Reports

Reports

The radiopharmaceutical business is witnessing a high growth rate due to technological developments in nuclear medicine and increasing applications in targeted therapy and diagnostic imaging. Radiopharmaceuticals have been referred to as labeled medicine with radioisotopes employed for disease diagnosis or treatment, that is, oncology, cardiology, and neurology.

The growing demand for early disease diagnosis and personalized treatment and tailored drugs and hence growing interest to create innovative radiopharmaceuticals drives the demand.

.webp)

Market leaders are making R&D investments in the development of innovative products with better image accuracy and therapy. Heavy prevalence of chronic disease and an exploding population are also generating demand for radiopharmaceuticals. Collaboration among drug company research centers and approvals are also driving market growth.

Exorbitant production cost and strict regulatory environments are, however, retarding market growth. Overall, there is going to be huge expansion in radiopharmaceutical market and therefore an incredibly significant business to invest and expand in the health care sector.

Radiopharmaceuticals are chemical substances having specific properties to be combined with radioactive isotopes, and employed in nuclear medicine to diagnose and treat diseases. Agents function by playing a key role in imaging modalities, i.e., positron emission tomography (PET) and single-photon emission computed tomography (SPECT). They allow clinicians to visualize physiological processes on a real-time basis. By binding with specific organs or tissues, radiopharmaceuticals industry are capable of offering accurate information regarding disease, particularly in oncology, cardiology, and neurology.

Radiopharmaceuticals are used more in targeted therapy, wherein the cancer cells are targeted and fewer other cells are destroyed. More focus on personalized medicine and early detection of disease has given a new vigor to this discipline. New radiopharmaceuticals are thus synthesized and produced with increasing sensitivity in diagnosis and therapeutic effects. Radiopharmaceuticals are a medical revolution today, offering better patient care and more treatment.

| Attribute | Detail |

|---|---|

| Radiopharmaceuticals Market Drivers | Rising Burden of Cancer and Cardiovascular Diseases Technological Advancements in Radiotracer Development |

Increased worldwide incidence of cancer and cardiovascular disease (CVDs) is the biggest growth driver to the radiopharmaceutical market. Radiopharmaceuticals are employed in therapy as well as diagnosis in oncology (e.g., PET and SPECT imaging) and cardiology (e.g., myocardial perfusion scintigraphy).

For example, in 2022 alone, more than 20 million new cases of cancer were reported globally, as estimated by the International Agency for Research on Cancer (IARC) and are projected to increase over more than 28 million by the year 2040. Fluorodeoxyglucose (18F-FDG) is among the most frequent radiopharmaceuticals used in PET scan staging and diagnosis of the other cancers like lung cancer, breast cancer, and colorectal cancer. Likewise, in cardiology, technetium-99m (Tc-99m) labeled agents are the gold standard for coronary artery disease (CAD) and myocardial perfusion imaging.

Growing demand for non-invasive diagnostic equipment is also causing industry growth. Conventional tissue biopsies are destructive and restrictive, while radiopharmaceutical imaging provides a real-time whole-body scan with high sensitivity. Curative radiopharmaceutical lutetium-177 (Lu-177) and iodine-131 (I-131) are gaining use for expanse prostate cancer and thyroid cancer treatments, respectively, hence fueling the industry.

With life expectancy also set to increase and lifestyle issues still maintaining the pace of NCDs (non-communicable disease), demand will be healthy in the forthcoming years for challenging and image-guided diagnosis-and consequently for radiopharmaceuticals.

Ongoing innovation in the chemistry of radiotracers and imaging equipment continuously reveals new fields for radiopharmaceuticals and expands the market exponentially. Emerging tracers are hitting molecular targets with remarkable precision, enabling individualized diagnosis and treatment, one of the top trends of precision medicine.

For instance, the identification of Ga-68 DOTATATE, a gallium tracer used in NET imaging, has improved diagnostic sensitivity as compared to earlier SPECT agents. A case in point is PSMA-targeted radiopharmaceuticals such as Ga-68 PSMA-11 and Lu-177 PSMA-617, which have revolutionized diagnosis and treatment of prostate cancer. Ga-68 PSMA-11 was approved by the FDA in 2020 and Lu-177 PSMA-617 in 2022, which shows how innovation is being translated into commercial approvals and application.

