Reports

Reports

Analysts’ Viewpoint on Market Scenario

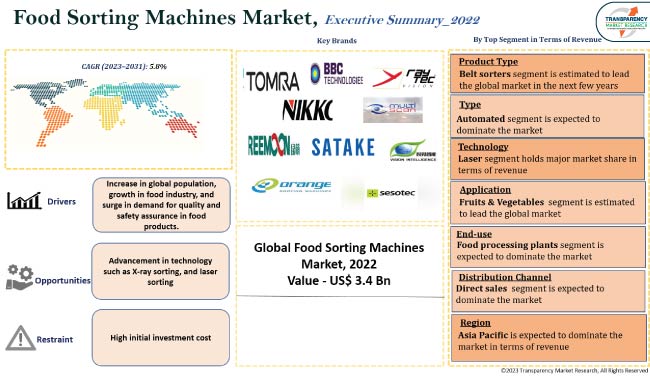

Surge in global population, growth in food industry, and demand for quality and safety assurance in food products are expected to fuel the food sorting machines market size in the next few years. These machines help streamline the sorting process, increase efficiency, reduce labor costs, and enhance the overall quality of the final product.

Manufacturers are introducing innovative products to expand their global reach. Food sorting machines market growth is significantly impacted by technological advancements such as optical sorting, X-ray sorting, laser sorting, and near infrared spectroscope.

The benefits offered by food sorting machines such as improved efficiency, increased productivity, reduced labor costs, and enhanced product quality are driving the food sorting machines growth across different segments of the food industry including processing plants, and packaging.

Food sorting machines are designed to sort and categorize various types of food products based on specific criteria such as size, shape, color, quality, and defects. The machines utilize advanced technologies such as sensors, cameras, and mechanical devices to analyze and sort large quantities of food rapidly and accurately.

The sorting process begins with a conveyor belt that carries the food items toward the sorting area. As the products move along the belt, they are subjected to inspection by sensors and cameras, which capture detailed information about their characteristics. The sensors can detect attributes such as size, weight, color, texture, and even chemical composition, depending on the complexity of the machine. The captured data is processed by a computer system that employs algorithms and machine learning techniques to make decisions about the quality and classification of the food products.

Food sorting machines are utilized in various stages of the food production and processing industry, including farming, harvesting, post-harvest handling, packaging, and distribution. The machines are commonly used for sorting fruits, vegetables, grains, nuts, seeds, seafood, and other food items that require consistent quality control and uniformity.

Growth in concerns about food safety and quality is leading to significant demand for food sorting equipment to ensure that only high-quality and safe products reach consumers. These machines identify and remove defected or contaminated items and reduce the risk of foodborne illnesses.

Consumers now-a-days have higher expectations regarding the quality and appearance of food products. They prefer products that are visually appealing, consistent in size and shape, and free from defects. Food sorting machines help meet these expectations by ensuring uniformity and consistency in the final products.

Moreover, the expanding food processing industry, driven by changing consumer preferences, urbanization, and rise in global population is boosting the food sorting machines market demand. As food processing companies scale up their operations to meet the increase in demand, they require efficient sorting solutions to maintain product quality and streamline their processes.

Technological advancements in food sorting machines such as machine vision system, artificial intelligence, sensors, machine learning algorithms, transmission of laser light, and high-speed color imaging have significantly enhanced the capabilities of food sorting machines. These advancements have revolutionized food sorting machines, enabling faster, more accurate sorting, improved product quality, enhanced food safety, and increased productivity in the food industry, offering lucrative opportunities for food sorting machines market development.

Moreover, food safety regulations and standards have become stricter worldwide. Food grading machines play a crucial role in helping food processing companies comply with these regulations by ensuring that the products meet the required quality and safety standards

By product type, the global food sorting machines market is bifurcated into channel sorters, freefall sorters, belt sorters, and ADR systems. According to the food sorting machines market analysis, the belt sorters segment is estimated to lead globally in the next few years. Belt sorters, also known as belt conveyor sorters, are an integral part of food sorting machines used in the food processing industry. They automatically separate and sort different types of food products based on specific criteria such as size, shape, color, or other quality parameters.

