Reports

Reports

Surfactants Market – An Overview

Organic compounds, derived from oleo chemical raw materials or petrochemical raw materials, the surface active agents or surfactants are use for thro properties such as foaming/defoaming, solvency, dispersion, and emulsification. Besides, its lubricity also adds to its popularity. Known to be extensively used in personal care products, these are superior cleaners. Additionally, these are also used in paints and coatings, and emulsion and polymerization.

Over the forecast period of 2015 to 2024, the surfactants market in the Asia Pacific is sett to chart a moderate yet solid growth rate, helping create new opportunities and generate a higher market worth.

Factors – trends and drivers – that are deemed significant in the market are elaborated upon below.

Asia Pacific Surfactants Market: Overview

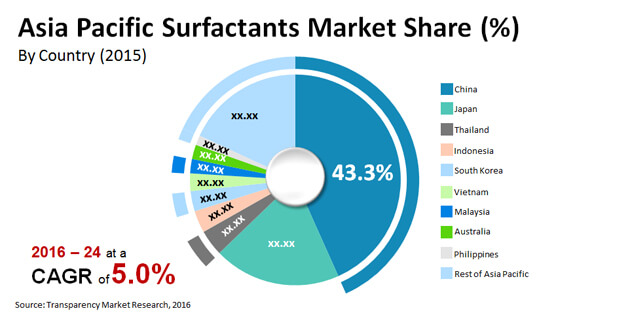

Surfactants or surface active agents are organic compounds that are manufactured using petrochemical raw materials such as ethylene and benzene or oleo-chemical raw materials such as coconut oil or palm oil. Surfactants are primarily used for their properties such as emulsification, dispersion, solvency, foaming/de-foaming and lubricity of water-based compositions. Owing to these reasons, surfactants are being used in a wide range of personal care products, paints and coatings, and emulsion polymerization. The research report states that the Asia Pacific surfactants market was valued at US$4.1 bn in 2015 and is expected to be worth US$6.3 bn by the end of 2024. Between the forecast years of 2016 and 2024, the overall market is expected to surge at a CAGR of 5.0%.

Growing Demand for Beauty Products Ensures Steady Uptake of Surfactants in Asia Pacific Market

The Asia Pacific surfactants market is expected to benefit from the flourishing personal care industry and the increasing demand for emulsion polymerization. The growing concerns pertaining to beauty, hygiene, and aesthetics have led to a skyrocketing demand for surfactants in the personal care industry in Asia Pacific. The regional market is also being fueled due to improving per capita incomes of consumers, changing lifestyles, and rise in the standard of living. Furthermore, the upstream integration with raw material suppliers and the expanding geographical reach is also expected to offer lucrative opportunities to manufacturers of emulsion polymers.

On the basis of product type, the Asia Pacific surfactant market is segmented into cationic, anionic, non ionic, and amphoteric product types. The non ionic surfactants held a dominant share in the overall market in 2015 in terms of volume. This segment accounted for nearly 30% of the overall market in 2015 due to their increasing adoption in the production of agrochemicals, paints and coatings, and concrete. During the forecast period, cationic and amphoteric surfactants are also expected to show steady growth as they have a higher purity and are thus expensive than their counterparts.

China Poised to Dominate Asia Pacific Surfactants Market as Key Consumer and Producer

The Asia Pacific surfactants market is segmented in countries such as China, India, Japan, Thailand, South Korea, Indonesia, Malaysia, Vietnam, Philippines, South Korea, and Australia. Of these, China is expected to dominate the Asia Pacific surfactants market. As of 2015, China accounted for a share of about 45% in the overall market in terms of volume. The phenomenal demand for and production of paints and coatings has put China in the lead. Japan followed this lead closely as it has been assessed to be the leading market for personal care products across the globe. The improving per capita incomes in Asia Pacific, emerging economies, and rising chemicals industry is expected to boost the demand for surfactants in these countries throughout the forecast period.

