Reports

Reports

One of the principal stimulants to the Germanium-68/Gallium-68 generators market is the growth of cyclotron facilities and networks of radiopharmacies. As increasing numbers of hospitals and diagnostic centers fit on-site or satellite production equipment, demand for efficient generator systems and hence for Germanium-68/Gallium-68 generators is pushed forward.

Enhanced logistics and cold-chain management also facilitate increased distribution in urban and semi-urban areas. Moreover, regulatory bodies are increasingly licensing decentralized radiopharmaceutical centers, which breeds generator adoption confidence. With the healthcare system investing in point-of-care imaging technology, the accessibility factor becomes an inducer in the market.

Economic studies often suggest that, in the event of initial investment in infrastructure, generators' production is eco-friendlier. This economic appeal makes hospitals and PET-scan facilities deploy these generators in their operations.

Currently, market trends indicate that manufacturers are focused on continuing to develop generator technology and the enhance user experience. There is a growth in modular design, plug-and-play generators that are easier to use, have lower maintenance expectations and smaller training obligations, which allow for use in resource-limited facilities.

Manufacturers can offer elution chemistries and buffers that allow for Gallium-68 production with reduced impurities, can change purity and imaging flows. There are new portable and compact footprint generators that can be brought or taken into small laboratories. There are integrated digital control systems to provide real-time performance metrics to illustrate generator reliability and safety as well as mitigate risks in operational planning. All of these developments serve to compound efficiencies in terms of the newer and user-friendly generator systems.

Manufacturers are distinguishing themselves based upon superior technical support, lifecycle services and training programs. These players have developed remote diagnostics, predictive maintenance platforms, and others to assess and promote generator demands while reducing generator down time.

Germanium-68/Gallium-68 (Ge-68/Ga-68) generator radiopharmaceuticals are a valuable modality in nuclear medicine, in the way that they supply Gallium-68, a radioracer utilized in positron emission tomography (PET) imaging. Ge-68/Ga-68 generators function through the generation of Ga-68 radioactively decaying from Ge-68, whereby in situ gallium-68 radiotracers are generated.

The availability of Gallium-68 is especially advantageous in targeting certain cancers, such as neuroendocrine tumors, and improving prior diagnostic accuracy and treatment monitoring. Coupled with the implicit convenience of using a Ge-68/Ga-68 generator, the availability of materials for efficiency and efficacy in today's modern medical imaging can be greatly facilitated in more than one way.

The generator has a column with an adsorbent material on which Germanium-68 is adsorbed. Upon isotope decay, Gallium-68 is formed and can be eluted by an appropriate solution, preferably hydrochloric acid. The process is analogous to the molybdenum-technetium generators used in standard nuclear medicine. The eluted solution of Ga-68 is finally applied to the radiolabelling of molecules, e.g., peptides, as tracers for PET scanning.

Gallium-68 sourced from generators is primarily applicable in oncology, cardiology, and neurology. It is integral to PET scans providing visualization to biological processes at the molecular level. In addition, Ga-68 has known utilization in imaging prostate cancer using Ga-68-labeled prostate-specific membrane antigen (PSMA) ligands.

Germanium-68/Gallium-68 generators offer a lot of freedom from cyclotron-produced isotopes and make Ga- 68 more available. Their small size, reliability, and ability to produce several elutions every day make them practical for clinical use. Also, advancements in generator technology have meaningfully improved yield, purity, and handling, which helps healthcare professionals with delivering Ga-68 imaging in a simpler and exact manner.

| Attribute | Detail |

|---|---|

| Germanium-68/Gallium-68 Generators Market Drivers |

|

Germanium-68/Gallium-68 generators offer continuous and on-demand availability of Gallium-68 isotopes for PET scanning. Since cancer patients need diagnosis and treatment urgently, the generators efficiently provide a constant supply of radiopharmaceuticals, which do not require cyclotron infrastructure. This allows hospitals and diagnostic centers to upgrade cancer imaging procedures with less delay, and better outcomes for patients. This technology ultimately provides for the medical community's needs for rapid and accurate diagnosis.

