Reports

Reports

Analysts’ Viewpoint

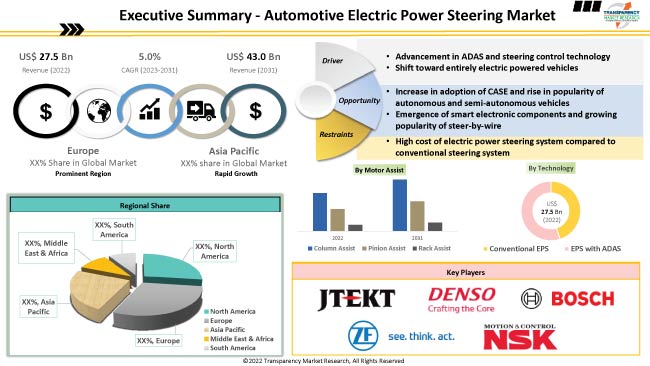

Significant growth in the automotive industry and increase in electronic & automation components in vehicles to meet safety & comfort requirements as per the norms suggested by regulatory authorities are driving the electric power steering market expansion. Established players, key manufacturers, and suppliers are forming joint ventures and alliances in order to implement sustainable business strategies.

Development of compact and inexpensive EPS-motor controller unit (MCU) offers lucrative opportunities for manufacturers. Focus of OEMs and companies toward simplifying software integration in EPS-MCU is expected to further propel market development.

Electric power steering (EPS) system helps a driver to effortlessly steer the vehicle. The system uses an electric motor mounted on the steering rack or steering column. The amount of torque, or rotational effort, the driver applies to the steering wheel is measured by sensors mounted to the motor. When determining how much assistance the driver needs to turn the front wheels, the sensors use the information they have collected. Speed of vehicle is the crucial factor in determining the output provided by EPS. Electric power steering (EPS) improves vehicle safety while enhancing handling and steering control by adapting the steering torque to the vehicle speed and providing active torque in dangerous driving scenarios.

Rise in sales of passenger & commercial vehicles across the globe and increase in penetration of electronic components in vehicles are propelling demand for electric power steering. Surge in demand for electric vehicles due to implementation of stringent emission norms is likely to augment global automotive electric power steering market size in the next few years. Advanced computational capability and specialized peripherals offered by automotive MCUs are driving demand for sophisticated car electric steering control operations.

Electric power steering system in a vehicle provides several benefits such as easy steer control, comfortable driving, power efficiency, and better fuel economy. The electric motor only draws power when needed. This eliminates conventional hydraulic fluid maintenance requirements. An electric power steering (EPS) enables any advanced driver assistance systems (ADAS) that involves turning the wheels without steering input from the driver. Features such as lane-keep assist, automated parking & lane changes, and ability to guide the car around obstacles utilize EPS's ability to steer itself when necessary. Therefore, adoption of EPS is increasing exponentially due to rise in vehicle sales.

Electric power steering systems are common in vehicles. However, these systems have a few shortcomings. Early EPS systems lacked the steering feel, or feedback from the road, which let drivers understand how the car was behaving, unlike classic hydraulic systems. Manufacturers have essentially fixed this problem, making the difference between the feel of electric and hydraulic power steering very negligible.

The global automotive electric power steering market is projected to be driven by usage of more advanced electric components in vehicles to enhance safety features. In order to enhance the quality and driving experience of vehicles, automakers are incorporating electric systems and components into their designs. Manufacturers are incorporating several electronic devices and systems to enhance the efficiency of vehicles and track the working of all major components in order to monitor faults in an effective manner. Electric power steering system penetration is likely to increase during the forecast period owing to several benefits over hydraulic power steering such as low maintenance cost and improved fuel efficiency.

In terms of motor assist, the column assist segment accounted for largest global automotive electric power steering market share in 2022. This is ascribed to high penetration of column assist in passenger vehicles. Furthermore, rise in passenger vehicle sales across the globe is projected to propel demand for column assist power steering systems in vehicles.

