Reports

Reports

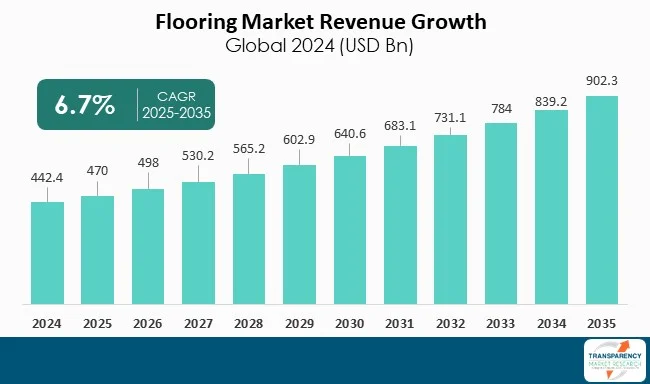

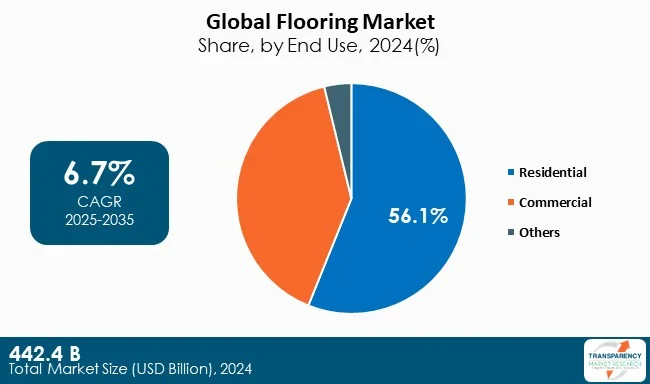

The Flooring market is anticipated to grow at a CAGR of 6.7% during the forecast period owing to the increasing demand for flooring from residential and commercial sectors. Rapid urbanization is leading to growth in housing development projects in the cities and their sub-urban areas. Due to population explosion in urban areas, there is a significant demand for apartments and homes that require flooring solutions with good quality.

In the emerging and matured markets, house owners invest frequently in remodeling projects for enhancing the aesthetics, comfort as well as the property value. Flooring upgrades have a central role to play in these renovations owing to their visible impact on appearance of the interiors. Healthcare facilities, retail stores, restaurants, offices, and hotels consistently need stylish and durable flooring for meeting the functional, aesthetic, as well as safety standards.

In the commercial buildings, the priority is low-maintenance and high-performance materials such as carpet tiles, ceramic and LVT. Asia-Pacific leads the global flooring market with 41.3% owing to the rapid urbanization, increasing disposable income, and growth in construction activities in China, India, and countries in South East Asia.

Flooring is the covering or material laid on a floor structure for creating an aesthetically pleasing, stable, and durable surface useful for different activities. Flooring constitutes materials such as carpet, wood, laminate, vinyl, stone, concrete, and tile. These materials provide unique properties such as visual appeal, water resistance, and durability.

Flooring offers a durable and stable surface for working, walking and various other activities. Some flooring materials such as carpet could provide warmth and comfort to a room. Flooring materials are selected based on their capability to withstand foot traffic, potential damage, and wear and tear.

Some types of flooring provide insulation against noise or heat loss. Flooring improves the aesthetics of space in a building. Design of some flooring types allows easy maintenance and easy cleaning. Stable, clean, and levelled subfloor is vital for appropriate flooring installation. It is ideal to install underlayment for providing moisture protection, insulation, and cushioning.

| Attribute | Detail |

|---|---|

| Flooring Market Drivers |

|

Notably, demand for resilient and low-maintenance flooring materials around the world has been chiefly responsible for the major changes in the global flooring industry. The last decade has seen consumers and developers favor a floor covering product not only for its attractiveness but for its superior longevity, with lower maintenance requirements. The last decade has seen cost-efficiency and evolving lifestyles prioritizing convenience as two primary drivers. Accordingly, floor coverings such as luxury vinyl tile (LVT), stone plastic composite (SPC), ceramic tile, and high-pressure laminates have emerged as significant contributors to the renovation and new sector of the flooring market.

