Reports

Reports

Cell culture industry is witnessing rapid growth, fueled by a synergy of factors such as biotechnology, enhanced research activity, and growing healthcare concerns. Contributing to the major drivers is the fast-growing demand for biopharmaceuticals including vaccines and monoclonal antibodies, which are largely dependent on cell culture production technologies.

With expansion of the healthcare sector, demand for new therapy for chronic illnesses like cancer, diabetes, and cardiovascular diseases has been increasing. This has further increased research and development expenditure, and demand for new cell culture technologies has been on the rise.

.webp)

Moreover, technology advancements are transforming the cell culture environment. New technologies such as 3D cell culture platforms, automated culture platforms, and microfluidics are enhancing fidelity and efficiency to cell-based studies. These technologies enable scientists to mimic in-vivo conditions more effectively, obtaining more relevant and realistic outcomes with drug discovery and development. Growing interest in personalized therapy is driving the requirement for novel cell culture methods since personalized therapy has to be clinically tested and supported by advanced cellular models.

Supportive regulatory landscape is also paving the way for expansion of the market. Facilitative regulation of health institutions allows for cell culture technology to be used in new drug development to determine safety and efficacy in treatments. Also, increased attention to stem cell research and regenerative medicine have brought new prospects for cell culture, along with increased funding and collaboration amongst academia, biotechnology companies, and pharmaceutical firms.

Cell culture implies the cultivation of and supporting cells in an artificial environment outside its native habitat, and most of the time in a laboratory. Cell culture, as a method, is the dissociation of intact cells from tissues and grown on a growth medium, which provides nutrients, gases, and growth factors. Cell culture holds a pivotal position in majority of healthcare industries as a fundamental tool for research, development, and manufacture.

Cell culture is widely used in the pharmaceutical industry for drug development and discovery. Researchers use cell cultures daily to monitor cellular response against novel chemicals, screen for drugs, and determine potential toxicity. Using multiple types of cell lines, scientists can model diseases like cancer, diabetes, and neurodegenerative diseases and come to a denominator of a complex systematic understanding of disease mechanisms and therapeutic targets.

Cell culture is the epicenter of biopharmaceutical production in biotechnology, such as for monoclonal antibodies, recombinant proteins, and vaccines. These therapeutic entities are derived from cultured cells that have been genetically modified to code for specific proteins or antibodies. Large-scale production, as a result of scalability of cell culture in bioreactors, does make them accessible as a consistent supply of life-saving medicines for meeting global healthcare demands.

Cell culture is also a vital tool for regenerative medicine and tissue engineering. Stem cells are being looked upon as a source of cells that can be differentiated into different types of cells for repairing or replacing damaged organs and tissues. Stem cells can be grown under controlled conditions by scientists, which can then be directed by them in development and explored as therapies for diseases such as spinal cord injury and cardiovascular disease.

In addition, cell culture is utilized in diagnostics. In-vitro testing using cultured cells facilitates the study of disease markers and diagnostic test development.

The cosmetics industry has also adopted cell culture technology to conduct safety testing. With cultured human skin cells, firms can check the safety and effectiveness of cosmetic ingredients without animal testing, thereby addressing ethical demands and regulatory demands.

| Attribute | Detail |

|---|---|

| Cell Culture Market Drivers |

|

Growing demand for biopharmaceuticals is one of the key drivers to the cell culture industry, revolutionizing the landscape of modern medicine and therapeutic advancement. Biopharmaceuticals are a broad range of products derived from biology such as monoclonal antibodies, vaccines, and recombinant proteins that have become the focal point due to their role in controlling chronic diseases, autoimmune diseases, and cancer.

This expanding demand is one aspect of a broader movement toward more specific and more personalized medicines, which generally rely on highly complex biological processes that can only be fruitfully explored with advanced cell culture techniques.

With the global health sector being subject to growing pressure in offering new therapies to more patients, particularly in the context of aging population and the prevalence of chronic diseases, cell culture increasingly assumes a vital role. Conventional drugs altogether fail in every aspect with regards to specificity and potency toward combating multifaceted biological states.

Conversely, biopharmaceuticals are engineered to bind to a target cell and make the disease more manageable at the molecular level. This specificity requires extensive research and development steps where cell culture is one of the key tools to simulate disease conditions and screen therapeutic compounds.

Furthermore, biopharmaceuticals’ development is closely associated with advances in genetic engineering and biotechnology. Recombinant DNA technology and the other technologies allow the production of therapeutic proteins from cultured cells, a process through which enormous amounts of high-purity product are manufactured. For example, monoclonal antibodies that are critical in oncology and immunotherapy are generated through hybridoma technology founded on cell culture for the repetitive proliferation of antibody-secreting cells. As demand for such novel treatments grows, demand also grows for productive and reproducible cell culture systems to aid in their production.

