Reports

Reports

Analysts’ Viewpoint on Flexible Substrate Market Scenario

Advances and developments in the semiconductor sector have a direct impact on all downstream technologies, as semiconductors are becoming the building blocks of all modern technology. Flexible substrates are utilized in various applications in consumer electronics, automotive, aerospace, biotechnology, telecommunications, military, information technology, energy, photovoltaics, and numerous other industries. However, the industry is estimated to focus on different substrate materials, finding a way for flexible electronics to be used in other applications.

Flexible substrates are playing an important role in the advancement of display devices, majorly in recent times, as the structural support and signal transmission path or medium. Flexibility is the ability of a material to bend without mechanical failure such as facture and plastic deformation. Currently, ultrathin glass, metal foil, and plastic (polymer) films are highly popular options for flexible substrates. Plastic substrates, particularly transparent plastic substrates, provide good optical transmittance comparable to thin glass, as well as flexibility and hardness comparable to metal foils. Thus, flexible optoelectronic devices such as flexible displays (TFT-LCDs or AMOLEDs), FPCBs, touch panels, electronic paper, and thin solar cells benefit from them.

Polyethylene terephthalate (PET), polyethylene naphthalate (PEN), and polyethylene propylene (PI) are among the plastic film materials used for flexible display devices, with PIs being one of the most promising plastic substrates for flexible optoelectronic devices due to their good thermal stability and mechanical & dielectric properties.

The adoption of electronic gadgets has fueled the demand for more innovative devices and technology in order to increase the focus on digitization. Flexible electronics devices are witnessing advances in communications, computing, healthcare, military systems, transportation, clean energy, and countless other applications. Smartphone-like devices are demanding more elegant designs and larger screen sizes for better visibility and experience; however, handling these devices is a major concern which has subsequently increased the demand for foldable smartphones. Advancements are being witnessed in durable foldable smartphones, as organic light-emitting polymers (OLEDs) improve and become more popular.

Display Supply Chain Consultants (DSCC) currently predicts the shipments of foldable smartphones to increase by 232% in 2021 to 7.5 million units. In 2022, these numbers are likely to increase by 112% to reach 15.9 million units, followed by 51 million units in shipments in 2026.

The benefits of flexible electronics are similar to low-cost alternative to more traditional electronics. Flex circuits provide companies the ability to offer more personalized experiences to consumers; the flexibility improves durability due unbreakable nature of the substrate or material.

Increasing population and mega trends such as digitization, IoT, autonomous driving, and cloud computing are also driving the demand for consumer electronics. These digitally compatible devices are all based on flexible substrates.

The issue of global warming has been increasing, and extensive research is being carried out on energy conversion devices for renewable energy production such as solar energy, wind power, hydroelectric energy, and biomass energy.

Small, thin, and flexible PV devices on films are being made that are lightweight and translucent. These films use little material and can generate electricity in low light, and even indoors. Integrating them into phones and watches, as well as walls and windows, would transform the world's energy generation, reduce pollution, and mitigate climate change.

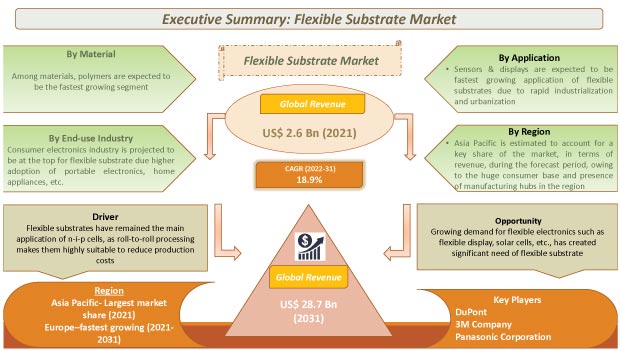

Flexible substrates have remained the main application of n-i-p cells, as roll-to-roll processing makes them highly interesting to reduce production costs as well as the energy payback time, particularly when low cost substrates such as poly-ethylene are used. Solar cell structures based on thin-film silicon are being utilized in order to obtain high efficiency.

