Reports

Reports

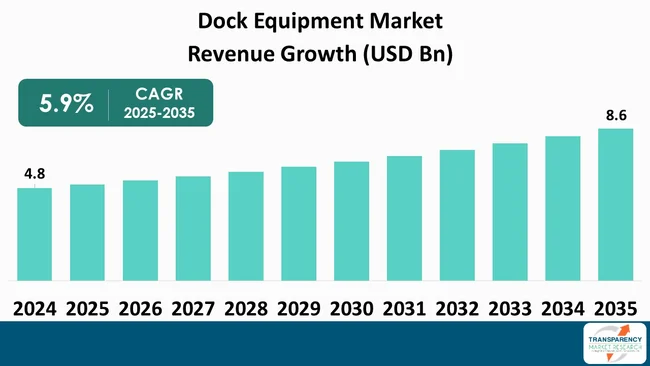

The global dock equipment market size was valued at US$ 4.8 Bn in 2024 and is projected to reach US$ 8.6 Bn by 2035, expanding at a CAGR of 5.9% from 2025 to 2035. The market growth is driven by automation, customizable retrofits, rising trade volumes, port modernization, decarbonization mandates, digital monitoring tools, aging infrastructure refurbishment, and supply-chain pressures that boost demand for dock equipment solutions.

The global dock equipment market is being driven by the demand for improved operational efficiency, compliance with safety standards, and the continuous modernization of the logistics infrastructure. Increasing adoption of robust dock-level platforms, vehicle restraint systems, protective shelters, and integrated control systems is seen as a result of these efforts to reduce loading times and the risk of injury.

Digital interfaces like automated processes, sensor networks, and telematics continue to shape products, as do retrofit programmes to enhance service life. Activities related to distribution centers, temperature-controlled storage, and omnichannel retail support steady replacement cycles. Although labor constraints and cautious capital allocation pose short-term challenges, the market is gradually consolidating around interoperable, safety-certified dock systems linked to warehouse and transport management environments.

Dock equipment comprise mechanical and electro-mechanical machines that service cargo handling between ships and docks, in ports, at berths, and in container terminals. They can be used for a range of handling operations such as container handling, yard stacking, bulk transfer, and roll-on/roll-off. Regular equipment includes ship-to-shore cranes, hydrocranes, and terminal tractors on the ship side and rubber-tired gantries, rail-mounted gantries, reachstackers, straddle carriers, and mobile harbor cranes available on the terminal side.

Manufacturers supply both - conventional and energy-efficient models, along with retrofit solutions and automation technologies such as remote control and semi-automated systems. The range of services conventionally extends to spare parts provision, telematics integration, maintenance programs, and energy monitoring software.

Equipment suppliers increasingly combine physical assets with lifecycle support, thereby covering installation, operator training, and predictive maintenance. This approach allows port operators to shift from capital-intensive procurement towards structured operational management. Technical specifications and case references are commonly shared by equipment producers and port authorities.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Growing industrial production, decentralization of manufacturing, and long-term demand for dock equipment have been steadily increasing. With the growth of production and distribution centers, an increasing number of locations require docking, which has created a structural demand for dependable docking facilities. The official industrial and manufacturing data in emerging market countries indicate the continuance of an expanding production sector, supported by the establishment of new factories, the addition of further production lines, and the expansion of logistics networks.

