Reports

Reports

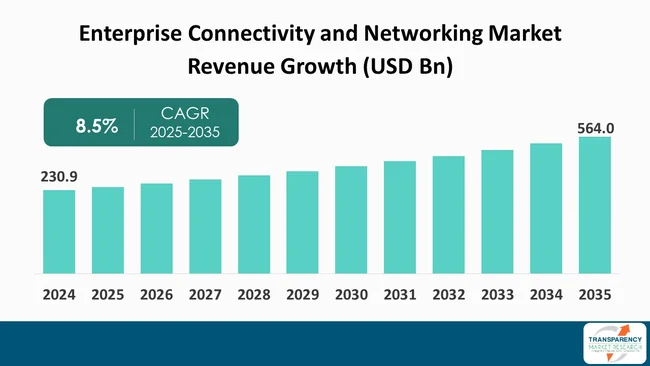

The global enterprise connectivity and networking market size was valued at US$ 230.9 billion in 2024 and is projected to reach US$ 564.0 billion by 2035, expanding at a CAGR of 8.5% from 2025 to 2035. The market growth is driven by IoT expansion fuels demand for high-performance networks and digital transformation driving demand for flexible network infrastructures.

The global enterprise connectivity and networking market has recorded a significant upward trend over the past few years, largely driven by the rising need for high-speed data transmission, cloud usage, and digital transformation projects. The market's anticipations are to continue increasing as companies are making more interconnections in order to be able to work remote, use multiple clouds, or manage IoT (Internet of Things) devices.

Furthermore, 5G is looked upon as a catalyzer to the unfolding of many new applications due to the rapid and stable nature of the network infrastructure. A company is able to achieve better operational efficiency as well as enhance the customer experience by leveraging the 5G network.

Moving toward hybrid networks which entail the combination of the conventional on-premise infrastructure and cloud-based services is an additional trend that is drawing more attention and acceptance. This change is expected to bring attributes such as the flexibility, scalability, and cost-efficiency to the users. Nevertheless, issues related to network security, data privacy, and the complexity of the management of the more complex networks still hold a worrisome position among the critical concerns.

The enterprise connectivity and networking covers the products and services that allow organizations to create, administer, and improve their communication and data networks. Since digital transformation has been changing the nature of enterprises significantly, the latter have become heavily reliant on strong and large-scale networking solutions in order to be able to communicate easily, share data, and work together beyond borders.

The enterprise connectivity and networking market provides various solutions including Wide Area Networks (WAN), Software-Defined WAN (SD-WAN), Network Security, Cloud Connectivity, and Managed Services. The rising need for fast, dependable secure networks stems from advancements in Cloud Computing and IoT together with Big Data technologies.

Recent market trends for customer connectivity and networking have changed rapidly, with a move to more flexible, scalable, and secure solutions that can support larger business needs. The widespread adoption of Software-Defined WAN (SD-WAN) is the most significant trend of the present era, allowing enterprises to manage traffic over various cloud platforms seamlessly, thereby not only making network performance efficient but also saving their costs.

Security continues to be an important concern, with companies concentrating on zero-trust security frameworks and using complete encryption to keep their private information safe in a network that is getting more complicated and distributed. Such tendencies are the foundation of a future that is more interconnected, can withstand shocks and is data-driven in terms of corporate networking. Moreover, 5G technology growth is significantly influencing the transformation of business networks. Such advantages as higher speeds, lower latency, and greater reliability make real-time analytics develop rapidly. For instance, The EU's Digital Compass Plan for 2024 highlighted the necessity of gigabit networks and 5G as an essential source of energy for companies in the area. The European Commission’s agenda aims to extend the reach of super-fast broadband to all enterprises within the EU by 2030, thus facilitating the use of distributed computing and the networking of higher capabilities.

| Attribute | Detail |

|---|---|

| Enterprise Connectivity and Networking Market Drivers |

|

The Internet of Things (IoT) drives a massive change throughout sectors as billions of linked devices and sensors produce enormous data volumes. Businesses today turn to sophisticated network technologies including 5G and SD-WAN together with edge computing to maintain uninterrupted data flow with minimal delay and increased dependability. Networks need to handle both - uninterrupted device communication and the complex security requirements of extensive IoT systems.