Thin-film solar cells are made by depositing a thin layer of semiconductor on a supporting material (substrates) such as glass, stainless steel, or polyimide, through a process called chemical vapor deposition. Flexible substrates offer several advantages over standard substrates, such as silicon, when it comes to PV components. They're lighter, more conformable to non-planar shapes, and have the potential for longer lifespans and lower manufacturing costs.

Solar power has a key role to play in decarbonizing the global economy. Falling production costs and improving efficiency are projected to drive the demand for solar power significantly. Recently, organic silicon cells have been utilized to make flexible solar panels. Flexible solar panels are ideal for portable solar applications given their light weight. Flexible solar panels, typically, have an efficiency rating between 7% and 15%.

Thus, advancements in different flexible substrates for solar cells also drive the flexible substrate market.

The next-generation flexible electronics open up a wide range of new applications such as flexible lighting and display technologies for consumer electronics, textiles, and architecture; wearables with sensors that help monitor health and habits; implantable electronics for improved medical imaging and diagnostics; as well as expanding the functionality of robots and unmanned aircraft through lightweight and conformable energy harvesting devices and sensors. Thus, a rise in the demand for flexible electronics such as flexible display, solar cells, etc., is projected to propel the global flexible substrate market during the forecast period.

In terms of region, the global flexible substrate market has been segmented into North America, Europe, South America, Asia Pacific, and Middle East & Africa. Asia Pacific is estimated to account for a major share of the market, in terms of revenue, during the forecast period, owing to the huge consumer base and presence of major manufacturing hubs in the region. Rise in demand for consumer electronics, safety, and autonomous features in automotive applications is a key driver for the global flexible substrate market in the region. Based on country, China accounted for a major share of the market in Asia Pacific.

Asia Pacific and Europe are key regions, in terms of major investments in products, such as foldable display. A display is the one of highest contributing components in electronics devices, as it acts as a human-machine interface.

The global flexible substrate market is consolidated with a small number of large-scale vendors controlling majority of the market share. Key firms are spending significant sums of money on comprehensive research and development, primarily to develop environment-friendly products. Expansion of product portfolios, new product launch, and mergers & acquisitions are the significant strategies adopted by the key players such as DuPont, Ube Industries, Ltd., Panasonic Corporation, Fuentek Kolon, LLC., Dow, DuPont Teijin Films, and 3M Company.

Each of these players has been profiled in the flexible substrate market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.6 Bn |

|

Market Forecast Value in 2031 |

US$ 28.7 Bn |

|

Growth Rate (CAGR) |

18.9% from Year-to-Year |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market size of flexible substrate was more than US$ 2.6 Bn in 2021

The flexible substrate market is projected to grow at a CAGR of 18.9% from 2022 to 2031

The flexible substrate market is likely to value over US$ 28.7 Bn in 2031

High demand of semiconductor chips and their increased use in the manufacturing of consumer electronics and medical & healthcare devices

The Asia Pacific is more lucrative region in the flexible substrate market

Key players operating in the global flexible substrate market are DuPont, Ube Industries, Ltd., Panasonic Corporation, Fuentek Kolon, LLC., Dow, DuPont Teijin Films, and 3M Company

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Flexible Substrate Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global PCB Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Flexible Substrate Market Analysis By Material

