Reports

Reports

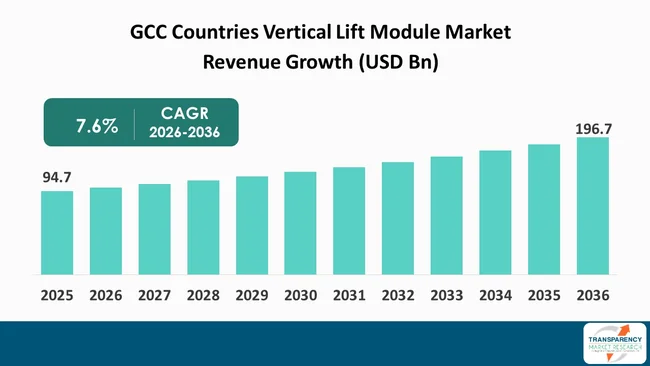

The GCC countries vertical lift module market size was valued at US$ 94.7 Bn in 2025 and is projected to reach US$ 196.7 Bn by 2036, expanding at a CAGR of 7.6% from 2026 to 2036. The market growth is driven by GCC infrastructure investments, urbanization trends, warehouse automation adoption, e-commerce expansion, manufacturing diversification, smart factory initiatives, and increasing demand for efficient, vertical lift module solutions.

The GCC countries vertical lift module (VLM) market is shifting from being a niche product for automation to a fundamental solution for intralogistics in many industry verticals such as warehousing, retail distribution, pharmaceuticals, and manufacturing. The VLMs' AS/RS (automated storage and retrieval systems) utilizing vertical space is increasingly in line with GCC’s economic diversification strategies, especially under national logistics and industrial transformation plans. The market is driven by high demand for large-scale distribution centers, urban fulfillment hubs, and regulated industries that rely on precision and space efficiency.

The market is propelled by increasing labor expenditures, warehouse space limitations in urban regions, and demand for enhanced picking accuracy. Governments in the GCC are investing heavily in logistics infrastructure, with Saudi Arabia and the UAE leading the development of giga-projects, bonded logistics zones, and smart industrial parks. The trend toward Industry 4.0 and Smart Warehousing has led VLMs to be a favored option as they are scalable and provide safety, in addition to being integrated with well-known warehouse management systems.

The major trends include the emergence of modular energy-efficient VLMs, high traction for non-refrigerated units for general merchandise, and increased customization for industry-specific requirements such as pharmaceuticals and aerospace. Vendors also emphasize predictive maintenance and IoT-enabled systems to minimize downtime.

In addition, the demand is focused on Saudi Arabia, followed by the UAE and Qatar, driven by growing e-commerce fulfillment centers and national logistics plans. Competing are global vendors and regional system integrators, and end-users are focused on ROI, reducing their footprint, and operational resiliency. In general, the GCC VLM market value growth is considered to be more of a building growth in line with the policies rather than short-term demand growth.

A VLM is an automated system that stores items vertically between two columns with an internal deck or tray extractor that brings the item to an ergonomic access opening. VLMs are best suited for applications where vertical warehouse space utilization can be optimized, while maintaining assistive picking accuracy, inventory control, and operator safety.

In the GCC countries, VLMs have become ubiquitous in warehouses, manufacturing plants, spare-parts distributors, pharmaceutical storage facilities, and e-commerce fulfilment hubs. Since they take up less space on the floor, they are often particularly useful in high-rent industrial districts and in urban logistics facilities.

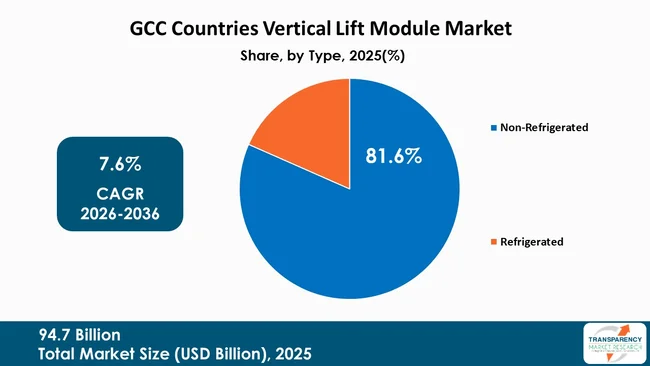

VLMs can be classified as non-refrigerated and refrigerated systems. Non-refrigerated VLMs transport a variety of goods such as electronics, clothing, automobile parts, and industrial parts. Refrigerated VLMs are based on a temperature-controlled environment, and they are used for the storage of pharmaceutical products, vaccines, or specialty chemicals.

