Reports

Reports

The exosome technology market is increasingly being driven by rapid developments in molecular biology and biotechnology, especially in personalized medicine. Increased research expenditures coupled with new methods of isolation and purification, are leading to more efficient use of exosomes in research and clinical settings.

Regulatory bodies are also looking forward to develop standards for using exosome-based products, which further aligns with the exosome technologies.

The increasing interest in liquid biopsy-based applications is a considerable factor driving the exosome technologies market expansion. A liquid biopsy based on exosomes offers a real-time, non-invasive approach for monitoring disease progression and response of treatment in comparison with invasive tissue biopsy. This has significant potential benefits, particularly in the context of cancer, where early detection and continued monitoring can sizably affect patient management.

There is a rising interest in less invasive diagnostics, along with a growing number of R&D partnerships between academic institutions and biotech companies, which are accelerating the creation of exosome-based liquid biopsy platforms. These developments is poised to lead to widespread clinical utility for exosomes in different therapeutic contexts.

The exosome technologies market trends suggest increasing integration of bioengineering or nanotechnology principles with research dedicated to exosomes. New technologies are aimed at producing large amounts of exosomes, or manipulating surface properties of exosomes to enhance their therapeutic use and target specificity.

Synthetic exosome mimetics are being created as a more cost-effective solution for its research and clinical use. Moreover, increased emphasis has been laid on standardization of protocols for exosome characterization and quantitation to achieve reproducibility in clinical trials. Furthermore, collaborations between pharmaceutical and diagnostic companies are driving innovation with several pilot programs aimed at drug delivery systems involving exosomes.

Key innovations are the advancements of new exosome isolation kits, mass-producible production platforms, and increased-throughput analytical platforms for exosome profiling.

Exosomes imply small extracellular vesicles released by cells and are essential for intercellular communication. They contain numerous bio-molecules (proteins, lipids, and nucleic acids) and have numerous possible diagnostic and therapeutic applications.

The exosome technologies constitute a range of products used for various stages of the exosome journey, including isolation kits, characterization kits, and detection kits that focus on the isolating, purifying, and analyzing exosomes. One of the positives associated with exosome technologies is that they have diagnostic as well as therapeutic potential for a broad spectrum of diseases including cardiovascular diseases, cancers, and neurological conditions.

Exosomes can be used as biomarkers for disease diagnosis as well as monitoring, and they can also be used as drug-delivery systems for various targeted therapies. However, there are also certain bottlenecks associated with the use of exosome technologies. For example, the heterogeneity of exosomes leads to complications in isolating as well as characterizing them. Moreover, the costs of exosome technologies and the lack of field standards do present a unique obstacle.

Exosome technologies include study, isolation, characterization, and therapeutic and diagnostic applications for exosomes; all for biomedical research and clinical applications. Size-exclusion chromatography, ultracentrifugation, and microfluidics are some of the advanced technologies that can be employed to extract and analyze exosomes from the biological fluids. Post isolation, exosomes could be analyzed for their molecular content, which could provide information regarding pathological and physiological processes in the subject being studied. Characterization techniques to analyze parameters such as size, structure, and composition of exosomes include flow cytometry, nanoparticle tracking analysis, and electron microscopy.

| Attribute | Detail |

|---|---|

| Exosome Technologies Market Drivers |

|

Chronic diseases such as cardiovascular diseases, cancer, and neurological diseases are the major reasons for mortality and morbidity globally. Exosomes deliver varying biomolecules such as nucleic acids, proteins, and lipids, which are also probable targets for therapy and indicators for disease detection.

In recent years, the use of exosomes for diagnosing and treating chronic diseases has been a well-known research topic. Liquid biopsy based on exosomes has also been an emerging technology with great potential to diagnose and monitor cardiovascular diseases, cancer, and the other chronic diseases on a non-invasive level.

Exosomes can be engineered to administer therapeutic molecules such as siRNA, microRNA, and drugs to targeted cells, thereby creating a new frontier in chronic disease therapy.

The rising prevalence of chronic diseases is a major contributor to the growth of exosome technologies, which allow for early diagnosis, ongoing monitoring, and personalized treatment.

For example, as per the data published by WHO, non-communicable diseases (NCDs), or, chronic diseases comprising heart disease, cancer, stroke, diabetes and chronic lung disease, as a whole, are responsible for 74% of fatalities globally. Moreover, over three-quarters of all NCD deaths, and 86% of the 17 million individuals who died pre-maturely, or prior to reaching 70 years of age, belong to the low- and middle-income nations.

