Reports

Reports

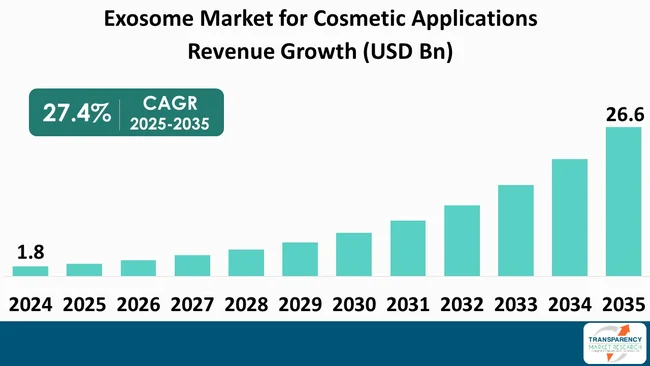

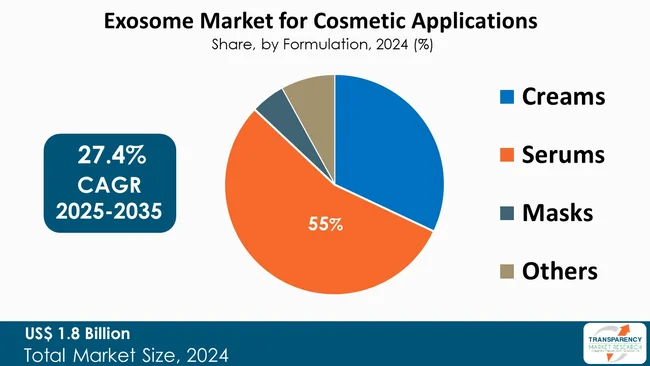

The global exosome market size in cosmetic applications was valued at US$ 1.8 billion in 2024 and is projected to reach US$ 26.6 billion by 2035, expanding at a CAGR of 27.4% from 2025 to 2035. The market growth is driven by Increase in demand for smaller, lightweight electronic devices boosts the exosome market for cosmetic applications and enhanced safety features position exosome as a preferred choice, particularly in safety-critical applications.

Exosome market for cosmetic applications is growing fast. This is primarily due to the combination of regenerative biotechnologies and the growing demand for high-end dermal rejuvenation treatments. Exosome-based skincare is the use of stem cell-derived nanovesicles, which are proven in clinical trials to enhance collagen induction and skin repair, and at the same time, this method is far safer and more effective than the conventional one.

The market’s momentum is further supported by the widespread use of lightweight electronic application devices, advanced post-procedure treatments, and the increasing preference of non-invasive solutions. North America is the leader regarding the adoption trend. The region is supported by a matured regulatory environment, a strong consumer preference for biotech-powered aesthetics, and market activities from the innovators like Lonza Group.

Technological advancements in scalable, safe exosome manufacturing, combined with the dominance of serum formulations, ensure both - deep dermal penetration and consistent results. As far as safety is concerned, exosomes have been biocompatibility and hypoallergenic properties tested and confirmed, thus they are the preferred substances for sensitive and post-treatment skin. The use of exosome-based beauty products is re-setting the standards of luxury skincare and aesthetic dermatology with the widening of their regional adoption and cross-industry collaboration.

Exosomes for cosmetic purposes are looked upon as the next big thing in regenerative aesthetics. They are a combination of cell-derived nanovesicles that play an important role in skin repair and rejuvenation at the molecular level. Such bioactive extracellular vesicles that are the products of stem cells and the other cell types consist of the compounds such as lipids, proteins, and nucleic acids that help in intercellular communication. The tissue thus becomes capable of producing collagen, elastin, and overall dermal health gets improved. The cosmetics industry is using exosomes in creams, serums, and injectable formulations for pigmentation correction, anti-aging, and scar reduction.