There is also a connection between cancer rates and a transition to precision medicine that relates to Ga-68 imaging. Ga-68 tracers, such as those that bind to somatostatin receptors, and those that bind to prostate specific membrane antigens, are ways in which oncologists can visualize the molecular markers associated with the different types of cancers to make this personalized medicine applicable to treatment planning or monitoring treatment effect.

As there continues to be a global rise in cancer, we are also seeing increased investment in PET imaging by healthcare providers, leading to an inevitable rise in the use of Ge-68/Ga-68 generators. The portability, reliability, and affordability of these generators help meet the growing clinical need for newer and better cancer diagnostics, thus the growing cancer burden continues to be a solid catalyst for the market.

Increased production of new radiopharmaceuticals has been a main force in the Germanium-68/Gallium-68 generator market. With new tracers in development that bind to receptors or biomarkers, there has been an increased demand for stable sources of Gallium-68. The newer agents allow for more specific tumor and other disease imaging and have opened up new clinical uses and generated steady demand for those generators that allow for on-site Ga-68 accessibility.

With new radiopharmaceuticals with indications such as Ga-68-peptides, antibodies, and small molecules, the diagnostic sensitivity has improved dramatically in the fields of oncology, cardiology, and various neurological diseases. Since these agents can target specifically and can target many different elements of disease, they will aid in personalizing medicine. Clinicians increasingly depend on the seamless availability of Gallium-68 as more of these agents receive regulatory approval. Demand is directly driving generator use.

Theranostic is a significant trend in radiopharmaceutical development. Theranostic means the same molecule can be used for diagnosis and therapy. Many new agents are based on Ga-68 for imaging and Lutetium-177 for therapy, thus completing the picture. The emergence of new agents will maximize the importance of Ge-68/Ga-68 generators as a fundamental part of theranostic methodologies, and to more seamlessly use them in patient care.

The pipeline for new radiopharmaceuticals continues to grow globally underpinned by sustained research and development expenditures, and the establishment of collaborations and partnerships between industry and academia. Each new Ga-68 based tracer will heighten dependency upon generators, which not only expands clinical use but secures the future of commercial patent for Ge-68/Ga-68 generators as effectively perennial infrastructure for next-generation molecular imaging.

In the Germanium-68/Gallium-68 generators market, there are advanced applications in the medical imaging sector as Germanium-68's long half-life of approximately 271 days provides a long-duration source of Gallium-68; which provides stable and dependable Ga-68 supply and allows the medical facility to not overly invest in complicated, expensive cyclotron infrastructure as the medical facility has stable Ga-68 routinely available for all PET scans to support the normal routine diagnostics imaging comparisons.

Gallium-68 is generated from a Germanium-68/Gallium-68 generator. Gallium-68 provides positron emission, allowing for excellent PET imaging of a tumor and is useful for detecting tumors, staging tumors using longitudinal scans, and monitoring therapy.

| Attribute | Detail |

|---|---|

| Leading Region |

|

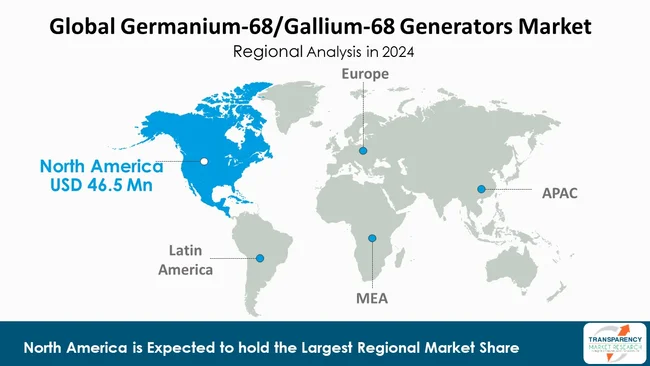

As per the latest germanium-68/gallium-68 generators market analysis, North America dominated in 2024. This is attributed to several factors, including the region's advanced healthcare infrastructure and use of PET imaging in patient care. In addition, healthcare providers in North America have a vested interest in starting treatments as early as possible for cancer patients. The area is fortunate to have a system of nuclear medicine capabilities and research organizations that drives the uptake of Ga-68-based imaging solutions in clinical practice.