The market also comprises hardware, which includes lift modules, trays, extractors; software, namely warehouse control system, inventory management interface; and services such as installation, integration, maintenance, and retrofitting. Vendors are also providing more tailored tray solutions and software integrations with Enterprise Resource Planning (ERP) and Warehouse Management System (WMS) applications.

VLMs & automated storage systems have a strong and growing relationship with logistics modernization, regulatory requirements, and faster order fulfillment. With regional supply chains increasingly complex, VLMs represent one of the core foundational automation technologies to deliver on accuracy, scalability, and operational efficiency.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Warehouse automation is rapidly developing in GCC as governments and the private sectors strive to upgrade supply chains and minimize dependency on the human workforce. Logisticians are now focusing on automation solutions that can implemented rapidly while achieving maximal use of space and offering quantifiable productivity improvements, with VLMs considered a strategic technology investment.

The government-led schemes like Saudi Arabia’s logistics transformation programs under the Ministry of Transport and Logistics Services and the UAE’s smart logistics corridors have resulted in the construction of massive, automation-friendly warehouses. According to the Times of India, the logistics area of the capacity is increasing, with more than 50 million parcels delivered in the logistics industry of Saudi Arabia between the months of April and June 2025. The total number of service orders, which also includes orders for food and express delivery, was above 101 million, fueling demand for small automated storage systems.

The reliance on labor in GCC warehouses has led to increased interest in automation that reduces headcount while increasing throughput due to rising compliance and accommodation costs. VLMs can boost picking productivity by a factor of 2 to 3 over manual shelving, alongside slashing picking error rates.

Furthermore, safety and ergonomics regulations are driving the adoption. VLMs remove ladder usage and repetitive bending and comply with workplace safety standards enforced by the local government. A number of industrial areas in Saudi Arabia have been equipped with state-of-the-art warehouses featuring vertical automated storage systems as part of their original design, demonstrating receding automation-first planning as opposed to potential retrofit. On a general scale, the expansion of automation in warehouses at such a rapid pace in the GCC is expected to enhance the predictable continuity of demand in VLM systems, especially in large-scale distribution and industrial sectors.

The growth of E-commerce in the GCC countries has transformed fulfillment needs and has been driving the need for faster, denser, and more accurate storage solutions. Penetration of online retail keeps on increasing, especially in Saudi Arabia and the UAE due to a young population, high smartphone penetration, and the enhancement of last-mile logistics infrastructure.

E-commerce warehousing has high SKU density, fast order turnaround, and a near-perfect picking environment all three factors combined create a high value environment for VLM utilization. In contrast to conventional racking, VLMs facilitate goods-to-person picking, which diminishes travel time and makes delivery commitments of the same or next day feasible.

This has been compounded by the digitally driven economy supported by government policies. The platforms working on the frameworks issued by the Ministry of Communications and Information Technology (MCIT) accentuate the logistics digitization and smart fulfillment. Top e-commerce players now offer more localized fulfillment to minimize cross-border shipping jams. This has resulted in mid-scale city warehouses where space limitations dictate vertical automation rather than horizontal growth.

The leading E-commerce companies in Saudi Arabia are investing in compact automated storage to boost order throughput per square meter without having to move their sites. As customers are getting more demanding for faster delivery and showing whatever inventory in real-time, VLMs are becoming more critical infrastructures in the e-commerce fulfilment ecosystem across the GCC countries.

The pharmaceutical industry is a massive growth opportunity for the GCC countries VLM market space, especially in temperature-controlled storage. Growing healthcare spending, more local drug manufacturing, and more demanding regulatory regimes are creating a need for that type of storage. Regulations such as the Saudi Food and Drug Authority have led to stringent regulations with pharmaceutical storage requirements, including temperature monitoring, batch traceability, limited access, etc. Refrigerated VLMs meet these needs by providing controlled environments, computerized access logs, and monitoring system interfaces.