The global cosmetics industry is witnessing a surge in exosome-based innovations, basically driven by the growing demand for biologically active, non-invasive ingredients that deliver lasting results. Companies are increasingly investing in scalable manufacturing, clinical validation, and regulatory compliance for differentiating premium exosome-infused skincare products.

The integration of exosomes aligns with the wider shift toward biotechnology-driven beauty solutions, wherein cellular-level rejuvenation and efficacy are the key competitive advantages. As regulatory clarity and awareness increase, the exosome-based cosmetics are poised to redefine the premium aesthetic dermatology and skincare landscape, merging biotechnology with luxury skincare performance.

| Attribute | Detail |

|---|---|

| Exosome Market for Cosmetic Applications Drivers |

|

The growing demand for a rapidly changing field of exosomes is the most significant factor behind the development of a small, portable, and lightweight electronic skincare device trend. Consumers are investing in portable and user-friendly devices like microcurrent massagers, nano-infusion tools, and ultrasonic applicators that not only make the products more absorbable but also more effective.

Essentially, what these gadgets do is provide an ideal setting for exosome-based solutions, which are nanoscale vesicles capable of deeper skin penetration, where the skin can then regenerate and rejuvenate. In fact, due to the advanced delivery systems, users are now able to layer exosome serums with at-home devices and thus achieve professional-grade skincare results, which is the reason why adoption is being facilitated across premium and clinical-grade beauty segments.

Market leaders are leveraging this movement. For instance, ExoCel Bio and Benev Company Inc. have formulated exosome-rich serums that are compatible with micro-needling and LED-based devices. These devices aid collagen stimulation and tissue repair. The skincare brands are also partnering with device manufacturers to design co-branded systems that unite biotechnology with precision delivery. The transition to multifunctional, lightweight, and travel-friendly skincare tools not only makes exosome-based products more accessible and attractive but also works as a global innovation and consumer expansion driver for biotech-powered cosmetics.

Improved safety and biocompatibility are some of the main reasons that exosomes are singled out as the most suitable constituents in the cosmetic industry, notably in those cases where product safety and skin tolerance are of utmost importance. Exosomes, unlike synthetic peptides or chemically active agents, are normally biologically extracellular vesicles that facilitate the cellular communication without the immune system being activated or irritation occurring. Their ability to offer regenerative bio-signals and at the same time have non-toxic and hypoallergenic properties makes them the perfect choice for the skincare of sensitive and post-procedure skin.

By meeting the highest safety standards for skin, and by undergoing tests for cytotoxicity and biocompatibility under the ISO 10993 guidelines, companies like ExoCoBio Inc. and Kimera Labs have launched products in the market. These confirmed safety results have led to dermatologist and medical spa acceptance, especially for post-laser and microneedling treatments. As a result, exosome-based formulations are fast becoming the instrument of choice for skin rejuvenation and regenerative aesthetics that are safe, effective, and scientifically validated, and thus, are the gold standard for consumers and practitioners.

Serums have become the most dominant form of exosome technology in the beauty industry due to their ability to penetrate the skin more effectively with lighter texture and higher concentration of bioactive ingredients. To name a few, exosome-infused serums allow for the dermal delivery of growth factors, peptides, and lipids deep into the skin layers, which will, in turn, activate collagen synthesis, cellular repair, and skin regeneration.

Besides, they are compatible with advanced application techniques like microneedling, iontophoresis, and ultrasonic infusion that, in turn, increase product efficacy and customer satisfaction. Several brands such as ExoCel Bio’s Revive Exosome Regenerative Complex and Benev’s Exosome Regenerative Complex SR have claimed the improvement of skin tone, elasticity, and texture within 2-4 weeks of regular use in dermatology clinics.

