Reports

Reports

Analysts’ Viewpoint on Carpets & Rugs Market Scenario

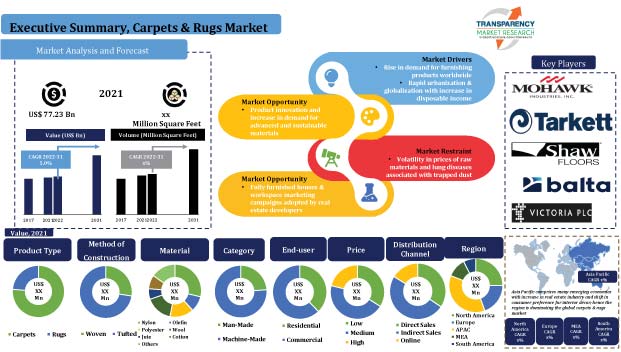

The carpets & rugs market is significantly driven by the rise in construction activities in developed and developing countries across the world. People are more inclined toward an esthetic appeal in their homes and workplaces, which is driving the global carpets & rugs market. Key suppliers are increasing their R&D spending and focusing on developing technologically upgraded carpets and rugs. Manufacturers are using advanced and sustainable materials to supply high-value products to their end-users. Increase in sale of carpets and rugs through online channels and e-commerce platforms is likely to create incremental opportunities for market players. Asia Pacific is expected to hold the highest share of the carpets & rugs market during the forecast period, due to the significant increase in construction activities in the region.

Carpets and rugs are used in residential and commercial sectors, as they protect floors by adding a layer of padding. They also add to the overall interior of a residential or workplace decor. Furthermore, carpets and rugs keep the floor from getting too cold in winters. The global carpets & rugs market is expected to grow at a decent pace during the forecast period owing to rapid urbanization, surge in construction activities, increase in disposable income of consumers, and rise in need for furnishing products in developing countries.

Demand for carpets and rugs has increased with the rise in infrastructure development and construction activities across the globe. Demand for furnishing products is also increasing in residential as well as commercial spaces for the improvement of workplaces as well as homes. According to India Brand Equity Foundation (IBEF), the real estate market in India is projected to reach a value of US$ 1 Trn by 2030, up from US$ 200 Bn in 2021, and account for 13% of the country's GDP by 2025. According to the National Association of Realtors, in the U.S., existing house sales hit a 15-year high of 6.12 million in 2021, indicating an 8.5% rise. According to the Office for National Statistics (ONS), monthly building output in the U.K. climbed by 1.1% in terms of volume in January 2022, and is currently at its highest level since September 2019.

Carpets and rugs offer functional characteristics such as slip prevention and thermal insulation. The freezing temperature makes carpets vital for residential homes in various regions. Wools of New Zealand conducted a research and discovered that carpets provide roughly 10 times more insulation than hard floor coverings. These factors are expected to drive the demand for rugs and carpets in the next few years.

Customers are increasingly inclined toward modern interiors in their homes and workplaces; thus, they tend to spend more on making esthetic improvements to their homes or offices. This is fueling the demand for carpets and rugs. Furthermore, increase in disposable income of the people, particularly in developing countries, is projected to boost the market. According to the World Bank, metropolitan regions are home to 55% of the world's population or over 4.2 billion people. This pattern is likely to continue. By 2050, roughly seven out of 10 people in the world would live in cities, with the urban population more than double the current level. Additionally, government and industry support for carpet and rug manufacturing is propelling the market. In some countries, such as Afghanistan, the carpet industry has long been a source of income for many households. Officials from Afghanistan's Carpet Manufacturers' Union aim to expand the carpet manufacturing industry from 18 to 34 provinces. Consequently, the market for carpets and rugs is projected to grow in the next few years.

In terms of product type, the global carpets & rugs market is bifurcated into carpets and rugs. The carpets segment is likely to hold a major share of the market during the forecast period. It is also expected to witness the highest growth rate during the forecast period. Global carpet manufacturers and dealers are introducing innovative products to meet the demands of customers. Higher preference for carpets can be primarily ascribed to their advantages and benefits over rugs. Carpeting is mostly fixed to the floor by glue or tacking, and cushion padding is underlain to provide a softness and cushioning effect, which makes it more preferred than rugs. Top carpet manufacturers & suppliers are targeting potential customers to increase their sales and revenue opportunities. However, demand for rugs is also expected to rise at a considerable rate during the forecast period.