The usage of loT is increasing rapidly in various fields such as Manufacturing, Healthcare, and Logistics. The need for strong, effective, and secure network systems will continue to rise. Businesses will have to connect more devices to the loT network to fully exploit the potential of loT that includes Operational Efficiency, Predictive Analytics, and Real-time Decision-making.

The government intends to utilize 5G networks together with loT technology for establishing an operational system that will enable smart urban areas along with autonomous vehicles and robotized production facilities. The approach demonstrates how vital rapid networks remain to handle the huge volume of data flows coming from numerous IoT devices. For instance, the Ministry of Industry and Information Technology (MIIT) in China acknowledges the essential role of IoT for industrial development and is working toward developing a national IoT plan that merges 5G infrastructure with IoT technology.

Modern technologies enable business operations to undergo transformation, which enhances operational efficiency and customer satisfaction simultaneously. For instance, the Australian Government has dedicated substantial resources toward enhancing the nation's digital infrastructure across Australia. Businesses throughout the nation access high-speed internet through the National Broadband Network (NBN), which functions as a vital component of the government's infrastructure plan for supporting cloud adoption and AI and digital operations.

Organizations need a strong and scalable network infrastructure to achieve successful digital strategy implementation through efficient high-volume data processing and real-time response with minimal latency. Successful digital strategies need organizations to develop network infrastructures which can process big data efficiently and deliver responses in real time with minimal delay.

The enterprises move toward next-generation solutions such as Software-Defined Networking (SDN) and 5G and edge computing as these solutions provide adaptable network systems that connect to cloud environments for organization-wide digital tool deployment.

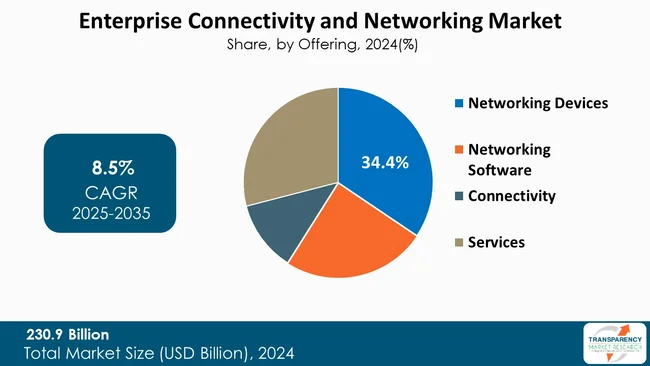

The networking device holds the highest enterprise connectivity and networking market share of 34.4 % in the ‘offering’ segment. The majority of market share in enterprise connectivity and networking belongs to networking devices. The market shares networking devices as companies require powerful routers switches wireless access points and gateways to handle expanding data traffic along with cloud and hybrid work environments.

Broadband service and long-distance data transmission have been one amongst the main concerns for companies recently, which has led them to renovate their systems radically to achieve higher bandwidth, to be sure that the latency is low and to have a safe connection between their different locations. Although software-defined networking (SDN) and connectivity come a long way in terms of popularity, it seems that the hardware still plays the crucial role, which is the reason why networking devices continue to be the leader in revenue and the most adopted segment.

For instance, the U.S. General Services Administration (GSA) runs a contract vehicle named Enterprise Infrastructure Solutions, which serves as the preferred contract for federal agencies needing enterprise telecommunications and networking services/infrastructure.

| Attribute | Detail |

|---|---|

| Leading Region |

|

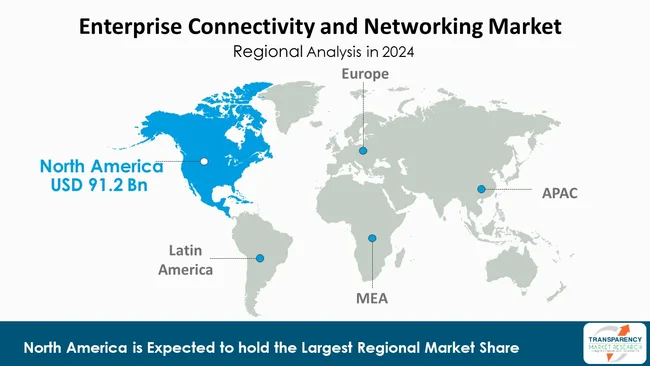

North America holds the highest share of 39.5% of the global enterprise connectivity and networking market. The United States is the major region that influences the trend of digital transformation and the need for a strong network infrastructure. The U.S., with its advanced technology, is the region where most of the tech giants are located and multiple industries are going up the digital ladder with the adoption of technologies such as cloud computing, artificial intelligence (Al), and big data analytics.