These serums are being heavily promoted as the best products to facilitate post-procedure recovery, especially after laser and micro needling treatments, which are the main causes of a few inflammations and a measurable reduction in the downtime. The use of biotechnology for treatment purposes, which comes in handy in the consumer-friendly formulation, has been the main reason why serums have become the most dominant product format worldwide in the global exosome-based cosmetics segment.

| Attribute | Detail |

|---|---|

| Leading Region |

|

An early adoption of biotechnology, efficient regulatory frameworks, and a large number of aesthetic dermatology clinics have helped North America to lead the exosome market for cosmetic applications. The major part of the United States is responsible for the exosome-market-based skincare and post-procedure serums commercialization by companies such as ExoCel Bio, Kimera Labs, and Benev Company Inc. The region's shift toward non-invasive, regenerative treatments, especially among 30-55 years old consumers, who make up more than 60% of the clinical aesthetic demand, is still backing the market growth.

Europe is the second largest market driven by innovation in cosmeceutical formulations and stern compliance with safety standards. France, Germany, and the U.K. are the implementers where medical spas and dermatology chains are increasingly using exosome-based products.

Asia Pacific is emerging as a high-growth market, especially in Japan and South Korea, where exosome-infused aesthetic therapies and skincare are being commercialized through K-beauty and biotech collaborations.

Lonza Group is a worldwide leader in biotechnology manufacturing and holds a significant position in the exosome ecosystem by offering the cell culture systems, purification platforms, and various contract development and manufacturing (CDMO) services required for exosome-based products. The company’s proficiency in bioprocessing at a large scale and the production of products that meet the requirements of regulatory authorities are the reasons why it has a competitive advantage in the supply of exosome materials of the highest quality for cosmetic and dermatological applications. Lonza’s facilities are not only capable of supporting R&D and commercial-scale production but also make the company a valuable partner for cosmetic brands that are at the forefront of integrating exosome-based formulations.

EVerzom, a French biotechnology company, is amongst the innovative companies in the exosome sector. The company is capable of the large-scale bio-manufacturing of extracellular vesicles through its own biomimetic shear-stress technology, which can produce up to 100 times more material compared to a conventional method. The company is actively interfacing with attractive cosmetic and pharmaceutical companies to create skin-pathway regenerative and anti-aging products utilizing exosome, thereby being the leading innovator in cosmetic exosome applications.

AEGLE Therapeutics and BioCat GmbH are some other major companies in the market. Each of these players has been profiled in the exosome market for cosmetic applications research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 1.8 Billion |

| Market Forecast Value in 2035 | US$ 26.6 Billion |

| Growth Rate (CAGR) | 27.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Billion for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Exosome Market for Cosmetic Applications opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Source

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The exosome market for cosmetic applications was valued at US$ 1.8 Bn in 2024

The exosome for cosmetic applications industry is expected to grow at a CAGR of 27.4% from 2025 to 2035

Increase in demand for smaller, lightweight electronic devices boosts the exosome market for cosmetic applications and enhanced safety features position exosome as a preferred choice, particularly in safety-critical applications

Serums was the largest formulation segment in the exosome market for cosmetic applications.

North America was the most lucrative region in 2024

AEGLE Therapeutics, EVerzom, BioCat GmbH and Lonza Group are some of the major companies in the global exosome market for cosmetic applications.

Table 1 Global Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 2 Global Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 3 Global Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation 2020 to 2035

Table 4 Global Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation 2020 to 2035

Table 5 Global Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 6 Global Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 7 Global Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 8 Global Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 9 Global Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Region, 2020 to 2035

Table 10 Global Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 11 North America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 12 North America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 13 North America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation 2020 to 2035

Table 14 North America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation 2020 to 2035

Table 15 North America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 16 North America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 17 North America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 18 North America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 19 North America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Country, 2020 to 2035

Table 20 North America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 21 U.S. Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 22 U.S. Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 23 U.S. Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation 2020 to 2035

Table 24 U.S. Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 25 U.S. Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 U.S. Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 U.S. Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 U.S. Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Canada Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 30 Canada Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 31 Canada Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 32 Canada Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 33 Canada Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 34 Canada Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35 Canada Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 36 Canada Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 37 Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 38 Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 39 Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation 2020 to 2035

