Reports

Reports

Analyst Viewpoint

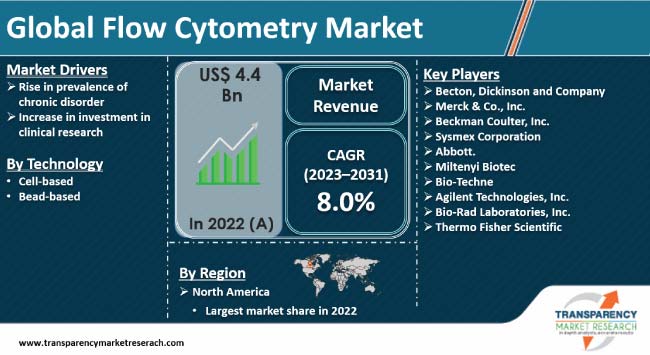

Rise in prevalence of chronic disorders and increase in investment in clinical research are propelling the flow cytometry market trajectory. Flow cytometry is gaining traction in stem cell research to examine the characteristics of mixed cell populations derived from peripheral blood, bone marrow, and solid tissues.

Data interpretation, standardization issues, and high cost associated with advanced flow cytometry equipment are expected to lead to flow cytometry market limitations. R&D of new drugs is likely to offer lucrative opportunities to vendors in the global flow cytometry industry. Key players are investing in advanced technologies and launching new products to expand their portfolio.

Flow cytometry is a technology that is employed in biology and medicine to analyze and sort cells based on their physical and chemical properties. It involves the passage of cells through a laser beam, measuring the scattered and fluorescent light to identify and quantify characteristics such as size and complexity. Using microscopy, about six parameters of a single cell can be detected, whereas flow cytometer instruments can detect up to 30 distinct parameters. Additionally, modern flow cytometers are capable of processing over 10,000 cells per second, thereby, enabling scientists to rapidly analyze and characterize millions of cells.

Flow cytometry plays a major role in diagnosing and finding early signs of immune deficiencies and cancer in patients. Immunophenotyping, biomarker analysis, and disease monitoring are some of the techniques utilized to determine severe chronic conditions.

Surge in prevalence of chronic diseases, such as leishmaniasis, HIV, and cancer amongst individuals is fueling the flow cytometry market development. According to the World Health Organization, cancer was one of the leading causes of death in 2020, accounting for approximately 10 million deaths. The most common types of cancer were breast cancer (2.26 million cases), lung cancer (2.21 million cases), colon and rectum cancer (1.93 million cases), prostate (1.41 million cases), skin (1.20 million cases), and stomach (1.09 million cases).

In April 2022, an article published in the journal Biochemistry Research International stated that Visceral Leishmaniasis (VL), also referred to as kala-azar, affects around 50,000-90,000 individuals globally every year. Thus, high incidence of VL is expected to spur the flow cytometry market growth in the near future. In December 2022, an article published in the journal Tropical Medicine and Infectious Disease discussed how the number of cases of leishmaniasis has been rising over the past five years. Flow cytometry in infectious disease diagnosis is employed to analyze and characterize cells, typically blood cells, to identify and quantify pathogens or abnormal immune responses associated with infections.

Rise in application of flow cytometry in stem cell research is propelling the market revenue. In April 2022, the International Journal of Laboratory Haematology published an article discussing the versatile applications of flow cytometry in examining the characteristics of mixed cell populations derived from peripheral blood (PB), bone marrow (BM), and solid tissues. This method enables the isolation of individual cells for further study.

Flow cytometry is an analytical method utilized in the detection and analysis of physical features of cells or particles during the drug discovery and development process. It has emerged as an important tool for safety and exploratory purposes due to its ability to quickly examine a large number of particles and provide statistically reliable information on the cell population.

R&D of new drugs is driving the flow cytometry market revenue. The need for developing new drugs has led to surge in investment in clinical research. In October 2021, BD Life Sciences-Biosciences, a segment of BD (Becton, Dickinson, and Company), collaborated with Christian Medical College (CMC), Vellore, to launch its second Centre of Excellence (CoE) in flow cytometry for clinical research in India. This CoE is expected to serve as the National Reference Center for clinical diagnostics applications, wherein hematologists, physicians, and lab specialists from across India can come together to deliberate and discuss standardization and the best practices in clinical flow cytometry, according to BD Life Sciences.