Government programs such as the FCC's broadband extension and the funding of 5G infrastructure are the main supporters of the rise of digital businesses. For instance, the Federal Communications Commission (FCC) remains dedicated to expanding high-speed broadband networks across the United States due to business digital transformation demands adequate broadband connectivity. The BEAD program secured US$ 1.5 Bn through FCC funding during 2024 to provide reliable internet access to untapped area.

Moreover, North America maintains established data centers together with advanced cybersecurity frameworks, which provide secure and scalable foundations to support digital business expansion. The growing dependency of companies on cloud-based solutions and IoT technologies leads to increasing demand for high-speed reliable networks throughout the entire region.

For instance, Canadian Innovation, Science and Economic Development Canada (ISED) leads national digital infrastructure enhancement projects. The Canadian government launched the Digital Infrastructure Fund during 2023, which dedicates US$1 Bn to improve high-speed internet access and digital connectivity for businesses located in remote and rural regions.

Cisco Systems, Inc., Broadcom, Huawei Technologies Co., Ltd., Juniper Networks, Inc., Arista Networks, Inc., Extreme Networks, Fortinet, Inc., Cloudflare, Inc., Riverbed Technology, SolarWinds Worldwide, LLC., F5, Inc., Pica8 Software Inc., Versa Networks, Inc., Peplink, CELONA INC. and others are some of the leading manufacturers operating in the global enterprise connectivity and networking market.

Each of these companies has been profiled in the enterprise connectivity and networking market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 230.9 Bn |

| Forecast Value in 2035 | More than US$ 564.0 Bn |

| CAGR | 8.5 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Enterprise Connectivity and Networking Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Enterprise Connectivity and Networking Market Segmentation | By Offering

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The enterprise connectivity and networking market was valued at US$ 230.9 Bn in 2024

The enterprise connectivity and networking market is projected to cross US$ 564.0 Bn by the end of 2035

IoT Expansion Fuels Demand for High-Performance Networks and Digital Transformation Driving Demand for Flexible Network Infrastructures

The CAGR is anticipated to be 8.5 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Cisco Systems, Inc., Broadcom, Huawei Technologies Co., Ltd., Juniper Networks, Inc., Arista Networks, Inc., Extreme Networks, Fortinet, Inc., Cloudflare, Inc., Riverbed Technology, SolarWinds Worldwide, LLC., F5, Inc., Pica8 Software Inc., Versa Networks, Inc., Peplink, CELONA INC. and others.