Key players operating in the global surfactants market ADM, Akzo Nobel N. V., Galaxy Surfactants, Dow Chemical, BASF S.E, Huntsman Corporation, Lonza Group, Evonik Industries, P & G Chemicals, Clariant International Ltd., and Stepan Company. The competition in the Asia Pacific surfactants market is quite fragmented. Companies are expected to focus on expanding their facilities and working on product innovation to ensure that they stay ahead of the competition. Most of these players are also expected to focus on development of bio-based surfactants as consumers are realizing the adverse effects of using chemical ones.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Size, Indicative (US$ Mn)

3.2. Top Trends

4. Market Overview

4.1. Surfactants Market Overview

4.2. Market Indicators

4.3. Drivers and Restraints Analysis

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Asia Pacific Surfactants Market Price Range Analysis, 2015

4.5. Porter’s Analysis

4.5.1. Threat of Substitutes

4.5.2. Bargaining Power of Buyers

4.5.3. Bargaining Power of Suppliers

4.5.4. Threat of New Entrants

4.5.5. Degree of Competition

4.6. Value Chain Analysis

5. Surfactants Market Analysis, by Product

5.1. Key Findings

5.2. Introduction

5.3. Surfactants Market Value Share Analysis, by Product

5.4. Surfactants Market Forecast, by Product

5.4.1. Cationic, 2015 – 2024

5.4.2. Anionic, 2015 – 2024

5.4.3. Amphoteric, 2015 – 2024

5.4.4. Non ionic, 2015 – 2024

5.4.5. Others, 2015 – 2024

6. Surfactants Market Analysis, by Application

6.1. Key Findings

6.2. Introduction

6.3. Surfactants Market Value Share Analysis, by Application

6.4. Surfactants Market Forecast, by Application

6.4.1. Personal Care, 2015 – 2024

6.4.2. Oilfield Chemicals, 2015 – 2024

6.4.3. Paints & Coatings, 2015 – 2024

6.4.4. Emulsion Polymerization, 2015 – 2024

6.4.5. Agrochemicals, 2015 – 2024

6.4.6. Concrete Additives, 2015 – 2024

7. Surfactants Market Analysis, by Country

7.1. Key Findings

7.2. Surfactants Market Value Share Analysis, by Country

7.3. Surfactants Market Forecast, by Country

7.3.1. China

7.3.2. Japan

7.3.3. Indonesia

7.3.4. Malaysia

7.3.5. Thailand

7.3.6. Vietnam

7.3.7. Philippines

7.3.8. South Korea

7.3.9. Australia

7.4. Market Attractiveness Analysis, by Country

8. South Korea Surfactants Market Analysis

8.1. Key Findings

8.2. South Korea Surfactants Market Value Share Analysis, by Product

8.3. South Korea Surfactants Market Forecast, by Product

8.3.1. Cationic, 2015 – 2024

8.3.2. Anionic, 2015 – 2024

8.3.3. Amphoteric, 2015 – 2024

8.3.4. Non ionic, 2015 – 2024

8.3.5. Others, 2015 – 2024

8.4. South Korea Surfactants Market Value Share Analysis, by Application

8.5. South Korea Surfactants Market Forecast, by Application

8.5.1. Personal Care, 2015 – 2024

8.5.2. Oilfield Chemicals, 2015 – 2024

8.5.3. Paints & Coatings, 2015 – 2024

8.5.4. Emulsion Polymerization, 2015 – 2024

8.5.5. Agrochemicals, 2015 – 2024

8.5.6. Concrete Additives, 2015 – 2024

8.6. South Korea Market Outlook, By Application

8.6.1. Personal Care

8.6.2. Oilfield Chemicals

