Reports

Reports

Analysts’ Viewpoint

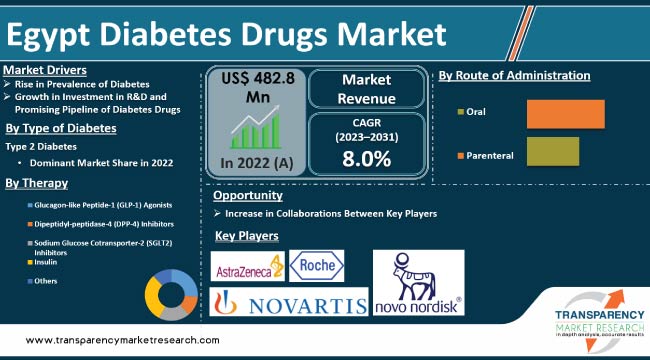

Increase in incidence of diabetes is a key factor augmenting the Egypt diabetes drugs market size. Type 1 and type 2 diabetes have become a major health concern in Egypt, and this trend is expected to continue in the near future. Rise in investments in R&D and promising pipeline of diabetes drugs are also fueling the Egypt diabetes drugs market development.

Government initiatives to address the diabetes epidemic, including subsidizing essential diabetes medications, promoting awareness campaigns, and improving healthcare infrastructure, are likely to boost the diabetes drugs market value in the near future. Local and multinational pharmaceutical companies are introducing new medications and adopting innovative treatment options. In line with the latest Egypt diabetes drugs market trends, they are also investing in technological advancements in drug delivery systems to strengthen their industry position.

Diabetes drugs, also known as antidiabetic medications or hypoglycemic agents, are pharmaceutical substances used to manage and control blood sugar levels in individuals with diabetes. Diabetes is a chronic medical condition characterized by elevated blood glucose (sugar) levels. Effective management of these levels is essential in preventing complications associated with the disease. There are various classes of diabetes drugs, each with a different mechanism of action and intended for specific types and stages of diabetes.

The Egypt diabetes drugs market encompasses a wide range of pharmaceuticals designed to manage and control blood sugar levels in individuals with diabetes, catering to both type 1 and type 2 diabetes. Key therapies include Glucagon-like Peptide-1 (GLP-1) Agonists, Dipeptidyl-peptidase-4 (DPP-4) Inhibitors, Sodium Glucose Cotransporter-2 (SGLT2) Inhibitors, and insulin.

Changes in lifestyle and increase in aging population are prominent factors boosting the diabetes market demand in Egypt. Market dynamics are also influenced by factors such as government initiatives, strong healthcare infrastructure, advancements in drug delivery systems, and introduction of innovative treatment options.

The data from the International Diabetes Federation (IDF) regarding Egypt's high prevalence of diabetes is a cause for concern. Dietary habits are playing a significant role in incidence of diabetes, as Egyptians are increasingly consuming processed foods, sugary drinks, and red meat, which are often high in saturated fats and calories. This type of diet can lead to weight gain and insulin resistance, both of which are risk factors for diabetes.

Sedentary lifestyle has become more common in Egypt, with several individuals spending long hours sitting at work or school. Physical inactivity is known to increase the risk of developing type 2 diabetes. Obesity is a major risk factor for diabetes, and Egypt has one of the highest obesity rates in the world. The combination of poor dietary choices and sedentary behaviors has contributed to an alarming rise in obesity rate in the country.

Growth in prevalence of diabetes in Egypt directly impacts market statistics. Rise in number of people diagnosed with diabetes is driving the demand for medications to manage the condition. This surge in demand is encouraging pharmaceutical companies to develop and offer a variety of drugs to cater to the needs of this expanding patient population.

Public health authorities in Egypt are implementing public awareness campaigns, educational initiatives, and policies that promote healthier eating habits and physical activities to mitigate the growing burden of diabetes in the country.

Surge in geriatric population is also creating lucrative Egypt diabetes drugs market opportunities for industry players. This elderly population is more susceptible to developing diabetes. According to the IDF, the prevalence of diabetes is the highest among the elderly population in Egypt, with 33.3% of people aged 65 and above living with the condition.

According to the Central Agency for Public Mobilization and Statistics (CAPMAS), Egypt's elderly population reached 6.5 million in 2019; of this, 3.5 million were males, while 3 million were females. The number has been increasing significantly since then and is expected to reach 10.5 million by 2030.

Pharmaceutical companies have significantly increased their investments in R&D activities to create new and innovative diabetes drugs. These emerging drugs not only enhance the quality of life for people with diabetes but also work to reduce the risk of diabetes-related complications.

