Reports

Reports

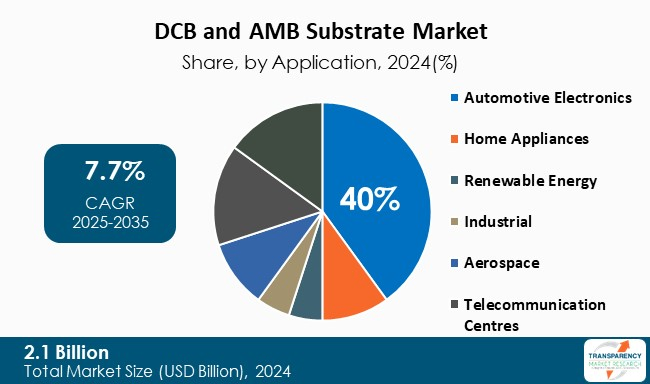

The global DCB and AMB Substrate market size was valued at US$ 2.1 billion in 2024 and is projected to reach US$ 4.7 billion by 2035, expanding at a CAGR of 7.7% from 2025 to 2035. The market growth is specifically driven by the electrification of transportation, and renewable energy expansion among others.

The DCB and AMB substrate market is undergoing revolution, propelled by the worldwide inclination toward high-efficiency power electronics. The substrates facilitate thermal management and electrical insulation in high-performance applications like electric vehicles (EVs), renewable energy installations, and industrial automation. The market is being influenced by the meteoric growth in transportation electrification, solar and wind energy equipment scale-up of deployment, and advancements in semiconductor technology.

Big players such as Rogers Corporation, Kyocera, and Ferrotec are investing heavily in expanding their capacity for production as well as improving the quality of ceramic substrates. These measures are changing the competitive scenario by providing more thermal-stable as well as economical solutions specifically for automotive and power electronics uses.

EV OEMs and energy storage firms’ collaborations are also providing these companies with a strategic edge. In addition, increasing applications of wide-bandgap semiconductors like SiC and GaN are creating demand for high-voltage and heat stress-resistant substrates like DCB and AMB. All these are driving the market toward innovation-led growth with a very high focus on thermal reliability, miniaturization, and long-term stability.

The market for DCB and AMB substrates is dominated by international demand for high-performance power management solutions in the automobile, renewable, and industrial spaces. One of the major drivers of demand is growing complexity in power electronics systems, particularly within power grids and electric vehicles. The substrates offer higher thermal conductance and electrical insulation and play a pivotal role in power modules and inverters.

Government support encouraging the shift to electric mobility and clean energy technologies has been a key driver in accelerating product engineering and manufacturing capability in the industry. Furthermore, the digital revolution of industries has increased the need for high-strength, high-performance circuit packaging — another demand kicker. Smart system applications in household appliances, cars, and industrial equipment are also on the rise for using DCB and AMB substrates as they are durable and possess an improved feature of heat dissipation. All these are gearing toward long-term sustainable objectives and will keep on accelerating the market.

| Attribute | Detail |

|---|---|

| DCB and AMB Substrate Market Drivers |

|

Rising adoption of electric vehicles (EVs) is one of the key growth drivers to the DCB and AMB substrate industry. EVs require highly efficient power modules with high operating temperature and voltages. DCB and AMB substrates have high thermal conductivity and mechanical strength, making them suitable applications in power control units, inverters, and onboard chargers — all of which have a crucial contribution to EV design.

As car makers transition to high-voltage drivetrains and solid-state batteries, the requirement for high-thermal cycle and electrical stress withstanding substrates is even more important. These substrates are also lighter and smaller than traditional materials, and therefore fit within the auto industry's weight savings objectives.

For example, more than 15 million EVs were sold worldwide in 2024 alone, as reported by a recent industry report, and the scenario is expected to persist in the upcoming period. Industry giants such as Tesla, BYD, and Volkswagen already integrate DCB and AMB substrates into their power modules to improve thermal efficiency and device lifetime. This development in EV architecture is shaping new expectations for substrate performance, thus broadening their field of application and establishing themselves as a significant force in the mobility map of the future.

The global transition toward renewable power sources such as solar and wind power is a huge growth driver for the DCB and AMB substrate market. The power inverter and converter technology infrastructure is put under the pressure of high voltage, high temperature, and continuous stress resisting material.

DCB and AMB substrates ensure thermal management and ruggedness required in such applications and are critical to photovoltaic inverter, wind turbine converter, and energy storage system design. Increasing use of wide-bandgap semiconductors like silicon carbide (SiC) for renewable energy applications places ever more stringent demands on substrates - both - high in thermal conductivity and low in thermal resistance — a combination best met by both - AMB and DCB technologies.