Some of the key advantages of belt sorters in food sorting applications are high sorting capacity, gentle handling, and precise sorting that contributes to improved productivity, product quality, and overall operational effectiveness in food processing facilities.

Based on type, the food sorting machines market is segmented into automated, and mechanical. The automated segment is likely to lead the global market during the forecast period. Automated food sorting machines offer numerous advantages, including increased efficiency, improved accuracy, higher throughput, enhanced quality control, cost savings, flexibility, and data-driven decision-making. These factors are creating value-grab food sorting machines market opportunities for companies operating in the sector.

According to the food sorting machines market forecast, Asia Pacific is likely to dominate the global landscape during the forecast period attributed to increased awareness of food security in China, India, and other countries. The industry is likely to benefit from rise in demand for packaged food goods in China.

Surge in sales of food and beverage products and ingredients through online platforms in Asia Pacific is increasing the food sorting machines market share across the region. Manufacturers in China, India, and South Korea are increasingly adopting food sorting machines to improve operations and food security.

The food sorting machines market is fragmented due to the presence of many local and global players. Competition is expected to intensify in the next few years due to the entry of local players. Various marketing strategies are being adopted by food sorting machines companies.

Suppliers and manufacturers are focusing on product developments and striving to meet the demands of customers as per latest food sorting machines market trends by introducing more efficient products at reasonable price.

TOMRA, BBC Technologies, NIKKO, Raytec Vision, Multiscan Technologies, Reemoon Technology Holdings, Satake Corporation, Orange Sorting Machines, Anhui Color Sort, and Sesotec are the key players in the food sorting machines market

Key players have been profiled in the food sorting machines market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 3.4 Bn |

|

Market Value in 2031 |

US$ 5.9 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 3.4 Bn in 2022

It is expected to reach US$ 5.9 Bn by 2031

It is estimated to grow at a CAGR of 5.8% by 2031

Advancement in technology, regulatory compliance, rise in preference for safe and quality food, and growth in food industry

The belt sorters segment holds major share

Asia Pacific is a more attractive region for vendors

TOMRA, BBC Technologies, NIKKO, Raytec Vision, Multiscan Technologies, Reemoon Technology Holdings, Satake Corporation, Orange Sorting Machines, Anhui Color Sort, and Sesotec

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Raw Type Analysis

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Food Sorting Machines Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Food Sorting Machines Market Analysis and Forecast, By Product Type

6.1. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

6.1.1. Channel Sorters

6.1.2. Freefall Sorters

6.1.3. Belt Sorters

6.1.4. ADR Systems

6.2. Incremental Opportunity, By Product Type

7. Global Food Sorting Machines Market Analysis and Forecast, By Type

7.1. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

7.1.1. Automated

7.1.2. Mechanical

7.2. Incremental Opportunity, By Type

8. Global Food Sorting Machines Market Analysis and Forecast, By Technology

8.1. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

8.1.1. Laser

8.1.2. Camera

8.1.3. LED

8.1.4. X-ray

8.2. Incremental Opportunity, By Technology

9. Global Food Sorting Machines Market Analysis and Forecast, By Application

9.1. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

9.1.1. Fruits & Vegetables

9.1.2. Grains

9.1.3. Dry Food

9.1.4. Dairy Products

9.1.5. Others

9.2. Incremental Opportunity, By Application

10. Global Food Sorting Machines Market Analysis and Forecast, By End Use

10.1. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

10.1.1. Food Processing Plants

10.1.2. Restaurants & Hotels

10.1.3. Others

10.2. Incremental Opportunity, By End-use

11. Global Food Sorting Machines Market Analysis and Forecast, By Distribution Channel

11.1. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.1.1. Direct Sales

11.1.2. Indirect sales

11.2. Incremental Opportunity, By Distribution Channel

12. Global Food Sorting Machines Market Analysis and Forecast, By Region

12.1. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, By Region

13. North America Food Sorting Machines Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Type Trend Analysis

13.2.1. Weighted Average Type

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Key Supplier Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