Availability of digital platform for flow cytometry is fueling the flow cytometry market value.

In July 2021, Becton, Dickinson, and Company introduced a reimagined digital platform for flow cytometry to enhance the online shopping experience for its consumers and procurement teams. The new BD Biosciences marketplace is an online destination that offers BD's research, clinical, and single-cell analysis, and multi-omic products, making it an attractive option for the most in-depth users of flow cytometry.

North America accounted for the largest flow cytometry market share in 2022, led by a rise in leishmaniasis and HIV cases. The increasing prevalence of leishmaniasis and HIV has highlighted the significance of flow cytometry in determining a patient's prognosis. In July 2022, the Government of Canada estimated 62,790 people were living with HIV in Canada from 2020 to 2021. Presence of major players is also driving the market dynamics of North America.

The global flow cytometry market landscape is highly competitive, with several opportunities for expansion and innovation. Flow cytometry companies are adopting various strategies, such as mergers and acquisitions and new product development, to expand their product portfolio.

Becton, Dickinson and Company, Merck & Co., Inc., Beckman Coulter, Inc., Thermo Fisher Scientific, Sysmex Corporation, Abbott, Miltenyi Biotec, Bio-Techne, Agilent Technologies, Inc., and Bio-Rad Laboratories, Inc. are some of the key players operating in this market.

Each of these companies has been profiled in the flow cytometry market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 4.4 Bn |

| Market Forecast (Value) in 2031 | US$ 8.8 Bn |

| Growth Rate (CAGR) | 8.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 4.4 Bn in 2022

It is anticipated to grow at a CAGR of 8.0% from 2023 to 2031

Rise in prevalence of chronic disorders and increase in investment in clinical research

North America was the leading region in 2022

Becton, Dickinson and Company, Merck & Co., Inc., Beckman Coulter, Inc., Thermo Fisher Scientific, Sysmex Corporation, Abbott, Miltenyi Biotec, Bio-Techne, Agilent Technologies, Inc., and Bio-Rad Laboratories, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Flow Cytometry Market

4. Market Overview

4.1. Introduction

4.1.1. Technology Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Flow Cytometry Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Technology/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Flow Cytometry Market Analysis and Forecast, by Technology

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Technology, 2017–2031

6.3.1. Cell-based

6.3.2. Bead-based

6.4. Market Attractiveness, by Technology

7. Global Flow Cytometry Market Analysis and Forecast, by Products & Services

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Products & Services, 2017–2031

7.3.1. Reagents & Consumables

7.3.2. Flow Cytometry Instruments

7.3.2.1. Cell Analyzers

7.3.2.2. Cell Sorters

7.3.3. Software

7.3.4. Services

7.3.5. 7.4 Market Attractiveness, by Products & Services

8. Global Flow Cytometry Market Analysis and Forecast, by Application

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Pharmaceutical & Drug Discovery