A good example is that a massive solar farm in Australia deployed SiC-based inverters with integrated DCB substrates recently to reduce thermal stress and enhance energy efficiency. With governments around the world committing ambitious net-zero carbon targets, capital spending on renewable infrastructure grows with preference for steady demand for high-performance substrates with long-term reliability and energy efficiency for power conversion systems.

Alumina substrates (Al₂O₃) are the most used material in the AMB and DCB substrate industry as they provide balanced performance without costing a fortune. Lacking the highest thermal conductivity as compared to the other materials like aluminum nitride or silicon nitride, alumina offers appropriate thermal and electrical insulation for the majority of power applications.

Its established process technology, large-scale availability, and compatibility with both - AMB and DCB technologies, for which they are made, make it the most demandable. These substrates enjoy broad application in consumer electronics, industrial control, and automotive medium power modules where cost is a limitation and thermal specifications are intermediate. Alumina substrates are preferred by manufacturers due to their mechanical strength, dielectric strength, and affordable cost, especially in mass volume manufacturing conditions.

For example, in the consumer appliance industry, air conditioners and washing machines with inverter drives make widespread application of Al₂O₃-based DCB substrates for motor control units. A recent product innovation by a prominent South Korean white goods manufacturer substituted conventional PCB substrates with alumina-based DCBs, where thermal efficiency increased by 15% and component failure rates reduced during the extended operating periods. All these - combined with extremely low material cost - will ensure alumina-based substrates will remain the market leader in majority of mid-range power electronics applications.

| Attribute | Detail |

|---|---|

| Leading Region |

|

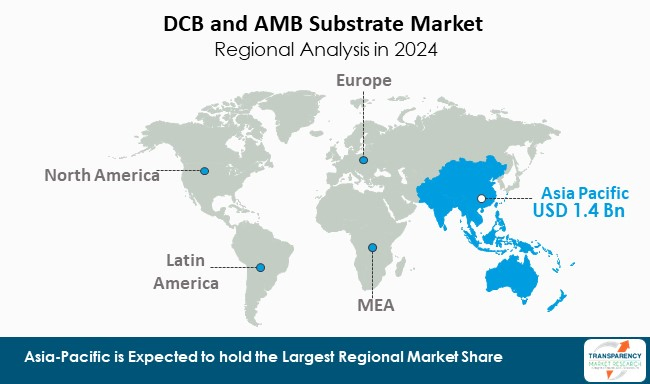

The Asia-Pacific (APAC) region leads with 67% revenue share for the global DCB and AMB substrate market due to its strong manufacturing base, high industrialization, and rising demand for electric mobility and renewable energy alternatives. Behemoth semiconductor manufacturing facilities and power electronics firms, including China, Japan, South Korea, and Taiwan, dominate the region and they are deeply integrated in their supply chain for substrate manufacturing.

China, for instance, has achieved huge strides in EV manufacturing, solar panel installation, and industrial automation — all extremely substrate-intensive. Technological self-sufficiency focus in the region by governments providing incentives also fuels substrate innovation expenditure and in-region production. On the other hand, with industry bellwethers such as Rogers Corporation Being R&D leaders, its native substrate manufacturing is very specialty and bulk-import driven. Also, domestic demand is growing in the Americas, particularly in defense, aerospace, and alternative energy applications, where quality and reliability are paramount.

For instance, South Korea's investment in EV and battery technology production has driven its domestic demand for DCB substrates to surge, with increased local capacity by firms such as Ferrotec. Such advanced local development further solidifies APAC as the hub of the DCB and AMB substrate industry.

Key players operating in the car detailing industry are investing through innovation, strategic partnerships, and technological advancements. They emphasize on enhancing imaging clarity and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

Rogers Corporation, Ferrotec, BYD, NGK Electronics Devices, Heraeus Electronics, Kyocera Corporation, Mitsubishi Materials Corporation, Denka Company Limited, Proterial, DOWA METALTECH Co., Ltd., Tong Hsing Electronic Industries, Maruwa Co., Ltd., CeramTec GmbH, Remtec, Inc., Stellar Industries Corp. are the key players in DCB and AMB Substrate Market.

