Reports

Reports

Analysts’ Viewpoint

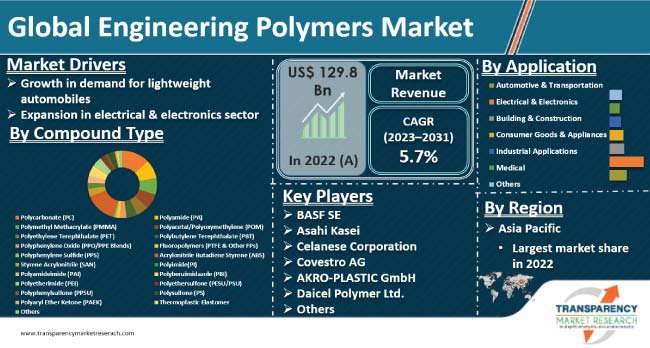

The engineering polymers market size is expected to grow at a steady pace during the forecast period due to rise in demand for lightweight automobiles and expansion in the electrical & electronics sector. Engineering polymers are widely used in various industries such as automotive, aerospace, electrical & electronics, and healthcare owing to their high performance, durability, and reliability.

Surge in focus on reducing vehicle weight, improving fuel efficiency, and meeting emission standards is anticipated to offer lucrative opportunities for vendors in the global engineering polymers industry. Rise in adoption of Electric Vehicles (EVs) is boosting the need for lightweight and thermally resistant materials for battery components and electric motors.

Engineering polymers, also known as engineering plastics or high-performance polymers, are a class of thermoplastic materials specifically designed to offer exceptional mechanical, thermal, electrical, and chemical properties. These materials are engineered to meet the demanding requirements of various industrial applications. They are distinct from commodity plastics due to their superior performance characteristics.

Engineering polymers maintain their shape and dimensions over a wide range of temperatures. They resist deformation over time when subjected to a constant load or stress. Engineering polymers are known for their impact resistance, which is crucial in applications where sudden impacts or dynamic loads occur. Some engineering polymers can be formulated to be flame-retardant, making them safe for use in applications with fire safety requirements.

Engineering plastic compounds are revolutionizing the construction, performance, safety, and functionality of cars. Single-mold components have helped manufacturers decrease vehicle assembly time, and quickly introduce design innovations and trim costs. Plastics help make cars lighter, thus reducing fuel demand and greenhouse gas emissions.

Engineering polymers such as reinforced plastics, thermoplastics, and composites are often used as substitutes for traditional materials, such as metal and glass, in automotive components. These materials are lighter in weight while offering comparable or even better performance characteristics, contributing to the overall weight reduction of vehicles.

Automakers are under pressure to develop vehicles that are more fuel-efficient and emit fewer emissions. This, in turn, is expected to spur the engineering polymers market value during the forecast period. Lightweighting is a key strategy to achieve these goals, and engineering polymers play a crucial role in this process. By using lightweight polymers in place of heavier materials, automakers can reduce the overall weight of vehicles, leading to improved fuel efficiency and reduced environmental impact.

Engineering polymers are being used in innovative applications such as 3D-printed components, self-healing materials, and smart surfaces. These applications can enhance the overall driving experience and contribute to the differentiation of vehicle models. Weight reduction in vehicles results in increased fuel efficiency and performance. Reducing a modern car's weight by 100 kg cuts fuel consumption by approximately 0.2 liters per 100 km and reduces CO2 emissions by around 10 g/km.

Engineering plastic compounds are utilized in the electrical & electronics sector for manufacturing various parts of integrated circuits, semiconductors, and resistors. The sector is focused on producing smaller, lighter, and more compact devices. Engineering polymers offer the advantage of being lightweight while maintaining structural integrity, making them ideal for use in components where weight reduction is crucial. Many electrical and electronic products generate heat during operation. Engineering polymers with excellent thermal stability can withstand high temperatures without deforming or degrading, ensuring the reliability and longevity of components.

