Reports

Reports

Analysts’ Viewpoint

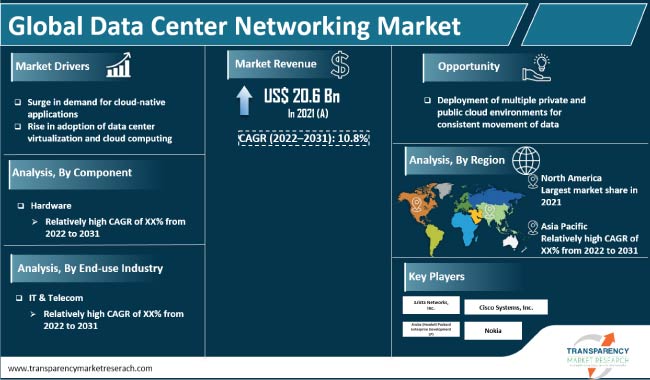

Surge in demand for cloud-native applications is fueling the data center networking market size. Data center networking integrates various networking resources such as switching, routing, and analytics. It allows organizations to store, process, and cater to data needs of various end-use software applications including websites, emails, and instant messaging services.

Rise in adoption of data center virtualization and cloud computing is expected to augment market progress during the forecast period. Data center virtualization helps enhance the performance of IT infrastructure and effectively manage private and public cloud services. Deployment of multiple private and public cloud environments for consistent movement of data is likely to offer lucrative growth opportunities for vendors in the sector.

Data center networking helps organizations provide access to networks, computing resources, and storage devices that enable the execution of a variety of business-critical applications. Additionally, data center networking solutions enable organizations to visualize and manage data center networks through a graphical interface.

Data center networking solutions facilitate fast data transfer to ensure high performance and delivery of information. Networking devices include switches, routers, interfaces, and network security equipment. These devices allow data centers to fetch the required information stored across computing and storage resources in a controlled environment to prevent illegal access. Data center networks need to be monitored to assure they are up and running across parameters such as network health, computing & storage resources, and security.

Networking devices such as switches, routers, and access points play a vital role in connecting multiple devices for interaction and sharing of information purposes over a computer network. Data center network infrastructure allows servers to connect and share information/applications with other servers and end-users including employees, clients, partners, and other stakeholders.

Rapid evolution in technology has led to an increase in demand for virtualization in the operation and management of data center networks. Data center networks offer various benefits such as ease of management, reduced cost, high scalability, and resource optimization.

Virtualization, which was traditionally a hardware-based function, has shifted to a software application and provides benefits mentioned above. It also allows reconfiguration and network visibility without the need for physical interaction with networking devices/infrastructure. These advantages are augmenting data center networking market growth.

Most organizations adopt data networking to manage data. They either deploy their own data center or lease one, based on their data privacy and storage requirements. Government organizations and large enterprises usually prefer to build their own data center architecture to maintain data privacy and security. On the other hand, some organizations choose to rent servers at co-location facilities.

Organizations across industry verticals, including BFSI, IT & telecom, healthcare, retail & ecommerce, media & entertainment, and manufacturing, largely dependent on cloud data centers to produce and process a large amount of data on daily basis. Cloud-based data centers enable accessibility from any worldwide location along with scalability, data security, increased compatibility, and higher availability. Thus, several organizations are migrating their business-critical applications to cloud data centers. This is estimated to boost market expansion in the near future.

Data has become a proprietary asset of an organization. It plays a vital role in every organizational task. Therefore, several organizations are investing significantly in data centers for smooth and consistent operations.

Data centers cater to the needs of business-critical applications by providing services such as data storage, management, backup & recovery, and running applications. Data created, captured, copied, and consumed has reached 94 zettabytes with over 4.66 billion active internet users globally. The volume is estimated to reach up to 149 zettabytes by the end of 2024. Thus, surge in data volume is likely to drive data center networking market revenue in the next few years.

Deployment of Multiple Private and Public Cloud Environments for Consistent Data Movement

Businesses across the globe are deploying multiple private as well as public cloud environments for consistent movement of data. Advancements in hybrid cloud have enabled businesses to design new guidelines to utilize public and private cloud and on-premise environments simultaneously, depending upon requirements. This offers cost optimization and flexibility. Thus, increase in adoption of hybrid data management is anticipated to boost market value in the next few years.