Each of these players has been profiled in the DCB and AMB substrate market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 2.1 Bn |

| Forecast Value in 2035 | US$ 4.7 Bn |

| CAGR | 7.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| DCB and AMB Substrate Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global DCB and AMB substrate market was valued at US$ 2.1 Bn in 2024

The global DCB and AMB substrate industry is projected to reach US$ 4.7 Bn by the end of 2035

Electrification of transportation, and renewable energy expansion are some of the factors driving the expansion of DCB and AMB substrate market.

The CAGR is anticipated to be 7.7% from 2025 to 2035

Rogers Corporation, Ferrotec, BYD, NGK Electronics Devices, Heraeus Electronics, Kyocera Corporation, Mitsubishi Materials Corporation, Denka Company Limited, Proterial, DOWA METALTECH Co., Ltd., Tong Hsing Electronic Industries, Maruwa Co., Ltd., CeramTec GmbH, Remtec, Inc., and Stellar Industries Corp among others

Table 01: Global DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 02: Global DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 03: Global DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 04: Global DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 05: North America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 06: North America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 07: North America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 08: North America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Country/Region, 2020 to 2035

Table 09: U.S. DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 10: U.S. DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 11: U.S. DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 12: Canada DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 13: Canada DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 14: Canada DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15: Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 16: Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 17: Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 18: Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Country/Region, 2020 to 2035

Table 19: Germany DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 20: Germany DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 21: Germany DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 22: UK DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 23: UK DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 24: UK DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25: France DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 26: France DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 27: France DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 28: Italy DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 29: Italy DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 30: Italy DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31: Spain DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 32: Spain DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 33: Spain DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 34: Switzerland DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 35: Switzerland DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 36: Switzerland DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 37: The Netherlands DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 38: The Netherlands DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 39: The Netherlands DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 40: Rest of Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 41: Rest of Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 42: Rest of Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43: Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 44: Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 45: Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 46: Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Country/Region, 2020 to 2035

Table 47: China DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 48: China DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 49: China DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 50: Japan DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 51: Japan DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 52: Japan DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53: India DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 54: India DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 55: India DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 56: South Korea DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 57: South Korea DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 58: South Korea DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 59: Australia & New Zealand DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 60: Australia & New Zealand DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 61: Australia & New Zealand DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 62: Rest of Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 63: Rest of Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 64: Rest of Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65: Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 66: Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 67: Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68: Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Country/Region, 2020 to 2035

Table 69: Brazil DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 70: Brazil DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 71: Brazil DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 72: Mexico DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 73: Mexico DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 74: Mexico DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 75: Argentina DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 76: Argentina DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 77: Argentina DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 78: Rest of Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 79: Rest of Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 80: Rest of Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 81: Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 82: Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 83: Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 84: Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Country/Region, 2020 to 2035

Table 85: GCC Countries DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 86: GCC Countries DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 87: GCC Countries DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 88: South Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 89: South Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 90: South Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 91: Rest of Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 92: Rest of Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Substrate Thickness, 2020 to 2035

Table 93: Rest of Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Figure 01: Global DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global DCB and AMB Substrate Market Value Share Analysis, by Region, 2024 and 2035

Figure 03: Global DCB and AMB Substrate Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 04: Global DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 05: Global DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 06: Global DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 07: Global DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 08: Global DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 09: Global DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 10: North America DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 11: North America DCB and AMB Substrate Market Value Share Analysis, by Country/Region, 2024 and 2035

Figure 12: North America DCB and AMB Substrate Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 13: North America DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 14: North America DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 15: North America DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 16: North America DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 17: North America DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 18: North America DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 19: U.S. DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 20: U.S. DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 21: U.S. DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 22: U.S. DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 23: U.S. DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 24: U.S. DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 25: U.S. DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 26: Canada DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: Canada DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 28: Canada DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 29: Canada DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 30: Canada DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 31: Canada DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 32: Canada DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 33: Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe DCB and AMB Substrate Market Value Share Analysis, by Country/Region, 2024 and 2035

Figure 35: Europe DCB and AMB Substrate Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 36: Europe DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 37: Europe DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 38: Europe DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 39: Europe DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 40: Europe DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 41: Europe DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 42: Germany DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Germany DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 44: Germany DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 45: Germany DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 46: Germany DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 47: Germany DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 48: Germany DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 49: UK DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: UK DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 51: UK DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 52: UK DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 53: UK DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 54: UK DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 55: UK DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 56: France DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: France DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 58: France DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 59: France DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 60: France DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 61: France DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 62: France DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 63: Italy DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 64: Italy DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 65: Italy DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 66: Italy DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 67: Italy DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 68: Italy DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 69: Italy DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 70: Spain DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 71: Spain DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 72: Spain DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 73: Spain DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 74: Spain DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 75: Spain DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 76: Spain DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 77: Switzerland DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 78: Switzerland DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 79: Switzerland DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 80: Switzerland DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 81: Switzerland DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 82: Switzerland DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 83: Switzerland DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 84: The Netherlands DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 85: The Netherlands DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 86: The Netherlands DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 87: The Netherlands DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 88: The Netherlands DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 89: The Netherlands DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 90: The Netherlands DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 91: Rest of Europe DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 92: Rest of Europe DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 93: Rest of Europe DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 94: Rest of Europe DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 95: Rest of Europe DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 96: Rest of Europe DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 97: Rest of Europe DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 98: Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 99: Asia Pacific DCB and AMB Substrate Market Value Share Analysis, by Country/Region, 2024 and 2035