8.3.2. Diagnostics

8.3.3. Others

8.4. Market Attractiveness, by Application

9. Global Flow Cytometry Market Analysis and Forecast, by End-user

9.1. Introduction and Definitions

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals & Diagnostic Labs

9.3.2. Academic & Research Institutions

9.3.3. Others

9.4. Market Attractiveness, by End-user

10. Global Flow Cytometry Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Region

11. North America Flow Cytometry Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Technology, 2017–2031

11.2.1. Cell-based

11.2.2. Bead-based

11.3. Market Attractiveness, by Technology

11.4. Market Value Forecast, by Products & Services, 2017–2031

11.4.1. Reagents & Consumables

11.4.2. Flow Cytometry Instruments

11.4.2.1. Cell Analyzers

11.4.2.2. Cell Sorters

11.4.3. Software

11.4.4. Services

11.5. Market Attractiveness, by Products & Services

11.6. Market Value Forecast, by Application, 2017–2031

11.6.1. Pharmaceutical & Drug Discovery

11.6.2. Diagnostics

11.6.3. Others

11.7. Market Attractiveness, by Application

11.8. Market Value Forecast, by End-user, 2017–2031

11.8.1. Hospitals & Diagnostic Labs

11.8.2. Academic & Research Institutions

11.8.3. Others

11.9. Market Attractiveness, by End-user

11.10. Market Value Forecast, by Country, 2017–2031

11.10.1. U.S.

11.10.2. Canada

11.11. Market Attractiveness Analysis

11.11.1. By Technology

11.11.2. By Products & Services

11.11.3. By Application

11.11.4. By End-user

11.11.5. By Country

12. Europe Flow Cytometry Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Technology, 2017–2031

12.2.1. Cell-based

12.2.2. Bead-based

12.3. Market Attractiveness, by Technology

12.4. Market Value Forecast, by Products & Services, 2017–2031

12.4.1. Reagents & Consumables

12.4.2. Flow Cytometry Instruments

12.4.2.1. Cell Analyzers

12.4.2.2. Cell Sorters

12.4.3. Software

12.4.4. Services

12.5. Market Attractiveness, by Products & Services

12.6. Market Value Forecast, by Application, 2017–2031

12.6.1. Pharmaceutical & Drug Discovery

12.6.2. Diagnostics

12.6.3. Others

12.7. Market Attractiveness, by Application

12.8. Market Value Forecast, by End-user, 2017–2031

12.8.1. Hospitals & Diagnostic Labs

12.8.2. Academic & Research Institutions

12.8.3. Others

12.9. Market Attractiveness, by End-user

12.10. Market Value Forecast, by Country/Sub-region, 2017–2031

12.10.1. Germany

12.10.2. U.K.

12.10.3. France

12.10.4. Italy

12.10.5. Spain

12.10.6. Rest of Europe

12.11. Market Attractiveness Analysis

12.11.1. By Technology

12.11.2. By Products & Services

12.11.3. By Application

12.11.4. By End-user

12.11.5. By Country/Sub-region

13. Asia Pacific Flow Cytometry Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Technology, 2017–2031

13.2.1. Cell-based

13.2.2. Bead-based

13.3. Market Attractiveness, by Technology

13.4. Market Value Forecast, by Products & Services, 2017–2031

13.4.1. Reagents & Consumables

13.4.2. Flow Cytometry Instruments

13.4.2.1. Cell Analyzers

13.4.2.2. Cell Sorters

13.4.3. Software

13.4.4. Services

13.5. Market Attractiveness, by Products & Services

13.6. Market Value Forecast, by Application, 2017–2031

13.6.1. Pharmaceutical & Drug Discovery

13.6.2. Diagnostics

13.6.3. Others

13.7. Market Attractiveness, by Application

13.8. Market Value Forecast, by End-user, 2017–2031

13.8.1. Hospitals & Diagnostic Labs

13.8.2. Academic & Research Institutions

13.8.3. Others

13.9. Market Attractiveness, by End-user

13.10. Market Value Forecast, by Country/Sub-region, 2017–2031

13.10.1. China

13.10.2. Japan

13.10.3. India

13.10.4. Australia & New Zealand

13.10.5. Rest of Asia Pacific

13.11. Market Attractiveness Analysis

13.11.1. By Technology

13.11.2. By Products & Services

13.11.3. By Application

13.11.4. By End-user

13.11.5. By Country/Sub-region

14. Latin America Flow Cytometry Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Technology, 2017–2031

14.2.1. Cell-based

14.2.2. Bead-based

14.3. Market Attractiveness, by Technology

14.4. Market Value Forecast, by Products & Services, 2017–2031

14.4.1. Reagents & Consumables

14.4.2. Flow Cytometry Instruments

14.4.2.1. Cell Analyzers

14.4.2.2. Cell Sorters

14.4.3. Software

14.4.4. Services

14.5. Market Attractiveness, by Products & Services

14.6. Market Value Forecast, by Application, 2017–2031

14.6.1. Pharmaceutical & Drug Discovery

14.6.2. Diagnostics

14.6.3. Others

14.7. Market Attractiveness, by Application

14.8. Market Value Forecast, by End-user, 2017–2031

14.8.1. Hospitals & Diagnostic Labs

14.8.2. Academic & Research Institutions

14.8.3. Others

14.9. Market Attractiveness, by End-user

14.10. Market Value Forecast, by Country/Sub-region, 2017–2031

14.10.1. Brazil

14.10.2. Mexico

14.10.3. Rest of Latin America

14.11. Market Attractiveness Analysis

14.11.1. By Technology

14.11.2. By Products & Services

14.11.3. By Application

14.11.4. By End-user

14.11.5. By Country/Sub-region

15. Middle East & Africa Flow Cytometry Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Technology, 2017–2031

15.2.1. Cell-based

15.2.2. Bead-based

15.3. Market Attractiveness, by Technology

15.4. Market Value Forecast, by Products & Services, 2017–2031

15.4.1. Reagents & Consumables

15.4.2. Flow Cytometry Instruments

