Reports

Reports

Analysts’ Viewpoint

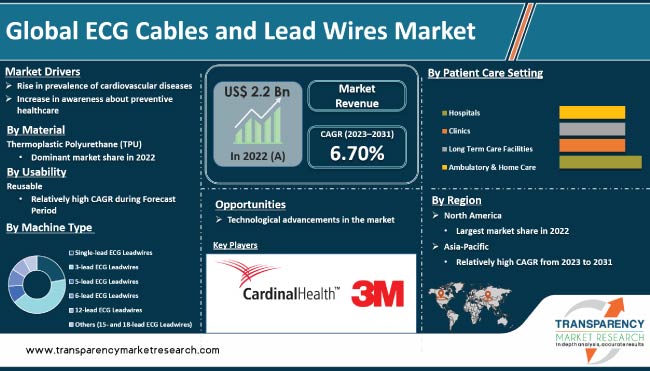

The global ECG cables and lead wires market is expected to be driven by rise in prevalence of cardiovascular diseases across the world. Increase in adoption of telemedicine and remote patient monitoring systems, which require reliable and high-quality ECG cables and lead wires to transmit accurate data from patients to healthcare providers, is anticipated propel market expansion. Furthermore, surge in healthcare spending and rise in awareness about cardiovascular diseases are fueling industry progress.

Technological advancements, such as development of wireless ECG cables and lead wires that improve patient comfort and integration of ECG cables & lead wires with other medical devices, offer lucrative opportunities to market players. Manufacturers are focusing on developing high quality and cost-effective products in order to increase market share.

ECG stands for electrocardiogram, which is a diagnostic test that measures the electrical activity of the heart. An ECG machine is used to record this electrical activity, which is represented on a graph as a series of waves and complexes. ECG cables and lead wires are components of the ECG machine that connect the patient to the ECG monitor. The ECG cable is the larger of the two components and connects the ECG machine to the patient's chest electrodes. ECG lead wires are smaller wires that connect the electrodes to the ECG cable.

ECG cables and lead wires are important components of the ECG machine because these transmit the electrical signals from the patient's heart to the ECG monitor. It is important that the cables and lead wires are of good quality and are properly connected to ensure accurate and reliable ECG recordings.

Cardiovascular diseases are a major health concern globally. The prevalence of these diseases has increased in the past few years. It increases with age, and people aged 65 years and older are at the highest risk. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for nearly 18 million deaths each year. CVDs are responsible for one in every three deaths in the U.S., or approximately 655,000 deaths annually.

Arrhythmia is a condition where the heart beats irregularly or too fast or slow. It can occur in people of all ages and could be caused by various factors such as high blood pressure, diabetes, and heart disease. The prevalence of CVDs has increased globally due to factors such as the aging population, unhealthy lifestyles, and poor diets. The risk of developing cardiovascular diseases increases with age; this trend has been observed in both developed and developing countries.

The rise in the prevalence of CVDs drives demand for diagnostic tools and medical devices such as ECG machines and related accessories such as cables and lead wires. ECG machines are used to diagnose and monitor various heart conditions, including arrhythmia, heart attack, and heart failure. The surge in demand for these devices is expected to propel the global ECG cables and lead wires market size.

The global ECG cables and lead wires market has witnessed significant growth in the past few years, driven by an increase in the adoption of patient monitoring devices and a rise in demand for more advanced medical equipment. ECG cables and lead wires are essential components of patient monitoring devices, connecting electrodes to the patient monitor, which enables medical professionals to obtain accurate and real-time data on a patient's cardiac activity.

ECG cables and lead wires are available in various types, such as reusable and disposable, and in different lengths and colors. These devices are used to measure impedance and ECG respiration in adult and pediatric patients and have become an integral part of cardiac care units. The rise in demand for ECG cables and lead wires due to a surge in the prevalence of heart-related diseases and conditions, such as arrhythmias and heart attacks, is expected to propel global ECG cables and lead wires market share in the next few years.

Implementation of embossed plastic location identifiers and color-coding, which aid in ensuring that electrodes are used correctly, is a significant trend in the market. Furthermore, several companies are offering a range of ECG patient cables that are compatible with the majority of patient monitors used in cardiac care units to ensure equipment interoperability and product traceability. Healthcare facilities seek to purchase equipment that is both reliable and compatible with their existing systems.