Advancement in cell culture technologies is an integrating driving force in the cell culture industry, largely adding research and therapeutic value across different health care sectors. With growing demands for more effective and targeted treatments, advancement in cell culture methods has risen to address these changing needs, revolutionizing the way scientists and researchers tackle cellular biology, drug discovery, and tissue engineering.

One of the key advancements has been the creation of 3D cell culture systems, which provide a more physiologically relevant environment than the conventional 2D cultures. In 2D systems, cells are cultured on flat planes, and this could provoke changed cell behavior and responses not seen in vivo.

Conversely, 3D cultures permit cells to expand three-dimensionally, which mimics the structure of the body tissue. This technology has proven invaluable in exploring intricate biological processes, such as drug action, cell-cell communication, and tumor development. Through this manner, scientists are able to generate more accurate data that improves predictability of the preclinical studies.

Further, bioreactor technology has revolutionized process efficiency and scalability of cell culture operations. Bioreactors are used to provide a controlled environment for cell culture where temperature, pH, and concentration of nutrients are accurately controlled. The systems can facilitate large-scale production of biologics like vaccines and monoclonal antibodies through use of optimal growth conditions and the capability of continuous monitoring and control. The ability to generate upscaling with minimal impact on cell viability and product quality is of highest priority in meeting high demand for biopharmaceuticals.

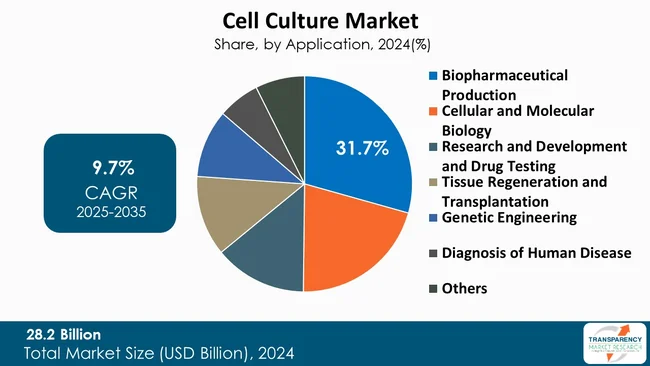

Biopharmaceutical production segment maintains dominance in the global cell culture market owing to the increasing demand for biologics such as monoclonal antibodies, vaccines, and recombinant proteins. Biopharmaceuticals are more potent in their action as compared to conventional small-molecule drugs, and possess specificity in curing diseases such as cancer and autoimmune diseases, thus requiring strong cell culture systems for their production.

In addition, improvements in cell culture technologies such as bioreactors and 3D culture systems have improved the production yield and efficiency of biopharmaceuticals. The technologies enable manufacturers to optimize growth conditions, enhance the quality of the product, and expand production based on market demand.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

As per the latest cell culture market analysis, North America dominated in 2024. The presence of many biopharmaceutical and biotechnology leading players in the region encourages innovation and accelerates the adoption of next-generation cell culture technologies. In addition, North America has an extremely advanced healthcare infrastructure, including well-equipped laboratories and research institutions, which further enhances the ability of the region as far as biopharmaceutical production and research are concerned.

Furthermore, the increasing prevalence of chronic diseases and the growing demand for biologics have prompted significant investments in cell culture techniques, driving cell culture market growth.

Companies engaged in the cell culture industry are increasingly focusing on efforts such as establishment of cutting-edge 3D culture systems, automated laboratory processes, and investment in bioreactor technology. Firms are also directing focus towards research institute collaborations for the establishment of novel cell culture approaches and the extension of applications in biopharmaceutical manufacturing as well as regenerative medicine.

Thermo Fisher Scientific Inc., Merck KGaA, Lonza, STEMCELL Technologies, Miltenyi Biotec, HiMedia Laboratories, Sartorius AG, Becton, Dickinson and Company, Corning Incorporated, Danaher Corporation, FUJIFILM Irvine Scientific, Inc., MP Biomedicals, PELOBIOTECH GmbH, GeminiBio LLC, REPROCELL Inc., Sino Biological, Inc., Takara Bio Inc., Biowest, Celprogen Inc., Bio-Rad Laboratories, Inc., and KCell Biosciences are some of the leading players operating in the global cell culture market.

Each of these players has been profiled in the cell culture market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 28.2 Bn |

| Forecast Value in 2035 | US$ 78.2 Bn |

| CAGR | 9.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global cell culture market was valued at US$ 28.2 Bn in 2024.

The global cell culture industry is projected to reach more than US$ 78.2 Bn by the end of 2035.

Rising demand for biopharmaceuticals, advancements in cell culture technologies and increasing prevalence of chronic disorders are some of the factors driving the expansion of cell culture market.

The CAGR is anticipated to be 9.7% from 2025 to 2035.