15.4.2.1. Cell Analyzers

15.4.2.2. Cell Sorters

15.4.3. Software

15.4.4. Services

15.5. Market Attractiveness, by Products & Services

15.6. Market Value Forecast, by Application, 2017–2031

15.6.1. Pharmaceutical & Drug Discovery

15.6.2. Diagnostics

15.6.3. Others

15.7. Market Attractiveness, by Application

15.8. Market Value Forecast, by End-user, 2017–2031

15.8.1. Hospitals & Diagnostic Labs

15.8.2. Academic & Research Institutions

15.8.3. Others

15.9. Market Attractiveness, by End-user

15.10. Market Value Forecast, by Country/Sub-region, 2017–2031

15.10.1. GCC Countries

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Market Attractiveness Analysis

15.11.1. By Technology

15.11.2. By Products & Services

15.11.3. By Application

15.11.4. By End-user

15.11.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of Companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Becton, Dickinson and Company

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Merck & Co., Inc.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Beckman Coulter, Inc.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Sysmex Corporation

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Abbott

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Miltenyi Biotec

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Bio-Techne

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Agilent Technologies, Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Bio-Rad Laboratories, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Thermo Fisher Scientific

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

List of Tables

Table 01: Global Flow Cytometry Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 02: Global Flow Cytometry Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 03: Global Flow Cytometry Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Flow Cytometry Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Flow Cytometry Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Flow Cytometry Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Flow Cytometry Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 08: North America Flow Cytometry Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 09: North America Flow Cytometry Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Flow Cytometry Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Flow Cytometry Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Flow Cytometry Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 13: Europe Flow Cytometry Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 14: Europe Flow Cytometry Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Europe Flow Cytometry Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Flow Cytometry Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Flow Cytometry Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 18: Asia Pacific Flow Cytometry Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 19: Asia Pacific Flow Cytometry Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Asia Pacific Flow Cytometry Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America Flow Cytometry Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Flow Cytometry Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 23: Latin America Flow Cytometry Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 24: Latin America Flow Cytometry Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 25: Latin America Flow Cytometry Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Flow Cytometry Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Flow Cytometry Market Size (US$ Mn) Forecast, by Technology, 2017–2031

Table 28: Middle East & Africa Flow Cytometry Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 29: Middle East & Africa Flow Cytometry Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Middle East & Africa Flow Cytometry Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Flow Cytometry Market Size (US$ Mn), by Region, 2022 and 2031

Figure 02: Global Flow Cytometry Market Revenue (US$ Mn), by Technology, 2022

Figure 03: Global Flow Cytometry Market Value Share, by Technology, 2022

Figure 04: Global Flow Cytometry Market Revenue (US$ Mn), by Products & Services, 2022

Figure 05: Global Flow Cytometry Market Value Share, by Products & Services, 2022

Figure 06: Global Flow Cytometry Market Revenue (US$ Mn), by Application, 2022

Figure 07: Global Flow Cytometry Market Value Share, by Application, 2022

Figure 08: Global Flow Cytometry Market Revenue (US$ Mn), by End-user, 2022

Figure 09: Global Flow Cytometry Market Value Share, by End-user, 2022

Figure 10: Global Flow Cytometry Market Value Share, by Region, 2022

Figure 11: Global Flow Cytometry Market Value (US$ Mn) Forecast, 2017–2031

Figure 12: Global Flow Cytometry Market Value Share Analysis, by Technology, 2022 and 2031

Figure 13: Global Flow Cytometry Market Attractiveness Analysis, by Technology, 2023-2031

Figure 14: Global Flow Cytometry Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 15: Global Flow Cytometry Market Attractiveness Analysis, by Products & Services, 2023-2031

Figure 16: Global Flow Cytometry Market Value Share Analysis, by Application, 2022 and 2031

Figure 17: Global Flow Cytometry Market Attractiveness Analysis, by Application, 2023-2031