Growth in R&D investments has led to a wider array of treatment choices for diabetes, which is particularly vital because individuals with diabetes have diverse needs and responses to various medications.

Availability of treatment options empowers people with diabetes in Egypt to find a therapy that best suits their individual circumstances. Additionally, intense competition in the Egypt diabetes drugs market has contributed to a decrease in the cost of these medications. This cost reduction is making diabetes drugs more affordable and accessible for the people in Egypt.

Innovative diabetes drugs currently in the pipeline include insulin analogs, oral medications, and injectable drugs. Insulin analogs, for instance, are designed to be more efficient and convenient compared to traditional insulins, offering longer-lasting effects.

A range of novel oral medications is also being developed to enhance blood sugar control and reduce the risk of complications. Similarly, new injectable medications are under development with the goal of not only improving blood sugar control but also promoting weight loss.

Thus, increase in R&D investments and promising pipeline of diabetes drugs are bolstering the market trajectory, ultimately enhancing the overall care and well-being of people living with diabetes in the country.

According to the diabetes drugs market analysis, the type 2 diabetes segment held significant share in 2022. Rise in prevalence of type 2 diabetes is anticipated to drive the segment during the forecast period.

Type 2 is the most prevalent type of diabetes and is characterized by the body’s inability to effectively utilize insulin. Some individuals can manage their blood glucose (blood sugar) levels through a healthy diet and regular exercise, while others may require medication or insulin to control their condition.

According to the data from the International Diabetes Federation, Egypt has more than eight million diabetes patients. The WHO estimates that around 30% of Egyptians suffer from hypertension, primarily due to excessive salt intake. Egypt was among the top 10 countries or territories with the highest estimated prevalence of diabetes in adults aged 20 to 79 in 2021.

Based on distribution channel, the retail pharmacies segment accounted for the largest Egypt diabetes drugs market share in 2022. Retail pharmacies often have pharmacists who can educate patients. This ensures that individuals understand how to use drugs effectively and safely.

Retail pharmacies also offer convenience and accessibility to patients with diabetes. These pharmacies are commonly located in residential areas. Increase in number of retail pharmacies, easy availability of diabetes drugs in these settings, and growth in preference among patients for easy access to medication and advice from trained pharmacists are likely to boost the retail pharmacies segment during the forecast period.

Introduction of oral diabetes control drugs has marked a significant advancement in the pharmaceutical sector, offering diversified options for diabetes management. Currently, oral anti-diabetic medications encompass a broad spectrum, including metformin, sulfonylureas, DPP-4 inhibitors, and SGLT-2 inhibitors.

These drugs play a crucial role in regulating blood sugar levels and exhibit diverse mechanisms of action, providing healthcare professionals with a range of tools for tailored diabetes treatment. Convenience and effectiveness associated with these oral medications have contributed to the surging preference for oral delivery methods in diabetes care.

This shift toward oral anti-diabetic drugs highlights the industry's commitment to improve the accessibility and efficacy of diabetes management, ultimately improving the quality of life for individuals living with diabetes, while expanding the horizons of pharmaceutical innovation in this vital therapeutic area.

The Egypt diabetes drugs landscape is consolidated, with the presence of small number of leading players. Expansion of product portfolio and mergers & acquisitions are key strategies implemented by the prominent players.

AstraZeneca, Boehringer Ingelheim International GmbH, Johnson & Johnson Services, Inc., Eli Lilly and Company, Merck & Co., Inc., Novartis AG, Novo Nordisk A/S, and Sanofi are some of the major players operating in the Egypt diabetes drugs market in Egypt.

Each of these companies have been summarized in the diabetes drugs market report based on parameters such as company overview, business strategies, financial overview, business segments, recent developments, and product portfolio.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 482.8 Mn |

| Market Forecast Value in 2031 | More than US$ 993.0 Mn |

| Growth Rate (CAGR) | 8.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, disease prevalence rate in Egypt, pipeline analysis, and value chain analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Country Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 482.8 Mn in 2022

It is projected to reach more than US$ 993.0 Mn by 2031

The CAGR is anticipated to be 8.0% from 2023 to 2031

Rise in prevalence of diabetes, growth in investment in R&D, and promising pipeline of diabetes drugs

AstraZeneca, Boehringer Ingelheim International GmbH, Johnson & Johnson Services, Inc., Eli Lilly and Company, Merck & Co., Inc., Novartis AG, Novo Nordisk A/S, and Sanofi

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Egypt Diabetes Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Type of Diabetes Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Egypt Diabetes Drugs Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Disease Prevalence & Incidence Rate