In terms of material, the thermoplastic polyurethane (TPU) segment dominated the global ECG cables and lead wires industry in 2022. TPU is a popular material of choice for ECG cables and lead wires due to its unique combination of properties such as flexibility, durability, and resistance to chemicals and abrasion. TPU is also known for its biocompatibility, which makes it suitable for use in medical devices.

Demand for TPU-based ECG cables and lead wires has increased in the past few years due to the rise in the adoption of advanced medical technologies and the need for more durable and reliable devices. TPU-based cables and lead wires are also preferred in applications that require high flexibility and low friction, such as wearable medical devices.

Based on usability, the reusable segment is projected to grow at a rapid pace during the forecast period. Reusable cables and lead wires are designed to withstand multiple uses, reducing the need for frequent replacements and lowering overall costs for healthcare providers. However, reusable cables and lead wires must be properly maintained and cleaned to ensure their safety and effectiveness. Proper cleaning and disinfection procedures are essential to prevent the transmission of infectious agents between patients. Hence, healthcare providers must ensure that they have the proper protocols and equipment in place to safely and effectively clean and disinfect reusable ECG cables and lead wires.

In terms of machine type, the 12-lead ECG lead wires segment dominated the global ECG cables and lead wires market in 2022. Growth of the segment can be ascribed to a rise in the prevalence of cardiovascular diseases and an increase in demand for advanced ECG monitoring systems. The 12-lead ECG system provides a more comprehensive and detailed view of the heart's electrical activity compared to the 3-lead ECG system, making it a preferred choice in diagnosing and monitoring various cardiac conditions.

The introduction of wireless and portable ECG monitoring devices that use 12-lead ECG lead wires is propelling the segment. These devices allow for remote monitoring of patients and offer real-time data transmission, making it easier for healthcare professionals to monitor patients in different settings.

Overall, the 12-lead ECG lead wires segment is expected to grow at a rapid pace in the next few years, driven by technological advancements and an increase in demand for more accurate and detailed cardiac monitoring.

Based on the patient care settings, the hospital's segment led the global market in 2022. Hospitals are the primary end-users of ECG machines, and demand for these devices is expected to rise as the global population ages and the incidence of cardiovascular diseases increases. This, in turn, is expected to bolster demand for ECG cables and lead wires in hospitals.

The ECG cables and lead wires market is highly competitive, with several global and regional players offering a range of products. These players include large medical device manufacturers and specialized companies that focus exclusively on ECG cables and lead wires. These devices are also used in clinics, ambulatory care centers, and home healthcare settings. However, hospitals are likely to be the largest segment during the forecast period.

As per ECG cables and lead wires market trends, North America accounted for the largest share of the global business in 2022. The market in the region is driven by the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and the presence of major players. The market in North America is also driven by an increase in the adoption of advanced ECG machines and monitoring systems, which require high-quality cables and lead wires for accurate measurements. Additionally, the surge in demand for home healthcare services and an increase in the availability of portable ECG machines and wearable devices are expected to accelerate ECG cables and lead wires market growth in the region.

The U.S. was the largest market for ECG cables and lead wires in North America in 2022. This is ascribed to a large population, a well-established healthcare system, and high healthcare spending. The country has a large number of hospitals, clinics, and diagnostic centers, which are the primary end-users of ECG machines and related accessories.

The market in Asia Pacific is projected to grow at a rapid pace during the forecast period. This is ascribed to a rise in the prevalence of cardiovascular diseases, an increase in healthcare expenditure, and the development of advanced medical technologies in the region.

This report provides profiles of leading players operating in the global ECG cables and leads wires industry. These include Cardinal Health, Inc., 3M Company, GE Healthcare, Koninklijke Philips NV, Abbott Laboratories, Boston Scientific Corporation, CONMED Corporation, Mindray Medical International Limited, Welch Allyn, Inc., Medtronic, Cables and Sensors, Curbell Medical Products, Inc. These players engage in mergers & acquisitions, strategic collaborations, and new product launches to expand their presence and increase market share.

The report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements in the market.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 2.2 Bn |

|

Forecast (Value) in 2031 |

More than US$ 4.0 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 2.2 Bn in 2022.

It is projected to reach more than US$ 4.0 Bn by 2031.

The CAGR is anticipated to be 6.7% from 2023 to 2031.

The thermoplastic polyurethane (TPU) held the largest share in 2022.