Saudi Arabia and the UAE see further vaccine storage, specialty drug distribution, and hospital pharmacy automation growth. The demand for local pharmaceutical production within national industrial policies has also increased storage requirements for raw materials and finished drugs. In 2025, Rifaf Company for Automated Intralogistic Solutions announced its accreditation by the Ministry of Industry and Mineral Resources as a certified provider of operational process automation.

The non- refrigerated segment accounted for the dominant 81.6% market share in the GCC VLM market in 2025, attributable to its vast adoption in retail, industrial, spare-parts, and E-commerce sectors. These are more versatile systems, with a lower capital cost than refrigerated, and a shorter delivery timeline. Non-refrigerated VLMs enjoy widespread popularity for electronics, fashion goods, automotive parts, tools, and general merchandise the four largest categories of warehouse SKUs in the region. As they can be adjusted for different tray heights and load weights, they can be used in either high-volume or high-mix production.

Manufacturers and distributors prefer non-refrigerated VLMs due to lower maintenance requirements and simpler regulatory compliance. In addition, these systems are often the first step toward warehouse automation, particularly for small and mid-sized enterprises transitioning from manual storage. The dominance of this segment reflects the broader structure of GCC trade, where non-perishable goods continue to represent the bulk of warehousing demand.

| Attribute | Detail |

|---|---|

| Leading Region |

|

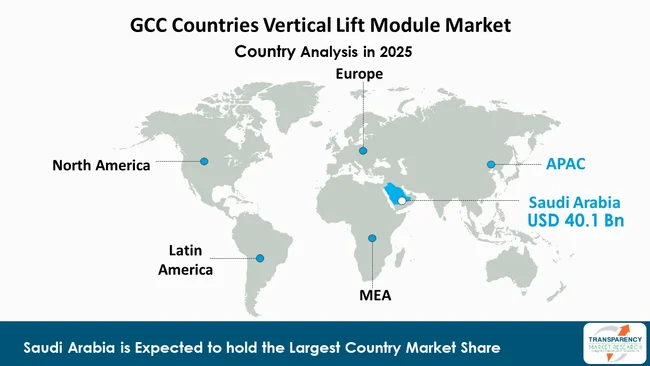

In 2025, Saudi Arabia accounted for the largest share, 42.3% of the GCC countries vertical lift module market, and this was attributed to the size, policy alignment, and industrial development. The nation’s logistics industry has been at the center of its economic diversification ambitions, attracting heavy investments in warehousing, industrial zones, and multimodal transport corridors. Saudi Arabia seeks to become a leading global logistics hub under national initiatives spearheaded by the Saudi Vision 2030. This is driving large-scale warehouse construction in Riyadh, Jeddah, and Dammam, much of it designed for automation readiness.

Saudi Arabia lies in the path of a growing regional distributors and producers who demand enhanced warehousing capabilities. Local system integrators and global VLM manufacturers have established partnerships or service centers in the KSA to provide a higher speed of delivery and after-sales services. Among the GCC countries, Saudi Arabia has a larger domestic consumer base, with more e-commerce order volumes, and sizeable pharmaceutical and industrial production capacities. The UAE is not far behind in strong uptake in its free zones, whilst Qatar and Oman demonstrate reliable albeit modest interest. Collectively, scale, policy support, and the industrial diversity that defines Saudi Arabia make it the powerhouse in the GCC VLM market.

Bastian Solutions, LLC, Dematic GmbH, Ferretto SpA, Gonvarri Material Handling (Dexion), Hänel GmbH & Co. KG, Jungheinrich AG, Kardex Group AG, Körber AG, Mecalux, S.A., Modula S.p.A., SSI SCHÄFER Group, Weland Solutions AB and other are some of the leading manufacturers operating in the GCC countries vertical lift module market.

Each of these companies has been profiled in the vertical lift module industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 94.7 Bn |

| Market Forecast Value in 2036 | US$ 196.7 Bn |

| Growth Rate (CAGR 2026 to 2036) | 7.6% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value and Units for Volume |

| Market Analysis | GCC countries qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Type

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The GCC countries vertical lift module market was valued at US$ 94.7 Bn in 2025

The GCC countries vertical lift module industry is projected to reach at US$ 196.7 Bn by the end of 2036

Rapid warehouse automation across GCC and e-commerce growth boosting fulfilment efficiency, are some of the driving factors for this market

The CAGR is anticipated to be 7.6% from 2026 to 2036

Bastian Solutions, LLC, Dematic GmbH, Ferretto SpA, Gonvarri Material Handling (Dexion), Hänel GmbH & Co. KG, Jungheinrich AG, Kardex Group AG, Körber AG, Mecalux, S.A., Modula S.p.A., SSI SCHÄFER Group, Weland Solutions AB, and others.