Thermo Fisher Scientific Inc., Merck KGaA, Lonza, STEMCELL Technologies, Miltenyi Biotec, HiMedia Laboratories, Sartorius AG, Becton, Dickinson and Company, Corning Incorporated, Danaher Corporation, FUJIFILM Irvine Scientific, Inc., MP Biomedicals, PELOBIOTECH GmbH, GeminiBio LLC, REPROCELL Inc., Sino Biological, Inc., Takara Bio Inc., Biowest, Celprogen Inc., Bio-Rad Laboratories, Inc. and KCell Biosciences.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cell Culture Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cell Culture Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Healthcare Expenditure across Key Regions / Countries

5.2. Recent Advancements in Cell Culture Technology

5.3. Cell Culture Instruments & Consumables Pricing Trends

5.4. Regulatory Scenario across Key Regions / Countries

5.5. PORTER’s Five Forces Analysis

5.6. PESTEL Analysis

5.7. Value Chain Analysis

5.8. Go-to-Market Strategy for New Market Entrants

5.9. Key Purchase Metrics for End-users

5.10. Key Industry Events (Partnerships, Collaborations, Product approvals, mergers & acquisitions)

5.11. Benchmarking of the Products Offered by the Leading Competitors

6. Global Cell Culture Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Instruments

6.3.1.1. Cell Culture Vessels (Bioreactors)

6.3.1.2. Carbon Dioxide Incubators

6.3.1.3. Biosafety Cabinets

6.3.1.4. Cryogenic Tanks

6.3.1.5. Serological Pipets

6.3.1.6. Cell Culture Flasks

6.3.1.7. Others

6.3.2. Media

6.3.2.1. Serum-free Media

6.3.2.1.1. Common Serum-free Media

6.3.2.1.2. Xeno-free Media

6.3.2.1.3. Animal-free Media

6.3.2.1.4. Protein-free Media

6.3.2.1.5. Chemically Defined Media

6.3.2.2. Classical Media

6.3.2.3. Lysogeny Broth (LB)

6.3.2.4. Specialty Media

6.3.2.5. Stem Cell Culture Media

6.3.2.6. Other Cell Culture Media

6.3.3. Sera

6.3.3.1. Fetal Bovine Serum

6.3.3.2. Newborn Calf Serum

6.3.3.3. Human Serum

6.3.3.4. Other Sera

6.3.4. Reagents

6.3.4.1. Albumin

6.3.4.1.1. Human Serum Albumin

6.3.4.1.2. Bovine Serum Albumin

6.3.4.1.3. Recombinant Serum Albumin

6.3.4.1.4. Other Albumin

6.3.4.2. Amino Acids

6.3.4.3. Attachment Factors

6.3.4.4. Growth Factors & Cytokines

6.3.4.5. Protease Inhibitors

6.3.4.6. Thrombin

6.3.4.7. Other Reagents

6.3.5. Accessories

6.4. Market Attractiveness By Product Type

7. Global Cell Culture Market Analysis and Forecasts, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application, 2020 to 2035

7.3.1. Biopharmaceutical Production

7.3.1.1. Monoclonal Antibodies

7.3.1.2. Vaccines

7.3.1.3. Cell and Gene Therapies

7.3.1.4. Other Therapies

7.3.2. Cellular and Molecular Biology

7.3.3. Research and Development and Drug Testing

7.3.4. Tissue Regeneration and Transplantation

7.3.5. Genetic Engineering

7.3.6. Diagnosis of Human Disease

7.3.7. Others

7.4. Market Attractiveness By Application

8. Global Cell Culture Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020 to 2035

8.3.1. Pharmaceutical & Biotechnology Companies

8.3.2. Hospitals and Diagnostic Laboratories

8.3.3. Contract Manufacturing Organizations (CMOs)

8.3.4. Academic and Research Institutes

8.3.5. Others

8.4. Market Attractiveness By End-user

9. Global Cell Culture Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Cell Culture Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2020 to 2035