Figure 100: Asia Pacific DCB and AMB Substrate Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 101: Asia Pacific DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 102: Asia Pacific DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 103: Asia Pacific DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 104: Asia Pacific DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 105: Asia Pacific DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 106: Asia Pacific DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 107: China DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 108: China DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 109: China DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 110: China DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 111: China DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 112: China DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 113: China DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 114: Japan DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 115: Japan DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 116: Japan DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 117: Japan DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 118: Japan DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 119: Japan DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 120: Japan DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 121: India DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 122: India DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 123: India DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 124: India DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 125: India DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 126: India DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 127: India DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 128: South Korea DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 129: South Korea DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 130: South Korea DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 131: South Korea DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 132: South Korea DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 133: South Korea DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 134: South Korea DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 135: Australia & New Zealand DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 136: Australia & New Zealand DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 137: Australia & New Zealand DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 138: Australia & New Zealand DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 139: Australia & New Zealand DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 140: Australia & New Zealand DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 141: Australia & New Zealand DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 142: Rest of Asia Pacific DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 143: Rest of Asia Pacific DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 144: Rest of Asia Pacific DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 145: Rest of Asia Pacific DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 146: Rest of Asia Pacific DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 147: Rest of Asia Pacific DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 148: Rest of Asia Pacific DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 149: Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 150: Latin America DCB and AMB Substrate Market Value Share Analysis, by Country/Region, 2024 and 2035

Figure 151: Latin America DCB and AMB Substrate Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 152: Latin America DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 153: Latin America DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 154: Latin America DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 155: Latin America DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 156: Latin America DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 157: Latin America DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 158: Brazil DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 159: Brazil DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 160: Brazil DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 161: Brazil DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 162: Brazil DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 163: Brazil DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 164: Brazil DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 165: Mexico DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 166: Mexico DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 167: Mexico DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 168: Mexico DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 169: Mexico DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 170: Mexico DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 171: Mexico DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 172: Argentina DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 173: Argentina DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 174: Argentina DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 175: Argentina DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 176: Argentina DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 177: Argentina DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 178: Argentina DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 179: Rest of Latin America DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 180: Rest of Latin America DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 181: Rest of Latin America DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 182: Rest of Latin America DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 183: Rest of Latin America DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 184: Rest of Latin America DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 185: Rest of Latin America DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 186: Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 187: Middle East & Africa DCB and AMB Substrate Market Value Share Analysis, by Country/Region, 2024 and 2035

Figure 188: Middle East & Africa DCB and AMB Substrate Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 189: Middle East & Africa DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 190: Middle East & Africa DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 191: Middle East & Africa DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 192: Middle East & Africa DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 193: Middle East & Africa DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 194: Middle East & Africa DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 195: GCC Countries DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 196: GCC Countries DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 197: GCC Countries DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 198: GCC Countries DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 199: GCC Countries DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 200: GCC Countries DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 201: GCC Countries DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 202: South Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 203: South Africa DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 204: South Africa DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 205: South Africa DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 206: South Africa DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 207: South Africa DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 208: South Africa DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 209: Rest of Middle East & Africa DCB and AMB Substrate Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 210: Rest of Middle East & Africa DCB and AMB Substrate Market Value Share Analysis, by Type, 2024 and 2035

Figure 211: Rest of Middle East & Africa DCB and AMB Substrate Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 212: Rest of Middle East & Africa DCB and AMB Substrate Market Value Share Analysis, by Substrate Thickness, 2024 and 2035

Figure 213: Rest of Middle East & Africa DCB and AMB Substrate Market Attractiveness Analysis, by Substrate Thickness, 2025 to 2035

Figure 214: Rest of Middle East & Africa DCB and AMB Substrate Market Value Share Analysis, by Application, 2024 and 2035

Figure 215: Rest of Middle East & Africa DCB and AMB Substrate Market Attractiveness Analysis, by Application, 2025 to 2035