Table 40 Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 41 Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45 Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 46 Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 47 Germany Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 48 Germany Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 49 Germany Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 50 Germany Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 51 Germany Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Germany Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Germany Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Germany Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 55 France Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 56 France Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 57 France Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 58 France Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 59 France Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 60 France Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 61 France Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 62 France Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 63 U.K. Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 64 U.K. Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 65 U.K. Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 66 U.K. Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 67 U.K. Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 68 U.K. Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 69 U.K. Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 70 U.K. Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 71 Italy Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 72 Italy Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 73 Italy Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 74 Italy Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 75 Italy Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Italy Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Italy Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Italy Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 79 Spain Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 80 Spain Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 81 Spain Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 82 Spain Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 83 Spain Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 Spain Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 Spain Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 Spain Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 87 Russia & CIS Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 88 Russia & CIS Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 89 Russia & CIS Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 90 Russia & CIS Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 91 Russia & CIS Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 92 Russia & CIS Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93 Russia & CIS Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 94 Russia & CIS Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 95 Rest of Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 96 Rest of Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 97 Rest of Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 98 Rest of Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 99 Rest of Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 100 Rest of Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101 Rest of Europe Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 102 Rest of Europe Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 103 Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 104 Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 105 Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 106 Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 107 Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 108 Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 109 Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 110 Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 111 Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 112 Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 113 China Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 114 China Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source 2020 to 2035

Table 115 China Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 116 China Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 117 China Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 118 China Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 119 China Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 120 China Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 121 Japan Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 122 Japan Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 123 Japan Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 124 Japan Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 125 Japan Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 126 Japan Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 127 Japan Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 128 Japan Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 129 India Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 130 India Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 131 India Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 132 India Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 133 India Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 India Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 India Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 India Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 137 ASEAN Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 138 ASEAN Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 139 ASEAN Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 140 ASEAN Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 141 ASEAN Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 ASEAN Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 143 ASEAN Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 ASEAN Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 145 Rest of Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 146 Rest of Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 147 Rest of Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 148 Rest of Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 149 Rest of Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 150 Rest of Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 151 Rest of Asia Pacific Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 152 Rest of Asia Pacific Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 153 Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 154 Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 155 Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 156 Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 157 Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 158 Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 159 Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 160 Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 161 Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 162 Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 163 Brazil Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 164 Brazil Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 165 Brazil Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 166 Brazil Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 167 Brazil Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Brazil Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 169 Brazil Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Brazil Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 171 Mexico Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 172 Mexico Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 173 Mexico Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 174 Mexico Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 175 Mexico Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 Mexico Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 Mexico Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 Mexico Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 180 Rest of Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 181 Rest of Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 182 Rest of Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 183 Rest of Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 184 Rest of Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 185 Rest of Latin America Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 186 Rest of Latin America Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 187 Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 188 Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 189 Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 190 Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 191 Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 192 Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 193 Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 194 Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 195 Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 196 Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 197 GCC Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 198 GCC Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 199 GCC Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 200 GCC Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 201 GCC Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 202 GCC Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 203 GCC Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 204 GCC Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 205 South Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 206 South Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 207 South Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 208 South Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 209 South Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 210 South Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 211 South Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 212 South Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Source, 2020 to 2035

Table 214 Rest of Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 215 Rest of Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 216 Rest of Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 217 Rest of Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Rest of Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Rest of Middle East & Africa Exosome Market for Cosmetic Applications Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Rest of Middle East & Africa Exosome Market for Cosmetic Applications Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Exosome Market for Cosmetic Applications Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 2 Global Exosome Market for Cosmetic Applications Attractiveness, by Source

Figure 3 Global Exosome Market for Cosmetic Applications Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 4 Global Exosome Market for Cosmetic Applications Attractiveness, by Formulation

Figure 5 Global Exosome Market for Cosmetic Applications Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Global Exosome Market for Cosmetic Applications Attractiveness, by Application

Figure 7 Global Exosome Market for Cosmetic Applications Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 Global Exosome Market for Cosmetic Applications Attractiveness, by End-use

Figure 9 Global Exosome Market for Cosmetic Applications Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 Global Exosome Market for Cosmetic Applications Attractiveness, by Region

Figure 11 North America Exosome Market for Cosmetic Applications Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 12 North America Exosome Market for Cosmetic Applications Attractiveness, by Source