In terms of material, the carpets & rugs market is segmented into nylon, olefin (polypropylene), polyester, wool, jute, cotton, and others (acrylic, trixeta, animal skins, etc.). The nylon segment is expected to grow at the fastest pace during the forecast period, as nylon is the most durable and stain-resistant carpet fiber compared to other material types. Furthermore, nylon carpets are ideal for high-traffic areas such as hallways and stairwells due to their resilience. However, the olefin (polypropylene) segment is expected to witness the highest growth rate during the forecast period, as olefin has strong stain and moisture resistance.

Asia Pacific is projected to hold the largest value share of the global carpets & rugs market during the forecast period. This can be primarily ascribed to the increase in construction activities in residential and commercial spaces; and rise in disposable income of the people in the region. China and India are among the world’s leading producers and exporters of carpets. Furthermore, Asia Pacific is home to the world’s largest textile industry. Top manufacturers in the Asia Pacific carpets & rugs market are focusing on the production of innovative products such as carpet flooring, carpet runners, handmade carpets, handmade rugs, and area rugs to gain higher revenue share. The carpets & rugs market in North America is also expected to grow at a significant pace during the forecast period, as customers in the region are more inclined toward getting higher value from interior design of their homes and workplaces.

The carpets & rugs market report concludes with the company profiles section, which includes key information about the leading players in the global carpet & rugs market. Most of the firms are spending significantly on comprehensive research and development activities, primarily to introduce innovative products. Expansion of product portfolios and mergers and acquisitions are the main strategies adopted by key players. Mohawk Industries, Inc., Milliken & Company, Tarkett Group, Shaw Industries Group, Inc., The Dixie Group, Inc., Balta Industries NV, Mannington Mills, Inc., Tai Ping Carpets International Ltd, Marquis Industries, Inc., and Victoria PLC are the prominent entities operating in this market.

Each of these players has been profiled in the carpets & rugs market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 77.23 Bn |

| Market Forecast Value in 2031 | US$ 123.73 Bn |

| Growth Rate (CAGR) | 5.0% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value & Million Square Feet for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 77.23 Bn in 2021

The market is estimated to grow at a CAGR of 5.0% during 2022-2031

Increase in demand for furnishing products is likely to drive the market

Carpets accounted for more than 50% share of the market in 2021

Asia Pacific is likely to be the most lucrative market during the forecast period

Mohawk Industries, Inc., Milliken & Company, Tarkett Group, Shaw Industries Group, Inc., The Dixie Group, Inc., Balta Industries NV, Mannington Mills, Inc., Tai Ping Carpets International Ltd, Marquis Industries, Inc., and Victoria PLC

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Home Furnishings Market Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Raw Material Analysis

5.9. COVID-19 Impact Analysis

5.10. Global Carpets & Rugs Market Analysis and Forecast, 2017-2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Million Square Feet)