Table 1: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Type

Table 2: GCC Countries Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Type

Table 3: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Orientation

Table 4: GCC Countries Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Orientation

Table 5: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Configuration

Table 6: GCC Countries Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Configuration

Table 7: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Maximum Load Capacity

Table 8: GCC Countries Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Maximum Load Capacity

Table 9: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Height (In meter)

Table 10: GCC Countries Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Height (In meter)

Table 11: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By End-use Industry

Table 12: GCC Countries Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By End-use Industry

Table 13: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Distribution Channel

Table 14: GCC Countries Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Distribution Channel

Table 15: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Country

Table 16: GCC Countries Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Country

Table 17: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Type

Table 18: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Type

Table 19: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Orientation

Table 20: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Orientation

Table 21: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Configuration

Table 22: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Configuration

Table 23: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Maximum Load Capacity

Table 24: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Maximum Load Capacity

Table 25: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Height (In meter)

Table 26: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Height (In meter)

Table 27: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By End-use Industry

Table 28: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By End-use Industry

Table 29: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Distribution Channel

Table 30: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Distribution Channel

Table 31: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Type

Table 32: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Type

Table 33: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Orientation

Table 34: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Orientation

Table 35: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Configuration

Table 36: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Configuration

Table 37: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Maximum Load Capacity

Table 38: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Maximum Load Capacity

Table 39: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Height (In meter)

Table 40: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Height (In meter)

Table 41: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By End-use Industry

Table 42: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By End-use Industry

Table 43: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Distribution Channel

Table 44: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Distribution Channel

Table 45: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Type

Table 46: Qatar Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Type

Table 47: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Orientation

Table 48: Qatar Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Orientation

Table 49: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Configuration

Table 50: Qatar Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Configuration

Table 51: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Maximum Load Capacity

Table 52: Qatar Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Maximum Load Capacity

Table 53: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Height (In meter)

Table 54: Qatar Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Height (In meter)

Table 55: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By End-use Industry

Table 56: Qatar Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By End-use Industry

Table 57: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Distribution Channel

Table 58: Qatar Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Distribution Channel

Table 59: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Type

Table 60: Kuwait Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Type

Table 61: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Orientation

Table 62: Kuwait Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Orientation

Table 63: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Configuration

Table 64: Kuwait Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Configuration

Table 65: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Maximum Load Capacity

Table 66: Kuwait Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Maximum Load Capacity

Table 67: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Height (In meter)

Table 68: Kuwait Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Height (In meter)

Table 69: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By End-use Industry

Table 70: Kuwait Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By End-use Industry

Table 71: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Distribution Channel

Table 72: Kuwait Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Distribution Channel

Table 73: Oman Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Type

Table 74: Oman Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Type

Table 75: Oman Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Orientation

Table 76: Oman Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Orientation

Table 77: Oman Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Configuration

Table 78: Oman Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Configuration

Table 79: Oman Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Maximum Load Capacity

Table 80: Oman Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Maximum Load Capacity

Table 81: Oman Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Height (In meter)

Table 82: Oman Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Height (In meter)

Table 83: Oman Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By End-use Industry

Table 84: Oman Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By End-use Industry

Table 85: Oman Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Distribution Channel

Table 86: Oman Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Distribution Channel

Table 87: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Type

Table 88: Bahrain Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Type

Table 89: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Orientation

Table 90: Bahrain Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Orientation

Table 91: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Configuration

Table 92: Bahrain Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Configuration

Table 93: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Maximum Load Capacity

Table 94: Bahrain Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Maximum Load Capacity

Table 95: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Height (In meter)

Table 96: Bahrain Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Height (In meter)

Table 97: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By End-use Industry

Table 98: Bahrain Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By End-use Industry

Table 99: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, 2021 to 2036 By Distribution Channel

Table 100: Bahrain Vertical Lift Module Market Volume (Units) Projection, 2021 to 2036 By Distribution Channel