13.6.1. Channel Sorters

13.6.2. Freefall Sorters

13.6.3. Belt Sorters

13.6.4. ADR Systems

13.7. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

13.7.1. Automated

13.7.2. Mechanical

13.8. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

13.8.1. Laser

13.8.2. Camera

13.8.3. LED

13.8.4. X-ray

13.9. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.9.1. Fruits & Vegetables

13.9.2. Grains

13.9.3. Dry Food

13.9.4. Dairy Products

13.9.5. Others

13.10. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

13.10.1. Food Processing Plants

13.10.2. Restaurants & Hotels

13.10.3. Others

13.11. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.11.1. Direct Sales

13.11.2. Indirect sales

13.12. Food Sorting Machines Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2027

13.12.1. U.S.

13.12.2. Canada

13.12.3. Rest of North America

13.13. Incremental Opportunity Analysis

14. Europe Food Sorting Machines Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Type Trend Analysis

14.2.1. Weighted Average Type

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Key Supplier Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

14.6.1. Channel Sorters

14.6.2. Freefall Sorters

14.6.3. Belt Sorters

14.6.4. ADR Systems

14.7. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

14.7.1. Automated

14.7.2. Mechanical

14.8. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

14.8.1. Laser

14.8.2. Camera

14.8.3. LED

14.8.4. X-ray

14.9. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.9.1. Fruits & Vegetables

14.9.2. Grains

14.9.3. Dry Food

14.9.4. Dairy Products

14.9.5. Others

14.10. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

14.10.1. Food Processing Plants

14.10.2. Restaurants & Hotels

14.10.3. Others

14.11. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.11.1. Direct Sales

14.11.2. Indirect sales

14.12. Food Sorting Machines Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

14.12.1. U.K.

14.12.2. Germany

14.12.3. France

14.12.4. Rest of Europe

14.13. Incremental Opportunity Analysis

15. Asia Pacific Food Sorting Machines Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Type Trend Analysis

15.2.1. Weighted Average Type

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Key Supplier Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

15.6.1. Channel Sorters

15.6.2. Freefall Sorters

15.6.3. Belt Sorters

15.6.4. ADR Systems

15.7. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

15.7.1. Automated

15.7.2. Mechanical

15.8. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

15.8.1. Laser

15.8.2. Camera

15.8.3. LED

15.8.4. X-ray

15.9. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

15.9.1. Fruits & Vegetables

15.9.2. Grains

15.9.3. Dry Food

15.9.4. Dairy Products

15.9.5. Others

15.10. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

15.10.1. Food Processing Plants

15.10.2. Restaurants & Hotels

15.10.3. Others

15.11. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.11.1. Direct Sales

15.11.2. Indirect sales

15.12. Food Sorting Machines Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

15.12.1. China

15.12.2. India

15.12.3. Japan

15.12.4. Rest of Asia Pacific

15.13. Incremental Opportunity Analysis

16. Middle East & Africa Food Sorting Machines Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Type Trend Analysis

16.2.1. Weighted Average Type

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Key Supplier Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