Based on technology, the EPS with ADAS segment is anticipated to dominate the global market during the projection period. Increase in trend of connected, autonomous, shared and electric (CASE) mobility and other allied technologies in automobile industry; and rise in penetration of autonomy levels, which include lane departure warning system, vehicle cruise control, and blind spot detection system, are likely to increase penetration of EPS with ADAS technologies in vehicles.

As per automotive electric power steering market forecast, Europe is projected to lead the global market during the forecast period. This is ascribed to higher sales of electric cars in the region. The market in the region is expected to be driven by presence of leading automotive companies in Germany, France, Italy, and the U.K. Presence of a number of OEM and tier-1 suppliers with cutting-edge electric power steering R&D capabilities is propelling the automobile electric power steering market in Europe.

The automotive electric power steering market in Asia Pacific is expected to grow at a rapid pace during the forecast period. This is ascribed to rapidly expanding manufacturing sector and stronger growth of automobile industry, where China is leading the mobility industry. Asia Pacific is at the forefront of supplying electric vehicles and components. Furthermore, consistent increase in EV sales in China, India, and ASEAN countries is likely to offer lucrative opportunities for market players. Increase in popularity of advanced safety features and comfortable ride experience is likely to bolster market development in Asia Pacific.

The market in North America is projected to grow at a rapid pace during the forecast period. This is ascribed to stronger sales of SUVs and light commercial vehicles than passenger cars. Manufacturers are increasing emphasis on embracing automation in automobile applications to create highly effective, safer and superior in-vehicle eco-system. This in turn is expected to accelerate market expansion in North America.

The global industry is fragmented, with the presence of large number of manufacturers controlling the market share. Expansion of product portfolio and merger & acquisition are the major strategies adopted by key players. Prominent players in the global market are DENSO Corporation, Robert Bosch GmbH, Sona Koyo Steering Systems Ltd., ZF Friedrichshafen AG, GKN plc, JTEKT Corporation, NSK Ltd., China Automotive Systems, Inc., Delphi Technologies, SHOWA Corporation, Hyundai Mobis, Mitsubishi Electric Corporation, Thyssenkrupp Business Area Components Technology, Mando Corp., Global Steering Systems, Zhejiang Shibao Company Limited, TRIDEC, and Hitachi Astemo, Ltd.

Key players have been profiled in the automotive electric power steering market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size Value in 2021 |

US$ 27.5 Bn |

|

Forecast (Value) in 2031 |

US$ 43.0 Bn |

|

Growth Rate (CAGR) |

5.0% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 27.5 Bn in 2022.

The CAGR is projected to be 5.0% from 2023 to 2031.

The global industry is anticipated to reach a value of US$ 43.0 Bn in 2031.

Advancement in ADAS & steering control technology and shift toward entirely electric powered vehicles.

Based on motor assist, the column assist segment dominated the industry in 2021.

Europe is the most lucrative market for automotive electric power steering.

Leading players in the global automotive electric power steering market are JTEKT Corporation, DENSO Corporation, Sona Koyo Steering Systems Ltd., ZF Friedrichshafen AG, GKN plc, Robert Bosch GmbH, NSK Ltd., Mitsubishi Electric Corporation, China Automotive Systems, Inc., Delphi Technologies, Hyundai Mobis, Thyssenkrupp Business Area Components Technology, SHOWA Corporation, Mando Corp., Global Steering Systems, Zhejiang Shibao Company Limited, TRIDEC, and Hitachi Astemo, Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, volume in million units, value in US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.7.1. List of Key Manufacturers

2.7.2. List of Customers

2.7.3. Level of Integration

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Technology Roadmap for Automotive Electric Power Steering System

4. Analysis on Market Share Distribution between Electronic Power Steering (EPS), Hydraulic Power Steering (HPS), and Electric Power Hydraulic Steering (EPHS)

5. Global Automotive Electric Power Steering Market, by Motor Assist

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Electric Power Steering Market Size & Forecast, by Motor Assist, 2017–2031,

5.2.1. Column Assist

5.2.2. Pinion Assist

5.2.3. Rack Assist

6. Global Automotive Electric Power Steering Market, by Technology

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Electric Power Steering Market Size & Forecast, by Technology, 2017-2031