5.1. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Material, 2017-2031

5.1.1. Polymers

5.1.1.1. Polyimides

5.1.1.2. Polyethylene Naphthalate (PEN)

5.1.1.3. Polyethylene Terephthalate (PET)

5.1.1.4. Others (Molecules, Oligomers, etc.)

5.1.2. Silicon

5.1.3. Glass

5.1.4. Metal Oxides

5.1.5. CNT (Carbon Nanotubes)

5.2. Market Attractiveness Analysis, By Material

6. Global Flexible Substrate Market Analysis by Application

6.1. Flexible Substrate Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Application, 2017-2031

6.1.1. Sensors

6.1.2. PCBs

6.1.3. Displays

6.1.4. Photovoltaic

6.1.5. Batteries

6.1.6. Light Emitting Diode (LED)

6.2. Market Attractiveness Analysis, By Application

7. Global Flexible Substrate Market Analysis by End-use Industry

7.1. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

7.1.1. Stationary

7.1.2. Portable Consumer Electronics

7.1.3. Automotive

7.1.4. Healthcare

7.1.5. IT and Telecom

7.1.6. Energy and Utilities

7.1.7. Aerospace and Defense

7.1.8. Others

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global Flexible Substrate Market Analysis and Forecast, By Region

8.1. Flexible Substrate Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Flexible Substrate Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Material, 2017-2031

9.3.1. Polymers

9.3.1.1. Polyimides

9.3.1.2. Polyethylene Naphthalate (PEN)

9.3.1.3. Polyethylene Terephthalate (PET)

9.3.1.4. Others (Molecules, Oligomers, etc.)

9.3.2. Silicon

9.3.3. Glass

9.3.4. Metal Oxides

9.3.5. CNT (Carbon Nanotubes)

9.4. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

9.4.1. Sensors

9.4.2. PCBs

9.4.3. Displays

9.4.4. Photovoltaic

9.4.5. Batteries

9.4.6. Light Emitting Diode (LED)

9.4.7. Others

9.5. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

9.5.1. Consumer Electronics

9.5.2. Automotive

9.5.3. Healthcare

9.5.4. IT and Telecom

9.5.5. Energy and Utilities

9.5.6. Aerospace and Defense

9.5.7. Others

9.6. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Material

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Flexible Substrate Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Material, 2017-2031

10.3.1. Polymers

10.3.1.1. Polyimides

10.3.1.2. Polyethylene Naphthalate (PEN)

10.3.1.3. Polyethylene Terephthalate (PET)

10.3.1.4. Others (Molecules, Oligomers, etc.)

10.3.2. Silicon

10.3.3. Glass

10.3.4. Metal Oxides

10.3.5. CNT (Carbon Nanotubes)

10.4. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

10.4.1. Sensors

10.4.2. PCBs

10.4.3. Displays

10.4.4. Photovoltaic

10.4.5. Batteries

10.4.6. Light Emitting Diode (LED)

10.4.7. Others

10.5. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

10.5.1. Consumer Electronics

10.5.2. Automotive

10.5.3. Healthcare

10.5.4. IT and Telecom

10.5.5. Energy and Utilities

10.5.6. Aerospace and Defense

10.5.7. Others

10.6. Flexible Substrate Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and sub-region, 2017-2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Material

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific Flexible Substrate Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Material, 2017-2031

11.3.1. Polymers

11.3.1.1. Polyimides

11.3.1.2. Polyethylene Naphthalate (PEN)

11.3.1.3. Polyethylene Terephthalate (PET)

11.3.1.4. Others (Molecules, Oligomers, etc.)

11.3.2. Silicon

11.3.3. Glass

11.3.4. Metal Oxides

11.3.5. CNT (Carbon Nanotubes)

11.4. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

11.4.1. Sensors

11.4.2. PCBs

11.4.3. Displays

11.4.4. Photovoltaic

11.4.5. Batteries

11.4.6. Light Emitting Diode (LED)

11.4.7. Others

11.5. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

11.5.1. Consumer Electronics

11.5.2. Automotive

11.5.3. Healthcare

11.5.4. IT and Telecom

11.5.5. Energy and Utilities

11.5.6. Aerospace and Defense

11.5.7. Others

11.6. Flexible Substrate Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Material

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East and Africa Flexible Substrate Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Material, 2017-2031