6. Global Carpets & Rugs Market Analysis and Forecast, By Type

6.1. Global Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Type, 2017-2031

6.1.1. Carpets

6.1.2. Rugs

6.2. Incremental Opportunity, By Type

7. Global Carpets & Rugs Market Analysis and Forecast, By Method of Construction

7.1. Global Carpets & Rugs Market Size (US$ Mn and Mn Square Feet) Forecast, By Method of Construction, 2017-2031

7.1.1. Woven

7.1.2. Tufted

7.1.2.1. Loop Pile

7.1.2.2. Cut Pile

7.2. Incremental Opportunity, By Method of Construction

8. Global Carpets & Rugs Market Analysis and Forecast, By Material

8.1. Global Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Material, 2017-2031

8.1.1. Nylon

8.1.2. Olefin (polypropylene)

8.1.3. Polyester

8.1.4. Wool

8.1.5. Jute

8.1.6. Cotton

8.1.7. Others

8.2. Incremental Opportunity, By Material

9. Global Carpets & Rugs Market Analysis and Forecast, By Category

9.1. Global Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Category, 2017-2031

9.1.1. Man Made

9.1.2. Machine Made

9.2. Incremental Opportunity, By Category

10. Global Carpets & Rugs Market Analysis and Forecast, By End-user

10.1. Global Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By End-user, 2017-2031

10.1.1. Residential

10.1.2. Commercial

10.2. Incremental Opportunity, By End-user

11. Global Carpets & Rugs Market Analysis and Forecast, By Price

11.1. Global Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Price, 2017-2031

11.1.1. Low

11.1.2. Medium

11.1.3. High

11.2. Incremental Opportunity, By Price

12. Global Carpets & Rugs Market Analysis and Forecast, By Distribution Channel

12.1. Global Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Distribution Channel, 2017-2031

12.1.1. Direct Sales

12.1.2. Indirect Sales

12.1.2.1. Hypermarket/Supermarket

12.1.2.2. Brand/Multi-brand Stores

12.1.2.3. Others

12.1.3. Online

12.1.3.1. E-Commerce Websites

12.1.3.2. Company- Owned Websites

12.2. Incremental Opportunity, By Distribution Channel

13. Global Carpets & Rugs Market Analysis and Forecast, By Region

13.1. Global Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Region, 2017-2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, By Region

14. North America Carpets & Rugs Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Demographic Overview

14.3. Key Trend Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Brand Analysis

14.6. Consumer Buying Behavior Analysis

14.7. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Type, 2017-2031

14.7.1. Carpets

14.7.2. Rugs

14.8. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Method of Construction, 2017-2031

14.8.1. Woven

14.8.2. Tufted

14.8.2.1. Loop Pile

14.8.2.2. Cut Pile

14.9. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Material, 2017-2031

14.9.1. Nylon

14.9.2. Olefin (polypropylene)

14.9.3. Polyester

14.9.4. Wool

14.9.5. Jute

14.9.6. Cotton

14.9.7. Others

14.10. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Category, 2017-2031

14.10.1. Man Made

14.10.2. Machine Made

14.11. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By End-user, 2017-2031

14.11.1. Residential

14.11.2. Commercial

14.12. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Price, 2017-2031

14.12.1. Low

14.12.2. Medium

14.12.3. High

14.13. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Distribution Channel, 2017-2031

14.13.1. Direct Sales

14.13.2. Indirect Sales

14.13.2.1. Hypermarket/Supermarket

14.13.2.2. Brand/Multi-brand Stores

14.13.2.3. Others

14.13.3. Online

14.13.3.1. E-Commerce Websites

14.13.3.2. Company- Owned Websites

14.14. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Country & Sub-region, 2017-2031

14.14.1. The U.S.

14.14.2. Canada

14.14.3. Rest of North America

14.15. Incremental Opportunity Analysis

15. Europe Carpets & Rugs Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Demographic Overview

15.3. Key Trend Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Brand Analysis

15.6. Consumer Buying Behavior Analysis

15.7. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Type, 2017-2031

15.7.1. Carpets

15.7.2. Rugs

15.8. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Method of Construction, 2017-2031

15.8.1. Woven

15.8.2. Tufted

15.8.2.1. Loop Pile

15.8.2.2. Cut Pile

15.9. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Material, 2017-2031

15.9.1. Nylon

15.9.2. Olefin (polypropylene)

15.9.3. Polyester

15.9.4. Wool

15.9.5. Jute

15.9.6. Cotton

15.9.7. Others

15.10. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Category, 2017-2031

15.10.1. Man Made

15.10.2. Machine Made

15.11. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By End-user, 2017-2031

15.11.1. Residential

15.11.2. Commercial

15.12. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Price, 2017-2031

15.12.1. Low

15.12.2. Medium

15.12.3. High

15.13. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Distribution Channel, 2017-2031

15.13.1. Direct Sales

15.13.2. Indirect Sales

15.13.2.1. Hypermarket/Supermarket

15.13.2.2. Brand/Multi-brand Stores

15.13.2.3. Others

15.13.3. Online

15.13.3.1. E-Commerce Websites

15.13.3.2. Company- Owned Websites

15.14. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Country & Sub-region, 2017-2031