Figure 1: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 2: GCC Countries Vertical Lift Module Market Volume (Units) Projection, By Type 2021 to 2036

Figure 3: GCC Countries Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2026 - 2036

Figure 4: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, By Orientation 2021 to 2036

Figure 5: GCC Countries Vertical Lift Module Market Volume (Units) Projection, By Orientation 2021 to 2036

Figure 6: GCC Countries Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Orientation 2026 - 2036

Figure 7: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, By Maximum Load Capacity 2021 to 2036

Figure 8: GCC Countries Vertical Lift Module Market Volume (Units) Projection, By Maximum Load Capacity 2021 to 2036

Figure 9: GCC Countries Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Maximum Load Capacity 2026 - 2036

Figure 10: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, By Height (In meter) 2021 to 2036

Figure 11: GCC Countries Vertical Lift Module Market Volume (Units) Projection, By Height (In meter) 2021 to 2036

Figure 12: GCC Countries Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Height (In meter) 2026 - 2036

Figure 13: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 14: GCC Countries Vertical Lift Module Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 15: GCC Countries Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2026 - 2036

Figure 16: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 17: GCC Countries Vertical Lift Module Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 18: GCC Countries Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2026 - 2036

Figure 19: GCC Countries Vertical Lift Module Market Value (US$ Bn) Projection, By Country2021 to 2036

Figure 20: GCC Countries Vertical Lift Module Market Volume (Units) Projection, By Country2021 to 2036

Figure 21: GCC Countries Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Country2026 - 2036

Figure 22: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 23: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, By Type 2021 to 2036

Figure 24: UAE (United Arab Emirates) Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2026 - 2036

Figure 25: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, By Orientation 2021 to 2036

Figure 26: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, By Orientation 2021 to 2036

Figure 27: UAE (United Arab Emirates) Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Orientation 2026 - 2036

Figure 28: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, By Maximum Load Capacity 2021 to 2036

Figure 29: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, By Maximum Load Capacity 2021 to 2036

Figure 30: UAE (United Arab Emirates) Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Maximum Load Capacity 2026 - 2036

Figure 31: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, By Height (In meter) 2021 to 2036

Figure 32: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, By Height (In meter) 2021 to 2036

Figure 33: UAE (United Arab Emirates) Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Height (In meter) 2026 - 2036

Figure 34: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 35: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 36: UAE (United Arab Emirates) Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2026 - 2036

Figure 37: UAE (United Arab Emirates) Vertical Lift Module Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 38: UAE (United Arab Emirates) Vertical Lift Module Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 39: UAE (United Arab Emirates) Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2026 - 2036

Figure 40: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 41: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, By Type 2021 to 2036

Figure 42: Saudi Arabia Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2026 - 2036

Figure 43: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, By Orientation 2021 to 2036

Figure 44: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, By Orientation 2021 to 2036

Figure 45: Saudi Arabia Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Orientation 2026 - 2036

Figure 46: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, By Maximum Load Capacity 2021 to 2036

Figure 47: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, By Maximum Load Capacity 2021 to 2036

Figure 48: Saudi Arabia Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Maximum Load Capacity 2026 - 2036

Figure 49: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, By Height (In meter) 2021 to 2036

Figure 50: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, By Height (In meter) 2021 to 2036

Figure 51: Saudi Arabia Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Height (In meter) 2026 - 2036

Figure 52: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 53: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 54: Saudi Arabia Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2026 - 2036

Figure 55: Saudi Arabia Vertical Lift Module Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 56: Saudi Arabia Vertical Lift Module Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 57: Saudi Arabia Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2026 - 2036

Figure 58: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 59: Qatar Vertical Lift Module Market Volume (Units) Projection, By Type 2021 to 2036

Figure 60: Qatar Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2026 - 2036

Figure 61: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, By Orientation 2021 to 2036

Figure 62: Qatar Vertical Lift Module Market Volume (Units) Projection, By Orientation 2021 to 2036

Figure 63: Qatar Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Orientation 2026 - 2036

Figure 64: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, By Maximum Load Capacity 2021 to 2036

Figure 65: Qatar Vertical Lift Module Market Volume (Units) Projection, By Maximum Load Capacity 2021 to 2036

Figure 66: Qatar Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Maximum Load Capacity 2026 - 2036

Figure 67: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, By Height (In meter) 2021 to 2036