One of the biggest drivers to the growth and development of flooring market is the rapid rate of urbanization in emerging markets, particularly in Asia-Pacific, the Middle East and North Africa and Latin America. As population moves to urban centers, the need for multi-family residential, offices, hospitals, schools, and retail spaces continues to grow. These applications need flooring that's cost-effective and resists wear, moisture, and chemical agents in particular service areas, such as healthcare and hospitality.

In hospitality and healthcare, flooring is undoubtedly an important aspect of hygiene, safety, consistency, and process. As a response to this, flooring manufacturers are required to formulate better products with antimicrobial coatings, slip resistance, stain resistance, and compressive strength.

Technological change has also been seen as a key enabler of this demand. For example, the development of click-lock installation systems and improved core materials have enhanced the installation of durable products and the digital printing of graphics and designs easier to create, as well as create products that replicate high-end finishes, like natural stone, or hardwood with good looks at low cost. Adopting new technologies facilitates reducing labor time and labour costs, while also extending the life of the product, which reduces total cost of ownership to the consumer.

From a commercial point of view, retail chains and office buildings are looking for flooring that is long-lasting, requires little maintenance, is visually pleasing (brand aesthetic), and tolerant of daily foot traffic. Similarly, many residential consumers want to carefully examine flooring that will also endure the stresses incurred by children, pets, and continuing cleaning, while still looking good and not having to replace them too often.

Additionally, the demand post-Covid is heavier for materials that can add to cleanliness and hygiene. Flooring that is stain resistant, moisture resistant, and easily sanitized is a must-specification in healthcare, education, and homes, thereby resulting in the increased adoption rate of durable surfaces such as LVT, ceramic tiles, and epoxy coatings.

The cumulative effects of these have rendered durability and low-maintenance a minimum standard in flooring specification today, and moving into the future. This demand will only grow as a result of continued economic growth in investments in housing and infrastructure, creating exciting growth potential for manufacturers that can innovate toward product performance, design, and sustainability.

Sustainability is a key motivating factor in the global flooring market, as regulatory pressure and corporate environmental philosophy, combined with consumer awareness, are all shifting toward green building practices. Public and private developers around the globe are mandating sustainable materials in both - commercial and residential spaces. Flooring is a major component of interior space and is subject to significant scrutiny, beyond aesthetic and performance needs, for its environmental impact.

The rise of green certification programs such as LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and WELL Building Standard has driven demand for flooring materials, among other products, with low VOC (volatile organic compounds) emissions and that are recyclable and come from a low carbon impact.

Many of the products under consideration are linoleum, cork, bamboo, reclaimed wood, recycled rubber, and bio-based vinyl. Manufacturers are also utilizing cradle-to-cradle design and recyclable product design for end-of-life product recovery.

Education and healthcare industries are the major consumers of green flooring due to their focus on indoor air quality and environmental responsibility. The same is true for government and institutional projects, which are often required to adopt rigid procurement criteria as they increasingly mandate an eco-label. The market advantage for manufacturers that develop products with sustainability in mind along with supply chain management are expected to produce increased brand loyalty.

Consumer sentiment has changed as well. Today's homeowners (and consumers of flooring especially millennials and Z) are better informed and more aware of their environmental impact. Homeowners today want flooring that meets their interior design needs, and ethical and environmental standards. Digital spaces and product transparency beacons like Environmental Product Declarations (EPDs) and Health Product Declarations (HPDs) allow consumers to make decisions based more on sustainability indicators.

Technological improvements have enhanced the shift. Innovative processes have made it possible to manufacture flooring products that incorporate post-consumer waste as well as utilizing renewable energy in the manufacturing process and minimizing glue or other harmful chemicals. In addition, products like modular flooring systems are gaining in popularity for their reusability and maintenance that contributes to lower waste over time.

The growing number of government incentives related to green buildings, particularly from governments in North America and Europe, is driving even more usage of sustainable flooring. Tax rebates, lower interest loans, zoning incentives, etc.

As such, sustainable flooring is a part of mainstream product portfolios and the evolution of corporate strategy rather than a niche segment in the "green" flooring segment of the market.

