Reports

Reports

The chemical industry is witnessing the impact of the COVID-19. Manufacturers in the Europe bio-emulsion polymers market should be aware about government-provided financial assistance. As such, a decline in coronavirus cases has led to reopening of manufacturing plants and businesses. This is predicted to boost market growth.

Many governments have considered extending their lines of credit, lowering tax burden, and offering supply chain assistance during unprecedented times post COVID-19. Companies in the Europe bio-emulsion polymers market are expecting potential cash flow constraints from overseas operations. Hence, manufacturers should plan for emergency funding to prepare for new loan undertaking and avail tax incentives to keep economies running.

Biodegradable polymers, such as polylactic acid (PLA), are being chemically synthesized using monomers obtained from agro-resources. PLA is gaining increased visibility in automotive, packaging, and medicine applications. However, its poor thermal stability, intrinsic brittleness, and rigidity in large-scale applications are likely to inhibit market growth. After several R&D efforts, companies in the Europe bio-emulsion polymers market have introduced boron nitride (BN) as a reinforcement inorganic material in PLA to improve its properties.

Polylactic acid polymers integrated with boron nitride are being used in the production of waterproof films, labels, and bakery packaging materials. With the help of PLA-BN polymer materials, manufacturers in the Europe bio-emulsion polymers market are tapping into incremental opportunities in packaging end-use cases.

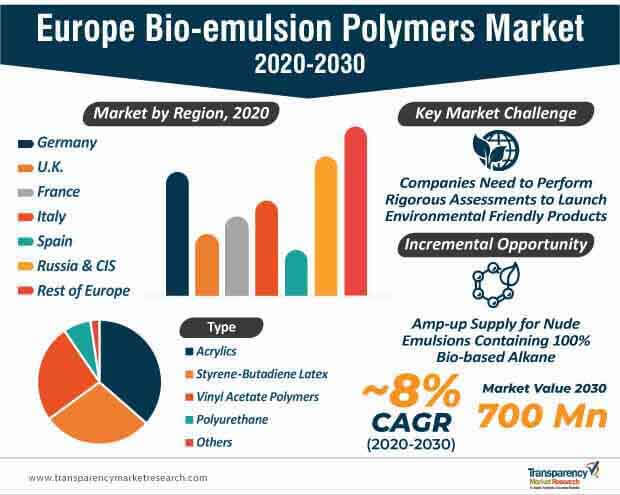

The Europe bio-emulsion polymers market is projected to expand at a healthy CAGR of ~8% during the forecast period. Bio-based raw materials for polymers are being highly publicized, since synthetic materials such as plastic today represent a major environmental problem. SEPPIC— a designer and supplier of specialty chemical products for health and wellbeing has amped up its supply of Sepilife™ Nude emulsion, which contains 100% bio-based alkane.

Manufacturers in the Europe bio-emulsion polymers market are producing easy-to-use liquid and powder polymers that are eliminating the need of neutralization, as polymers are pre-neutralized during the synthesis process. These liquid and powder polymers are omitting the need to add surfactants, since the inverse latex composition is adjusted to obtain a spontaneous phase inversion when added in water.

Bio-based paints are creating value grab opportunities for companies in the Europe bio-emulsion polymers market. For instance, the Dow Chemical Company— a U.S. multinational chemical corporation has launched PRIMAL™, a bio-based acrylic emulsion produced from carbon obtained from plants. Thus, European manufacturers are increasing the availability of USDA (United States Department of Agriculture) certified products to boost their credibility credentials in the market.

The Europe bio-emulsion polymers market is predicted to reach a valuation of ~US$ 700 Mn by the end of 2030. Renewable feedstocks are being used in the production of waterborne polymeric dispersions.

Social awareness about environmental impact, owing to synthetic polymers has catalyzed growth of the Europe bio-emulsion polymers market. Renewable resource reagents, such as monomers, crosslinkers, and surfactants, are gaining prominence in emulsion and mini-emulsion polymerization processes. However, manufacturers need to perform sustainability assessment of new reagents and processes in order to develop environment-friendly products. Such assessments have led to innovations in sustainable waterborne coatings and adhesives.

The increasing number of PhD position job opportunities in the field of sustainable chemistry is grabbing the attention of companies in the Europe bio-emulsion polymers market. Manufacturers should team up with students and researchers keen on developing stable emulsions from renewable feedstock. Companies are boosting their R&D muscle in innovative chemical pathways by combining organic and polymer chemistries to develop bio-based emulsions.