6.2.1. Conventional EPS

6.2.2. EPS with ADAS

7. Global Automotive Electric Power Steering Market, by Component

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Electric Power Steering Market Size & Forecast, by Component, 2017-2031

7.2.1. EPS Control Module

7.2.2. Electric Motor

7.2.3. Rack & Pinion

7.2.4. Steering Column

8. Global Automotive Electric Power Steering Market, by Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Electric Power Steering Market Size & Forecast, by Vehicle Type, 2017-2031

8.2.1. Passenger Vehicles

8.2.1.1. Hatchback

8.2.1.2. Sedan

8.2.1.3. Utility Vehicles

8.2.2. Light Commercial Vehicles

8.2.3. Heavy Duty Trucks

8.2.4. Buses & Coaches

9. Global Automotive Electric Power Steering Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Electric Power Steering Market Size & Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Automotive Electric Power Steering Market

10.1. Market Snapshot

10.2. Automotive Electric Power Steering Market Size & Forecast, by Motor Assist, 2017-2031

10.2.1. Column Assist

10.2.2. Pinion Assist

10.2.3. Rack Assist

10.3. Automotive Electric Power Steering Market Size & Forecast, 2017-2031, By Technology

10.3.1. Conventional EPS

10.3.2. EPS with ADAS

10.4. Automotive Electric Power Steering Market Size & Forecast, by Component, 2017-2031

10.4.1. EPS Control Module

10.4.2. Electric Motor

10.4.3. Rack & Pinion

10.4.4. Steering Column

10.5. Automotive Electric Power Steering Market Size & Forecast, by Vehicle Type, 2017-2031

10.5.1. Passenger Vehicles

10.5.1.1. Hatchback

10.5.1.2. Sedan

10.5.1.3. Utility Vehicles

10.5.2. Light Commercial Vehicles

10.5.3. Heavy Duty Trucks

10.5.4. Buses & Coaches

10.6. Key Country Analysis – North America Automotive Electric Power Steering Market Size & Forecast, 2017-2031

10.6.1. The U. S.

10.6.2. Canada

10.6.3. Mexico

11. Europe Automotive Electric Power Steering Market

11.1. Market Snapshot

11.2. Automotive Electric Power Steering Market Size & Forecast, by Motor Assist, 2017-2031

11.2.1. Column Assist

11.2.2. Pinion Assist

11.2.3. Rack Assist

11.3. Automotive Electric Power Steering Market Size & Forecast, by Technology, 2017-2031

11.3.1. Conventional EPS

11.3.2. EPS with ADAS

11.4. Automotive Electric Power Steering Market Size & Forecast, by Component, 2017-2031

11.4.1. EPS Control Module

11.4.2. Electric Motor

11.4.3. Rack & Pinion

11.4.4. Steering Column

11.5. Automotive Electric Power Steering Market Size & Forecast, by Vehicle Type, 2017-2031

11.5.1. Passenger Vehicles

11.5.1.1. Hatchback

11.5.1.2. Sedan

11.5.1.3. Utility Vehicles

11.5.2. Light Commercial Vehicles

11.5.3. Heavy Duty Trucks

11.5.4. Buses & Coaches

11.6. Key Country Analysis - Europe Automotive Electric Power Steering Market Size & Forecast, by Country/Sub-region, 2017-2031

11.6.1. Germany

11.6.2. U. K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Nordic Countries

11.6.7. Russia & CIS

11.6.8. Rest of Europe

12. Asia Pacific Automotive Electric Power Steering Market

12.1. Market Snapshot

12.2. Automotive Electric Power Steering Market Size & Forecast, by Motor Assist, 2017-2031

12.2.1. Column Assist

12.2.2. Pinion Assist

12.2.3. Rack Assist

12.3. Automotive Electric Power Steering Market Size & Forecast, by Technology, 2017-2031

12.3.1. Conventional EPS

12.3.2. EPS with ADAS

12.4. Automotive Electric Power Steering Market Size & Forecast, by Component, 2017-2031

12.4.1. EPS Control Module

12.4.2. Electric Motor

12.4.3. Rack & Pinion

12.4.4. Steering Column

12.5. Automotive Electric Power Steering Market Size & Forecast, by Vehicle Type, 2017-2031

12.5.1. Passenger Vehicles

12.5.1.1. Hatchback

12.5.1.2. Sedan

12.5.1.3. Utility Vehicles

12.5.2. Light Commercial Vehicles

12.5.3. Heavy Duty Trucks

12.5.4. Buses & Coaches

12.6. Key Country Analysis - Asia Pacific Automotive Electric Power Steering Market Size & Forecast, by Country/Sub-region, 2017-2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. ASEAN Countries