Technological advancements in electronic gadgets and devices are boosting the electrical & electronics sector. This, in turn, is propelling the engineering polymers market expansion. Rise in adoption of smart devices and Internet of Things (IoT) equipment is driving demand for miniaturized yet highly functional components. Engineering polymers enable the production of sensors, connectors, and housings for these devices, contributing to their overall performance and reliability.

The usage of electronic devices and gadgets is growing in vehicles for applications such as power electronic systems, infotainment, electric power steering, seat control, keyless entry, braking systems, and HEV battery charging. Such increase in adoption of electronic devices is prompting the use of recycled plastics for producing casings, circuit boards, and other components that are extensively used for manufacturing electronic devices for households and vehicles.

According to the latest engineering polymers market trends, the polycarbonate (PC) compound type segment is expected to dominate the industry during the forecast period. PC is a thermoplastic polymer that contains carbonate groups in its chemical structure. It is known for its strength, toughness, and optical transparency. Polycarbonate is easily worked, molded, and thermoformed, making it versatile for various applications. It is used in engineering as an impact-resistant and transparent material, often found in products such as safety glass, eyeglass lenses, compact discs, and bullet-proof glass.

Polycarbonate is virtually unbreakable and vandal-proof, making it the ideal choice of material for safety glazing. Examples include shelters, bicycle sheds, machines and technical products, illuminated signs, and marine glazing.

Polycarbonate scores highly in terms of sustainability. It has a long service lifespan and the panels are fully recyclable. Polycarbonate sheets are resistant to UV rays, making them suitable as a sheet material for exterior applications. PC is suitable for a greenhouse, a boat window, basketball backboards, or a terrace canopy.

According to the latest engineering polymers market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. Expansion in manufacturing and electrical & electronics sectors is fueling the market dynamics of the region. China is a major market for engineering polymers as it is a global manufacturing powerhouse. The country is witnessing a significant demand for engineering polymers in various industries such as electrical & electronics, building & construction, automotive, and solar energy.

The electrical & electronics sector in Asia Pacific is projected to grow at a rapid pace. Rapid industrialization and urbanization in China, India, and Southeast Asian countries is driving the engineering polymers market statistics in the region. These countries are witnessing a surge in infrastructure development and construction activities.

The global industry is highly competitive and consists of several small and medium-sized engineering polymer manufacturers. Most businesses are investing significantly in R&D activities to increase their engineering polymers market share. They are also developing recyclable engineering polymers to address environmental concerns.

BASF SE, Asahi Kasei, Celanese Corporation, Covestro AG, AKRO-PLASTIC GmbH, Daicel Polymer Ltd., and Kawasaki Sanko Kasei Co., Ltd. are key entities operating in this market. Each of these players has been profiled in the engineering polymers market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 129.8 Bn |

| Market Forecast Value in 2031 | US$ 211.8 Bn |

| Growth Rate (CAGR) | 5.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2022 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 129.8 Bn in 2022

It is projected to grow at a CAGR of 5.7% from 2023 to 2031

Growth in demand for lightweight automobiles and expansion in electrical & electronics sector

Polycarbonate (PC) was the largest compound type segment in 2022

Asia Pacific was the most lucrative region in 2022

BASF SE, Asahi Kasei, Celanese Corporation, Covestro AG, AKRO-PLASTIC GmbH, Daicel Polymer Ltd., and Kawasaki Sanko Kasei Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Engineering Polymers Market Analysis and Forecast, 2023-2031

