Reports

Reports

Adoption of Direct-to-Consumer Laboratory Testing amid Covid-19 Pandemic

The Europe direct-to-consumer laboratory testing market witnessed an increasing demand due to consumer awareness in European countries. The increasing prevalence of infectious diseases post-pandemic is also driving the growth of the Europe direct-to-consumer laboratory testing market. Advancements in healthcare and adoption of direct-to-consumer laboratory testing methods are due to the rapidly spreading coronavirus in the European countries. Companies in the Europe direct-to-consumer laboratory testing market are focused on providing their services to cater to the increasing demand for consumer-driven laboratory testing procedures. These companies are striving to grab lucrative revenue opportunities by conducting rapid testing outside clinics and hospitals. Market players are entering into mergers & agreements with contract manufacturers to develop necessary testing kits that can be directly used by consumers.

Popularity Due to Increasing Consumer Awareness in European Countries

The Europe direct-to-consumer laboratory testing market is expected to surpass US$ 7.8 Bn by 2031. In countries such as Spain, Germany, France, and Italy, consumers are more aware of the advantages of direct-to-consumer laboratory tests over conventional laboratory testing methods. Increasing demand for disease risk assessment tests, COVID-19 tests, pregnancy tests, and various other nutrigenetics tests are boosting the Europe direct-to-consumer laboratory testing market. Governments are investing in promoting awareness and importance of such testing methods to cater to the increasing demand from consumers. The rising presence of companies and market players to provide these convenience services also fuels the Europe direct-to-consumer laboratory testing market.

Increasing Geriatric Population and Growing Prevalence of Infectious Diseases

With changing lifestyles and increasing prevalence of infectious diseases such as coronavirus, HIV, Influenza, etc., there is a continuous demand for rapid diagnosis and treatment. The rise in the number of lifestyle diseases such as diabetes, heart diseases, obesity, hypertension, cancer, etc. has augmented the demand for convenient diagnostic tests. Rapid test procedures, availability of test kits, and accurate results can prevent the spreading of such diseases. People are adopting innovative healthcare practices with rapid advancements in technologies. The increasing geriatric population in Europe is responsible for the increasing demand for convenient direct-to-consumer laboratory tests (DTC), which, in turn, boost the Europe direct-to-consumer laboratory testing market growth. Ongoing research & development in the direct-to-consumer procedures to perform variety of tests is likely to drive market in Europe.

Rapid Advancements in Healthcare, Test Confidentiality, and Convenience

Due to rapid advancements in the healthcare industry, acceptance of telehealth practices, and digitalization, people are becoming smarter to take advantage of recent trends and technologies that are being used in healthcare. Direct-to-consumer laboratory tests allow consumers to save their time and efforts to visit medical professionals for disease diagnosis. Direct-to-consumer laboratory tests can be ordered online from laboratory and test results are used to monitor health condition and to find out unknown medical disorders. This is the efficient way to involve consumer in the clinical diagnosis process; hence, they are called consumer-focused. The increasing popularity of such tests is due to its confidentiality and convenience where consumer need not have to wait for test results and tiring procedure to meet healthcare professionals. This factor contributes to the growth of the Europe direct-to-consumer laboratory testing market.

Analysts’ Viewpoint

Increased awareness and genetic research & development activities initiated by various countries are driving the market in the region. The acceptance of modern technological practices introduced in the healthcare industry for the betterment of patients is also contributing to the Europe direct-to-consumer laboratory testing market growth. Consumer-driven testing is widely popular in European countries, due to its increased awareness, convenience, and accurate diagnosis of various health conditions. Increasing efforts of companies operating in the Europe direct-to-consumer laboratory testing market boost the demand for personalized healthcare services on a timely basis, where consumers can order test kits online and laboratory professionals delivers test results directly to the consumers without the involvement of health practitioners.

