2020 to 2035

14.2.1. Rapid-acting insulin

14.2.2. Short-acting insulin

14.2.3. Intermediate-acting insulin

14.2.4. Long-acting insulin

14.2.5. Biphasic insulin

14.3. Market Value Forecast By Application, 2020 to 2035

14.3.1. Type 1 Diabetes

14.3.2. Type 2 Diabetes

14.3.3. Gestational Diabetes

14.4. Market Value Forecast By Delivery Device, 2020 to 2035

14.4.1. Pens

14.4.2. Insulin Pumps

14.4.3. Syringes

14.4.4. Jets

14.5. Market Value Forecast By Source, 2020 to 2035

14.5.1. Human Insulin

14.5.2. Insulin Analog

14.6. Market Value Forecast By Distribution Channel, 2020 to 2035

14.6.1. Hospital Pharmacies

14.6.2. Retail Pharmacies

14.6.3. Online Pharmacies

14.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.7.1. China

14.7.2. India

14.7.3. Japan

14.7.4. South Korea

14.7.5. Australia & New Zealand

14.7.6. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Product Type

14.8.2. By Application

14.8.3. By Delivery Device

14.8.4. By Source

14.8.5. By Distribution Channel

14.8.6. By Country/Sub-region

15. Latin America Insulin Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Product Type, 2020 to 2035

15.2.1. Rapid-acting insulin

15.2.2. Short-acting insulin

15.2.3. Intermediate-acting insulin

15.2.4. Long-acting insulin

15.2.5. Biphasic insulin

15.3. Market Value Forecast By Application, 2020 to 2035

15.3.1. Type 1 Diabetes

15.3.2. Type 2 Diabetes

15.3.3. Gestational Diabetes

15.4. Market Value Forecast By Delivery Device, 2020 to 2035

15.4.1. Pens

15.4.2. Insulin Pumps

15.4.3. Syringes

15.4.4. Jets

15.5. Market Value Forecast By Source, 2020 to 2035

15.5.1. Human Insulin

15.5.2. Insulin Analog

15.6. Market Value Forecast By Distribution Channel, 2020 to 2035

15.6.1. Hospital Pharmacies

15.6.2. Retail Pharmacies

15.6.3. Online Pharmacies

15.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Argentina

15.7.4. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Product Type

15.8.2. By Application

15.8.3. By Delivery Device

15.8.4. By Source

15.8.5. By Distribution Channel

15.8.6. By Country/Sub-region

16. Middle East & Africa Insulin Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast By Product Type, 2020 to 2035

16.2.1. Rapid-acting insulin

16.2.2. Short-acting insulin

16.2.3. Intermediate-acting insulin

16.2.4. Long-acting insulin

16.2.5. Biphasic insulin

16.3. Market Value Forecast By Application, 2020 to 2035

16.3.1. Type 1 Diabetes

16.3.2. Type 2 Diabetes

16.3.3. Gestational Diabetes

16.4. Market Value Forecast By Delivery Device, 2020 to 2035

16.4.1. Pens

16.4.2. Insulin Pumps

16.4.3. Syringes

16.4.4. Jets

16.5. Market Value Forecast By Source, 2020 to 2035

16.5.1. Human Insulin

16.5.2. Insulin Analog

16.6. Market Value Forecast By Distribution Channel, 2020 to 2035

16.6.1. Hospital Pharmacies

16.6.2. Retail Pharmacies

16.6.3. Online Pharmacies

16.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Product Type

16.8.2. By Application

16.8.3. By Delivery Device

16.8.4. By Source

16.8.5. By Distribution Channel

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of companies)