10.2.1. Instruments

10.2.1.1. Cell Culture Vessels (Bioreactors)

10.2.1.2. Carbon Dioxide Incubators

10.2.1.3. Biosafety Cabinets

10.2.1.4. Cryogenic Tanks

10.2.1.5. Serological Pipets

10.2.1.6. Cell Culture Flasks

10.2.1.7. Others

10.2.2. Media

10.2.2.1. Serum-free Media

10.2.2.1.1. Common Serum-free Media

10.2.2.1.2. Xeno-free Media

10.2.2.1.3. Animal-free Media

10.2.2.1.4. Protein-free Media

10.2.2.1.5. Chemically Defined Media

10.2.2.2. Classical Media

10.2.2.3. Lysogeny Broth (LB)

10.2.2.4. Specialty Media

10.2.2.5. Stem Cell Culture Media

10.2.2.6. Other Cell Culture Media

10.2.3. Sera

10.2.3.1. Fetal Bovine Serum

10.2.3.2. Newborn Calf Serum

10.2.3.3. Human Serum

10.2.3.4. Other Sera

10.2.4. Reagents

10.2.4.1. Albumin

10.2.4.1.1. Human Serum Albumin

10.2.4.1.2. Bovine Serum Albumin

10.2.4.1.3. Recombinant Serum Albumin

10.2.4.1.4. Other Albumin

10.2.4.2. Amino Acids

10.2.4.3. Attachment Factors

10.2.4.4. Growth Factors & Cytokines

10.2.4.5. Protease Inhibitors

10.2.4.6. Thrombin

10.2.4.7. Other Reagents

10.2.5. Accessories

10.3. Market Value Forecast By Application, 2020 to 2035

10.3.1. Biopharmaceutical Production

10.3.1.1. Monoclonal Antibodies

10.3.1.2. Vaccines

10.3.1.3. Cell and Gene Therapies

10.3.1.4. Other Therapies

10.3.2. Cellular and Molecular Biology

10.3.3. Research and Development and Drug Testing

10.3.4. Tissue Regeneration and Transplantation

10.3.5. Genetic Engineering

10.3.6. Diagnosis of Human Disease

10.3.7. Others

10.4. Market Value Forecast By End-user, 2020 to 2035

10.4.1. Pharmaceutical & Biotechnology Companies

10.4.2. Hospitals and Diagnostic Laboratories

10.4.3. Contract Manufacturing Organizations (CMOs)

10.4.4. Academic and Research Institutes

10.4.5. Others

10.5. Market Value Forecast By Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Cell Culture Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2020 to 2035