12.3.1. Polymers

12.3.1.1. Polyimides

12.3.1.2. Polyethylene Naphthalate (PEN)

12.3.1.3. Polyethylene Terephthalate (PET)

12.3.1.4. Others (Molecules, Oligomers, etc.)

12.3.2. Silicon

12.3.3. Glass

12.3.4. Metal Oxides

12.3.5. CNT (Carbon Nanotubes)

12.4. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

12.4.1. Sensors

12.4.2. PCBs

12.4.3. Displays

12.4.4. Photovoltaic

12.4.5. Batteries

12.4.6. Light Emitting Diode (LED)

12.4.7. Others

12.5. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

12.5.1. Consumer Electronics

12.5.2. Automotive

12.5.3. Healthcare

12.5.4. IT and Telecom

12.5.5. Energy and Utilities

12.5.6. Aerospace and Defense

12.5.7. Others

12.6. Flexible Substrate Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Material

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Flexible Substrate Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Material, 2017-2031

13.3.1. Polymers

13.3.1.1. Polyimides

13.3.1.2. Polyethylene Naphthalate (PEN)

13.3.1.3. Polyethylene Terephthalate (PET)

13.3.1.4. Others (Molecules, Oligomers, etc.)

13.3.2. Silicon

13.3.3. Glass

13.3.4. Metal Oxides

13.3.5. CNT (Carbon Nanotubes)

13.4. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

13.4.1. Sensors

13.4.2. PCBs

13.4.3. Displays

13.4.4. Photovoltaic

13.4.5. Batteries

13.4.6. Light Emitting Diode (LED)

13.4.7. Others

13.5. Flexible Substrate Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

13.5.1. Consumer Electronics

13.5.2. Automotive

13.5.3. Healthcare

13.5.4. IT and Telecom

13.5.5. Energy and Utilities

13.5.6. Aerospace and Defense

13.5.7. Others

13.6. Flexible Substrate Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Material

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Flexible Substrate Market Competition Matrix - a Dashboard View

