Reports

Reports

Technological advancements have played an imperative role in transforming the modern day healthcare industry. Over the past decade, minimally invasive surgeries, also known as laparoscopy, have garnered significance, as they require smaller incisions. With additional efforts toward minimizing the size of surgical incisions, minimally invasive procedures are set to gain traction in the near future. The advent of robotic technology, significant developments in endomechanical devices, and adoption of cutting-edge optical camera and imaging technologies are projected to accelerate the growth of the endosurgery devices market during the forecast period (2019-2027).

The demand for laparoscopic procedures is witnessing a notable growth across the world, owing to a range of benefits, such as less morbidity, faster healing, swift recovery, improved outcome, and low degree of discomfort. Surge in the adoption of these procedures has directly impacted the demand for endosurgery devices. Moreover, growing awareness regarding the advantages of laparoscopic surgeries, advent of robotic assisted endosurgery devices, and evolution of modern day surgical procedures are some of the leading factors that are expected to propel the expansion of the endosurgery devices market in the near future.

Minimally invasive procedures are associated with shorter hospital stays and significantly low degree of discomfort compared to conventional surgical techniques. However, despite these advantages, alternative treatments such as technologically advanced endoscopic surgeries, which include natural orifice transluminal endoscopic surgery (NOTES), endoscopic sub mucosal dissection (ESD), and suturing that require training and a high level of expertise could slow down the growth of the endosurgery devices market.

Although a broad range of endosurgery devices, such electrosurgical knifes, hemostatic forceps, suturing devices, and distal attachment caps are available, these conventional endosurgery devices lack the capabilities of advanced endosurgery devices. For instance, there is a dearth of desired dexterity required to carry out fine surgical maneuvers such nonaxial tissue manipulation and triangulation of instruments. Due to the limitations of conventional endosurgery devices, endoscopic robotic systems have made an entry into the endosurgery devices market. The entry of robotic endosurgery devices, including dissection tools, electrocautery devices, and sutures have resulted in effective, precise, reliable, and safe endoscopic procedures. At present, manufacturers operating in the endosurgery devices market are focusing on addressing the issues pertaining to instrument control and locomotion to improve the performance and overall output of these devices.

Participants within the endosurgery devices sphere are investing resources on the development of robotic systems with improved flexibility. For instance, the Flex Robotic System manufactured by Medrobotics was specially developed to perform neck and head surgeries. It was given the U.S. FDA approval in 2017. The adoption of these devices is expected to gain steady momentum in the coming years, as these devices continue to simplify the complexities involved with conventional procedures.

Sensing the growing demand for advanced endosurgery devices, stakeholders in the current endosurgery devices market landscape are leaning toward the development of new, cutting-edge endosurgery devices and are simultaneously pushing to gain approval from the FDA. For instance, in September 2019, Apollo Endosurgery was given the FDA clearance for the newly developed suture anchor device specifically designed to work in conjunction with OverStitch endoscopic suturing systems. The company revealed that obtaining the clearance from the FDA would enable it to improve the overall distribution of their suture-anchor systems and gross margins. Moreover, with better control over their supply chain, the company aims to expand its footprint in the global endosurgery devices market.

In September 2019, Ethicon launched the first powered circular stapler to address the complications related to gastric, thoracic, and colorectal surgery. The newly developed endosurgery device, ECHELON CIRCULAR Powered Stapler is a combination of two novel technologies of the company –3D Stapling Technology and Gripping Surface Technology (GST). Companies operating in the healthcare technology sphere are expected to focus on the development of cutting-edge devices that offer high degree of precision, accuracy, and end results.