11.2.1. Instruments

11.2.1.1. Cell Culture Vessels (Bioreactors)

11.2.1.2. Carbon Dioxide Incubators

11.2.1.3. Biosafety Cabinets

11.2.1.4. Cryogenic Tanks

11.2.1.5. Serological Pipets

11.2.1.6. Cell Culture Flasks

11.2.1.7. Others

11.2.2. Media

11.2.2.1. Serum-free Media

11.2.2.1.1. Common Serum-free Media

11.2.2.1.2. Xeno-free Media

11.2.2.1.3. Animal-free Media

11.2.2.1.4. Protein-free Media

11.2.2.1.5. Chemically Defined Media

11.2.2.2. Classical Media

11.2.2.3. Lysogeny Broth (LB)

11.2.2.4. Specialty Media

11.2.2.5. Stem Cell Culture Media

11.2.2.6. Other Cell Culture Media

11.2.3. Sera

11.2.3.1. Fetal Bovine Serum

11.2.3.2. Newborn Calf Serum

11.2.3.3. Human Serum

11.2.3.4. Other Sera

11.2.4. Reagents

11.2.4.1. Albumin

11.2.4.1.1. Human Serum Albumin

11.2.4.1.2. Bovine Serum Albumin

11.2.4.1.3. Recombinant Serum Albumin

11.2.4.1.4. Other Albumin

11.2.4.2. Amino Acids

11.2.4.3. Attachment Factors

11.2.4.4. Growth Factors & Cytokines

11.2.4.5. Protease Inhibitors

11.2.4.6. Thrombin

11.2.4.7. Other Reagents

11.2.5. Accessories

11.3. Market Value Forecast By Application, 2020 to 2035

11.3.1. Biopharmaceutical Production

11.3.1.1. Monoclonal Antibodies

11.3.1.2. Vaccines

11.3.1.3. Cell and Gene Therapies

11.3.1.4. Other Therapies

11.3.2. Cellular and Molecular Biology

11.3.3. Research and Development and Drug Testing

11.3.4. Tissue Regeneration and Transplantation

11.3.5. Genetic Engineering

11.3.6. Diagnosis of Human Disease

11.3.7. Others

11.4. Market Value Forecast By End-user, 2020 to 2035

11.4.1. Pharmaceutical & Biotechnology Companies

11.4.2. Hospitals and Diagnostic Laboratories

11.4.3. Contract Manufacturing Organizations (CMOs)

11.4.4. Academic and Research Institutes

11.4.5. Others

11.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country / Sub-region

12. Asia Pacific Cell Culture Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Instruments

12.2.1.1. Cell Culture Vessels (Bioreactors)

12.2.1.2. Carbon Dioxide Incubators

12.2.1.3. Biosafety Cabinets

12.2.1.4. Cryogenic Tanks

12.2.1.5. Serological Pipets

12.2.1.6. Cell Culture Flasks

12.2.1.7. Others

12.2.2. Media

12.2.2.1. Serum-free Media

12.2.2.1.1. Common Serum-free Media

12.2.2.1.2. Xeno-free Media

12.2.2.1.3. Animal-free Media

12.2.2.1.4. Protein-free Media

12.2.2.1.5. Chemically Defined Media

12.2.2.2. Classical Media

12.2.2.3. Lysogeny Broth (LB)

12.2.2.4. Specialty Media

12.2.2.5. Stem Cell Culture Media

12.2.2.6. Other Cell Culture Media

12.2.3. Sera

12.2.3.1. Fetal Bovine Serum

12.2.3.2. Newborn Calf Serum

12.2.3.3. Human Serum

12.2.3.4. Other Sera

12.2.4. Reagents

12.2.4.1. Albumin

12.2.4.1.1. Human Serum Albumin

12.2.4.1.2. Bovine Serum Albumin

12.2.4.1.3. Recombinant Serum Albumin

12.2.4.1.4. Other Albumin

12.2.4.2. Amino Acids

12.2.4.3. Attachment Factors

12.2.4.4. Growth Factors & Cytokines

12.2.4.5. Protease Inhibitors

12.2.4.6. Thrombin

12.2.4.7. Other Reagents

12.2.5. Accessories

12.3. Market Value Forecast By Application, 2020 to 2035

12.3.1. Biopharmaceutical Production

12.3.1.1. Monoclonal Antibodies

12.3.1.2. Vaccines

12.3.1.3. Cell and Gene Therapies

12.3.1.4. Other Therapies

12.3.2. Cellular and Molecular Biology

12.3.3. Research and Development and Drug Testing

12.3.4. Tissue Regeneration and Transplantation

12.3.5. Genetic Engineering

12.3.6. Diagnosis of Human Disease

12.3.7. Others

12.4. Market Value Forecast By End-user, 2020 to 2035

12.4.1. Pharmaceutical & Biotechnology Companies

12.4.2. Hospitals and Diagnostic Laboratories

12.4.3. Contract Manufacturing Organizations (CMOs)

12.4.4. Academic and Research Institutes

12.4.5. Others

12.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country / Sub-region

13. Latin America Cell Culture Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Instruments

13.2.1.1. Cell Culture Vessels (Bioreactors)

13.2.1.2. Carbon Dioxide Incubators

13.2.1.3. Biosafety Cabinets

13.2.1.4. Cryogenic Tanks

13.2.1.5. Serological Pipets

13.2.1.6. Cell Culture Flasks

13.2.1.7. Others

13.2.2. Media

13.2.2.1. Serum-free Media

13.2.2.1.1. Common Serum-free Media

13.2.2.1.2. Xeno-free Media

13.2.2.1.3. Animal-free Media

13.2.2.1.4. Protein-free Media

13.2.2.1.5. Chemically Defined Media

13.2.2.2. Classical Media

13.2.2.3. Lysogeny Broth (LB)

13.2.2.4. Specialty Media

13.2.2.5. Stem Cell Culture Media

13.2.2.6. Other Cell Culture Media

13.2.3. Sera

13.2.3.1. Fetal Bovine Serum

13.2.3.2. Newborn Calf Serum

13.2.3.3. Human Serum

13.2.3.4. Other Sera

13.2.4. Reagents

13.2.4.1. Albumin

13.2.4.1.1. Human Serum Albumin

13.2.4.1.2. Bovine Serum Albumin

13.2.4.1.3. Recombinant Serum Albumin

13.2.4.1.4. Other Albumin

13.2.4.2. Amino Acids

13.2.4.3. Attachment Factors

13.2.4.4. Growth Factors & Cytokines

13.2.4.5. Protease Inhibitors

13.2.4.6. Thrombin

13.2.4.7. Other Reagents

13.2.5. Accessories

13.3. Market Value Forecast By Application, 2020 to 2035

13.3.1. Biopharmaceutical Production

13.3.1.1. Monoclonal Antibodies

13.3.1.2. Vaccines

13.3.1.3. Cell and Gene Therapies

13.3.1.4. Other Therapies

13.3.2. Cellular and Molecular Biology

13.3.3. Research and Development and Drug Testing

13.3.4. Tissue Regeneration and Transplantation