Analysts’ Viewpoint

Various coronavirus implications might involve customs and duties as well as transfer-pricing considerations, if substitute components or materials are internally sourced. Apart from acrylics, bio-based alkanes are gaining prominence in emulsion polymers and omitting the need to add surfactants in order to obtain an oil-in-water type emulsion. Bio-based alkanes are eliminating the need for high shear during formulation, owing to electrostatic repulsions between the anionic groups. Nanotechnology holds promising potentials in bio-emulsion polymerization processes. However, manufacturers should conduct sustainability assessment of new reagents and processes in order to develop environment-friendly products. Hence, companies in the Europe bio-emulsion polymers market must increase their research expenditure and collaborate with PhD researchers to innovate in bio-based emulsions.

Europe Bio-emulsion Polymers Market: Overview

Rise in Usage of Bio-emulsion Polymers in Paints & Coatings Treatment Sector: A Key Driver

Increase in Demand for Acrylic-based Bio-emulsion Polymers

Rise in Applications of Bio-emulsion Polymers in Paints & Coatings

Europe Bio-emulsion Polymers Market: Competition Landscape

Europe Bio-emulsion Polymers Market: Key Developments

Europe Bio-emulsion Polymers Market is expected to reach US$ 700 Mn By 2030

Europe Bio-emulsion Polymers Market is estimated to rise at a CAGR of 8% during forecast period

Bio-emulsion polymers market in Europe is driven by the rise in demand for bio-emulsion polymers in the paints & coatings application

Key players of Europe Bio-emulsion Polymers Market are BASF SE, Aquapak Polymers Ltd, Lactips, Arkema S.A., and DSM

1. Executive Summary

1.1. Europe Bio-emulsion Polymer Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

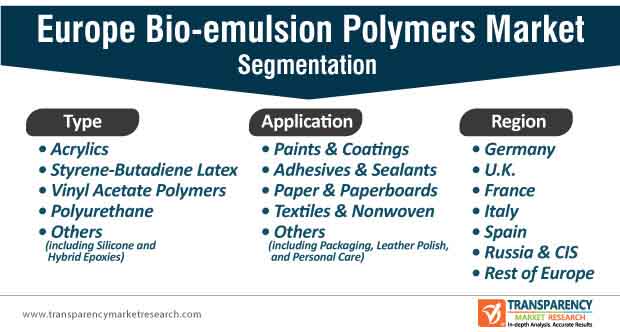

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Bio-emulsion Polymers Market Production Outlook

5. Bio-emulsion Polymers Price Trend Analysis, 2019–2030

5.1. By Type

5.2. By Country and Sub-region

6. Europe Bio-emulsion Polymers Market Analysis and Forecast, by Type, 2019–2030

6.1. Introduction and Definitions

6.2. Europe Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

6.2.1. Acrylics

6.2.2. Styrene-Butadiene Latex

6.2.3. Vinyl Acetate Polymers

6.2.4. Polyurethane

6.2.5. Others

6.3. Europe Bio-emulsion Polymers Market Attractiveness, by Type

7. Europe Bio-emulsion Polymers Market Analysis and Forecast, by Application, 2019–2030

7.1. Introduction and Definitions

7.2. Europe Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

7.2.1. Paints & Coatings

7.2.2. Adhesives & Sealants

7.2.3. Paper & Paperboards

7.2.4. Textiles & Non-woven

7.2.5. Others

7.3. Europe Bio-emulsion Polymers Market Attractiveness, by Application

8. Europe Bio-emulsion Polymers Market Analysis and Forecast, by Country and Sub-region, 2019–2030

8.1. Key Findings

8.2. Europe Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

8.2.1. Germany

8.2.2. U.K.

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Russia & CIS

8.2.7. Rest of Europe

8.3. Europe Bio-emulsion Polymers Market Attractiveness, by Country and Sub-region

8.3.1. Germany Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

8.3.2. Germany Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.3.3. France Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

8.3.4. France Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.3.5. U.K. Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

8.3.6. U.K. Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.3.7. Italy Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

8.3.8. Italy Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.3.9. Spain Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

8.3.10. Spain Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.3.11. Russia & CIS Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

8.3.12. Russia & CIS Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.3.13. Rest of Europe Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2019–2030

8.3.14. Rest of Europe Bio-emulsion Polymers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9. Competition Landscape