15.14.1. U.K.

15.14.2. Germany

15.14.3. France

15.14.4. Rest of Europe

15.15. Incremental Opportunity Analysis

16. Asia Pacific Carpets & Rugs Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Demographic Overview

16.3. Key Trend Analysis

16.3.1. Demand Side

16.3.2. Supply Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Brand Analysis

16.6. Consumer Buying Behavior Analysis

16.7. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Type, 2017-2031

16.7.1. Carpets

16.7.2. Rugs

16.8. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Method of Construction, 2017-2031

16.8.1. Woven

16.8.2. Tufted

16.8.2.1. Loop Pile

16.8.2.2. Cut Pile

16.9. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Material, 2017-2031

16.9.1. Nylon

16.9.2. Olefin (polypropylene)

16.9.3. Polyester

16.9.4. Wool

16.9.5. Jute

16.9.6. Cotton

16.9.7. Others

16.10. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Category, 2017-2031

16.10.1. Man Made

16.10.2. Machine Made

16.11. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By End-user, 2017-2031

16.11.1. Residential

16.11.2. Commercial

16.12. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Price, 2017-2031

16.12.1. Low

16.12.2. Medium

16.12.3. High

16.13. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Distribution Channel, 2017-2031

16.13.1. Direct Sales

16.13.2. Indirect Sales

16.13.2.1. Hypermarket/Supermarket

16.13.2.2. Brand/Multi-brand Stores

16.13.2.3. Others

16.13.3. Online

16.13.3.1. E-Commerce Websites

16.13.3.2. Company- Owned Websites

16.14. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Country & Sub-region, 2017-2031

16.14.1. China

16.14.2. India

16.14.3. Japan

16.14.4. Rest of Asia Pacific

16.15. Incremental Opportunity Analysis

17. Middle East & Africa Carpets & Rugs Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Demographic Overview

17.3. Key Trend Analysis

17.3.1. Demand Side

17.3.2. Supply Side

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Brand Analysis

17.6. Consumer Buying Behavior Analysis

17.7. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Type, 2017-2031

17.7.1. Carpets

17.7.2. Rugs

17.8. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Method of Construction, 2017-2031

17.8.1. Woven

17.8.2. Tufted

17.8.2.1. Loop Pile

17.8.2.2. Cut Pile

17.9. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Material, 2017-2031

17.9.1. Nylon

17.9.2. Olefin (polypropylene)

17.9.3. Polyester

17.9.4. Wool

17.9.5. Jute

17.9.6. Cotton

17.9.7. Others

17.10. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Category, 2017-2031

17.10.1. Man Made

17.10.2. Machine Made

17.11. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By End-user, 2017-2031

17.11.1. Residential

17.11.2. Commercial

17.12. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Price, 2017-2031

17.12.1. Low

17.12.2. Medium

17.12.3. High

17.13. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Distribution Channel, 2017-2031

17.13.1. Direct Sales

17.13.2. Indirect Sales

17.13.2.1. Hypermarket/Supermarket

17.13.2.2. Brand/Multi-brand Stores

17.13.2.3. Others

17.13.3. Online

17.13.3.1. E-Commerce Websites

17.13.3.2. Company- Owned Websites

17.14. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Country & Sub-region, 2017-2031

17.14.1. GCC

17.14.2. South Africa

17.14.3. Rest of Middle East & Africa

17.15. Incremental Opportunity Analysis

18. South America Carpets & Rugs Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Demographic Overview

18.3. Key Trend Analysis

18.3.1. Demand Side

18.3.2. Supply Side

18.4. Price Trend Analysis

18.4.1. Weighted Average Selling Price (US$)

18.5. Brand Analysis

18.6. Consumer Buying Behavior Analysis

18.7. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Type, 2017-2031

18.7.1. Carpets

18.7.2. Rugs

18.8. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Method of Construction, 2017-2031