12.6.5. South Korea

12.6.6. ANZ

12.6.7. Rest of Asia Pacific

13. Middle East & Africa Automotive Electric Power Steering Market

13.1. Market Snapshot

13.2. Automotive Electric Power Steering Market Size & Forecast, by Motor Assist, 2017-2031

13.2.1. Column Assist

13.2.2. Pinion Assist

13.2.3. Rack Assist

13.3. Automotive Electric Power Steering Market Size & Forecast, by Technology, 2017-2031

13.3.1. Conventional EPS

13.3.2. EPS with ADAS

13.4. Automotive Electric Power Steering Market Size & Forecast, by Component, 2017-2031

13.4.1. EPS Control Module

13.4.2. Electric Motor

13.4.3. Rack & Pinion

13.4.4. Steering Column

13.5. Automotive Electric Power Steering Market Size & Forecast, by Vehicle Type, 2017-2031

13.5.1. Passenger Vehicles

13.5.1.1. Hatchback

13.5.1.2. Sedan

13.5.1.3. Utility Vehicles

13.5.2. Light Commercial Vehicles

13.5.3. Heavy Duty Trucks

13.5.4. Buses & Coaches

13.6. Key Country Analysis - Middle East & Africa Automotive Electric Power Steering Market Size & Forecast, by Country/Sub-region, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Turkey

13.6.4. Rest of Middle East & Africa

14. South America Automotive Electric Power Steering Market

14.1. Market Snapshot

14.2. Automotive Electric Power Steering Market Size & Forecast, by Motor Assist, 2017-2031

14.2.1. Column Assist

14.2.2. Pinion Assist

14.2.3. Rack Assist

14.3. Automotive Electric Power Steering Market Size & Forecast, by Technology, 2017-2031

14.3.1. Conventional EPS

14.3.2. EPS with ADAS

14.4. Automotive Electric Power Steering Market Size & Forecast, by Component, 2017-2031

14.4.1. EPS Control Module

14.4.2. Electric Motor

14.4.3. Rack & Pinion

14.4.4. Steering Column

14.5. Automotive Electric Power Steering Market Size & Forecast, by Vehicle Type, 2017-2031

14.5.1. Passenger Vehicles

14.5.1.1. Hatchback

14.5.1.2. Sedan

14.5.1.3. Utility Vehicles

14.5.2. Light Commercial Vehicles

14.5.3. Heavy Duty Trucks

14.5.4. Buses & Coaches

14.6. Key Country Analysis - South America Automotive Electric Power Steering Market Size & Forecast, 2017-2031

14.6.1. Brazil

14.6.2. Argentina

14.6.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. JTEKT Corporation

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. DENSO Corporation

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Sona Koyo Steering Systems Ltd.

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. ZF Friedrichshafen

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. GKN plc.

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Robert Bosch GmbH

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. NSK Ltd.

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Mitsubishi Electric Corporation

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. China Automotive Systems, Inc.

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Delphi Technologies

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Hyundai Mobis

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Thyssenkrupp

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. SHOWA Corporation

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Mando Corp.

