Reports

Reports

Analysts’ Viewpoint

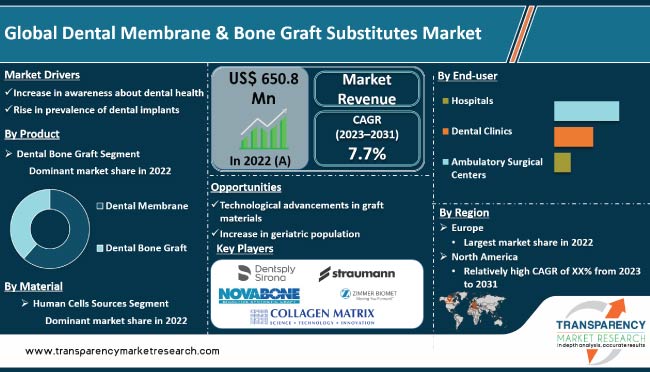

Technological advancements in graft materials are driving the global dental membrane & bone graft substitutes market. These advancements have revolutionized the field of regenerative dentistry, offering improved biocompatibility, tissue engineering approaches, and synthetic graft materials that closely resemble natural bone.

Emergence of 3D printing technology that enables precise fabrication of graft materials with customized shapes and interconnected porosity is propelling market expansion. Furthermore, development of combination products integrating dental membranes and bone graft substitutes has simplified surgical procedures and enhanced treatment outcomes.

Increase in awareness about dental health and rise in demand for dental implant procedures offer lucrative opportunities for market players. Manufacturers are focusing on development of improved materials and techniques in order to increase market share.

Dental membrane & bone graft substitutes are two important materials used in dental and oral surgery procedures to promote bone regeneration and enhance the success of dental implant placement.

Dental membranes are thin barriers or sheets that are used to guide and protect the growth of new bone and soft tissue during the healing process. These are typically made of biocompatible materials, such as expanded polytetrafluoroethylene (ePTFE) or collagen.

Bone graft substitutes are materials used to replace or augment natural bone in areas where bone loss or defects have occurred. These provide a scaffold for new bone growth and can be derived from synthetic materials, allografts (cadaveric bone), xenografts (animal-derived), or alloplasts (synthetic biomaterials).

Bone graft substitute acts as a three-dimensional framework, allowing bone-forming cells to migrate into the graft material and initiate new bone formation. Some graft materials have bioactive properties that promote the recruitment and differentiation of bone-forming cells, accelerating the bone healing process.

Rise in prevalence of dental implant procedures, aging population, technological advancements, patient awareness, dental tourism, and emergence of regenerative dentistry are driving demand for dental membranes and bone graft substitutes. Hence, manufacturers and researchers continue to invest in developing improved materials and techniques to meet this demand and enhance patient outcomes.

Rise in awareness about dental health is driving the global dental membrane & bone graft substitutes market value. Dental health awareness has increased significantly in the past few years, with more people realizing the importance of maintaining good oral hygiene and seeking dental treatments to address various dental conditions.

Dental membranes are thin barriers used in oral surgeries to promote proper healing and tissue regeneration. These are often used in procedures such as guided tissue regeneration (GTR) and guided bone regeneration (GBR) to create a favorable environment for new bone and tissue growth. These membranes help to prevent the migration of soft tissue cells into the surgical site, allowing the bone and tissue to regenerate more effectively.

Bone graft substitutes are materials used to replace or augment bone in dental procedures. These are commonly used in dental implant surgeries, where they help to support and stabilize the implant.

Bone graft substitutes can be synthetic, derived from natural sources, or a combination of both. These provide a scaffold for new bone formation and promote the integration of the implant with the surrounding bone.

Increase in awareness about dental health has led to higher demand for dental procedures, including dental implant surgeries and periodontal treatments. Consequently, demand for dental membranes and bone graft substitutes has also risen. These products are crucial in promoting successful outcomes in dental surgeries by aiding in proper tissue regeneration and facilitating the integration of dental implants.

Technological advancements in graft materials are driving the dental membrane & bone graft substitutes market demand. These advancements have brought about significant improvements in the performance and efficacy of graft materials, leading to better patient outcomes and expanded treatment options.

Graft materials used in dental membrane & bone graft substitutes are designed to closely mimic the properties of natural bone, allowing for improved biocompatibility. This reduces the risk of adverse reactions and promotes successful integration with the patient's own bone.

Advances in tissue engineering have enabled the development of graft materials that incorporate growth factors, bioactive molecules, and cells to enhance bone regeneration. These engineered materials provide a more favorable environment for cell growth and tissue formation, leading to accelerated and more efficient healing.

Graft materials with bioactive properties, such as calcium phosphate ceramics and bioactive glass, stimulate bone formation and can be gradually resorbed by the body as new bone tissue develops. These materials eliminate the need for a second surgical procedure to remove non-resorbable grafts, providing a more patient-friendly approach.