9.1. Europe Bio-emulsion Polymers Company Market Share Analysis, 2019

9.2. Product Mapping

9.2.1. By Type

9.2.2. By Application

9.3. Competition Matrix

9.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

9.4.1. BASF SE

9.4.1.1. Company Description

9.4.1.2. Business Overview

9.4.1.3. Financial Overview

9.4.1.4. Strategic Overview

9.4.2. Aquapak Polymers Ltd.

9.4.2.1. Company Description

9.4.2.2. Business Overview

9.4.3. Lactips

9.4.3.1. Company Description

9.4.3.2. Business Overview

9.4.4. Arkema S.A.

9.4.4.1. Company Description

9.4.4.2. Business Overview

9.4.5. DSM

9.4.5.1. Company Description

9.4.5.2. Business Overview

9.4.5.3. Financial Overview

9.4.5.4. Strategic Overview

10. Primary Research: Key Insights

11. Appendix

List of Tables

Table 01: Europe Bio-emulsion Polymers Market Volume (Tons) Forecast, by Type, 2019–2030

Table 02: Europe Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 03: Europe Bio-emulsion Polymers Market Volume (Tons) Forecast, by Application, 2019–2030

Table 04: Europe Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 05: Europe Bio-emulsion Polymers Market Volume (Tons) Forecast, by Country and Sub-region, 2019–2030

Table 06: Europe Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 07: Germany Bio-emulsion Polymers Market Volume (Tons) Forecast, by Type, 2019–2030

Table 08: Germany Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 09: Germany Bio-emulsion Polymers Market Volume (Tons) Forecast, by Application, 2019–2030

Table 10: Germany Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 11: U.K. Bio-emulsion Polymers Market Volume (Tons) Forecast, by Type, 2019–2030

Table 12: U.K. Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 13: U.K. Bio-emulsion Polymers Market Volume (Tons) Forecast, by Application, 2019–2030

Table 14: U.K. Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 15: France Bio-emulsion Polymers Market Volume (Tons) Forecast, by Type, 2019–2030

Table 16: France Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 17: France Bio-emulsion Polymers Market Volume (Tons) Forecast, by Application, 2019–2030

Table 18: France Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 19: Italy Bio-emulsion Polymers Market Volume (Tons) Forecast, by Type, 2019–2030

Table 20: Italy Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 21: Italy Bio-emulsion Polymers Market Volume (Tons) Forecast, by Application, 2019–2030

Table 22: Italy Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 23: Spain Bio-emulsion Polymers Market Volume (Tons) Forecast, by Type, 2019–2030

Table 24: Spain Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 25: Spain Bio-emulsion Polymers Market Volume (Tons) Forecast, by Application, 2019–2030

Table 26: Spain Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 27: Russia & CIS Bio-emulsion Polymers Market Volume (Tons) Forecast, by Type, 2019–2030

Table 28: Russia & CIS Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 29: Russia & CIS Bio-emulsion Polymers Market Volume (Tons) Forecast, by Application, 2019–2030

Table 30: Russia & CIS Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 31: Rest of Europe Bio-emulsion Polymers Market Volume (Tons) Forecast, by Type, 2019–2030

Table 32: Rest of Europe Bio-emulsion Polymers Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 33: Rest of Europe Bio-emulsion Polymers Market Volume (Tons) Forecast, by Application, 2019–2030

Table 34: Rest of Europe Bio-emulsion Polymers Market Value(US$ Mn) Forecast, by Application, 2019–2030

List of Figures

Figure 01: Market Share of Key Players Operating in Adhesives Market

Figure 02: Share of Each Segment of Europe Paints & Coatings Market (2018)

Figure 03: Global Paints & Coatings Market (Projected Share in Each Region)

Figure 04: Price Trend Analysis (US$/Ton), 2019-2030, by Type

Figure 05: Europe Bio-emulsion Polymers Market Volume Share Analysis, by Type, 2019, 2024, and 2030

Figure 06: Europe Bio-emulsion Polymers Market Attractiveness Analysis, by Type

Figure 07: Europe Bio-emulsion Polymers Market Volume Share Analysis, by Application, 2019, 2024, and 2030

Figure 08: Europe Bio-emulsion Polymers Market Attractiveness Analysis, by Application

Figure 09: Europe Bio-emulsion Polymers Market Volume Share Analysis, by Country and Sub-region, 2019, 2024, and 2030

Figure 10: Europe Bio-emulsion Polymers Market Attractiveness Analysis, by Country and Sub-region

Figure 11: Bio-emulsion Polymers Market Share Analysis, by Company, 2019