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Global Steering Systems

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Zhejiang Shibao Company Limited

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

16.17. TRIDEC

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Production Locations

16.17.4. Product Portfolio

16.17.5. Competitors & Customers

16.17.6. Subsidiaries & Parent Organization

16.17.7. Recent Developments

16.17.8. Financial Analysis

16.17.9. Profitability

16.17.10. Revenue Share

16.18. Hitachi Automotive Systems

16.18.1. Company Overview

16.18.2. Company Footprints

16.18.3. Production Locations

16.18.4. Product Portfolio

16.18.5. Competitors & Customers

16.18.6. Subsidiaries & Parent Organization

16.18.7. Recent Developments

16.18.8. Financial Analysis

16.18.9. Profitability

16.18.10. Revenue Share

16.19. Others

16.19.1. Company Overview

16.19.2. Company Footprints

16.19.3. Production Locations

16.19.4. Product Portfolio

16.19.5. Competitors & Customers

16.19.6. Subsidiaries & Parent Organization

16.19.7. Recent Developments

16.19.8. Financial Analysis

16.19.9. Profitability

16.19.10. Revenue Share

List of Tables

Table 1: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Table 2: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Table 3: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Table 4: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 5: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 6: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 7: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Table 12: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Table 13: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Table 14: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 15: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 16: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 17: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 18: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Table 22: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Table 23: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Table 24: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 25: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 26: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 27: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 28: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 29: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country/Sub-region, 2017-2031

Table 30: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 31: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Table 32: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Table 33: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Table 34: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 35: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 36: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 37: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 39: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country/Sub-region, 2017-2031

Table 40: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Table 42: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Table 43: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Table 44: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 45: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 46: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 47: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 48: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 49: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country/Sub-region, 2017-2031

Table 50: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 51: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Table 52: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Table 53: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Table 54: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 55: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 56: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 57: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 58: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 59: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country/Sub-region, 2017-2031

Table 60: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 1: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Figure 2: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Figure 3: Global Automotive Electric Power Steering Market, Incremental Opportunity, by Motor Assist, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Figure 5: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 6: Global Automotive Electric Power Steering Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 8: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 9: Global Automotive Electric Power Steering Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Electric Power Steering Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Electric Power Steering Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Figure 17: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Figure 18: North America Automotive Electric Power Steering Market, Incremental Opportunity, by Motor Assist, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Figure 20: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 21: North America Automotive Electric Power Steering Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 23: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 24: North America Automotive Electric Power Steering Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 26: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 27: North America Automotive Electric Power Steering Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Electric Power Steering Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Figure 32: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Figure 33: Europe Automotive Electric Power Steering Market, Incremental Opportunity, by Motor Assist, Value (US$ Bn), 2023-2031

Figure 34: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Figure 35: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 36: Europe Automotive Electric Power Steering Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 38: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 39: Europe Automotive Electric Power Steering Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 41: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 42: Europe Automotive Electric Power Steering Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country/Sub-region, 2017-2031

Figure 44: Europe Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Figure 45: Europe Automotive Electric Power Steering Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Figure 47: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Figure 48: Asia Pacific Automotive Electric Power Steering Market, Incremental Opportunity, by Motor Assist, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Figure 50: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 51: Asia Pacific Automotive Electric Power Steering Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 53: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 54: Asia Pacific Automotive Electric Power Steering Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Asia Pacific Automotive Electric Power Steering Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country/Sub-region, 2017-2031

Figure 59: Asia Pacific Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Figure 60: Asia Pacific Automotive Electric Power Steering Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Figure 62: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Figure 63: Middle East & Africa Automotive Electric Power Steering Market, Incremental Opportunity, by Motor Assist, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Figure 65: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 66: Middle East & Africa Automotive Electric Power Steering Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 68: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 69: Middle East & Africa Automotive Electric Power Steering Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 71: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 72: Middle East & Africa Automotive Electric Power Steering Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country/Sub-region, 2017-2031

Figure 74: Middle East & Africa Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Figure 75: Middle East & Africa Automotive Electric Power Steering Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Motor Assist, 2017-2031

Figure 77: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Motor Assist, 2017-2031

Figure 78: South America Automotive Electric Power Steering Market, Incremental Opportunity, by Motor Assist, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Technology, 2017-2031

Figure 80: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 81: South America Automotive Electric Power Steering Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 82: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 83: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 84: South America Automotive Electric Power Steering Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 85: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 86: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 87: South America Automotive Electric Power Steering Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 88: South America Automotive Electric Power Steering Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 89: South America Automotive Electric Power Steering Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Figure 90: South America Automotive Electric Power Steering Market, Incremental Opportunity, by Country/Sub-region, Value (US$ Bn), 2023-2031