13.3.5. Genetic Engineering

13.3.6. Diagnosis of Human Disease

13.3.7. Others

13.4. Market Value Forecast By End-user, 2020 to 2035

13.4.1. Pharmaceutical & Biotechnology Companies

13.4.2. Hospitals and Diagnostic Laboratories

13.4.3. Contract Manufacturing Organizations (CMOs)

13.4.4. Academic and Research Institutes

13.4.5. Others

13.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country / Sub-region

14. Middle East & Africa Cell Culture Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2020 to 2035

14.2.1. Instruments

14.2.1.1. Cell Culture Vessels (Bioreactors)

14.2.1.2. Carbon Dioxide Incubators

14.2.1.3. Biosafety Cabinets

14.2.1.4. Cryogenic Tanks

14.2.1.5. Serological Pipets

14.2.1.6. Cell Culture Flasks

14.2.1.7. Others

14.2.2. Media

14.2.2.1. Serum-free Media

14.2.2.1.1. Common Serum-free Media

14.2.2.1.2. Xeno-free Media

14.2.2.1.3. Animal-free Media

14.2.2.1.4. Protein-free Media

14.2.2.1.5. Chemically Defined Media

14.2.2.2. Classical Media

14.2.2.3. Lysogeny Broth (LB)

14.2.2.4. Specialty Media

14.2.2.5. Stem Cell Culture Media

14.2.2.6. Other Cell Culture Media

14.2.3. Sera

14.2.3.1. Fetal Bovine Serum

14.2.3.2. Newborn Calf Serum

14.2.3.3. Human Serum

14.2.3.4. Other Sera

14.2.4. Reagents

14.2.4.1. Albumin

14.2.4.1.1. Human Serum Albumin

14.2.4.1.2. Bovine Serum Albumin

14.2.4.1.3. Recombinant Serum Albumin

14.2.4.1.4. Other Albumin

14.2.4.2. Amino Acids

14.2.4.3. Attachment Factors

14.2.4.4. Growth Factors & Cytokines

14.2.4.5. Protease Inhibitors

14.2.4.6. Thrombin

14.2.4.7. Other Reagents

14.2.5. Accessories

14.3. Market Value Forecast By Application, 2020 to 2035

14.3.1. Biopharmaceutical Production

14.3.1.1. Monoclonal Antibodies

14.3.1.2. Vaccines

14.3.1.3. Cell and Gene Therapies

14.3.1.4. Other Therapies

14.3.2. Cellular and Molecular Biology

14.3.3. Research and Development and Drug Testing

14.3.4. Tissue Regeneration and Transplantation

14.3.5. Genetic Engineering

14.3.6. Diagnosis of Human Disease

14.3.7. Others

14.4. Market Value Forecast By End-user, 2020 to 2035

14.4.1. Pharmaceutical & Biotechnology Companies

14.4.2. Hospitals and Diagnostic Laboratories

14.4.3. Contract Manufacturing Organizations (CMOs)

14.4.4. Academic and Research Institutes

14.4.5. Others

14.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country / Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. Thermo Fisher Scientific Inc.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Merck KGaA

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Lonza

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. STEMCELL Technologies

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Miltenyi Biotec

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. HiMedia Laboratories

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Sartorius AG

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Becton, Dickinson and Company

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Corning Incorporated

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Danaher Corporation

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. FUJIFILM Irvine Scientific, Inc.

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. MP Biomedicals

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. PELOBIOTECH GmbH

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. GeminiBio LLC

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. REPROCELL Inc.

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Product Portfolio

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

15.3.16. Sino Biological, Inc.

15.3.16.1. Company Overview

15.3.16.2. Financial Overview

15.3.16.3. Product Portfolio

15.3.16.4. Business Strategies

15.3.16.5. Recent Developments

15.3.17. Takara Bio Inc.

15.3.17.1. Company Overview

15.3.17.2. Financial Overview

15.3.17.3. Product Portfolio

15.3.17.4. Business Strategies

15.3.17.5. Recent Developments

15.3.18. Biowest

15.3.18.1. Company Overview

15.3.18.2. Financial Overview

15.3.18.3. Product Portfolio

15.3.18.4. Business Strategies

15.3.18.5. Recent Developments

15.3.19. Celprogen Inc.

15.3.19.1. Company Overview

15.3.19.2. Financial Overview

15.3.19.3. Product Portfolio

15.3.19.4. Business Strategies

15.3.19.5. Recent Developments

15.3.20. Bio-Rad Laboratories, Inc.

15.3.20.1. Company Overview

15.3.20.2. Financial Overview

15.3.20.3. Product Portfolio

15.3.20.4. Business Strategies

15.3.20.5. Recent Developments

15.3.21. KCell Biosciences

15.3.21.1. Company Overview

15.3.21.2. Financial Overview

15.3.21.3. Product Portfolio

15.3.21.4. Business Strategies

15.3.21.5. Recent Developments

List of Tables

Table 01: Global Cell Culture Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Cell Culture Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 03: Global Cell Culture Market Value (US$ Bn) Forecast, By Media, 2020 to 2035

Table 04: Global Cell Culture Market Value (US$ Bn) Forecast, By Serum-free Media, 2020 to 2035

Table 05: Global Cell Culture Market Value (US$ Bn) Forecast, By Sera, 2020 to 2035

Table 06: Global Cell Culture Market Value (US$ Bn) Forecast, By Reagents, 2020 to 2035

Table 07: Global Cell Culture Market Value (US$ Bn) Forecast, By Albumin, 2020 to 2035