This has led to a rising demand for efficient dock systems that can provide high throughput with a high level of operational safety. Reports on industrial activity and policies by international bodies are focusing on domestic production and regional production networks. Initiatives such as industrial subsidies and the creation of special economic zones are fostering the emergence of new logistics and warehousing infrastructures in Asia, Latin America, and regions in Eastern Europe. This expansion has made modern dock installations a critical component of industrial planning.

e-Commerce expansion has continued to drive the warehouses and distribution. The basic aim is to plan and operate their loading areas. Increasing parcel counts, more diverse SKUs, and faster delivery expectations meant that facilities had to process more trailers per shift while keeping dwell times low. The Department of Commerce's Census Bureau reports that the total retail sales for the quarter ended 2Q 2025 were estimated at US$ 1,865.4 Bn, suggesting online demand was still strong. This steady volume motivated retailers and 3PLs to refine dock operations for quicker, more controlled processing.

Under these conditions, dependable dock levelers, automated vehicle-restraint systems, and quick-connect communication or lighting setups has become more significant, as they support limiting handling errors, misalignment, and product damage during high-frequency loading cycles. Reverse-logistics activity has added further strain.

Safety requirements has remained a central factor. OSHA has reports associated with loading dock operations, reminding that throughput increases must be reduced by engineered controls and training. Industry commentary throughout 2024 has consistently highlighted a close correlation between the growth in online sales and the strain on distribution networks, which have driven investment in equipment and layouts that increase the efficiency of docks without diminishing worker protection, among other things.

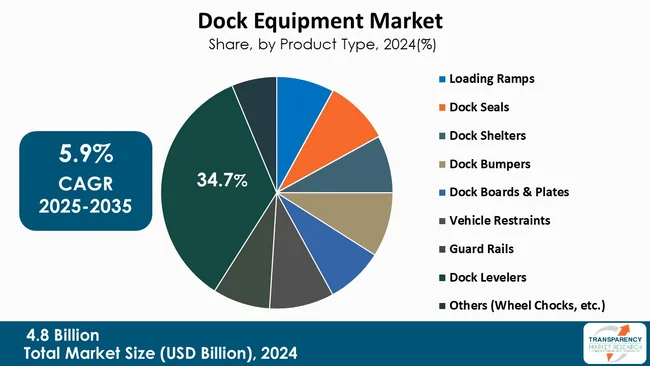

Dock levelers continue to dominate the dock equipment market, accounting for the largest product group with a share of 34.7%. This importance is due to the mechanical function they perform; a leveler acts as a link between the dock face and the bed of the trailer, compensating for height differences and for motion of the trailer while loading/unloading. As this function is required in most industrial and commercial facilities, levelers are incorporated into the majority of new construction projects and retrofits.

Their broader use is reinforced by the availability of multiple configurations that address different load environments. Across these categories, manufacturers frame levelers as equipment that directly influences handling quality and worker conditions: a properly functioning hydraulic platform reduces forklift or pallet jack impact forces, helps protect goods, and limits operator fatigue.

A substantial aftermarket also supports their long service life. As levelers are safety-critical and typically remain in operation for decades, facilities invest in replacement components, periodic inspections, and rebuilds. Companies such as Kelley, known for early development of air-powered designs, highlight durability and compatibility with older installations, showing levelers continue to command the largest share of both capital investment and ongoing dock-equipment service spending.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America, particularly the United States and Canada, represents the primary hub for demand, production, and innovation in dock equipment, accounting for about the revenue share of 37.5%. The region takes advantage of an extensive range of warehouses and distribution centers for retail, e-Commerce, and third-party logistics, as well as having a robust manufacturing base that is consistently supplied with material handling needs. Regulatory focus on workplace safety and growing implementation of automation also contribute to further fueling the market and technological advancements.

The United States continues to maintain one of the world’s most extensive manufacturing and logistics sectors, ensuring steady requirements for dock-level products and systems. European regions, notably Germany and the Netherlands, maintain relevance through strong cold-chain operations and automation adoption, supported by suppliers such as ASSA ABLOY. Since many global customers, including major retailers and industrial manufacturers, coordinate procurement through North America, the region continues to secure a substantial portion of advanced dock system projects and related service operations.