The epidemic of chronic diseases has devastating impacts the health of families and individuals and communities and is set to overwhelm the health systems. The socioeconomic impact of the diseases makes prevention and control of the diseases the most urgent priority for development.

Increasing clinical use of exosome-based diagnostics is driving research and investment in exosome platforms. Clinicians are increasingly relying on liquid biopsies that examine tumor-derived exosomal biomarkers to diagnose non-invasive, highly sensitive, and specific diseases. The minimally invasive diagnosis leads to demand for robust technologies to isolate, detect and characterize exosomes.

As exosome-based assays become increasingly common in hospitals, there is a growing demand for point-of-care (POC) solutions. POC systems allow turnaround time to be shortened, workflow to be simplified, and delivery of diagnostic tests to lessen reliance upon central labs and their records. Developers are currently engineering novel microfluidic devices, immunoaffinity capture technologies and AI analytics, which can satisfy clinical demand for speed and precision.

Exosome technologies are also adopted by the clinicians performing clinical trials. As of mid-2023, 74 trials were assessing exosome-based diagnostic tests, demonstrating growing clinical validation, and acceptance. Similarly, regulatory clearances for exosome tests, such as Bio-Techne's ExoDx Prostate IntelliScore for prostate cancer, and Guardant's 360 CDx for non-small cell lung cancer demonstrate growing institutional confidence and adoption into clinical practice.

For instance, according to data published by National Library of Medicine (NLM), Exosome Diagnostics undertook an observational clinical trial on an efficacy study of the diagnostic test "ExoDx Prostate Intelliscore (EPI)". The observational trial included 532 participants with early clinical evidence of prostate cancer, including a cohort with high prostate-specific antigen levels that fell into a limit range of 2.0-10 ng/ml.

The participants were divided into two cohorts, where the first cohort were men who were already scheduled to have an initial prostate biopsy, and the second cohort comprised men who did not have a scheduled prostate biopsy. The aims of the study were to measure the performance of the urine test for the men in the first cohort and determine whether the urine test results could add or contribute to the decision-making process around whether to biopsy. The study concluded that, EPI was a non-invasive, straightforward, urine assay of gene expression, which had been validated on all the participants. The test significantly improved identification of patients with potentially more relevant disease and would ultimately lessen the overall number of inappropriate biopsies. Currently, ExoDx is the only exosome-based prostate cancer test that provides a unique data point to help with the prostate biopsy decision.

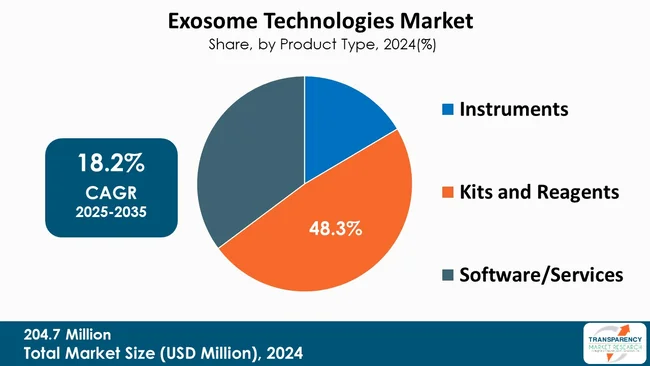

The kits and reagents segment leads the global exosome technologies market as kits and reagents are essential for isolating, purifying, and characterizing exosomes for both - research and clinical use, and such products are generally standardized, dependable, and simple to use, thereby making them time-efficient and reliably reproducible by the intended user.

Additionally, as diagnostics and therapeutics using exosomes are being used increasingly across biotechnology companies, laboratories, and clinical sites, high demand has emerged for quality kits and reagents. Kits and reagents are widely accepted in terms of assay sensitivity, adoption scalability, and friendly usability across a range of samples, leading to these products representing the most distinct offerings in the market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is the dominant region in the exosome technologies market due to the region’s strong infrastructure and funding, which is utilized for supporting biomedical innovation. Moreover, North America has a history of adoption of advanced diagnostics and therapeutics early in its application to clinical care.