One of the key innovations is alpha-emitting radiopharmaceuticals with highly localized delivery of very high doses of radiation with minimal off-target effect. Actinium-225 (Ac-225) drugs are in early clinical development for a variety of tumors, speaking of strong pipeline.

Hybrid imaging technologies such as PET/CT and PET/MRI also expanded the applications of radiopharmaceuticals by providing sensitive functional and anatomical information in a single session. These platforms require highly selective radiotracers, and this has fueled R&D expenditures by pharmaceutical companies and universities.

Therefore, advances in instrumentation, target identification, and radiochemistry not only increase the efficacy of diagnosis but also enlarge the horizon for clinical utility of radiopharmaceuticals, thereby acting as a key driver to the growth of the market.

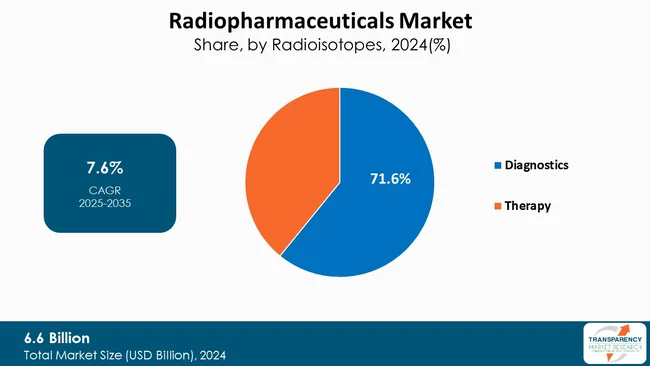

Diagnostics radioisotopes are leading the radiopharmaceuticals market. Their biggest strength is their inherent utility in non-invasive imaging modalities such as PET and SPECT, enabling proper visualization of physiological functions and resulting in early disease diagnosis and accurate diagnosis. This aspect is highly critical when it comes to oncology, as early detection of tumors greatly increases the success rate of treatment.

Besides, rising cases of individuals with chronic diseases and an aging population have created a demand for efficient diagnostic tests. With shift toward preventive medicine, the demand for accurate diagnostic tests has never been higher. Diagnostic radioisotopes such as Technetium-99m and Fluorine-18 are chosen based on their longest available half-life and imaging properties, thereby being well-fitted for clinical use on a daily basis.

Additionally, process and technological innovation have expanded access and utilization of these radioisotopes, further extending their use. Approving processes and establishing manufacturing plants for radiopharmaceuticals have also contributed to the expansion in the market. With healthcare trending toward earlier diagnosis and more personal treatment methods, diagnostics radioisotopes will be the market leaders in radiopharmaceuticals, and heavily influence patient treatment and outcomes.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America holds the largest share of the radiopharmaceuticals market. Firstly, the region boasts a well-established healthcare infrastructure, which includes advanced medical facilities and a high level of investment in research and development. This environment does foster innovation and the rapid introduction of new radiopharmaceuticals, especially in targeted therapies and diagnostic imaging.

Secondly, the growing prevalence of chronic diseases such as cancer and cardiovascular conditions has driven demand for effective therapeutic and diagnostic solutions. North America’s aging population further amplifies this need, as older individuals are more likely to develop these conditions.

Additionally, the presence of major pharmaceutical companies and biotechnology firms in the region enables collaboration and enhances the development of new radiopharmaceuticals. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) have also been proactive in approving new products, thereby ascertaining that advancements reach the market efficiently.

Key players in the global radiopharmaceuticals market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Advanced Accelerator Applications, Bayer AG, Eli Lilly and Company, GE HealthCare, ITM Isotopen Technologien München AG, Jubilant Pharma Limited, Lantheus Holdings, Inc., Nihon Medi-Physics, Siemens Healthineers AG, Telix Pharmaceuticals are some of the leading key players.