North America is expected to dominate the industry during the forecast period. The region held the largest share in 2021. Rise in utilization of data center networking technologies, surge in data generation, and increase in demand for colocation facilities and edge data centers are fueling market revenue in the region. The U.S. is a major growth engine of the sector in North America, owing to the presence of key vendors in the country.

Europe is likely to follow North America in terms of data center networking market share due to the rise in number of data centers in countries such as the U.K., Germany, and France. The industry in Asia Pacific is estimated to grow at the fastest rate during the forecast period. Implementation of government policies for data localization, rapid digital transformation in various sectors, and surge in penetration of mobile networks are fueling data center networking market statistics in the region.

The global industry is highly fragmented, with a few large-scale vendors holding significant shareAnalysis of Key Players . Key companies are investing substantially in comprehensive R&D activities to enhance market share and sustain their market position. Expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by vendors.

Arista Networks, Inc., Broadcom, Cisco Systems, Inc., Dell Inc., Extreme Networks, Aruba (Hewlett Packard Enterprise Development LP), Huawei Technologies Co., Ltd., Juniper Networks, Inc., Nokia, stl.tech, VMware, Inc., and Zoho Corporation Pvt. Ltd. are prominent market entities.

These vendors have been profiled in the data center networking market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 20.6 Bn |

|

Market Forecast Value in 2031 |

US$ 56.3 Bn |

|

Growth Rate(CAGR) |

10.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2016–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 20.6 Bn in 2021.

It is estimated to be 10.8% during 2022 to 2031.

It is expected to reach US$ 56.3 Bn in 2031.

Deployment of multiple private and public cloud environments for consistent movement of data.

Surge in demand for cloud-native applications and rise in adoption of data center virtualization and cloud computing.

North America is a more attractive region for vendors.

Arista Networks, Inc., Broadcom, Cisco Systems, Inc., Dell Inc., Extreme Networks, Aruba (Hewlett Packard Enterprise Development LP), Huawei Technologies Co., Ltd., Juniper Networks, Inc., Nokia, stl.tech, VMware, Inc., and Zoho Corporation Pvt. Ltd.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global Data Center Networking Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Data Center Networking Market

4.5. Market Opportunity Assessment – by Region (North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.5.1. By Component

4.5.2. By End-use Industry

5. Global Data Center Networking Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

5.2. Pricing Model Analysis/Price Trend Analysis

6. Global Data Center Networking Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Data Center Networking Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.1.1. Ethernet Switch

6.3.1.2. Router

6.3.1.3. Storage Area Network (SAN)

6.3.1.4. Network Security Equipment

6.3.1.5. Application Delivery Controller (ADC)

6.3.1.6. Others

6.3.2. Software

6.3.2.1. Switching Operating System (OS)

6.3.2.2. Virtual Switch

6.3.2.3. Management Software

6.3.2.4. Controller

6.3.3. Services

6.3.3.1. Installation & Integration

6.3.3.2. Training & Consulting

6.3.3.3. Support & Maintenance

7. Global Data Center Networking Market Analysis, by End-use Industry

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Data Center Networking Market Size (US$ Bn) Forecast, by End-use Industry, 2018 - 2031

7.3.1. BFSI

7.3.2. IT & Telecom

7.3.3. Healthcare

7.3.4. Retail & Ecommerce

7.3.5. Government

7.3.6. Media & Entertainment

7.3.7. Manufacturing

7.3.8. Others

8. Global Data Center Networking Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Data Center Networking Market Analysis and Forecast