17.2. Market Share Analysis By Company (2024)

17.3. Company Profiles

17.3.1. Shanghai Fosun Pharmaceutical Co., Ltd.

17.3.1.1. Company Overview

17.3.1.2. Financial Overview

17.3.1.3. Financial Overview

17.3.1.4. Business Strategies

17.3.1.5. Recent Developments

17.3.2. Tonghua Dongbao

17.3.2.1. Company Overview

17.3.2.2. Financial Overview

17.3.2.3. Financial Overview

17.3.2.4. Business Strategies

17.3.2.5. Recent Developments

17.3.3. Eli Lilly and Company

17.3.3.1. Company Overview

17.3.3.2. Financial Overview

17.3.3.3. Financial Overview

17.3.3.4. Business Strategies

17.3.3.5. Recent Developments

17.3.4. Sanofi

17.3.4.1. Company Overview

17.3.4.2. Financial Overview

17.3.4.3. Financial Overview

17.3.4.4. Business Strategies

17.3.4.5. Recent Developments

17.3.5. Novo Nordisk A/S

17.3.5.1. Company Overview

17.3.5.2. Financial Overview

17.3.5.3. Financial Overview

17.3.5.4. Business Strategies

17.3.5.5. Recent Developments

17.3.6. Julphar

17.3.6.1. Company Overview

17.3.6.2. Financial Overview

17.3.6.3. Financial Overview

17.3.6.4. Business Strategies

17.3.6.5. Recent Developments

17.3.7. Biocon Ltd.

17.3.7.1. Company Overview

17.3.7.2. Financial Overview

17.3.7.3. Financial Overview

17.3.7.4. Business Strategies

17.3.7.5. Recent Developments

17.3.8. Becton, Dickinson, and Company

17.3.8.1. Company Overview

17.3.8.2. Financial Overview

17.3.8.3. Financial Overview

17.3.8.4. Business Strategies

17.3.8.5. Recent Developments

17.3.9. Ypsomed AG

17.3.9.1. Company Overview

17.3.9.2. Financial Overview

17.3.9.3. Financial Overview

17.3.9.4. Business Strategies

17.3.9.5. Recent Developments

17.3.10. Biodel, Inc.

17.3.10.1. Company Overview

17.3.10.2. Financial Overview

17.3.10.3. Financial Overview

17.3.10.4. Business Strategies

17.3.10.5. Recent Developments

17.3.11. B. Braun Melsungen AG

17.3.11.1. Company Overview

17.3.11.2. Financial Overview

17.3.11.3. Financial Overview

17.3.11.4. Business Strategies

17.3.11.5. Recent Developments

List of Tables

Table 01: Global Insulin Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Insulin Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 03: Global Insulin Market Value (US$ Mn) Forecast, By Delivery Device, 2020 to 2035

Table 04: Global Insulin Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 05: Global Insulin Market Value (US$ Mn) Forecast, By Distribution Channel, 2020 to 2035

Table 06: Global Insulin Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 07: North America Insulin Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 08: North America Insulin Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 09: North America Insulin Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 10: North America Insulin Market Value (US$ Mn) Forecast, By Delivery Device, 2020 to 2035

Table 11: North America Insulin Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 12: North America Insulin Market Value (US$ Mn) Forecast, By Distribution Channel, 2020 to 2035

Table 13: Europe Insulin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 14: Europe Insulin Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 15: Europe Insulin Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 16: Europe Insulin Market Value (US$ Mn) Forecast, By Delivery Device, 2020 to 2035

Table 17: Europe Insulin Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 18: Europe Insulin Market Value (US$ Mn) Forecast, By Distribution Channel, 2020 to 2035

Table 19: Asia Pacific Insulin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 20: Asia Pacific Insulin Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 21: Asia Pacific Insulin Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 22: Asia Pacific Insulin Market Value (US$ Mn) Forecast, By Delivery Device, 2020 to 2035

Table 23: Asia Pacific Insulin Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 24: Asia Pacific Insulin Market Value (US$ Mn) Forecast, By Distribution Channel, 2020 to 2035

Table 25: Latin America Insulin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 26: Latin America Insulin Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 27: Latin America Insulin Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 28: Latin America Insulin Market Value (US$ Mn) Forecast, By Delivery Device, 2020 to 2035

Table 29: Latin America Insulin Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 30: Latin America Insulin Market Value (US$ Mn) Forecast, By Distribution Channel, 2020 to 2035

Table 31: Middle East & Africa Insulin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 32: Middle East & Africa Insulin Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 33: Middle East & Africa Insulin Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 34: Middle East & Africa Insulin Market Value (US$ Mn) Forecast, By Delivery Device, 2020 to 2035

Table 35: Middle East & Africa Insulin Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 36: Middle East & Africa Insulin Market Value (US$ Mn) Forecast, By Distribution Channel, 2020 to 2035

List of Figures

Figure 01: Global Insulin Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Figure 02: Global Insulin Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 03: Global Insulin Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 04: Global Insulin Market Revenue (US$ Mn), by Rapid-acting insulin, 2020 to 2035

Figure 05: Global Insulin Market Revenue (US$ Mn), by Short-acting insulin, 2020 to 2035

Figure 06: Global Insulin Market Revenue (US$ Mn), by Intermediate-acting insulin, 2020 to 2035

Figure 07: Global Insulin Market Revenue (US$ Mn), by Long-acting insulin, 2020 to 2035

Figure 08: Global Insulin Market Revenue (US$ Mn), by Biphasic insulin, 2020 to 2035

Figure 09: Global Insulin Market Value Share Analysis, By Application, 2024 and 2035

Figure 10: Global Insulin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 11: Global Insulin Market Revenue (US$ Mn), by Type 1 Diabetes, 2020 to 2035

Figure 12: Global Insulin Market Revenue (US$ Mn), by Type 2 Diabetes, 2020 to 2035

Figure 13: Global Insulin Market Revenue (US$ Mn), by Gestational Diabetes, 2020 to 2035