North America is expected to account for the significant share during the forecast period.

Cardinal Health, Inc., 3M Company, GE Healthcare, Koninklijke Philips NV, Abbott Laboratories, Boston Scientific Corporation, CONMED Corporation, Mindray Medical International Limited, Welch Allyn, Inc., Medtronic, Cables and Sensors, and Curbell Medical Products, Inc. are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global ECG Cables and Lead Wires Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global ECG Cables and Lead Wires Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Key Material/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global ECG Cables and Lead Wires Market Analysis and Forecast, by Material

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Material, 2017–2031

6.3.1. Thermoplastic Polyurethane (TPU)

6.3.2. Thermoplastic Elastomer (TPE)

6.3.3. Others (silicone, PVC)

6.4. Market Attractiveness Analysis, by Material

7. Global ECG Cables and Lead Wires Market Analysis and Forecast, by Usability

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Usability, 2017–2031

7.3.1. Disposable

7.3.2. Reusable

7.4. Market Attractiveness Analysis, by Usability

8. Global ECG Cables and Lead Wires Market Analysis and Forecast, by Machine Type

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Machine Type, 2017–2031

8.3.1. Single-lead ECG Leadwires

8.3.2. 3-lead ECG Leadwires

8.3.3. 5-lead ECG Leadwires

8.3.4. 6-lead ECG Leadwires

8.3.5. 12-lead ECG Leadwires

8.3.6. Others (15- and 18-lead ECG Leadwires)

8.4. Market Attractiveness Analysis, by Machine Type

9. Global ECG Cables and Lead Wires Market Analysis and Forecast, by Patient Care Setting

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Patient Care Setting, 2017–2031

9.3.1. Hospitals

9.3.2. Clinics

9.3.3. Long Term Care Facilities

9.3.4. Ambulatory & Home Care

9.4. Market Attractiveness Analysis, by Patient Care Setting

10. Global ECG Cables and Lead Wires Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America ECG Cables and Lead Wires Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Material, 2017–2031