Each of these players has been profiled in the radiopharmaceuticals market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 6.6 Bn |

| Forecast Value in 2035 | US$ 14.6 Bn |

| CAGR | 7.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Radiopharmaceuticals Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.6 Bn in 2024.

It is projected to cross US$ 14.6 Bn by the end of 2035.

Rising burden of cancer and cardiovascular diseases and technological advancements in radiotracer development.

It is anticipated to grow at a CAGR of 7.6% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Advanced Accelerator Applications, Bayer AG, Eli Lilly and Company, GE Healthcare, ITM Isotopen Technologien München AG, Jubilant Pharma Limited, Lantheus Holdings, Inc., Nihon Medi-Physics, Siemens Healthineers AG, Telix Pharmaceuticals and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Radiopharmaceuticals Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Radiopharmaceuticals Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. FDA Approved Radiopharmaceuticals Products

5.2. Epidemiology of Major Diseases

5.3. Reimbursement Scenario by key Countries/Regions

5.4. Pricing Analysis

5.5. Pipeline Analysis

5.6. Technological Advancements & Development

5.7. Insights on Pioneering Targeted in Radiotherapy

5.8. Regulatory Scenario by Country/Regions

5.9. Key Industry Events (Product Launch, Key Mergers and Acquisitions, etc.)

5.10. Number of Radiotherapy Centers: Major Country

6. Global Radiopharmaceuticals Market Analysis and Forecast, by Radioisotopes

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Radioisotopes, 2020 to 2035

6.3.1. Diagnostics

6.3.1.1. Fluorine-18 (F-18)

6.3.1.1.1. Fludeoxyglucose (FDG)

6.3.1.1.2. Sodium Fluoride

6.3.1.1.3. Flucicovine

6.3.1.1.4. Florbetapir

6.3.1.1.5. Florbetaben

6.3.1.1.6. Others

6.3.1.2. Gallium-68 (Ga-68)

6.3.1.2.1. Dotatate

6.3.1.2.2. Dotatoc

6.3.1.2.3. PSMA-11

6.3.1.3. Technetium-99m (Tc-99)

6.3.1.4. Iodine-123 (I-123)

6.3.1.5. Others

6.3.2. Therapy

6.3.2.1. Iodine-131 (I-131)

6.3.2.2. Yttrium-90 (Y-90)

6.3.2.3. Lutetium-177 (Lu-177)

6.3.2.3.1. Lu-PSMA-617

6.3.2.3.2. Lu-DOTA-TATE

6.3.2.4. Others

6.4. Market Attractiveness Analysis, by Radioisotopes

7. Global Radiopharmaceuticals Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020 to 2035

7.3.1. Oncology

7.3.1.1. Prostate Cancer

7.3.1.2. Breast Cancer

7.3.1.3. Neuroendocrine Tumors

7.3.1.4. Thyroid Cancer

7.3.1.5. Colorectal Cancer

7.3.1.6. Liver Cancer

7.3.1.7. Others

7.3.2. Neurology

7.3.2.1. Alzheimer's Disease

7.3.2.2. Parkinson's Disease

7.3.2.3. Others

7.3.3. Cardiology

7.3.4. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Radiopharmaceuticals Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2020 to 2035

8.3.1. Hospitals

8.3.2. Diagnostics and Imaging Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Radiopharmaceuticals Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020 to 2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Radiopharmaceuticals Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Radioisotopes, 2020 to 2035