Europe Direct-to-Consumer Laboratory Testing Market: Overview

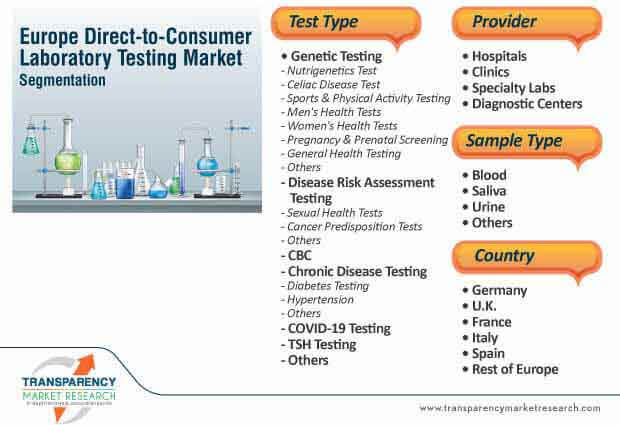

Europe Direct-to-Consumer Laboratory Testing Market: Key Segments

Europe Direct-to-Consumer Laboratory Testing Market: Regional Outlook

Companies Covered in Europe Direct-to-Consumer Laboratory Testing Market Report

Europe Direct-to-Consumer Laboratory Testing Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 603 Mn |

|

Market Forecast Value in 2031 |

US$ 7.8 Bn |

|

Growth Rate (CAGR) |

26% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key industry events, etc. |

|

Competition Landscape |

Market share analysis by company (2020) |

|

Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, key financials, etc. |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regions Covered |

Europe |

|

Germany |

|

|

U.K. |

|

|

France |

|

|

Italy |

|

|

Spain |

|

|

Rest of Europe |

|

|

Companies Profiled |

23andMe, Inc. |

|

Ancestry |

|

|

CircleDNA |

|

|

Eurofins Scientific |

|

|

Family Tree DNA (Gene by Gene) |

|

|

Laboratory Corporation of America Holdings |

|

|

Living DNA Ltd. |

|

|

Medichecks.com Ltd. |

|

|

MyHeritage Ltd. |

|

|

MyMedLab, Inc. |

|

|

Quest Diagnostics Incorporated |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Europe direct-to-consumer laboratory testing market is expected to surpass US$ 7.8 Bn by 2031

Europe direct-to-consumer laboratory testing market is driven by increasing geriatric population and growing prevalence of infectious diseases

Europe direct-to-consumer laboratory testing market is driven by increasing geriatric population and growing prevalence of infectious diseases

The diagnostic centers segment dominated the direct-to-consumer laboratory testing market in Europe during the forecast period.

Key players in the direct-to-consumer laboratory testing market include 23andMe, Inc., Ancestry, CircleDNA, Eurofins Scientific, Family Tree DNA (Gene by Gene)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Europe Direct-to-Consumer Laboratory Testing Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Europe Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industrial Events (licensing partnerships/mergers & acquisitions)

5.2. Disease Prevalence & Incidence Rate

5.3. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Europe Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Sample Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Sample Type, 2017–2031

6.3.1. Blood

6.3.2. Urine

6.3.3. Saliva

6.3.4. Others

6.4. Market Attractiveness Analysis, by Sample Type

7. Europe Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Test Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Test Type, 2017–2031