11.2.1. Thermoplastic Polyurethane (TPU)

11.2.2. Thermoplastic Elastomer (TPE)

11.2.3. Others (silicone, PVC)

11.3. Market Value Forecast, by Usability, 2017–2031

11.3.1. Disposable

11.3.2. Reusable

11.4. Market Value Forecast, by Machine Type, 2017–2031

11.4.1. Single-lead ECG Leadwires

11.4.2. 3-lead ECG Leadwires

11.4.3. 5-lead ECG Leadwires

11.4.4. 6-lead ECG Leadwires

11.4.5. 12-lead ECG Leadwires

11.4.6. Others (15- and 18-lead ECG Leadwires)

11.5. Market Value Forecast, by Patient Care Setting, 2017–2031

11.5.1. Hospitals

11.5.2. Clinics

11.5.3. Long Term Care Facilities

11.5.4. Ambulatory & Home Care

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Material

11.7.2. By Usability

11.7.3. By Machine Type

11.7.4. By Patient Care Setting

11.7.5. By Country/Sub-region

12. Europe ECG Cables and Lead Wires Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Material, 2017–2031

12.2.1. Thermoplastic Polyurethane (TPU)

12.2.2. Thermoplastic Elastomer (TPE)

12.2.3. Others (silicone, PVC)

12.3. Market Value Forecast, by Usability, 2017–2031

12.3.1. Disposable

12.3.2. Reusable

12.4. Market Value Forecast, by Machine Type, 2017–2031

12.4.1. Single-lead ECG Leadwires

12.4.2. 3-lead ECG Leadwires

12.4.3. 5-lead ECG Leadwires

12.4.4. 6-lead ECG Leadwires

12.4.5. 12-lead ECG Leadwires

12.4.6. Others (15- and 18-lead ECG Leadwires)

12.5. Market Value Forecast, by Patient Care Setting, 2017–2031

12.5.1. Hospitals

12.5.2. Clinics

12.5.3. Long Term Care Facilities

12.5.4. Ambulatory & Home Care

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Material

12.7.2. By Usability

12.7.3. By Machine Type

12.7.4. By Patient Care Setting

12.7.5. By Country/Sub-region

13. Asia Pacific ECG Cables and Lead Wires Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Material, 2017–2031

13.2.1. Thermoplastic Polyurethane (TPU)

13.2.2. Thermoplastic Elastomer (TPE)

13.2.3. Others (silicone, PVC)

13.3. Market Value Forecast, by Usability, 2017–2031

13.3.1. Disposable

13.3.2. Reusable

13.4. Market Value Forecast, by Machine Type, 2017–2031

13.4.1. Single-lead ECG Leadwires

13.4.2. 3-lead ECG Leadwires

13.4.3. 5-lead ECG Leadwires

13.4.4. 6-lead ECG Leadwires

13.4.5. 12-lead ECG Leadwires

13.4.6. Others (15- and 18-lead ECG Leadwires)

13.5. Market Value Forecast, by Patient Care Setting, 2017–2031

13.5.1. Hospitals

13.5.2. Clinics

13.5.3. Long Term Care Facilities

13.5.4. Ambulatory & Home Care

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Material

13.7.2. By Usability

13.7.3. By Machine Type

13.7.4. By Patient Care Setting

13.7.5. By Country/Sub-region

14. Latin America ECG Cables and Lead Wires Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Material, 2017–2031

14.2.1. Thermoplastic Polyurethane (TPU)

14.2.2. Thermoplastic Elastomer (TPE)

14.2.3. Others (silicone, PVC)

14.3. Market Value Forecast, by Usability, 2017–2031

14.3.1. Disposable

14.3.2. Reusable

14.4. Market Value Forecast, by Machine Type, 2017–2031

14.4.1. Single-lead ECG Leadwires

14.4.2. 3-lead ECG Leadwires

14.4.3. 5-lead ECG Leadwires

14.4.4. 6-lead ECG Leadwires

14.4.5. 12-lead ECG Leadwires

14.4.6. Others (15- and 18-lead ECG Leadwires)

14.5. Market Value Forecast, by Patient Care Setting, 2017–2031

14.5.1. Hospitals

14.5.2. Clinics

14.5.3. Long Term Care Facilities

14.5.4. Ambulatory & Home Care

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Material

14.7.2. By Usability

14.7.3. By Machine Type

14.7.4. By Patient Care Setting

14.7.5. By Country/Sub-region

15. Middle East & Africa ECG Cables and Lead Wires Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Material, 2017–2031

15.2.1. Thermoplastic Polyurethane (TPU)

15.2.2. Thermoplastic Elastomer (TPE)

15.2.3. Others (silicone, PVC)

15.3. Market Value Forecast, by Usability, 2017–2031

15.3.1. Disposable

15.3.2. Reusable

15.4. Market Value Forecast, by Machine Type, 2017–2031

15.4.1. Single-lead ECG Leadwires

15.4.2. 3-lead ECG Leadwires

15.4.3. 5-lead ECG Leadwires

15.4.4. 6-lead ECG Leadwires

15.4.5. 12-lead ECG Leadwires

15.4.6. Others (15- and 18-lead ECG Leadwires)

15.5. Market Value Forecast, by Patient Care Setting, 2017–2031

15.5.1. Hospitals

15.5.2. Clinics

15.5.3. Long Term Care Facilities

15.5.4. Ambulatory & Home Care

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Material

15.7.2. By Usability

15.7.3. By Machine Type

15.7.4. By Patient Care Setting

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2022

16.3. Company Profiles

16.3.1. Cardinal Health, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. 3M Company

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. GE Healthcare

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Koninklijke Philips NV

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Abbott Laboratories

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Boston Scientific Corporation

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. CONMED Corporation

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Mindray Medical International Limited

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Welch Allyn, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Curbell Medical Materials, Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Medtronic

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. Cables and Sensors

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

List of Tables

Table 01: Global ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 02: Global ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 03: Global ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Machine Type, 2017–2031

Table 04: Global ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2031

Table 05: Global ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: Global ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 08: North America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 10: North America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Machine Type, 2017–2031

Table 11: North America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2031

Table 13: North America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 14: Europe ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 15: Europe ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 16: Europe ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 17: Europe ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Machine Type, 2017–2031

Table 18: Europe ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2031

Table 20: Europe ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Asia Pacific ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Asia Pacific ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 23: Asia Pacific ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 24: Asia Pacific ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Machine Type, 2017–2031

Table 25: Asia Pacific ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2031

Table 26: Latin America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Latin America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 28: Latin America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 29: Latin America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Machine Type, 2017–2031