10.2.1. Diagnostics

10.2.1.1. Fluorine-18 (F-18)

10.2.1.1.1. Fludeoxyglucose (FDG)

10.2.1.1.2. Sodium Fluoride

10.2.1.1.3. Flucicovine

10.2.1.1.4. Florbetapir

10.2.1.1.5. Florbetaben

10.2.1.1.6. Others

10.2.1.2. Gallium-68 (Ga-68)

10.2.1.2.1. Dotatate

10.2.1.2.2. Dotatoc

10.2.1.2.3. PSMA-11

10.2.1.3. Technetium-99m (Tc-99)

10.2.1.4. Iodine-123 (I-123)

10.2.1.5. Others

10.2.2. Therapy

10.2.2.1. Iodine-131 (I-131)

10.2.2.2. Yttrium-90 (Y-90)

10.2.2.3. Lutetium-177 (Lu-177)

10.2.2.3.1. Lu-PSMA-617

10.2.2.3.2. Lu-DOTA-TATE

10.2.2.4. Others

10.3. Market Value Forecast, by Application, 2020 to 2035

10.3.1. Oncology

10.3.1.1. Prostate Cancer

10.3.1.2. Breast Cancer

10.3.1.3. Neuroendocrine Tumors

10.3.1.4. Thyroid Cancer

10.3.1.5. Colorectal Cancer

10.3.1.6. Liver Cancer

10.3.1.7. Others

10.3.2. Neurology

10.3.2.1. Alzheimer's Disease

10.3.2.2. Parkinson's Disease

10.3.2.3. Others

10.3.3. Cardiology

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2020 to 2035

10.4.1. Hospitals

10.4.2. Diagnostics and Imaging Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Radioisotopes

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Radiopharmaceuticals Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Radioisotopes, 2020 to 2035

11.2.1. Diagnostics

11.2.1.1. Fluorine-18 (F-18)

11.2.1.1.1. Fludeoxyglucose (FDG)

11.2.1.1.2. Sodium Fluoride

11.2.1.1.3. Flucicovine

11.2.1.1.4. Florbetapir

11.2.1.1.5. Florbetaben

11.2.1.1.6. Others

11.2.1.2. Gallium-68 (Ga-68)

11.2.1.2.1. Dotatate

11.2.1.2.2. Dotatoc

11.2.1.2.3. PSMA-11

11.2.1.3. Technetium-99m (Tc-99)

11.2.1.4. Iodine-123 (I-123)

11.2.1.5. Others

11.2.2. Therapy

11.2.2.1. Iodine-131 (I-131)

11.2.2.2. Yttrium-90 (Y-90)

11.2.2.3. Lutetium-177 (Lu-177)

11.2.2.3.1. Lu-PSMA-617

11.2.2.3.2. Lu-DOTA-TATE

11.2.2.4. Others

11.3. Market Value Forecast, by Application, 2020 to 2035

11.3.1. Oncology

11.3.1.1. Prostate Cancer

11.3.1.2. Breast Cancer

11.3.1.3. Neuroendocrine Tumors

11.3.1.4. Thyroid Cancer

11.3.1.5. Colorectal Cancer

11.3.1.6. Liver Cancer

11.3.1.7. Others

11.3.2. Neurology

11.3.2.1. Alzheimer's Disease

11.3.2.2. Parkinson's Disease

11.3.2.3. Others

11.3.3. Cardiology

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2020 to 2035

11.4.1. Hospitals

11.4.2. Diagnostics and Imaging Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Radioisotopes

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Radiopharmaceuticals Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Radioisotopes, 2020 to 2035