The high level of awareness about exosome technologies among clinical care professionals further enhances this positive trajectory of an emerging area of application and innovation in clinical care. Collectively, the variety of factors fostering the development of exosome technologies is likely to solidify North America as the premier region in the pursuit of innovation and application of exosome technologies across several medical applications.

The key market strategies pursued by the companies for contributing to exosome technologies market growth include engaging in strategic partnerships with research institutions, undertaking funding for clinical trials for validation, and expanding the product portfolios. The market players are also focusing on mergers and acquisitions, receiving approval from the regulators (e.g., FDA) , and the development of cost-effective and scalable technologies that can help market players reinforce their competitive market position and drive widespread usage at the global level.

ExoCan Healthcare Technologies Pvt Ltd, Capricor Therapeutics, Inc., Exocobio, Creative Biolabs, VivaZome Therapeutics Pty Ltd, EXO Biologics, Exosome Diagnostics GmbH, Coya Therapeutics, Inc., RION, Thermo Fisher Scientific, System Biosciences, LLC, AEGLE Therapeutics, Fujifilm Holding Corporation, Bio-Techne Corporation, and NOVIQ, are some of the leading players operating in the global exosome technologies market.

Each of these players has been profiled in the exosome technologies market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

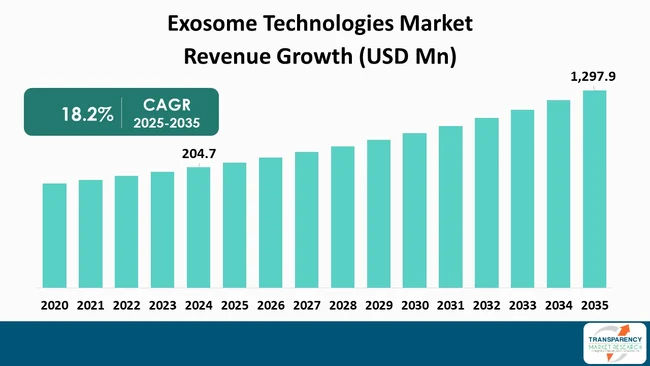

| Size in 2024 | US$ 204.7 Mn |

| Forecast Value in 2035 | US$ 1.3 Bn |

| CAGR | 18.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn/Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global exosome technologies market was valued at US$ 204.7 Mn in 2024

The global exosome technologies industry is projected to reach more than US$ 1.3 Bn by the end of 2035

The rising prevalence of chronic diseases, increasing adoption of exosome-based diagnostics in clinical settings, new rapid developments in biotechnology and molecular biology, and supportive regulatory frameworks and government funding for exosome research are some of the factors driving the expansion of exosome technologies market.

The CAGR is anticipated to be 18.2% from 2025 to 2035

ExoCan Healthcare Technologies Pvt Ltd, Capricor Therapeutics, Inc., Exocobio, Creative Biolabs, VivaZome Therapeutics Pty Ltd, EXO Biologics, Exosome Diagnostics GmbH, Coya Therapeutics, Inc., RION, Thermo Fisher Scientific Inc., System Biosciences, LLC, AEGLE Therapeutics, Fujifilm Holding Corporation, Bio-Techne Corporation, and NOVIQ

Table 01: Global Exosome Technologies Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Exosome Technologies Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 03: Global Exosome Technologies Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 04: Global Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic, 2020 to 2035

Table 05: Global Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic Area, 2020 to 2035

Table 06: Global Exosome Technologies Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 07: Global Exosome Technologies Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 08: Global Exosome Technologies Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 09: North America Exosome Technologies Market Value (US$ Mn) Forecast, by Country, 2020-2035

Table 10: North America Exosome Technologies Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 11: North America Exosome Technologies Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 12: North America Exosome Technologies Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 13: North America Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic, 2020 to 2035

Table 14: North America Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic Area, 2020 to 2035

Table 15: North America Exosome Technologies Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 16: North America Exosome Technologies Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 17: Europe Exosome Technologies Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Europe Exosome Technologies Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 19: Europe Exosome Technologies Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 20: Europe Exosome Technologies Market Value (US$ Mn) Forecast, By Diagnostic, 2020 to 2035

Table 21: Europe Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutics, 2020 to 2035

Table 22: Europe Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic Area, 2020 to 2035

Table 23: Europe Exosome Technologies Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 24: Europe Exosome Technologies Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 25: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 26: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 27: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 28: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 29: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic, 2020 to 2035

Table 30: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic Area, 2020 to 2035