Table 08: Global Cell Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 09: Global Cell Culture Market Value (US$ Bn) Forecast, By Biopharmaceutical Production, 2020 to 2035

Table 10: Global Cell Culture Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Global Cell Culture Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 12: North America - Cell Culture Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13: North America - Cell Culture Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 14: North America Cell Culture Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 15: North America Cell Culture Market Value (US$ Bn) Forecast, By Media, 2020 to 2035

Table 16: North America Cell Culture Market Value (US$ Bn) Forecast, By Serum-free Media, 2020 to 2035

Table 17: North America Cell Culture Market Value (US$ Bn) Forecast, By Sera, 2020 to 2035

Table 18: North America Cell Culture Market Value (US$ Bn) Forecast, By Reagents, 2020 to 2035

Table 19: North America Cell Culture Market Value (US$ Bn) Forecast, By Albumin, 2020 to 2035

Table 20: North America - Cell Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 21: North America - Cell Culture Market Value (US$ Bn) Forecast, By Biopharmaceutical Production, 2020 to 2035

Table 22: North America - Cell Culture Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 23: Europe - Cell Culture Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 24: Europe - Cell Culture Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 25: Europe Cell Culture Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 26: Europe Cell Culture Market Value (US$ Bn) Forecast, By Media, 2020 to 2035

Table 27: Europe Cell Culture Market Value (US$ Bn) Forecast, By Serum-free Media, 2020 to 2035

Table 28: Europe Cell Culture Market Value (US$ Bn) Forecast, By Sera, 2020 to 2035

Table 29: Europe Cell Culture Market Value (US$ Bn) Forecast, By Reagents, 2020 to 2035

Table 30: Europe Cell Culture Market Value (US$ Bn) Forecast, By Albumin, 2020 to 2035

Table 31: Europe - Cell Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 32: Europe - Cell Culture Market Value (US$ Bn) Forecast, By Biopharmaceutical Production, 2020 to 2035

Table 33: Europe - Cell Culture Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 34: Asia Pacific - Cell Culture Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 35: Asia Pacific - Cell Culture Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 36: Asia Pacific Cell Culture Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 37: Asia Pacific Cell Culture Market Value (US$ Bn) Forecast, By Media, 2020 to 2035

Table 38: Asia Pacific Cell Culture Market Value (US$ Bn) Forecast, By Serum-free Media, 2020 to 2035

Table 39: Asia Pacific Cell Culture Market Value (US$ Bn) Forecast, By Sera, 2020 to 2035

Table 40: Asia Pacific Cell Culture Market Value (US$ Bn) Forecast, By Reagents, 2020 to 2035

Table 41: Asia Pacific Cell Culture Market Value (US$ Bn) Forecast, By Albumin, 2020 to 2035

Table 42: Asia Pacific - Cell Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 43: Asia Pacific - Cell Culture Market Value (US$ Bn) Forecast, By Biopharmaceutical Production, 2020 to 2035

Table 44: Asia Pacific - Cell Culture Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 45: Latin America - Cell Culture Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 46: Latin America - Cell Culture Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 47: Latin America Cell Culture Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 48: Latin America Cell Culture Market Value (US$ Bn) Forecast, By Media, 2020 to 2035

Table 49: Latin America Cell Culture Market Value (US$ Bn) Forecast, By Serum-free Media, 2020 to 2035

Table 50: Latin America Cell Culture Market Value (US$ Bn) Forecast, By Sera, 2020 to 2035

Table 51: Latin America Cell Culture Market Value (US$ Bn) Forecast, By Reagents, 2020 to 2035

Table 52: Latin America Cell Culture Market Value (US$ Bn) Forecast, By Albumin, 2020 to 2035

Table 53: Latin America - Cell Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 54: Latin America - Cell Culture Market Value (US$ Bn) Forecast, By Biopharmaceutical Production, 2020 to 2035

Table 55: Latin America - Cell Culture Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 56: Middle East & Africa - Cell Culture Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 57: Middle East & Africa - Cell Culture Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 58: Middle East & Africa Cell Culture Market Value (US$ Bn) Forecast, By Instruments, 2020 to 2035

Table 59: Middle East & Africa Cell Culture Market Value (US$ Bn) Forecast, By Media, 2020 to 2035

Table 60: Middle East & Africa Cell Culture Market Value (US$ Bn) Forecast, By Serum-free Media, 2020 to 2035

Table 61: Middle East & Africa Cell Culture Market Value (US$ Bn) Forecast, By Sera, 2020 to 2035

Table 62: Middle East & Africa Cell Culture Market Value (US$ Bn) Forecast, By Reagents, 2020 to 2035

Table 63: Middle East & Africa Cell Culture Market Value (US$ Bn) Forecast, By Albumin, 2020 to 2035