18.8.1. Woven

18.8.2. Tufted

18.8.2.1. Loop Pile

18.8.2.2. Cut Pile

18.9. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Material, 2017-2031

18.9.1. Nylon

18.9.2. Olefin (polypropylene)

18.9.3. Polyester

18.9.4. Wool

18.9.5. Jute

18.9.6. Cotton

18.9.7. Others

18.10. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Category, 2017-2031

18.10.1. Man Made

18.10.2. Machine Made

18.11. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By End-user, 2017-2031

18.11.1. Residential

18.11.2. Commercial

18.12. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Price, 2017-2031

18.12.1. Low

18.12.2. Medium

18.12.3. High

18.13. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Distribution Channel, 2017-2031

18.13.1. Direct Sales

18.13.2. Indirect Sales

18.13.2.1. Hypermarket/Supermarket

18.13.2.2. Brand/Multi-brand Stores

18.13.2.3. Others

18.13.3. Online

18.13.3.1. E-Commerce Websites

18.13.3.2. Company- Owned Websites

18.14. Carpets & Rugs Market Size (US$ Mn and Million Square Feet) Forecast, By Country & Sub-region, 2017-2031

18.14.1. Brazil

18.14.2. Rest of South America

18.15. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Market Player - Competition Dashboard

19.2. Market Share Analysis-2021 (%)

19.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

19.3.1. Balta industries NV.

19.3.1.1. Company Overview

19.3.1.2. Sales Area/Geographical Presence

19.3.1.3. Financial/Revenue (Segmental Revenue)

19.3.1.4. Strategy & Business Overview

19.3.1.5. Sales Channel Analysis

19.3.1.6. Product Portfolio & Pricing

19.3.2. Mannington mills, Inc.

19.3.2.1. Company Overview

19.3.2.2. Sales Area/Geographical Presence

19.3.2.3. Financial/Revenue (Segmental Revenue)

19.3.2.4. Strategy & Business Overview

19.3.2.5. Sales Channel Analysis

19.3.2.6. Product Portfolio & Pricing

19.3.3. Marquis industries, Inc.

19.3.3.1. Company Overview

19.3.3.2. Sales Area/Geographical Presence

19.3.3.3. Financial/Revenue (Segmental Revenue)

19.3.3.4. Strategy & Business Overview

19.3.3.5. Sales Channel Analysis

19.3.3.6. Product Portfolio & Pricing

19.3.4. Milliken & company.

19.3.4.1. Company Overview

19.3.4.2. Sales Area/Geographical Presence

19.3.4.3. Financial/Revenue (Segmental Revenue)

19.3.4.4. Strategy & Business Overview

19.3.4.5. Sales Channel Analysis

19.3.4.6. Product Portfolio & Pricing

19.3.5. Mohawk industries, Inc.

19.3.5.1. Company Overview

19.3.5.2. Sales Area/Geographical Presence

19.3.5.3. Financial/Revenue (Segmental Revenue)

19.3.5.4. Strategy & Business Overview

19.3.5.5. Sales Channel Analysis

19.3.5.6. Product Portfolio & Pricing

19.3.6. Shaw industries group, Inc.

19.3.6.1. Company Overview

19.3.6.2. Sales Area/Geographical Presence

19.3.6.3. Financial/Revenue (Segmental Revenue)

19.3.6.4. Strategy & Business Overview

19.3.6.5. Sales Channel Analysis

19.3.6.6. Product Portfolio & Pricing

19.3.7. Tai Ping Carpets International Limited

19.3.7.1. Company Overview

19.3.7.2. Sales Area/Geographical Presence

19.3.7.3. Financial/Revenue (Segmental Revenue)

19.3.7.4. Strategy & Business Overview

19.3.7.5. Sales Channel Analysis

19.3.7.6. Product Portfolio & Pricing

19.3.8. Tarkett SA

19.3.8.1. Company Overview

19.3.8.2. Sales Area/Geographical Presence

19.3.8.3. Financial/Revenue (Segmental Revenue)

19.3.8.4. Strategy & Business Overview

19.3.8.5. Sales Channel Analysis

19.3.8.6. Product Portfolio & Pricing

19.3.9. The Dixie Group Inc.

19.3.9.1. Company Overview

19.3.9.2. Sales Area/Geographical Presence

19.3.9.3. Financial/Revenue (Segmental Revenue)

19.3.9.4. Strategy & Business Overview

19.3.9.5. Sales Channel Analysis

19.3.9.6. Product Portfolio & Pricing

19.3.10. Victoria PLC

19.3.10.1. Company Overview

19.3.10.2. Sales Area/Geographical Presence

19.3.10.3. Financial/Revenue (Segmental Revenue)

19.3.10.4. Strategy & Business Overview

19.3.10.5. Sales Channel Analysis

19.3.10.6. Product Portfolio & Pricing

20. Key Takeaways

20.1. Identification of Potential Market Spaces

20.1.1. Type

20.1.2. Method of Construction

20.1.3. Material

20.1.4. Category

20.1.5. End-user

20.1.6. Price

20.1.7. Distribution Channel

20.1.8. Region

20.2. Understanding the Buying Process of Customers

20.3. Prevailing Market Risks

20.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Table 2: Global Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Table 3: Global Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Table 4: Global Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Table 5: Global Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Table 6: Global Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Table 7: Global Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Table 8: Global Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Table 9: Global Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Table 10: Global Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Table 11: Global Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Table 12: Global Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Table 13: Global Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Table 14: Global Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Table 15: Global Carpets & Rugs Market, Region, Million Square Feet, 2017-2031

Table 16: Global Carpets & Rugs Market, Region, US$ Mn, 2017-2031