Table 31: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 32: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 33: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 34: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 35: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 36: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 37: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic, 2020 to 2035

Table 38: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic Area, 2020 to 2035

Table 39: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 40: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 41: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 42: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 43: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 44: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 45: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic, 2020 to 2035

Table 46: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, By Therapeutic Area, 2020 to 2035

Table 47: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, By Source, 2020 to 2035

Table 48: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Exosome Technologies Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Exosome Technologies Market Attractiveness Analysis, By Product Type, 2025–2035

Figure 03: Global Exosome Technologies Market Revenue (US$ Mn), by Instruments, 2020 to 2035

Figure 04: Global Exosome Technologies Market Revenue (US$ Mn), by Kits and Reagent, 2020 to 2035

Figure 05: Global Exosome Technologies Market Revenue (US$ Mn), by Software/Services, 2020 to 2035

Figure 06: Global Exosome Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 07: Global Exosome Technologies Market Attractiveness Analysis, By Application, 2025–2035

Figure 08: Global Exosome Technologies Market Revenue (US$ Mn), by Diagnostics, 2020 to 2035

Figure 09: Global Exosome Technologies Market Revenue (US$ Mn), by Therapeutic, 2020 to 2035

Figure 10: Global Exosome Technologies Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 11: Global Exosome Technologies Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 12: Global Exosome Technologies Market Attractiveness Analysis, By Therapeutic Area, 2025–2035

Figure 13: Global Exosome Technologies Market Revenue (US$ Mn), by Oncology, 2020 to 2035

Figure 14: Global Exosome Technologies Market Revenue (US$ Mn), by Neurodegenerative Disorders, 2020 to 2035

Figure 15: Global Exosome Technologies Market Revenue (US$ Mn), by Cardiology, 2020 to 2035

Figure 16: Global Exosome Technologies Market Revenue (US$ Mn), by Immunology and Inflammation, 2020 to 2035

Figure 17: Global Exosome Technologies Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 18: Global Exosome Technologies Market Value Share Analysis, By Source, 2024 and 2035

Figure 19: Global Exosome Technologies Market Attractiveness Analysis, By Source, 2025–2035

Figure 20: Global Exosome Technologies Market Revenue (US$ Mn), by HEK293 cells, 2020 to 2035

Figure 21: Global Exosome Technologies Market Revenue (US$ Mn), by Mesenchymal Stem Cell, 2020 to 2035

Figure 22: Global Exosome Technologies Market Revenue (US$ Mn), by Platelet, 2020 to 2035

Figure 23: Global Exosome Technologies Market Revenue (US$ Mn), by Erythrocyte, 2020 to 2035

Figure 24: Global Exosome Technologies Market Revenue (US$ Mn), by NK cell-derived exosomes, 2020 to 2035

Figure 25: Global Exosome Technologies Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 26: Global Exosome Technologies Market Value Share Analysis, By End-User, 2024 and 2035

Figure 27: Global Exosome Technologies Market Attractiveness Analysis, By End-User, 2025–2035

Figure 28: Global Exosome Technologies Market Revenue (US$ Mn), by Hospitals and Clinical Laboratories, 2020 to 2035

Figure 29: Global Exosome Technologies Market Revenue (US$ Mn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 30: Global Exosome Technologies Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 31: Global Exosome Technologies Market Value Share Analysis, By Region, 2024 and 2035

Figure 32: Global Exosome Technologies Market Attractiveness Analysis, By Region, 2025–2035

Figure 33: North America Exosome Technologies Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 34: North America Exosome Technologies Market Value Share Analysis, by Country, 2024 and 2035

Figure 35: North America Exosome Technologies Market Attractiveness Analysis, by Country, 2025–2035

Figure 36: North America Exosome Technologies Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 37: North America Exosome Technologies Market Attractiveness Analysis, By Product Type, 2025–2035

Figure 38: North America Exosome Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 39: North America Exosome Technologies Market Attractiveness Analysis, By Application, 2025–2035

Figure 40: North America Exosome Technologies Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 41: North America Exosome Technologies Market Attractiveness Analysis, By Therapeutic Area, 2025–2035

Figure 42: North America Exosome Technologies Market Value Share Analysis, By Source, 2024 and 2035

Figure 43: North America Exosome Technologies Market Attractiveness Analysis, By Source, 2025–2035