Analysts’ Viewpoint

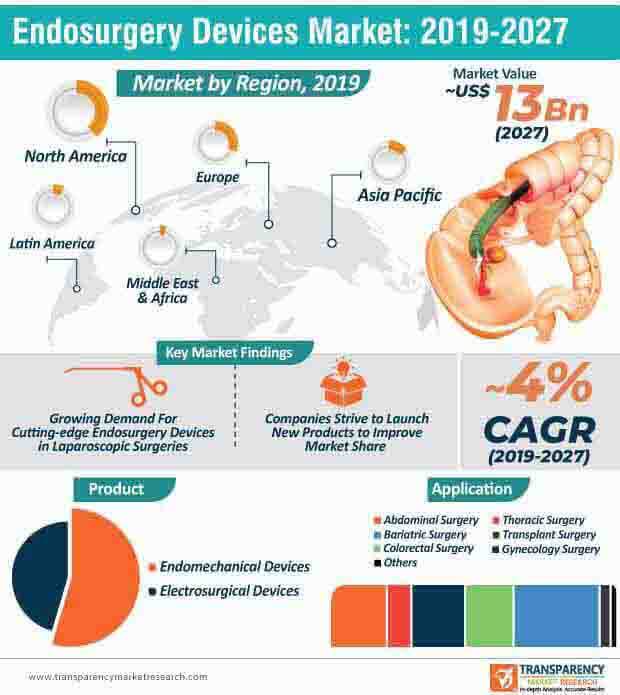

The endosurgery devices market is expected to grow at a CAGR of ~4% during the forecast period and attain a market value of ~US$ 13 Bn by 2027. The onset of state-of-the-art technologies, developments in robotic surgical systems, and integration of advanced imaging technologies will continue to bolster the growth of the market for endosurgery devices in the near future. Companies should engage in the development of new products with improved capabilities and functionalities. The adoption of these devices for abdominal, thoracic, bariatric, and gynecology surgeries, among others, will continue to grow during the forecast period, particularly in developed regions, including North America and Europe.

Endosurgery Devices Market: Overview

Launch of New Endosurgery Devices-based Products: Key Drivers

Rise in Minimally Invasive Surgeries

Surge in Adoption of Advanced Robotic Endosurgery Devices

High Demand for Endosurgery Devices in Bariatric Surgery

North America to Dominate Endosurgery Devices Market

Endosurgery Devices Market: Competition Landscape

In the global endosurgery devices market report, we have discussed individual strategies, followed by company profiles of the manufacturers of endosurgery devices. The ‘competitive landscape’ section has been included in the global endosurgery devices market report to provide readers with a dashboard view of the key players operating in the global endosurgery devices market.

Endosurgery devices market to reach a valuation of ~US$13 Bn By 2027

Endosurgery devices market is projected to expand at a CAGR of ~4% from 2019 to 2027

Endosurgery devices market is driven by growing awareness regarding the advantages of laparoscopic surgeries

North America accounted for a major share of the global endosurgery devices market

Key players in the global endosurgery devices market are Medtronic, Stryker, Ethicon, Inc., KARL STORZ SE & Co. KG, Olympus Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Endosurgery Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Endosurgery Devices Market Analysis and Forecast, 2019–2027

5. Market Outlook

5.1. Technological Advancements

5.2. Key Mergers & Acquisitions

5.3. Applied SWOT Analysis

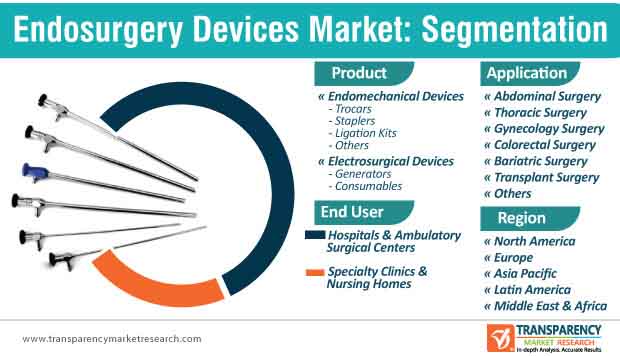

6. Global Endosurgery Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Market Value Forecast, by Product, 2019–2027

6.2.1. Endomechanical Devices

6.2.1.1. Trocars

6.2.1.2. Staplers

6.2.1.3. Ligation Kits

6.2.1.4. Others

6.2.2. Electrosurgical Devices

6.2.2.1. Generators

6.2.2.2. Consumables

6.2.2.2.1. Monopolar

6.2.2.2.2. Bipolar

6.2.2.2.3. Vessel Sealing

6.3. Market Attractiveness, by Product

7. Global Endosurgery Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Market Value Forecast, by Application, 2019–2027

7.2.1. Abdominal Surgery

7.2.2. Thoracic Surgery

7.2.3. Gynecology

7.2.4. Colorectal Surgery

7.2.5. Bariatric Surgery

7.2.6. Transplant Surgery

7.2.7. Others

7.3. Market Attractiveness, by Application

8. Global Endosurgery Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Market Value Forecast, by End-user, 2019–2027

8.2.1. Hospitals & Ambulatory Surgical Centers

8.2.2. Specialty Clinics & Nursing Homes

8.3. Market Attractiveness, by End-user

9. Global Endosurgery Devices Market Analysis and Forecast, by Region

9.1. Global Endosurgery Devices Market Scenario

9.2. Market Value Forecast, by Region, 2019–2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Endosurgery Devices Market Analysis and Forecast