Figure 14: Global Insulin Market Value Share Analysis, By Delivery Device, 2024 and 2035

Figure 15: Global Insulin Market Attractiveness Analysis, By Delivery Device, 2025 to 2035

Figure 16: Global Insulin Market Revenue (US$ Mn), by Pens, 2020 to 2035

Figure 17: Global Insulin Market Revenue (US$ Mn), by Insulin Pumps, 2020 to 2035

Figure 18: Global Insulin Market Revenue (US$ Mn), by Syringes, 2020 to 2035

Figure 19: Global Insulin Market Revenue (US$ Mn), by Jets, 2020 to 2035

Figure 20: Global Insulin Market Value Share Analysis, By Source, 2024 and 2035

Figure 21: Global Insulin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 22: Global Insulin Market Revenue (US$ Mn), by Human Insulin, 2020 to 2035

Figure 23: Global Insulin Market Revenue (US$ Mn), by Insulin Analog, 2020 to 2035

Figure 24: Global Insulin Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 25: Global Insulin Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 26: Global Insulin Market Revenue (US$ Mn), by Hospital Pharmacies, 2020 to 2035

Figure 27: Global Insulin Market Revenue (US$ Mn), by Retail Pharmacies, 2020 to 2035

Figure 28: Global Insulin Market Revenue (US$ Mn), by Online Pharmacies, 2020 to 2035

Figure 29: Global Insulin Market Value Share Analysis, By Region, 2024 and 2035

Figure 30: Global Insulin Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 31: North America Insulin Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 32: North America Insulin Market Value Share Analysis, by Country, 2024 and 2035

Figure 33: North America Insulin Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 34: North America Insulin Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 35: North America Insulin Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 36: North America Insulin Market Value Share Analysis, By Application, 2024 and 2035

Figure 37: North America Insulin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 38: North America Insulin Market Value Share Analysis, By Delivery Device, 2024 and 2035

Figure 39: North America Insulin Market Attractiveness Analysis, By Delivery Device, 2025 to 2035

Figure 40: North America Insulin Market Value Share Analysis, By Source, 2024 and 2035

Figure 41: North America Insulin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 42: North America Insulin Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 43: North America Insulin Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 44: Europe Insulin Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 45: Europe Insulin Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 46: Europe Insulin Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 47: Europe Insulin Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 48: Europe Insulin Market Value Share Analysis, By Application, 2024 and 2035

Figure 49: Europe Insulin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 50: Europe Insulin Market Value Share Analysis, By Delivery Device, 2024 and 2035

Figure 51: Europe Insulin Market Attractiveness Analysis, By Delivery Device, 2025 to 2035

Figure 52: Europe Insulin Market Value Share Analysis, By Source, 2024 and 2035

Figure 53: Europe Insulin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 54: Europe Insulin Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 55: Europe Insulin Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 56: Asia Pacific Insulin Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 57: Asia Pacific Insulin Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 58: Asia Pacific Insulin Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 59: Asia Pacific Insulin Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 60: Asia Pacific Insulin Market Value Share Analysis, By Application, 2024 and 2035

Figure 61: Asia Pacific Insulin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 62: Asia Pacific Insulin Market Value Share Analysis, By Delivery Device, 2024 and 2035

Figure 63: Asia Pacific Insulin Market Attractiveness Analysis, By Delivery Device, 2025 to 2035

Figure 64: Asia Pacific Insulin Market Value Share Analysis, By Source, 2024 and 2035

Figure 65: Asia Pacific Insulin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 66: Asia Pacific Insulin Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 67: Asia Pacific Insulin Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 68: Latin America Insulin Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 69: Latin America Insulin Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 70: Latin America Insulin Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 71: Latin America Insulin Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 72: Latin America Insulin Market Value Share Analysis, By Application, 2024 and 2035

Figure 73: Latin America Insulin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 74: Latin America Insulin Market Value Share Analysis, By Delivery Device, 2024 and 2035

Figure 75: Latin America Insulin Market Attractiveness Analysis, By Delivery Device, 2025 to 2035

Figure 76: Latin America Insulin Market Value Share Analysis, By Source, 2024 and 2035

Figure 77: Latin America Insulin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 78: Latin America Insulin Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 79: Latin America Insulin Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 80: Middle East & Africa Insulin Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 81: Middle East & Africa Insulin Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 82: Middle East & Africa Insulin Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 83: Middle East & Africa Insulin Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 84: Middle East & Africa Insulin Market Value Share Analysis, By Delivery Device, 2024 and 2035

Figure 85: Middle East & Africa Insulin Market Attractiveness Analysis, By Delivery Device, 2025 to 2035

Figure 86: Middle East & Africa Insulin Market Value Share Analysis, By Source, 2024 and 2035

Figure 87: Middle East & Africa Insulin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 88: Middle East & Africa Insulin Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 89: Middle East & Africa Insulin Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035