ALUTECH Group, ASSA ABLOY Group, Blue Giant Equipment Corporation, DoorHan, Gandhi Automations Pvt Ltd, Hörmann LLC, Jebsen & Jessen Group (MHE Demag), Jost’s Engineering Company Limited, Kopron SpA, NANI Verladetechnik, Pentalift Equipment Corporation, Rite-Hite, Shanghai Fastlink Door Co., Ltd., Stertil Group, and Systems LLC (McGuire) are some of the leading manufacturers operating in the global dock equipment market.

Each of these companies has been profiled in the dock equipment market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 4.8 Bn |

| Market Forecast Value in 2035 | US$ 8.6 Bn |

| Growth Rate (CAGR 2025 to 2035) | 5.9 % |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global dock equipment market was valued at US$ 4.8 Bn in 2024

The global dock equipment industry is projected to reach at US$ 8.6 Bn by the end of 2035

Rising global industrialization & expansion of manufacturing hubs, and e-commerce surge demands faster & safer dock throughput are some of the factors driving the expansion of the dock equipment market.

The CAGR is anticipated to be 5.9 % from 2025 to 2035

ALUTECH Group, ASSA ABLOY Group, Blue Giant Equipment Corporation, DoorHan, Gandhi Automations Pvt Ltd, Hörmann LLC, Jebsen & Jessen Group (MHE Demag), Jost’s Engineering Company Limited, Kopron SpA, NANI Verladetechnik, Pentalift Equipment Corporation, Rite-Hite, Shanghai Fastlink Door Co., Ltd., Stertil Group, Systems LLC (McGuire), and others