14.1.1. Global Flexible Substrate Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Ube Industries, Ltd.

15.1.1. Overview

15.1.2. Material Portfolio

15.1.3. Material Pricing

15.1.4. Sales Footprint

15.1.5. Key Subsidiaries or Distributors

15.1.6. Strategy and Recent Developments

15.1.7. Key Financials

15.2. DuPont

15.2.1. Overview

15.2.2. Material Portfolio

15.2.3. Material Pricing

15.2.4. Sales Footprint

15.2.5. Key Subsidiaries or Distributors

15.2.6. Strategy and Recent Developments

15.2.7. Key Financials

15.3. 3M Company

15.3.1. Overview

15.3.2. Material Portfolio

15.3.3. Material Pricing

15.3.4. Sales Footprint

15.3.5. Key Subsidiaries or Distributors

15.3.6. Strategy and Recent Developments

15.3.7. Key Financials

15.4. Panasonic Corporation

15.4.1. Overview

15.4.2. Material Portfolio

15.4.3. Material Pricing

15.4.4. Sales Footprint

15.4.5. Key Subsidiaries or Distributors

15.4.6. Strategy and Recent Developments

15.4.7. Key Financials

15.5. Schott

15.5.1. Overview

15.5.2. Material Portfolio

15.5.3. Material Pricing

15.5.4. Sales Footprint

15.5.5. Key Subsidiaries or Distributors

15.5.6. Strategy and Recent Developments

15.5.7. Key Financials

15.6. Fuentek Kolon, LLC.

15.6.1. Overview

15.6.2. Material Portfolio

15.6.3. Material Pricing

15.6.4. Sales Footprint

15.6.5. Key Subsidiaries or Distributors

15.6.6. Strategy and Recent Developments

15.6.7. Key Financials

15.7. Dow

15.7.1. Overview

15.7.2. Material Portfolio

15.7.3. Material Pricing

15.7.4. Sales Footprint

15.7.5. Key Subsidiaries or Distributors

15.7.6. Strategy and Recent Developments

15.7.7. Key Financials

15.8. Jiangsu SuCushi Technology Co.

15.8.1. Overview

15.8.2. Material Portfolio

15.8.3. Material Pricing

15.8.4. Sales Footprint

15.8.5. Key Subsidiaries or Distributors

15.8.6. Strategy and Recent Developments

15.8.7. Key Financials

15.9. Nippon Electric Glass Co., Ltd.

15.9.1. Overview

15.9.2. Material Portfolio

15.9.3. Material Pricing

15.9.4. Sales Footprint

15.9.5. Key Subsidiaries or Distributors

15.9.6. Strategy and Recent Developments

15.9.7. Key Financials

15.10. DuPont Teijin Films

15.10.1. Overview

15.10.2. Material Portfolio

15.10.3. Material Pricing

15.10.4. Sales Footprint

15.10.5. Key Subsidiaries or Distributors

15.10.6. Strategy and Recent Developments

15.10.7. Key Financials

15.11. BenQ Materials Corporation

15.11.1. Overview

15.11.2. Material Portfolio

15.11.3. Material Pricing

15.11.4. Sales Footprint

15.11.5. Key Subsidiaries or Distributors

15.11.6. Strategy and Recent Developments

15.11.7. Key Financials

15.12. Sheldahl Corporation

15.12.1. Overview

15.12.2. Material Portfolio

15.12.3. Material Pricing

15.12.4. Sales Footprint

15.12.5. Key Subsidiaries or Distributors

15.12.6. Strategy and Recent Developments

15.12.7. Key Financials

15.13. Polyonics, Inc.

15.13.1. Overview

15.13.2. Material Portfolio

15.13.3. Material Pricing

15.13.4. Sales Footprint

15.13.5. Key Subsidiaries or Distributors

15.13.6. Strategy and Recent Developments

15.13.7. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Understanding Buying Process of Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Flexible Substrate Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 2: Global Flexible Substrate Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 3: Global Flexible Substrate Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 4: Global Flexible Substrate Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 5: North America Flexible Substrate Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 6: North America Flexible Substrate Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 7: North America Flexible Substrate Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 8: North America Flexible Substrate Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 9: Europe Flexible Substrate Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 10: Europe Flexible Substrate Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 11: Europe Flexible Substrate Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 12: Europe Flexible Substrate Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 13: Asia Pacific Flexible Substrate Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 14: Asia Pacific Flexible Substrate Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 15: Asia Pacific Flexible Substrate Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 16: Asia Pacific Flexible Substrate Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 17: Middle East and Africa Flexible Substrate Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 18: Middle East and Africa Flexible Substrate Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 19: Middle East and Africa Flexible Substrate Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 20: Middle East and Africa Flexible Substrate Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 21: South America Flexible Substrate Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 22: South America Flexible Substrate Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 23: South America Flexible Substrate Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2031

Table 24: South America Flexible Substrate Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Flexible Substrate

Figure 02: Porter Five Forces Analysis - Global Flexible Substrate

Figure 03: Application Road Map - Global Flexible Substrate

Figure 04: Global Flexible Substrate Market, Value (US$ Mn), 2017-2031

Figure 05: Global Flexible Substrate Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 06: Global Flexible Substrate Market Projections by Material, Value (US$ Mn), 2017-2031

Figure 07: Global Flexible Substrate Market, Incremental Opportunity, by Material, 2023-2031

Figure 08: Global Flexible Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 09: Global Flexible Substrate Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 10: Global Flexible Substrate Market, Incremental Opportunity, by Application, 2023-2031

Figure 11: Global Flexible Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 12: Global Flexible Substrate Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 13: Global Flexible Substrate Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 14: Global Flexible Substrate Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 15: Global Flexible Substrate Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 16: Global Flexible Substrate Market, Incremental Opportunity, by Region, 2023-2031

Figure 17: Global Flexible Substrate Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Flexible Substrate Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 19: North America Flexible Substrate Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 20: North America Flexible Substrate Market Projections by Material Value (US$ Mn), 2017-2031

Figure 21: North America Flexible Substrate Market, Incremental Opportunity, by Material, 2023-2031

Figure 22: North America Flexible Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 23: North America Flexible Substrate Market Projections by Application Value (US$ Mn), 2017-2031