Table 64: Middle East & Africa - Cell Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 65: Middle East & Africa - Cell Culture Market Value (US$ Bn) Forecast, By Biopharmaceutical Production, 2020 to 2035

Table 66: Middle East & Africa - Cell Culture Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Cell Culture Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Cell Culture Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Cell Culture Market Revenue (US$ Bn), by Instruments, 2020 to 2035

Figure 04: Global Cell Culture Market Revenue (US$ Bn), by Media, 2020 to 2035

Figure 05: Global Cell Culture Market Revenue (US$ Bn), by Sera, 2020 to 2035

Figure 06: Global Cell Culture Market Revenue (US$ Bn), by Reagents, 2020 to 2035

Figure 07: Global Cell Culture Market Revenue (US$ Bn), by Accessories, 2020 to 2035

Figure 08: Global Cell Culture Market Value Share Analysis, By Application, 2024 and 2035

Figure 09: Global Cell Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 10: Global Cell Culture Market Revenue (US$ Bn), by Biopharmaceutical Production, 2020 to 2035

Figure 11: Global Cell Culture Market Revenue (US$ Bn), by Cellular and Molecular Biology, 2020 to 2035

Figure 12: Global Cell Culture Market Revenue (US$ Bn), by Research and Development and Drug Testing, 2020 to 2035

Figure 13: Global Cell Culture Market Revenue (US$ Bn), by Tissue Regeneration and Transplantation, 2020 to 2035

Figure 14: Global Cell Culture Market Revenue (US$ Bn), by Genetic Engineering, 2020 to 2035

Figure 15: Global Cell Culture Market Revenue (US$ Bn), by Diagnosis of Human Disease, 2020 to 2035

Figure 16: Global Cell Culture Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Cell Culture Market Value Share Analysis, By End-user, 2024 and 2035

Figure 18: Global Cell Culture Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 19: Global Cell Culture Market Revenue (US$ Bn), by Pharmaceutical & Biotechnology Companies, 2020 to 2035

Figure 20: Global Cell Culture Market Revenue (US$ Bn), by Hospitals and Diagnostic Laboratories, 2020 to 2035

Figure 21: Global Cell Culture Market Revenue (US$ Bn), by Contract Manufacturing Organizations (CMOs), 2020 to 2035

Figure 22: Global Cell Culture Market Revenue (US$ Bn), by Academic and Research Institutes, 2020 to 2035

Figure 23: Global Cell Culture Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 24: Global Cell Culture Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Cell Culture Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America - Cell Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America - Cell Culture Market Value Share Analysis, by Country, 2024 and 2035

Figure 28: North America - Cell Culture Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 29: North America - Cell Culture Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 30: North America - Cell Culture Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 31: North America - Cell Culture Market Value Share Analysis, By Application, 2024 and 2035

Figure 32: North America - Cell Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 33: North America - Cell Culture Market Value Share Analysis, By End-user, 2024 and 2035

Figure 34: North America - Cell Culture Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 35: Europe - Cell Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: Europe - Cell Culture Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 37: Europe - Cell Culture Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 38: Europe - Cell Culture Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 39: Europe - Cell Culture Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 40: Europe - Cell Culture Market Value Share Analysis, By Application, 2024 and 2035

Figure 41: Europe - Cell Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 42: Europe - Cell Culture Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Europe - Cell Culture Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Asia Pacific - Cell Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific - Cell Culture Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Asia Pacific - Cell Culture Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Asia Pacific - Cell Culture Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 48: Asia Pacific - Cell Culture Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 49: Asia Pacific - Cell Culture Market Value Share Analysis, By Application, 2024 and 2035

Figure 50: Asia Pacific - Cell Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 51: Asia Pacific - Cell Culture Market Value Share Analysis, By End-user, 2024 and 2035

Figure 52: Asia Pacific - Cell Culture Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 53: Latin America - Cell Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Latin America - Cell Culture Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 55: Latin America - Cell Culture Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 56: Latin America - Cell Culture Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 57: Latin America - Cell Culture Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 58: Latin America - Cell Culture Market Value Share Analysis, By Application, 2024 and 2035

Figure 59: Latin America - Cell Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 60: Latin America - Cell Culture Market Value Share Analysis, By End-user, 2024 and 2035

Figure 61: Latin America - Cell Culture Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 62: Middle East & Africa - Cell Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 63: Middle East & Africa - Cell Culture Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 64: Middle East & Africa - Cell Culture Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 65: Middle East & Africa - Cell Culture Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 66: Middle East & Africa - Cell Culture Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 67: Middle East & Africa - Cell Culture Market Value Share Analysis, By Application, 2024 and 2035

Figure 68: Middle East & Africa - Cell Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 69: Middle East & Africa - Cell Culture Market Value Share Analysis, By End-user, 2024 and 2035

Figure 70: Middle East & Africa - Cell Culture Market Attractiveness Analysis, By End-user, 2025 to 2035