10.1. Market Overview

10.2. Market Value Forecast, by Product, 2019–2027

10.2.1. Endomechanical Devices

10.2.1.1. Trocars

10.2.1.2. Staplers

10.2.1.3. Ligation Kits

10.2.1.4. Others

10.2.2. Electrosurgical Devices

10.2.2.1. Generators

10.2.2.2. Consumables

10.2.2.2.1. Monopolar

10.2.2.2.2. Bipolar

10.2.2.2.3. Vessel Sealing

10.3. Market Value Forecast, by Application, 2019–2027

10.3.1. Abdominal Surgery

10.3.2. Thoracic Surgery

10.3.3. Gynecology

10.3.4. Colorectal Surgery

10.3.5. Bariatric Surgery

10.3.6. Transplant Surgery

10.3.7. Others

10.4. Market Value Forecast, by End-user, 2019–2027

10.4.1. Hospitals & Ambulatory Surgical Centers

10.4.2. Specialty Clinics & Nursing Homes

10.5. Market Value Forecast, by Country, 2019–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Endosurgery Devices Market Analysis and Forecast

11.1. Market Overview

11.2. Market Value Forecast, by Product, 2019–2027

11.2.1. Endomechanical Devices

11.2.1.1. Trocars

11.2.1.2. Staplers

11.2.1.3. Ligation Kits

11.2.1.4. Others

11.2.2. Electrosurgical Devices

11.2.2.1. Generators

11.2.2.2. Consumables

11.2.2.2.1. Monopolar

11.2.2.2.2. Bipolar

11.2.2.2.3. Vessel Sealing

11.3. Market Value Forecast, by Application, 2019–2027

11.3.1. Abdominal Surgery

11.3.2. Thoracic Surgery

11.3.3. Gynecology

11.3.4. Colorectal Surgery

11.3.5. Bariatric Surgery

11.3.6. Transplant Surgery

11.3.7. Others

11.4. Market Value Forecast, by End-user , 2019–2027

11.4.1. Hospitals & Ambulatory Surgical Centers

11.4.2. Specialty Clinics & Nursing Homes

11.5. Market Value Forecast, by Country/Sub-region, 2019–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-Region

12. Asia Pacific Endosurgery Devices Market Analysis and Forecast

12.1. Market Overview

12.2. Market Value Forecast, by Product, 2019–2027

12.2.1. Endomechanical Devices

12.2.1.1. Trocars

12.2.1.2. Staplers

12.2.1.3. Ligation Kits

12.2.1.4. Others

12.2.2. Electrosurgical Devices

12.2.2.1. Generators

12.2.2.2. Consumables

12.2.2.2.1. Monopolar

12.2.2.2.2. Bipolar

12.2.2.2.3. Vessel Sealing

12.3. Market Value Forecast, by Application, 2019–2027

12.3.1. Abdominal Surgery

12.3.2. Thoracic Surgery

12.3.3. Gynecology

12.3.4. Colorectal Surgery

12.3.5. Bariatric Surgery

12.3.6. Transplant Surgery

12.3.7. Others

12.4. Market Value Forecast, by End-user, 2019–2027

12.4.1. Hospitals & Ambulatory Surgical Centers

12.4.2. Specialty Clinics & Nursing Homes

12.5. Market Value Forecast, by Country/Sub-region, 2019–2027

12.5.1. Japan

12.5.2. China

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-Region

13. Latin America Endosurgery Devices Market Analysis and Forecast

13.1. Market Overview

13.2. Market Value Forecast, by Product, 2019–2027

13.2.1. Endomechanical Devices

13.2.1.1. Trocars

13.2.1.2. Staplers

13.2.1.3. Ligation Kits

13.2.1.4. Others

13.2.2. Electrosurgical Devices

13.2.2.1. Generators

13.2.2.2. Consumables

13.2.2.2.1. Monopolar

13.2.2.2.2. Bipolar

13.2.2.2.3. Vessel Sealing

13.3. Market Value Forecast, by Application, 2019–2027

13.3.1. Abdominal Surgery

13.3.2. Thoracic Surgery

13.3.3. Gynecology

13.3.4. Colorectal Surgery

13.3.5. Bariatric Surgery

13.3.6. Transplant Surgery

13.3.7. Others

13.4. Market Value Forecast, by End-user, 2019–2027

13.4.1. Hospitals & Ambulatory Surgical Centers

13.4.2. Specialty Clinics & Nursing Homes

13.5. Market Value Forecast, by Country/Sub-region, 2019–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-Region

14. Middle East & Africa Endosurgery Devices Market Analysis and Forecast