7.3.1. Genetic Testing

7.3.1.1. Nutrigenetics Test

7.3.1.1.1. Weight Control

7.3.1.1.2. Lactose Intolerance

7.3.1.1.3. Others

7.3.1.2. Celiac Disease Test

7.3.1.3. Sports & Physical Activity Testing

7.3.1.4. Men's Health Tests

7.3.1.5. Women's Health Tests

7.3.1.6. Pregnancy & Prenatal Screening Test

7.3.1.7. General Health Testing

7.3.1.8. Others

7.3.2. Disease Risk Assessment Testing

7.3.2.1. Sexual Health Tests

7.3.2.1.1. HIV

7.3.2.1.2. Chlamydia

7.3.2.1.3. Others

7.3.2.2. Cancer Predisposition Tests

7.3.2.3. Others

7.3.3. CBC

7.3.4. Chronic Disease Testing

7.3.4.1. Diabetes Testing

7.3.4.2. Hypertension

7.3.4.3. Others

7.3.5. COVID-19 Testing

7.3.6. TSH Testing

7.3.7. Others

7.4. Market Attractiveness Analysis, by Test Type

8. Europe Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Provider

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Provider, 2017–2031

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Speciality Labs

8.3.4. Diagnostic Centres

8.4. Market Attractiveness Analysis, by Provider

9. Germany Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Sample Type, 2017–2031

9.2.1. Blood

9.2.2. Urine

9.2.3. Saliva

9.2.4. Others

9.3. Market Value Forecast, by Test Type, 2017–2031

9.3.1. Genetic Testing

9.3.1.1. Nutrigenetics Test

9.3.1.1.1. Weight Control

9.3.1.1.2. Lactose Intolerance

9.3.1.1.3. Others

9.3.1.2. Celiac Disease Test

9.3.1.3. Sports & Physical Activity Testing

9.3.1.4. Men's Health Tests

9.3.1.5. Women's Health Tests

9.3.1.6. Pregnancy & Prenatal Screening Test

9.3.1.7. General Health Testing

9.3.1.8. Others

9.3.2. Disease Risk Assessment Testing

9.3.2.1. Sexual Health Tests

9.3.2.1.1. HIV

9.3.2.1.2. Chlamydia

9.3.2.1.3. Others

9.3.2.2. Cancer Predisposition Tests

9.3.2.3. Others

9.3.3. CBC

9.3.4. Chronic Disease Testing

9.3.4.1. Diabetes Testing

9.3.4.2. Hypertension

9.3.4.3. Others

9.3.5. COVID-19 Testing

9.3.6. TSH Testing

9.3.7. Others

9.4. Market Value Forecast, by Provider, 2017–2031

9.4.1. Hospitals

9.4.2. Clinics

9.4.3. Speciality Labs

9.4.4. Diagnostic Centres

10. U.K. Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Sample Type, 2017–2031

10.2.1. Blood

10.2.2. Urine

10.2.3. Saliva

10.2.4. Others

10.3. Market Value Forecast, by Test Type, 2017–2031

10.3.1. Genetic Testing

10.3.1.1. Nutrigenetics Test

10.3.1.1.1. Weight Control

10.3.1.1.2. Lactose Intolerance

10.3.1.1.3. Others

10.3.1.2. Celiac Disease Test

10.3.1.3. Sports & Physical Activity Testing

10.3.1.4. Men's Health Tests

10.3.1.5. Women's Health Tests

10.3.1.6. Pregnancy & Prenatal Screening Test

10.3.1.7. General Health Testing

10.3.1.8. Others

10.3.2. Disease Risk Assessment Testing

10.3.2.1. Sexual Health Tests

10.3.2.1.1. HIV

10.3.2.1.2. Chlamydia

10.3.2.1.3. Others

10.3.2.2. Cancer Predisposition Tests

10.3.2.3. Others

10.3.2.4. CBC

10.3.2.5. Chronic Disease Testing

10.3.2.5.1. Diabetes Testing

10.3.2.5.2. Hypertension

10.3.2.5.3. Others

10.3.2.6. COVID-110 Testing

10.3.2.7. TSH Testing

10.3.2.8. Others

10.4. Market Value Forecast, by Provider, 2017–2031

10.4.1. Hospitals

10.4.2. Clinics

10.4.3. Speciality Labs

10.4.4. Diagnostic Centres

11. France Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Sample Type, 2017–2031

11.2.1. Blood

11.2.2. Urine

11.2.3. Saliva

11.2.4. Others

11.3. Market Value Forecast, by Test Type, 2017–2031

11.3.1. Genetic Testing

11.3.1.1. Nutrigenetics Test

11.3.1.1.1. Weight Control

11.3.1.1.2. Lactose Intolerance

11.3.1.1.3. Others

11.3.1.2. Celiac Disease Test

11.3.1.3. Sports & Physical Activity Testing

11.3.1.4. Men's Health Tests

11.3.1.5. Women's Health Tests

11.3.1.6. Pregnancy & Prenatal Screening Test

11.3.1.7. General Health Testing

11.3.1.8. Others

11.3.2. Disease Risk Assessment Testing