5.2. Pipeline Analysis

5.3. Regulatory Scenario of Egypt

5.4. Value Chain Analysis

5.5. COVID-19 Impact Analysis

6. Egypt Diabetes Drugs Market Analysis and Forecast, By Type of Diabetes

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Type of Diabetes, 2017 - 2031

6.3.1. Type 1 Diabetes

6.3.2. Type 2 Diabetes

6.3.3. Others

6.4. Market Attractiveness By Type of Diabetes

7. Egypt Diabetes Drugs Market Analysis and Forecast, By Therapy

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Therapy, 2017 - 2031

7.3.1. Glucagon-like Peptide-1 (GLP-1) Agonists

7.3.2. Dipeptidyl-peptidase-4 (DPP-4) Inhibitors

7.3.3. Sodium Glucose Cotransporter-2 (SGLT2) Inhibitors

7.3.4. Insulin

7.3.5. Others

7.4. Market Attractiveness By Therapy

8. Egypt Diabetes Drugs Market Analysis and Forecast, By Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Route of Administration, 2017 - 2031

8.3.1. Oral

8.3.2. Parenteral

8.4. Market Attractiveness By Route of Administration

9. Egypt Diabetes Drugs Market Analysis and Forecast, By Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Distribution Channel, 2017 - 2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness By Distribution Channel

10. Competition Landscape

10.1. Market Player – Competition Matrix (By Tier and Size of Companies)

10.2. Market Share Analysis By Company (2022)

10.3. Company Profiles

10.3.1. AstraZeneca

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Strategic Overview

10.3.1.5. SWOT Analysis

10.3.2. Boehringer Ingelheim International GmbH

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Strategic Overview

10.3.2.5. SWOT Analysis

10.3.3. Johnson & Johnson Services, Inc.

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Strategic Overview

10.3.3.5. SWOT Analysis

10.3.4. Eli Lilly and Company

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Strategic Overview

10.3.4.5. SWOT Analysis

10.3.5. Merck & Co., Inc.

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Strategic Overview

10.3.5.5. SWOT Analysis

10.3.6. Novartis AG

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Strategic Overview

10.3.6.5. SWOT Analysis

10.3.7. Novo Nordisk A/S

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Strategic Overview

10.3.7.5. SWOT Analysis

10.3.8. Sanofi

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Strategic Overview

10.3.8.5. SWOT Analysis

List of Tables

Table 01: Egypt Diabetes Drugs Market Value (US$ Mn) Forecast, by Type of Diabetes, 2017–2031

Table 02: Egypt Diabetes Drugs Market Value (US$ Mn) Forecast, by Therapy, 2017–2031

Table 03: Egypt Diabetes Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 04: Egypt Diabetes Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Egypt Diabetes Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Egypt Diabetes Drugs Market Value Share, by Type, 2022

Figure 03: Egypt Diabetes Drugs Market Value Share, by Therapy, 2022

Figure 04: Egypt Diabetes Drugs Market Value Share, by Route of Administration, 2022

Figure 05: Egypt Diabetes Drugs Market Value Share, by Distribution Channel, 2022

Figure 06: Egypt Diabetes Drugs Market Value Share Analysis, by Type of Diabetes, 2022 and 2031

Figure 07: Egypt Diabetes Drugs Market Attractiveness, by Type of Diabetes, 2023-2031

Figure 08: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Type 1 Diabetes, 2017–2031

Figure 09: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Type 2 Diabetes, 2017–2031

Figure 10: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Others, 2017–2031

Figure 11: Egypt Diabetes Drugs Market Value Share Analysis, by Therapy, 2022 and 2031

Figure 12: Egypt Diabetes Drugs Market Attractiveness Analysis, by Therapy, 2023–2031

Figure 13: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Glucagon-like Peptide-1 (GLP-1) Agonists, 2017–2031

Figure 14: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Dipeptidyl-peptidase-4 (DPP-4) Inhibitors, 2017–2031

Figure 15: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Sodium-glucose Cotransporter-2 (SGLT2), 2017–2031

Figure 16: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Insulin, 2017–2031

Figure 17: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Others, 2017–2031

Figure 18: Egypt Diabetes Drugs Market, by Route of Administration, 2022 and 2031

Figure 19: Egypt Diabetes Drugs Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 20: Egypt Diabetes Drugs Market (US$ Mn), by Oral, 2017–2031

Figure 21: Egypt Diabetes Drugs Market (US$ Mn), by Parenteral, 2017–2031

Figure 22: Egypt Diabetes Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 23: Egypt Diabetes Drugs Market Attraction, by Distribution Channel, 2023-2031

Figure 24: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 25: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 26: Egypt Diabetes Drugs Market Revenue (US$ Mn), by Online Pharmacies, 2017–2031