9.1. Regional Outlook

9.2. Data Center Networking Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

9.2.1. By Component

9.2.2. By End-use Industry

9.3. Data Center Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

9.3.1. U.S.

9.3.2. Canada

9.3.3. Mexico

10. Europe Data Center Networking Market Analysis and Forecast

10.1. Regional Outlook

10.2. Data Center Networking Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

10.2.1. By Component

10.2.2. By End-use Industry

10.3. Data Center Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe

11. Asia Pacific Data Center Networking Market Analysis and Forecast

11.1. Regional Outlook

11.2. Data Center Networking Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

11.2.1. By Component

11.2.2. By End-use Industry

11.3. Data Center Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Rest of Asia Pacific

12. Middle East & Africa Data Center Networking Market Analysis and Forecast

12.1. Regional Outlook

12.2. Data Center Networking Market Size (US$ Bn) Analysis and Forecast (2018 – 2031)

12.2.1. By Component

12.2.2. By End-use Industry

12.3. Data Center Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

12.3.1. Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. South Africa

12.3.4. Rest of Middle East & Africa

13. South America Data Center Networking Market Analysis and Forecast

13.1. Regional Outlook

13.2. Data Center Networking Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

13.2.1. By Component

13.2.2. By End-use Industry

13.3. Data Center Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

13.3.1. Brazil

13.3.2. Argentina

13.3.3. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2021)

14.3. Competitive Scenario

14.3.1. List of Emerging, Prominent, and Leading Players

14.3.2. Major Mergers & Acquisitions, Expansions, Partnerships, etc.

15. Company Profiles

15.1. Arista Networks, Inc.

15.1.1. Business Overview

15.1.2. Company Revenue

15.1.3. Product Portfolio

15.1.4. Geographic Footprint

15.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.2. Broadcom

15.2.1. Business Overview

15.2.2. Company Revenue

15.2.3. Product Portfolio

15.2.4. Geographic Footprint

15.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.3. Cisco Systems, Inc.

15.3.1. Business Overview

15.3.2. Company Revenue

15.3.3. Product Portfolio

15.3.4. Geographic Footprint

15.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.4. Dell Inc.

15.4.1. Business Overview

15.4.2. Company Revenue

15.4.3. Product Portfolio

15.4.4. Geographic Footprint

15.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.5. Extreme Networks

15.5.1. Business Overview

15.5.2. Company Revenue

15.5.3. Product Portfolio

15.5.4. Geographic Footprint

15.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.6. Aruba (Hewlett Packard Enterprise Development LP)

15.6.1. Business Overview

15.6.2. Company Revenue

15.6.3. Product Portfolio

15.6.4. Geographic Footprint

15.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.7. Huawei Technologies Co., Ltd.

15.7.1. Business Overview

15.7.2. Company Revenue

15.7.3. Product Portfolio

15.7.4. Geographic Footprint

15.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.8. Juniper Networks, Inc.

15.8.1. Business Overview

15.8.2. Company Revenue

15.8.3. Product Portfolio

15.8.4. Geographic Footprint

15.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.9. Nokia

15.9.1. Business Overview

15.9.2. Company Revenue

15.9.3. Product Portfolio

15.9.4. Geographic Footprint

15.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.10. stl.tech

15.10.1. Business Overview

15.10.2. Company Revenue

15.10.3. Product Portfolio

15.10.4. Geographic Footprint

15.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.11. VMware, Inc.

15.11.1. Business Overview

15.11.2. Company Revenue

15.11.3. Product Portfolio

15.11.4. Geographic Footprint

15.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.12. Zoho Corporation Pvt. Ltd.

15.12.1. Business Overview

15.12.2. Company Revenue

15.12.3. Product Portfolio

15.12.4. Geographic Footprint

15.12.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.13. Others

15.13.1. Business Overview

15.13.2. Company Revenue

15.13.3. Product Portfolio

15.13.4. Geographic Footprint

15.13.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16. Key Takeaway

List of Tables

Table 1: Acronyms Used in the Data Center Networking Market

Table 2: North America Data Center Networking Market Revenue Analysis, by Country, 2022 and 2031 (US$ Bn)

Table 3: Europe Data Center Networking Market Revenue Analysis, by Country, 2022 and 2031 (US$ Bn)

Table 4: Asia Pacific Data Center Networking Market Revenue Analysis, by Country, 2022 and 2031 (US$ Bn)

Table 5: Middle East & Africa Data Center Networking Market Revenue Analysis, by Country, 2022 and 2031 (US$ Bn)

Table 6: South America Data Center Networking Market Revenue Analysis, by Country, 2022 and 2031 (US$ Bn)