Table 17: North America Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Table 18: North America Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Table 19: North America Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Table 20: North America Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Table 21: North America Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Table 22: North America Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Table 23: North America Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Table 24: North America Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Table 25: North America Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Table 26: North America Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Table 27: North America Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Table 28: North America Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Table 29: North America Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Table 30: North America Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Table 31: North America Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Table 32: North America Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Table 33: Europe Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Table 34: Europe Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Table 35: Europe Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Table 36: Europe Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Table 37: Europe Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Table 38: Europe Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Table 39: Europe Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Table 40: Europe Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Table 41: Europe Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Table 42: Europe Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Table 43: Europe Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Table 44: Europe Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Table 45: Europe Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Table 46: Europe Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Table 47: Europe Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Table 48: Europe Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Table 49: Asia Pacific Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Table 50: Asia Pacific Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Table 51: Asia Pacific Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Table 52: Asia Pacific Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Table 53: Asia Pacific Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Table 54: Asia Pacific Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Table 55: Asia Pacific Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Table 56: Asia Pacific Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Table 57: Asia Pacific Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Table 58: Asia Pacific Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Table 59: Asia Pacific Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Table 60: Asia Pacific Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Table 61: Asia Pacific Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Table 62: Asia Pacific Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Table 63: Asia Pacific Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Table 64: Asia Pacific Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Table 65: Middle East & Africa Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Table 66: Middle East & Africa Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Table 67: Middle East & Africa Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Table 68: Middle East & Africa Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Table 69: Middle East & Africa Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Table 70: Middle East & Africa Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Table 71: Middle East & Africa Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Table 72: Middle East & Africa Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Table 73: Middle East & Africa Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Table 74: Middle East & Africa Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Table 75: Middle East & Africa Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Table 76: Middle East & Africa Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Table 77: Middle East & Africa Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Table 78: Middle East & Africa Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Table 79: Middle East & Africa Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Table 80: Middle East & Africa Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Table 81: South America Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Table 82: South America Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Table 83: South America Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Table 84: South America Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Table 85: South America Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Table 86: South America Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Table 87: South America Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Table 88: South America Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Table 89: South America Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Table 90: South America Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Table 91: South America Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Table 92: South America Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Table 93: South America Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Table 94: South America Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Table 95: South America Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Table 96: South America Carpets & Rugs Market, Country, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Figure 2: Global Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Figure 3: Global Carpets & Rugs Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 4: Global Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Figure 5: Global Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Figure 6: Global Carpets & Rugs Market, Method of Construction, Incremental Opportunity, 2017-2031

Figure 7: Global Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Figure 8: Global Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Figure 9: Global Carpets & Rugs Market, Category, Incremental Opportunity, 2017-2031

Figure 10: Global Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Figure 11: Global Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Figure 12: Global Carpets & Rugs Market, Material, Incremental Opportunity, 2017-2031

Figure 13: Global Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Figure 14: Global Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Figure 15: Global Carpets & Rugs Market, Price, Incremental Opportunity, 2017-2031