16.6.1. Channel Sorters

16.6.2. Freefall Sorters

16.6.3. Belt Sorters

16.6.4. ADR Systems

16.7. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

16.7.1. Automated

16.7.2. Mechanical

16.8. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

16.8.1. Laser

16.8.2. Camera

16.8.3. LED

16.8.4. X-ray

16.9. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

16.9.1. Fruits & Vegetables

16.9.2. Grains

16.9.3. Dry Food

16.9.4. Dairy Products

16.9.5. Others

16.10. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

16.10.1. Food Processing Plants

16.10.2. Restaurants & Hotels

16.10.3. Others

16.11. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.11.1. Direct Sales

16.11.2. Indirect sales

16.12. Food Sorting Machines Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

16.12.1. GCC

16.12.2. South Africa

16.12.3. Rest of Middle East & Africa

16.13. Incremental Opportunity Analysis

17. South America Food Sorting Machines Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Type Trend Analysis

17.2.1. Weighted Average Type

17.3. Key Trends Analysis

17.3.1. Demand Side Analysis

17.3.2. Supply Side Analysis

17.4. Key Supplier Analysis

17.5. Consumer Buying Behavior Analysis

17.6. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

17.6.1. Channel Sorters

17.6.2. Freefall Sorters

17.6.3. Belt Sorters

17.6.4. ADR Systems

17.7. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

17.7.1. Automated

17.7.2. Mechanical

17.8. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Technology, 2017 - 2031

17.8.1. Laser

17.8.2. Camera

17.8.3. LED

17.8.4. X-ray

17.9. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

17.9.1. Fruits & Vegetables

17.9.2. Grains

17.9.3. Dry Food

17.9.4. Dairy Products

17.9.5. Others

17.10. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

17.10.1. Food Processing Plants

17.10.2. Restaurants & Hotels

17.10.3. Others

17.11. Food Sorting Machines Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

17.11.1. Direct Sales

17.11.2. Indirect sales

17.12. Food Sorting Machines Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

17.12.1. Brazil

17.12.2. Rest of South America

17.13. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis - 2022 (%)

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. TOMRA

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. BBC Technologies

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. NIKKO

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. Raytec Vision

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. Multiscan Technologies

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. Reemoon Technology Holdings

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. Satake Corporation

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. Orange Sorting Machines

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. Anhui Color Sort

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. Sesotec

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

19. Go to Market Strategy

19.1. Identification of Potential Market Spaces

19.1.1. Product Type

19.1.2. Type

19.1.3. Technology

19.1.4. Application

19.1.5. End-use

19.1.6. Distribution channel

19.1.7. Region

19.2. Understanding the Procurement Process of End-Users

19.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Food Sorting Machines Market by Product Type, Thousand Units 2017-2031

Table 2: Global Food Sorting Machines Market by Product Type, US$ Bn 2017-2031

Table 3: Global Food Sorting Machines Market by Type, Thousand Units 2017-2031

Table 4: Global Food Sorting Machines Market by Type, US$ Bn 2017-2031

Table 5: Global Food Sorting Machines Market by Technology, Thousand Units 2017-2031

Table 6: Global Food Sorting Machines Market by Technology, US$ Bn 2017-2031

Table 7: Global Food Sorting Machines Market by Application, Thousand Units 2017-2031

Table 8: Global Food Sorting Machines Market by Application, US$ Bn 2017-2031

Table 9: Global Food Sorting Machines Market by End-use, Thousand Units 2017-2031

Table 10: Global Food Sorting Machines Market by End-use, US$ Bn 2017-2031

Table 11: Global Food Sorting Machines Market by Distribution Channel, Thousand Units, 2017-2031

Table 12: Global Food Sorting Machines Market by Distribution Channel, US$ Bn 2017-2031

Table 13: Global Food Sorting Machines Market by Region, Thousand Units, 2017-2031

Table 14: Global Food Sorting Machines Market by Region, US$ Bn 2017-2031

Table 15: North America Food Sorting Machines Market by Product Type, Thousand Units 2017-2031

Table 16: North America Food Sorting Machines Market by Product Type, US$ Bn 2017-2031

Table 17: North America Food Sorting Machines Market by Type, Thousand Units 2017-2031

Table 18: North America Food Sorting Machines Market by Type, US$ Bn 2017-2031

Table 19: North America Food Sorting Machines Market by Technology, Thousand Units 2017-2031