Figure 13 North America Exosome Market for Cosmetic Applications Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 14 North America Exosome Market for Cosmetic Applications Attractiveness, by Formulation

Figure 15 North America Exosome Market for Cosmetic Applications Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 16 North America Exosome Market for Cosmetic Applications Attractiveness, by Application

Figure 17 North America Exosome Market for Cosmetic Applications Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 18 North America Exosome Market for Cosmetic Applications Attractiveness, by End-use

Figure 19 North America Exosome Market for Cosmetic Applications Attractiveness, by Country and Sub-region

Figure 20 Europe Exosome Market for Cosmetic Applications Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 21 Europe Exosome Market for Cosmetic Applications Attractiveness, by Source

Figure 22 Europe Exosome Market for Cosmetic Applications Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 23 Europe Exosome Market for Cosmetic Applications Attractiveness, by Formulation

Figure 24 Europe Exosome Market for Cosmetic Applications Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 25 Europe Exosome Market for Cosmetic Applications Attractiveness, by Application

Figure 26 Europe Exosome Market for Cosmetic Applications Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 27 Europe Exosome Market for Cosmetic Applications Attractiveness, by End-use

Figure 28 Europe Exosome Market for Cosmetic Applications Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 29 Europe Exosome Market for Cosmetic Applications Attractiveness, by Country and Sub-region

Figure 30 Asia Pacific Exosome Market for Cosmetic Applications Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 31 Asia Pacific Exosome Market for Cosmetic Applications Attractiveness, by Source

Figure 32 Asia Pacific Exosome Market for Cosmetic Applications Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 33 Asia Pacific Exosome Market for Cosmetic Applications Attractiveness, by Formulation

Figure 34 Asia Pacific Exosome Market for Cosmetic Applications Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 35 Asia Pacific Exosome Market for Cosmetic Applications Attractiveness, by Application

Figure 36 Asia Pacific Exosome Market for Cosmetic Applications Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 37 Asia Pacific Exosome Market for Cosmetic Applications Attractiveness, by End-use

Figure 38 Asia Pacific Exosome Market for Cosmetic Applications Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 39 Asia Pacific Exosome Market for Cosmetic Applications Attractiveness, by Country and Sub-region

Figure 40 Latin America Exosome Market for Cosmetic Applications Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 41 Latin America Exosome Market for Cosmetic Applications Attractiveness, by Source

Figure 42 Latin America Exosome Market for Cosmetic Applications Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 43 Latin America Exosome Market for Cosmetic Applications Attractiveness, by Formulation

Figure 44 Latin America Exosome Market for Cosmetic Applications Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 45 Latin America Exosome Market for Cosmetic Applications Attractiveness, by Application

Figure 46 Latin America Exosome Market for Cosmetic Applications Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 47 Latin America Exosome Market for Cosmetic Applications Attractiveness, by End-use

Figure 48 Latin America Exosome Market for Cosmetic Applications Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 49 Latin America Exosome Market for Cosmetic Applications Attractiveness, by Country and Sub-region

Figure 50 Middle East & Africa Exosome Market for Cosmetic Applications Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 51 Middle East & Africa Exosome Market for Cosmetic Applications Attractiveness, by Source

Figure 52 Middle East & Africa Exosome Market for Cosmetic Applications Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 53 Middle East & Africa Exosome Market for Cosmetic Applications Attractiveness, by Formulation

Figure 54 Middle East & Africa Exosome Market for Cosmetic Applications Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 55 Middle East & Africa Exosome Market for Cosmetic Applications Attractiveness, by Application

Figure 56 Middle East & Africa Exosome Market for Cosmetic Applications Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 57 Middle East & Africa Exosome Market for Cosmetic Applications Attractiveness, by End-use

Figure 58 Middle East & Africa Exosome Market for Cosmetic Applications Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 59 Middle East & Africa Exosome Market for Cosmetic Applications Attractiveness, by Country and Sub-region