11.3.2.1. Sexual Health Tests

11.3.2.1.1. HIV

11.3.2.1.2. Chlamydia

11.3.2.1.3. Others

11.3.2.2. Cancer Predisposition Tests

11.3.2.3. Others

11.3.3. CBC

11.3.4. Chronic Disease Testing

11.3.4.1. Diabetes Testing

11.3.4.2. Hypertension

11.3.4.3. Others

11.3.5. COVID-19 Testing

11.3.6. TSH Testing

11.3.7. Others

11.4. Market Value Forecast, by Provider, 2017–2031

11.4.1. Hospitals

11.4.2. Clinics

11.4.3. Speciality Labs

11.4.4. Diagnostic Centres

12. Italy Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Sample Type, 2017–2031

12.2.1. Blood

12.2.2. Urine

12.2.3. Saliva

12.2.4. Others

12.3. Market Value Forecast, by Test Type, 2017–2031

12.3.1. Genetic Testing

12.3.1.1. Nutrigenetics Test

12.3.1.1.1. Weight Control

12.3.1.1.2. Lactose Intolerance

12.3.1.1.3. Others

12.3.1.2. Celiac Disease Test

12.3.1.3. Sports & Physical Activity Testing

12.3.1.4. Men's Health Tests

12.3.1.5. Women's Health Tests

12.3.1.6. Pregnancy & Prenatal Screening Test

12.3.1.7. General Health Testing

12.3.1.8. Others

12.3.2. Disease Risk Assessment Testing

12.3.2.1. Sexual Health Tests

12.3.2.1.1. HIV

12.3.2.1.2. Chlamydia

12.3.2.1.3. Others

12.3.2.2. Cancer Predisposition Tests

12.3.2.3. Others

12.3.3. CBC

12.3.4. Chronic Disease Testing

12.3.4.1. Diabetes Testing

12.3.4.2. Hypertension

12.3.4.3. Others

12.3.5. COVID-19 Testing

12.3.6. TSH Testing

12.3.7. Others

12.4. Market Value Forecast, by Provider, 2017–2031

12.4.1. Hospitals

12.4.2. Clinics

12.4.3. Speciality Labs

12.4.4. Diagnostic Centres

13. Spain Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Sample Type, 2017–2031

13.2.1. Blood

13.2.2. Urine

13.2.3. Saliva

13.2.4. Others

13.3. Market Value Forecast, by Test Type, 2017–2031

13.3.1. Genetic Testing

13.3.1.1. Nutrigenetics Test

13.3.1.1.1. Weight Control

13.3.1.1.2. Lactose Intolerance

13.3.1.1.3. Others

13.3.1.2. Celiac Disease Test

13.3.1.3. Sports & Physical Activity Testing

13.3.1.4. Men's Health Tests

13.3.1.5. Women's Health Tests

13.3.1.6. Pregnancy & Prenatal Screening Test

13.3.1.7. General Health Testing

13.3.1.8. Others

13.3.2. Disease Risk Assessment Testing

13.3.2.1. Sexual Health Tests

13.3.2.1.1. HIV

13.3.2.1.2. Chlamydia

13.3.2.1.3. Others

13.3.2.2. Cancer Predisposition Tests

13.3.2.3. Others

13.3.3. CBC

13.3.4. Chronic Disease Testing

13.3.4.1. Diabetes Testing

13.3.4.2. Hypertension

13.3.4.3. Others

13.3.5. COVID-19 Testing

13.3.6. TSH Testing

13.3.7. Others

13.4. Market Value Forecast, by Provider, 2017–2031

13.4.1. Hospitals

13.4.2. Clinics

13.4.3. Speciality Labs

13.4.4. Diagnostic Centres

14. Rest of Europe Countries Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Sample Type, 2017–2031

14.2.1. Blood

14.2.2. Urine

14.2.3. Saliva

14.2.4. Others

14.3. Market Value Forecast, by Test Type, 2017–2031

14.3.1. Genetic Testing

14.3.1.1. Nutrigenetics Test

14.3.1.1.1. Weight Control

14.3.1.1.2. Lactose Intolerance

14.3.1.1.3. Others

14.3.1.2. Celiac Disease Test

14.3.1.3. Sports & Physical Activity Testing

14.3.1.4. Men's Health Tests

14.3.1.5. Women's Health Tests

14.3.1.6. Pregnancy & Prenatal Screening Test

14.3.1.7. General Health Testing

14.3.1.8. Others

14.3.2. Disease Risk Assessment Testing

14.3.2.1. Sexual Health Tests

14.3.2.1.1. HIV

14.3.2.1.2. Chlamydia

14.3.2.1.3. Others

14.3.2.2. Cancer Predisposition Tests

14.3.2.3. Others

14.3.3. CBC

14.3.4. Chronic Disease Testing

14.3.4.1. Diabetes Testing

14.3.4.2. Hypertension

14.3.4.3. Others

14.3.5. COVID-19 Testing

14.3.6. TSH Testing

14.3.7. Others

14.4. Market Value Forecast, by Provider, 2017–2031

14.4.1. Hospitals

14.4.2. Clinics

14.4.3. Speciality Labs

14.4.4. Diagnostic Centres

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Company Profiles

15.2.1. 23andMe, Inc.