Figure 68: Qatar Vertical Lift Module Market Volume (Units) Projection, By Height (In meter) 2021 to 2036

Figure 69: Qatar Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Height (In meter) 2026 - 2036

Figure 70: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 71: Qatar Vertical Lift Module Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 72: Qatar Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2026 - 2036

Figure 73: Qatar Vertical Lift Module Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 74: Qatar Vertical Lift Module Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 75: Qatar Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2026 - 2036

Figure 76: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 77: Kuwait Vertical Lift Module Market Volume (Units) Projection, By Type 2021 to 2036

Figure 78: Kuwait Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2026 - 2036

Figure 79: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, By Orientation 2021 to 2036

Figure 80: Kuwait Vertical Lift Module Market Volume (Units) Projection, By Orientation 2021 to 2036

Figure 81: Kuwait Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Orientation 2026 - 2036

Figure 82: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, By Maximum Load Capacity 2021 to 2036

Figure 83: Kuwait Vertical Lift Module Market Volume (Units) Projection, By Maximum Load Capacity 2021 to 2036

Figure 84: Kuwait Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Maximum Load Capacity 2026 - 2036

Figure 85: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, By Height (In meter) 2021 to 2036

Figure 86: Kuwait Vertical Lift Module Market Volume (Units) Projection, By Height (In meter) 2021 to 2036

Figure 87: Kuwait Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Height (In meter) 2026 - 2036

Figure 88: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 89: Kuwait Vertical Lift Module Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 90: Kuwait Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2026 - 2036

Figure 91: Kuwait Vertical Lift Module Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 92: Kuwait Vertical Lift Module Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 93: Kuwait Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2026 - 2036

Figure 94: Oman Vertical Lift Module Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 95: Oman Vertical Lift Module Market Volume (Units) Projection, By Type 2021 to 2036

Figure 96: Oman Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2026 - 2036

Figure 97: Oman Vertical Lift Module Market Value (US$ Bn) Projection, By Orientation 2021 to 2036

Figure 98: Oman Vertical Lift Module Market Volume (Units) Projection, By Orientation 2021 to 2036

Figure 99: Oman Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Orientation 2026 - 2036

Figure 100: Oman Vertical Lift Module Market Value (US$ Bn) Projection, By Maximum Load Capacity 2021 to 2036

Figure 101: Oman Vertical Lift Module Market Volume (Units) Projection, By Maximum Load Capacity 2021 to 2036

Figure 102: Oman Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Maximum Load Capacity 2026 - 2036

Figure 103: Oman Vertical Lift Module Market Value (US$ Bn) Projection, By Height (In meter) 2021 to 2036

Figure 104: Oman Vertical Lift Module Market Volume (Units) Projection, By Height (In meter) 2021 to 2036

Figure 105: Oman Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Height (In meter) 2026 - 2036

Figure 106: Oman Vertical Lift Module Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 107: Oman Vertical Lift Module Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 108: Oman Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2026 - 2036

Figure 109: Oman Vertical Lift Module Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 110: Oman Vertical Lift Module Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 111: Oman Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2026 - 2036

Figure 112: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 113: Bahrain Vertical Lift Module Market Volume (Units) Projection, By Type 2021 to 2036

Figure 114: Bahrain Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2026 - 2036

Figure 115: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, By Orientation 2021 to 2036

Figure 116: Bahrain Vertical Lift Module Market Volume (Units) Projection, By Orientation 2021 to 2036

Figure 117: Bahrain Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Orientation 2026 - 2036

Figure 118: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, By Maximum Load Capacity 2021 to 2036

Figure 119: Bahrain Vertical Lift Module Market Volume (Units) Projection, By Maximum Load Capacity 2021 to 2036

Figure 120: Bahrain Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Maximum Load Capacity 2026 - 2036

Figure 121: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, By Height (In meter) 2021 to 2036

Figure 122: Bahrain Vertical Lift Module Market Volume (Units) Projection, By Height (In meter) 2021 to 2036

Figure 123: Bahrain Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Height (In meter) 2026 - 2036

Figure 124: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 125: Bahrain Vertical Lift Module Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 126: Bahrain Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2026 - 2036

Figure 127: Bahrain Vertical Lift Module Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 128: Bahrain Vertical Lift Module Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 129: Bahrain Vertical Lift Module Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2026 - 2036