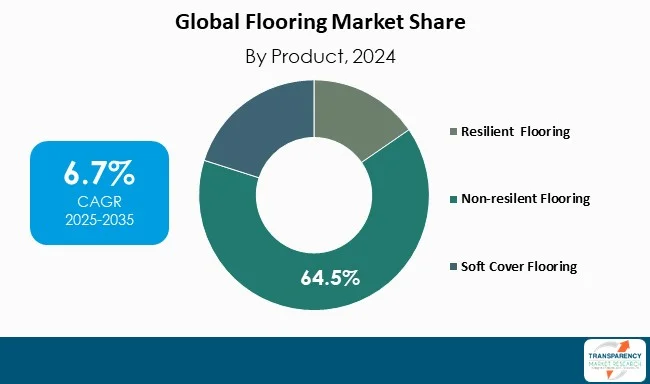

Non-resilient flooring accounts for 64.5% of the global flooring market share and is the most used category of flooring as it is durable, affordable, and offers tremendous aesthetic possibilities. Non-resilient flooring is composed of commercially manufactured materials such as ceramic tile, natural stone, concrete, and terrazzo. These materials are built to be strong and last long, which can fulfill the needs of nearly any space that is quite valuable in high traffic environments including commercial, hospital, educational, and in residential uses.

Another reason for the excessive popularity of non-resilient flooring is also the great diversity of aesthetics available from non-resilient materials. Manufacturers have worked to deliver designs with more textures, patterns and colors, so even if facing a lower budget, the look of more expensive product like wood or marble can be achieved.

Moreover, non-resilient flooring is often selected in warm climate regions as the material and composition has thermal properties that increase the transpiration and offer cooler feeling in indoor spaces. Similarly, it is capable of being utilized with underfloor heating in cold climate regions.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific, Which Consists of 41.3% Share of Global Market |

Asia Pacific region is observed to have 41.3% share of the global flooring market that can largely be attributed to increasing urbanization triggering construction activities and the increasing disposable income in the region. Countries such as China and India are experiencing an unprecedented level of growth related to construction when it comes to residential and commercial infrastructure.

Complimenting this growth trajectory are various government initiatives related to smart cities and industrial development while the size of population is helping to further fuel the demand for resilient flooring and non-resilient flooring solutions.

Europe has 23.0% share of the flooring market globally owing to increased demand for eco-friendly and sustainable flooring solutions, availability of building codes and laws, and increasing renovation rates from the residential and commercial industry. A strong emphasis on energy-efficient buildings, as well as consumers’ preference for the aesthetics of their building in terms of the quality and unique designs of flooring material is stimulating growth in the market and across much of the region, specifically referring to Western and Eastern Europe.

The 15.7% share North America enjoys in the global flooring market can be traced to strong residential and commercial construction, level of renovation rates, and consumer behaviors toward flooring solutions exhibit aesthetic choice and durability. The region benefits from growth rates associated with strong technology, increased demand for luxury vinyl tiles and cleaner, engineered, wood, in addition to stringent building codes that provide incentives to use sustainable, healthy, and high-performing flooring materials, optimally.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 442.4 Bn |

| Market Forecast Value in 2035 | US$ 902.3Bn |

| Growth Rate (CAGR) | 6.7% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Million Square Meters for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Flooring market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Material

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The flooring market stood at US$ 333.6 Bn in 2021.

The flooring market is expected to grow at a CAGR of 6.4% from 2022 to 2031.

Increase in demand for novel products and expansion of construction sector are driving the global flooring market.

The ceramic tile segment held 43.2% value share of the market in 2021.

Asia Pacific was the most lucrative region with value share of 46.2% of the flooring market in 2021.

Armstrong World Industries, Inc., Interface, Inc., Forbo Holding AG, The Dixie Group, Inc., James Halstead Plc, LX Hausys, J&J Flooring LLC, Tarkett S.A, Mohawk Industries, Inc., Boral Limited, and Shaw Industries Group, Inc.