Table 20: North America Food Sorting Machines Market by Technology, US$ Bn 2017-2031

Table 21: North America Food Sorting Machines Market by Application, Thousand Units 2017-2031

Table 22: North America Food Sorting Machines Market by Application, US$ Bn 2017-2031

Table 23: North America Food Sorting Machines Market by End-use, Thousand Units 2017-2031

Table 24: North America Food Sorting Machines Market by End-use, US$ Bn 2017-2031

Table 25: North America Food Sorting Machines Market by Distribution Channel, Thousand Units, 2017-2031

Table 26: North America Food Sorting Machines Market by Distribution Channel, US$ Bn 2017-2031

Table 27: Europe Food Sorting Machines Market by Product Type, Thousand Units 2017-2031

Table 28: Europe Food Sorting Machines Market by Product Type, US$ Bn 2017-2031

Table 29: Europe Food Sorting Machines Market by Type, Thousand Units 2017-2031

Table 30: Europe Food Sorting Machines Market by Type, US$ Bn 2017-2031

Table 31: Europe Food Sorting Machines Market by Technology, Thousand Units 2017-2031

Table 32: Europe Food Sorting Machines Market by Technology, US$ Bn 2017-2031

Table 33: Europe Food Sorting Machines Market by Application, Thousand Units 2017-2031

Table 34: Europe Food Sorting Machines Market by Application, US$ Bn 2017-2031

Table 35: Europe Food Sorting Machines Market by End-use, Thousand Units 2017-2031

Table 36: Europe Food Sorting Machines Market by End-use, US$ Bn 2017-2031

Table 37: Europe Food Sorting Machines Market by Distribution Channel, Thousand Units, 2017-2031

Table 38: Europe Food Sorting Machines Market by Distribution Channel, US$ Bn 2017-2031

Table 39: Asia Pacific Food Sorting Machines Market by Product Type, Thousand Units 2017-2031

Table 40: Asia Pacific Food Sorting Machines Market by Product Type, US$ Bn 2017-2031

Table 41: Asia Pacific Food Sorting Machines Market by Type, Thousand Units 2017-2031

Table 42: Asia Pacific Food Sorting Machines Market by Type, US$ Bn 2017-2031

Table 43: Asia Pacific Food Sorting Machines Market by Technology, Thousand Units 2017-2031

Table 44: Asia Pacific Food Sorting Machines Market by Technology, US$ Bn 2017-2031

Table 45: Asia Pacific Food Sorting Machines Market by Application, Thousand Units 2017-2031

Table 46: Asia Pacific Food Sorting Machines Market by Application, US$ Bn 2017-2031

Table 47: Asia Pacific Food Sorting Machines Market by End-use, Thousand Units 2017-2031

Table 48: Asia Pacific Food Sorting Machines Market by End-use, US$ Bn 2017-2031

Table 49: Asia Pacific Food Sorting Machines Market by Distribution Channel, Thousand Units, 2017-2031

Table 50: Asia Pacific Food Sorting Machines Market by Distribution Channel, US$ Bn 2017-2031

Table 51: Middle East & Africa Food Sorting Machines Market by Product Type, Thousand Units 2017-2031

Table 52: Middle East & Africa Food Sorting Machines Market by Product Type, US$ Bn 2017-2031

Table 53: Middle East & Africa Food Sorting Machines Market by Type, Thousand Units 2017-2031

Table 54: Middle East & Africa Food Sorting Machines Market by Type, US$ Bn 2017-2031

Table 55: Middle East & Africa Food Sorting Machines Market by Technology, Thousand Units 2017-2031

Table 56: Middle East & Africa Food Sorting Machines Market by Technology, US$ Bn 2017-2031

Table 57: Middle East & Africa Food Sorting Machines Market by Application, Thousand Units 2017-2031