14.1. Market Overview

14.2. Market Value Forecast, by Product, 2019–2027

14.2.1. Endomechanical Devices

14.2.1.1. Trocars

14.2.1.2. Staplers

14.2.1.3. Ligation Kits

14.2.1.4. Others

14.2.2. Electrosurgical Devices

14.2.2.1. Generators

14.2.2.2. Consumables

14.2.2.2.1. Monopolar

14.2.2.2.2. Bipolar

14.2.2.2.3. Vessel Sealing

14.3. Market Value Forecast, by Application, 2019–2027

14.3.1. Abdominal Surgery

14.3.2. Thoracic Surgery

14.3.3. Gynecology

14.3.4. Colorectal Surgery

14.3.5. Bariatric Surgery

14.3.6. Transplant Surgery

14.3.7. Others

14.4. Market Value Forecast, by End-user, 2019–2027

14.4.1. Hospitals & Ambulatory Surgical Centers

14.4.2. Specialty Clinics & Nursing Homes

14.5. Market Value Forecast By Country/Sub-region, 2019–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Israel

14.5.4. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-Region

15. Competition Landscape

15.1. Market Player - Competition Matrix

15.2. Market Position Analysis/Ranking, by Company, 2018

15.3. Company Profiles

15.3.1. Medtronic

15.3.1.1. Company Description

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. Strategic Overview

15.3.1.5. SWOT Analysis

15.3.2. Stryker

15.3.2.1. Company Description

15.3.2.2. Financial Overview

15.3.2.3. Strategic Overview

15.3.2.4. SWOT Analysis

15.3.3. Ethicon, Inc. (Johnson & Johnson)

15.3.3.1. Company Description

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. Karl Storz SE & Co. KG

15.3.4.1. Company Description

15.3.4.2. Strategic Overview

15.3.4.3. SWOT Analysis

15.3.5. Olympus Corporation

15.3.5.1. Company Description

15.3.5.2. Financial Overview

15.3.5.3. Strategic Overview

15.3.5.4. SWOT Analysis

15.3.6. Erbe Elektromedizin GmbH

15.3.6.1. Company Description

15.3.6.2. Strategic Overview

15.3.6.3. SWOT Analysis

15.3.7. Meril Life Sciences Pvt. Ltd.

15.3.7.1. Company Description

15.3.7.2. Product Portfolio

15.3.7.3. Strategic Overview

15.3.7.4. SWOT Analysis

15.3.8. Healthium Medtech

15.3.8.1. Company Description

15.3.8.2. Strategic Overview

15.3.8.3. SWOT Analysis

15.3.9. CONMED Corporation

15.3.9.1. Company Description

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. Strategic Overview

15.3.9.5. SWOT Analysis

15.3.10. Reach Surgical

15.3.10.1. Company Description

15.3.10.2. Strategic Overview

15.3.10.3. SWOT Analysis

List of Tables

Table 01: Key Mergers & Acquisitions in the Endosurgery Devices Market

Table 02: Global Endosurgery Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 03: Global Endosurgery Devices Market Value (US$ Mn) Forecast, by Endomechanical Devices, 2017–2027

Table 04: Global Endosurgery Devices Market Value (US$ Mn) Forecast, by Electrosurgical Devices, 2017–2027

Table 05: Global Endosurgery Devices Market Value (US$ Mn) Forecast, by Consumables, 2017–2027

Table 06: Global Endosurgery Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 07: Global Endosurgery Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 08: Global Endosurgery Devices Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 09: North America Endosurgery Devices Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 10: North America Endosurgery Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 11: North America Endosurgery Devices Market Value (US$ Mn) Forecast, by Endomechanical Devices, 2017–2027

Table 12: North America Endosurgery Devices Market Value (US$ Mn) Forecast, by Electrosurgical Devices, 2017–2027

Table 13: North America Endosurgery Devices Market Value (US$ Mn) Forecast, by Consumables, 2017–2027