Figure 24: North America Flexible Substrate Market, Incremental Opportunity, by Application, 2023-2031

Figure 25: North America Flexible Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 26: North America Flexible Substrate Market Projections by End-use Industry (US$ Mn), 2017-2031

Figure 27: North America Flexible Substrate Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 28: North America Flexible Substrate Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 29: North America Flexible Substrate Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 30: North America Flexible Substrate Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 31: North America Flexible Substrate Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 32: Europe Flexible Substrate Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 33: Europe Flexible Substrate Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 34: Europe Flexible Substrate Market Projections by Material Value (US$ Mn), 2017-2031

Figure 35: Europe Flexible Substrate Market, Incremental Opportunity, by Material, 2023-2031

Figure 36: Europe Flexible Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 37: Europe Flexible Substrate Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 38: Europe Flexible Substrate Market, Incremental Opportunity, by Application, 2023-2031

Figure 39: Europe Flexible Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 40: Europe Flexible Substrate Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 41: Europe Flexible Substrate Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 42: Europe Flexible Substrate Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 43: Europe Flexible Substrate Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 44: Europe Flexible Substrate Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 45: Europe Flexible Substrate Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 46: Asia Pacific Flexible Substrate Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 47: Asia Pacific Flexible Substrate Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 48: Asia Pacific Flexible Substrate Market Projections by Material Value (US$ Mn), 2017-2031

Figure 49: Asia Pacific Flexible Substrate Market, Incremental Opportunity, by Material, 2023-2031

Figure 50: Asia Pacific Flexible Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 51: Asia Pacific Flexible Substrate Market Projections by Application Value (US$ Mn), 2017-2031

Figure 52: Asia Pacific Flexible Substrate Market, Incremental Opportunity, by Application, 2023-2031

Figure 53: Asia Pacific Flexible Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 54: Asia Pacific Flexible Substrate Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 55: Asia Pacific Flexible Substrate Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 56: Asia Pacific Flexible Substrate Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 57: Asia Pacific Flexible Substrate Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 58: Asia Pacific Flexible Substrate Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 59: Asia Pacific Flexible Substrate Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 60: MEA Flexible Substrate Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 61: MEA Flexible Substrate Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 62: MEA Flexible Substrate Market Projections by Material Value (US$ Mn), 2017-2031

Figure 63: MEA Flexible Substrate Market, Incremental Opportunity, by Material, 2023-2031

Figure 64: MEA Flexible Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 65: MEA Flexible Substrate Market Projections by Application Value (US$ Mn), 2017-2031

Figure 66: MEA Flexible Substrate Market, Incremental Opportunity, by Application, 2023-2031

Figure 67: MEA Flexible Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 68: MEA Flexible Substrate Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 69: MEA Flexible Substrate Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 70: MEA Flexible Substrate Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 71: MEA Flexible Substrate Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 72: MEA Flexible Substrate Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 73: MEA Flexible Substrate Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 74: South America Flexible Substrate Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 75: South America Flexible Substrate Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 76: South America Flexible Substrate Market Projections by Material Value (US$ Mn), 2017-2031

Figure 77: South America Flexible Substrate Market, Incremental Opportunity, by Material, 2023-2031

Figure 78: South America Flexible Substrate Market Share Analysis, by Material, 2023 and 2031

Figure 79: South America Flexible Substrate Market Projections by Application Value (US$ Mn), 2017-2031

Figure 80: South America Flexible Substrate Market, Incremental Opportunity, by Application, 2023-2031

Figure 81: South America Flexible Substrate Market Share Analysis, by Application, 2023 and 2031

Figure 82: South America Flexible Substrate Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 83: South America Flexible Substrate Market, Incremental Opportunity, by End-use Industry, 2023-2031

Figure 84: South America Flexible Substrate Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 85: South America Flexible Substrate Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 86: South America Flexible Substrate Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 87: South America Flexible Substrate Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 88: Global Flexible Substrate Market Competition

Figure 89: Global Flexible Substrate Market Company Share Analysis