8.6.3. Paints & Coatings

8.6.4. Emulsion Polymerization

8.6.5. Agrochemicals

8.6.6. Concrete Additives

9. Japan Surfactants Market Analysis

9.1. Key Findings

9.2. Japan Surfactants Market Value Share Analysis, by Product

9.3. Japan Surfactants Market Forecast, by Product

9.3.1. Cationic, 2015 – 2024

9.3.2. Anionic, 2015 – 2024

9.3.3. Amphoteric, 2015 – 2024

9.3.4. Non ionic, 2015 – 2024

9.3.5. Others, 2015 – 2024

9.4. Japan Surfactants Market Value Share Analysis, by Application

9.5. Japan Surfactants Market Forecast, by Application

9.5.1. Personal Care, 2015 – 2024

9.5.2. Oilfield Chemicals, 2015 – 2024

9.5.3. Paints & Coatings, 2015 – 2024

9.5.4. Emulsion Polymerization, 2015 – 2024

9.5.5. Agrochemicals, 2015 – 2024

9.5.6. Concrete Additives, 2015 – 2024

9.6. Japan Market Outlook, By Application

9.6.1. Personal Care

9.6.2. Oilfield Chemicals

9.6.3. Paints & Coatings

9.6.4. Emulsion Polymerization

9.6.5. Agrochemicals

9.6.6. Concrete Additives

10. China Surfactants Market Analysis

10.1. Key Findings

10.2. China Surfactants Market Value Share Analysis, by Product

10.3. China Surfactants Market Forecast, by Product

10.3.1. Cationic, 2015 – 2024

10.3.2. Anionic, 2015 – 2024

10.3.3. Amphoteric, 2015 – 2024

10.3.4. Non ionic, 2015 – 2024

10.3.5. Others, 2015 – 2024

10.4. China Surfactants Market Value Share Analysis, by Application

10.5. China Surfactants Market Forecast, by Application

10.5.1. Personal Care, 2015 – 2024

10.5.2. Oilfield Chemicals, 2015 – 2024

10.5.3. Paints & Coatings, 2015 – 2024

10.5.4. Emulsion Polymerization, 2015 – 2024

10.5.5. Agrochemicals, 2015 – 2024

10.5.6. Concrete Additives, 2015 – 2024

10.6. China Market Outlook, By Application

10.6.1. Personal Care

10.6.2. Oilfield Chemicals

10.6.3. Paints & Coatings

10.6.4. Emulsion Polymerization

10.6.5. Agrochemicals

10.6.6. Concrete Additives

11. Indonesia Surfactants Market Analysis

11.1. Key Findings

11.2. Indonesia Surfactants Market Value Share Analysis, by Product

11.3. Indonesia Surfactants Market Forecast, by Product

11.3.1. Cationic, 2015 – 2024

11.3.2. Anionic, 2015 – 2024

11.3.3. Amphoteric, 2015 – 2024

11.3.4. Non ionic, 2015 – 2024

11.3.5. Others, 2015 – 2024

11.4. Indonesia Surfactants Market Value Share Analysis, by Application

11.5. Indonesia Surfactants Market Forecast, by Application

11.5.1. Personal Care, 2015 – 2024

11.5.2. Oilfield Chemicals, 2015 – 2024

11.5.3. Paints & Coatings, 2015 – 2024

11.5.4. Emulsion Polymerization, 2015 – 2024

11.5.5. Agrochemicals, 2015 – 2024

11.5.6. Concrete Additives, 2015 – 2024

11.6. Indonesia Market Outlook, By Application

11.6.1. Personal Care

11.6.2. Oilfield Chemicals

11.6.3. Paints & Coatings

11.6.4. Emulsion Polymerization

11.6.5. Agrochemicals

11.6.6. Concrete Additives

12. South Korea Surfactants Market Analysis

12.1. Key Findings

12.2. Malaysia Surfactants Market Value Share Analysis, by Product

12.3. Malaysia Surfactants Market Forecast, by Product

12.3.1. Cationic, 2015 – 2024

12.3.2. Anionic, 2015 – 2024

12.3.3. Amphoteric, 2015 – 2024