Table 58: Middle East & Africa Food Sorting Machines Market by Application, US$ Bn 2017-2031

Table 59: Middle East & Africa Food Sorting Machines Market by End-use, Thousand Units 2017-2031

Table 60: Middle East & Africa Food Sorting Machines Market by End-use, US$ Bn 2017-2031

Table 61: Middle East & Africa Food Sorting Machines Market by Distribution Channel, Thousand Units, 2017-2031

Table 62: Middle East & Africa Food Sorting Machines Market by Distribution Channel, US$ Bn 2017-2031

Table 63: South America Food Sorting Machines Market by Product Type, Thousand Units 2017-2031

Table 64: South America Food Sorting Machines Market by Product Type, US$ Bn 2017-2031

Table 65: South America Food Sorting Machines Market by Type, Thousand Units 2017-2031

Table 66: South America Food Sorting Machines Market by Type, US$ Bn 2017-2031

Table 67: South America Food Sorting Machines Market by Technology, Thousand Units 2017-2031

Table 68: South America Food Sorting Machines Market by Technology, US$ Bn 2017-2031

Table 69: South America Food Sorting Machines Market by Application, Thousand Units 2017-2031

Table 70: South America Food Sorting Machines Market by Application, US$ Bn 2017-2031

Table 71: South America Food Sorting Machines Market by End-use, Thousand Units 2017-2031

Table 72: South America Food Sorting Machines Market by End-use, US$ Bn 2017-2031

Table 73: South America Food Sorting Machines Market by Distribution Channel, Thousand Units, 2017-2031

Table 74: South America Food Sorting Machines Market by Distribution Channel, US$ Bn 2017-2031

List of Figures

Figure 1: Global Food Sorting Machines Market Projections, by Product Type, Thousand Units 2017-2031

Figure 2: Global Food Sorting Machines Market Projections, by Product Type, US$ Bn 2017-2031

Figure 3: Global Food Sorting Machines Market, Incremental Opportunity, by Product Type, US$ Bn 2023 -2031

Figure 4: Global Food Sorting Machines Market Projections, by Type, Thousand Units 2017-2031

Figure 5: Global Food Sorting Machines Market Projections, by Type, US$ Bn 2017-2031

Figure 6: Global Food Sorting Machines Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 7: Global Food Sorting Machines Market Projections, by Technology, Thousand Units 2017-2031

Figure 8: Global Food Sorting Machines Market Projections, by Technology, US$ Bn 2017-2031

Figure 9: Global Food Sorting Machines Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 10: Global Food Sorting Machines Market Projections, by Application, Thousand Units 2017-2031

Figure 11: Global Food Sorting Machines Market Projections, by Application, US$ Bn 2017-2031

Figure 12: Global Food Sorting Machines Market, Incremental Opportunity, by Application, US$ Bn 2023 -2031

Figure 13: Global Food Sorting Machines Market Projections, by End-use, Thousand Units 2017-2031

Figure 14: Global Food Sorting Machines Market Projections, by End-use, US$ Bn 2017-2031

Figure 15: Global Food Sorting Machines Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 16: Global Food Sorting Machines Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 17: Global Food Sorting Machines Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 18: Global Food Sorting Machines Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 19: Global Food Sorting Machines Market Projections, by Region, Thousand Units , 2017-2031

Figure 20: Global Food Sorting Machines Market Projections, by Region, US$ Bn 2017-2031

Figure 21: Global Food Sorting Machines Market, Incremental Opportunity, by Region, US$ Bn 2023 -2031

Figure 22: North America Food Sorting Machines Market Projections, by Product Type, Thousand Units 2017-2031

Figure 23: North America Food Sorting Machines Market Projections, by Product Type, US$ Bn 2017-2031

Figure 24: North America Food Sorting Machines Market, Incremental Opportunity, by Product Type, US$ Bn 2023 -2031

Figure 25: North America Food Sorting Machines Market Projections, by Type, Thousand Units 2017-2031