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Strategic Overview

15.2.1.4. SWOT Analysis

15.2.2. Ancestry

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. SWOT Analysis

15.2.3. CircleDNA

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. SWOT Analysis

15.2.4. Eurofins Scientific

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. SWOT Analysis

15.2.5. Family Tree DNA (Gene by Gene)

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. SWOT Analysis

15.2.6. Laboratory Corporation of America Holdings

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.6.5. SWOT Analysis

15.2.7. Living DNA Ltd.

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. SWOT Analysis

15.2.8. Medichecks.com Ltd.

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. SWOT Analysis

15.2.9. MyHeritage Ltd.

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. SWOT Analysis

15.2.10. MyMedLab, Inc.

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. SWOT Analysis

15.2.11. Quest Diagnostics Incorporated

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.11.3. Financial Overview

15.2.11.4. Strategic Overview

15.2.11.5. SWOT Analysis

List of Tables

Table 01: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 02: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 03: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 04: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 05: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 06: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 07: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 08: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 09: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 10: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 11: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 12: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 13: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 14: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 15: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 16: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 17: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 18: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 19: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 20: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 21: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 22: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 23: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 24: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 25: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 26: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 27: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 28: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 29: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 30: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 31: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 32: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 33: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 34: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 35: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 36: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 37: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 38: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 39: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 40: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 41: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 42: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 43: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 44: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 45: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 46: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 47: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 48: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

Table 49: Rest of Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sample Type, 2017–2031

Table 50: Rest of Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 51: Rest of Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Genetic Testing, 2017–2031

Table 52: Rest of Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Nutrigenetics Test, 2017–2031

Table 53: Rest of Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Disease Risk Assessment Testing, 2017–2031

Table 54: Rest of Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Sexual Health Tests, 2017–2031

Table 55: Rest of Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Chronic Disease Testing, 2017–2031

Table 56: Rest of Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, by Provider, 2017–2031

List of Figures

Figure 01: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 02: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 03: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Blood, 2017–2031

Figure 04: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Urine, 2017–2031

Figure 05: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Urine, 2017–2031

Figure 06: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Others, 2017–2031

Figure 07: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 08: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 09: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Genetic Testing, 2017–2031

Figure 10: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Disease Risk Assessment Testing, 2017–2031

Figure 11: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by CBC, 2017–2031

Figure 12: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Chronic Disease Testing, 2017–2031

Figure 13: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by COVID-19 Testing, 2017–2031

Figure 14: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by TSH Testing, 2017–2031

Figure 15: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Others, 2017–2031

Figure 16: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 17: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031

Figure 18: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Hospitals, 2017–2031

Figure 19: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Clinics, 2017–2031

Figure 20: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Specialty Labs, 2017–2031

Figure 21: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Mn), by Diagnostic Centers, 2017–2031

Figure 22: Germany Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Germany Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 24: Germany Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 25: Germany Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 26: Germany Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 27: Germany Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 28: Germany Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031

Figure 29: U.K. Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: U.K. Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 31: U.K. Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 32: U.K. Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 33: U.K. Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 34: U.K. Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 35: U.K. Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031

Figure 36: France Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: France Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 38: France Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 39: France Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 40: France Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 41: France Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 42: France Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031

Figure 43: Italy Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 44: Italy Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 45: Italy Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 46: Italy Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 47: Italy Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 48: Italy Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 49: Italy Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031

Figure 50: Spain Direct-to-Consumer Laboratory Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 51: Spain Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Sample Type, 2020 and 2031

Figure 52: Spain Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Sample Type, 2021–2031

Figure 53: Spain Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Test Type, 2020 and 2031

Figure 54: Spain Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Test Type, 2021–2031

Figure 55: Spain Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Provider, 2020 and 2031

Figure 56: Spain Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Provider, 2021–2031