Additionally, there are ongoing supportive environments, investment from governments, and collaborations between universities and industry, which strengthens the capabilities of the region. The ongoing regulatory approvals afforded to new Ga-68 radiopharmaceuticals for clinical use and government initiatives that are geared toward supporting "precision medicine," will enhance the consistency of demand generators and keep North America in a leadership role in the sector.

The market players in the Germanium-68/Gallium-68 generators market are employing a variety of approaches including upgrading generators' efficiency and purity, growing their distribution channels and providing customers with appealing pricing strategies. They will also seek to create alliances with research organizations, develop theranostics applications, and to offer OEM training, services, and digital monitoring practices to improve acceptance and encourage long-term customer involvement.

IRE ELiT, ITM Isotopen Technologien München AG (ITM), IThemba Labs, IBA Radiopharma Solutions, Eckert & Ziegler, Curium, Eczacıbaşı-Monrol, Telix Pharmaceuticals Limited, B. J. Madan & Co., and Isotope JSC, are some of the leading players operating in the global Germanium-68/Gallium-68 generators Market.

Each of these players has been profiled in the Germanium-68/Gallium-68 Generators market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

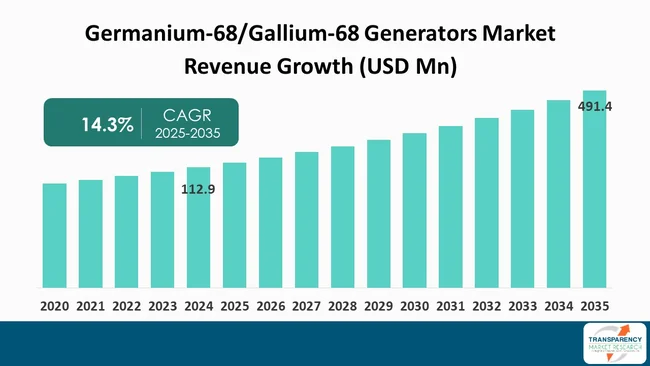

| Size in 2024 | US$ 112.9 Mn |

| Forecast Value in 2035 | US$ 491.4 Mn |

| CAGR | 14.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type of Generator

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

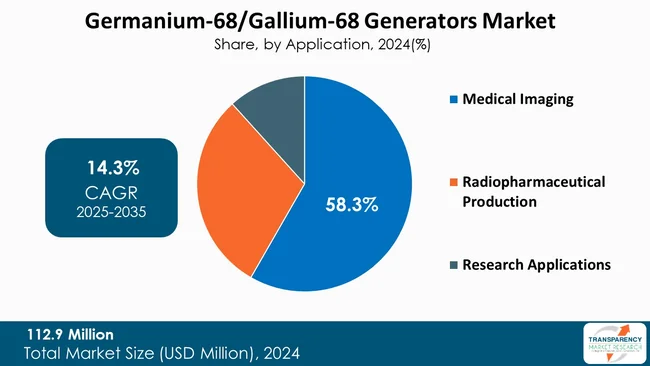

The global Germanium-68/Gallium-68 generators market was valued at US$ 112.9 Mn in 2024

The global Germanium-68/Gallium-68 generators industry is projected to reach more than US$ 491.4 Mn by the end of 2035

Rising prevalence of cancer, increasing development of novel radiopharmaceuticals, advancements in nuclear medicine and PET imaging, evolving regulatory frameworks, and increased healthcare expenditure are some of the factors driving the expansion of Germanium-68/Gallium-68 generators market.