12.3.4. Non ionic, 2015 – 2024

12.3.5. Others, 2015 – 2024

12.4. Malaysia Surfactants Market Value Share Analysis, by Application

12.5. Malaysia Surfactants Market Forecast, by Application

12.5.1. Personal Care, 2015 – 2024

12.5.2. Oilfield Chemicals, 2015 – 2024

12.5.3. Paints & Coatings, 2015 – 2024

12.5.4. Emulsion Polymerization, 2015 – 2024

12.5.5. Agrochemicals, 2015 – 2024

12.5.6. Concrete Additives, 2015 – 2024

12.6. Malaysia Market Outlook, By Application

12.6.1. Personal Care

12.6.2. Oilfield Chemicals

12.6.3. Paints & Coatings

12.6.4. Emulsion Polymerization

12.6.5. Agrochemicals

12.6.6. Concrete Additives

13. Thailand Surfactants Market Analysis

13.1. Key Findings

13.2. Thailand Surfactants Market Value Share Analysis, by Product

13.3. Thailand Surfactants Market Forecast, by Product

13.3.1. Cationic, 2015 – 2024

13.3.2. Anionic, 2015 – 2024

13.3.3. Amphoteric, 2015 – 2024

13.3.4. Non ionic, 2015 – 2024

13.3.5. Others, 2015 – 2024

13.4. Thailand Surfactants Market Value Share Analysis, by Application

13.5. Thailand Surfactants Market Forecast, by Application

13.5.1. Personal Care, 2015 – 2024

13.5.2. Oilfield Chemicals, 2015 – 2024

13.5.3. Paints & Coatings, 2015 – 2024

13.5.4. Emulsion Polymerization, 2015 – 2024

13.5.5. Agrochemicals, 2015 – 2024

13.5.6. Concrete Additives, 2015 – 2024

13.6. Thailand Market Outlook, By Application

13.6.1. Personal Care

13.6.2. Oilfield Chemicals

13.6.3. Paints & Coatings

13.6.4. Emulsion Polymerization

13.6.5. Agrochemicals

13.6.6. Concrete Additives

14. Vietnam Surfactants Market Analysis

14.1. Key Findings

14.2. Vietnam Surfactants Market Value Share Analysis, by Product

14.3. Vietnam Surfactants Market Forecast, by Product

14.3.1. Cationic, 2015 – 2024

14.3.2. Anionic, 2015 – 2024

14.3.3. Amphoteric, 2015 – 2024

14.3.4. Non ionic, 2015 – 2024

14.3.5. Others, 2015 – 2024

14.4. Vietnam Surfactants Market Value Share Analysis, by Application

14.5. Vietnam Surfactants Market Forecast, by Application

14.5.1. Personal Care, 2015 – 2024

14.5.2. Oilfield Chemicals, 2015 – 2024

14.5.3. Paints & Coatings, 2015 – 2024

14.5.4. Emulsion Polymerization, 2015 – 2024

14.5.5. Agrochemicals, 2015 – 2024

14.5.6. Concrete Additives, 2015 – 2024

14.6. Vietnam Market Outlook, By Application

14.6.1. Personal Care

14.6.2. Oilfield Chemicals

14.6.3. Paints & Coatings

14.6.4. Emulsion Polymerization

14.6.5. Agrochemicals

14.6.6. Concrete Additives

15. Australia Surfactants Market Analysis

15.1. Key Findings

15.2. Australia Surfactants Market Value Share Analysis, by Product

15.3. Australia Surfactants Market Forecast, by Product

15.3.1. Cationic, 2015 – 2024

15.3.2. Anionic, 2015 – 2024

15.3.3. Amphoteric, 2015 – 2024

15.3.4. Non ionic, 2015 – 2024

15.3.5. Others, 2015 – 2024

15.4. Australia Surfactants Market Value Share Analysis, by Application

15.5. Australia Surfactants Market Forecast, by Application

15.5.1. Personal Care, 2015 – 2024

15.5.2. Oilfield Chemicals, 2015 – 2024

15.5.3. Paints & Coatings, 2015 – 2024

15.5.4. Emulsion Polymerization, 2015 – 2024