Table 14: North America Endosurgery Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 15: North America Endosurgery Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 16: Europe Endosurgery Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Europe Endosurgery Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 18: Europe Endosurgery Devices Market Value (US$ Mn) Forecast, by Endomechanical Devices, 2017–2027

Table 19: Europe Endosurgery Devices Market Value (US$ Mn) Forecast, by Electrosurgical Devices, 2017–2027

Table 20: Europe Endosurgery Devices Market Value (US$ Mn) Forecast, by Consumables, 2017–2027

Table 21: Europe Endosurgery Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 22: Europe Endosurgery Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 23: Asia Pacific Endosurgery Devices Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2027

Table 24: Asia Pacific Endosurgery Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 25: Asia Pacific Endosurgery Devices Market Value (US$ Mn) Forecast, by Endomechanical Devices, 2017–2027

Table 26: Asia Pacific Endosurgery Devices Market Value (US$ Mn) Forecast, by Electrosurgical Devices, 2017–2027

Table 27: Asia Pacific Endosurgery Devices Market Value (US$ Mn) Forecast, by Consumables, 2017–2027

Table 28: Asia Pacific Endosurgery Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 29: Asia Pacific Endosurgery Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 30: Latin America Endosurgery Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 31: Latin America Endosurgery Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 32: Latin America Endosurgery Devices Market Value (US$ Mn) Forecast, by Endomechanical Devices, 2017–2027

Table 33: Latin America Endosurgery Devices Market Value (US$ Mn) Forecast, by Electrosurgical Devices, 2017–2027

Table 34: Latin America Endosurgery Devices Market Value (US$ Mn) Forecast, by Consumables, 2017–2027

Table 35: Latin America Endosurgery Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 36: Latin America Endosurgery Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 37: Middle East & Africa Endosurgery Devices Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2027

Table 38: Middle East & Africa Endosurgery Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 39: Middle East & Africa Endosurgery Devices Market Value (US$ Mn) Forecast, by Endomechanical Devices, 2017–2027

Table 40: Middle East & Africa Endosurgery Devices Market Value (US$ Mn) Forecast, by Electrosurgical Devices, 2017–2027

Table 41: Middle East & Africa Endosurgery Devices Market Value (US$ Mn) Forecast, by Consumables, 2017–2027

Table 42: Middle East & Africa Endosurgery Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 43: Middle East & Africa Endosurgery Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Endosurgery Devices Market Value (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 02: Global Endosurgery Devices Market Value Share (%), by Application, 2018

Figure 03: Global Endosurgery Devices Market Value Share Analysis by Product, 2018

Figure 04: Global Endosurgery Devices Market Value Share, by Product, 2018

Figure 05: Global Endosurgery Devices Market Value Share, by Application, 2018

Figure 06: Global Endosurgery Devices Market Value Share, by End-user, 2018

Figure 07: Global Endosurgery Devices Value Share, by Region, 2018

Figure 08: Global Endosurgery Devices Market Value (US$ Mn) Forecast, 2017–2027

Figure 09: Global Endosurgery Devices Market Value Share (%), by Product, 2018 and 2027

Figure 10: Global Endosurgery Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Endomechanical Devices, 2017–2027

Figure 11: Global Endosurgery Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Electrosurgical Devices, 2017–2027

Figure 12: Global Endosurgery Devices Market Attractiveness Analysis, by Product, 2019–2027

Figure 13: Global Endosurgery Devices Market Value Share, by Application, 2018 and 2027

Figure 14: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Abdominal Surgery, 2017–2027

Figure 15: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Thoracic Surgery, 2017–2027

Figure 16: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Gynecology Surgery, 2017–2027

Figure 17: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Colorectal Surgery, 2017–2027

Figure 18: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Bariatric Surgery, 2017–2027

Figure 19: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Transplant Surgery, 2017–2027

Figure 20: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 21: Global Endosurgery Devices Market Attractiveness, by Application, 2019–2027

Figure 22: Global Endosurgery Devices Market Value Share, by End-user, 2018 and 2027

Figure 23: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Hospitals & Ambulatory Surgical Centers, 2017–2027

Figure 24: Global Endosurgery Devices Market Value (US$ Mn) and Y-o-Y Growth, by Specialty Clinics, 2017–2027

Figure 25: Global Endosurgery Devices Market Attractiveness, by End-user, 2019–2027

Figure 26: Global Endosurgery Devices Market Value Share, by Region, 2018 and 2027