Table 1 Global Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 2 Global Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 3 Global Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 4 Global Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 5 Global Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 6 Global Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 7 Global Flooring Market Volume (Million Square Meters) Forecast, by Region, 2025 to 2035

Table 8 Global Flooring Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 10 North America Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 11 North America Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 12 North America Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 13 North America Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 14 North America Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 15 North America Flooring Market Volume (Million Square Meters) Forecast, by Country, 2025 to 2035

Table 16 North America Flooring Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 U.S. Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 18 U.S. Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 19 U.S. Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 20 U.S. Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 21 U.S. Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 22 U.S. Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 23 Canada Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 24 Canada Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 25 Canada Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 26 Canada Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 27 Canada Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 28 Canada Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 29 Europe Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 30 Europe Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 31 Europe Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 32 Europe Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 33 Europe Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 34 Europe Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 35 Europe Flooring Market Volume (Million Square Meters) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe Flooring Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 38 Germany Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 39 Germany Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 40 Germany Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 41 Germany Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 42 Germany Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 43 France Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 44 France Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 45 France Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 46 France Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 47 France Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 48 France Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 49 U.K. Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 50 U.K. Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 51 U.K. Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 52 U.K. Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 53 U.K. Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 54 U.K. Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 55 Italy Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 56 Italy Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 57 Italy Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 58 Italy Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 59 Italy Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 60 Italy Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 61 Spain Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 62 Spain Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 63 Spain Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 64 Spain Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 65 Spain Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 66 Spain Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 67 Russia & CIS Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 68 Russia & CIS Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 69 Russia & CIS Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 70 Russia & CIS Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 71 Russia & CIS Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 72 Russia & CIS Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 73 Rest of Europe Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 74 Rest of Europe Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 75 Rest of Europe Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 76 Rest of Europe Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 77 Rest of Europe Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 78 Rest of Europe Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 79 Asia Pacific Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 80 Asia Pacific Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 81 Asia Pacific Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 82 Asia Pacific Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 83 Asia Pacific Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 84 Asia Pacific Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 85 Asia Pacific Flooring Market Volume (Million Square Meters) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific Flooring Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 88 China Flooring Market Value (US$ Bn) Forecast, by Material 2025 to 2035

Table 89 China Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 90 China Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 91 China Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 92 China Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 93 Japan Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 94 Japan Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 95 Japan Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 96 Japan Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 97 Japan Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 98 Japan Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 99 India Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 100 India Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 101 India Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 102 India Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 103 India Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 104 India Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 105 India Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 106 India Flooring Market Value (US$ Bn) Forecast, by End Use 2025 to 2035

Table 107 ASEAN Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 108 ASEAN Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 109 ASEAN Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 110 ASEAN Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 111 ASEAN Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 112 ASEAN Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 113 Rest of Asia Pacific Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 114 Rest of Asia Pacific Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 115 Rest of Asia Pacific Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 116 Rest of Asia Pacific Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 117 Rest of Asia Pacific Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 118 Rest of Asia Pacific Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 119 Latin America Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 120 Latin America Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 121 Latin America Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 122 Latin America Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 123 Latin America Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 124 Latin America Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 125 Latin America Flooring Market Volume (Million Square Meters) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America Flooring Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 128 Brazil Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 129 Brazil Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 130 Brazil Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 131 Brazil Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 132 Brazil Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 133 Mexico Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 134 Mexico Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 135 Mexico Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 136 Mexico Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 137 Mexico Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 138 Mexico Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 139 Rest of Latin America Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 140 Rest of Latin America Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 141 Rest of Latin America Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 142 Rest of Latin America Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 143 Rest of Latin America Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 144 Rest of Latin America Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 145 Middle East & Africa Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 146 Middle East & Africa Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 147 Middle East & Africa Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 148 Middle East & Africa Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 149 Middle East & Africa Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 150 Middle East & Africa Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 151 Middle East & Africa Flooring Market Volume (Million Square Meters) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa Flooring Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 154 GCC Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 155 GCC Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 156 GCC Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 157 GCC Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 158 GCC Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 159 South Africa Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 160 South Africa Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 161 South Africa Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 162 South Africa Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 163 South Africa Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 164 South Africa Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Table 165 Rest of Middle East & Africa Flooring Market Volume (Million Square Meters) Forecast, by Material, 2025 to 2035

Table 166 Rest of Middle East & Africa Flooring Market Value (US$ Bn) Forecast, by Material, 2025 to 2035

Table 167 Rest of Middle East & Africa Flooring Market Volume (Million Square Meters) Forecast, by Product, 2025 to 2035

Table 168 Rest of Middle East & Africa Flooring Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 169 Rest of Middle East & Africa Flooring Market Volume (Million Square Meters) Forecast, by End Use, 2025 to 2035

Table 170 Rest of Middle East & Africa Flooring Market Value (US$ Bn) Forecast, by End Use, 2025 to 2035

Figure 1 Global Flooring Market Volume Share Analysis, by Material, 2024. 2028, and 2035