Figure 44: North America Exosome Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 45: North America Exosome Technologies Market Attractiveness Analysis, By End-user, 2025–2035

Figure 46: Europe Exosome Technologies Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 47: Europe Exosome Technologies Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 48: Europe Exosome Technologies Market Attractiveness Analysis, by Country / Sub-region, 2025–2035

Figure 49: Europe Exosome Technologies Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 50: Europe Exosome Technologies Market Attractiveness Analysis, By Product Type, 2025–2035

Figure 51: Europe Exosome Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Europe Exosome Technologies Market Attractiveness Analysis, By Application, 2025–2035

Figure 53: Europe Exosome Technologies Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 54: Europe Exosome Technologies Market Attractiveness Analysis, By Therapeutic Area, 2025–2035

Figure 55: Europe Exosome Technologies Market Value Share Analysis, By Source, 2024 and 2035

Figure 56: Europe Exosome Technologies Market Attractiveness Analysis, By Source, 2025–2035

Figure 57: Europe Exosome Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 58: Europe Exosome Technologies Market Attractiveness Analysis, By End-user, 2025–2035

Figure 59: Asia Pacific Exosome Technologies Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 60: Asia Pacific Exosome Technologies Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 61: Asia Pacific Exosome Technologies Market Attractiveness Analysis, by Country/Sub-region, 2025–2035

Figure 62: Asia Pacific Exosome Technologies Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 63: Asia Pacific Exosome Technologies Market Attractiveness Analysis, By Product Type, 2025–2035

Figure 64: Asia Pacific Exosome Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 65: Asia Pacific Exosome Technologies Market Attractiveness Analysis, By Application, 2025–2035

Figure 66: Asia Pacific Exosome Technologies Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 67: Asia Pacific Exosome Technologies Market Attractiveness Analysis, By Therapeutic Area, 2025–2035

Figure 68: Asia Pacific Exosome Technologies Market Value Share Analysis, By Source, 2024 and 2035

Figure 69: Asia Pacific Exosome Technologies Market Attractiveness Analysis, By Source, 2025–2035

Figure 70: Asia Pacific Exosome Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 71: Asia Pacific Exosome Technologies Market Attractiveness Analysis, By End-user, 2025–2035

Figure 72: Latin America Exosome Technologies Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 73: Latin America Exosome Technologies Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 74: Latin America Exosome Technologies Market Attractiveness Analysis, by Country / Sub-region, 2025–2035

Figure 75: Latin America Exosome Technologies Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 76: Latin America Exosome Technologies Market Attractiveness Analysis, By Product Type, 2025–2035

Figure 77: Latin America Exosome Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 78: Latin America Exosome Technologies Market Attractiveness Analysis, By Application, 2025–2035

Figure 79: Latin America Exosome Technologies Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 80: Latin America Exosome Technologies Market Attractiveness Analysis, By Therapeutic Area, 2025–2035

Figure 81: Latin America Exosome Technologies Market Value Share Analysis, By Source, 2024 and 2035

Figure 82: Latin America Exosome Technologies Market Attractiveness Analysis, By Source, 2025–2035

Figure 83: Latin America Exosome Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 84: Latin America Exosome Technologies Market Attractiveness Analysis, By End-user, 2025–2035

Figure 85: Middle East & Africa Exosome Technologies Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 86: Middle East & Africa Exosome Technologies Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 87: Middle East & Africa Exosome Technologies Market Attractiveness Analysis, by Country / Sub-region, 2025–2035

Figure 88: Middle East & Africa Exosome Technologies Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 89: Middle East & Africa Exosome Technologies Market Attractiveness Analysis, By Product Type, 2025–2035

Figure 90: Middle East & Africa Exosome Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 91: Middle East & Africa Exosome Technologies Market Attractiveness Analysis, By Application, 2025–2035

Figure 92: Middle East & Africa Exosome Technologies Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 93: Middle East & Africa Exosome Technologies Market Attractiveness Analysis, By Therapeutic Area, 2025–2035

Figure 94: Middle East & Africa Exosome Technologies Market Value Share Analysis, By Source, 2024 and 2035

Figure 95: Middle East & Africa Exosome Technologies Market Attractiveness Analysis, By Source, 2025–2035

Figure 96: Middle East & Africa Exosome Technologies Market Value Share Analysis, By End-user, 2024 and 2035

Figure 97: Middle East & Africa Exosome Technologies Market Attractiveness Analysis, By End-user, 2025–2035