2.6.1. Global Engineering Polymers Market Volume (Kilo Tons)

2.6.2. Global Engineering Polymers Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.11.1. Cost Structure Analysis

3. Economic Recovery Post COVID-19 Impact

3.1. Impact on Supply Chain of Engineering Polymers

3.2. Impact on Demand for Engineering Polymers– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario

5. Production Output Analysis (Kilo Tons), by Region, 2023

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Compound Type

6.2. Price Comparison Analysis by Region

7. Global Engineering Polymers Market Analysis and Forecast, by Compound Type, 2023–2031

7.1. Introduction and Definitions

7.2. Global Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

7.2.1. Polycarbonate (PC)

7.2.2. Polyamide (PA)

7.2.3. Polymethyl Methacrylate (PMMA)

7.2.4. Polyacetal/Polyoxymethylene (POM)

7.2.5. Polyethylene Terephthalate (PET)

7.2.6. Polybutylene Terephthalate (PBT)

7.2.7. Polyphenylene Oxide (PPO/PPE Blends)

7.2.8. Fluoropolymers (PTFE & Other FPs)

7.2.9. Polyphenylene Sulfide (PPS)

7.2.10. Acrylonitrile Butadiene Styrene (ABS)

7.2.11. Styrene Acrylonitrile (SAN)

7.2.12. Polyimide (PI)

7.2.13. Polyamideimide (PAI)

7.2.14. Polybenzimidazole (PBI)

7.2.15. Polyetherimide (PEI)

7.2.16. Polyethersulfone (PESU/PSU)

7.2.17. Polyphenylsulfone (PPSU)

7.2.18. Polysulfone (PS)

7.2.19. Polyaryl Ether Ketone (PAEK)

7.2.20. Thermoplastic Elastomer

7.2.21. Others

7.3. Global Engineering Polymers Market Attractiveness, by Compound Type

8. Global Engineering Polymers Market Analysis and Forecast, by End-use, 2023–2031

8.1. Introduction and Definitions

8.2. Global Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

8.2.1. Automotive & Transportation

8.2.2. Electrical & Electronics

8.2.3. Building & Construction

8.2.4. Consumer Goods & Appliances

8.2.5. Industrial Applications

8.2.6. Medical

8.2.7. Others

8.3. Global Engineering Polymers Market Attractiveness, by End-use

9. Global Engineering Polymers Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Engineering Polymers Market Attractiveness, by Region

10. North America Engineering Polymers Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

10.3. North America Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

10.4. North America Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

10.4.1. U.S. Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

10.4.2. U.S. Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

10.4.3. Canada Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

10.4.4. Canada Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

10.5. North America Engineering Polymers Market Attractiveness Analysis

11. Europe Engineering Polymers Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

11.3. Europe Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

11.4. Europe Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

11.4.1. Germany Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

11.4.2. Germany Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

11.4.3. France Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

11.4.4. France Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

11.4.5. U.K. Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

11.4.6. U.K. Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

11.4.7. Italy Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

11.4.8. Italy Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

11.4.9. Russia & CIS Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

11.4.10. Russia & CIS Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

11.4.11. Rest of Europe Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

11.4.12. Rest of Europe Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

11.5. Europe Engineering Polymers Market Attractiveness Analysis

12. Asia Pacific Engineering Polymers Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type

12.3. Asia Pacific Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.4. Asia Pacific Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

12.4.1. China Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

12.4.2. China Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.4.3. Japan Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

12.4.4. Japan Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.4.5. India Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

12.4.6. India Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.4.7. ASEAN Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

12.4.8. ASEAN Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.4.9. Rest of Asia Pacific Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

12.4.10. Rest of Asia Pacific Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.5. Asia Pacific Engineering Polymers Market Attractiveness Analysis

13. Latin America Engineering Polymers Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

13.3. Latin America Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.4. Latin America Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

13.4.1. Brazil Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

13.4.2. Brazil Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.4.3. Mexico Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

13.4.4. Mexico Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.4.5. Rest of Latin America Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

13.4.6. Rest of Latin America Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.5. Latin America Engineering Polymers Market Attractiveness Analysis

14. Middle East & Africa Engineering Polymers Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

14.3. Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.4. Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

14.4.1. GCC Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

14.4.2. GCC Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.4.3. South Africa Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

14.4.4. South Africa Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.4.5. Rest of Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Compound Type, 2023–2031

14.4.6. Rest of Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.5. Middle East & Africa Engineering Polymers Market Attractiveness Analysis