Table 7: Impact Analysis of Drivers & Restraints

Table 8: Global Data Center Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 9: Global Data Center Networking Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 10: Global Data Center Networking Market Volume (US$ Bn) Forecast, by Region, 2018 – 2031

Table 11: North America Data Center Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 12: North America Data Center Networking Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 13: North America Data Center Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 14: U.S. Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 15: Canada Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 16: Mexico Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 17: Europe Data Center Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 18: Europe Data Center Networking Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 19: Europe Data Center Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 20: Germany Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: U.K. Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 22: France Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Italy Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: Spain Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Asia Pacific Data Center Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 26: Asia Pacific Data Center Networking Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 27: Asia Pacific Data Center Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 28: China Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: India Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Japan Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: ASEAN Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: Middle East & Africa Data Center Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 33: Middle East & Africa Data Center Networking Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 34: Middle East & Africa Data Center Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 35: Saudi Arabia Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: United Arab Emirates Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: South Africa Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: South America Data Center Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 39: South America Data Center Networking Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 40: South America Data Center Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 41: Brazil Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: Argentina Data Center Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: Mergers & Acquisitions, Expansions (1/4)

Table 44: Mergers & Acquisitions, Expansions (2/4)

Table 45: Mergers & Acquisitions, Expansions (3/4)

Table 46: Mergers & Acquisitions, Expansions (4/4)

List of Figures

Figure 1: Global Data Center Networking Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Data Center Networking Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of Data Center Networking Market

Figure 4: Global Data Center Networking Market (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Major Drivers for Adoption of Data Center Networking

Figure 6: Global Data Center Networking Market Attractiveness Assessment, by Component

Figure 7: Global Data Center Networking Market Attractiveness Assessment, by End-use Industry

Figure 8: Global Data Center Networking Market Attractiveness Assessment, by Region

Figure 9: Global Data Center Networking Market Revenue (US$ Bn) Historic Trends, 2016 - 2021

Figure 10: Global Data Center Networking Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 - 2021

Figure 11: Global Data Center Networking Market Value Share Analysis, by Component, 2022

Figure 12: Global Data Center Networking Market Value Share Analysis, by Component, 2031

Figure 13: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 14: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 15: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 16: Global Data Center Networking Market Value Share Analysis, by End-use Industry, 2022

Figure 17: Global Data Center Networking Market Value Share Analysis, by End-use Industry, 2031

Figure 18: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 19: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 20: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 21: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2022 – 2031

Figure 22: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 23: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 24: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 25: Global Data Center Networking Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 26: Global Data Center Networking Market Opportunity (US$ Bn), by Region

Figure 27: Global Data Center Networking Market Opportunity Share (%), by Region, 2022–2031

Figure 28: Global Data Center Networking Market Size (US$ Bn), by Region, 2022 & 2031

Figure 29: Global Data Center Networking Market Value Share Analysis, by Region, 2022

Figure 30: Global Data Center Networking Market Value Share Analysis, by Region, 2031

Figure 31: North America Data Center Networking Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 32: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 33: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 34: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 35: South America Data Center Networking Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 36: North America Data Center Networking Market Revenue Opportunity Share, by Component

Figure 37: North America Data Center Networking Market Revenue Opportunity Share, by End-use Industry

Figure 38: North America Data Center Networking Market Revenue Opportunity Share, by Country

Figure 39: North America Data Center Networking Market Value Share Analysis, by Component, 2022

Figure 40: North America Data Center Networking Market Value Share Analysis, by Component, 2031

Figure 41: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 42: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 43: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 44: North America Data Center Networking Market Value Share Analysis, by End-use Industry, 2022

Figure 45: North America Data Center Networking Market Value Share Analysis, by End-use Industry, 2031

Figure 46: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 47: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 48: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 49: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2022 – 2031

Figure 50: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 51: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 52: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 53: North America Data Center Networking Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 54: North America Data Center Networking Market Value Share Analysis, by Country, 2022

Figure 55: North America Data Center Networking Market Value Share Analysis, by Country, 2031

Figure 56: U.S. Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 57: Canada Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 58: Mexico Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 59: Europe Data Center Networking Market Revenue Opportunity Share, by Component

Figure 60: Europe Data Center Networking Market Revenue Opportunity Share, by End-use Industry

Figure 61: Europe Data Center Networking Market Revenue Opportunity Share, by Country