Table 01: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 02: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 03: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 04: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 05: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 06: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 07: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 08: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 09: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 10: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 11: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 12: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 13: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 14: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 15: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 16: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 17: U.S. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 18: U.S. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 19: U.S. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 20: U.S. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 21: U.S. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 22: U.S. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 23: U.S. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 24: Canada Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 25: Canada Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 26: Canada Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 27: Canada Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 28: Canada Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 29: Canada Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 30: Canada Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 31: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 32: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 33: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 34: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 35: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 36: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 37: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 38: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 39: Germany Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 40: Germany Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 41: Germany Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 42: Germany Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 43: Germany Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 44: Germany Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 45: Germany Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 46: U.K. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 47: U.K. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 48: U.K. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 49: U.K. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 50: U.K. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 51: U.K. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 52: U.K. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 53: France Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 54: France Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 55: France Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 56: France Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 57: France Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 58: France Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 59: France Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 60: Italy Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 61: Italy Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 62: Italy Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 63: Italy Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 64: Italy Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 65: Italy Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 66: Italy Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 67: Spain Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 68: Spain Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 69: Spain Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 70: Spain Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 71: Spain Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 72: Spain Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 73: Spain Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 74: The Netherlands Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 75: The Netherlands Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 76: The Netherlands Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 77: The Netherlands Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 78: The Netherlands Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 79: The Netherlands Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 80: The Netherlands Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 81: Rest of Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 82: Rest of Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 83: Rest of Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 84: Rest of Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 85: Rest of Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 86: Rest of Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 87: Rest of Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 88: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 89: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 90: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 91: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 92: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 93: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 94: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 95: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 96: China Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 97: China Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 98: China Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 99: China Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 100: China Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 101: China Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 102: China Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 103: Japan Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 104: Japan Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 105: Japan Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 106: Japan Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 107: Japan Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 108: Japan Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 109: Japan Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 110: India Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 111: India Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 112: India Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 113: India Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 114: India Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 115: India Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 116: India Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 117: South Korea Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 118: South Korea Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 119: South Korea Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 120: South Korea Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 121: South Korea Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 122: South Korea Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 123: South Korea Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 124: ASEAN Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 125: ASEAN Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 126: ASEAN Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 127: ASEAN Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 128: ASEAN Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 129: ASEAN Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 130: ASEAN Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 131: Australia and New Zealand Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 132: Australia and New Zealand Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 133: Australia and New Zealand Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 134: Australia and New Zealand Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 135: Australia and New Zealand Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 136: Australia and New Zealand Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 137: Australia and New Zealand Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 138: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 139: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 140: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 141: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 142: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 143: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 144: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 145: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 146: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 147: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 148: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 149: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 150: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 151: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 152: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 153: Brazil Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 154: Brazil Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 155: Brazil Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 156: Brazil Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 157: Brazil Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 158: Brazil Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 159: Brazil Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 160: Mexico Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 161: Mexico Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 162: Mexico Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 163: Mexico Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 164: Mexico Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 165: Mexico Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 166: Mexico Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 167: Argentina Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 168: Argentina Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 169: Argentina Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 170: Argentina Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 171: Argentina Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 172: Argentina Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 173: Argentina Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 174: Rest of Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 175: Rest of Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 176: Rest of Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 177: Rest of Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 178: Rest of Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 179: Rest of Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 180: Rest of Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 181: Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 182: Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 183: Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 184: Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 185: Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 186: Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 187: Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 188: Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 189: GCC Countries Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 190: GCC Countries Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 191: GCC Countries Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 192: GCC Countries Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 193: GCC Countries Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 194: GCC Countries Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 195: GCC Countries Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 196: South Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 197: South Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 198: South Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 199: South Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 200: South Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 201: South Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 202: South Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 203: Rest of Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 204: Rest of Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Devices, 2020 to 2035

Table 205: Rest of Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Networking Software, 2020 to 2035

Table 206: Rest of Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Connectivity, 2020 to 2035

Table 207: Rest of Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 208: Rest of Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 209: Rest of Middle East and Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Figure 01: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 02: Global Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 03: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Networking Devices, 2020 to 2035

Figure 04: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Networking Software, 2020 to 2035

Figure 05: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Connectivity, 2020 to 2035

Figure 06: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 07: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 08: Global Enterprise Connectivity and Networking Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 09: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Large Enterprises, 2020 to 2035

Figure 10: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Small and Medium Enterprises (SMEs), 2020 to 2035

Figure 11: Global Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 12: Global Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2024 and 2035

Figure 13: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Aerospace & Defense, 2025 to 2035

Figure 14: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Media & Communication, 2020 to 2035

Figure 15: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 16: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Banking, Financial Services & Insurance (BFSI), 2020 to 2035

Figure 17: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Transportation & Logistics, 2020 to 2035

Figure 18: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by IT & Telecom, 2020 to 2035

Figure 19: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Government, Retail & E-commerce, 2020 to 2035

Figure 20: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Enterprise Connectivity and Networking Market Value Share Analysis, By Region, 2024 and 2035

Figure 22: Global Enterprise Connectivity and Networking Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 23: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 24: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2024 and 2035