Figure 16: Global Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Figure 17: Global Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Figure 18: Global Carpets & Rugs Market, End User, Incremental Opportunity, 2017-2031

Figure 19: Global Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Figure 20: Global Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Figure 21: Global Carpets & Rugs Market, Distribution Channel, Incremental Opportunity, 2017-2031

Figure 22: Global Carpets & Rugs Market, Region, Million Square Feet, 2017-2031

Figure 23: Global Carpets & Rugs Market, Region, US$ Mn, 2017-2031

Figure 24: Global Carpets & Rugs Market, Region, Incremental Opportunity, 2017-2031

Figure 25: North America Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Figure 26: North America Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Figure 27: North America Carpets & Rugs Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 28: North America Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Figure 29: North America Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Figure 30: North America Carpets & Rugs Market, Method of Construction, Incremental Opportunity, 2017-2031

Figure 31: North America Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Figure 32: North America Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Figure 33: North America Carpets & Rugs Market, Category, Incremental Opportunity, 2017-2031

Figure 34: North America Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Figure 35: North America Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Figure 36: North America Carpets & Rugs Market, Material, Incremental Opportunity, 2017-2031

Figure 37: North America Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Figure 38: North America Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Figure 39: North America Carpets & Rugs Market, Price, Incremental Opportunity, 2017-2031

Figure 40: North America Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Figure 41: North America Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Figure 42: North America Carpets & Rugs Market, End User, Incremental Opportunity, 2017-2031

Figure 43: North America Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Figure 44: North America Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Figure 45: North America Carpets & Rugs Market, Distribution Channel, Incremental Opportunity, 2017-2031

Figure 46: North America Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Figure 47: North America Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Figure 48: North America Carpets & Rugs Market, Country, Incremental Opportunity, 2017-2031

Figure 49: Europe Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Figure 50: Europe Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Figure 51: Europe Carpets & Rugs Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 52: Europe Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Figure 53: Europe Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Figure 54: Europe Carpets & Rugs Market, Method of Construction, Incremental Opportunity, 2017-2031

Figure 55: Europe Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Figure 56: Europe Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Figure 57: Europe Carpets & Rugs Market, Category, Incremental Opportunity, 2017-2031

Figure 58: Europe Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Figure 59: Europe Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Figure 60: Europe Carpets & Rugs Market, Material, Incremental Opportunity, 2017-2031

Figure 61: Europe Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Figure 62: Europe Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Figure 63: Europe Carpets & Rugs Market, Price, Incremental Opportunity, 2017-2031

Figure 64: Europe Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Figure 65: Europe Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Figure 66: Europe Carpets & Rugs Market, End User, Incremental Opportunity, 2017-2031

Figure 67: Europe Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Figure 68: Europe Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Figure 69: Europe Carpets & Rugs Market, Distribution Channel, Incremental Opportunity, 2017-2031

Figure 70: Europe Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Figure 71: Europe Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Figure 72: Europe Carpets & Rugs Market, Country, Incremental Opportunity, 2017-2031

Figure 73: Asia Pacific Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Figure 74: Asia Pacific Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Figure 75: Asia Pacific Carpets & Rugs Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 76: Asia Pacific Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Figure 77: Asia Pacific Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Figure 78: Asia Pacific Carpets & Rugs Market, Method of Construction, Incremental Opportunity, 2017-2031

Figure 79: Asia Pacific Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Figure 80: Asia Pacific Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Figure 81: Asia Pacific Carpets & Rugs Market, Category, Incremental Opportunity, 2017-2031

Figure 82: Asia Pacific Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Figure 83: Asia Pacific Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Figure 84: Asia Pacific Carpets & Rugs Market, Material, Incremental Opportunity, 2017-2031

Figure 85: Asia Pacific Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Figure 86: Asia Pacific Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Figure 87: Asia Pacific Carpets & Rugs Market, Price, Incremental Opportunity, 2017-2031

Figure 88: Asia Pacific Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Figure 89: Asia Pacific Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Figure 90: Asia Pacific Carpets & Rugs Market, End User, Incremental Opportunity, 2017-2031