Figure 2 Global Flooring Market Attractiveness, by Material

Figure 3 Global Flooring Market Volume Share Analysis, by Product, 2024. 2028, and 2035

Figure 4 Global Flooring Market Attractiveness, by Product

Figure 5 Global Flooring Market Volume Share Analysis, by End Use, 2024. 2028, and 2035

Figure 6 Global Flooring Market Attractiveness, by End Use

Figure 7 Global Flooring Market Volume Share Analysis, by Region, 2024. 2028, and 2035

Figure 8 Global Flooring Market Attractiveness, by Region

Figure 9 North America Flooring Market Volume Share Analysis, by Material, 2024. 2028, and 2035

Figure 10 North America Flooring Market Attractiveness, by Material

Figure 11 North America Flooring Market Volume Share Analysis, by Product, 2024. 2028, and 2035

Figure 12 North America Flooring Market Attractiveness, by Product

Figure 13 North America Flooring Market Volume Share Analysis, by End Use, 2024. 2028, and 2035

Figure 14 North America Flooring Market Attractiveness, by End Use

Figure 15 North America Flooring Market Attractiveness, by Country and Sub-region

Figure 16 Europe Flooring Market Volume Share Analysis, by Material, 2024. 2028, and 2035

Figure 17 Europe Flooring Market Attractiveness, by Material

Figure 18 Europe Flooring Market Volume Share Analysis, by Product, 2024. 2028, and 2035

Figure 19 Europe Flooring Market Attractiveness, by Product

Figure 20 Europe Flooring Market Volume Share Analysis, by End Use, 2024. 2028, and 2035

Figure 21 Europe Flooring Market Attractiveness, by End Use

Figure 22 Europe Flooring Market Volume Share Analysis, by Country and Sub-region, 2024. 2028, and 2035

Figure 23 Europe Flooring Market Attractiveness, by Country and Sub-region

Figure 24 Asia Pacific Flooring Market Volume Share Analysis, by Material, 2024. 2028, and 2035

Figure 25 Asia Pacific Flooring Market Attractiveness, by Material

Figure 26 Asia Pacific Flooring Market Volume Share Analysis, by Product, 2024. 2028, and 2035

Figure 27 Asia Pacific Flooring Market Attractiveness, by Product

Figure 28 Asia Pacific Flooring Market Volume Share Analysis, by End Use, 2024. 2028, and 2035

Figure 29 Asia Pacific Flooring Market Attractiveness, by End Use

Figure 30 Asia Pacific Flooring Market Volume Share Analysis, by Country and Sub-region, 2024. 2028, and 2035

Figure 31 Asia Pacific Flooring Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Flooring Market Volume Share Analysis, by Material, 2024. 2028, and 2035

Figure 33 Latin America Flooring Market Attractiveness, by Material

Figure 34 Latin America Flooring Market Volume Share Analysis, by Product, 2024. 2028, and 2035

Figure 35 Latin America Flooring Market Attractiveness, by Product

Figure 36 Latin America Flooring Market Volume Share Analysis, by End Use, 2024. 2028, and 2035

Figure 37 Latin America Flooring Market Attractiveness, by End Use

Figure 38 Latin America Flooring Market Volume Share Analysis, by Country and Sub-region, 2024. 2028, and 2035

Figure 39 Latin America Flooring Market Attractiveness, by Country and Sub-region

Figure 40 Middle East & Africa Flooring Market Volume Share Analysis, by Material, 2024. 2028, and 2035

Figure 41 Middle East & Africa Flooring Market Attractiveness, by Material

Figure 42 Middle East & Africa Flooring Market Volume Share Analysis, by Product, 2024. 2028, and 2035

Figure 43 Middle East & Africa Flooring Market Attractiveness, by Product

Figure 44 Middle East & Africa Flooring Market Volume Share Analysis, by End Use, 2024. 2028, and 2035

Figure 45 Middle East & Africa Flooring Market Attractiveness, by End Use

Figure 46 Middle East & Africa Flooring Market Volume Share Analysis, by Country and Sub-region, 2024. 2028, and 2035

Figure 47 Middle East & Africa Flooring Market Attractiveness, by Country and Sub-region