Figure 18: Global Flow Cytometry Market Revenue (US$ Mn), by End-user, 2022

Figure 19: Global Flow Cytometry Market Value Share, by End-user, 2022

Figure 20: Global Flow Cytometry Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Flow Cytometry Market Attractiveness Analysis, by Region, 2023-2031

Figure 22: North America Flow Cytometry Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 23: North America Flow Cytometry Market Attractiveness Analysis, by Country, 2023–2031

Figure 24: North America Flow Cytometry Market Value Share Analysis, by Country, 2022 and 2031

Figure 25: North America Flow Cytometry Market Value Share Analysis, by Technology, 2022 and 2031

Figure 26: North America Flow Cytometry Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 27: North America Flow Cytometry Market Value Share Analysis, by Application, 2022 and 2031

Figure 28: North America Flow Cytometry Market Value Share Analysis, by End-user, 2022 and 2031

Figure 29: North America Flow Cytometry Market Attractiveness Analysis, by Technology, 2023–2031

Figure 30: North America Flow Cytometry Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 31: North America Flow Cytometry Market Attractiveness Analysis, by Application, 2023–2031

Figure 32: North America Flow Cytometry Market Attractiveness Analysis, by End-user, 2023–2031

Figure 33: Europe Flow Cytometry Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 34: Europe Flow Cytometry Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 35: Europe Flow Cytometry Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Europe Flow Cytometry Market Value Share Analysis, by Technology, 2022 and 2031

Figure 37: Europe Flow Cytometry Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 38: Europe Flow Cytometry Market Value Share Analysis, by Application, 2022 and 2031

Figure 39: Europe Flow Cytometry Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Europe Flow Cytometry Market Attractiveness Analysis, by Technology, 2023–2031

Figure 41: Europe Flow Cytometry Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 42: Europe Flow Cytometry Market Attractiveness Analysis, by Application, 2023–2031

Figure 43: Europe Flow Cytometry Market Attractiveness Analysis, by End-user, 2023–2031

Figure 44: Asia Pacific Flow Cytometry Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 45: Asia Pacific Flow Cytometry Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Asia Pacific Flow Cytometry Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Asia Pacific Flow Cytometry Market Value Share Analysis, by Technology, 2022 and 2031

Figure 48: Asia Pacific Flow Cytometry Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 49: Asia Pacific Flow Cytometry Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Asia Pacific Flow Cytometry Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Asia Pacific Flow Cytometry Market Attractiveness Analysis, by Technology, 2023–2031

Figure 52: Asia Pacific Flow Cytometry Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 53: Asia Pacific Flow Cytometry Market Attractiveness Analysis, by Application, 2023–2031

Figure 54: Asia Pacific Flow Cytometry Market Attractiveness Analysis, by End-user, 2022–2031

Figure 55: Latin America Flow Cytometry Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 56: Latin America Flow Cytometry Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 57: Latin America Flow Cytometry Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 58: Latin America Flow Cytometry Market Value Share Analysis, by Technology, 2022 and 2031

Figure 59: Latin America Flow Cytometry Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 60: Latin America Flow Cytometry Market Value Share Analysis, by Application, 2022 and 2031

Figure 61: Latin America Flow Cytometry Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Latin America Flow Cytometry Market Attractiveness Analysis, by Technology, 2023–2031

Figure 63: Latin America Flow Cytometry Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 64: Latin America Flow Cytometry Market Attractiveness Analysis, by Application, 2023–2031

Figure 65: Latin America Flow Cytometry Market Attractiveness Analysis, by End-user, 2023–2031

Figure 66: Middle East & Africa Flow Cytometry Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 67: Middle East & Africa Flow Cytometry Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 68: Middle East & Africa Flow Cytometry Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 69: Middle East & Africa Flow Cytometry Market Value Share Analysis, by Technology, 2022 and 2031

Figure 70: Middle East & Africa Flow Cytometry Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 71: Middle East & Africa Flow Cytometry Market Value Share Analysis, by Application, 2022 and 2031

Figure 72: Middle East & Africa Flow Cytometry Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Middle East & Africa Flow Cytometry Market Attractiveness Analysis, by Technology, 2023–2031

Figure 74: Middle East & Africa Flow Cytometry Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 75: Middle East & Africa Flow Cytometry Market Attractiveness Analysis, by Application, 2023–2031

Figure 76: Middle East & Africa Flow Cytometry Market Attractiveness Analysis, by End-user, 2023–2031