Figure 26: North America Food Sorting Machines Market Projections, by Type, US$ Bn 2017-2031

Figure 27: North America Food Sorting Machines Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 28: North America Food Sorting Machines Market Projections, by Technology, Thousand Units 2017-2031

Figure 29: North America Food Sorting Machines Market Projections, by Technology, US$ Bn 2017-2031

Figure 30: North America Food Sorting Machines Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 31: North America Food Sorting Machines Market Projections, by Application, Thousand Units 2017-2031

Figure 32: North America Food Sorting Machines Market Projections, by Application, US$ Bn 2017-2031

Figure 33: North America Food Sorting Machines Market, Incremental Opportunity, by Application, US$ Bn 2023 -2031

Figure 34: North America Food Sorting Machines Market Projections, by End-use, Thousand Units 2017-2031

Figure 35: North America Food Sorting Machines Market Projections, by End-use, US$ Bn 2017-2031

Figure 36: North America Food Sorting Machines Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 37: North America Food Sorting Machines Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 38: North America Food Sorting Machines Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 39: North America Food Sorting Machines Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 40: Europe Food Sorting Machines Market Projections, by Product Type, Thousand Units 2017-2031

Figure 41: Europe Food Sorting Machines Market Projections, by Product Type, US$ Bn 2017-2031

Figure 42: Europe Food Sorting Machines Market, Incremental Opportunity, by Product Type, US$ Bn 2023 -2031

Figure 43: Europe Food Sorting Machines Market Projections, by Type, Thousand Units 2017-2031

Figure 44: Europe Food Sorting Machines Market Projections, by Type, US$ Bn 2017-2031

Figure 45: Europe Food Sorting Machines Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 46: Europe Food Sorting Machines Market Projections, by Technology, Thousand Units 2017-2031

Figure 47: Europe Food Sorting Machines Market Projections, by Technology, US$ Bn 2017-2031

Figure 48: Europe Food Sorting Machines Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 49: Europe Food Sorting Machines Market Projections, by Application, Thousand Units 2017-2031

Figure 50: Europe Food Sorting Machines Market Projections, by Application, US$ Bn 2017-2031

Figure 51: Europe Food Sorting Machines Market, Incremental Opportunity, by Application, US$ Bn 2023 -2031

Figure 52: Europe Food Sorting Machines Market Projections, by End-use, Thousand Units 2017-2031

Figure 53: Europe Food Sorting Machines Market Projections, by End-use, US$ Bn 2017-2031

Figure 54: Europe Food Sorting Machines Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 55: Europe Food Sorting Machines Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 56: Europe Food Sorting Machines Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 57: Europe Food Sorting Machines Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 58: Asia Pacific Food Sorting Machines Market Projections, by Product Type, Thousand Units 2017-2031

Figure 59: Asia Pacific Food Sorting Machines Market Projections, by Product Type, US$ Bn 2017-2031

Figure 60: Asia Pacific Food Sorting Machines Market, Incremental Opportunity, by Product Type, US$ Bn 2023 -2031

Figure 61: Asia Pacific Food Sorting Machines Market Projections, by Type, Thousand Units 2017-2031

Figure 62: Asia Pacific Food Sorting Machines Market Projections, by Type, US$ Bn 2017-2031

Figure 63: Asia Pacific Food Sorting Machines Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 64: Asia Pacific Food Sorting Machines Market Projections, by Technology, Thousand Units 2017-2031

Figure 65: Asia Pacific Food Sorting Machines Market Projections, by Technology, US$ Bn 2017-2031

Figure 66: Asia Pacific Food Sorting Machines Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 67: Asia Pacific Food Sorting Machines Market Projections, by Application, Thousand Units 2017-2031

Figure 68: Asia Pacific Food Sorting Machines Market Projections, by Application, US$ Bn 2017-2031

Figure 69: Asia Pacific Food Sorting Machines Market, Incremental Opportunity, by Application, US$ Bn 2023 -2031