Figure 91: Asia Pacific Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Figure 92: Asia Pacific Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Figure 93: Asia Pacific Carpets & Rugs Market, Distribution Channel, Incremental Opportunity, 2017-2031

Figure 94: Asia Pacific Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Figure 95: Asia Pacific Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Figure 96: Asia Pacific Carpets & Rugs Market, Country, Incremental Opportunity, 2017-2031

Figure 97: Middle East & Africa Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Figure 98: Middle East & Africa Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Figure 99: Middle East & Africa Carpets & Rugs Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 100: Middle East & Africa Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Figure 101: Middle East & Africa Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Figure 102: Middle East & Africa Carpets & Rugs Market, Method of Construction, Incremental Opportunity, 2017-2031

Figure 103: Middle East & Africa Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Figure 104: Middle East & Africa Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Figure 105: Middle East & Africa Carpets & Rugs Market, Category, Incremental Opportunity, 2017-2031

Figure 106: Middle East & Africa Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Figure 107: Middle East & Africa Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Figure 108: Middle East & Africa Carpets & Rugs Market, Material, Incremental Opportunity, 2017-2031

Figure 109: Middle East & Africa Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Figure 110: Middle East & Africa Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Figure 111: Middle East & Africa Carpets & Rugs Market, Price, Incremental Opportunity, 2017-2031

Figure 112: Middle East & Africa Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Figure 113: Middle East & Africa Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Figure 114: Middle East & Africa Carpets & Rugs Market, End User, Incremental Opportunity, 2017-2031

Figure 115: Middle East & Africa Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Figure 116: Middle East & Africa Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Figure 117: Middle East & Africa Carpets & Rugs Market, Distribution Channel, Incremental Opportunity, 2017-2031

Figure 118: Middle East & Africa Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Figure 119: Middle East & Africa Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Figure 120: Middle East & Africa Carpets & Rugs Market, Country, Incremental Opportunity, 2017-2031

Figure 121: South America Carpets & Rugs Market, by Product Type, Million Square Feet, 2017-2031

Figure 122: South America Carpets & Rugs Market, by Product Type, US$ Mn, 2017-2031

Figure 123: South America Carpets & Rugs Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 124: South America Carpets & Rugs Market, Method of Construction, Million Square Feet, 2017-2031

Figure 125: South America Carpets & Rugs Market, Method of Construction, US$ Mn, 2017-2031

Figure 126: South America Carpets & Rugs Market, Method of Construction, Incremental Opportunity, 2017-2031

Figure 127: South America Carpets & Rugs Market, Category, Million Square Feet, 2017-2031

Figure 128: South America Carpets & Rugs Market, Category, US$ Mn, 2017-2031

Figure 129: South America Carpets & Rugs Market, Category, Incremental Opportunity, 2017-2031

Figure 130: South America Carpets & Rugs Market, Material, Million Square Feet, 2017-2031

Figure 131: South America Carpets & Rugs Market, Material, US$ Mn, 2017-2031

Figure 132: South America Carpets & Rugs Market, Material, Incremental Opportunity, 2017-2031

Figure 133: South America Carpets & Rugs Market, Price, Million Square Feet, 2017-2031

Figure 134: South America Carpets & Rugs Market, Price, US$ Mn, 2017-2031

Figure 135: South America Carpets & Rugs Market, Price, Incremental Opportunity, 2017-2031

Figure 136: South America Carpets & Rugs Market, End User, Million Square Feet, 2017-2031

Figure 137: South America Carpets & Rugs Market, End User, US$ Mn, 2017-2031

Figure 138: South America Carpets & Rugs Market, End User, Incremental Opportunity, 2017-2031

Figure 139: South America Carpets & Rugs Market, Distribution Channel, Million Square Feet, 2017-2031

Figure 140: South America Carpets & Rugs Market, Distribution Channel, US$ Mn, 2017-2031

Figure 141: South America Carpets & Rugs Market, Distribution Channel, Incremental Opportunity, 2017-2031

Figure 142: South America Carpets & Rugs Market, Country, Million Square Feet, 2017-2031

Figure 143: South America Carpets & Rugs Market, Country, US$ Mn, 2017-2031

Figure 144: South America Carpets & Rugs Market, Country, Incremental Opportunity, 2017-2031