15.5.5. Agrochemicals, 2015 – 2024

15.5.6. Concrete Additives, 2015 – 2024

15.6. Australia Market Outlook, By Application

15.6.1. Personal Care

15.6.2. Oilfield Chemicals

15.6.3. Paints & Coatings

15.6.4. Emulsion Polymerization

15.6.5. Agrochemicals

15.6.6. Concrete Additives

16. Philippines Surfactants Market Analysis

16.1. Key Findings

16.2. Philippines Surfactants Market Value Share Analysis, by Product

16.3. Philippines Surfactants Market Forecast, by Product

16.3.1. Cationic, 2015 – 2024

16.3.2. Anionic, 2015 – 2024

16.3.3. Amphoteric, 2015 – 2024

16.3.4. Non ionic, 2015 – 2024

16.3.5. Others, 2015 – 2024

16.4. Philippines Surfactants Market Value Share Analysis, by Application

16.5. Philippines Surfactants Market Forecast, by Application

16.5.1. Personal Care, 2015 – 2024

16.5.2. Oilfield Chemicals, 2015 – 2024

16.5.3. Paints & Coatings, 2015 – 2024

16.5.4. Emulsion Polymerization, 2015 – 2024

16.5.5. Agrochemicals, 2015 – 2024

16.5.6. Concrete Additives, 2015 – 2024

16.6. Philippines Market Outlook, By Application

16.6.1. Personal Care

16.6.2. Oilfield Chemicals

16.6.3. Paints & Coatings

16.6.4. Emulsion Polymerization

16.6.5. Agrochemicals

16.6.6. Concrete Additives

17. Competition Landscape

17.1. Company Profiles

17.1.1. The Dow Chemical Company

17.1.1.1. Company Description

17.1.1.2. Business Overview

17.1.1.3. SWOT Analysis

17.1.1.4. Financial Details

17.1.1.5. Strategic Overview

17.1.2. Archer Daniels Midland Company

17.1.2.1. Company Description

17.1.2.2. Business Overview

17.1.2.3. SWOT Analysis

17.1.2.4. Financial Details

17.1.2.5. Strategic Overview

17.1.3. Akzo Nobel N.V.

17.1.3.1. Company Description

17.1.3.2. Business Overview

17.1.3.3. Strategic Overview

17.1.4. Galaxy Surfactants Limited

17.1.4.1. Company Description

17.1.4.2. Business Overview

17.1.4.3. SWOT Analysis

17.1.4.4. Financial Details

17.1.4.5. Strategic Overview

17.1.5. BASF SE

17.1.5.1. Company Description

17.1.5.2. Business Overview

17.1.5.3. SWOT Analysis

17.1.5.4. Financial Details

17.1.5.5. Strategic Overview

17.1.6. Huntsman Corporation

17.1.6.1. Company Description

17.1.6.2. Business Overview

17.1.6.3. Strategic Overview

17.1.7. Evonik Industries AG

17.1.7.1. Company Description

17.1.7.2. Business Overview

17.1.7.3. Strategic Overview

17.1.8. P&G Chemicals

17.1.8.1. Company Description

17.1.8.2. Business Overview

17.1.8.3. Strategic Overview

17.1.9. Lonza Group

17.1.9.1. Company Description

17.1.9.2. Business Overview

17.1.9.3. Strategic Overview

17.1.10. Clariant

17.1.10.1. Company Description

17.1.10.2. Business Overview

17.1.10.3. Strategic Overview

17.1.11. Stepan Company

17.1.11.1. Company Description

17.1.11.2. Business Overview

17.1.11.3. Strategic Overview

List of Tables

Table 1 Asia Pacific Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 2 Asia Pacific Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 3 Asia Pacific Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 4 Asia Pacific Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