12.2.1. Diagnostics

12.2.1.1. Fluorine-18 (F-18)

12.2.1.1.1. Fludeoxyglucose (FDG)

12.2.1.1.2. Sodium Fluoride

12.2.1.1.3. Flucicovine

12.2.1.1.4. Florbetapir

12.2.1.1.5. Florbetaben

12.2.1.1.6. Others

12.2.1.2. Gallium-68 (Ga-68)

12.2.1.2.1. Dotatate

12.2.1.2.2. Dotatoc

12.2.1.2.3. PSMA-11

12.2.1.3. Technetium-99m (Tc-99)

12.2.1.4. Iodine-123 (I-123)

12.2.1.5. Others

12.2.2. Therapy

12.2.2.1. Iodine-131 (I-131)

12.2.2.2. Yttrium-90 (Y-90)

12.2.2.3. Lutetium-177 (Lu-177)

12.2.2.3.1. Lu-PSMA-617

12.2.2.3.2. Lu-DOTA-TATE

12.2.2.4. Others

12.3. Market Value Forecast, by Application, 2020 to 2035

12.3.1. Oncology

12.3.1.1. Prostate Cancer

12.3.1.2. Breast Cancer

12.3.1.3. Neuroendocrine Tumors

12.3.1.4. Thyroid Cancer

12.3.1.5. Colorectal Cancer

12.3.1.6. Liver Cancer

12.3.1.7. Others

12.3.2. Neurology

12.3.2.1. Alzheimer's Disease

12.3.2.2. Parkinson's Disease

12.3.2.3. Others

12.3.3. Cardiology

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2020 to 2035

12.4.1. Hospitals

12.4.2. Diagnostics and Imaging Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. South Korea

12.5.5. Australia & Newzealend

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Radioisotopes

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Radiopharmaceuticals Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Radioisotopes, 2020 to 2035

13.2.1. Diagnostics

13.2.1.1. Fluorine-18 (F-18)

13.2.1.1.1. Fludeoxyglucose (FDG)

13.2.1.1.2. Sodium Fluoride

13.2.1.1.3. Flucicovine

13.2.1.1.4. Florbetapir

13.2.1.1.5. Florbetaben

13.2.1.1.6. Others

13.2.1.2. Gallium-68 (Ga-68)

13.2.1.2.1. Dotatate

13.2.1.2.2. Dotatoc

13.2.1.2.3. PSMA-11

13.2.1.3. Technetium-99m (Tc-99)

13.2.1.4. Iodine-123 (I-123)

13.2.1.5. Others

13.2.2. Therapy

13.2.2.1. Iodine-131 (I-131)

13.2.2.2. Yttrium-90 (Y-90)

13.2.2.3. Lutetium-177 (Lu-177)

13.2.2.3.1. Lu-PSMA-617

13.2.2.3.2. Lu-DOTA-TATE

13.2.2.4. Others

13.3. Market Value Forecast, by Application, 2020 to 2035

13.3.1. Oncology

13.3.1.1. Prostate Cancer

13.3.1.2. Breast Cancer

13.3.1.3. Neuroendocrine Tumors

13.3.1.4. Thyroid Cancer

13.3.1.5. Colorectal Cancer

13.3.1.6. Liver Cancer

13.3.1.7. Others

13.3.2. Neurology

13.3.2.1. Alzheimer's Disease

13.3.2.2. Parkinson's Disease

13.3.2.3. Others

13.3.3. Cardiology

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2020 to 2035

13.4.1. Hospitals

13.4.2. Diagnostics and Imaging Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Radioisotopes

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Radiopharmaceuticals Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Radioisotopes, 2020 to 2035

14.2.1. Diagnostics

14.2.1.1. Fluorine-18 (F-18)

14.2.1.1.1. Fludeoxyglucose (FDG)

14.2.1.1.2. Sodium Fluoride

14.2.1.1.3. Flucicovine

14.2.1.1.4. Florbetapir

14.2.1.1.5. Florbetaben

14.2.1.1.6. Others

14.2.1.2. Gallium-68 (Ga-68)

14.2.1.2.1. Dotatate

14.2.1.2.2. Dotatoc

14.2.1.2.3. PSMA-11

14.2.1.3. Technetium-99m (Tc-99)

14.2.1.4. Iodine-123 (I-123)

14.2.1.5. Others

14.2.2. Therapy

14.2.2.1. Iodine-131 (I-131)

14.2.2.2. Yttrium-90 (Y-90)

14.2.2.3. Lutetium-177 (Lu-177)

14.2.2.3.1. Lu-PSMA-617

14.2.2.3.2. Lu-DOTA-TATE

14.2.2.4. Others

14.3. Market Value Forecast, by Application, 2020 to 2035

14.3.1. Oncology

14.3.1.1. Prostate Cancer

14.3.1.2. Breast Cancer

14.3.1.3. Neuroendocrine Tumors

14.3.1.4. Thyroid Cancer

14.3.1.5. Colorectal Cancer

14.3.1.6. Liver Cancer

14.3.1.7. Others

14.3.2. Neurology

14.3.2.1. Alzheimer's Disease

14.3.2.2. Parkinson's Disease

14.3.2.3. Others

14.3.3. Cardiology

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2020 to 2035

14.4.1. Hospitals

14.4.2. Diagnostics and Imaging Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Radioisotopes

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Advanced Accelerator Applications