15. Competition Landscape

15.1. Market Players - Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, 2022

15.3. Market Footprint Analysis

15.3.1. By Compound Type

15.3.2. By End-use

15.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.4.1. BASF SE

15.4.1.1. Company Revenue

15.4.1.2. Business Overview

15.4.1.3. Product Segments

15.4.1.4. Geographic Footprint

15.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.2. Asahi Kasei

15.4.2.1. Company Revenue

15.4.2.2. Business Overview

15.4.2.3. Product Segments

15.4.2.4. Geographic Footprint

15.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.3. Celanese Corporation

15.4.3.1. Company Revenue

15.4.3.2. Business Overview

15.4.3.3. Product Segments

15.4.3.4. Geographic Footprint

15.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.4. Covestro AG

15.4.4.1. Company Revenue

15.4.4.2. Business Overview

15.4.4.3. Product Segments

15.4.4.4. Geographic Footprint

15.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.5. AKRO-PLASTIC GmbH

15.4.5.1. Company Revenue

15.4.5.2. Business Overview

15.4.5.3. Product Segments

15.4.5.4. Geographic Footprint

15.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.6. Daicel Polymer Ltd.

15.4.6.1. Company Revenue

15.4.6.2. Business Overview

15.4.6.3. Product Segments

15.4.6.4. Geographic Footprint

15.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.7. Kawasaki Sanko Kasei Co., Ltd.

15.4.7.1. Company Revenue

15.4.7.2. Business Overview

15.4.7.3. Product Segments

15.4.7.4. Geographic Footprint

15.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 2: Global Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 3: Global Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 4: Global Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 5: Global Engineering Polymers Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 6: Global Engineering Polymers Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 7: North America Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 8: North America Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 9: North America Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 10: North America Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 11: North America Engineering Polymers Market Volume (Kilo Tons) Forecast, by Country/Sub-region, 2023–2031

Table 12: North America Engineering Polymers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 13: U.S. Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 14: U.S. Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 15: U.S. Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 16: U.S. Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 17: Canada Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 18: Canada Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 19: Canada Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 20: Canada Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 21: Europe Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 22: Europe Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 23: Europe Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 24: Europe Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 25: Europe Engineering Polymers Market Volume (Kilo Tons) Forecast, by Country/Sub-region, 2023–2031

Table 26: Europe Engineering Polymers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 27: Germany Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 28: Germany Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 29: Germany Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 30: Germany Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 31: France Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 32: France Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 33: France Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 34: France Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 35: U.K. Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 36: U.K. Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 37: U.K. Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 38: U.K. Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 39: Italy Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 40: Italy Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 41: Italy Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 42: Italy Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 43: Spain Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 44: Spain Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 45: Spain Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 46: Spain Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 47: Russia & CIS Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 48: Russia & CIS Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 49: Russia & CIS Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 50: Russia & CIS Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 51: Rest of Europe Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 52: Rest of Europe Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 53: Rest of Europe Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 54: Rest of Europe Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 55: Asia Pacific Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 56: Asia Pacific Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 57: Asia Pacific Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 58: Asia Pacific Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 59: Asia Pacific Engineering Polymers Market Volume (Kilo Tons) Forecast, by Country/Sub-region, 2023–2031

Table 60: Asia Pacific Engineering Polymers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 61: China Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 62: China Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type 2023–2031

Table 63: China Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 64: China Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 65: Japan Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 66: Japan Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 67: Japan Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 68: Japan Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 69: India Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 70: India Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 71: India Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 72: India Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 73: India Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 74: India Engineering Polymers Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 75: ASEAN Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 76: ASEAN Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 77: ASEAN Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 78: ASEAN Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 79: Rest of Asia Pacific Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 80: Rest of Asia Pacific Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 81: Rest of Asia Pacific Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 82: Rest of Asia Pacific Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 83: Latin America Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 84: Latin America Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 85: Latin America Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 86: Latin America Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 87: Latin America Engineering Polymers Market Volume (Kilo Tons) Forecast, by Country/Sub-region, 2023–2031