Figure 25: North America Enterprise Connectivity and Networking Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 26: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 27: North America Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 28: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 29: North America Enterprise Connectivity and Networking Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 30: North America Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 31: North America Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 32: U.S. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: U.S. Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 34: U.S. Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 35: U.S. Enterprise Connectivity and Networking Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 36: U.S. Enterprise Connectivity and Networking Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 37: U.S. Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 38: U.S. Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 39: Canada Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Canada Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 41: Canada Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 42: Canada Enterprise Connectivity and Networking Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 43: Canada Enterprise Connectivity and Networking Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 44: Canada Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 45: Canada Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 46: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 48: Europe Enterprise Connectivity and Networking Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 49: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 50: Europe Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 51: Europe Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 52: Europe Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 53: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 54: Europe Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 55: Germany Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Germany Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 57: Germany Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 58: Germany Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 59: Germany Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 60: Germany Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 61: Germany Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 62: U.K. Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 63: U.K. Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 64: U.K. Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 65: U.K. Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 66: U.K. Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 67: U.K. Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 68: U.K. Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 69: France Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 70: France Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 71: France Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 72: France Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 73: France Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 74: France Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 75: France Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 76: Italy Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: Italy Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 78: Italy Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 79: Italy Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 80: Italy Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 81: Italy Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 82: Italy Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 83: Spain Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 84: Spain Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 85: Spain Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 86: Spain Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 87: Spain Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 88: Spain Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 89: Spain Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 90: The Netherlands Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 91: The Netherlands Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 92: The Netherlands Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 93: The Netherlands Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 94: The Netherlands Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 95: The Netherlands Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 96: The Netherlands Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 97: Rest of Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 98: Rest of Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 99: Rest of Europe Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 100: Rest of Europe Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 101: Rest of Europe Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 102: Rest of Europe Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 103: Rest of Europe Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 104: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 105: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 106: Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 107: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 108: Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 109: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 110: Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 111: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 112: Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 113: China Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 114: China Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 115: China Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 116: China Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 117: China Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 118: China Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 119: China Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 120: India Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 121: India Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 122: India Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 123: India Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 124: India Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 125: India Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 126: India Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 127: Japan Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 128: Japan Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 129: Japan Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 130: Japan Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 131: Japan Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 132: Japan Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 133: Japan Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 134: South Korea Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 135: South Korea Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 136: South Korea Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 137: South Korea Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 138: South Korea Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 139: South Korea Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 140: South Korea Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 141: Australia Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 142: Australia Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 143: Australia Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 144: Australia Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 145: Australia Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 146: Australia Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 147: Australia Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 148: ASEAN Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 149: ASEAN Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 150: ASEAN Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 151: ASEAN Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 152: ASEAN Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 153: ASEAN Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 154: ASEAN Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 155: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 156: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 157: Rest of Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 158: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 159: Rest of Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 160: Rest of Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 161: Rest of Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 162: Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 163: Latin America Enterprise Connectivity and Networking Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 164: Latin America Enterprise Connectivity and Networking Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 165: Latin America Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 166: Latin America Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 167: Latin America Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 168: Latin America Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 169: Latin America Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 170: Latin America Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 171: Brazil Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 172: Brazil Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 173: Brazil Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 174: Brazil Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 175: Brazil Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 176: Brazil Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 177: Brazil Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 178: Mexico Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 179: Mexico Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 180: Mexico Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 181: Mexico Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 182: Mexico Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 183: Mexico Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 184: Mexico Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 185: Argentina Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 186: Argentina Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 187: Argentina Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 188: Argentina Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 189: Argentina Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 190: Argentina Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 191: Argentina Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 192: Rest of Latin America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 193: Rest of Latin America Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 194: Rest of Latin America Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 195: Rest of Latin America Enterprise Connectivity and Networking Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 196: Rest of Latin America Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 197: Rest of Latin America Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 198: Rest of Latin America Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 199: Middle East and Africa Data Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 200: Middle East and Africa Data Enterprise Connectivity and Networking Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 201: Middle East and Africa Data Enterprise Connectivity and Networking Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 202: Middle East and Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 203: Middle East and Africa Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 204: Middle East and Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 205: Middle East and Africa Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 206: Middle East and Africa Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 207: Middle East and Africa Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 208: GCC Countries Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 209: GCC Countries Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 210: GCC Countries Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 211: GCC Countries Enterprise Connectivity and Networking Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 212: GCC Countries Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 213: GCC Countries Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 214: GCC Countries Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 215: South Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: South Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 217: South Africa Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 218: South Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 219: South Africa Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 220: South Africa Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 221: South Africa Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 222: Rest of Middle East Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 223: Rest of Middle East Enterprise Connectivity and Networking Market Value Share Analysis, by Offering, 2024 and 2035

Figure 224: Rest of Middle East Enterprise Connectivity and Networking Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 225: Rest of Middle East Enterprise Connectivity and Networking Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 226: Rest of Middle East Enterprise Connectivity and Networking Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 227: Rest of Middle East Enterprise Connectivity and Networking Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 228: Rest of Middle East Enterprise Connectivity and Networking Market Attractiveness Analysis, by End-User Industry, 2025 to 2035