Table 5 Asia Pacific Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Country, 2015–2024

Table 6 South Korea Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 7 South Korea Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 8 Japan Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 9 Japan Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 10 China Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 11 China Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 12 China Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 13 Indonesia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 14 Indonesia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 15 Indonesia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, By Application, 2015–2024

Table 16 Malaysia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 17 Malaysia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 18 Malaysia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 19 Thailand Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 20 Thailand Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 21 Thailand Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 22 Vietnam Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, By Product Type, 2015–2024

Table 23 Vietnam Surfactants Market Size (US$ Mn) and Volume (Tons ) Forecast, By Application, 2015–2024

Table 24 Vietnam Surfactants Market Size (US$ Mn) and Volume (Tons ) Forecast, By Application, 2015–2024

Table 25 Australia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type, 2015–2024

Table 26 Australia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 27 Australia Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2015–2024

Table 28 Philippines Surfactants Market Size (US$ Mn) and Volume (Tons) Forecast, By Product Type, 2015–2024

Table 29 Philippines Surfactants Market Size (US$ Mn) and Volume (Tons ) Forecast, By Application, 2015–2024

Table 30 Philippines Surfactants Market Size (US$ Mn) and Volume (Tons ) Forecast, By Application, 2015–2024

List of Figures

Figure 1 Asia Pacific Surfactants Market

Figure 2 Cationic Surfactants Price (US$/Ton) Analysis, 2015

Figure 3 Anionic Surfactants Price (US$/Ton) Analysis, 2015

Figure 4 Non-ionic Surfactants Price (US$/Ton) Analysis, 2015

Figure 5 Amphoteric Surfactants Price (US$/Ton) Analysis, 2015

Figure 6 Asia Pacific Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 7 Surfactants Market, for Cationic Surfactants

Figure 8 Surfactants Market, for Anionic Surfactants

Figure 9 Surfactants Market, for Non-ionic Surfactants

Figure 10 Surfactants Market, for Amphoteric Surfactants

Figure 11 Asia Pacific Market Value Share Analysis, by Application, 2015 and 2024

Figure 12 Asia Pacific Surfactants Market, by Personal Care

Figure 13 Asia Pacific Surfactants Market, by Oilfield Chemicals

Figure 14 Asia Pacific Surfactants Market, by Paints & Coatings

Figure 15 Asia Pacific Surfactants Market, by Emulsion Polymerization

Figure 16 Asia Pacific Surfactants Market, by Agrochemicals

Figure 17 Asia Pacific Surfactants Market, by Concrete Additives

Figure 18 Asia Pacific Market Value Share Analysis, by Country, 2015 and 2024

Figure 19 Asia Pacific Surfactants Market Attractiveness Analysis, by Country

Figure 20 South Korea Surfactants Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 21 South Korea Surfactants Market Value Share Analysis, by Application, 2015 and 2024

Figure 22 Japan Surfactants Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 23 Japan Surfactants Market Value Share Analysis, by Application, 2015 and 2024

Figure 24 China Surfactants Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 25 China Surfactants Market Value Share Analysis, by Application, 2015 and 2024

Figure 26 Indonesia Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 27 Indonesia Market Value Share Analysis, by Application, 2015 and 2024

Figure 28 Malaysia Surfactants Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 29 Malaysia Surfactants Market Value Share Analysis, by Application, 2015 and 2024

Figure 30 Thailand Surfactants Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 31 Thailand Surfactants Market Value Share Analysis, by Application, 2015 and 2024

Figure 32 Vietnam Market Value Share Analysis By Product Type, 2015 and 2024

Figure 33 Vietnam Market Value Share Analysis By Application, 2015 and 2024

Figure 34 Australia Surfactants Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 35 Australia Surfactants Market Value Share Analysis, by Application, 2015 and 2024

Figure 36 Philippines Market Value Share Analysis By Product Type, 2015 and 2024

Figure 37 Philippines Market Value Share Analysis By Application, 2015 and 2024