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Bayer AG

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Eli Lilly and Company

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. GE Healthcare

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. ITM Isotopen Technologien München AG

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Jubilant Pharma Limited

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Lantheus Holdings, Inc.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Nihon Medi-Physics

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Siemens Healthineers AG

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Telix Pharmaceuticals

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

List of Tables

Table 01: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Radioisotopes, 2020 to 2035

Table 02: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Diagnostics, 2020 to 2035

Table 03: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Fluorine-18 (F-18), 2020 to 2035

Table 04: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Gallium-68 (Ga-68), 2020 to 2035

Table 05: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Therapy, 2020 to 2035

Table 06: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Lutetium-177 (Lu-177), 2020 to 2035

Table 07: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Oncology, 2020 to 2035

Table 09: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Neurology, 2020 to 2035

Table 10: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Global Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 12: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Radioisotopes, 2020 to 2035

Table 14: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Diagnostics, 2020 to 2035

Table 15: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Fluorine-18 (F-18), 2020 to 2035

Table 16: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Gallium-68 (Ga-68), 2020 to 2035

Table 17: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Therapy, 2020 to 2035

Table 18: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Lutetium-177 (Lu-177), 2020 to 2035

Table 19: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Oncology, 2020 to 2035

Table 21: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Neurology, 2020 to 2035

Table 22: North America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 23: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 24: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Radioisotopes, 2020 to 2035

Table 25: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Diagnostics, 2020 to 2035

Table 26: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Fluorine-18 (F-18), 2020 to 2035

Table 27: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Gallium-68 (Ga-68), 2020 to 2035

Table 28: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Therapy, 2020 to 2035

Table 29: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Lutetium-177 (Lu-177), 2020 to 2035

Table 30: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 31: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Oncology, 2020 to 2035

Table 32: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Neurology, 2020 to 2035

Table 33: Europe Radiopharmaceuticals Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 34: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 35: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Radioisotopes, 2020 to 2035

Table 36: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Diagnostics, 2020 to 2035

Table 37: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Fluorine-18 (F-18), 2020 to 2035

Table 38: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Gallium-68 (Ga-68), 2020 to 2035

Table 39: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Therapy, 2020 to 2035

Table 40: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Lutetium-177 (Lu-177), 2020 to 2035

Table 41: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 42: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Oncology, 2020 to 2035

Table 43: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Neurology, 2020 to 2035

Table 44: Asia Pacific Radiopharmaceuticals Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 45: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 46: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Radioisotopes, 2020 to 2035

Table 47: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Diagnostics, 2020 to 2035

Table 48: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Fluorine-18 (F-18), 2020 to 2035

Table 49: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Gallium-68 (Ga-68), 2020 to 2035

Table 50: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Therapy, 2020 to 2035

Table 51: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Lutetium-177 (Lu-177), 2020 to 2035

Table 52: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 53: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Oncology, 2020 to 2035

Table 54: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Neurology, 2020 to 2035

Table 55: Latin America Radiopharmaceuticals Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 56: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 57: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Radioisotopes, 2020 to 2035

Table 58: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Diagnostics, 2020 to 2035

Table 59: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Fluorine-18 (F-18), 2020 to 2035

Table 60: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Gallium-68 (Ga-68), 2020 to 2035

Table 61: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Therapy, 2020 to 2035

Table 62: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Lutetium-177 (Lu-177), 2020 to 2035

Table 63: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 64: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Oncology, 2020 to 2035

Table 65: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By Neurology, 2020 to 2035

Table 66: Middle East & Africa Radiopharmaceuticals Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Radiopharmaceuticals Market Value Share Analysis, By Radioisotopes, 2024 and 2035

Figure 02: Global Radiopharmaceuticals Market Attractiveness Analysis, By Radioisotopes, 2025 to 2035