Table 30: Latin America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2031

Table 31: Middle East and Africa ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East and Africa ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 33: Middle East and Africa ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 34: Middle East and Africa ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Machine Type, 2017–2031

Table 35: Middle East and Africa ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2031

List of Figures

Figure 01: Global ECG Cables and Lead Wires Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global ECG Cables and Lead Wires Market Value Share, by Material, 2022

Figure 03: Global ECG Cables and Lead Wires Market Value Share, by Usability, 2022

Figure 04: Global ECG Cables and Lead Wires Market Value Share, by Machine Type, 2022

Figure 05: Global ECG Cables and Lead Wires Market Value Share, by Patient Care Setting, 2022

Figure 08: Global ECG Cables and Lead Wires Market Value Share Analysis, by Material, 2022 and 2031

Figure 09: Global ECG Cables and Lead Wires Market Attractiveness Analysis, Material, 2023–2031

Figure 10: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Thermoplastic Polyurethane (TPU), 2017–2031

Figure 11: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Thermoplastic Elastomer (TPE), 2017–2031

Figure 12: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Others (silicone, PVC), 2017–2031

Figure 15: Global ECG Cables and Lead Wires Market Value Share Analysis, by Usability, 2022 and 2031

Figure 16: Global ECG Cables and Lead Wires Market Attractiveness Analysis, Usability, 2023–2031

Figure 17: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Disposable, 2017–2031

Figure 18: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Reusable, 2017–2031

Figure 21: Global ECG Cables and Lead Wires Market Value Share Analysis, by Machine Type, 2022 and 2031

Figure 23: Global ECG Cables and Lead Wires Market Attractiveness Analysis, Machine Type, 2023–2031

Figure 24: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Single-lead ECG Leadwires, 2017–2031

Figure 25: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by 3-lead ECG Leadwires, 2017–2031

Figure 24: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by 5-lead ECG Leadwires, 2017–2031

Figure 25: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by 6-lead ECG Leadwires, 2017–2031

Figure 24: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by 12-lead ECG Leadwires, 2017–2031

Figure 25: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Others (15- and 18-lead ECG Leadwires), 2017–2031

Figure 26: Global ECG Cables and Lead Wires Market Value Share Analysis, by Patient Care Setting, 2022 and 2031

Figure 27: Global ECG Cables and Lead Wires Market Attractiveness Analysis, Patient Care Setting, 2023–2031

Figure 28: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 29: Global ECG Cables and Lead Wires Market Revenue (US$ Mn), by Clinics, 2017–2031

Figure 30: Global ECG Cables and Lead Wires Market Value Share Analysis, by Long Term Care Facilities, 2022-2031

Figure 30: Global ECG Cables and Lead Wires Market Value Share Analysis, by Ambulatory & Home Care 2022-2031

Figure 36: Global ECG Cables and Lead Wires Market Value Share Analysis, by Region, 2022 and 2031

Figure 37: Global ECG Cables and Lead Wires Market Attractiveness Analysis, by Region, 2023–2031

Figure 38: North America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 39: North America ECG Cables and Lead Wires Market Value Share Analysis, by Material, 2022 and 2031

Figure 40: North America ECG Cables and Lead Wires Market Attractiveness Analysis, Material, 2023–2031

Figure 41: North America ECG Cables and Lead Wires Market Value Share Analysis, by Usability, 2022 and 2031

Figure 42: North America ECG Cables and Lead Wires Market Attractiveness Analysis, Usability, 2023–2031

Figure 43: North America ECG Cables and Lead Wires Market Value Share Analysis, by Machine Type, 2022 and 2031

Figure 44: North America ECG Cables and Lead Wires Market Attractiveness Analysis, Machine Type, 2023–2031

Figure 45: North America ECG Cables and Lead Wires Market Value Share Analysis, by Patient Care Setting, 2022 and 2031

Figure 46: North America ECG Cables and Lead Wires Market Attractiveness Analysis, Patient Care Setting, 2023–2031

Figure 49: Europe ECG Cables and Lead Wires Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 50: Europe ECG Cables and Lead Wires Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 51: Europe ECG Cables and Lead Wires Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 52: Europe ECG Cables and Lead Wires Market Value Share Analysis, by Material, 2022 and 2031

Figure 53: Europe ECG Cables and Lead Wires Market Attractiveness Analysis, Material, 2023–2031