Figure 27: Global Endosurgery Devices Market Attractiveness, by Region, 2019–2027

Figure 28: North America Endosurgery Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 29: North America Endosurgery Devices Market Value Share (%), by Country, 2018 and 2027

Figure 30: North America Endosurgery Devices Market Attractiveness, by Country, 2019–2027

Figure 31: North America Endosurgery Devices Market Value Share, by Product, 2018 and 2027

Figure 32: North America Endosurgery Devices Market Attractiveness, by Product, 2019–2027

Figure 33: North America Endosurgery Devices Market Value Share Analysis, by Application, 2018 and 2027

Figure 34: North America Endosurgery Devices Market Attractiveness, by Application, 2019–2027

Figure 35: North America Endosurgery Devices Market Value Share, by End-user, 2018 and 2027

Figure 36: North America Endosurgery Devices Market Attractiveness, by End-user, 2019–2027

Figure 37: Europe Endosurgery Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 38: Europe Endosurgery Devices Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 39: Europe Endosurgery Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 40: Europe Endosurgery Devices Market Value Share, by Product, 2018 and 2027

Figure 41: Europe Endosurgery Devices Market Attractiveness, by Product, 2019–2027

Figure 42: Europe Endosurgery Devices Market Value Share Analysis, by Application, 2018 and 2027

Figure 43: Europe Endosurgery Devices Market Attractiveness, by Application, 2019–2027

Figure 44: Europe Endosurgery Devices Market Value Share, by End-user, 2018 and 2027

Figure 45: Europe Endosurgery Devices Market Attractiveness, by End-user, 2019–2027

Figure 46: Asia Pacific Endosurgery Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 47: Asia Pacific Endosurgery Devices Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 48: Asia Pacific Endosurgery Devices Market Attractiveness, by Country/Sub-Region, 2019–2027

Figure 49: Asia Pacific Endosurgery Devices Market Value Share, by Product, 2018 and 2027

Figure 50: Asia Pacific Endosurgery Devices Market Attractiveness, by Product, 2019–2027

Figure 51: Asia Pacific Endosurgery Devices Market Value Share Analysis, by Application, 2018 and 2027

Figure 52: Asia Pacific Endosurgery Devices Market Attractiveness, by Application, 2019–2027

Figure 53: Asia Pacific Endosurgery Devices Market Value Share, by End-user, 2018 and 2027

Figure 54: Asia Pacific Endosurgery Devices Market Attractiveness, by End-user, 2019–2027

Figure 55: Latin America Endosurgery Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 56: Latin America Endosurgery Devices Market Value Share (%), by Country/Sub-Region, 2018 and 2027

Figure 57: Latin America Endosurgery Devices Market Attractiveness, by Country/Sub-Region, 2019–2027

Figure 58: Latin America Endosurgery Devices Market Value Share, by Product, 2018 and 2027

Figure 59: Latin America Endosurgery Devices Market Attractiveness, by Product, 2019–2027

Figure 60: Latin America Endosurgery Devices Market Value Share Analysis, by Application, 2018 and 2027

Figure 61: Latin America Endosurgery Devices Market Attractiveness, by Application, 2019–2027

Figure 62: Latin America Endosurgery Devices Market Value Share, by End-user, 2018 and 2027

Figure 63: Latin America Endosurgery Devices Market Attractiveness, by End-user, 2019–2027

Figure 64: Middle East & Africa Endosurgery Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 65: Middle East & Africa Endosurgery Devices Market Value Share (%), by Country/Sub-Region, 2018 and 2027

Figure 66: Middle East & Africa Endosurgery Devices Market Attractiveness, by Country/Sub-Region, 2019–2027

Figure 67: Middle East & Africa Endosurgery Devices Market Value Share, by Product, 2018 and 2027

Figure 68: Middle East & Africa Endosurgery Devices Market Attractiveness, by Product, 2019–2027

Figure 69: Middle East & Africa Endosurgery Devices Market Value Share Analysis, by Application, 2018 and 2027

Figure 70: Middle East & Africa Endosurgery Devices Market Attractiveness, by Application, 2019–2027

Figure 71: Middle East & Africa Endosurgery Devices Market Value Share, by End-user, 2018 and 2027

Figure 72: Middle East & Africa Endosurgery Devices Market Attractiveness, by End-user, 2019–2027

Figure 73: Market Position Analysis, 2018, by Tier and Size of the Company