Table 01: Global Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 02: Global Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 03: Global Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 04: Global Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 05: Global Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 06: Global Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 07: Global Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 08: Global Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 09: Global Dock Equipment Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 10: Global Dock Equipment Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Table 11: North America Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 12: North America Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 13: North America Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 14: North America Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 15: North America Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 16: North America Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 17: North America Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 18: North America Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 19: North America Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 20: North America Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 21: U.S. Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 22: U.S. Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 23: U.S. Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 24: U.S. Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 25: U.S. Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 26: U.S. Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 27: U.S. Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 28: U.S. Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 29: Canada Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 30: Canada Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 31: Canada Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 32: Canada Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 33: Canada Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 34: Canada Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 35: Canada Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 36: Canada Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 37: Europe Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 38: Europe Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 39: Europe Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 40: Europe Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 41: Europe Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 42: Europe Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 43: Europe Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 44: Europe Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 45: Europe Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 46: Europe Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 47: U.K. Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 48: U.K. Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 49: U.K. Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 50: U.K. Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 51: U.K. Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 52: U.K. Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 53: U.K. Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 54: U.K. Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 55: Germany Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 56: Germany Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 57: Germany Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 58: Germany Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 59: Germany Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 60: Germany Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 61: Germany Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 62: Germany Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 63: France Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 64: France Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 65: France Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 66: France Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 67: France Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 68: France Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 69: France Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 70: France Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 71: Italy Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 72: Italy Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 73: Italy Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 74: Italy Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 75: Italy Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 76: Italy Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 77: Italy Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 78: Italy Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 79: Spain Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 80: Spain Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 81: Spain Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 82: Spain Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 83: Spain Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 84: Spain Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 85: Spain Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 86: Spain Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 87: The Netherlands Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 88: The Netherlands Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 89: The Netherlands Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 90: The Netherlands Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 91: The Netherlands Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 92: The Netherlands Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 93: The Netherlands Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 94: The Netherlands Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 95: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 96: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 97: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 98: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 99: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 100: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 101: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 102: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 103: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 104: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 105: China Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 106: China Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 107: China Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 108: China Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 109: China Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 110: China Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 111: China Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 112: China Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 113: India Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 114: India Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 115: India Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 116: India Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 117: India Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 118: India Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 119: India Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 120: India Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 121: Japan Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 122: Japan Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 123: Japan Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 124: Japan Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 125: Japan Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 126: Japan Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 127: Japan Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 128: Japan Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 129: Australia Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 130: Australia Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 131: Australia Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 132: Australia Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 133: Australia Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 134: Australia Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 135: Australia Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 136: Australia Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 137: South Korea Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 138: South Korea Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 139: South Korea Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 140: South Korea Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 141: South Korea Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 142: South Korea Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 143: South Korea Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 144: South Korea Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 145: ASEAN Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 146: ASEAN Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 147: ASEAN Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 148: ASEAN Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 149: ASEAN Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 150: ASEAN Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 151: ASEAN Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 152: ASEAN Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 153: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 154: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 155: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 156: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 157: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 158: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 159: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 160: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 161: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 162: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 163: GCC Countries Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 164: GCC Countries Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 165: GCC Countries Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 166: GCC Countries Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 167: GCC Countries Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 168: GCC Countries Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 169: GCC Countries Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 170: GCC Countries Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 171: South Africa Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 172: South Africa Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 173: South Africa Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 174: South Africa Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 175: South Africa Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 176: South Africa Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 177: South Africa Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 178: South Africa Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 179: Latin America Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 180: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 181: Latin America Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 182: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 183: Latin America Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 184: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 185: Latin America Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 186: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 187: Latin America Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 188: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 189: Brazil Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 190: Brazil Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 191: Brazil Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 192: Brazil Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 193: Brazil Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 194: Brazil Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 195: Brazil Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 196: Brazil Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 197: Mexico Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 198: Mexico Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 199: Mexico Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 200: Mexico Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 201: Mexico Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 202: Mexico Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 203: Mexico Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 204: Mexico Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 205: Argentina Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 206: Argentina Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 207: Argentina Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Table 208: Argentina Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 209: Argentina Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 210: Argentina Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 211: Argentina Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 212: Argentina Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 01: Global Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 02: Global Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 03: Global Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 04: Global Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 05: Global Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 06: Global Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 07: Global Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 08: Global Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 09: Global Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 10: Global Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 11: Global Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 12: Global Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 13: Global Dock Equipment Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 14: Global Dock Equipment Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 15: Global Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 16: North America Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 17: North America Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 18: North America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 19: North America Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 20: North America Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 21: North America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 22: North America Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 23: North America Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 24: North America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 25: North America Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 26: North America Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 27: North America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 28: North America Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 29: North America Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 30: North America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 32: U.S. Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 33: U.S. Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 34: U.S. Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 35: U.S. Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 36: U.S. Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 37: U.S. Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 38: U.S. Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 39: U.S. Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 40: U.S. Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 41: U.S. Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 42: U.S. Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Canada Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 44: Canada Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 45: Canada Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 46: Canada Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 47: Canada Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 48: Canada Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 49: Canada Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 50: Canada Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 51: Canada Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 52: Canada Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 53: Canada Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 54: Canada Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 55: Europe Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 56: Europe Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 57: Europe Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 58: Europe Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 59: Europe Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 60: Europe Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 61: Europe Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 62: Europe Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 63: Europe Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 64: Europe Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Europe Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 66: Europe Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 68: Europe Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 69: Europe Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 71: U.K. Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 72: U.K. Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 73: U.K. Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 74: U.K. Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 75: U.K. Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 76: U.K. Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 77: U.K. Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 78: U.K. Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 79: U.K. Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: U.K. Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 81: U.K. Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Germany Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 83: Germany Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 84: Germany Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 85: Germany Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 86: Germany Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 87: Germany Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 88: Germany Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 89: Germany Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 90: Germany Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 91: Germany Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 92: Germany Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 93: Germany Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 94: France Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 95: France Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 96: France Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 97: France Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 98: France Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 99: France Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 100: France Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 101: France Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 102: France Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 103: France Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 104: France Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 105: France Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 106: Italy Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 107: Italy Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 108: Italy Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 109: Italy Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 110: Italy Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 111: Italy Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 112: Italy Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 113: Italy Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 114: Italy Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 115: Italy Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Italy Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 117: Italy Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Spain Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 119: Spain Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 120: Spain Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 121: Spain Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 122: Spain Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 123: Spain Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 124: Spain Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 125: Spain Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 126: Spain Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 127: Spain Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 128: Spain Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 129: Spain Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: The Netherlands Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 131: The Netherlands Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 132: The Netherlands Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 133: The Netherlands Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 134: The Netherlands Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 135: The Netherlands Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 136: The Netherlands Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 137: The Netherlands Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 138: The Netherlands Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 139: The Netherlands Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 140: The Netherlands Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 141: The Netherlands Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 143: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 144: Asia Pacific Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 145: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 146: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 147: Asia Pacific Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 148: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 149: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 150: Asia Pacific Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 151: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 152: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 153: Asia Pacific Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Asia Pacific Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 157: China Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 158: China Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 159: China Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 160: China Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 161: China Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 162: China Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 163: China Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 164: China Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 165: China Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 166: China Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 167: China Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 168: China Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 169: India Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 170: India Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 171: India Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 172: India Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 173: India Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 174: India Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 175: India Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 176: India Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 177: India Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 178: India Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 179: India Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 180: India Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 181: Japan Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 182: Japan Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 183: Japan Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 184: Japan Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 185: Japan Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 186: Japan Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 187: Japan Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 188: Japan Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 189: Japan Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 190: Japan Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 191: Japan Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 192: Japan Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 193: Australia Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 194: Australia Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 195: Australia Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 196: Australia Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 197: Australia Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 198: Australia Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 199: Australia Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 200: Australia Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 201: Australia Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 202: Australia Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 203: Australia Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 204: Australia Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: South Korea Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 206: South Korea Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 207: South Korea Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 208: South Korea Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 209: South Korea Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 210: South Korea Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 211: South Korea Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 212: South Korea Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 213: South Korea Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 214: South Korea Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 215: South Korea Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 216: South Korea Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 217: ASEAN Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 218: ASEAN Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 219: ASEAN Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 220: ASEAN Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 221: ASEAN Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 222: ASEAN Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 223: ASEAN Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 224: ASEAN Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 225: ASEAN Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 226: ASEAN Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 227: ASEAN Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 228: ASEAN Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 229: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 230: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 231: Middle East & Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 232: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 233: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 234: Middle East & Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 235: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 236: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 237: Middle East & Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 238: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 239: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 240: Middle East & Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 241: Middle East & Africa Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 245: GCC Countries Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 246: GCC Countries Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 247: GCC Countries Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 248: GCC Countries Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 249: GCC Countries Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 250: GCC Countries Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 251: GCC Countries Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 252: GCC Countries Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 253: GCC Countries Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 254: GCC Countries Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 255: GCC Countries Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 256: South Africa Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 257: South Africa Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 258: South Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 259: South Africa Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 260: South Africa Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 261: South Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 262: South Africa Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 263: South Africa Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 264: South Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 265: South Africa Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Africa Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Africa Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: Latin America Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 269: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 270: Latin America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 271: Latin America Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 272: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 273: Latin America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 274: Latin America Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 275: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 276: Latin America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 277: Latin America Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 278: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 279: Latin America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 280: Latin America Dock Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 281: Latin America Dock Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 282: Latin America Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 284: Brazil Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 285: Brazil Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 286: Brazil Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 287: Brazil Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 288: Brazil Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 289: Brazil Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 290: Brazil Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 291: Brazil Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 292: Brazil Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 293: Brazil Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 294: Brazil Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 295: Mexico Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 296: Mexico Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 297: Mexico Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 298: Mexico Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 299: Mexico Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 300: Mexico Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 301: Mexico Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 302: Mexico Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 303: Mexico Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 304: Mexico Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 305: Mexico Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 306: Mexico Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 307: Argentina Dock Equipment Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 308: Argentina Dock Equipment Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 309: Argentina Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 310: Argentina Dock Equipment Market Value (US$ Bn) Projection, By Automation 2020 to 2035

Figure 311: Argentina Dock Equipment Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 312: Argentina Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Automation 2025 to 2035

Figure 313: Argentina Dock Equipment Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 314: Argentina Dock Equipment Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 315: Argentina Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 316: Argentina Dock Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 317: Argentina Dock Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 318: Argentina Dock Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035