The CAGR is anticipated to be 14.3% from 2025 to 2035

IRE ELiT, ITM Isotopen Technologien München AG (ITM), IThemba Labs, IBA Radiopharma Solutions, Eckert & Ziegler, Curium, Eczacıbaşı-Monrol, Telix Pharmaceuticals Limited, B. J. Madan & Co., and Isotope JSC

Table 01: Global Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Type of Generator, 2020 to 2035

Table 02: Global Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Activity Level of Generators, 2020 to 2035

Table 03: Global Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Type of Generator, 2020 to 2035

Table 08: North America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Activity Level of Generators, 2020 to 2035

Table 09: North America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 12: Europe - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Type of Generator, 2020 to 2035

Table 13: Europe - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Activity Level of Generators, 2020 to 2035

Table 14: Europe - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 17: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Type of Generator, 2020 to 2035

Table 18: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Activity Level of Generators, 2020 to 2035

Table 19: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Latin America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Type of Generator, 2020 to 2035

Table 23: Latin America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Activity Level of Generators, 2020 to 2035

Table 24: Latin America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 27: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Type of Generator, 2020 to 2035

Table 28: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Activity Level of Generators, 2020 to 2035

Table 29: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Type of Generator, 2024 and 2035

Figure 02: Global Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Type of Generator, 2025 to 2035

Figure 03: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Static Generators, 2020 to 2035

Figure 04: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Mobile Generators, 2020 to 2035

Figure 05: Global Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Activity Level of Generators, 2024 and 2035

Figure 06: Global Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Activity Level of Generators, 2025 to 2035

Figure 07: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by 50 mCi, 2020 to 2035

Figure 08: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by 100 mCi, 2020 to 2035

Figure 09: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Application, 2024 and 2035

Figure 11: Global Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 12: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Medical Imaging, 2020 to 2035

Figure 13: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Radiopharmaceutical Production, 2020 to 2035

Figure 14: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Research Applications, 2020 to 2035

Figure 15: Global Germanium-68/Gallium-68 Generators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 16: Global Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 17: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Hospitals and Clinics, 2020 to 2035

Figure 18: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Diagnostics Centers, 2020 to 2035

Figure 19: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Academic and Research Institutes, 2020 to 2035

Figure 20: Global Germanium-68/Gallium-68 Generators Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Region, 2024 and 2035

Figure 22: Global Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 23: North America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 24: North America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, by Country, 2024 and 2035

Figure 25: North America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 26: North America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Type of Generator, 2024 and 2035

Figure 27: North America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Type of Generator, 2025 to 2035

Figure 28: North America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Activity Level of Generators, 2024 and 2035

Figure 29: North America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Activity Level of Generators, 2025 to 2035

Figure 30: North America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Application, 2024 and 2035

Figure 31: North America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 32: North America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 33: North America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 34: Europe - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Europe - Germanium-68/Gallium-68 Generators Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 36: Europe - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 37: Europe - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Type of Generator, 2024 and 2035

Figure 38: Europe - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Type of Generator, 2025 to 2035

Figure 39: Europe - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Activity Level of Generators, 2024 and 2035

Figure 40: Europe - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Activity Level of Generators, 2025 to 2035

Figure 41: Europe - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Application, 2024 and 2035

Figure 42: Europe - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 43: Europe - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 44: Europe - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 45: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: Asia Pacific - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Type of Generator, 2024 and 2035

Figure 49: Asia Pacific - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Type of Generator, 2025 to 2035

Figure 50: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Activity Level of Generators, 2024 and 2035

Figure 51: Asia Pacific - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Activity Level of Generators, 2025 to 2035

Figure 52: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: Asia Pacific - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: Asia Pacific - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Asia Pacific - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 56: Latin America - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Latin America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 58: Latin America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 59: Latin America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Type of Generator, 2024 and 2035

Figure 60: Latin America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Type of Generator, 2025 to 2035

Figure 61: Latin America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Activity Level of Generators, 2024 and 2035

Figure 62: Latin America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Activity Level of Generators, 2025 to 2035

Figure 63: Latin America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Application, 2024 and 2035

Figure 64: Latin America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 65: Latin America - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 66: Latin America - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 67: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 69: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 70: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Type of Generator, 2024 and 2035

Figure 71: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Type of Generator, 2025 to 2035

Figure 72: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Activity Level of Generators, 2024 and 2035

Figure 73: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Activity Level of Generators, 2025 to 2035

Figure 74: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By Application, 2024 and 2035

Figure 75: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 76: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 77: Middle East & Africa - Germanium-68/Gallium-68 Generators Market Attractiveness Analysis, By End-user, 2025 to 2035