In terms of product, the dental bone graft segment accounted for the largest global dental membrane & bone graft substitutes market share. Dental bone grafts are widely used in various dental and oral surgery procedures to promote bone regeneration and provide a stable foundation for dental implants.

Dental bone grafts can be derived from various sources, including autografts (patient's own bone), allografts (donor bone), xenografts (animal-derived), and synthetic graft materials. These grafts can be used to fill bone defects, augment bone volume, and provide structural support in cases of bone loss or resorption.

Dental implants have become a popular and effective treatment option for replacing missing teeth. Dental bone grafts play a crucial role in ensuring successful implant placement by providing adequate bone support and stability.

Based on material, the human cells sources segment dominated the global dental membrane & bone graft substitutes industry in 2022. Human cell sources, such as mesenchymal stem cells (MSCs) derived from bone marrow or adipose tissue, have been studied for their regenerative capabilities in promoting bone healing and regeneration. These cells can be combined with scaffolds or matrices to create advanced dental membrane & bone graft substitute products.

Usage of human cell sources in dental membrane & bone graft substitutes offers several potential advantages, including enhanced tissue integration, improved healing response, and personalized treatment options. By utilizing the patient's own cells or allogenic cell sources, it may be possible to optimize the regenerative potential and improve treatment outcomes.

As the field of regenerative dentistry continues to advance, ongoing research and developments in human cell sources as materials for dental membrane & bone graft substitutes are expected. This, in turn, is likely to augment the segment in the near future.

In terms of end-user, the dental clinics segment is anticipated to dominate the global dental membrane & bone graft substitutes market from 2023 to 2031. Dental clinics play a crucial role in providing various dental and oral surgical procedures, including dental implant placement and bone grafting. These procedures often require the use of dental membranes and bone graft substitutes to enhance bone regeneration and ensure successful treatment outcomes.

Dental clinics are typically equipped with the necessary infrastructure, equipment, and trained professionals to perform these procedures. These clinics serve a wide range of patients, including those seeking restorative and cosmetic dental treatments. Dental clinics also provide comprehensive oral care, which could involve addressing bone defects, guided tissue regeneration, and implant-supported restorations.

Demand for dental membrane & bone graft substitutes in dental clinics is driven by factors such as rise in prevalence of dental implant procedures, increase in awareness about dental health, advancements in dental technology, and surge in aging population.

Europe is a prominent market for dental membrane & bone graft substitutes. The region has witnessed significant advancements in dental and oral surgery procedures. Countries such as Germany, France, and the U.K. have well-established healthcare infrastructure and strong focus on dental implantology, which are fueling the growth of the market in the region.

North America, particularly the U.S., has a mature dental industry and is a major market for dental membrane & bone graft substitutes. The region has a high adoption rate of advanced dental procedures, including dental implants, and an increasing geriatric population. Moreover, presence of key market players and ongoing research & development activities drive the market in North America.

The dental membrane & bone graft substitutes market in Asia Pacific has witnessed rapid growth in the past few years. Countries such as China, Japan, and South Korea are experiencing rise in dental tourism, increase in awareness about oral health, and growing demand for dental implant procedures. Surge in disposable income, improving healthcare infrastructure, and large patient pool contribute to market growth in the region.

Product portfolio and merger & acquisition are the key strategies adopted by leading manufacturers in the dental membrane & bone graft substitutes market. ACE Surgical Supply Co., Inc., Botiss Biomaterials GmbH, Collagen Matrix, Inc., CURASAN AG, Dentsply Sirona, Geistlich Pharma, KLS Martin Group, LifeNet Health, Medtronic plc, NovaBone Products LLC, Osteogenics Biomedical, RTI Surgical Holdings, Inc., Salvin Dental Specialties, Inc., and Straumann Group are the prominent players in the market.

The dental membrane & bone graft substitutes market report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 650.8 Mn |

|

Forecast (Value) in 2031 |

US$ 1.3 Bn |

|

Growth Rate (CAGR) |

7.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 650.8 Mn in 2022

It is projected to reach more than US$ 1.3 Bn by 2031

The industry is anticipated to grow at a CAGR of 7.7% from 2023 to 2031

Increase in awareness about dental health and rise in prevalence of dental implants are anticipated to propel the market.