Figure 03: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Diagnostics, 2020 to 2035

Figure 04: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Therapy, 2020 to 2035

Figure 05: Global Radiopharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 06: Global Radiopharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 07: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 08: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 09: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 10: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 11: Global Radiopharmaceuticals Market Value Share Analysis, By End-user, 2024 and 2035

Figure 12: Global Radiopharmaceuticals Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 13: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 14: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Diagnostics and Imaging Centers, 2020 to 2035

Figure 15: Global Radiopharmaceuticals Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Radiopharmaceuticals Market Value Share Analysis, By Region, 2024 and 2035

Figure 17: Global Radiopharmaceuticals Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 18: North America - Radiopharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 19: North America - Radiopharmaceuticals Market Value Share Analysis, by Country, 2024 and 2035

Figure 20: North America - Radiopharmaceuticals Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 21: North America - Radiopharmaceuticals Market Value Share Analysis, By Radioisotopes, 2024 and 2035

Figure 22: North America - Radiopharmaceuticals Market Attractiveness Analysis, By Radioisotopes, 2025 to 2035

Figure 23: North America - Radiopharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 24: North America - Radiopharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 25: North America - Radiopharmaceuticals Market Value Share Analysis, By End-user, 2024 and 2035

Figure 26: North America - Radiopharmaceuticals Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 27: Europe - Radiopharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: Europe - Radiopharmaceuticals Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 29: Europe - Radiopharmaceuticals Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 30: Europe Radiopharmaceuticals Market Value Share Analysis, By Radioisotopes, 2024 and 2035

Figure 31: Europe Radiopharmaceuticals Market Attractiveness Analysis, By Radioisotopes, 2025 to 2035

Figure 32: Europe - Radiopharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 33: Europe - Radiopharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 34: Europe - Radiopharmaceuticals Market Value Share Analysis, By End-user, 2024 and 2035

Figure 35: Europe - Radiopharmaceuticals Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 36: Asia Pacific - Radiopharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Asia Pacific - Radiopharmaceuticals Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 38: Asia Pacific - Radiopharmaceuticals Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 39: Asia Pacific - Radiopharmaceuticals Market Value Share Analysis, By Radioisotopes, 2024 and 2035

Figure 40: Asia Pacific - Radiopharmaceuticals Market Attractiveness Analysis, By Radioisotopes, 2025 to 2035

Figure 41: Asia Pacific - Radiopharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 42: Asia Pacific - Radiopharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 43: Asia Pacific - Radiopharmaceuticals Market Value Share Analysis, By End-user, 2024 and 2035

Figure 44: Asia Pacific - Radiopharmaceuticals Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 45: Latin America - Radiopharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Latin America - Radiopharmaceuticals Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 47: Latin America - Radiopharmaceuticals Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 48: Latin America - Radiopharmaceuticals Market Value Share Analysis, By Radioisotopes, 2024 and 2035

Figure 49: Latin America - Radiopharmaceuticals Market Attractiveness Analysis, By Radioisotopes, 2025 to 2035

Figure 50: Latin America - Radiopharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 51: Latin America - Radiopharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 52: Latin America - Radiopharmaceuticals Market Value Share Analysis, By End-user, 2024 and 2035

Figure 53: Latin America - Radiopharmaceuticals Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 54: Middle East & Africa - Radiopharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Middle East & Africa - Radiopharmaceuticals Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 56: Middle East & Africa - Radiopharmaceuticals Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 57: Middle East & Africa - Radiopharmaceuticals Market Value Share Analysis, By Radioisotopes, 2024 and 2035

Figure 58: Middle East & Africa - Radiopharmaceuticals Market Attractiveness Analysis, By Radioisotopes, 2025 to 2035

Figure 59: Middle East & Africa - Radiopharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 60: Middle East & Africa - Radiopharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 61: Middle East & Africa - Radiopharmaceuticals Market Value Share Analysis, By End-user, 2024 and 2035

Figure 62: Middle East & Africa - Radiopharmaceuticals Market Attractiveness Analysis, By End-user, 2025 to 2035