Table 88: Latin America Engineering Polymers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 89: Brazil Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 90: Brazil Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 91: Brazil Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 92: Brazil Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 93: Mexico Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 94: Mexico Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 95: Mexico Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 96: Mexico Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 97: Rest of Latin America Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 98: Rest of Latin America Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 99: Rest of Latin America Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 100: Rest of Latin America Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 101: Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 102: Middle East & Africa Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 103: Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 104: Middle East & Africa Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 105: Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) Forecast, by Country/Sub-region, 2023–2031

Table 106: Middle East & Africa Engineering Polymers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 107: GCC Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 108: GCC Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 109: GCC Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 110: GCC Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 111: South Africa Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 112: South Africa Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 113: South Africa Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 114: South Africa Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 115: Rest of Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) Forecast, by Compound Type, 2023–2031

Table 116: Rest of Middle East & Africa Engineering Polymers Market Value (US$ Bn) Forecast, by Compound Type, 2023–2031

Table 117: Rest of Middle East & Africa Engineering Polymers Market Volume (Kilo Tons) Forecast, by End-use, 2023–2031

Table 118: Rest of Middle East & Africa Engineering Polymers Market Value (US$ Bn) Forecast, by End-use, 2023–2031

List of Figures

Figure 1: Global Engineering Polymers Market Volume Share Analysis, by Compound Type, 2022, 2027, and 2031

Figure 2: Global Engineering Polymers Market Attractiveness, by Compound Type

Figure 3: Global Engineering Polymers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 4: Global Engineering Polymers Market Attractiveness, by End-use

Figure 5: Global Engineering Polymers Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Engineering Polymers Market Attractiveness, by Region

Figure 7: North America Engineering Polymers Market Volume Share Analysis, by Compound Type, 2022, 2027, and 2031

Figure 8: North America Engineering Polymers Market Attractiveness, by Compound Type

Figure 9: North America Engineering Polymers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: North America Engineering Polymers Market Attractiveness, by End-use

Figure 11: North America Engineering Polymers Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 12: North America Engineering Polymers Market Attractiveness, by Country/Sub-region

Figure 13: Europe Engineering Polymers Market Volume Share Analysis, by Compound Type, 2022, 2027, and 2031

Figure 14: Europe Engineering Polymers Market Attractiveness, by Compound Type

Figure 15: Europe Engineering Polymers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 16: Europe Engineering Polymers Market Attractiveness, by End-use

Figure 17: Europe Engineering Polymers Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 18: Europe Engineering Polymers Market Attractiveness, by Country/Sub-region

Figure 19: Asia Pacific Engineering Polymers Market Volume Share Analysis, by Compound Type, 2022, 2027, and 2031

Figure 20: Asia Pacific Engineering Polymers Market Attractiveness, by Compound Type

Figure 21: Asia Pacific Engineering Polymers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: Asia Pacific Engineering Polymers Market Attractiveness, by End-use

Figure 23: Asia Pacific Engineering Polymers Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Engineering Polymers Market Attractiveness, by Country/Sub-region

Figure 25: Latin America Engineering Polymers Market Volume Share Analysis, by Compound Type, 2022, 2027, and 2031

Figure 26: Latin America Engineering Polymers Market Attractiveness, by Compound Type

Figure 27: Latin America Engineering Polymers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 28: Latin America Engineering Polymers Market Attractiveness, by End-use

Figure 29: Latin America Engineering Polymers Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Engineering Polymers Market Attractiveness, by Country/Sub-region

Figure 31: Middle East & Africa Engineering Polymers Market Volume Share Analysis, by Compound Type, 2022, 2027, and 2031

Figure 32: Middle East & Africa Engineering Polymers Market Attractiveness, by Compound Type

Figure 33: Middle East & Africa Engineering Polymers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 34: Middle East & Africa Engineering Polymers Market Attractiveness, by End-use

Figure 35: Middle East & Africa Engineering Polymers Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Engineering Polymers Market Attractiveness, by Country/Sub-region