Europe is projected to account for major market share from 2023 to 2031

ACE Surgical Supply Co., Inc., Botiss Biomaterials GmbH, Collagen Matrix, Inc., CURASAN AG, Dentsply Sirona, Geistlich Pharma, KLS Martin Group, LifeNet Health, Medtronic plc, NovaBone Products LLC, Osteogenics Biomedical, RTI Surgical Holdings, Inc., Salvin Dental Specialties, Inc., Straumann Group, and Zimmer Biomet Holdings, Inc. are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Dental Membrane & Bone Graft Substitutes Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancements

5.2. Emerging Trends In Dental Bone Graft

5.3. Regulatory Scenario by Region/Globally

5.4. COVID-19 Pandemic Impact on Industry

6. Global Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Dental Membrane

6.3.1.1. Resorbable

6.3.1.2. Non-resorbable

6.3.2. Dental Bone Graft

6.3.2.1. Autograft

6.3.2.2. Allograft

6.3.2.3. Demineralized Bone Matrix

6.3.2.4. Xenograft

6.3.2.5. Synthetic Bone Graft Substitute

6.4. Market Attractiveness Analysis, by Product

7. Global Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast, by Material

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Material, 2017-2031

7.3.1. Hydrogel

7.3.2. Collagen

7.3.3. Polytetrafluoroethylene (PTFE)

7.3.4. Human Cells Sources

7.3.5. Hydroxyapatite (HA)

7.3.6. Tricalcium Phosphate (TCP)

7.3.7. Other Species

7.4. Market Attractiveness Analysis, by Material

8. Global Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Dental Clinics

8.3.2.1. Individual Practice

8.3.2.2. Group Practice

8.3.3. Ambulatory Surgical Centers

8.4. Market Attractiveness Analysis, by End-user

9. Global Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Dental Membrane

10.2.1.1. Resorbable

10.2.1.2. Non-resorbable

10.2.2. Dental Bone Graft

10.2.2.1. Autograft

10.2.2.2. Allograft

10.2.2.3. Demineralized Bone Matrix

10.2.2.4. Xenograft

10.2.2.5. Synthetic Bone Graft Substitute

10.3. Market Value Forecast, by Material, 2017-2031

10.3.1. Hydrogel

10.3.2. Collagen

10.3.3. Polytetrafluoroethylene (PTFE)

10.3.4. Human Cells Sources

10.3.5. Hydroxyapatite (HA)

10.3.6. Tricalcium Phosphate (TCP)

10.3.7. Other Species

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Dental Clinics

10.4.2.1. Individual Practice

10.4.2.2. Group Practice

10.4.3. Ambulatory Surgical Centers

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Material

10.6.3. By End-user

10.6.4. By Country

11. Europe Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Dental Membrane

11.2.1.1. Resorbable

11.2.1.2. Non-resorbable

11.2.2. Dental Bone Graft

11.2.2.1. Autograft

11.2.2.2. Allograft

11.2.2.3. Demineralized Bone Matrix

11.2.2.4. Xenograft

11.2.2.5. Synthetic Bone Graft Substitute

11.3. Market Value Forecast, by Material, 2017-2031

11.3.1. Hydrogel

11.3.2. Collagen

11.3.3. Polytetrafluoroethylene (PTFE)

11.3.4. Human Cells Sources

11.3.5. Hydroxyapatite (HA)

11.3.6. Tricalcium Phosphate (TCP)

11.3.7. Other Species

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Dental Clinics

11.4.2.1. Individual Practice

11.4.2.2. Group Practice

11.4.3. Ambulatory Surgical Centers

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Material

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Dental Membrane

12.2.1.1. Resorbable

12.2.1.2. Non-resorbable

12.2.2. Dental Bone Graft

12.2.2.1. Autograft

12.2.2.2. Allograft

12.2.2.3. Demineralized Bone Matrix

12.2.2.4. Xenograft

12.2.2.5. Synthetic Bone Graft Substitute

12.3. Market Value Forecast, by Material, 2017-2031

12.3.1. Hydrogel

12.3.2. Collagen

12.3.3. Polytetrafluoroethylene (PTFE)

12.3.4. Human Cells Sources

12.3.5. Hydroxyapatite (HA)

12.3.6. Tricalcium Phosphate (TCP)

12.3.7. Other Species

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Dental Clinics

12.4.2.1. Individual Practice

12.4.2.2. Group Practice

12.4.3. Ambulatory Surgical Centers

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Material

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Dental Membrane

13.2.1.1. Resorbable

13.2.1.2. Non-resorbable

13.2.2. Dental Bone Graft

13.2.2.1. Autograft

13.2.2.2. Allograft

13.2.2.3. Demineralized Bone Matrix

13.2.2.4. Xenograft

13.2.2.5. Synthetic Bone Graft Substitute

13.3. Market Value Forecast, by Material, 2017-2031

13.3.1. Hydrogel

13.3.2. Collagen

13.3.3. Polytetrafluoroethylene (PTFE)

13.3.4. Human Cells Sources

13.3.5. Hydroxyapatite (HA)

13.3.6. Tricalcium Phosphate (TCP)

13.3.7. Other Species

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Dental Clinics

13.4.2.1. Individual Practice

13.4.2.2. Group Practice

13.4.3. Ambulatory Surgical Centers

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Material

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017-2031

14.2.1. Dental Membrane

14.2.1.1. Resorbable

14.2.1.2. Non-resorbable

14.2.2. Dental Bone Graft

14.2.2.1. Autograft

14.2.2.2. Allograft

14.2.2.3. Demineralized Bone Matrix

14.2.2.4. Xenograft

14.2.2.5. Synthetic Bone Graft Substitute

14.3. Market Value Forecast, by Material, 2017-2031

14.3.1. Hydrogel

14.3.2. Collagen

14.3.3. Polytetrafluoroethylene (PTFE)

14.3.4. Human Cells Sources

14.3.5. Hydroxyapatite (HA)

14.3.6. Tricalcium Phosphate (TCP)

14.3.7. Other Species

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Dental Clinics

14.4.2.1. Individual Practice

14.4.2.2. Group Practice

14.4.3. Ambulatory Surgical Centers

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Material

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. ACE Surgical Supply Co., Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Botiss Biomaterials GmbH

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Collagen Matrix, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. CURASAN AG

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Dentsply Sirona

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Geistlich Pharma

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. KLS Martin Group

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. LifeNet Health

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Medtronic plc

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. NovaBone Products LLC

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Osteogenics Biomedical

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. RTI Surgical Holdings, Inc.

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. Salvin Dental Specialties, Inc.