Figure 54: Europe ECG Cables and Lead Wires Market Value Share Analysis, by Usability, 2022 and 2031

Figure 55: Europe ECG Cables and Lead Wires Market Attractiveness Analysis, Usability, 2023–2031

Figure 56: Europe ECG Cables and Lead Wires Market Value Share Analysis, by Machine Type, 2022 and 2031

Figure 57: Europe ECG Cables and Lead Wires Market Attractiveness Analysis, Machine Type, 2023–2031

Figure 58: Europe ECG Cables and Lead Wires Market Value Share Analysis, by Patient Care Setting, 2022 and 2031

Figure 59: Europe ECG Cables and Lead Wires Market Attractiveness Analysis, Patient Care Setting, 2023–2031

Figure 62: Asia Pacific ECG Cables and Lead Wires Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 63: Asia Pacific ECG Cables and Lead Wires Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 64: Asia Pacific ECG Cables and Lead Wires Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 65: Asia Pacific ECG Cables and Lead Wires Market Value Share Analysis, by Material, 2022 and 2031

Figure 66: Asia Pacific ECG Cables and Lead Wires Market Attractiveness Analysis, Material, 2023–2031

Figure 67: Asia Pacific ECG Cables and Lead Wires Market Value Share Analysis, by Usability, 2022 and 2031

Figure 68: Asia Pacific ECG Cables and Lead Wires Market Attractiveness Analysis, Usability, 2023–2031

Figure 69: Asia Pacific ECG Cables and Lead Wires Market Value Share Analysis, by Machine Type, 2022 and 2031

Figure 70: Asia Pacific ECG Cables and Lead Wires Market Attractiveness Analysis, Machine Type, 2023–2031

Figure 71: Asia Pacific ECG Cables and Lead Wires Market Value Share Analysis, by Patient Care Setting, 2022 and 2031

Figure 72: Asia Pacific ECG Cables and Lead Wires Market Attractiveness Analysis, Patient Care Setting, 2023–2031

Figure 75: Latin America ECG Cables and Lead Wires Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 76: Latin America ECG Cables and Lead Wires Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 77: Latin America ECG Cables and Lead Wires Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 78: Latin America ECG Cables and Lead Wires Market Value Share Analysis, by Material, 2022 and 2031

Figure 79: Latin America ECG Cables and Lead Wires Market Attractiveness Analysis, Material, 2023–2031

Figure 80: Latin America ECG Cables and Lead Wires Market Value Share Analysis, by Usability, 2022 and 2031

Figure 81: Latin America ECG Cables and Lead Wires Market Attractiveness Analysis, Usability, 2023–2031

Figure 82: Latin America ECG Cables and Lead Wires Market Value Share Analysis, by Machine Type, 2022 and 2031

Figure 83: Latin America ECG Cables and Lead Wires Market Attractiveness Analysis, Machine Type, 2023–2031

Figure 84: Latin America ECG Cables and Lead Wires Market Value Share Analysis, by Patient Care Setting, 2022 and 2031

Figure 85: Latin America ECG Cables and Lead Wires Market Attractiveness Analysis, Patient Care Setting, 2023–2031

Figure 88: Middle East and Africa ECG Cables and Lead Wires Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 89: Middle East and Africa ECG Cables and Lead Wires Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 90: Middle East and Africa ECG Cables and Lead Wires Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 91: Middle East and Africa ECG Cables and Lead Wires Market Value Share Analysis, by Material, 2022 and 2031

Figure 92: Middle East and Africa ECG Cables and Lead Wires Market Attractiveness Analysis, Material, 2023–2031

Figure 93: Middle East and Africa ECG Cables and Lead Wires Market Value Share Analysis, by Usability, 2022 and 2031

Figure 94: Middle East and Africa ECG Cables and Lead Wires Market Attractiveness Analysis, Usability, 2023–2031

Figure 95: Middle East and Africa ECG Cables and Lead Wires Market Value Share Analysis, by Machine Type, 2022 and 2031

Figure 96: Middle East and Africa ECG Cables and Lead Wires Market Attractiveness Analysis, Machine Type, 2023–2031

Figure 97: Middle East and Africa ECG Cables and Lead Wires Market Value Share Analysis, by Patient Care Setting, 2022 and 2031

Figure 98: Middle East and Africa ECG Cables and Lead Wires Market Attractiveness Analysis, Patient Care Setting, 2023–2031