Figure 70: Asia Pacific Food Sorting Machines Market Projections, by End-use, Thousand Units 2017-2031

Figure 71: Asia Pacific Food Sorting Machines Market Projections, by End-use, US$ Bn 2017-2031

Figure 72: Asia Pacific Food Sorting Machines Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 73: Asia Pacific Food Sorting Machines Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 74: Asia Pacific Food Sorting Machines Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 75: Asia Pacific Food Sorting Machines Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 76: Middle East & Africa Food Sorting Machines Market Projections, by Product Type, Thousand Units 2017-2031

Figure 77: Middle East & Africa Food Sorting Machines Market Projections, by Product Type, US$ Bn 2017-2031

Figure 78: Middle East & Africa Food Sorting Machines Market, Incremental Opportunity, by Product Type, US$ Bn 2023 -2031

Figure 79: Middle East & Africa Food Sorting Machines Market Projections, by Type, Thousand Units 2017-2031

Figure 80: Middle East & Africa Food Sorting Machines Market Projections, by Type, US$ Bn 2017-2031

Figure 81: Middle East & Africa Food Sorting Machines Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 82: Middle East & Africa Food Sorting Machines Market Projections, by Technology, Thousand Units 2017-2031

Figure 83: Middle East & Africa Food Sorting Machines Market Projections, by Technology, US$ Bn 2017-2031

Figure 84: Middle East & Africa Food Sorting Machines Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 85: Middle East & Africa Food Sorting Machines Market Projections, by Application, Thousand Units 2017-2031

Figure 86: Middle East & Africa Food Sorting Machines Market Projections, by Application, US$ Bn 2017-2031

Figure 87: Middle East & Africa Food Sorting Machines Market, Incremental Opportunity, by Application, US$ Bn 2023 -2031

Figure 88: Middle East & Africa Food Sorting Machines Market Projections, by End-use, Thousand Units 2017-2031

Figure 89: Middle East & Africa Food Sorting Machines Market Projections, by End-use, US$ Bn 2017-2031

Figure 90: Middle East & Africa Food Sorting Machines Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 91: Middle East & Africa Food Sorting Machines Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 92: Middle East & Africa Food Sorting Machines Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 93: Middle East & Africa Food Sorting Machines Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 94: South America Food Sorting Machines Market Projections, by Product Type, Thousand Units 2017-2031

Figure 95: South America Food Sorting Machines Market Projections, by Product Type, US$ Bn 2017-2031

Figure 96: South America Food Sorting Machines Market, Incremental Opportunity, by Product Type, US$ Bn 2023 -2031

Figure 97: South America Food Sorting Machines Market Projections, by Type, Thousand Units 2017-2031

Figure 98: South America Food Sorting Machines Market Projections, by Type, US$ Bn 2017-2031

Figure 99: South America Food Sorting Machines Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 100: South America Food Sorting Machines Market Projections, by Technology, Thousand Units 2017-2031

Figure 101: South America Food Sorting Machines Market Projections, by Technology, US$ Bn 2017-2031

Figure 102: South America Food Sorting Machines Market, Incremental Opportunity, by Technology, US$ Bn 2023 -2031

Figure 103: South America Food Sorting Machines Market Projections, by Application, Thousand Units 2017-2031

Figure 104: South America Food Sorting Machines Market Projections, by Application, US$ Bn 2017-2031

Figure 105: South America Food Sorting Machines Market, Incremental Opportunity, by Application, US$ Bn 2023 -2031

Figure 106: South America Food Sorting Machines Market Projections, by End-use, Thousand Units 2017-2031

Figure 107: South America Food Sorting Machines Market Projections, by End-use, US$ Bn 2017-2031

Figure 108: South America Food Sorting Machines Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 109: South America Food Sorting Machines Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 110: South America Food Sorting Machines Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 111: South America Food Sorting Machines Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031