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

15.3.14. Straumann Group

15.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.14.2. Product Portfolio

15.3.14.3. Financial Overview

15.3.14.4. SWOT Analysis

15.3.14.5. Strategic Overview

15.3.15. Zimmer Biomet Holdings, Inc.

15.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.15.2. Product Portfolio

15.3.15.3. Financial Overview

15.3.15.4. SWOT Analysis

15.3.15.5. Strategic Overview

List of Table

Table 01: Global Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 03: Global Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 06: North America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 07: North America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 08: North America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 09: Europe Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 11: Europe Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 12: Europe Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 15: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 16: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Latin America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 19: Latin America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 20: Latin America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 23: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 24: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figure

Figure 01: Global Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Dental Membrane & Bone Graft Substitutes Market Value Share, by Product, 2022

Figure 03: Global Dental Membrane & Bone Graft Substitutes Market Value Share, by Material, 2022

Figure 04: Global Dental Membrane & Bone Graft Substitutes Market Value Share, by End-user, 2022

Figure 05: Global Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Product, 2022 and 2031

Figure 06: Global Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Product, 2023-2031

Figure 07: Global Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Material, 2022 and 2031

Figure 08: Global Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Material 2023-2031

Figure 09: Global Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 10: Global Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, End-user, 2023-2031

Figure 11: Global Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 12: Global Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 13: Global Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Region, 2022 and 2031

Figure 14: Global Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Region, 2023-2031

Figure 15: North America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, 2017-2031

Figure 16: North America Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Country, 2022 and 2031

Figure 17: North America Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Country, 2023-2031

Figure 18: North America Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Product, 2022 and 2031

Figure 19: North America Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Product, 2023-2031

Figure 20: North America Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Material, 2022 and 2031

Figure 21: North America Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Material 2023-2031

Figure 22: North America Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 23: North America Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, End-user, 2023-2031

Figure 24: Europe Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, 2017-2031

Figure 25: Europe Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Europe Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 27: Europe Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Product, 2022 and 2031

Figure 28: Europe Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Product, 2023-2031

Figure 29: Europe Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Material, 2022 and 2031

Figure 30: Europe Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Material 2023-2031

Figure 29: Europe Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 30: Europe Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, End-user, 2023-2031

Figure 31: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, 2017-2031

Figure 32: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Product, 2022 and 2031

Figure 35: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Product, 2023-2031

Figure 36: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Material, 2022 and 2031

Figure 37: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Material 2023-2031

Figure 38: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 39: Asia Pacific Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, End-user, 2023-2031

Figure 40: Latin America Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, 2017-2031

Figure 41: Latin America Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Latin America Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43: Latin America Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Product, 2022 and 2031

Figure 44: Latin America Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Product, 2023-2031

Figure 45: Latin America Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Material, 2022 and 2031

Figure 46: Latin America Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Material, 2023-2031

Figure 47: Latin America Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 48: Latin America Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, End-user, 2023-2031

Figure 49: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value (US$ Mn) Forecast, 2017-2031

Figure 50: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 51: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 52: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Product, 2022 and 2031

Figure 53: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Product, 2023-2031

Figure 54: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by Material, 2022 and 2031

Figure 55: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by Material 2023-2031

Figure 56: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Value Share Analysis, by End-user, 2022 and 2031

Figure 57: Middle East & Africa Dental Membrane & Bone Graft Substitutes Market Attractiveness Analysis, by End-user, 2023-2031

Figure 58: Global Dental Membrane & Bone Graft Substitutes Market Share Analysis By Company (2022)