Figure 62: Europe Data Center Networking Market Value Share Analysis, by Component, 2022

Figure 63: Europe Data Center Networking Market Value Share Analysis, by Component, 2031

Figure 64: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 65: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 66: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 67: Europe Data Center Networking Market Value Share Analysis, by End-use Industry, 2022

Figure 68: Europe Data Center Networking Market Value Share Analysis, by End-use Industry, 2031

Figure 69: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 70: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 71: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 72: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2022 – 2031

Figure 73: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 74: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 75: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 76: Europe Data Center Networking Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 77: Europe Data Center Networking Market Value Share Analysis, by Country, 2022

Figure 78: Europe Data Center Networking Market Value Share Analysis, by Country, 2031

Figure 79: Germany Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 80: U.K. Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 81: France Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 82: Italy Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 83: Spain Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 84: Rest of Europe Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 85: Asia Pacific Data Center Networking Market Revenue Opportunity Share, by Component

Figure 86: Asia Pacific Data Center Networking Market Revenue Opportunity Share, by End-use Industry

Figure 87: Asia Pacific Data Center Networking Market Revenue Opportunity Share, by Country

Figure 88: Asia Pacific Data Center Networking Market Value Share Analysis, by Component, 2022

Figure 89: Asia Pacific Data Center Networking Market Value Share Analysis, by Component, 2031

Figure 90: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 91: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 92: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 93: Asia Pacific Data Center Networking Market Value Share Analysis, by End-use Industry, 2022

Figure 94: Asia Pacific Data Center Networking Market Value Share Analysis, by End-use Industry, 2031

Figure 95: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 96: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 97: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 98: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2022 – 2031

Figure 99: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 100: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 101: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 102: Asia Pacific Data Center Networking Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 103: Asia Pacific Data Center Networking Market Value Share Analysis, by Country, 2022

Figure 104: Asia Pacific Data Center Networking Market Value Share Analysis, by Country, 2031

Figure 105: China Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 106: India Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 107: Japan Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 108: ASEAN Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 109: Middle East & Africa Data Center Networking Market Revenue Opportunity Share, by Component

Figure 110: Middle East & Africa Data Center Networking Market Revenue Opportunity Share, by End-use Industry

Figure 111: Middle East & Africa Data Center Networking Market Revenue Opportunity Share, by Country

Figure 112: Middle East & Africa Data Center Networking Market Value Share Analysis, by Component, 2022

Figure 113: Middle East & Africa Data Center Networking Market Value Share Analysis, by Component, 2031

Figure 114: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 115: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 116: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 117: Middle East & Africa Data Center Networking Market Value Share Analysis, by End-use Industry, 2022

Figure 118: Middle East & Africa Data Center Networking Market Value Share Analysis, by End-use Industry, 2031

Figure 119: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 120: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 121: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 122: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2022 – 2031

Figure 123: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 124: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 125: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 126: Middle East & Africa Data Center Networking Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 127: Middle East & Africa Data Center Networking Market Value Share Analysis, by Country, 2022

Figure 128: Middle East & Africa Data Center Networking Market Value Share Analysis, by Country, 2031

Figure 129: Saudi Arabia Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 130: United Arab Emirates Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 131: South Africa Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 132: South America Data Center Networking Market Revenue Opportunity Share, by Component

Figure 133: South America Data Center Networking Market Revenue Opportunity Share, by End-use Industry

Figure 134: South America Data Center Networking Market Revenue Opportunity Share, by Country

Figure 135: South America Data Center Networking Market Value Share Analysis, by Component, 2022

Figure 136: South America Data Center Networking Market Value Share Analysis, by Component, 2031

Figure 137: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 138: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 139: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 140: South America Data Center Networking Market Value Share Analysis, by End-use Industry, 2022

Figure 141: South America Data Center Networking Market Value Share Analysis, by End-use Industry, 2031

Figure 142: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 143: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 144: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 145: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2022 – 2031

Figure 146: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 147: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 148: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 149: South America Data Center Networking Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 150: South America Data Center Networking Market Value Share Analysis, by Country, 2022

Figure 151: South America Data Center Networking Market Value Share Analysis, by Country, 2031

Figure 152: Brazil Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 153: Argentina Data Center Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031